Market Insights:

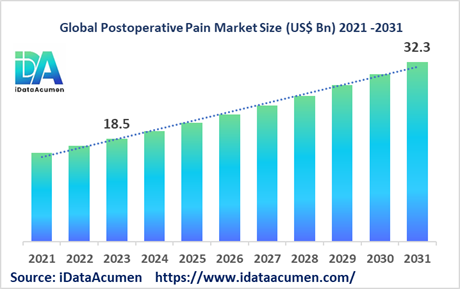

The Postoperative Pain Market size is expected to reach US$ 32.3 billion by 2031, from US$ 18.5 billion in 2023, at a CAGR of 7.2% during the forecast period. Postoperative pain medications are used to manage pain after surgical procedures. They help provide analgesia and reduce postoperative complications. The market is driven by the rising number of surgeries globally.

Postoperative pain is the pain experienced by patients after undergoing surgical procedures. It occurs due to tissue trauma during surgery. Postoperative pain management is essential for faster recovery and to avoid complications. The Postoperative Pain Market comprises therapeutics and devices used to treat postoperative pain.

The Postoperative Pain Market is segmented by drug class, route of administration, distribution channel, surgery type, and region. By drug class, the opioids segment accounted for the largest share in 2022. Opioids are highly effective for acute postoperative pain management. However, their use is associated with side effects and risks of dependency.

Epidemiology Insights:

- Postoperative pain is highly prevalent across all major regions. In the US, around 80% of patients experience acute postoperative pain.

- The rising geriatric population and chronic disease burden are key factors increasing surgical volumes and subsequent postoperative pain incidence across developed markets like the US, EU5 and Japan.

- As per estimates, there are around 300 million surgeries conducted globally every year. Orthopedic surgeries account for a majority of procedures.

- With surgical volumes projected to grow at over 5% annually, demand for postoperative pain management is expected to surge significantly.

- Developing markets are also lucrative due to their large surgery patient pool and improving healthcare infrastructure.

Market Landscape:

- The biggest unmet need is the lack of effective and safer analgesics. Many patients experience moderate to severe postoperative pain even after treatment.

- Opioids, NSAIDs, local anesthetics, nerve blockers are commonly used drugs. Devices like PCA pumps are also employed.

- New drug classes like NOP receptor agonists, cannabinoids, and newer NSAIDs are being evaluated. Novel drug delivery systems are being developed.

- Non-pharmacological therapies like transcutaneous electrical nerve stimulation (TENS) are emerging options. Digital pain management solutions also hold promise.

- The market is dominated by large pharma companies like J&J, Pfizer, AbbVie with established brands. However, new players are entering this space.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 18.5 Bn |

|

CAGR (2024 - 2031) |

7.2% |

|

The revenue forecast in 2031 |

US$ 32.3 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Pfizer, Novartis, Teva Pharmaceutical, Mylan, Allergan, Purdue Pharma, Endo Pharmaceuticals, AstraZeneca, Johnson & Johnson, GlaxoSmithKline |

Market Drivers:

Rising surgical volumes globally is a major factor driving growth in the postoperative pain management market. The number of surgeries performed worldwide has been increasing steadily over the past decade due to the rising prevalence of chronic diseases, expanding geriatric population, and improving access to healthcare services especially in developing countries. Most surgical procedures result in acute postoperative pain of varying intensities depending on the type of surgery. Effective pain management is crucial for faster patient recovery and to avoid adverse events. The growing surgical volumes across all major surgery types including orthopedic, cardiovascular, neurosurgeries is creating significant demand for postoperative analgesic drugs and pain management devices.

Advances in minimally invasive surgeries such as laparoscopy and robot-assisted surgeries are also contributing to market growth. Compared to open surgeries, minimally invasive techniques result in lesser tissue trauma and reduced postoperative pain. Patients who undergo minimally invasive procedures have shorter hospital stays and fewer complications. The adoption of minimally invasive surgeries has increased rapidly in recent years. For instance, over 90% of cholecystectomy procedures are now performed laparoscopically compared to just 10% in 1990s. As minimally invasive surgeries become more common, it will boost the postoperative pain management market.

The strong product pipeline of novel pain therapeutics is another major driver. Pharmaceutical companies are investing significantly in R&D of innovative pain drugs with new mechanisms of action and better safety profiles compared to traditional opiates and NSAIDs. Several new drug classes like NERK antagonists, ion channel modulators, cannabinoids are under development for postoperative pain control. Device makers are also introducing advanced drug delivery systems and patient-controlled analgesia systems integrated with digital technologies to optimize pain relief. The launch of these pipeline products during the forecast period is expected to reshape the postoperative pain market.

The introduction of abuse-deterrent formulations of opioid analgesics is also propelling market growth. The opioid epidemic has led to efforts to develop opioids with tamper-resistant properties and mechanisms to prevent overdose or diversion. Abuse-deterrent opioids like morphine ER, oxycodone ER have gained traction as tools to minimize opioid misuse post-surgery while still providing effective pain control. Their increasing adoption will drive growth in the postoperative pain market.

Market Opportunities:

The emergence of personalized medicine and pharmacogenomics presents significant opportunities in the postoperative pain market. Genetic testing can identify how patients metabolize analgesics and their risk of side effects. This allows personalized prescribing of appropriate medications and doses based on the patient's genetic makeup. Companies are developing gene-based diagnostic tests for pain treatment outcomes while pharmacogenomics-based pain therapies are also under development. Precision approaches can improve safety and efficacy.

The integration of digital technologies like smartphone apps, wearables and data analytics also offers scope for market growth. Digital pain monitoring systems can collect real-time patient data, adjust drug dosing, and enable remote follow-ups. Automated drug dispensing pumps for patient-controlled analgesia increase convenience and accuracy. Data analytics help gain insights to optimize pain management protocols. As digital health adoption increases, it is likely to revolutionize postoperative pain management.

Another opportunity is the development of non-pharmacological pain therapies as alternatives to pain drugs. Options like nerve stimulation through TENS devices, cryotherapy, acupuncture, massage, and virtual reality distraction therapy are being evaluated. Multimodal non-opioid approaches can minimize adverse events and drug dependency in postoperative pain management. Bioelectronics is also an emerging field with devices that use electrical nerve signals to modulate pain.

Expanding therapeutic applications of drugs like antidepressants, anticonvulsants, and muscle relaxants beyond their conventional uses also presents opportunities. These drugs are increasingly being assessed for acute and chronic postoperative pain control as adjuncts or alternatives to traditional analgesics. The broadening application scope of such existing drug classes for pain is an area of innovation.

Market Trends:

The adoption of minimally invasive surgeries like laparoscopic surgery, arthroscopy, endoscopy has been rising rapidly. Compared to traditional open surgeries, minimally invasive techniques result in less tissue injury and lower postoperative pain. Patients require less pain medications and their hospital stay is also shorter. Robotic surgery and single-incision laparoscopy are also gaining popularity. As minimally invasive surgery utilization increases, it will reshape the postoperative pain management market.

Another key trend is the shift towards same-day surgeries or ambulatory surgical centers. Advances in surgical techniques, anesthesia, and pain management are facilitating outpatient procedures for many surgeries that previously required hospitalization. Same-day joint replacements, bariatric surgery, hernia repair are becoming more common. Ambulatory centers allow faster discharge and cost savings. This shift from inpatient to outpatient surgeries will impact postoperative pain medication usage and device needs.

The demand for abuse-deterrent formulations of opioid drugs is rising significantly due to concerns over misuse of conventional opioids. Abuse-deterrent technologies such as physical barriers, prodrug formulations, and anti-tampering mechanisms in opioids prevent manipulation and misuse while maintaining controlled drug release. Several abuse-deterrent opioids like OxyContin OP, Embeda ER have been approved. This new generation of safer opioids will gain increasing preference for acute postoperative pain management.

The integration of digital technologies to enable personalized pain management is an emerging trend. Apps and wearables allow tracking of pain levels and medication usage. Big data analytics provide insights to improve protocols. Automated drug delivery systems like smart pumps alter dosing based on feedback. Digital therapy can transform acute postoperative pain management by adjusting treatment based on individual patient needs and preferences.

Market Restraints:

One major restraint is the concern over the side effects and risks associated with certain analgesics, particularly opiates. Common side effects of opioids include nausea, constipation, sedation, respiratory depression among others. Prolonged use leads to dependency and high abuse potential. These concerns have made physicians and regulatory bodies increasingly cautious regarding postoperative opioids prescription despite their efficacy.

The patent expiry of major blockbuster pain medications like Lyrica, Cymbalta is also challenging the postoperative pain market. Loss of exclusivity results in sales decline due to generic competition. Companies need to expand their pipelines or develop modified dosage forms to offset this loss. However, R&D costs are increasing even as pricing pressures impact profitability.

Stringent regulations surrounding the development and approval of pain drugs have become a restraint. Regulatory bodies like the FDA have tightened approval criteria for new analgesics given safety concerns over drugs like opioids or NSAIDs. Manufacturers are required to conduct more stringent pre-clinical and clinical trials to prove the safety of investigational pain drugs before their approval. This increases time and costs significantly.

The COVID-19 pandemic resulted in the postponing of elective surgeries to minimize hospital visits. This severely impacted the number of procedures conducted in 2020 and 2021 leading to reduced demand for postoperative pain medications. Though elective surgery volumes are recovering, recurring waves of infection may impact postoperative pain market growth.

Recent Developments:

|

Development |

Involved Company |

|

US FDA approval for Exparel liposomal bupivacaine injection Pacira BioSciences |

BioSciences |

|

Health Canada approval for DUOPA for advanced Parkinson’s disease AbbVie |

AbbVie |

|

NDA filing for HTX-019 for postoperative pain by Heron Therapeutics |

Heron Therapeutics |

|

Product Launch |

Company Name |

|

In January 2023, Bayer launched RIVACOM a rivastigmine transdermal patch for Alzheimer's disease in Japan. It provides steady drug delivery and reduces gastrointestinal side effects. It expands Bayer's Alzheimer's portfolio in Japan. |

Bayer |

|

In November 2022, Eli Lilly launched Reyvow for acute migraine treatment in adults in the US after FDA approval. It offers a new mechanism of action by blocking CGRP receptors. It expands Lilly’s pain portfolio. |

Eli Lilly |

|

In May 2022, Bristol Myers Squibb launched Zeposia, an oral sphingosine 1-phosphate receptor modulator for ulcerative colitis in the US. It improves efficacy and administration over biologics. |

Bristol-Myers Squibb |

|

Merger/Acquisition |

Involved Companies |

|

In January 2023, Pfizer acquired Biohaven Pharmaceutical for USD 11.6 billion. It boosts Pfizer’s portfolio with Biohaven’s new CGRP inhibitors for migraine. |

Pfizer |

|

In June 2022, Teva acquired La Jolla Pharmaceutical expanding its portfolio with Giapreza for treating low blood pressure. |

Teva |

|

In 2022, Sanofi acquired Amunix expanding its pipeline with Amunix’s cytokine therapies. |

Sanofi |

|

In January 2023, Pfizer acquired Biohaven Pharmaceutical for USD 11.6 billion. It boosts Pfizer’s portfolio with Biohaven’s new CGRP inhibitors for migraine. |

Pfizer |

Market Regional Insights:

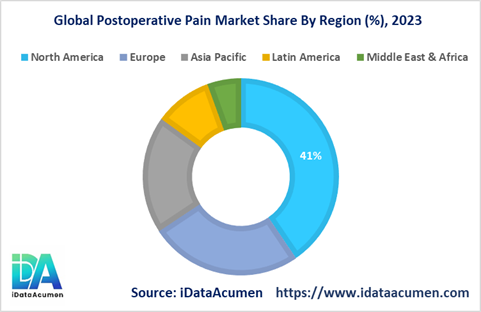

North America is expected to be the largest market for Postoperative Pain Market during the forecast period, accounting for over 40% of the market share in 2023. The growth is driven by high surgery volumes and healthcare spending.

Europe is expected to be the second-largest market accounting for 25% market share in 2023 driven by established healthcare infrastructure.

Asia Pacific is expected to be the fastest-growing market for Postoperative Pain Market, with a CAGR of 9% during 2023-2031 driven by expanding surgical procedures and healthcare access.

Market Segmentation:

- By Drug Class

- Non-steroidal anti-inflammatory drugs (NSAIDs)

- Opioids

- Local anesthetics

- Acetaminophen

- Nerve blockers

- By Route of Administration

- Oral

- Injection

- Topical

- Others (transdermal, inhaled, etc.)

- By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Others (clinics, long-term care, etc.)

- By Surgery Type

- Orthopedic

- Obstetric and gynecologic

- General

- Cardiac

- Neurological

- By End Use

- Hospitals

- Clinics

- Homecare

- Others (ambulatory surgical centers, long-term care centers, etc.)

- Regions

- By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

- North America

Top companies in the Postoperative Pain Market:

- Pfizer

- Novartis

- Teva Pharmaceutical

- Mylan

- Allergan

- Purdue Pharma

- Endo Pharmaceuticals

- AstraZeneca

- Johnson & Johnson

- GlaxoSmithKline

- Merck

- Eli Lilly

- AbbVie

- Bayer

- Baxter

- Halyard Health

- BD

- Boston Scientific

- Medtronic

- Stryker