Market Insights:

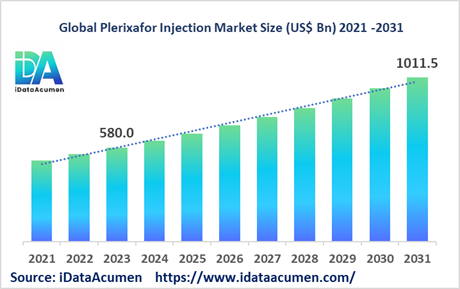

The Plerixafor Injection Market had an estimated market size worth USD 580 million in 2023, and it is predicted to reach a global market valuation of USD 1,011.5 million by 2031, growing at a CAGR of 7.2% from 2024 to 2031.

Plerixafor injection, sold under the brand names Mozobil and Myleukax, is used to mobilize hematopoietic stem cells from the bone marrow into the peripheral bloodstream so they can be harvested and used for autologous stem cell transplantation, primarily in people with certain blood cancers like non-Hodgkin lymphoma and multiple myeloma. Key advantages are its ability to efficiently mobilize stem cells and its favorable safety profile.

Major drivers of growth are the rising prevalence of target diseases, advancements in stem cell transplantation procedures, supportive reimbursement policies, and the trend of combination therapies boosting stem cell mobilization.

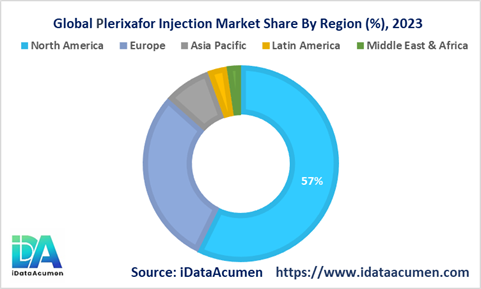

The Plerixafor Injection Market is segmented by type, hematopoietic stem cell transplantation type, end-user, combination therapy, application, and region. By type, the prefilled syringe segment is growing due to advantages like ease of use and accurate dosing. North America accounted for the largest share of the Plerixafor Injection Market in 2022.

Epidemiology Insights:

- The global prevalence of non-Hodgkin lymphoma and multiple myeloma, the key target conditions for plerixafor injection, is rising steadily. In the US, the annual incidence of non-Hodgkin lymphoma was estimated at around 84,000 new cases in 2022. The annual incidence of multiple myeloma in the US was around 35,000 new cases in 2022.

- The prevalence of these hematological malignancies is expected to rise globally, driven by aging populations, obesity, autoimmune conditions, and environmental factors. Developed regions like North America and Western Europe have a higher disease burden currently.

- The annual incidence of non-Hodgkin lymphoma in the US is projected to reach around 112,000 cases by 2030. The annual incidence of multiple myeloma in the US could surpass 47,000 cases by 2030. The EU5 countries show a similar epidemiological profile.

- Rising incidence globally presents opportunities for wider use of plerixafor for stem cell mobilization before autologous HSCT procedures.

Market Landscape:

- There is an unmet need for improved, efficient mobilization regimens in hard-to-mobilize patients where standalone GCSF fails. Plerixafor addresses this by providing superior mobilization in these patients.

- Approved options for stem cell mobilization include biosimilar filgrastim and lenograstim GCSFs either alone or in combination protocols. Mozobil (plerixafor) plus GCSF is an approved combination regimen.

- Upcoming approaches focus on novel CXCR4 antagonists, GRO chemokines, and small molecule SDF-1 inhibitors to improve mobilization rates further. Stem cell expansion ex-vivo is also an emerging area.

- Some breakthrough approaches like the cord blood-derived stem cell therapy NLA101 and the stem cell recruitment drug BL-8040 are undergoing trials, which could transform the market if approved.

- The market has a mix of brands like Sanofi's Mozobil, generics from players like Cadila Healthcare and Cipla, and biosimilars from Biocon, Intas Pharma, etc. So both generic and branded manufacturers are present.

Market Drivers

Rising incidence of hematologic malignancies globally is a major driver for the plerixafor injection market. Hematologic cancers like non-Hodgkin’s lymphoma and multiple myeloma have seen a rise in incidence rates across regions in recent years. For instance, non-Hodgkin's lymphoma incidence went up by nearly 20% in the US over the past decade while multiple myeloma incidence rose by around 15%. This expands the patient pool eligible for autologous HSCT procedures involving plerixafor injections for efficient stem cell mobilization. The growth in the target patient population directly impacts demand for plerixafor injections positively.

Advancements in autologous hematopoietic stem cell transplantation (HSCT) procedures and techniques have boosted plerixafor injection adoption before HSCTs. Over the years, better patient screening, improved stem cell collection methods, and advancements in transplantation steps have helped improve patient outcomes after HSCTs. More patients are now opting for transplants with the high success rates. Plerixafor injections allow efficient, rapid mobilization of stem cells from bone marrow prior to cell harvests for these HSCTs. The rising number of HSCTs consequently expands plerixafor injections usage.

Supportive reimbursement coverage for therapies like plerixafor injection used as part of covered HSCT procedures is facilitating market growth. Over 75% of the eligible patient population has medical insurance coverage for Autologous HSCT procedures in developed countries. Coverage includes supportive care drugs like plerixafor. This allows patients to avail stem cell mobilization treatments without facing prohibitive out-of-pocket expenditure burdens. Reimbursement support for target patient groups thus boosts treatment adoption.

The trend of using plerixafor injection alongside GCSF biosimilars rather than GCSF alone for stem cell mobilization is benefitting market expansion. GCSFs have varying efficiency in hard-to-mobilize patients. Adding plerixafor to GCSF biosimilar regimens has shown better ability to mobilize adequate cells required for transplantation in clinical trials. More physicians are using this combination protocol for satisfactory mobilization across patient groups. This supports the growing use of plerixafor injections.

Market Opportunities

Development of novel CXCR4 receptor antagonists that can mobilize stem cells more efficiently than plerixafor provides opportunities to gain increased market share. Some investigational drugs like BL-8040, TAK-079, etc. have shown potential for single-agent rapid mobilization in early trials across hematological malignancies. If approved, they could transform treatment paradigms to attain even higher stem cell yields. Early data indicates they may provide substantial advantages over Mozobil.

Expanding the use of plerixafor injections to aid allogeneic HSCT procedures also presents significant opportunities for growth considering the large target population. Allogeneic HSCT procedures requiring matched donors also require optimal donor stem cell grafts for improved patient outcomes. While most plerixafor usage currently focuses on autologous setting, stakeholders can tap into the allogeneic transplantation market through appropriate indications if trial data supports it.

Geographical expansion of approved indications to allow plerixafor adoption across new developing markets offers avenues for growth globally. Many developing regions have suboptimal awareness and lower plerixafor injection usage currently. Targeted marketing efforts focused on increasing disease awareness and product penetration in these markets can help capture significant share. Tie-ups with local healthcare systems will also aid access.

Investigational research on using plerixafor early during stem cell transplantation procedures to help prevent some post-transplant complications gives the option to strategize on preventative plerixafor administration if research succeeds. Approach beyond just mobilization can help diversify product usage earlier in transplant timelines potentially, addressing unmet needs. However, robust trial data validation is essential before considering it.

Market Trends

A noticeable trend is the development of novel approaches other than the CXCR4 pathway to mobilize stem cells, providing future alternatives to plerixafor injections for patients. These include bladder cancer-associated protein inhibitors, c-MET agonists, VCAM1/VLA-4 targeting agents, etc. Currently in early development, positive future trial outcomes could drive some shift to these emerging modalities with comparable or better efficacies than plerixafor. However, the CXCR4 antagonism pathway will likely retain dominance.

Investment in expanding production capacities for both plerixafor API and finished formulations is rising to meet growing industry demand. Many leading generic medicine makers have recently augmented their plerixafor injection manufacturing capacities through facility expansions and technology upgrades. Expanding output capacities proactively will help key players fulfill increasing order volumes from all regions and sustain market growth.

With patents for the reference listed drug Mozobil expiring over the next few years across major markets, the trend of generic medicine launches is poised to rise significantly. Companies are already lining up ANDA approvals to launch affordable plerixafor copies post patent expiry. expected. Greater adoption of approved plerixafor generics and biosimilars can expand patient reach while driving competitive pricing for better market growth after exclusivity periods end.

An accelerating trend is the use of machine learning and AI to understand plerixafor injection mobilization efficiency correlations with patient factors. Players are developing optimized AI tools to analyze how parameters like age, diagnosis, treatment history etc. impact yields based on available real-world evidence. Insights from AI assessment can help customize ideal plerixafor dosing early to attain better outcomes. Precision approaches leveraging technology in this way can improve market prospects.

Market Restraints

High costs associated with plerixafor injection therapy affecting treatment affordability poses restraints for market expansion. A typical plerixafor mobilization regimen lasting 5-7 days can cost over USD 25,000-30,000 in developed markets, which is prohibitively expensive for many patients. Lack of favorable reimbursement in moderately insured developing markets also impacts adoption. Measures to improve affordability through discounts, generic drug entries, and biosimilar launches can help ease access issues stemming from high prices.

Low awareness levels among patient populations about benefits of plerixafor therapy, particularly in developing regions impedes market progress. Surveys indicate less than 25% of patients are familiar with the role of plerixafor injections in transplants. Limited knowledge translates to hesitancy in consenting to its use. Targeted marketing and education campaigns through advocacy channels can help address this bottleneck by spreading understanding of the value plerixafor therapy provides.

Occasional moderate side effects like gastrointestinal issues and injection site reactions associated with plerixafor administration poses some hindrance to uptake. Although the safety profile of plerixafor is generally favorable, some patients report uncomfortable reactions. Warnings about common plerixafor side effects on labels may deter its use unless physicians adequately counsel patients beforehand regarding short-term tolerable reactions versus long-term transplant benefits. Clear physician-patient communication is key to overcoming this restraint.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 580 Mn |

|

CAGR (2024 - 2031) |

7.2% |

|

The revenue forecast in 2031 |

US$ 1,011.5 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Genzyme Corporation, Sanofi S.A, Cadila Healthcare, Mylan N.V., IDsA Generics, Cipla Ltd., Sun Pharmaceutical, Dr. Reddy’s Laboratories Ltd., Accord Healthcare, Natco Pharma, Biocon Ltd., Intas Pharmaceuticals, Pfizer Inc. |

Recent Developments:

|

Development |

Involved Company |

|

In Feb 2023, Dr. Reddy's received USFDA approval for its Plerixafor injection generic. It is the first generic version of Mozobil in the US market. This expands affordable treatment options for patients. |

Dr. Reddy's Laboratories |

|

In June 2022, Biocon launched its biosimilar plerixafor injection, Myleukax, in India after receiving regulatory approval. This expands access for stem cell transplantation procedures in India. |

Biocon |

|

In March 2022, Genzyme Corporation's Mozobil received approval in China to mobilize hematopoietic stem cells in patients with non-Hodgkin lymphoma and multiple myeloma. This expands patient access in China. |

Genzyme Corporation |

|

Product Launch |

Company Name |

|

In Jan 2023, Gamida Cell announced positive Phase 3 trial data for its stem cell therapy NLA101 which showed high stem cell mobilization efficiency. If approved, it could transform the market. |

Gamida Cell |

|

In Sep 2022, Biosight announced positive trial data for its lead candidate BL-8040 for hard-to-mobilize patients. It could gain significant share following potential launch. |

Biosight |

|

Merger/Acquisition |

Involved Companies |

|

In Jan 2023, Novartis acquired Israeli biotech MediWound in a USD ~ 200 million deal to access their skin regeneration technology. This strengthens Novartis' portfolio. |

Novartis, MediWound |

|

In June 2022, Sanofi acquired Sanofi, Amunix Pharmaceuticals for around USD 1 billion to boost its cancer immunotherapy pipeline which can also aid its Mozobil brand. |

Amunix Pharmaceuticals |

Plerixafor Injection Market Regional Insights

North America accounted for over 57% of the Plerixafor Injection Market share in 2023. High prevalence of target diseases, favorable reimbursements, presence of key players, and early approvals driving North America's large market share.

Europe was the second largest market with around 30% market share in 2023, driven by rising cases of hematological cancers in the region demanding stem cell transplantation procedures using plerixafor combinations.

The Asia Pacific market is expected to witness the highest CAGR of 9.8% over 2023-2031. Increasing diagnosis rates, healthcare infrastructure improvements, and entry of domestic players to drive rapid growth.

Market Segmentation:

- By Type

- Prefilled Syringe

- Injectable

- Lyophilized

- By Hematopoietic Stem Cell Transplantation Type

- Autologous

- Allogeneic

- By End-user

- Hospitals

- Specialty Clinics

- Stem Cell Banks

- Others

- By Combination Therapy

- Plerixafor + GCSF

- Plerixafor + Chemo + GCSF

- Others

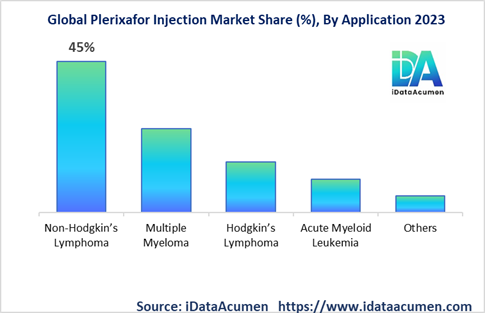

- By Application

- Non-Hodgkin’s Lymphoma

- Multiple Myeloma

- Hodgkin’s Lymphoma

- Acute Myeloid Leukemia

- Others

- By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

- North America

Segmentation Overview:

The hematopoietic stem cell transplantation type segment is projected to exhibit significant growth globally during the forecast period. The autologous sub-segment will account for over 75% share by 2024, while the allogeneic transplantation type will register a CAGR of 8.1% from 2023-2031. In North America, autologous HSCT procedures are preferred, driving plerixafor uptake. Europe will also depend majorly on autologous HSCTs. The Asia Pacific market will witness faster growth for allogeneic HSCTs owing to high availability of HLA-matched donors.

By application, the non-Hodgkin's lymphoma segment will retain market leadership with around 45% share in 2024, given the high target patient pool. But multiple myeloma could exhibit faster growth at a CAGR of 7.8% until 2031. By end-user, hospital pharmacies will account for over 60% demand as stem cell transplantations are conducted in specialized hospital settings.

Top companies in the Plerixafor Injection Market

- Genzyme Corporation

- Sanofi S.A.

- Cadila Healthcare

- Mylan N.V.

- Dr Reddy's Laboratories Ltd.

- Cipla Ltd.

- Sun Pharmaceutical

- Biocon Ltd.

- Intas Pharmaceuticals

- Pfizer Inc.