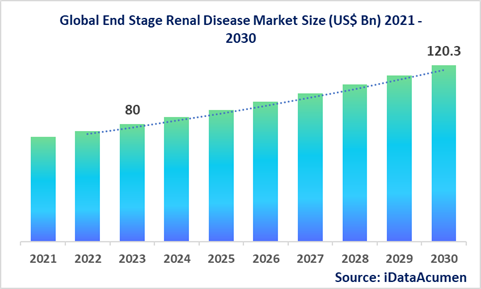

The End Stage Renal Disease (ESRD) Market is poised for substantial growth, with projections indicating that it will reach a staggering US$ 120.3 billion by the year 2030. This represents a substantial increase from the US$ 80.0 billion recorded in 2023, reflecting a robust Compound Annual Growth Rate (CAGR) of 6% over the forecast period spanning from 2023 to 2030.

ESRD, in essence, signifies the terminal phase of chronic kidney disease, where the kidneys have essentially lost their capacity to effectively filter waste products from the bloodstream. To sustain life at this stage, patients require either dialysis or a kidney transplant. The surge in diabetes and hypertension cases, which are the leading culprits behind ESRD, stands as a pivotal factor fueling the expansion of this market.

Globally, the incidence of ESRD is on an upward trajectory, with over 2 million individuals commencing dialysis each year. The ESRD market is meticulously segmented based on treatment, products and services, end-user demographics, and geographic regions. Among these segments, hemodialysis emerges as the frontrunner, boasting the largest market share. Its prominence is attributed to its widespread adoption and the introduction of cutting-edge hemodialysis devices. Notably, in 2021, Fresenius Medical Care introduced the 5008-dialysis machine, equipped with touchscreen functionality and connectivity features for remote monitoring, exemplifying the innovation driving this sector.

The landscape of this market is largely shaped by key players in the dialysis service realm, with industry giants such as Fresenius Medical Care, DaVita, and Baxter at the forefront of industry dominance. These major players have established a strong foothold, contributing significantly to the market's growth and development.

Epidemiology Insights:

- The prevalence of ESRD is highest in North America, East Asia, and Europe. In the US, ESRD prevalence in 2022 was 961 per million population.

- Diabetes and hypertension remain the leading causes of ESRD globally, driven by aging populations and unhealthy lifestyles. Obesity is an emerging risk factor.

- In the US, ESRD incidence rate is 353 per million population as of 2021. In EU5, the average incidence rate is around 180 per million population.

- The growing ESRD patient pool presents opportunities for dialysis services and equipment, especially in emerging economies like India and China where healthcare infrastructure is improving.

- ESRD is not a rare disease. It is one of the most common severe chronic conditions worldwide.

Market Landscape:

- There is a need for more convenient and flexible dialysis options compared to in-center hemodialysis. Home hemodialysis and peritoneal dialysis aim to address this but are underutilized currently.

- Hemodialysis, peritoneal dialysis, and kidney transplantation are the common ESRD treatment modalities. Drug treatment is used to manage complications.

- Wearable artificial kidneys, bioengineered kidneys, and implantable dialysis devices are emerging futuristic technologies. Stem cell therapies to repair kidney damage are also being explored.

- 3D bioprinting of kidney tissue and advancements in organ decellularization to reduce transplant rejection are game-changing innovations in the pipeline.

- The market is dominated by major dialysis service companies like Fresenius Medical Care, DaVita, and Baxter. Device makers like B. Braun, Nipro, and Medtronic are other key players.

End Stage Renal Disease Market Drivers:

The incidence of end stage renal disease (ESRD) is rising globally, driven by an aging population and increased prevalence of diabetes, hypertension, and obesity. This growing patient pool is a major driver of the ESRD treatment market.

Rising prevalence of diabetes and hypertension

Diabetes and hypertension are the leading causes of ESRD worldwide. According to data, approximately 40-50% of ESRD cases are attributed to diabetic kidney disease. With rising rates of these diseases due to lifestyle changes and population aging, the number of patients progressing to ESRD is increasing. For instance, in the US the prevalence of ESRD is expected to grow at an annual rate of 1-4% over the next decade as per estimates. This expanding patient pool will drive demand for dialysis equipment, consumables, and services. Companies are expanding dialysis service networks especially in developing markets to tap growth opportunities offered by the rising ESRD incidence.

Technological advancements and product innovation

Advances in dialysis techniques and equipment are improving treatment efficiency and quality of life for ESRD patients. For example, wearable artificial kidney devices promise greater convenience and flexibility over conventional dialysis. Innovations like artificial intelligence-enabled smart dialysis machines that automatically adjust treatment parameters also enhance the standard of care. Further, remote patient monitoring and telehealth solutions enable home dialysis assistance. Market leaders are investing significantly in R&D to develop next-gen dialysis products and home hemodialysis systems to capitalize on changing market needs. This pushes technology innovation and adoption.

Favorable government policies

Government initiatives to improve ESRD treatment rates and reimbursement policies that cover dialysis costs are key drivers increasing treatment accessibility and affordability. For instance, China’s healthcare reforms expanded insurance coverage for dialysis and led to rapid growth in the number of dialysis centers. Japan’s universal insurance system also provides accessible and low-cost dialysis. Such favorable policies encourage dialysis service expansion particularly in emerging countries with improving healthcare infrastructure and insurance coverage.

Increase in renal transplants

The number of kidney transplants performed globally has increased steadily over the past decade as transplant waiting lists expand. Advancements in organ preservation techniques, minimally invasive transplantation procedures, paired donation programs, and use of marginal donors have boosted transplant rates in developed countries. Further, rising awareness about organ donation in emerging markets is widening access. Transplants offer a cost-effective alternative to long-term dialysis. Growth in procedures will spur demand for immunosuppressants and post-transplant therapeutic drugs.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 80.0 Bn |

|

CAGR (2023 - 2030) |

6% |

|

The revenue forecast in 2030 |

US$ 120.3 Bn |

|

Base year for estimation |

2021 |

|

Historical data |

2017-2020 |

|

Forecast period |

2023-2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Fresenius Medical Care, DaVita, Baxter, B. Braun, Nipro, Medtronic, Nikkiso, Asahi Kasei, Toray, NxStage Medical |

End Stage Renal Disease Market Opportunities:

The ESRD treatment space has immense scope for innovation across the technology and services spectrum to improve clinical outcomes and quality of life for patients.

Home hemodialysis systems

Currently, over 90% of dialysis patients undergo in-center hemodialysis, which is cumbersome. Expanding home hemodialysis options and capabilities can disrupt the market. For instance, easy-to-use compact hemodialysis machines for home use combined with remote monitoring technology provide opportunities to tap the home dialysis segment. Market players are also developing implantable hemodialysis devices for overnight home use. Promoting home hemodialysis through policy incentives and lowering device costs can help realize the potential.

Wearable artificial kidneys

Wearable artificial kidney (WAK) devices are futuristic dialysis systems connected externally to a patient's circulation to filter blood continuously. They promise truly liberating, 24-hour dialysis anytime and anywhere without clinic visits. WAKs currently in development utilize advanced nanotechnology and microfluidics. With miniaturization, patient convenience and compliance can be significantly improved compared to existing dialysis methods. If efficacy and costs are viable, WAKs could transform ESRD management.

Incorporating regenerative medicine

Cell and gene therapies to regenerate kidney function have shown early promise in animal models and human trials. For example, injecting mesenchymal stem cells in ESRD patients was found to improve residual kidney function. Further research on techniques using patient-derived cells to engineer replacement kidney tissue for transplantation is underway. Bioprinting may enable 3D printed organs. As regenerative medicine advances, curative solutions to potentially eliminate dialysis dependency can emerge.

Deploying artificial intelligence

The application of AI tools in ESRD treatment is still nascent with vast potential. AI-enabled decision support systems can aid clinicians in aspects like treatment planning and medication management. Machine learning algorithms can analyze patient data to predict outcomes, risk of hospitalization, and optimize prescriptions. Chatbots and virtual assistants can support patient education and monitoring. Automation of tedious administrative tasks is another application. Intelligent analytics of population health data can also inform policies. AI adoption can significantly enhance efficiency and personalization.

End Stage Renal Disease Market Trends:

The ESRD treatment landscape is undergoing major changes led by technology innovation, a shift towards patient-centric care, and digital health integration.

Development of cutting-edge dialysis modalities

High throughput hemodialysis using membranes with superior filtration capacity allows shorter, less frequent dialysis. Portable hemodialysis devices are advancing home dialysis prospects. Peritoneal dialysis is also being enhanced via approaches like implantable ports. New modalities that improve blood purification efficiency and mimic natural kidney function are emerging from R&D. Adoption of cutting-edge techniques can potentially reduce morbidity.

Industry consolidation through mergers and acquisitions

Seeking growth opportunities and economies of scale, mergers and acquisitions involving dialysis services majors, specialized kidney care providers, and medical device companies are rising. For example, recent consolidations include Baxter’s acquisition of Medi-Nav and DaVita’s MedSleuth buyout. Such strategic deals give players access to new geographies, patient pools, products, analytics, and resources. Market consolidation also increases access to integrated ESRD care.

Expanding real-world data platforms and collaborations

Real-world evidence from clinical practice is becoming vital for informing product development and care decisions. Patients on dialysis generate significant data. Collaborative initiatives like the Kidney Disease: Improving Global Outcomes program and the European Renal Registry Network are expanding. Public-private partnerships like American Society of Nephrology's CKDopps also enhance real-world data collection. These trends promote evidence-based personalized medicine.

Increasing uptake of digital health technologies

Digital solutions like telehealth, remote monitoring apps, electronic medical records, and data analytics are gaining traction in ESRD management. For example, uptake of telehealth for dialysis assistance rose during the COVID-19 pandemic. Digital trend enables care coordination, medication compliance monitoring, and better clinical decisions. It also empowers patients with self-care tools. Integrating digital health can significantly improve outcomes.

End Stage Renal Disease Market Restraints:

While the ESRD treatment market outlook is positive overall, some challenges exist.

High costs of dialysis

Dialysis imposes a substantial economic burden on healthcare systems due to expensive equipment, high resource use, and long-term treatment. In developing countries like India, many patients cannot afford ongoing dialysis. In the US, Medicare ESRD costs reached US$ 126 billion in 2020. Without policy measures to control costs through funding and incentives for more affordable modalities, expenses remain a major barrier.

Morbidity and low survival rates on dialysis

Dialysis is associated with complications like infections, cardiovascular disease, and other co-morbidities that adversely impact quality of life and survival. Mortality rates of dialysis patients remain higher than desired despite medical advancements. Such relatively poor clinical outcomes deter uptake and hinder market growth. Better solutions to morbidity are needed.

Shortage of trained staff

Limited training capacity results in shortages of qualified dialysis technicians and nephrologists globally. This restricts service expansion and technology adoption. For instance, developing regions like Africa and India face an acute lack of skilled dialysis staff hampering growth. Increased training infrastructure and vocational programs can help ease this bottleneck.

Recent Developments:

|

Development |

Company Name |

|

In January 2023, Outset Medical launched the Tablo Hemodialysis System for hospitals and dialysis centers in Europe. Tablo is an FDA-approved compact hemodialysis machine that provides dialysis treatment using just water and connected to a standard electrical outlet and drain. |

Outset Medical |

|

In November 2022, Medtronic received FDA approval for its Invigor Heart Failure (HF) system, an implantable pulmonary artery pressure sensor for patients with chronic HF. It helps monitor changes in pulmonary pressure to better manage medications. |

Medtronic |

|

In September 2022, Baxter acquired Medi-Nav, expanding Baxter’s remote patient monitoring capabilities for home dialysis patients. |

Baxter |

|

In June 2022, Fresenius Medical Care launched its new-generation 5008 hemodialysis system with touchscreen interface and connectivity features for telehealth. |

Fresenius Medical Care |

|

In May 2022, DaVita acquired MedSleuth, a renal care analytics platform provider, to strengthen DaVita’s capabilities in data analytics and risk stratification. |

DaVita |

|

In March 2022, Nipro and Baylor Scott & White Health partnered to open dialysis clinics in Texas, US as part of Nipro's expansion in North America. |

Nipro Corporation |

|

In January 2022, Quanta Dialysis Technologies raised USD 245 million in Series D financing to advance clinical trials of its SC+ personalized hemodialysis system. |

Quanta Dialysis Technologies |

End Stage Renal Disease Market Regional Insights:

ESRD treatment rates vary significantly across geographic regions due to differences in access to care.

The landscape of End Stage Renal Disease (ESRD) treatment is marked by significant regional disparities, primarily stemming from variations in healthcare accessibility and infrastructure. A closer examination of the regional insights reveals noteworthy trends and factors driving market dynamics.

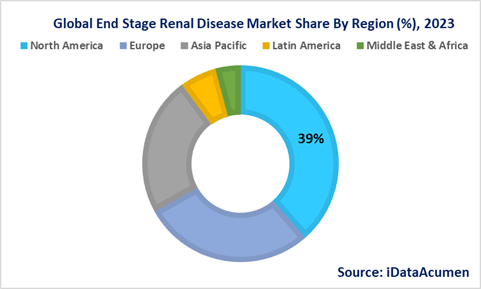

- North America: Leading the Way North America emerges as the powerhouse in the ESRD market, commanding a substantial market share of 38.7% in 2023. This dominance can be attributed to the high prevalence of ESRD cases in the United States, bolstered by a favorable reimbursement environment. As such, North America is anticipated to maintain its position as the largest market throughout the forecast period.

- Europe: The Second-Largest Contender Europe follows closely behind, securing the status of the second-largest ESRD market, with a market share of 28.5% in 2023. The region is witnessing a surge in ESRD incidence rates, supported by robust public healthcare funding. This funding infusion acts as a catalyst, propelling the growth of ESRD treatment options across European countries.

- Asia Pacific: A Rapidly Evolving Frontier The Asia Pacific region is poised to be the fastest-growing ESRD market, projected to achieve an impressive CAGR of 7.2% during the forecast period. This growth is underpinned by the concerted efforts to expand access to dialysis in countries like China and India. The vast patient populations in these regions present significant opportunities for market expansion and innovation.

- Other Regions: Contributing to Global Growth Latin America and the Middle East & Africa regions also play vital roles in the global ESRD market. Latin America commands a market share of 6.1%, while the Middle East & Africa accounts for 4.1%. Although these regions hold relatively smaller shares, they are integral contributors to the overall growth and diversity of the ESRD market.

In summary, the regional dynamics of the ESRD market underscore the influence of healthcare infrastructure, disease prevalence, and reimbursement policies on market growth. While North America and Europe maintain their positions as key players, the Asia Pacific region emerges as a dynamic growth frontier, with untapped potential for the future. Additionally, Latin America and the Middle East & Africa continue to be integral to the global ESRD landscape.

End Stage Renal Disease Market Segmentation:

- By Treatment Type

- Hemodialysis

- Peritoneal Dialysis

- Transplantation

- Others

- By Product & Services

- Equipment (Dialysis machines, water treatment, dialyzers)

- Consumables (Bloodlines, dialysate solutions)

- Services (In-center dialysis, home dialysis support)

- Software (EMR systems, telehealth)

- Others

- By Setting

- In-center

- Home-based

- Regions

- By End User

- Hospitals

- Dialysis Centers

- Home Care

- Others (clinics, ASCs)

- By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

Top companies in the End Stage Renal Disease Market:

- Fresenius Medical Care

- DaVita

- Baxter

- B. Braun

- Nipro

- Medtronic

- Nikkiso

- Asahi Kasei

- Toray

- NxStage Medical