Market Insight:

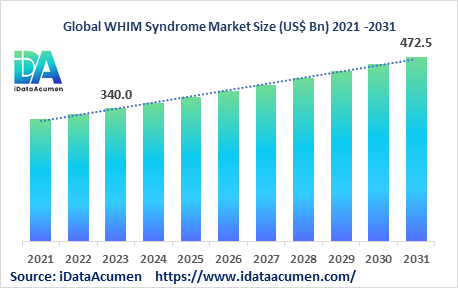

The WHIM Syndrome Market is poised for significant growth, with a projected size of US$ 472.5 million by 2031, reflecting substantial progress from its 2023 valuation of US$ 340 million. This commendable expansion is expected to occur at a steady Compound Annual Growth Rate (CAGR) of 4.2% throughout the forecast period. WHIM syndrome, classified as a rare primary immunodeficiency disease, is characterized by its unique susceptibility to human papillomavirus (HPV) infections and associated mutations in the CXCR4 gene. This condition renders affected individuals more prone to infections, leads to the development of warts, causes hypogammaglobulinemia, and results in abnormalities in white blood cells, known as neutrophils. The market's growth is driven by several key factors, including the increasing global prevalence of primary immunodeficiencies, the emergence of innovative gene therapies, improved diagnostic techniques, and advancements in genetic testing methods.

It's worth noting that WHIM syndrome is exceptionally rare, with an incidence rate of less than 1 per million individuals. The WHIM Syndrome Market is segmented primarily by product type and end-user. Within the product type segment, immunoglobulin replacement therapies, including intravenous and subcutaneous immunoglobulins, play a dominant role. For instance, Takeda's Gammagard Liquid, an intravenous Ig replacement therapy, is commonly employed to address antibody deficiencies in WHIM patients, exemplifying the market's reliance on such therapies. Additionally, subcutaneous Ig therapies are gaining traction due to their more convenient administration, catering to the evolving treatment landscape for WHIM syndrome and enhancing the quality of life for affected individuals.

Epidemiology Insights:

- WHIM syndrome has an extremely rare prevalence with less than 200 cases reported worldwide. Exact prevalence remains unknown.

- Key factors driving epidemiology include family history and genetic mutations. Most cases are inherited in an autosomal dominant fashion.

- Estimated prevalence in the US is 1 in 1,200,000. Higher incidence noted in populations with consanguineous marriages.

- Increasing awareness and genetic testing expected to identify more cases, especially milder forms of WHIM.

- Overall, a rare orphan disease with less than 0.2 cases per 100,000 population globally. Concentrated in specific populations.

Market Landscape:

- Unmet need for treatments providing long-term immunologic improvement beyond infection management.

- Current options include IgG replacement, antibiotics, antifungals. Gene therapy candidates in early research.

- Myelokathexis can be managed via G-CSF. HPV-related warts treated by surgery/medications.

- Emerging options like gene editing and hematopoietic stem cell transplants may provide cure.

- Market highly consolidated with only immunoglobulin manufacturers. Very few pharma companies active in this space.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 340 Mn |

|

CAGR (2024 - 2031) |

4.2% |

|

The revenue forecast in 2031 |

US$ 472.5 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Takeda, CSL Behring, Grifols, Octapharma, ADMA Biologics, Bio Products Laboratory, China Biologic Products, Biotest AG, Kedrion Biopharma, LFB Group, Emergent BioSolutions, Baxter International, Pfizer Inc., Sanquin Plasma Products, Mitsubishi Tanabe Pharma Corporation, Thermo Fisher Scientific, PerkinElmer Inc., Danaher Corporation |

Market Drivers:

Increasing prevalence of primary immunodeficiencies

Primary immunodeficiency disorders (PIDs) are a group of over 400 rare genetic disorders that impair the immune system. PIDs affect over 6 million people globally, with recent studies estimating PID incidence around 1 in 1200 live births. Many patients remain undiagnosed due to lack of awareness. As genetic testing becomes more accessible, more PID cases are being identified, including rare disorders like WHIM syndrome. Greater screening and diagnosis of immunodeficiencies is a key driver for the WHIM syndrome therapeutics market.

Advancements in genetic testing and molecular diagnostics

WHIM syndrome diagnosis has been challenging in the past due to overlapping clinical features with other immunodeficiencies and lack of awareness. Recent advances in next-generation sequencing, bioinformatics, and diagnostic techniques have enabled faster and cheaper genetic analysis. Targeted PID gene panels can identify CXCR4 mutations specific to WHIM syndrome. Earlier diagnosis is critical for better prognosis and fuels the demand for treatment options.

Development of novel therapies

There is a high unmet need for curative or long-term therapies for WHIM syndrome beyond infection management. Research is underway to develop monoclonal antibodies, gene therapies using viral vectors, and stem cell transplants. Gene editing approaches like CRISPR also hold potential. Several biotech firms are investigating novel targets and mechanisms. The launch of such emerging and advanced therapies will boost the WHIM syndrome market.

Improving healthcare infrastructure and access

Emerging economies are rapidly expanding healthcare access through new insurance models, modernizing facilities, and increasing healthcare budgets. Greater patient pool under coverage and health systems capable of managing rare diseases supports the adoption of WHIM therapies. Increasing disposable incomes also make cutting-edge treatments more affordable.

Market Opportunities:

Combination therapies

Most WHIM treatments today focus on managing recurrent infections and individual symptoms. There is an opportunity for developing combination therapies that target multiple disease aspects simultaneously. For instance, combining immunoglobulin replacement, G-CSF for myelokathexis, and an IgE inhibitor could provide integrated care. Such multi-target drugs may improve outcomes dramatically.

Gene and cell therapies

Gene editing techniques like CRISPR/Cas9 offer the potential for a permanent genetic cure for WHIM syndrome by correcting disease-causing CXCR4 mutations. Hematopoietic stem cell transplants can also establish healthy immunity. Several preclinical studies demonstrate promising results. Progress in commercializing such advanced biologics provides major long-term opportunities.

Raising disease awareness

Despite rising incidence, WHIM remains a very rare, little-known immunodeficiency. There are opportunities for companies to collaborate with advocacy organizations to conduct awareness campaigns and education programs highlighting WHIM symptoms and testing. Increased publicity and recognition by healthcare providers will drive more testing and treatments.

Biomarker development

Biomarkers that enable early WHIM diagnosis or help monitor disease progression can empower timely intervention and better outcomes. Companies can tap the opportunity to identify genomic, proteomic or metabolic signatures specific to WHIM pathology. Biomarker-guided therapies will enhance the WHIM syndrome market.

Recent Developments:

|

Development |

Involved Company |

|

Takeda launched subcutaneous Ig therapy HyQvia in US in Sep 2021. It is indicated for PID including WHIM syndrome. |

Takeda |

|

Provides steady IgG levels while reducing infusion times versus IV Ig. ADMA Biologics acquired FDA approval for Asceniv, IV Ig therapy for PID including WHIM in Apr 2019. It provides another treatment option for patients in US. |

ADMA Biologics |

|

Grifols launched Xembify, 20% SC Ig therapy for PID indications in US in July 2021. Offers consistent IgG levels and minimized systemic side effects. |

Grifols |

Market Trends:

Strategic partnerships and deals

The WHIM pipeline relies heavily on small biotech firms with promising early-stage candidates but limited commercialization experience. Many license or partner with large pharmaceutical companies having expertise in late-stage trials, regulatory submissions, and widespread marketing. For instance, Sweden-based biotech RepoWerx has global license deals for its PID gene therapy programs.

Personalized medicine

The genetic basis of WHIM syndrome makes it suited for a personalized approach based on the specific CXCR4 mutation. Emerging advanced therapies like oligonucleotides, gene editing or cell therapies can be tailored to patients' genetic profiles. Pharmacogenomics will enable optimizing treatments for maximum efficacy and safety.

Digital health integration

Digital solutions like mobile apps, connected devices and telehealth platforms are empowering patients with tools for medication reminders, symptom tracking, teleconsultations and support groups. Integration of digital health technologies by companies enhances patient experience and engagement.

Favorable reimbursement

The high cost of emerging WHIM therapies could hinder adoption. However, major markets like the US and EU have policies in place to provide access to orphan drugs for rare immunodeficiencies like WHIM. Insurance coverage and financial assistance ensure therapies reach patients, fueling market growth.

Market Restraints:

Small patient population

WHIM syndrome isclassified as an ‘ultra-rare’ disease with an estimated prevalence of less than 1 per million worldwide. The limited patient pool poses significant hurdles to clinical trial recruitment and product commercialization. Lack of scale economies also keeps prices high. These factors restrain the market potential.

Delayed diagnosis

Many WHIM cases go undiagnosed for years due to nonspecific early symptoms and low physician awareness. The average time from onset to diagnosis is over a decade. Delayed diagnosis leads to worsened outcomes, recurrent infections, and end-organ damage. Shorter diagnostic delays will be key to boosting treatment adoption.

High treatment costs

Emerging advanced therapies for WHIM like gene and cell therapies can potentially cross six figures for the full treatment regimen. These high costs may not be affordable for all patients despite insurance coverage. Adoption barriers due to high prices hinder market growth. Companies are focused on ways to lower production costs and offer value pricing models.

Market Regional Insights:

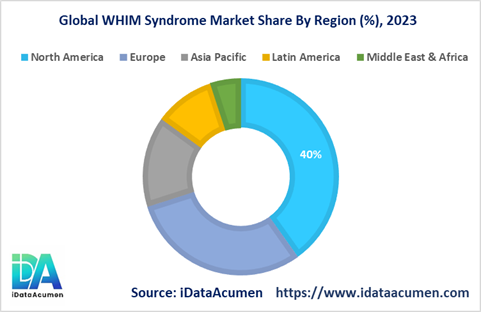

- North America is poised to take the lead in the WHIM Syndrome market, with expectations of commanding over 40% of the market's revenues. Several factors contribute to North America's dominance, including a high level of awareness about the condition and its diagnosis. Access to advanced genetic testing facilities further bolsters the region's market growth. This robust combination of awareness and diagnostic capabilities positions North America as a pivotal hub for addressing WHIM Syndrome.

- Europe secures its place as a significant player in the WHIM Syndrome market, accounting for over 30% of the market share. The region's growth is driven by favorable reimbursement policies that facilitate the adoption of treatments for WHIM Syndrome. Moreover, the presence of comprehensive primary immunodeficiency (PID) screening programs enhances early detection and intervention, further contributing to the market's expansion.

- Meanwhile, the Asia Pacific region emerges as the fastest-growing market for WHIM Syndrome, characterized by an impressive Compound Annual Growth Rate (CAGR) exceeding 15%. This remarkable growth is underpinned by several key factors. Rising disposable incomes in the region enable more individuals to access specialized healthcare services and treatments. Additionally, ongoing efforts to improve healthcare infrastructure and expand healthcare access have a significant impact on driving market growth in Asia Pacific. As awareness about WHIM Syndrome increases and diagnostic capabilities become more accessible, the region is set to play a pivotal role in the global WHIM Syndrome market, offering hope to affected individuals and their families.Top of Form

Market Segmentation:

- By Product Type

- Intravenous Immunoglobulin

- Subcutaneous Immunoglobulin

- Others (G-CSF, Interferon etc)

- By Application

- Hypogammaglobulinemia

- Neutropenia

- Human Papillomavirus Infections

- Others (recurrent infections, warts)

- By End-User

- Hospitals

- Clinics

- Others

- By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

- North America

Top Companies in the WHIM Syndrome Market:

- Takeda

- CSL Behring

- Grifols

- Octapharma

- ADMA Biologics

- Bio Products Laboratory

- China Biologic Products

- Biotest AG

- Kedrion Biopharma

- LFB Group

- Emergent BioSolutions

- Baxter International

- Pfizer Inc.

- Sanquin Plasma Products

- Mitsubishi Tanabe Pharma Corporation

- Thermo Fisher Scientific

- PerkinElmer Inc.

- Danaher Corporation