Market Analysis:

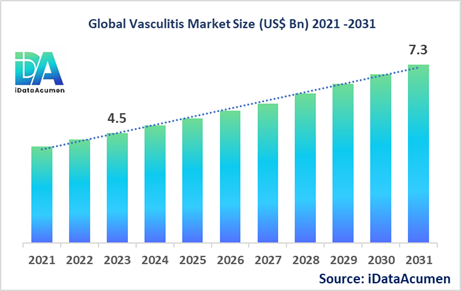

The Vasculitis Market size is expected to reach USD 7.3 billion by 2031, from USD 4.5 billion in 2023, at a CAGR of 6.3% during the forecast period.

Vasculitis refers to inflammation of blood vessels caused by an overactive immune system attacking the blood vessel. It can restrict blood flow and damage tissues and organs. Treatment involves immunosuppressants and anti-inflammatory drugs. The Vasculitis Market is segmented by disease type, drug class, route of administration, distribution channel, and region. By disease type, the small vessel vasculitis segment is expected to grow significantly due to rising prevalence of ANCA-associated vasculitides like granulomatosis with polyangiitis.

Epidemiology Insights:

- The prevalence of vasculitis is estimated to be around 40-50 cases per million population in the U.S. and Europe. The annual incidence is around 20 cases per million population.

- The key factors driving epidemiological trends are increasing autoimmune disorders, genetic factors, infections, and exposure to certain drugs/toxins.

- ANCA-associated vasculitides like granulomatosis with polyangiitis have a prevalence of 3 per 100,000 adults in the U.S.

- The growing and aging population globally presents opportunities for growth owing to higher disease burden.

- Many types of vasculitis like Behcet's disease, giant cell arteritis are rare diseases with prevalence of less than 200,000 patients in the U.S.

Market Landscape:

- There are high unmet needs for targeted therapies with lesser side effects and improved efficacy. Most treatments focus on suppressing the overactive immune system.

- Current options include corticosteroids, immunosuppressants, biologics like anti-TNF inhibitors, IL-6 inhibitors, and B-cell inhibitors.

- Emerging therapies like avacopan, Tadekinig alfa, and ozoralizumab that target specific inflammatory pathways show promise.

- Gene therapies targeting the molecular drivers of vasculitis offer breakthrough potential.

- The market is dominated by small generic manufacturers along with pharmas with novel patented biologics.

Market Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 4.5 Bn |

|

CAGR (2024 - 2031) |

6.3% |

|

The revenue forecast in 2031 |

US$ 7.3 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

GlaxoSmithKline, Genentech, ChemoCentryx, Kiniksa Pharmaceuticals, Takeda Pharmaceuticals, Teijin Pharma, Otsuka Pharmaceutical, Boehringer Ingelheim, Merck & Co., Bristol-Myers Squibb |

Market Drivers:

The rising prevalence of autoimmune disorders is a major factor driving growth in the vasculitis market. Autoimmune conditions like rheumatoid arthritis, lupus, and granulomatosis with polyangiitis among others are associated with a higher risk of developing different types of vasculitis. The global burden of autoimmune diseases continues to increase rapidly. According to recent research, the prevalence of vasculitis is estimated to be around 50 cases per 100,000 adults in developed countries. The strong link between autoimmunity and vasculitis is creating significant demand for targeted therapies.

The growing diagnosis rates aided by advancing technology is anticipated to propel market growth during the forecast period. Diagnosis of vasculitis can be challenging owing to the diverse symptoms involving multiple organs and systems. Tests like tissue biopsy, CT scans, MRIs along with ANCA assays are crucial for accurate diagnosis and determining the severity and subtype of vasculitis. Adoption of precision diagnostic tests enables quick turnaround time and improves early intervention. Key players are focusing on developing molecular biomarkers and genomic tests for reliable diagnosis.

The aging global population and subsequent growth in chronic and autoimmune conditions also support market expansion. Elderly individuals are more susceptible to developing vasculitis. The global geriatric population, comprising people aged 60 years and above, is projected to reach nearly 2.1 billion by 2050. With advancing age, the immune system tends to deteriorate, increasing susceptibility to vasculitis. Age is an important risk factor in conditions like giant cell arteritis and Takayasu's arteritis.

Extensive research and investments by biopharma companies to develop targeted biologic therapies provide significant prospects. Most current treatments like steroids have high toxicity and adverse effects. Many firms are conducting trials evaluating novel molecules that can selectively inhibit cytokines and immune cell types driving inflammation in vasculitis. Regulatory approval of emerging biologics like avacopan, voclosporin, and mavrilimumab in recent years validates this approach.

Market Opportunities:

The unique pathophysiology and immunological markers of vasculitis provide avenues to develop precision medicine approaches. Unlike standard treatments, precision therapies based on the patient's molecular profile can improve prognosis while minimizing adverse events. Research identifying specific genetic mutations, autoantibodies, and cytokines involved in vasculitis subtypes enables tailored solutions. AI and big data analytics will further support drug discovery.

Emerging markets in Asia Pacific and Latin America present considerable opportunities owing to improving healthcare infrastructure and increasing access. Large underdiagnosed and undertreated patient populations exist in these regions due to lack of awareness and high cost of biologics. Local manufacturing, partnerships, and differential pricing models will help expand reach in untapped markets.

Development of oral medications with higher safety represents an area of unmet need. Most current vasculitis treatments require intravenous infusion or injection. The availability of oral drugs will increase patient compliance and enable easy self-administration, especially for long-term therapies. Oral formulations of biologics and JAK inhibitors are being evaluated in trials.

Gene therapies that can correct the genetic factors influencing immune dysfunction have exponential potential. Gene mutations linked to vasculitis provide targets for editing or silencing. CRISPR-Cas9, RNAi therapeutics, and viral vector delivery systems are making gene therapy clinically feasible. Investigational treatment options like site-specific immuno-gene therapy indicate promise for intractable vasculitis.

Market Trends:

The vasculitis market is gradually moving towards targeted immunotherapy over broad immunosuppression. Regulatory approval of the first targeted biologic therapies like avacopan, benlysta, and mavrilimumab has paved the way for this shift. Blocking specific inflammatory pathway molecules reduces systemic toxicity. Research on antibodies, fusion proteins, recombinant proteins, and cell therapies continues.

Strategic partnerships between global biopharma giants and emerging biotech firms are increasing to accelerate drug development. Leveraging combined expertise is catalyzing the translation of novel molecules from lab to clinic. Collaborations also facilitate the pooling of vasculitis patient data critical for clinical trials of orphan drugs.

Medical societies and patient advocacy groups are raising disease awareness and promoting research funding. Efforts to increase understanding among patients, physicians, and the public support early diagnosis and access to treatment. For instance, the Vasculitis Foundation conducts awareness campaigns globally.

Personalized medicine approaches leveraging patient genetics, biomarkers, and clinical data are gaining traction to predict outcomes. Identifying patients likely to respond to certain therapies allows improved clinical decision-making. Tools integrating clinical informatics with molecular profiling show potential to transform vasculitis management.

Market Restraints:

The heterogeneous and overlapping nature of vasculitis symptoms makes diagnosis challenging, hindering market growth. Lack of awareness among primary care physicians about different types often leads to misdiagnosis and delayed treatment. For certain forms like drug-induced vasculitis, determining the trigger is difficult. Extensive collaborations across rheumatology, neurology, and nephrology specialties are required.

High costs associated with novel biologics and targeted drugs may restrain adoption, especially in developing regions. For instance, the annual cost of certain FDA-approved biologics can range between USD 100,000-250,000. Lack of adequate insurance coverage and limited access to specialty infusion centers also hamper uptake of emerging therapies.

A major share of the vasculitis market comprises generic steroids and immunosuppressants with low profit margins for manufacturers. Established first-line drugs like methotrexate, mycophenolate mofetil, and azathioprine being available as low-cost generics negatively impact investment in R&D for novel products. Strict regulations further add to development costs and timelines.

Recent Developments:

|

Development |

Involved Company |

|

FDA approval of benralizumab for Hypereosinophilic Syndrome |

AstraZeneca |

|

Launch of mavrilimumab for treatment of Giant Cell Arteritis in EU |

Kiniksa Pharmaceuticals |

|

Acquisition of ChemoCentryx by Amgen for $3.7B |

Amgen, ChemoCentryx |

|

Product Launch |

Company Name |

|

In May 2022, AstraZeneca’s benralizumab received FDA approval for the treatment of hypereosinophilic syndrome, a rare blood vessel inflammation disease. The IL-5 inhibitor biologic provides a novel targeted treatment approach. |

AstraZeneca’s |

|

In January 2023, Kiniksa Pharmaceuticals launched mavrilimumab in the EU for giant cell arteritis, a chronic vasculitis condition. The IL-6 inhibitor addresses an unmet need in this orphan disease segment. |

Kiniksa Pharmaceuticals |

|

In October 2022, GSK’s Benlysta received FDA approval for children with lupus nephritis, a kidney inflammation condition related to systemic lupus erythematosus. It offers the first biologic treatment for this patient population. |

GSK’s Benlysta |

|

Merger/Acquisition |

Involved Companies |

|

In May 2022, Amgen acquired ChemoCentryx for $3.7 billion to expand its inflammation and autoimmunity portfolio with the late-stage C5aR inhibitor avacopan for ANCA-associated vasculitis treatment. |

Amgen |

|

In December 2021, AstraZeneca acquired Caelum Biosciences and its late-stage asset CAEL-101 for amyloid light-chain amyloidosis, a rare systemic vasculitis disease, in a deal worth up to $500 million. |

AstraZeneca |

Market Regional Insights:

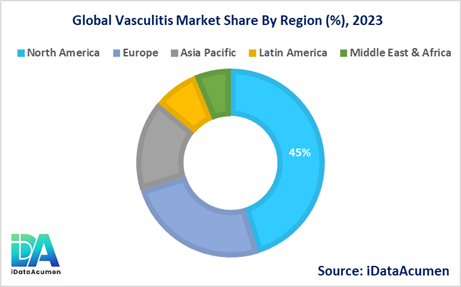

Vasculitis represents a group of rare autoimmune disorders marked by blood vessel inflammation. North America is expected to dominate the global Vasculitis market during the forecast period, accounting for over 45% of the market share in 2024. The well-established healthcare infrastructure and higher disease burden in the region contribute to the large market size.

Europe accounts for the second largest share of over 25% in 2024, driven by the presence of major pharma companies coupled with rising research on novel biologics.

The Asia Pacific market is anticipated to expand at the highest CAGR exceeding 8% over 2024-2031 owing to improving diagnosis rates and increasing healthcare expenditure.

Market Segmentation:

- By Disease Type

- Large vessel vasculitis

- Medium vessel vasculitis

- Small vessel vasculitis

- Variable vessel vasculitis

- Single organ vasculitis

- Others

- By Drug Class

- Corticosteroids

- Immunosuppressants

- NSAIDs

- Biologics

- Interleukin inhibitors

- Integrin inhibitors

- Others

- By Route of Administration

- Oral

- Injectable

- Intravenous

- Topical

- Inhalation

- Others

- By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Clinics & infusion centers

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top companies in the Vasculitis Market:

- GlaxoSmithKline

- Genentech

- ChemoCentryx

- Kiniksa Pharmaceuticals

- Takeda Pharmaceuticals

- Teijin Pharma

- Otsuka Pharmaceutical

- Boehringer Ingelheim

- Merck & Co.

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Eli Lilly

- AbbVie

- Amgen

- Pfizer

- Johnson & Johnson

- Momenta Pharmaceuticals

- Emergent BioSolutions

- EMD Serono

- Biogen