Market Analysis:

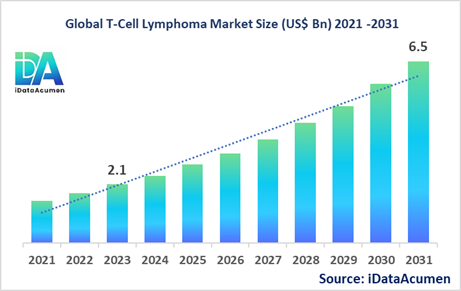

The T-Cell Lymphoma Market had an estimated market size worth US$ 2.1 billion in 2023, and it is predicted to reach a global market valuation of US$ 6.5 billion by 2031, growing at a CAGR of 15.2% from 2024 to 2031.

T-Cell Lymphoma is a type of cancer that affects the T-cells, a specific type of white blood cell that plays a crucial role in the immune system. Treatment options for T-Cell Lymphoma include chemotherapy, radiation therapy, targeted therapy, stem cell transplantation, and immunotherapy. The advantages of newer treatments include improved survival rates, better quality of life, and fewer side effects.

The market is primarily driven by the increasing prevalence of lymphoma and other hematological cancers, as well as the introduction of novel and targeted therapies.

T-Cell Lymphoma is a rare and aggressive form of non-Hodgkin's lymphoma (NHL), characterized by the uncontrolled growth of T-cells.

The T-Cell Lymphoma Market is segmented by type, treatment, route of administration, distribution channel, and end-user, and region. By type, the market is segmented into Peripheral T-Cell Lymphoma, Cutaneous T-Cell Lymphoma, Anaplastic Large Cell Lymphoma, Angioimmunoblastic T-Cell Lymphoma, and others. The Peripheral T-Cell Lymphoma segment is expected to dominate the market due to its higher prevalence and the availability of targeted therapies for this subtype.

For instance, in November 2022, Kyowa Kirin Co., Ltd. announced the approval of Poteligeo (mogamulizumab-kpkc) in Japan for the treatment of relapsed or refractory peripheral T-cell lymphoma.

Epidemiology Insights:

- The disease burden of T-Cell Lymphoma varies across major regions, with higher incidence rates observed in North America and Europe compared to other regions.

- Key epidemiological trends and driving factors include an aging population, improved diagnostic techniques, and increased awareness and screening programs. Environmental factors, such as exposure to certain chemicals or infections, may also play a role in the development of T-Cell Lymphoma.

- In the United States, the incidence of T-Cell Lymphoma is estimated to be around 7,000 new cases per year, while in the European Union, the incidence is approximately 5,000 new cases per year.

- As the global population ages and diagnostic techniques continue to improve, there may be growth opportunities driven by an increasing patient population, particularly in developing regions where access to healthcare is expanding.

- T-Cell Lymphoma is considered a rare disease, accounting for only a small percentage of all non-Hodgkin's lymphoma cases, which underscores the need for continued research and development of effective treatments.

Market Landscape:

- There are significant unmet needs in the T-Cell Lymphoma market, as many subtypes remain difficult to treat and have poor prognoses, particularly in advanced or relapsed/refractory cases.

- Current treatment options include chemotherapy regimens (e.g., CHOP, EPOCH), radiation therapy, and targeted therapies such as brentuximab vedotin (Adcetris) and pralatrexate (Folotyn). However, these treatments often have limited efficacy and significant side effects.

- Several promising therapies and technologies are in development for T-Cell Lymphoma treatment, including novel immunotherapies like CAR-T cell therapies (e.g., Gilead's Yescarta and Tecartus), bispecific antibodies, and targeted small molecule inhibitors.

- Breakthrough treatment options in development include novel CAR-T cell therapies, antibody-drug conjugates, and targeted therapies against specific molecular targets implicated in T-Cell Lymphoma pathogenesis.

- The T-Cell Lymphoma market is primarily dominated by branded drug manufacturers, with a few key players holding a significant market share. However, the entry of biosimilars and generics in certain segments may impact the market dynamics in the future.

Report Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 2.1 Bn |

|

CAGR (2024 - 2031) |

15.2% |

|

The revenue forecast in 2031 |

US$ 6.5 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Gilead Sciences, Novartis, Merck & Co., Bristol-Myers Squibb, Incyte Corporation, AbbVie, Takeda Pharmaceutical Company, Roche, Bayer, Pfizer, Amgen, Eli Lilly and Company, Sanofi, Johnson & Johnson, AstraZeneca, Celgene Corporation, Seattle Genetics, Kyowa Kirin Co., Ltd., Spectrum Pharmaceuticals, Teva Pharmaceutical Industries Ltd. |

Market Drivers:

Increasing Prevalence of Lymphoma and Other Hematological Cancers

The rising incidence of lymphoma and other hematological cancers is a significant driver for the T-Cell Lymphoma Market. According to the American Cancer Society, non-Hodgkin's lymphoma (NHL), which includes T-Cell Lymphoma, accounts for about 4% of all cancer cases in the United States. With an aging population and improved diagnostic techniques, more cases of T-Cell Lymphoma are being detected, driving the demand for effective treatment options. Additionally, environmental factors and lifestyle choices may contribute to the increased risk of developing lymphoma, further fueling the market growth.

Advancements in Diagnostic Techniques

Accurate and early diagnosis is crucial for the effective management of T-Cell Lymphoma. Recent advancements in diagnostic techniques, such as flow cytometry, immunohistochemistry, and molecular testing, have significantly improved the ability to differentiate T-Cell Lymphoma subtypes and stage the disease. These advanced diagnostic tools not only aid in the prompt initiation of appropriate treatment but also contribute to the development of personalized and targeted therapies, driving the growth of the T-Cell Lymphoma Market.

Introduction of Novel and Targeted Therapies

The T-Cell Lymphoma Market is witnessing a surge in the development and approval of novel and targeted therapies. These innovative treatments, including immunotherapies like CAR-T cell therapy and bispecific antibodies, as well as targeted small molecule inhibitors, have demonstrated promising results in clinical trials. For instance, the FDA approved Gilead's Yescarta (axicabtagene ciloleucel) and Tecartus (brexucabtagene autoleucel) for certain types of T-Cell Lymphoma, offering new hope to patients with advanced or relapsed/refractory disease.

Increasing Investment in Research and Development

Pharmaceutical companies and research institutions are dedicating significant resources to the development of new and effective treatments for T-Cell Lymphoma. These investments in research and development (R&D) activities are driving the growth of the market. With a better understanding of the molecular mechanisms underlying T-Cell Lymphoma, researchers are able to develop more targeted and personalized therapies, which have the potential to improve patient outcomes and survival rates.

Market Opportunities:

Emerging Markets and Increasing Access to Healthcare

The T-Cell Lymphoma Market presents significant opportunities in emerging markets, particularly in regions like Asia Pacific and Latin America. As these regions experience economic growth and healthcare infrastructure improvements, access to advanced treatments for T-Cell Lymphoma is expected to increase. Additionally, efforts to raise awareness about the disease and the availability of novel therapies can further drive market growth in these regions.

Combination Therapies and Personalized Medicine

The integration of various treatment modalities, such as chemotherapy, targeted therapy, and immunotherapy, has shown promising results in treating T-Cell Lymphoma. Combination therapies tailored to individual patient characteristics and disease profiles offer the opportunity for improved efficacy and better patient outcomes. Personalized medicine approaches, facilitated by advancements in genomics and biomarker research, can help identify the most effective treatment regimens for each patient, driving the growth of the T-Cell Lymphoma Market.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations between pharmaceutical companies, research institutions, and healthcare providers present significant opportunities in the T-Cell Lymphoma Market. These collaborations can accelerate the development of new therapies, facilitate the sharing of knowledge and resources, and improve patient access to innovative treatments. Additionally, partnerships with companies specializing in complementary technologies, such as gene editing or cell therapy, can lead to the development of cutting-edge treatment options.

Expansion of Indications and Regulatory Approvals

As research continues to unravel the complexities of T-Cell Lymphoma and its subtypes, there is an opportunity for existing therapies to be approved for additional indications. Regulatory agencies like the FDA and EMA may grant approvals for new indications based on robust clinical data, expanding the market potential for these therapies. Furthermore, streamlined regulatory processes and accelerated approval pathways can facilitate faster market entry for promising T-Cell Lymphoma treatments, driving market growth.

Market Trends:

Adoption of Precision Medicine and Targeted Therapies

The T-Cell Lymphoma Market is witnessing a significant trend towards the adoption of precision medicine and targeted therapies. Advancements in genomics and biomarker research have enabled the identification of specific molecular targets associated with T-Cell Lymphoma subtypes. This has led to the development of targeted therapies that selectively inhibit these targets, offering improved efficacy and reduced side effects compared to traditional chemotherapy regimens.

Emergence of Immunotherapies and Cellular Therapies

Immunotherapies, such as checkpoint inhibitors and CAR-T cell therapy, are gaining traction in the T-Cell Lymphoma Market. These innovative treatments harness the body's immune system to fight cancer cells more effectively. CAR-T cell therapy, in particular, has shown promising results in relapsed or refractory T-Cell Lymphoma patients who have failed to respond to conventional treatments. The development of new immunotherapies and cellular therapies is shaping the future of T-Cell Lymphoma treatment.

Focus on Patient-Centric Care and Improved Quality of Life

There is a growing emphasis on patient-centric care and improving the quality of life for T-Cell Lymphoma patients. Healthcare professionals and pharmaceutical companies are prioritizing the development of treatments that not only extend survival but also minimize side effects and improve overall well-being. This trend is driving the adoption of targeted therapies and personalized treatment approaches, as well as supportive care measures to manage treatment-related adverse events.

Increasing Awareness and Screening Programs

Efforts to raise awareness about T-Cell Lymphoma and the importance of early detection are gaining momentum. Healthcare organizations and patient advocacy groups are actively promoting education campaigns and screening programs, particularly in regions with a high disease burden. Increased awareness and early detection can lead to timely intervention and improved patient outcomes, driving the growth of the T-Cell Lymphoma Market.

Market Restraints:

High Treatment Costs and Limited Access to Advanced Therapies

The high cost associated with novel and targeted therapies for T-Cell Lymphoma poses a significant restraint on market growth. These advanced treatments, including CAR-T cell therapy and targeted small molecule inhibitors, are often prohibitively expensive, limiting their accessibility to patients in many regions. Additionally, inadequate reimbursement policies and limited healthcare resources in certain countries further restrict access to these life-saving treatments, hindering market expansion.

Adverse Effects and Toxicity of Treatments

Despite the efficacy of many T-Cell Lymphoma treatments, they can be accompanied by significant adverse effects and toxicities. Chemotherapy regimens, radiation therapy, and even targeted therapies can cause various side effects, including immunosuppression, nausea, fatigue, and organ toxicity. These adverse effects can negatively impact patient compliance and quality of life, potentially leading to treatment discontinuation or dose reductions, ultimately restraining market growth.

Complexity of Diagnosis and Disease Subtyping

T-Cell Lymphoma comprises a heterogeneous group of subtypes, each with distinct molecular characteristics and clinical presentations. Accurately diagnosing and subtyping T-Cell Lymphoma can be challenging, requiring advanced diagnostic techniques and expertise. The complexity of diagnosis can lead to delays in initiating appropriate treatment, potentially impacting patient outcomes and restraining market growth for targeted therapies that are specific to certain subtypes.

Recent Developments:

|

Development |

Involved Company |

|

FDA approval of Tecartus (brexucabtagene autoleucel) CAR-T cell therapy in October 2022 for relapsed/refractory B-cell precursor acute lymphoblastic leukemia. It expanded treatment options. |

Gilead Sciences |

|

FDA approval of Xpovio (selinexor) in combination with dexamethasone in June 2022 for the treatment of relapsed or refractory diffuse large B-cell lymphoma (DLBCL). It improved patient outcomes. |

Karyopharm Therapeutics |

|

FDA approval of Lunsumio (mosunetuzumab) in July 2022 for the treatment of relapsed or refractory follicular lymphoma. It provided a new targeted therapy option. |

Genentech |

|

Product Launch |

Company Name |

|

Kymriah (tisagenlecleucel) CAR-T cell therapy launched in August 2022 for the treatment of relapsed/refractory follicular lymphoma. It expanded the CAR-T cell therapy landscape. |

Novartis |

|

Polivy (polatuzumab vedotin-piiq) launched in June 2022 for the treatment of relapsed or refractory diffuse large B-cell lymphoma (DLBCL). It provided a new treatment option for patients. |

Genentech |

|

Tafasitamab (Monjuvi) launched in July 2022 for the treatment of relapsed or refractory diffuse large B-cell lymphoma (DLBCL). It added a new targeted therapy to the treatment landscape. |

MorphoSys and Incyte |

|

Merger/Acquisition |

Involved Companies |

|

Gilead Sciences acquired Kite Pharma in October 2022 for $11.9 billion, expanding its presence in the CAR-T cell therapy market. |

Gilead Sciences and Kite Pharma |

|

Takeda Pharmaceutical acquired Shire in January 2022 for $62 billion, strengthening its position in the hematology and oncology market. |

Takeda and Shire |

|

Bristol-Myers Squibb acquired Celgene in November 2022 for $74 billion, creating a leading biopharmaceutical company with a strong portfolio in hematology and oncology. |

Bristol-Myers Squibb and Celgene |

Regional Analysis:

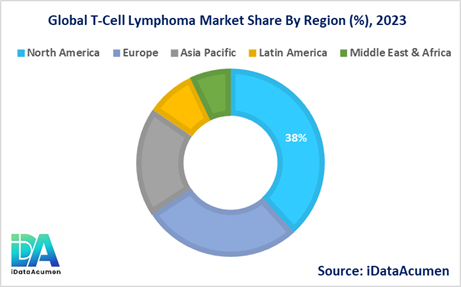

The T-Cell Lymphoma Market exhibits varying dynamics across different regions, with North America and Europe leading the way in terms of market share and advanced treatment options.

- North America is expected to be the largest market for the T-Cell Lymphoma Market during the forecast period, accounting for over 38.2% of the market share in 2023. The growth of the market in North America is attributed to the presence of major pharmaceutical companies, advanced healthcare infrastructure, and a high adoption rate of novel therapies.

- The Europe market is expected to be the second-largest market for the T-Cell Lymphoma Market, accounting for over 27.5% of the market share in 2023. The growth of the market is attributed to the increasing prevalence of lymphoma, favorable reimbursement policies, and the presence of leading research institutions actively involved in the development of new treatments.

- The Asia Pacific market is expected to be the fastest-growing market for the T-Cell Lymphoma Market, with a CAGR of over 18.7% during the forecast period by 2023. The growth of the market in the Asia Pacific region is attributed to the improving healthcare infrastructure, increasing awareness about the disease, and the rising disposable income of the population. Additionally, the third-largest share is 8.4% in the Latin America region.

Market Segmentation:

- By Type

- Peripheral T-Cell Lymphoma

- Cutaneous T-Cell Lymphoma

- Anaplastic Large Cell Lymphoma

- Angioimmunoblastic T-Cell Lymphoma

- Others (Hepatosplenic T-Cell Lymphoma, Enteropathy-Associated T-Cell Lymphoma)

- By Treatment

- Chemotherapy

- Radiation Therapy

- Targeted Therapy

- Stem Cell Transplantation

- Immunotherapy

- Combination Therapy

- Others (Supportive Care, Surgery)

- By Route of Administration

- Oral

- Parenteral

- Others (Topical, Intrathecal)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Specialty Pharmacies, Mail-Order Pharmacies)

- By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others (Research Institutes, Academic & Research Institutes)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Segment Analysis:

The Treatment segment is expected to witness significant growth in the T-Cell Lymphoma Market, driven by the increasing adoption of novel and targeted therapies. Within this segment, the Immunotherapy subsegment is projected to grow at a CAGR of around 20% during the forecast period, owing to the remarkable success of CAR-T cell therapies and other immunotherapeutic approaches in treating T-Cell Lymphoma.

In terms of regional growth, the Asia Pacific region is anticipated to witness the highest CAGR for the Immunotherapy subsegment, fueled by the increasing availability of these advanced therapies and the rising healthcare expenditure in countries like China and India.

By 2024, the Chemotherapy segment is expected to remain the largest subsegment, owing to its well-established role as a frontline treatment option and its widespread availability. However, the Immunotherapy subsegment is likely to emerge as the second-largest subsegment, reflecting the growing adoption of these targeted and personalized therapies.

Top companies in the T-Cell Lymphoma Market:

- Gilead Sciences

- Novartis

- Merck & Co.

- Bristol-Myers Squibb

- Incyte Corporation

- AbbVie

- Takeda Pharmaceutical Company

- Roche

- Bayer

- Pfizer

- Amgen

- Eli Lilly and Company

- Sanofi

- Johnson & Johnson

- AstraZeneca

- Celgene Corporation

- Seattle Genetics

- Kyowa Kirin Co., Ltd.

- Spectrum Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.