Market Analysis:

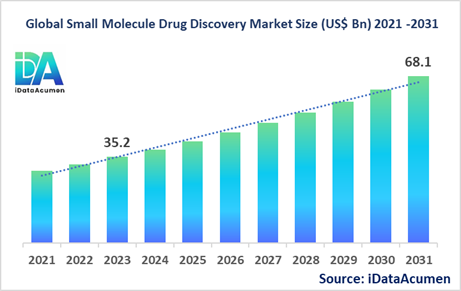

The Small Molecule Drug Discovery Market had an estimated market size worth US$ 35.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 68.1 billion by 2031, growing at a CAGR of 8.6% from 2024 to 2031. Small molecule drugs are low molecular weight organic compounds that can regulate biological processes and are used for treating various diseases. They are synthesized chemically and can interact with specific target proteins in the body, such as receptors, enzymes, or ion channels, to produce a therapeutic effect. Small molecule drugs offer advantages such as high specificity, potency, and the ability to modulate protein-protein interactions, making them valuable in the treatment of various conditions.

The market growth is driven by the increasing prevalence of chronic diseases, advancements in computational drug discovery techniques, and rising investments in pharmaceutical research and development.

The Small Molecule Drug Discovery Market is segmented by therapeutic area, drug type, target class, molecule type, phase of development, service type, and technology. By therapeutic area, the market is segmented into oncology, cardiovascular diseases, infectious diseases, metabolic disorders, neurological disorders, autoimmune diseases, and others. The oncology segment is expected to experience significant growth due to the rising incidence of cancer and the development of targeted small molecule drugs for various cancer types.

Recent examples of product/technology launches in this segment include Merck's launch of the small molecule drug Keytruda (pembrolizumab) for the treatment of certain types of lung cancer and melanoma in 2022, and Pfizer's approval of the small molecule drug Cibinqo (abrocitinib) for the treatment of atopic dermatitis in 2021.

Epidemiology Insights:

- The disease burden varies across major regions, with higher incidences of chronic diseases like cancer, cardiovascular diseases, and diabetes in developed regions like North America and Europe, while infectious diseases remain prevalent in developing regions like Africa and parts of Asia.

- Key epidemiological trends and driving factors in major markets include an aging population, sedentary lifestyles, and rising obesity rates, which contribute to the increasing prevalence of chronic diseases. Additionally, improved diagnostic techniques and increased disease awareness have led to better disease detection and reporting.

- In the United States, it is estimated that nearly 1.9 million new cancer cases were diagnosed in 2022, while in the European Union, cardiovascular diseases account for over 3.9 million deaths annually.

- The increasing patient population, particularly for chronic diseases, presents growth opportunities for the development of targeted and effective small molecule drugs to address unmet medical needs.

- Certain rare diseases, such as lysosomal storage disorders, also drive the demand for small molecule drug discovery efforts to develop orphan drugs for these conditions.

Market Landscape:

- There are significant unmet needs in the market, particularly for diseases with limited or ineffective treatment options, such as certain types of cancer, neurodegenerative disorders, and rare genetic diseases.

- Current treatment options include small molecule drugs, biologics, and combination therapies targeting various disease pathways. Examples of approved small molecule drugs include Gleevec (imatinib) for chronic myeloid leukemia, Lipitor (atorvastatin) for cholesterol management, and Januvia (sitagliptin) for type 2 diabetes.

- Upcoming therapies and technologies in the market include the development of targeted small molecule drugs based on advancements in computational drug discovery, biomarker identification, and personalized medicine approaches.

- Breakthrough treatment options currently in development include small molecule drugs targeting novel targets or mechanisms, such as inhibitors of protein-protein interactions, epigenetic modulators, and RNA-based therapeutics.

- The market composition is diverse, with a presence of both branded drug manufacturers and generic drug companies. However, branded drug manufacturers often dominate the market for newer and patented small molecule drugs.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 35.2 Bn |

|

CAGR (2024 - 2031) |

8.6% |

|

The revenue forecast in 2031 |

US$ 68.1 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Pfizer Inc., Novartis AG, Merck & Co., Inc., Roche Holding AG, Johnson & Johnson, GlaxoSmithKline plc, AstraZeneca plc, Sanofi, Bristol-Myers, Squibb Company, Eli Lilly and Company, AbbVie Inc., Bayer AG, Boehringer Ingelheim International GmbH, Takeda Pharmaceutical Company Limited, Astellas Pharma Inc., Daiichi Sankyo Company, Limited Eisai Co., Ltd., Otsuka Holdings Co., Ltd., Shionogi & Co., Ltd., Chugai Pharmaceutical Co., Ltd. |

Market Drivers:

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, cardiovascular disorders, and metabolic disorders is a significant driver for the small molecule drug discovery market. As the global population ages and lifestyle factors contribute to the burden of these diseases, there is a growing demand for effective and targeted therapeutic options. Small molecule drugs offer the potential to modulate specific biological pathways and targets, making them valuable in addressing the complex mechanisms underlying chronic conditions. This driver has fueled extensive research efforts to discover and develop novel small molecule compounds that can improve patient outcomes and quality of life.

Advancements in Computational Drug Discovery Techniques

Technological advancements in computational drug discovery techniques, such as molecular modeling, virtual screening, and artificial intelligence (AI)/machine learning (ML) algorithms, have revolutionized the small molecule drug discovery process. These computational approaches enable researchers to rapidly screen and identify promising lead compounds, optimize their properties, and predict their interactions with target proteins. This has accelerated the drug discovery timeline and improved the efficiency of the entire process, driving the growth of the small molecule drug discovery market.

Rising Investments in Pharmaceutical Research and Development

Pharmaceutical companies and research institutions are increasingly investing in research and development (R&D) activities to fuel innovation and stay competitive in the market. The pursuit of novel small molecule drug candidates has been a significant focus area for these investments. Substantial resources are being allocated to cutting-edge technologies, such as high-throughput screening, combinatorial chemistry, and advanced analytical techniques, to aid in the discovery and optimization of small molecule drugs. These investments have propelled the growth of the small molecule drug discovery market by enabling the exploration of new therapeutic targets and the development of innovative treatment options.

Growing Focus on Personalized Medicine

The concept of personalized medicine, which tailors treatment strategies to an individual's genetic profile and molecular characteristics, has gained significant traction in recent years. Small molecule drugs play a crucial role in this approach, as they can be designed to target specific molecular targets or pathways associated with a patient's disease. This targeted approach has the potential to improve treatment efficacy, reduce side effects, and ultimately enhance patient outcomes. The growing emphasis on personalized medicine has driven the demand for small molecule drug discovery efforts, fueling market growth.

Market Opportunities:

Emerging Markets and Unmet Medical Needs

Developing and emerging markets represent a significant opportunity for the small molecule drug discovery market. Many of these regions have a high burden of chronic and infectious diseases, but limited access to effective treatments. By addressing these unmet medical needs, pharmaceutical companies can tap into new market segments and improve global healthcare accessibility. Additionally, the development of affordable small molecule drugs could significantly impact the management of diseases in resource-limited settings, presenting a compelling opportunity for market growth.

Collaborative Research and Partnerships

Collaborative research and strategic partnerships between pharmaceutical companies, academic institutions, and biotechnology firms have become increasingly important in the small molecule drug discovery landscape. By pooling resources, expertise, and diverse perspectives, these collaborations can accelerate the discovery and development of novel small molecule drugs. Cross-functional teams can leverage complementary strengths and technologies, leading to more efficient and effective drug discovery processes. This trend presents an opportunity for stakeholders to leverage synergies and drive innovation in the small molecule drug discovery market.

Drug Repurposing and Repositioning

Drug repurposing and repositioning, which involves exploring new therapeutic applications for existing small molecule drugs, present a promising opportunity in the market. This approach can significantly reduce development costs and timelines, as well as leverage existing safety and efficacy data. By identifying new targets or mechanisms of action for approved small molecule drugs, researchers can potentially unlock new treatment options for various diseases. This strategy has gained traction in recent years and offers an opportunity to maximize the value of existing small molecule drug candidates.

Advancement in Targeted Drug Delivery Systems

The development of advanced drug delivery systems, such as nanoparticles, liposomes, and polymeric carriers, presents an opportunity to enhance the efficacy and safety of small molecule drugs. These delivery systems can improve the solubility, bioavailability, and targeted delivery of small molecule drugs to specific tissues or organs, reducing off-target effects and improving therapeutic outcomes. By leveraging these cutting-edge delivery technologies, pharmaceutical companies can create differentiated and improved small molecule drug products, tapping into new market opportunities.

Market Trends:

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of AI and ML technologies has emerged as a significant trend in the small molecule drug discovery market. These advanced computational approaches are being utilized to accelerate various stages of the drug discovery process, including target identification, virtual screening, lead optimization, and predictive modeling. AI/ML algorithms can rapidly analyze vast amounts of data, identify patterns, and make predictions, enabling more efficient and informed decision-making. This trend has the potential to revolutionize the way small molecule drugs are discovered and developed, driving innovation and productivity in the market.

Focus on Targeted Therapy and Precision Medicine

The increasing emphasis on targeted therapy and precision medicine has become a prominent trend in the small molecule drug discovery market. Researchers are actively pursuing the development of small molecule drugs that can precisely target specific molecular pathways or genetic aberrations associated with diseases. This approach aims to deliver more effective and personalized treatments while minimizing off-target effects and adverse reactions. By leveraging advances in genomics, proteomics, and biomarker research, small molecule drug discovery efforts are being tailored to specific patient populations, aligning with the broader trend of precision medicine.

Adoption of High-Throughput Screening and Combinatorial Chemistry

High-throughput screening (HTS) and combinatorial chemistry techniques have gained widespread adoption in the small molecule drug discovery market. HTS enables the rapid screening of vast chemical libraries against potential drug targets, accelerating the identification of lead compounds. Combinatorial chemistry, on the other hand, allows for the efficient synthesis and optimization of small molecule compound libraries, expanding the chemical diversity available for screening. These techniques have significantly increased the speed and productivity of the drug discovery process, contributing to the market's growth and driving the development of novel small molecule drug candidates.

Emphasis on Drug Repurposing and Repositioning

Drug repurposing and repositioning have emerged as significant trends in the small molecule drug discovery market. This approach involves exploring new therapeutic applications for existing small molecule drugs that have already undergone clinical testing or received regulatory approval. By leveraging existing safety and efficacy data, researchers can potentially accelerate the development process and reduce associated costs. This trend has gained traction due to its potential to unlock new treatment options and maximize the value of existing small molecule drug candidates.

Market Restraints:

High Costs and Long Development Timelines

The small molecule drug discovery process is inherently costly and time-consuming, posing a significant restraint on market growth. From target identification and lead optimization to extensive preclinical and clinical testing, the development of a new small molecule drug can take years and require substantial financial investments. Furthermore, the risk of failure during any stage of the development process can result in significant losses for pharmaceutical companies. These high costs and long development timelines can deter investment and hinder the progress of new small molecule drug candidates, ultimately limiting market growth.

Stringent Regulatory Requirements and Approval Processes

The small molecule drug discovery market is subject to stringent regulatory requirements and rigorous approval processes imposed by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations are in place to ensure the safety, efficacy, and quality of small molecule drugs before they can be marketed and prescribed to patients. However, navigating these complex regulatory landscapes can be challenging, time-consuming, and costly for pharmaceutical companies. Failure to comply with regulatory guidelines can result in delays, additional costs, or even rejection of drug candidates, hindering market growth.

Patent Expiration and Generic Competition

The expiration of patents on successful small molecule drugs can significantly impact market growth. Once a patent expires, generic versions of the drug can enter the market, leading to intense competition and price erosion. This competition from generic manufacturers can substantially reduce the revenue potential of branded small molecule drugs, often prompting pharmaceutical companies to shift their focus towards developing new and innovative drug candidates. Additionally, the threat of generic competition can discourage investment in certain therapeutic areas or drug classes, potentially limiting the diversity of small molecule drug discovery efforts.

Recent Developments:

|

Development |

Involved Company |

|

Approval of Krazati (adagrasib) for KRAS G12C-mutated non-small cell lung cancer in December 2022. |

Mirati Therapeutics |

|

Approval of Tezspire (tezepelumab) for severe asthma in December 2021. |

AstraZeneca |

|

Approval of Quviviq (daridorexant) for insomnia in January 2022. |

Idorsia Pharmaceuticals |

|

Product Launch |

Company Name |

|

Launch of Cibinqo (abrocitinib) for atopic dermatitis in January 2022. |

Pfizer |

|

Launch of Opseltra (fidanserine) for sleep disorders in May 2022. |

Idorsia Pharmaceuticals |

|

Launch of Vuity (pilocarpine HCl ophthalmic solution) for presbyopia in October 2021. |

Allergan (AbbVie) |

|

Merger/Acquisition |

Involved Companies |

|

Acquisition of Global Blood Therapeutics by Pfizer in August 2022. |

Pfizer and Global Blood Therapeutics |

|

Acquisition of Aragon Pharmaceuticals by Servier in January 2022. |

Servier and Aragon Pharmaceuticals |

|

Acquisition of Sirtris Pharmaceuticals by GlaxoSmithKline in September 2022. |

GlaxoSmithKline and Sirtris Pharmaceuticals |

Market Regional Insights:

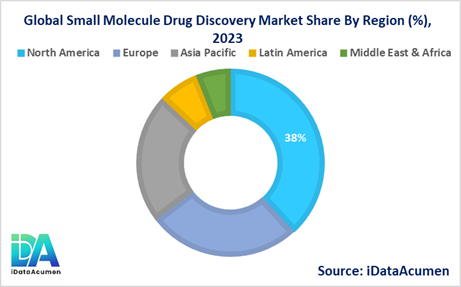

The Small Molecule Drug Discovery Market exhibits significant regional variations due to factors such as healthcare infrastructure, disease prevalence, and regulatory environments.

- North America is expected to be the largest market for the Small Molecule Drug Discovery Market during the forecast period, accounting for over 38.2% of the market share in 2023. The growth of the market in North America is attributed to the presence of well-established pharmaceutical companies, strong research and development capabilities, and a high prevalence of chronic diseases.

- Europe is expected to be the second-largest market for the Small Molecule Drug Discovery Market, accounting for over 26.5% of the market share in 2023. The growth of the market in Europe is driven by government initiatives to promote pharmaceutical research, the presence of leading academic institutions, and a focus on personalized medicine approaches.

- The Asia-Pacific market is expected to be the fastest-growing market for the Small Molecule Drug Discovery Market, with a CAGR of over 9.2% during the forecast period by 2030. The growth of the market in the Asia-Pacific region is attributed to the increasing healthcare expenditure, rising prevalence of chronic diseases, and the presence of emerging pharmaceutical companies, particularly in countries like China and India.

Market Report Segmentation:

- By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- Metabolic Disorders

- Neurological Disorders

- Autoimmune Diseases

- Others (Respiratory Diseases, Musculoskeletal Disorders, etc.)

- By Drug Type

- Small Molecule Synthetic Drugs

- Small Molecule Biologics

- Small Molecule Vaccines

- Small Molecule Gene Therapies

- Others (Peptides, Oligonucleotides, etc.)

- By Target Class

- G-protein-coupled Receptors (GPCRs)

- Kinases

- Proteases

- Ion Channels

- Nuclear Receptors

- Enzymes

- Others (DNA/RNA, Cytokines, etc.)

- By Molecule Type

- Synthetic Compounds

- Natural Compounds

- Peptides

- Oligonucleotides

- Others (Carbohydrates, Lipids, etc.)

- By Phase of Development

- Preclinical

- Phase I

- Phase II

- Phase III

- Approved/Marketed Drugs

- By Service Type

- Lead Identification Services

- Lead Optimization Services

- Candidate Selection Services

- Bioavailability and Solubility Studies

- Others (Pharmacokinetic Studies, Toxicology Studies, etc.)

- By Technology

- High-throughput Screening (HTS)

- Computer-aided Drug Design (CADD)

- Combinatorial Chemistry

- Bioinformatics

- Structural Biology

- Nanotechnology

- Others (Genomics, Proteomics, etc.)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

The oncology segment of the Small Molecule Drug Discovery Market is expected to experience significant growth across all regions, driven by the increasing incidence of cancer and the development of targeted small molecule drugs. This segment is projected to have a CAGR of around 9.5% from 2023 to 2030, with a market size of approximately $18.2 billion by 2030.

In North America and Europe, the oncology segment is anticipated to be the largest due to the high prevalence of cancer, well-established healthcare infrastructure, and the presence of leading pharmaceutical companies investing in cancer research. The Asia-Pacific region is also expected to witness rapid growth in the oncology segment, driven by increasing cancer rates, rising healthcare expenditure, and the emergence of local pharmaceutical companies.

The small molecule synthetic drugs segment is likely to be the largest and second-largest segment in 2024, owing to the widespread use of these compounds in various therapeutic areas and their well-established manufacturing processes. This segment is expected to hold a dominant market share due to factors such as higher efficacy, better stability, and lower production costs compared to other drug types.

Top Companies in the Small Molecule Drug Discovery Market

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Roche Holding AG

- Johnson & Johnson

- GlaxoSmithKline plc

- AstraZeneca plc

- Sanofi

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- AbbVie Inc.

- Bayer AG

- Boehringer Ingelheim International GmbH

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Daiichi Sankyo Company, Limited

- Eisai Co., Ltd.

- Otsuka Holdings Co., Ltd.

- Shionogi & Co., Ltd.

- Chugai Pharmaceutical Co., Ltd.