Market Analysis:

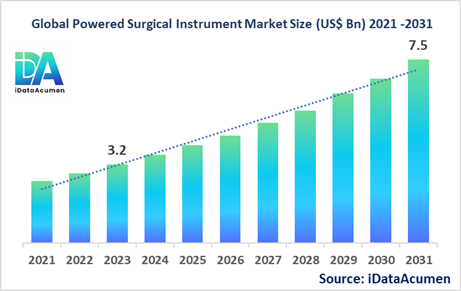

The Powered Surgical Instrument Market had an estimated market size worth US$ 3.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 7.5 billion by 2031, growing at a CAGR of 11.2% from 2024 to 2031. Powered surgical instruments are medical devices that use an external power source, such as electricity or batteries, to perform various surgical procedures. These instruments are designed to improve precision, control, and efficiency during surgical interventions, enabling surgeons to perform complex procedures with greater accuracy and ease. Their usage has been increasing due to the growing demand for minimally invasive surgeries, which result in shorter hospital stays, faster recovery times, and reduced post-operative complications.

The market is primarily driven by the rising prevalence of chronic diseases, technological advancements, and the increasing adoption of minimally invasive surgical procedures.

The Powered Surgical Instrument Market is segmented by product type, power source, application, end-user, technology, usability, and region. By product type, the market is segmented into orthopedic surgical instruments, cardiovascular surgical instruments, neurosurgical instruments, ophthalmic surgical instruments, obstetrics and gynecology surgical instruments, and others (dental, ENT, plastic surgery, etc.). The orthopedic surgical instruments segment is expected to witness significant growth due to the increasing incidence of orthopedic disorders and the rising adoption of minimally invasive orthopedic surgeries.

In terms of recent developments, Medtronic plc launched its Hugo™ Robotic-Assisted Surgery (RAS) system in January 2022, which is designed to tackle complex surgical procedures with improved precision and control.

Epidemiology Insights:

- The disease burden associated with chronic conditions is highest in North America and Europe, primarily due to factors such as aging populations, sedentary lifestyles, and unhealthy dietary habits.

- Key epidemiological trends driving the demand for surgical interventions include the rising prevalence of obesity, cardiovascular diseases, cancer, and musculoskeletal disorders across major markets like the United States, the European Union, and Japan.

- According to the Centers for Disease Control and Prevention (CDC), the prevalence of cardiovascular diseases in the United States was estimated at around 126.6 million adults in 2018, while the prevalence of cancer was approximately 16.9 million cases in 2019.

- The increasing patient population suffering from chronic diseases presents significant growth opportunities for the powered surgical instrument market, as surgical interventions become more prevalent for disease management and treatment.

- While most chronic diseases are not considered rare, certain conditions like Parkinson's disease, Huntington's disease, and certain types of cancers are classified as rare diseases, further driving the demand for specialized surgical instruments.

Market Landscape:

- There are significant unmet needs in the powered surgical instrument market, particularly in terms of improving precision, reducing surgical site infections, and enhancing ergonomics for surgeons during long and complex procedures.

- Current treatment options involve the use of traditional manual surgical instruments, as well as powered instruments for various surgical specialties, including orthopedics, cardiovascular, neurosurgery, and others.

- Upcoming therapies and technologies in the market include the integration of robotics, artificial intelligence (AI), and augmented reality (AR) into powered surgical instruments, enabling enhanced precision, real-time guidance, and improved surgical outcomes.

- Breakthrough treatment options currently being developed include the use of advanced imaging techniques, such as intraoperative imaging and 3D surgical navigation systems, to provide surgeons with real-time information during procedures.

- The market is dominated by branded medical device manufacturers, with a significant presence of large, well-established players. However, there is a growing presence of smaller, niche players focusing on specialized surgical instruments or emerging technologies.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 3.2 Bn |

|

CAGR (2024 - 2031) |

11.2% |

|

The revenue forecast in 2031 |

US$ 7.5 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Stryker Corporation, Medtronic plc, Johnson & Johnson, Zimmer Biomet Holdings, Inc., B. Braun Melsungen AG, Smith & Nephew plc, Conmed Corporation, Arthrex, Inc., DePuy Synthes, Microaire Surgical Instruments LLC, KLS Martin Group, Symmetry Surgical Inc., Erbe Elektromedizin GmbH, Applied Medical Resources Corporation, Accurate Surgical & Scientific Instruments Corporation, Case Medical, Inc., GerMedUSA, Inc., MTR Corporation, Implus LLC, Integra LifeSciences |

Market Drivers:

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, such as cardiovascular disorders, cancer, and musculoskeletal conditions, is a significant driver for the powered surgical instrument market. As the global population ages and lifestyle-related risk factors persist, the demand for surgical interventions to manage these conditions has been on the rise. Powered surgical instruments offer enhanced precision and control, enabling surgeons to perform complex procedures more effectively, thereby improving patient outcomes.

Technological Advancements

Continuous technological advancements in the field of powered surgical instruments have been driving market growth. The integration of robotics, artificial intelligence (AI), and advanced imaging technologies has revolutionized surgical procedures, enabling minimally invasive approaches with improved accuracy and reduced recovery times. These cutting-edge technologies have made surgeries safer, more efficient, and less invasive, leading to increased adoption of powered surgical instruments.

Increasing Demand for Minimally Invasive Surgeries

There is a growing preference for minimally invasive surgical procedures, as they offer numerous benefits, including smaller incisions, reduced pain, faster recovery times, and lower risk of complications. Powered surgical instruments are essential for performing these minimally invasive procedures, as they provide enhanced dexterity, precision, and control in confined surgical spaces. This increasing demand for minimally invasive surgeries is driving the adoption of powered surgical instruments across various medical specialties.

Growing Geriatric Population

The global population is aging rapidly, and with age comes an increased risk of developing chronic conditions that may require surgical interventions. The geriatric population is more susceptible to conditions such as osteoarthritis, cardiovascular diseases, and certain types of cancer, among others. Powered surgical instruments offer improved ergonomics and precision, which are particularly beneficial for treating this demographic, as surgeries can be more complex and require greater precision.

Market Opportunities:

Integration of Artificial Intelligence (AI) and Machine Learning

The integration of AI and machine learning technologies into powered surgical instruments presents a significant opportunity for market growth. These technologies have the potential to enhance surgical precision, improve decision-making, and provide real-time guidance to surgeons during procedures. AI-enabled surgical systems can analyze patient data, imaging scans, and surgical scenarios to suggest optimal approaches and minimize potential risks, ultimately leading to better patient outcomes.

Development of Patient-Specific Surgical Instruments

Advances in 3D printing and personalized medicine have opened up opportunities for the development of patient-specific surgical instruments. By leveraging patient data and imaging scans, manufacturers can create customized instruments tailored to individual patient anatomy and surgical requirements. This approach can improve surgical accuracy, reduce procedural time, and potentially lead to better patient outcomes, creating a new market avenue for powered surgical instruments.

Expansion into Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present a significant growth opportunity for the powered surgical instrument market. As healthcare infrastructure and expenditure continue to improve in these regions, the demand for advanced surgical technologies is expected to rise. Manufacturers can capitalize on these emerging markets by offering cost-effective and locally adapted powered surgical instruments, thereby expanding their global footprint and reaching a wider patient population.

Adoption of Sustainable and Reusable Instruments

There is an increasing focus on sustainable practices in the healthcare industry, driven by environmental concerns and the need for cost-effective solutions. The development of reusable and environmentally friendly powered surgical instruments presents an opportunity for market growth. Reusable instruments not only reduce medical waste but also offer cost savings for healthcare providers in the long run. Manufacturers that prioritize sustainability in their product designs and manufacturing processes can gain a competitive edge in the market.

Market Trends:

Integration of Robotics and Automation

The integration of robotics and automation technologies has emerged as a significant trend in the powered surgical instrument market. Robotic surgical systems offer enhanced precision, dexterity, and control during complex procedures, reducing the risk of human error and enabling minimally invasive approaches. Manufacturers are continuously developing and refining robotic surgical platforms, incorporating advanced features such as haptic feedback, augmented reality guidance, and seamless integration with imaging modalities.

Focus on Ergonomic Design

As surgical procedures become more complex and demanding, there is a growing emphasis on ergonomic design in powered surgical instruments. Manufacturers are prioritizing the development of instruments that minimize physical strain and fatigue for surgeons, reducing the risk of musculoskeletal disorders and improving overall surgical performance. This trend includes features such as lightweight materials, optimized grip designs, and intuitive user interfaces.

Development of Battery-Powered Instruments

The development of battery-powered surgical instruments is a notable trend in the market. These instruments offer increased mobility and flexibility during surgical procedures, as they eliminate the need for tethered power sources. Battery-powered instruments are particularly useful in settings where access to power outlets is limited, such as remote healthcare facilities or field hospitals. Manufacturers are focusing on extending battery life and improving charging capabilities to enhance the usability of these instruments.

Increasing Focus on Hybrid Operating Rooms

Hybrid operating rooms, which combine advanced imaging technologies with surgical capabilities, are gaining traction in the healthcare industry. These multifunctional rooms enable seamless integration of imaging modalities, such as CT scanners or fluoroscopy systems, with powered surgical instruments. This trend is driven by the desire for more accurate and efficient surgical procedures, as well as the need for real-time guidance and visualization during complex interventions.

Market Restraints:

High Costs and Investment Requirements

The high costs associated with powered surgical instruments and the required infrastructure can be a significant restraint for market growth. These advanced instruments often involve substantial upfront investments, including the cost of the instruments themselves, as well as ancillary equipment, training, and maintenance. This financial burden can pose challenges, particularly for smaller healthcare facilities and hospitals with limited budgets, potentially limiting the adoption of powered surgical instruments.

Stringent Regulatory Approvals and Compliance

The powered surgical instrument market is subject to stringent regulatory approvals and compliance requirements to ensure patient safety and efficacy. Manufacturers must navigate complex regulatory processes, including clinical trials and extensive documentation, before their products can be commercialized. This lengthy and resource-intensive process can delay product launches and hinder market growth, particularly for smaller players or startups with limited resources.

Risk of Surgical Site Infections and Complications

Despite the benefits of powered surgical instruments, there is a potential risk of surgical site infections and complications associated with their use. Improper sterilization, equipment malfunction, or user error can increase the risk of infections or adverse events during surgical procedures. This risk can raise concerns among healthcare providers and patients, potentially hindering the adoption of powered surgical instruments in some cases.

Recent Developments:

|

Development |

Involved Company |

|

Stryker launched its SAHARA Surgical Foot Switch in April 2022, enhancing surgical efficiency and ergonomics. |

Stryker Corporation |

|

Medtronic launched its Hugo™ Robotic-Assisted Surgery system in January 2022, enabling complex surgical procedures. |

Medtronic plc |

|

Johnson & Johnson received FDA approval for its CERENOVUS Stroke Engine in March 2023, for ischemic stroke treatment. |

Johnson & Johnson |

|

Product Launch |

Company Name |

|

Smith & Nephew launched its TOURNIQUET STREAM Tourniquet System in August 2022, improving surgical control. |

Smith & Nephew plc |

|

Zimmer Biomet launched its ROSA Knee System in October 2021, enabling robotically-assisted knee replacement surgeries. |

Zimmer Biomet Holdings, Inc. |

|

B. Braun launched its Aesculap Neuro Dissector in March 2023, designed for neurosurgical procedures. |

B. Braun Melsungen AG |

|

Merger/Acquisition |

Involved Companies |

|

Stryker acquired Vocera Communications in February 2022, enhancing its digital care capabilities. |

Stryker Corporation, Vocera Communications |

|

Smith & Nephew acquired Engaged Health Solutions in January 2023, expanding its digital surgery portfolio. |

Smith & Nephew plc, Engaged Health Solutions |

|

Zimmer Biomet acquired Embric Health in September 2022, strengthening its orthopedic surgical portfolio. |

Zimmer Biomet Holdings, Inc., Embric Health |

Market Regional Insights:

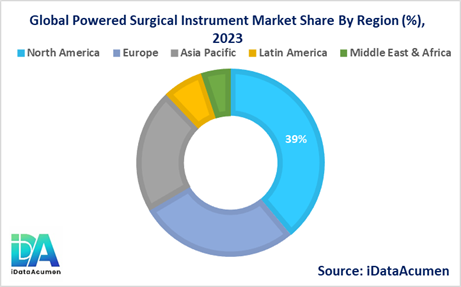

The Powered Surgical Instrument Market is heavily influenced by regional factors, including healthcare infrastructure, economic development, and disease prevalence.

- North America is expected to be the largest market for the Powered Surgical Instrument Market during the forecast period, accounting for over 38.7% of the market share in 2023. The growth of the market in North America is attributed to the presence of well-established healthcare facilities, favorable reimbursement policies, and the increasing adoption of advanced surgical technologies.

- Europe is expected to be the second-largest market for the Powered Surgical Instrument Market, accounting for over 27.5% of the market share in 2023. The growth of the market is attributed to the rising prevalence of chronic diseases, improving healthcare infrastructure, and the presence of leading medical device manufacturers in the region.

- The Asia-Pacific market is expected to be the fastest-growing market for the Powered Surgical Instrument Market, with a CAGR of over 21.3% during the forecast period by 2023. The growth of the market in the Asia-Pacific region is attributed to the increasing healthcare expenditure, growing medical tourism industry, and rising awareness about advanced surgical procedures, and third largest share 21.3%.

Market Segmentation:

- By Product Type

- Orthopedic surgical instruments

- Cardiovascular surgical instruments

- Neurosurgical instruments

- Ophthalmic surgical instruments

- Obstetrics and gynecology surgical instruments

- Others (Dental, ENT, Plastic Surgery, etc.)

- By Power Source

- Electric-powered instruments

- Battery-powered instruments

- Pneumatic-powered instruments

- Others (Hydraulic, etc.)

- By Application

- Orthopedic surgery

- Cardiovascular surgery

- Neurosurgery

- Ophthalmology

- Obstetrics and gynecology

- Others (Dental, ENT, Plastic Surgery, etc.)

- By End-User

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Others (Research institutes, academic institutions, etc.)

- By Technology

- Robotics

- Minimally invasive surgical instruments

- Conventional surgical instruments

- Others (Imaging-guided, AI-assisted, etc.)

- By Usability

- Reusable surgical instruments

- Disposable surgical instruments

- By Component

- Handpieces

- Power consoles

- Accessories

- Others (Footswitches, cables, etc.)

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Analysis of Segments:

- By Product Type: The orthopedic surgical instruments segment is projected to witness significant growth across all regions, driven by the increasing prevalence of musculoskeletal disorders, rising geriatric population, and the growing demand for minimally invasive orthopedic surgeries. This segment is expected to have a CAGR of around 12-14% during the forecast period and account for the largest market share by 2024.

- By Power Source: The battery-powered instruments segment is anticipated to be the fastest-growing segment, particularly in the Asia-Pacific and Latin American regions. The growing adoption of portable surgical devices and the increasing demand for ambulatory surgical centers are fueling the growth of this segment, with a projected CAGR of around 15-18% during the forecast period. However, the electric-powered instruments segment is expected to remain the largest in 2024, owing to its widespread adoption and established infrastructure.

- By End-User: The hospitals segment is likely to dominate the market in 2024, accounting for the largest share, driven by the increasing number of surgical procedures performed in hospital settings. However, the ambulatory surgical centers segment is expected to witness the highest growth, with a CAGR of around 14-16%, due to the rising demand for cost-effective and convenient surgical procedures.

Top companies in the Powered Surgical Instrument Market

- Stryker Corporation

- Medtronic plc

- Johnson & Johnson

- Zimmer Biomet Holdings, Inc.

- B. Braun Melsungen AG

- Smith & Nephew plc

- Conmed Corporation

- Arthrex, Inc.

- DePuy Synthes (Johnson & Johnson)

- Microaire Surgical Instruments LLC

- KLS Martin Group

- Symmetry Surgical Inc.

- Erbe Elektromedizin GmbH

- Applied Medical Resources Corporation

- Accurate Surgical & Scientific Instruments Corporation

- Case Medical, Inc.

- GerMedUSA, Inc.

- MTR Corporation

- Implus LLC

- Integra LifeSciences