Market Analysis:

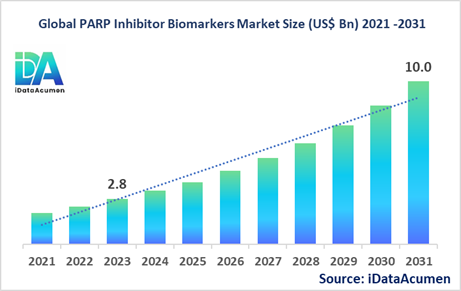

The PARP Inhibitor Biomarkers Market had an estimated market size worth US$ 2.8 billion in 2023, and it is predicted to reach a global market valuation of US$ 10.0 billion by 2031, growing at a CAGR of 17.2% from 2024 to 2031.

PARP inhibitors are a class of targeted cancer therapies that inhibit the enzyme poly (ADP-ribose) polymerase (PARP), which is involved in DNA repair mechanisms. They are particularly effective in treating cancers with deficiencies in DNA repair pathways, such as BRCA-mutated cancers. PARP inhibitors offer a targeted approach to cancer treatment, with fewer side effects compared to traditional chemotherapy.

The rising prevalence of cancer, increasing adoption of biomarker testing, and a growing pipeline of PARP inhibitors are the major drivers fueling the market's growth.

The PARP Inhibitor Biomarkers Market is segmented by product type, cancer type, biomarker type, therapy, end-user, and region. By product type, the market is segmented into olaparib, rucaparib, niraparib, talazoparib, and others. The olaparib segment is expected to dominate the market due to its wide range of approved indications, including ovarian, breast, and prostate cancers. AstraZeneca's Lynparza (olaparib) was one of the first approved PARP inhibitors and continues to be a market leader.

Epidemiology Insights:

- The disease burden of cancers that can be treated with PARP inhibitors, such as ovarian, breast, and prostate cancers, is significant across major regions like North America, Europe, and Asia-Pacific.

- Key epidemiological trends driving the need for PARP inhibitors include an aging population, increasing cancer incidence rates, and improved diagnostic techniques for identifying BRCA mutations and other genetic biomarkers.

- In the United States, it is estimated that around 1 in 400 individuals carries a BRCA1 or BRCA2 mutation, increasing their risk of developing breast, ovarian, and other cancers.

- The patient population eligible for PARP inhibitor therapy is expected to grow due to advancements in biomarker testing and the expansion of approved indications for these drugs.

- While cancers treated with PARP inhibitors are not considered rare diseases, there is a significant unmet need for targeted therapies, particularly in advanced and relapsed settings.

Market Landscape:

- Despite the availability of PARP inhibitors, there are still unmet needs in terms of improving response rates, overcoming drug resistance mechanisms, and expanding treatment options for different cancer types and stages.

- Current treatment options include approved PARP inhibitors like olaparib, rucaparib, niraparib, and talazoparib, primarily used in ovarian, breast, and prostate cancers with BRCA mutations.

- Several upcoming therapies and technologies aim to improve the efficacy and broaden the applicability of PARP inhibitors, such as combination therapies with other targeted agents or immunotherapies.

- Breakthrough treatment options under development include novel PARP inhibitors with improved potency and selectivity, as well as approaches targeting different DNA repair pathways or synthetic lethality mechanisms.

- The PARP Inhibitor Biomarkers Market is dominated by branded drug manufacturers, with a few major players like AstraZeneca, GlaxoSmithKline, and Clovis Oncology holding significant market shares.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 2.8 Bn |

|

CAGR (2024 - 2031) |

17.2% |

|

The revenue forecast in 2031 |

US$ 10.0 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

AstraZeneca, GlaxoSmithKline, Clovis Oncology, Pfizer, Merck & Co., Abbvie, Eisai Co., Repare Therapeutics, Artios Pharma, Oncologie, Ribon Therapeutics, Arcus Biosciences, Checkpoint Therapeutics, Verastem Oncology, Syros Pharmaceuticals, Sierra Oncology, Tesaro, Corcept Therapeutics, Biomarin Pharmaceutical, Aprea Therapeutics |

Market Drivers:

Rising Prevalence of Cancer and Genetic Testing

The growing incidence of cancer globally is a significant driver for the PARP Inhibitor Biomarkers Market. As cancer rates continue to rise, there is an increasing demand for effective and targeted therapies like PARP inhibitors. Additionally, advancements in genetic testing and biomarker identification have facilitated the identification of patients who may benefit from PARP inhibitor therapy, particularly those with BRCA mutations or deficiencies in DNA repair mechanisms. The ability to personalize treatment based on genetic profiles has driven the adoption of PARP inhibitors in clinical practice.

Expansion of Approved Indications and Combination Therapies

Initially approved for ovarian cancer, PARP inhibitors have now received approval for various other cancer types, including breast, prostate, and pancreatic cancers. As more indications are added, the market for PARP inhibitors is expected to grow substantially. Furthermore, ongoing research is exploring the potential of combining PARP inhibitors with other targeted therapies, immunotherapies, or chemotherapies, which could further enhance their efficacy and expand their applicability.

Favorable Regulatory Environment and Reimbursement Landscape

Regulatory bodies, such as the FDA and EMA, have been supportive of the development and approval of PARP inhibitors, recognizing their potential as targeted therapies with fewer side effects compared to traditional chemotherapy. Additionally, favorable reimbursement policies in major markets have facilitated access to these therapies, driving market growth.

Continued Investment in Research and Development

Pharmaceutical companies are investing heavily in the research and development of novel PARP inhibitors and exploring new mechanisms of action. This ongoing R&D investment is fueled by the promising clinical results and commercial success of approved PARP inhibitors. As new and potentially more potent or selective PARP inhibitors enter the pipeline, the market is expected to grow further.

Market Opportunities:

Expansion into New Cancer Types and Indications

While PARP inhibitors are currently approved for several cancer types, there is a significant opportunity to explore their potential in other cancers with DNA repair deficiencies or synthetic lethality mechanisms. Ongoing clinical trials are investigating the use of PARP inhibitors in cancers such as lung, gastric, and colorectal cancers, among others. Successful results could lead to expanded indications and a broader patient population eligible for PARP inhibitor therapy.

Liquid Biopsy and Non-Invasive Biomarker Testing

Advancements in liquid biopsy techniques and non-invasive biomarker testing hold great promise for the PARP Inhibitor Biomarkers Market. These methods enable the detection of cancer-specific biomarkers, such as circulating tumor DNA (ctDNA), from a simple blood sample, potentially replacing invasive tissue biopsies. This could improve patient access to biomarker testing and facilitate the identification of suitable candidates for PARP inhibitor therapy.

Development of Novel Drug Delivery Systems

Researchers are exploring novel drug delivery systems for PARP inhibitors, such as nanoparticles, liposomes, or targeted delivery mechanisms. These approaches aim to improve the bioavailability, specificity, and efficacy of PARP inhibitors while reducing potential side effects. Successful development of such delivery systems could enhance the therapeutic potential of PARP inhibitors and open up new market opportunities.

Exploring Non-Oncology Applications

While PARP inhibitors are primarily developed for cancer treatment, there is an opportunity to investigate their potential in non-oncology therapeutic areas. Preclinical and early-stage clinical studies have suggested that PARP inhibitors may have applications in conditions such as inflammatory diseases, cardiovascular diseases, and neurodegenerative disorders. Exploring these non-oncology indications could significantly expand the market for PARP inhibitors.

Market Trends:

Increasing Adoption of Biomarker-Driven Precision Medicine

The growing emphasis on personalized medicine and the identification of specific biomarkers has driven the adoption of PARP inhibitors. As healthcare providers and patients recognize the benefits of targeted therapies based on genetic profiles, the demand for PARP inhibitors in biomarker-positive patient populations is expected to increase.

Development of Companion Diagnostics

Parallel to the development of PARP inhibitors, there has been a trend towards the creation of companion diagnostic tests. These tests aim to identify patients with specific biomarkers, such as BRCA mutations or other DNA repair deficiencies, who are most likely to respond to PARP inhibitor therapy. The availability of accurate and reliable companion diagnostics is crucial for effective patient selection and treatment optimization.

Focus on Combination Therapies

While PARP inhibitors have shown promising results as monotherapies, there is a growing trend towards exploring their potential in combination with other cancer treatments. Clinical trials are evaluating the efficacy of PARP inhibitors in combination with chemotherapies, targeted therapies, and immunotherapies. These combination approaches aim to improve response rates, overcome resistance mechanisms, and achieve better treatment outcomes.

Emphasis on Early Detection and Adjuvant/Neoadjuvant

Settings In addition to their use in advanced or metastatic cancers, there is a trend towards exploring the role of PARP inhibitors in earlier stages of cancer treatment. Clinical trials are investigating the use of PARP inhibitors as adjuvant or neoadjuvant therapies, with the goal of reducing the risk of recurrence and improving overall survival rates.

PARP Inhibitor Biomarkers Market Restraints

High Treatment Costs and Access Barriers

PARP inhibitors are generally expensive therapies, which can limit patient access, particularly in regions with limited healthcare resources or inadequate insurance coverage. The high treatment costs may pose a significant financial burden on patients, healthcare providers, and payers, potentially restraining market growth.

Drug Resistance and Limited Efficacy in Certain Patient Populations

While PARP inhibitors have shown promising results in specific patient populations, their efficacy can be limited in others. Drug resistance mechanisms, such as the development of secondary mutations or the activation of alternative DNA repair pathways, can render PARP inhibitors less effective over time. Additionally, some patients may not respond well to these therapies due to their genetic or molecular profiles.

Potential Side Effects and Safety

Concerns Like many targeted cancer therapies, PARP inhibitors can have side effects, including fatigue, nausea, anemia, and potential toxicities. While generally better tolerated than traditional chemotherapies, these side effects can impact patient quality of life and may lead to treatment discontinuation in some cases. Ongoing research is necessary to address safety concerns and improve the tolerability of PARP inhibitors.

Recent Developments:

|

Development |

Company Name |

|

Lynparza (olaparib) approved in May 2022 for adjuvant treatment of early-stage BRCA-mutated breast cancer, expanding its use beyond advanced settings. |

AstraZeneca |

|

Rubraca (rucaparib) approved in January 2023 for the treatment of metastatic castration-resistant prostate cancer with BRCA mutations, expanding its indications. |

Clovis Oncology |

|

Talzenna (talazoparib) approved in March 2022 for the treatment of HER2-negative locally advanced or metastatic breast cancer with germline BRCA mutations. |

Pfizer |

|

Zejula (niraparib) approved in April 2023 for the treatment of advanced ovarian, fallopian tube, or primary peritoneal cancer, expanding its indications. |

GlaxoSmithKline |

|

Lynparza (olaparib) approved in September 2021 for the adjuvant treatment of BRCA-mutated, high-risk early-stage ovarian cancer after first-line chemotherapy. |

AstraZeneca |

|

Acquisition of Tesaro Inc. for $5.1 billion in January 2019, gaining access to the PARP inhibitor Zejula (niraparib). |

GlaxoSmithKline |

|

Collaboration between AstraZeneca and Merck in August 2022 to evaluate the combination of Lynparza and Merck's immunotherapy Keytruda in various cancer types. |

AstraZeneca, Merck |

|

Merger between Clovis Oncology and Oncologie Inc. in November 2021, strengthening their position in the PARP inhibitor market. |

Clovis Oncology, Oncologie Inc. |

Market Regional Insights:

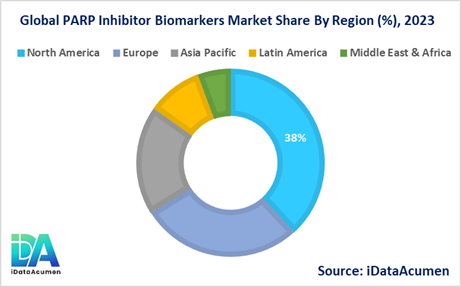

The PARP Inhibitor Biomarkers Market is witnessing significant growth across various regions due to the increasing prevalence of cancers, advancements in biomarker testing, and the availability of targeted therapies like PARP inhibitors.

- North America is expected to be the largest market for the PARP Inhibitor Biomarkers Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of major pharmaceutical companies, well-established healthcare infrastructure, and favorable reimbursement policies for PARP inhibitor therapies.

- Europe is expected to be the second-largest market for the PARP Inhibitor Biomarkers Market, accounting for over 27.9% of the market share in 2024. The growth of the market is attributed to the increasing adoption of PARP inhibitors, rising awareness about personalized medicine, and the availability of advanced diagnostic techniques for biomarker testing.

- The Asia-Pacific market is expected to be the fastest-growing market for the PARP Inhibitor Biomarkers Market, with a CAGR of over 18.7% during the forecast period by 2024. The growth of the market in Asia-Pacific is attributed to the improving healthcare infrastructure, increasing cancer incidence rates, and growing investments in cancer research and development, particularly in countries like China, India, and Japan.

Market Segmentation:

- By Product Type

- Olaparib

- Rucaparib

- Niraparib

- Talazoparib

- Others (Veliparib, Pamiparib, etc.)

- By Cancer Type

- Ovarian Cancer

- Breast Cancer

- Prostate Cancer

- Lung Cancer

- Pancreatic Cancer

- Others (Colorectal, Gastric, etc.)

- By Biomarker Type

- BRCA Mutations

- HRR Gene Mutations

- PARP Expression

- Others (SLFN11, ETS, etc.)

- By Therapy

- Monotherapy

- Combination Therapy

- By End User

- Hospitals

- Specialty Clinics

- Cancer Research Centers

- Others (Diagnostic Laboratories, etc.)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Drug Stores, etc.)

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segmentation Analysis:

For the PARP Inhibitor Biomarkers Market, the following segments are projected to experience significant growth in specific regions, along with their Compound Annual Growth Rate (CAGR) and market size projections:

- By Product Type:

- The olaparib segment is expected to dominate the market and witness strong growth, particularly in North America and Europe, due to its wide range of approved indications and market leadership. It is projected to have a CAGR of around 18-20% in these regions during the forecast period.

- The rucaparib segment is expected to be the second-largest and fastest-growing segment, driven by its recent approval for prostate cancer and potential expansion into other cancer types. It may see a CAGR of around 20-22% in North America and Europe.

- By Cancer Type:

- The ovarian cancer segment is expected to remain the largest segment in 2024, with a projected market size of around $3 billion, owing to the well-established use of PARP inhibitors in this indication.

- The breast cancer segment is likely to be the second-largest and fastest-growing segment, with a CAGR of around 20-22% in North America and Europe, due to the increasing adoption of PARP inhibitors as adjuvant and neoadjuvant therapies.

- By Biomarker Type:

- The BRCA mutations segment is expected to continue dominating the market, driven by the proven efficacy of PARP inhibitors in BRCA-mutated cancers.

- However, the HRR gene mutations segment is projected to witness the highest growth, with a CAGR of around 22-24% in North America and Europe, as more PARP inhibitors targeting these mutations are approved and adopted.

The analysis should consider factors such as approved indications, pipeline products, market penetration, and regional variations in healthcare infrastructure and patient populations.

Top companies in the PARP Inhibitor Biomarkers Market:

- AstraZeneca

- GlaxoSmithKline

- Clovis Oncology

- Pfizer

- Merck & Co.

- Abbvie

- Eisai Co.

- Repare Therapeutics

- Artios Pharma

- Oncologie

- Ribon Therapeutics

- Arcus Biosciences

- Checkpoint Therapeutics

- Verastem Oncology

- Syros Pharmaceuticals

- Sierra Oncology

- Tesaro

- Corcept Therapeutics

- Biomarin Pharmaceutical

- Aprea Therapeutics

The PARP Inhibitor Biomarkers Market is consolidated, with a few major players like AstraZeneca, GlaxoSmithKline, and Clovis Oncology holding significant market shares.