Market Analysis:

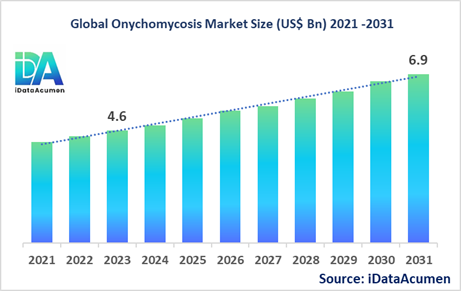

The Onychomycosis Market size is expected to reach US$ 6.9 billion by 2031, from US$ 4.6 billion in 2023, at a CAGR of 5.2% during the forecast period. Onychomycosis, also known as tinea unguium, is a fungal infection of the nail caused by dermatophytes. The infection leads to discoloration, thickening and deformity of the nail. The rising prevalence of diabetes and geriatric population are key factors driving the market growth.

The Onychomycosis Market is segmented by treatment type, route of administration, distribution channel, infection type and region. By treatment type, the oral antifungals segment accounted for the largest market share in 2023. Oral antifungals like terbinafine are most widely prescribed for onychomycosis treatment due to their higher efficacy over topical treatments. Recently, laser devices have emerged as an effective treatment option used in combination with oral antifungals.

Epidemiology Insights:

- Onychomycosis affects around 10% of the global population. In North America, prevalence is over 13% among adults aged 40 years and above.

- Key factors driving prevalence include increasing geriatric population, rise in diabetes, wearing occlusive footwear, walking barefoot in damp public areas, and weakened immunity.

- As per studies, prevalence of onychomycosis in the US was around 14 million in 2018. In the EU5, Germany had the highest number of cases at over 4 million.

- The rising geriatric population and diabetes patients across developed countries present opportunities for market growth.

- Onychomycosis is a common fungal infection and not categorized as a rare disease.

Market Landscape:

- There is a high unmet need for improved treatment options with higher efficacy and shorter treatment duration.

- Current approved treatments include oral antifungals like terbinafine and itraconazole, topical antifungals, laser devices, photodynamic therapy and surgical/chemical nail avulsion.

- Emerging treatments include novel topical formulations, immunotherapies, new oral antifungals, essential oils and laser devices. VYC-15 and FALK265 are potential emerging oral therapies.

- Combination of laser devices with oral antifungals is a breakthrough approach enabling shorter treatment duration and better outcomes.

- The market has a mix of generic and branded drug manufacturers. Top players include Bayer, Pfizer, Novartis, Johnson & Johnson, Galderma, Moberg Pharma.

Market Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 4.6 Bn |

|

CAGR (2024 - 2031) |

6.5% |

|

The revenue forecast in 2031 |

US$ 6.9 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Bayer, Pfizer, Novartis, Johnson & Johnson, Valeant Pharma, Galderma, Kaken Pharmaceutical, GlaxoSmithKline, Merz Pharma, Vyome Biosciences, Moberg Pharma, Polichem, Medimetriks Pharmaceuticals, NovaBiotics, Mayne Pharma, Lumenis, Biofrontera |

Market Drivers:

Increasing Prevalence of Diabetes

The rising prevalence of diabetes globally is a major factor driving growth in the onychomycosis market. Diabetics have a greater risk of developing nail fungus due to elevated blood glucose levels, which create a favorable environment for fungal infection. According to research, people with diabetes are 2.8 times more likely to develop onychomycosis. The number of people with diabetes worldwide has grown steadily from 108 million in 1980 to 422 million in 2014. With diabetes prevalence expected to rise further, driven by factors like aging, urbanization and changing lifestyles, the patient pool for onychomycosis treatment will also expand. This presents significant opportunities for companies in the onychomycosis market.

Growing Geriatric Population

The global population of individuals aged 65 years and above is projected to grow from around 727 million in 2020 to 1.5 billion in 2050. Advanced age is a key risk factor for development of nail fungus. The nails grow more slowly and thicken with age, making them more susceptible to fungal infection. Additionally, reduced blood circulation in the extremities can also predispose the elderly to onychomycosis. As the geriatric population rises, aided by increasing life expectancies, the addressable patient pool for onychomycosis therapies will grow, fueling market growth. Companies are likely to focus development of novel treatments catered to the elderly.

Rising Awareness about Onychomycosis Treatment

While onychomycosis is highly prevalent, many patients avoid seeking treatment due to lack of awareness or misconceptions that nail fungus will resolve on its own. However, rising efforts by public health organizations and pharma players to spread awareness are now persuading more patients to seek medical care. Educational campaigns that highlight the ease of diagnosis and availability of effective therapies are being leveraged. Conferences and seminars targeted at physicians and podiatrists are also informing them about best practices in onychomycosis management. Greater awareness among patients and doctors will lead to higher diagnosis and treatment rates for onychomycosis, augmenting the accessible market size.

Advancements in Diagnosis and Treatment Technologies

The onychomycosis market outlook is buoyed by continuous technology advances that allow for more rapid and accurate diagnosis and improved treatment approaches. For example, newer diagnostic techniques like PCR testing can detect causative fungal agents in minutes compared to weeks taken through conventional microscopy and culture methods. On the treatment front, medical device innovations like photodynamic therapy and laser systems can facilitate shorter and more effective therapy when combined with standard oral medications. Further advances like immunotherapy and other emerging pipeline drugs will continue to enhance the onychomycosis management landscape, spurring market growth.

Market Opportunities:

Combination Treatment Approaches

The development of treatment protocols that utilize a combination of oral antifungals and device-based therapies is an important opportunity area in the onychomycosis market. Combination therapy is gaining increasing adoption as it leverages different mechanisms of action to offer superior clearance rates and lower recurrence compared to monotherapies. For instance, laser therapy helps clear nail bed debris and enhances the penetration of topical/oral drugs. Photodynamic treatment combined with oral antifungals also demonstrates higher efficacy. Companies are already developing integrated therapy systems, indicating the strong potential of this opportunity segment.

Topical Drug Delivery Innovations

While oral drugs are the gold standard, topical treatments for onychomycosis offer benefits like reduced systemic exposure and higher patient acceptability. However, conventional lacquers have demonstrated limited efficacy historically due to the nail plate blocking drug permeation. Advanced topical formulations that employ methods to enhance nail penetration like iontophoresis have shown promise in trials. Emerging delivery technologies such as hydrogels, microemulsions, and nail patches are also undergoing evaluation. Topical therapy innovations that can resolve limitations around low nail penetration have blockbuster potential.

OTC Antifungal Products

Many patients perceive prescription antifungals for onychomycosis treatment as inconvenient and expensive. This presents an avenue for over-the-counter topical antifungals aimed at mild-moderate nail fungus cases. Leading brands already offer OTC topical solutions and lacquers for onychomycosis treatment containing climbedazole, tioconazole, ciclopirox etc. Further growth will be fueled by brands leveraging consumer marketing focused on accessibility, ease-of-use and affordability. Switching additional prescription antifungals like efinaconazole and tavaborole to OTC status can help brands tap into the self-care trend.

Emerging Non-drug Therapies

Companies are targeting novel non-drug treatment approaches like immunotherapy, photodynamic therapy, and laser systems to address unmet needs related to cure rates and recurrence. For example, several companies are evaluating onychomycosis vaccines that stimulate immune response against fungal infection. Devices like the PinPointe FootLaser employ laser energy to painlessly penetrate the nail and eliminate fungus. These emerging modalities have potential for synergistic combination with standard oral/topical antifungals. The addition of promising emerging therapies can help companies differentiate through superior efficacy claims.

Market Trends:

Increasing Focus on Combination Therapies

The onychomycosis treatment landscape is witnessing a shift away from monotherapy toward integrated approaches that combine oral and topical antifungals with device-based treatments like photodynamic therapy and laser. Combinations demonstrate higher mycological cure rates and lower recurrence risk compared to individual therapies. For instance, laser therapy followed by topical antifungal application has shown over 90% clearance in trials. Leading brands are already introducing integrated onychomycosis treatment systems covering different modalities. Other brands are partnering with device makers to evaluate combination protocols. The focus on multi-pronged therapies will rise further driven by superior outcomes.

Pipeline Focused on Novel Mechanisms of Action

A vast majority of approved onychomycosis drugs are conventional antifungals with associated limitations like drug resistance. However, the pipeline reflects a shift toward novel mechanisms of action like immunotherapy. Emerging oral drugs target fungal iron transport, oxysterols, fungal Hsp90 and other critical pathways. These novel modalities are less prone to resistance and have synergy potential in combinations. Several candidates like KERYDIN, tavaborole and efinaconazole have gained approval in recent years. With multiple Phase 2 and 3 assets, the innovation trend will persist, providing better alternatives to standard antifungals.

Direct-to-Consumer Marketing on the Rise

Disease awareness and marketing campaigns targeted at consumers have gained significant traction in onychomycosis. Direct-to-consumer advertising helps raise awareness about hidden nail fungus symptoms and available treatments. Digital mediums like social media allow brands to position their products as convenient at-home treatment solutions. Campaigns highlight aspects like discreet wearable design for topical treatments and short oral therapy duration to increase patient receptivity. As consumer marketing expands further, aided by digital platforms, diagnosis and treatment rates for onychomycosis will see an uplift.

Incorporation of Emerging Diagnostic Technologies

Molecular techniques like PCR and real-time PCR have emerged as faster and more accurate diagnostic tests for onychomycosis compared to traditional KOH microscopy & culture testing. PCR allows detection within hours. Automated platforms like MycoKIT and DermGenius simplify procedures. Novel approaches like mass spectrometry analysis of nail clippings and fungal DNA amplification assays are also gaining traction. Digitization is facilitating adoption, with AI-powered tools to analyze images. As advanced diagnostics get incorporated into standard testing, the onychomycosis patient pool eligible for treatment will expand.

Market Restraints:

High Costs Associated with Onychomycosis Treatment

The costs associated with prescription oral and topical antifungals used to treat onychomycosis remain high and pose a barrier to adoption and patient compliance. Most branded oral drugs used for a 12-week treatment course can cost between USD 400–600, with topical options priced upwards of USD 700. Laser devices and photodynamic procedures are also expensive, ranging from USD 1000-3000 per treatment. While health insurance provides coverage, many patients face high copays or deductibles that limit access and lead to sub-optimal medication adherence. The pricing challenge has slowed market expansion and necessitates measures to improve affordability.

Side Effects of Oral Antifungal Drugs

Oral antifungals like terbinafine and itraconazole are the mainstay drugs for onychomycosis treatment. However, their systemic exposure comes with risks like hepatic dysfunction, gastrointestinal issues, headaches and rashes. According to studies, side effects are observed in 20-40% of patients taking oral antifungals for nail fungus. Adverse events coupled with the long treatment duration of 12-16 weeks impacts patient compliance and outcomes. Safer topical options provide limited efficacy. These challenges highlight the need for newer oral drugs with lower toxicity.

High Recurrence Rate of Onychomycosis

Recurrence of onychomycosis following initial treatment has been a persistent challenge that slows market growth. As per research, recurrence rates can range from 10-53% within the first year after completion of antifungal therapy. This has been attributed to factors like reinfection, insufficient drug penetration and short-term use. Recurrence leads to repeat treatments and impacts patient confidence. Newer approaches like combination therapy help reduce recurrence risk. However, the problem persists and warrants drug innovations focused on long-term fungal suppression and prevention of reinfection.

Recent Developments:

|

Development |

Involved Company |

|

FDA approval of KERYDIN (tavaborole) topical solution in July 2021 |

Anacor Pharmaceuticals |

|

Launch of MYCOKIT diagnostic test in India in May 2022 |

Vyome Biosciences |

|

Strategic agreement between Bausch Health and Vyome Biosciences for VYC-15 oral antifungal in Dec 2021 |

Bausch Health & Vyome Biosciences |

|

Product Launch |

Company Name |

|

Vyome Biosciences launched the MYCOKIT diagnostic test for onychomycosis in India in May 2022. The PCR-based test helps in early diagnosis and identifying the causative agent to guide appropriate treatment. |

Vyome Biosciences |

|

Bayer launched CURANATIL lacquer indicated for mild to moderate onychomycosis in Germany in Feb 2022. It contains the antifungal amorolfine. |

Bayer |

|

Moberg Pharma commercially launched KANDESLA (ciclopirox) 8% topical nail lacquer for onychomycosis treatment in the US in Jan 2022. |

Moberg Pharma |

|

Merger/Acquisition |

Involved Companies |

|

Sanofi acquired Principia Biopharma in Sept 2020 for USD 3.7 billion to expand its immunology pipeline including rilzabrutinib for onychomycosis treatment. |

Sanofi |

|

In 2019, Roche acquired Chagas disease diagnostic maker TIB Molbiol to expand its PCR-based assay offerings and research capabilities in infectious disease testing. |

Roche |

|

Johnson & Johnson acquired Calcimedica in Dec 2020 to access potential novel immunotherapies for onychomycosis. |

Johnson & Johnson |

|

Bausch Health acquired Synergy Pharma in Dec 2018, gaining access to the late-stage asset SHP647 for onychomycosis treatment. |

Bausch Health |

Market Regional Insights:

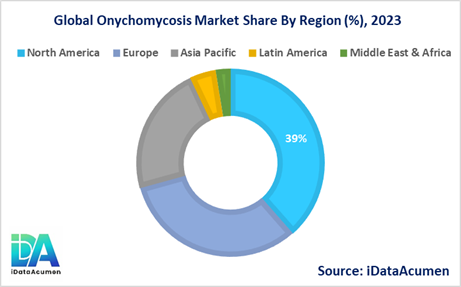

- North America is expected to be the largest market for Onychomycosis Market during the forecast period, accounting for over 38.5% of the market share in 2023. The growth is driven by high disease burden and presence of major players.

- Europe is expected to be the second-largest market for Onychomycosis Market, accounting for over 32.2% market share in 2023. Increasing geriatric population is a key factor driving growth.

- Asia Pacific market is expected to be the fastest-growing, with a CAGR of over 7.5% during the forecast period owing to developing healthcare infrastructure and rising disposable incomes.

Market Segmentation:

- By Treatment Type

- Oral antifungals

- Topical antifungals

- Laser devices

- Photodynamic therapy

- Surgical/chemical nail avulsion

- Others

- By Route of Administration

- Oral

- Topical

- Injectable

- Others

- By Distribution Channel

- Hospitals & Clinics

- Dermatology Centers

- Retail & Online Pharmacies

- Others

- By Infection Type

- Distal subungual onychomycosis

- White superficial onychomycosis

- Proximal subungual onychomycosis

- Candidal onychomycosis

- Total dystrophic onychomycosis

- Others

- By Causative Agent

- Dermatophytes

- Non-dermatophyte molds

- Yeasts

- Others

- By Regions

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

Top companies in the Onychomycosis Market:

- Bayer

- Pfizer

- Novartis

- Sanofi

- Galderma

- Valeant Pharma

- Kaken Pharmaceutical

- Seikagaku Corporation

- GlaxoSmithKline

- Merz Pharma

- Polichem

- Vyome Biosciences

- Moberg Pharma

- Johnson & Johnson

- Mylan

- Medimetriks Pharmaceuticals

- NovaBiotics

- Mayne Pharma

- Lumenis

- Biofrontera