Market Analysis:

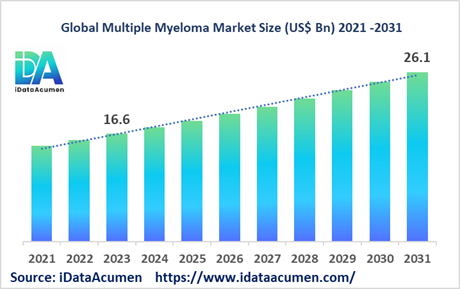

The Multiple Myeloma Market size is expected to reach US$ 26.1 billion by 2031, from US$ 16.6 billion in 2023, at a CAGR of 5.8% during the forecast period. Multiple myeloma is a type of blood cancer that starts in the plasma cells of the bone marrow. It leads to an excessive accumulation of these abnormal plasma cells, suppressing the production of normal blood cells. The rising incidence of multiple myeloma globally, especially among the elderly population, is driving the market growth. Key drivers include the aging population, new drug launches, and advances in diagnostics.

The Multiple Myeloma Market is segmented by drug class, distribution channel, line of treatment, and region. By drug class, the market is dominated by immunomodulatory drugs like Revlimid by Bristol-Myers Squibb. These drugs work by regulating the immune system to attack myeloma cells. Their increasing use in combination therapies is driving the growth of this segment. For example, in May 2021, Bristol Myers Squibb received the FDA approval for the combination of Opdivo (nivolumab) with Revlimid and dexamethasone for treating multiple myeloma.

Epidemiology Insights:

- Multiple myeloma accounts for approximately 1% of all cancers. Over 32,000 new cases are estimated to be diagnosed in the US in 2023.

- The incidence rates are increasing in most developed countries at a rate of 0.8% per year. This is linked to aging populations.

- The 5-year prevalence of multiple myeloma is around 230,000 cases in the top 8 countries (US, Japan, France, Germany, Italy, Spain, UK, Canada).

- The increasing prevalence provides opportunities for drug sales and the development of novel therapies. However, low diagnosis rates remain a concern.

Market Landscape:

- High unmet needs exist, as multiple myeloma remains an incurable cancer. Patients eventually relapse and develop resistance to therapies.

- Current treatments include chemotherapy, steroids, stem cell transplants, immunotherapies like monoclonal antibodies, and targeted therapies.

- Many new drug classes like CAR T-cell therapies, bispecific antibodies, and ADCs are being explored for relapsed/refractory MM. For example, Bristol Myers' Breyanzi, a BCMA-targeted CAR-T therapy.

- The market is dominated by patented, branded drugs. Biosimilars are starting to emerge.

Market Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 16.6 Bn |

|

CAGR (2024 - 2031) |

5.8% |

|

The revenue forecast in 2031 |

US$ 26.1 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Takeda, Janssen, Bristol Myers Squibb, Amgen, Novartis, AbbVie, GlaxoSmithKline, Roche, Merck, Johnson & Johnson |

Market Drivers:

Advances in Multiple Myeloma Drug Development

Multiple myeloma treatment has seen major advances in the last decade with the development and approval of novel therapies like monoclonal antibodies, immunomodulators, and proteasome inhibitors. These drugs have significantly improved patient outcomes by enhancing response rates and progression-free survival. For instance, the monoclonal antibody daratumumab (Darzalex by Janssen) received FDA approval in 2015 as a breakthrough therapy for treating multiple myeloma. It has shown improved efficacy when used in combination regimens for both frontline and relapsed/refractory settings. Such innovative drug development is a major driver propelling the multiple myeloma market growth.

Rising Investments in R&D for Novel Therapies

Pharmaceutical companies are increasingly focusing their R&D efforts on developing novel treatments for multiple myeloma, given the high unmet need and lucrative market potential. Several drug classes like CAR T-cell therapies, antibody-drug conjugates (ADCs), bispecific antibodies, and epigenetic inhibitors are being explored as potential therapies. For example, Bristol Myers Squibb recently acquired Celgene in a $74 billion deal to strengthen its oncology pipeline including Celgene’s promising CAR T-cell therapy bb2121 for multiple myeloma. Such rising investments in R&D across novel mechanisms of action will lead to new drug approvals, fueling further growth of the MM market.

Increasing Use of Combination Treatment Regimens

The paradigm for multiple myeloma treatment is gradually shifting from monotherapy to combination regimens. Combining drugs with different mechanisms of action has been shown to improve response rates compared to individual agents. For instance, combining an immunomodulator like lenalidomide with a proteasome inhibitor and dexamethasone is now considered standard of care in newly diagnosed MM patients. Recently approved triple combo regimens like daratumumab plus Revlimid and dexamethasone are also gaining popularity. This increasing use of synergistic combination therapies will boost drug sales, propelling market growth.

Improving Access to Healthcare Globally

The multiple myeloma market is poised for expansion with improving healthcare access in emerging economies and rising healthcare spending across the globe. Developing nations are making efforts to strengthen their healthcare infrastructure and enable better disease diagnosis and treatment. The approval and launch of patented oncology drugs in new geographical markets also improves access. Furthermore, favorable reimbursement makes these advanced myeloma therapies accessible to a wider patient pool. The improving access to healthcare globally will result in increased drug sales and treatment adoption.

Market Opportunities:

Development of Curative Therapies

Despite recent treatment advances, multiple myeloma remains an incurable cancer. All patients eventually relapse and develop resistance to approved therapies. This represents a significant unmet need and lucrative opportunity for drug developers to come up with curative therapies that can eradicate residual myeloma cells. Novel modalities like CAR T-cell therapy and antibody-drug conjugates hold potential in advancing towards a cure. The company that develops a safe, effective and durable curative therapy could gain first-mover advantage and capture substantial market share.

Biosimilar Development

The growing multiple myeloma market has been dominated by a few patented, branded drugs like Revlimid, Velcade and Darzalex. However, many of these top-selling drugs will see patent expiries in the coming years. This will pave the way for biosimilar development, providing opportunity to generic manufacturers. Biosimilars of filgrastim, rituximab and bevacizumab have already been approved. The development and launch of biosimilars for widely used MM drugs will make the treatment more affordable and accessible while also allowing biosimilar makers to gain share.

Expansion in Emerging Markets

The multiple myeloma market has tremendous growth opportunities in the emerging markets of Asia Pacific and Latin America considering their large population base and rising cancer incidence. Many multinational companies are focusing on launching their drugs in these regions. For instance, Takeda recently launched Ninlaro in China. Local players can also flourish by developing biosimilars and affordable generics for these markets. Increasing investments in healthcare infrastructure and patient assistance programs will also aid adoption of novel MM therapies in emerging economies.

Development of Companion Diagnostics

The development of companion diagnostics that can detect specific biomarkers to identify the patient population likely to benefit from a particular therapy will unlock new opportunities. For example, Janssen's Darzalex is now approved in combination with a CD38 diagnostic. Companion diagnostics will allow for more targeted treatment, improved outcomes and higher sales of paired therapeutic agents. They will also aid in monitoring residual disease and relapse. Introducing similar companion diagnostics for other multiple myeloma drugs can help providers determine optimal treatment plans.

Market Trends:

Combination Therapies with Immunotherapies

Immunotherapies that harness the patient's immune system to attack myeloma cells are gaining significant traction in multiple myeloma. Antibody-based immunotherapies like daratumumab and elotuzumab have shown improved efficacy in combination with standard agents. The focus is now shifting to combine immunotherapies like these monoclonal antibodies with other novel drugs having different mechanisms of action. For instance, combinations of daratumumab with CAR T-cell therapy and ADC are being evaluated. Such synergistic combinations will improve patient outcomes compared to monotherapy.

Development of Oral Therapies

Multiple myeloma treatment typically involves intravenous or subcutaneous administration of drugs. This reduces quality of life for patients due to repeated doctor visits and injections. Recognizing this unmet need, companies are now attempting to develop effective oral therapies for multiple myeloma. For example, Amgen’s Kyprolis and Karyopharm’s Xpovio have been launched in oral formulations. Oral administration improves patient compliance and convenience. More efforts to formulate monoclonal antibodies and other novel MM drugs into oral medication will be a key trend.

Big Data Analytics and Precision Medicine

Pharmaceutical companies are leveraging big data analytics and machine learning to enable precision medicine for multiple myeloma. Large datasets help identify specific biomarkers that can predict patient outcomes and response to particular therapies. This allows for more personalized treatment. Big data analytics also aid in tracking patient jouneys to understand unmet needs. Insights from real-world evidence ultimately support the development and commercial success of novel MM therapies.

Value-based Pricing Models

Given the high cost burden of multiple myeloma treatment, especially novel targeted therapies and immunotherapies, there is a shift towards value-based pricing models. These link the pricing of drugs to their overall value delivered based on metrics like clinical efficacy and patient outcomes. For instance, outcomes-based contracts have been implemented for Amgen’s Blincyto and Novartis’ Kymriah wherein payment is tied to achievement of pre-defined treatment milestones. The adoption of such pricing strategies will ensure patient access while also benefiting manufacturers.

Market Restraints:

High Costs of Novel Therapies

The median monthly cost of multiple myeloma treatment with newer drugs now exceeds $20,000, imposing a huge economic burden on patients and payers. For instance, the CAR T-cell therapy therapies Breyanzi and Abecma have been priced over $400,000. While these advanced therapies improve outcomes, their premium pricing makes adoption and reimbursement challenging. The high costs of novel MM drugs coupled with limited insurance coverage in emerging markets restraints market growth to some extent.

Adverse Effects of Therapies

While recent drug advances have improved efficacy, most multiple myeloma therapies are associated with moderate to severe adverse effects. For example, immunotherapies can cause cytokine release syndrome and neurotoxicity while thalidomide leads to nausea and somnolence. The adverse effects coupled with increased treatment complexity due to combination regimens may negatively impact patient compliance and therapy discontinuation rates. This can restrain the growth of multiple myeloma market to some degree.

Low Diagnosis Rates

Delayed diagnosis of multiple myeloma remains a key challenge globally, especially in developing nations where access to diagnostic technologies is limited. Patients are often diagnosed at an advanced stage when treatment outcomes are poor. Early diagnosis is pivotal when dealing with an aggressive malignancy like myeloma. Concerted efforts are required to improve diagnosis rates through screening programs and diagnostic access. The low diagnosis rates, particularly in emerging economies, restraints growth opportunities to some extent.

Recent Developments:

|

Development |

Involved Company |

|

FDA approval of melphalan flufenamide (Pepaxto) in Feb 2021 for relapsed/refractory multiple myeloma |

Oncopeptides |

|

Acquisition of Legend Biotech by Janssen for $7 billion in June 2023 |

Johnson & Johnson |

|

Positive phase 3 data for isatuximab in newly diagnosed multiple myeloma patients published in Dec 2021 |

Sanofi |

|

Product Launch |

Company Name |

|

Sarclisa (isatuximab), a monoclonal antibody, was approved by the FDA in March 2020 for relapsed/refractory multiple myeloma. Developed by Sanofi, Sarclisa showed improved progression-free survival when combined with standard therapies. |

Sanofi |

|

Xpovio (selinexor), an oral XPO1 inhibitor, was approved by the FDA in Dec 2019 in combination with dexamethasone for treating relapsed/refractory multiple myeloma. Developed by Karyopharm Therapeutics, Xpovio offers a new mechanism of action for patients whose disease is refractory to immunomodulatory drugs and proteasome inhibitors. |

Karyopharm Therapeutics |

|

Pomalyst (pomalidomide) was approved by the FDA in Feb 2013 in combination with dexamethasone for relapsed/refractory multiple myeloma patients who have received at least 2 prior therapies. Developed by Bristol-Myers Squibb, it provided a novel immunomodulatory drug option. |

Bristol-Myers Squibb |

|

Merger/Acquisition |

Involved Companies |

|

Bristol Myers Squibb acquired Celgene in Nov 2019 for $74 billion, combining two leading companies in oncology and immunology. The acquisition strengthened Bristol Myers’ position in multiple myeloma with blockbuster Revlimid (lenalidomide). |

Bristol Myers Squibb, Celgene |

Market Regional Insights:

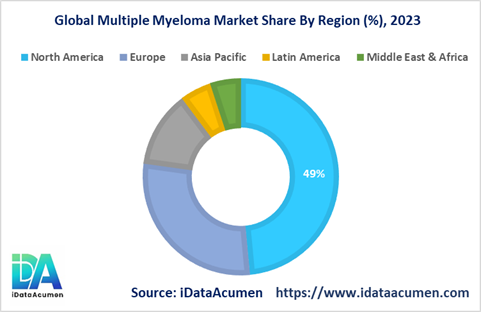

North America dominated the global multiple myeloma market in 2023, accounting for 48.5% of the market share. The high disease burden, growing elderly population, presence of key players, and high diagnosis rates are driving the North American market.

Europe accounted for the second largest share of the multiple myeloma market in 2023 at 26.1%. Rising prevalence, favorable government policies, and product launches by regional companies like GSK and Sanofi are propelling the European multiple myeloma market.

The Asia Pacific market is anticipated to expand at the fastest CAGR during the forecast period owing to improving healthcare infrastructure, increasing spending on oncology care, and growing patient pool in the region’s developing economies.

Market Segmentation:

- By Drug Class

- Immunomodulatory drugs (IMiDs)

- Proteasome inhibitors

- Monoclonal antibodies

- Histone deacetylase inhibitors

- Immunotherapies

- By Route of Administration

- Oral

- Injectable

- Intravenous

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Line of Treatment

- Frontline

- Second-line

- Third-line and beyond

- By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

- North America

Top companies in the Multiple Myeloma Market:

- Takeda

- Janssen

- Bristol Myers Squibb

- Amgen

- Novartis

- AbbVie

- GlaxoSmithKline

- Roche

- Merck

- Johnson & Johnson