Market Insights:

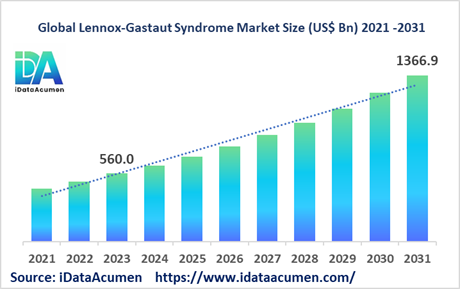

The Lennox-Gastaut Syndrome (LGS) Market is poised for remarkable growth, with a projected market size of USD 1,366.9 million by 2031, up from USD 560 million in 2023. This surge represents an impressive compound annual growth rate (CAGR) of 11.8% By 2024-2031. LGS, a rare and severe form of childhood-onset epilepsy characterized by a spectrum of seizure types, intellectual disability, and developmental delays, is managed through a multifaceted approach involving anti-epileptic drugs, vagus nerve stimulation, ketogenic diet, and occasionally surgical intervention. Key factors driving this expansion include the rising global prevalence of LGS and the continuous development of novel therapeutic options.

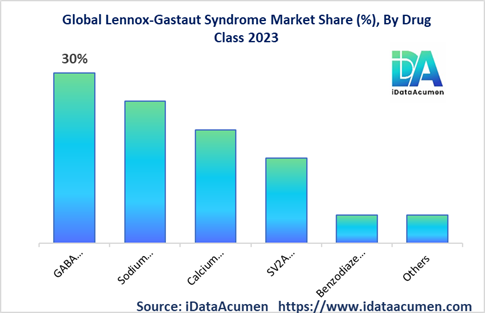

Typically manifesting between the ages of 3 and 5, LGS exhibits a complex market landscape, segmented by drug class, route of administration, distribution channel, age group, treatment type, and geographical region. Within the drug class category, the market is further divided into GABA modulators, sodium channel blockers, calcium channel blockers, SV2A modulators, benzodiazepines, and others. Among these, the GABA modulators segment is anticipated to seize the largest market share. This dominance is attributed to the widespread utilization of GABA-enhancing anti-epileptic drugs such as clobazam, often prescribed as a primary therapy for LGS. Notably, in May 2022, Zogenix achieved a significant milestone with the approval of Fintepla (fenfluramine) by the US FDA, marking a promising addition to the arsenal of treatments available for managing LGS seizures.

Epidemiology Insights:

- The prevalence of LGS is estimated to be around 1 in 20,000 to 26,000 children globally. LGS accounts for 1-4% of childhood epilepsies.

- In the US, the prevalence of LGS is about 0.9 per 10,000 children. In the EU, LGS prevalence ranges from 0.1-0.28 per 10,000. In Japan, prevalence is 0.1 per 10,000 children.

- The incidence of newly diagnosed LGS cases is estimated to be 2 per 100,000 children per year in the US.

- The increasing cases of pediatric epilepsy globally, especially in developing regions, is expected to drive LGS patient growth. Diagnosis rates are also improving.

- LGS is considered a rare disease. It is refractory to treatment and requires lifelong care.

Market Landscape:

- Significant unmet needs exist for LGS treatment as over 90% of patients continue to experience seizures despite therapy. Many patients develop drug-resistant LGS.

- Currently approved therapies include clobazam, valproate, lamotrigine, topiramate, felbamate, rufinamide, cannabidiol, and fenfluramine. Non-pharmacological options are vagus nerve stimulation and ketogenic diet.

- The pipeline includes therapies like huperzine A, ganaxolone, allopregnanolone, and cx-8998. Neurostimulation devices are also being developed.

- Gene replacement therapy and immunotherapy are emerging as potential breakthrough approaches for managing LGS.

- The market has a mix of branded anti-epileptic drugs from players like Eisai, Zogenix, GW Pharma, and generics from companies like Sunovion, Upsher-Smith, Pfizer.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 560 Mn |

|

CAGR (2024 - 2031) |

11.8% |

|

The revenue forecast in 2031 |

US$ 1,366.9 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Eisai, Lundbeck, INSYS Therapeutics, GW Pharmaceuticals, Zogenix, Supernus Pharmaceuticals, Marinus Pharmaceuticals, Upsher-Smith Laboratories, Johnson & Johnson, Valeant Pharmaceuticals, Pfizer, UCB, Acorda Therapeutics, Bausch Health, Sunovion Pharmaceuticals, SK Life Science, Arvelle Therapeutics, Biocodex, Novartis, GlaxoSmithKline |

Market Drivers:

Increasing Disease Prevalence

Lennox-Gastaut syndrome (LGS) is a rare and severe form of epilepsy that typically begins in early childhood. The exact prevalence is uncertain but estimates indicate it affects around 1 in 20,000 to 1 in 26,000 children worldwide. In the US, the prevalence is approximately 0.9 per 10,000 children. The incidence of new cases is around 2 per 100,000 children per year in the US. The rising prevalence of LGS globally is a major factor expected to drive market growth during the forecast period.

The increasing number of pediatric epilepsy cases in both developed and developing regions will contribute to more patients being diagnosed with LGS. Expanding population bases, growing awareness about LGS among physicians and improvements in diagnostic techniques are also leading to more cases being identified and treated. As more patients seek treatment, the demand for anti-epileptic drugs and devices will rise, fueling market expansion.

Product Innovation and Pipeline

There is a substantial need for more effective drugs and devices to manage LGS as the condition is highly treatment-resistant with most patients continuing to experience debilitating seizures despite therapy. Currently available options provide inadequate seizure control and there is an urgency for better solutions. Companies are responding by channeling investments into LGS research and developing innovative therapies.

In recent years, novel products like the SV2A inhibitor Fintepla, cannabidiol drugs, and the nasal spray Valtoco have been approved specifically for LGS providing new options for managing seizures. The pipeline also looks promising with candidates like huperzine A, ganaxolone, and neurostimulation devices in development. Investment in cutting-edge areas like gene therapy is also underway. As these innovative products secure approvals and launch, they will address significant unmet needs in the LGS market.

Rising Awareness and Access

LGS remains under-recognized and misdiagnosed in many countries due to limited knowledge among primary care providers. Patients often undergo treatment delays because of these issues. However, initiatives by patient advocacy groups and shifting physician attitudes are slowly improving awareness about LGS. Educational programs targeted at pediatricians and neurologists are helping enhance disease understanding.

Pharmaceutical companies are also undertaking patient access programs to increase testing and early LGS detection. Improved awareness among doctors supports timely referrals and treatment. In parallel, health policies like the Affordable Care Act are promoting access to anti-epileptic medications in previously underserved groups. As diagnosis and treatment access become more widespread, the patient pool is likely to expand driving market growth.

Favorable Government Policy

Regulatory policies play an important role in facilitating drug development and approvals for rare diseases like LGS. The US FDA offers incentives like Orphan Drug Designation, fast-track review status, breakthrough therapy status, and priority review to spur research. Recent LGS drug approvals may not have been possible without such initiatives. The FDA is also supportive of expedited development plans leveraging real-world data.

In Europe, the EMA provides similar incentives through its PRIME scheme and Adaptive Pathways program. Favorable regulations provide sponsors with tangible benefits making LGS an attractive area for investment. As more developers receive special status for their candidates, new drug launches will accelerate – propelling market expansion.

Market Opportunities:

Drug Repurposing

Drug repurposing involves identifying new therapeutic applications for existing approved medications. It provides a time and cost-efficient drug development strategy compared to new chemical entity development. The approach is gaining increasing traction in the pharmaceutical industry. Several commonly used drugs are now being evaluated for repurposing in LGS based on early signals of efficacy.

For instance, the antipsychotic drug lurasidone was recently reported to show potential in controlling LGS seizures. The calcium channel blocker bepridil also exhibited promising effects in preliminary studies. As more drugs demonstrate positive results in pilot LGS trials, sponsors may initiate large-scale confirmatory studies and apply for label expansions. Successful repurposing of approved drugs for LGS will generate new rapid-to-market opportunities.

Combination Therapies

Most LGS patients require multiple medications concurrently to control seizures as monotherapies are typically inadequate. However, there is limited evidence on optimal combinations. The emerging trend of evaluating different anti-epileptic drug cocktails provides fresh opportunities to identify effective regimens tailored to individual needs.

For example, adjuvant cannabidiol was found to enhance the efficacy of clobazam based on analysis of drug interactions. As data from combination trials accumulates, it will guide prescribing, augmenting outcomes. Companies can also co-formulate proprietary fixed-dose combinations creating more convenient LGS therapies. Overall, a personalized multi-drug approach represents an area of significant potential.

Expansion into Emerging Markets

The LGS market remains largely concentrated in North America and Europe presently. However, the disease burden is steadily growing in emerging regions. This offers an attractive expansion opportunity for companies as large underserved patient pools exist in Asia Pacific, Latin America, Middle East and Africa. Investing in clinical education programs and collaborating with local partners can help improve diagnosis rates and access in these untapped markets.

Adapting pricing and marketing strategies to suit local needs will also be key. Companies who prioritize emerging markets can gain substantial first-mover advantage. As healthcare infrastructure and spending capacity evolves, these countries will contribute substantially to driving market growth.

Digital Health Integration

Incorporating digital health tools like mobile apps, wearables, and telemedicine into LGS management can improve patient adherence, engagement, and outcomes. Digital epilepsy trackers enable better seizure logging and monitoring. Platforms integrating smart medication sensors with provider portals allow remote treatment optimization. AI-enabled chatbots and patient education apps also empower self-management.

While still nascent, adoption of such technologies will likely accelerate creating opportunities for digital therapeutics companies. Collaborations between pharma and tech firms can help integrate digital solutions into existing workflows and commercial offerings – delivering substantial value.

Market Trends:

Increased Use of Genetic Testing

Advances in genetic sequencing have enabled better elucidation of the role of underlying mutations in LGS and other epileptic encephalopathies. Widescale testing helps identify candidate genetic defects that may be driving disease progression. For instance, variants in genes including GABRA1, ALG13, SCN8A, and KCNT1 have been implicated in LGS.

Genetic diagnosis allows personalized treatment approaches based on targetable mutations. It also facilitates prognostication, family screening and counseling. Moreover, recognizing specific gene variants presents opportunities for tailored gene therapies. As sequencing costs continue declining, the application of genomic analysis in the diagnostic workup is anticipated to gain further prominence.

Big Data and Real-World Evidence

Pharmaceutical companies are increasingly harnessing big data analytics and real-world evidence (RWE) to support various LGS drug development needs. Advanced data mining techniques help uncover patterns and insights from vast healthcare datasets that can aid clinical trial design and recruitment. RWE is enabling more efficient pediatric trial execution.

Post-approval, RWE gathered from electronic records, registries and mobile health apps is demonstrating products’ real-world usefulness. The 21st Century Cures Act is promoting big data and RWE integration. As analytics capabilities and data usefulness improve, data-driven approaches will likely become ubiquitous.

Patient-centric Drug Delivery Solutions

Patient-centric formulation is emerging as a key differentiating element in the LGS market. Adherence and usability challenges associated with oral anti-seizure medications in pediatric patients has prompted development of innovative formulations and delivery mechanisms. Nasal sprays, oral dissolving tablets, oral solutions/suspensions and transdermal patches are among novel formats being adopted.

Eisai’s Fycompa pediatric suspension and Zogenix’s needle-free Fintepla system exemplify the focus on optimizing ease of use. As patients’ therapy needs and preferences take center stage, patient-centric delivery methods will dominate new product innovation.

Expansion of Neurostimulation Devices

Vagus nerve stimulation through implanted devices is an established adjunctive LGS therapy. However, the high upfront costs and invasiveness limits widespread use. Emerging non-invasive or minimally-invasive electrical stimulation modalities like external trigeminal nerve stimulation offer safer, cheaper alternatives.

Promising pilot study results have sparked development programs. Moreover, closed-loop smart systems that apply targeted stimulation in response to brain activity changes are advancing. Neurostimulation is a rapidly evolving field and continued innovation will provide new options for device-based LGS control.

Market Restraints:

Side Effects of Pharmacotherapy

Most anti-seizure drugs used in LGS are associated with considerable adverse effects due to their modulation of central neurotransmitters. Issues like somnolence, fatigue, dizziness, nausea, vomiting, weight gain, suicidal ideation and dermatological reactions are frequently observed with medications like clobazam, lamotrigine, rufinamide etc.

The polypharmacy approach also increases risks of drug interactions. Frequent side effects coupled with tolerability concerns due to long-term use tend to negatively impact adherence and continuation – restraining market growth. Developing better tolerated drugs remains a challenge.

High Treatment Costs

The direct costs of managing LGS pose a substantial economic burden on patients and the healthcare system. In the US, the average annual direct costs for LGS treatment is around $50,000 per patient with AEDs and hospitalizations accounting for the bulk of expenses. Access to newer branded AEDs is especially limited in developing regions due to high prices.

Many patients also require lifelong therapy placing additional constraints on healthcare budgets. Without measures to improve affordability, the prohibitive pricing of LGS treatment will continue hindering market growth to an extent.

Patent Expiry of Key Drugs

Market growth is significantly dependent on the commercial success of patented branded therapies protected from competition. However, many first-in-class anti-epileptic drugs including ezogabine, rufinamide, and perampanel will encounter patent expiry during the forecast period.

This will precipitate launch of low-cost generics eroding revenues. Companies may also face pressure to cut prices in line with cheaper alternatives. The patent cliff represents a key restraining factor that could impede near-term market progress until more proprietary products emerge.

Recent Developments:

|

Development |

Involved Company |

|

November 2022: SK Life Science, Biohaven |

SK Life Science |

|

February 2022: FDA approved Fintepla Zogenix (fenfluramine) oral solution for LGS |

Fintepla Zogenix |

|

January 2021: GW Pharma reported positive phase 3 results for cannabidiol in treating seizures associated with LGS |

GW Pharmaceuticals |

|

December 2020: Eisai launched oral suspension for adjunctive treatment of LGS seizures in patients ≥12 years |

Eisai Fycompa (perampanel) |

|

May 2022: Neurelis’ Valtoco (NRL-1) Neurelis nasal spray approved by FDA for acute treatment of LGS seizures |

Neurelis |

|

March 2022: FDA granted orphan drug Marinus Pharmaceuticals designation to ganaxolone IV for LGS |

Marinus Pharmaceuticals |

|

August 2021: Jazz Pharma completed Jazz Pharmaceuticals, GW acquisition of GW Pharma, gaining Pharmaceuticals cannabidiol drug Epidiolex approved for LGS |

Jazz Pharma |

Regional Insights:

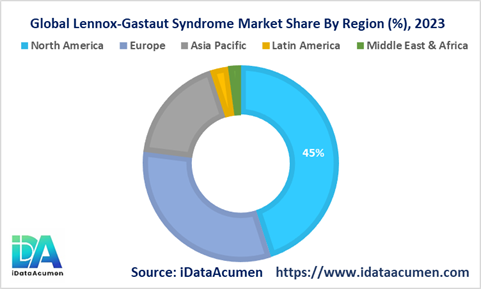

The prevalence of Lennox Gastaut Syndrome (LGS) varies significantly across different geographic regions, with several factors like awareness, healthcare accessibility, and income levels influencing the growth of the LGS market.

North America is anticipated to emerge as the dominant player in the Lennox Gastaut Syndrome Market, capturing a substantial market share of over 45% in 2023. The robust growth of the market in North America can be attributed to the region's high rates of LGS diagnosis and ongoing advancements in drug development, making it a key contributor to market expansion.

Following closely, the European market is poised to become the second-largest segment in the Lennox Gastaut Syndrome Market, representing more than 32% of the market share in 2023. The growth in this region is fueled by the increasing incidence of pediatric epilepsy cases and the approval of innovative therapies, further bolstering the market's growth trajectory.

Simultaneously, the Asia Pacific market is projected to be the most rapidly expanding segment in the Lennox Gastaut Syndrome Market, boasting a remarkable CAGR of over 14% throughout the forecast period. This accelerated growth in the Asia Pacific region can be attributed to the rising prevalence of LGS and the pressing unmet medical needs of individuals affected by this condition, solidifying its position as a burgeoning market of significant importance.

Top of Form

Lennox Gastaut Syndrome Market Segmentation:

- By Drug Class

- GABA modulators

- Sodium channel blockers

- Calcium channel blockers

- SV2A modulators

- Benzodiazepines

- Others

- By Route of Administration

- Oral

- Intravenous

- Intranasal

- Transdermal

- Others

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

- By Age Group

- Infants & Toddlers (0 - 2 years)

- Children (3 - 12 years)

- Adolescents (13 - 18 years)

- Adults (>18 years)

- By Treatment Type

- Monotherapy

- Adjunctive/Combination Therapy

- Vagus Nerve Stimulation

- Ketogenic Diet

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top companies in the Lennox Gastaut Syndrome Market:

- Eisai

- Lundbeck

- INSYS Therapeutics

- GW Pharmaceuticals

- Zogenix

- Supernus Pharmaceuticals

- Marinus Pharmaceuticals

- Upsher-Smith Laboratories

- Johnson & Johnson

- Valeant Pharmaceuticals

- Pfizer

- UCB

- Acorda Therapeutics

- Bausch Health

- Sunovion Pharmaceuticals

- SK Life Science

- Arvelle Therapeutics

- Biocodex

- Novartis

- GlaxoSmithKline