Market Analysis:

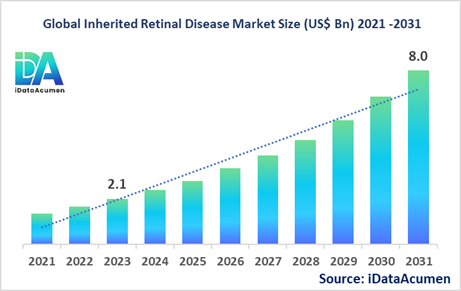

The Inherited Retinal Disease Market had an estimated market size worth US$ 2.1 billion in 2023, and it is predicted to reach a global market valuation of US$ 8.0 billion by 2031, growing at a CAGR of 18.2% from 2024 to 2031.

Inherited retinal diseases (IRDs) are a group of genetic disorders that affect the retina, leading to progressive vision loss and, in some cases, complete blindness. These diseases are caused by mutations in genes that play crucial roles in the development and function of the retina. The treatment of IRDs is primarily focused on managing symptoms and slowing the progression of vision loss, with some promising gene therapies emerging in recent years.

The major drivers of the market include the increasing prevalence of inherited retinal diseases due to an aging population, advancements in gene therapies and diagnostics, growing awareness, and rising healthcare expenditure.

The Inherited Retinal Disease Market is segmented by disease type, gene mutation, treatment type, route of administration, end-user, and region. By disease type, the market is segmented into retinitis pigmentosa, Stargardt disease, Leber congenital amaurosis, Usher syndrome, cone-rod dystrophy, and others. The retinitis pigmentosa segment is expected to witness significant growth due to its high prevalence and ongoing research efforts to develop effective treatments.

An example of a recent product launch in this segment is Spark Therapeutics' LUXTURNA, a gene therapy approved by the FDA in 2017 for the treatment of biallelic RPE65 mutation-associated retinal dystrophy, a rare form of inherited retinal disease.

Epidemiology Insights:

- The disease burden of inherited retinal diseases varies across major regions. In North America and Europe, the prevalence is estimated to be around 1 in 3,000 to 7,000 individuals, while in Asia-Pacific and other developing regions, the prevalence may be higher due to factors such as consanguineous marriages and limited access to genetic testing and counseling.

- Key epidemiological trends and driving factors behind epidemiological changes across major markets like the US, EU5, and Japan include improved diagnostic techniques, increased awareness and genetic testing, and better disease understanding through research efforts.

- According to recent studies, the estimated prevalence of inherited retinal diseases in the US is around 200,000 individuals, while in Europe, it is estimated to be around 300,000 individuals. In Japan, the prevalence is estimated to be around 50,000 individuals.

- The increasing patient population due to improved diagnosis and awareness presents growth opportunities for the development of novel treatments and therapies for inherited retinal diseases, particularly in regions with higher prevalence rates.

- Inherited retinal diseases are considered rare diseases, with a prevalence of less than 1 in 2,000 individuals in most populations.

Market Landscape:

- There are significant unmet needs in the inherited retinal disease market with respect to treatment options, as most currently available treatments are focused on symptom management and slowing disease progression, rather than addressing the underlying genetic cause.

- Current treatment options and approved therapies include nutritional supplements (such as vitamin A and lutein), low-vision aids, and, in some cases, gene therapies like Spark Therapeutics' LUXTURNA for biallelic RPE65 mutation-associated retinal dystrophy.

- Several upcoming therapies and technologies are being developed for the treatment of inherited retinal diseases, including gene therapies, gene editing techniques like CRISPR, stem cell therapies, and optogenetic approaches.

- Breakthrough treatment options currently in development include gene editing therapies that aim to correct the underlying genetic mutations responsible for inherited retinal diseases, as well as stem cell-based therapies that aim to regenerate or replace damaged retinal cells.

- The inherited retinal disease market is heavily dominated by pharmaceutical and biotechnology companies developing novel therapies, with a relatively smaller presence of generic drug manufacturers.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 2.1 Bn |

|

CAGR (2024 - 2031) |

18.2% |

|

The revenue forecast in 2031 |

US$ 8.0 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Spark Therapeutics (Novartis), ProQR Therapeutics, AGTC, Nightstar Therapeutics (Biogen), Horama, Sanofi, Editas Medicine, Acucela, Shire (Takeda), Novelion Therapeutics, Kubota Vision, Regenxbio, GenSight Biologics, Nanoscope Therapeutics, Ocugen, Allergan (AbbVie), Ionis Pharmaceuticals, Alkeus Pharmaceuticals, Gemini Therapeutics, Ophthotech |

Market Drivers:

Increasing Prevalence of Inherited Retinal Diseases

The growing prevalence of inherited retinal diseases (IRDs) is a significant driver for the market's growth. IRDs are a group of rare genetic disorders that affect the retina, leading to progressive vision loss and, in some cases, complete blindness. As the global population ages and awareness about these conditions increases, more cases are being diagnosed and recognized. Additionally, advancements in genetic testing and diagnostic techniques have improved the identification of individuals with IRDs, contributing to the rise in prevalence rates.

Advancements in Gene Therapy Research and Development

Gene therapy has emerged as a promising treatment approach for inherited retinal diseases, as these conditions are caused by genetic mutations. Significant progress has been made in developing gene therapies that aim to correct the underlying genetic defects or introduce functional genes to restore retinal function. The recent approval of Luxturna, a gene therapy for the treatment of a rare form of IRD, has paved the way for further research and development in this field. Ongoing clinical trials and the potential for future approvals are driving the growth of the Inherited Retinal Disease Market.

Increasing Investments in Research and Development

Pharmaceutical and biotechnology companies, research institutions, and government agencies are investing heavily in research and development efforts to understand the underlying mechanisms of inherited retinal diseases and develop effective treatments. These investments have led to significant advancements in areas such as gene therapy, stem cell therapy, and gene editing technologies like CRISPR. The influx of funding and resources is fueling innovation and driving the market's growth.

Improved Access to Genetic Testing and Counseling Services

As the importance of genetic testing and counseling services for inherited retinal diseases becomes more widely recognized, access to these services is improving. Healthcare providers, advocacy groups, and government initiatives are working to increase awareness and availability of genetic testing and counseling services. This improved access enables earlier diagnosis, facilitates informed decision-making, and supports the development of personalized treatment strategies, driving the growth of the Inherited Retinal Disease Market.

Market Opportunities:

Development of Novel Gene Editing Technologies

The emergence of advanced gene editing technologies, such as CRISPR-Cas9, presents a significant opportunity for the Inherited Retinal Disease Market. These technologies have the potential to precisely correct the genetic mutations responsible for inherited retinal diseases, offering a promising avenue for developing curative therapies. Several research efforts are underway to explore the application of gene editing in the treatment of IRDs, and successful clinical trials could open up new avenues for personalized and targeted therapies.

Expansion of Stem Cell Therapy Research

Stem cell therapy is another area of active research in the field of inherited retinal diseases. Stem cells have the potential to regenerate or replace damaged retinal cells, offering a therapeutic approach for IRDs. Ongoing research efforts are exploring the use of different types of stem cells, such as induced pluripotent stem cells (iPSCs) and mesenchymal stem cells (MSCs), for the treatment of IRDs. Successful clinical trials and potential approvals in this area could unlock new opportunities and drive market growth.

Personalized Medicine Approaches

The growing understanding of the genetic basis of inherited retinal diseases has paved the way for personalized medicine approaches. By tailoring treatments based on an individual's specific genetic profile, healthcare providers can potentially improve treatment outcomes and efficacy. The development of personalized gene therapies, targeted therapies, and precision medicine strategies presents a significant opportunity for the Inherited Retinal Disease Market to address the diverse range of genetic mutations underlying these conditions.

Collaboration and Strategic Partnerships

Collaborative efforts and strategic partnerships among pharmaceutical companies, biotechnology firms, academic institutions, and research organizations can drive innovation and accelerate the development of new treatments for inherited retinal diseases. By pooling resources, expertise, and technology, these collaborations can facilitate the translation of research findings into clinical applications, expedite clinical trials, and bring promising therapies to market more rapidly.

Market Trends:

Increasing Focus on Rare Diseases

There is a growing trend of pharmaceutical and biotechnology companies prioritizing the development of treatments for rare diseases, including inherited retinal diseases. This trend is driven by factors such as unmet medical needs, regulatory incentives, and potential for higher returns on investment. As more companies focus on rare diseases, it leads to increased research and development efforts, clinical trials, and potential new treatment options for inherited retinal diseases.

Adoption of Advanced Genetic Testing Technologies

The adoption of advanced genetic testing technologies, such as next-generation sequencing (NGS) and whole-genome sequencing (WGS), is a significant trend in the Inherited Retinal Disease Market. These technologies enable more accurate and comprehensive genetic analysis, leading to improved diagnosis, disease monitoring, and personalized treatment approaches. As these technologies become more accessible and affordable, their adoption is expected to increase, driving market growth.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning techniques in the field of inherited retinal diseases is an emerging trend. AI and machine learning can be leveraged for various applications, such as analyzing large genomic datasets, identifying potential drug targets, and optimizing drug design. Additionally, these technologies can assist in interpreting medical images and retinal scans, improving diagnostic accuracy and monitoring disease progression.

Patient-Centric Approaches and Improved Access to Care

There is a growing trend towards patient-centric approaches in the Inherited Retinal Disease Market, with a focus on improving access to care and enhancing patient outcomes. This includes efforts to raise awareness about inherited retinal diseases, provide genetic counseling services, and facilitate access to clinical trials and emerging treatments. Additionally, there is an emphasis on incorporating patient perspectives and experiences in the development of new therapies and treatment strategies.

Market Restraints:

High Costs and Reimbursement Challenges

The high costs associated with developing and manufacturing gene therapies, stem cell therapies, and other advanced treatments for inherited retinal diseases act as a significant restraint on market growth. These treatments often involve complex manufacturing processes, specialized facilities, and extensive clinical trials, resulting in substantial upfront investments. Additionally, reimbursement challenges and limited coverage by healthcare payers can restrict patient access to these expensive treatments, hindering market growth.

Regulatory Hurdles and Ethical Considerations

The development and commercialization of novel treatments for inherited retinal diseases face regulatory hurdles and ethical considerations. Gene therapies, gene editing technologies, and stem cell-based therapies are subject to rigorous regulatory scrutiny and stringent safety and efficacy requirements. Navigating these regulatory challenges can be time-consuming and resource-intensive, potentially slowing down the market's growth. Furthermore, ethical concerns surrounding genetic modifications and the use of embryonic stem cells can create additional barriers.

Limited Awareness and Lack of Specialized Healthcare Infrastructure

In certain regions, limited awareness about inherited retinal diseases and a lack of specialized healthcare infrastructure can restrain market growth. These conditions often go undiagnosed or misdiagnosed, particularly in areas with limited access to genetic testing and counseling services. Additionally, the lack of specialized ophthalmology centers and trained healthcare professionals can hinder the delivery of advanced treatments and therapies, limiting market penetration in underserved areas.

Recent Developments:

|

Development |

Involved Company |

|

In October 2022, Editas Medicine announced positive interim data from the ongoing RUBY clinical trial evaluating its gene editing therapy for the treatment of Leber congenital amaurosis. This development highlights the potential of gene editing as a therapeutic approach for inherited retinal diseases. |

Editas Medicine |

|

In September 2021, ProQR Therapeutics announced the initiation of a Phase 2/3 clinical trial for its investigational therapy, QR-421a, for the treatment of Usher syndrome and non-syndromic retinitis pigmentosa. This trial represents a significant step towards developing potential treatments for these inherited retinal diseases. |

ProQR Therapeutics |

|

In June 2020, AGTC announced positive interim data from a Phase 1/2 clinical trial of its gene therapy candidate, XLRP, for the treatment of X-linked retinitis pigmentosa. This development demonstrates the potential of gene therapy approaches for inherited retinal diseases. |

AGTC |

|

Product Launch |

Company Name |

|

In December 2022, Biogen acquired Nightstar Therapeutics, a company developing gene therapies for inherited retinal diseases, including choroideremia and X-linked retinitis pigmentosa. This acquisition reinforces Biogen's commitment to developing novel treatments for rare diseases. |

Biogen (acquired Nightstar Therapeutics) |

|

In November 2021, Sanofi announced the acquisition of Translate Bio, a company developing mRNA-based therapies for various diseases, including inherited retinal diseases. This acquisition expands Sanofi's portfolio in the field of genetic medicines. |

Sanofi (acquired Translate Bio) |

|

In September 2020, Novartis completed the acquisition of Spark Therapeutics, the developer of LUXTURNA, the first FDA-approved gene therapy for a rare form of inherited retinal disease. This acquisition strengthened Novartis' position in the gene therapy market. |

Novartis (acquired Spark Therapeutics) |

|

Merger/Acquisition |

Involved Companies |

|

In August 2022, Allergan (now part of AbbVie) announced the acquisition of Editas Medicine's eye disease portfolio, including programs for inherited retinal diseases. This acquisition aims to expand Allergan's pipeline in the ophthalmology space. |

AbbVie (acquired Editas Medicine's eye disease portfolio) |

|

In July 2021, Shire (now part of Takeda) acquired Nightstar Therapeutics, a company developing gene therapies for inherited retinal diseases. This acquisition strengthened Takeda's presence in the rare disease and ophthalmology markets. |

Takeda (acquired Nightstar Therapeutics) |

|

In April 2020, Ocugen acquired the rights to develop and commercialize a novel gene therapy candidate for the treatment of rhodopsin-mediated inherited retinal diseases from CanSinoBIO. This acquisition expanded Ocugen's pipeline in the ophthalmology space. |

Ocugen (acquired rights from CanSinoBIO) |

Market Regional Insights:

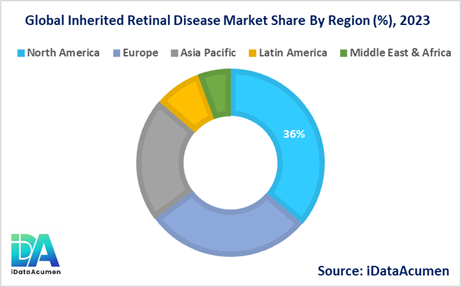

North America is expected to be the largest market for the Inherited Retinal Disease Market during the forecast period, accounting for over 36.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of a well-established healthcare infrastructure, increasing investments in research and development, and a higher adoption rate of advanced treatments and therapies.

The Europe market is expected to be the second-largest market for the Inherited Retinal Disease Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the growing awareness of inherited retinal diseases, increasing healthcare expenditure, and the presence of major pharmaceutical and biotechnology companies actively involved in developing novel therapies.

The Asia Pacific market is expected to be the fastest-growing market for the Inherited Retinal Disease Market, with a CAGR of over 21.4% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the increasing prevalence of inherited retinal diseases, improving healthcare infrastructure, and rising investments in research and development activities by both domestic and international companies.

Market Segmentation:

- By Disease Type

- Retinitis Pigmentosa

- Stargardt Disease

- Leber Congenital Amaurosis

- Usher Syndrome

- Cone-Rod Dystrophy

- By Gene Mutation

- RPE65 Mutation

- ABCA4 Mutation

- USH2A Mutation

- RPGR Mutation

- CNGA3 Mutation

- CNGB3 Mutation

- Others (PRPH2, RHO, etc.)

- By Treatment Type

- Gene Therapy

- Stem Cell Therapy

- Nutritional Supplements

- Low-Vision Aids

- Others (Retinal Implants, Optogenetics, etc.)

- By Route of Administration

- Intravitreal

- Subretinal

- Intravenous

- Others (Topical, Oral, etc.)

- By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Research Institutes

- By Distribution Channel

- Direct Tenders

- Retail Sales

- Others (E-commerce, Hospital Pharmacies, etc.)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

- "By Disease Type" Segment:

- The retinitis pigmentosa segment is projected to have the largest market share and witness significant growth in North America and Europe due to its high prevalence and ongoing research efforts to develop effective treatments.

- The Leber congenital amaurosis segment is expected to grow at a higher CAGR in the Asia Pacific region, driven by increasing awareness, improved diagnostics, and the development of gene therapies.

- In 2024, the retinitis pigmentosa segment is likely to be the largest, followed by the Stargardt disease segment.

- "By Treatment Type" Segment:

- The gene therapy segment is anticipated to exhibit the highest CAGR across all regions, particularly in North America and Europe, driven by the approval of novel gene therapies and ongoing clinical trials.

- The nutritional supplements segment is expected to maintain a significant market share, especially in regions with limited access to advanced treatments.

- In 2024, the nutritional supplements segment is likely to be the largest, while the gene therapy segment is expected to be the second-largest and fastest-growing segment.

Top Companies in the Inherited Retinal Disease Market

- Spark Therapeutics (Novartis)

- ProQR Therapeutics

- AGTC

- Nightstar Therapeutics (Biogen)

- Horama

- Sanofi

- Editas Medicine

- Acucela

- Shire (Takeda)

- Novelion Therapeutics

- Kubota Vision

- Regenxbio

- GenSight Biologics

- Nanoscope Therapeutics

- Ocugen

- Allergan (AbbVie)

- Ionis Pharmaceuticals

- Alkeus Pharmaceuticals

- Gemini Therapeutics

- Ophthotech