Market Analysis:

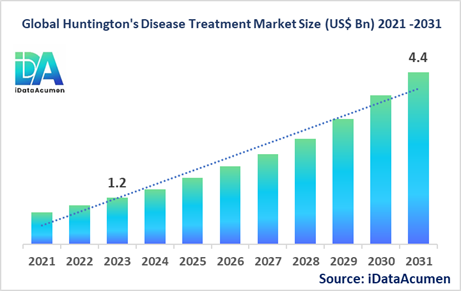

The Huntington's Disease Treatment Market had an estimated market size worth US$ 1.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 4.4 billion by 2031, growing at a CAGR of 17.8% from 2024 to 2031.

Huntington's disease is a rare, inherited disorder that causes progressive brain damage, affecting movement, cognition, and psychiatric state. There is no cure, but treatments can help manage the symptoms. The increasing prevalence of the disease, the degenerative nature, and the lack of a cure are driving the demand for effective treatments.

The Huntington's Disease Treatment Market is segmented by product type, route of administration, distribution channel, end-user, mechanism of action, and stage of disease, and region. By product type, the market is segmented into gene therapies, antisense oligonucleotides, small molecule drugs, and others (symptomatic treatments, etc.). The gene therapy segment is growing rapidly due to advancements in gene editing technologies and the potential for curative treatments.

Epidemiology Insights:

- The disease burden of Huntington's disease is highest in North America and Europe, with an estimated prevalence of 4-8 per 100,000 people. The burden is lower in Asia and Africa due to lower awareness and diagnosis rates.

- Key epidemiological trends include an increasing prevalence in developed countries due to better diagnosis and improved life expectancy of patients. Conversely, developing countries may see a rise in cases due to improved access to genetic testing and awareness.

- In the United States, the estimated prevalence of Huntington's disease is around 30,000 cases, while in the EU5 countries (Germany, France, Italy, Spain, and the UK), the prevalence is estimated to be around 50,000 cases.

- The increasing patient population, especially in emerging markets, presents growth opportunities for the development of new treatments and therapies.

- Huntington's disease is a rare, genetic disorder, affecting approximately 1 in 10,000 individuals globally.

Market Landscape:

- There are significant unmet needs in the Huntington's disease treatment market, as current treatments only manage symptoms and do not slow or stop disease progression.

- Current treatment options include medications to manage symptoms such as movement disorders, psychiatric disturbances, and cognitive impairment. Examples include tetrabenazine (Xenazine), antipsychotics, antidepressants, and cognitive therapies.

- Upcoming therapies and technologies in development include gene therapies, antisense oligonucleotides, and small molecule drugs that target the underlying genetic cause of the disease.

- Breakthrough treatments being developed include CRISPR gene-editing therapies, stem cell therapies, and RNA interference (RNAi) therapies, which have the potential to slow or even reverse disease progression.

- The market is currently dominated by branded drug manufacturers, as there are no generic treatments available for Huntington's disease. However, generic drug manufacturers may enter the market if symptomatic treatments go off-patent.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.2 Bn |

|

CAGR (2024 - 2031) |

17.8% |

|

The revenue forecast in 2031 |

US$ 4.4 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Roche, Ionis Pharmaceuticals, Wave Life Sciences, UniQure, Sangamo Therapeutics, Pfizer, Teva Pharmaceutical Industries, Novartis, Valeant Pharmaceuticals, Allergan |

Market Drivers:

Increasing Prevalence of Huntington's Disease

The increasing prevalence of Huntington's disease is a significant driver for the growth of the treatment market. As a rare, inherited disorder, the disease affects a substantial population globally, creating a pressing need for effective therapies. With advancements in genetic testing and improved awareness, more cases are being diagnosed, leading to a higher demand for treatment options. This growing patient population represents a substantial market opportunity for pharmaceutical companies and researchers to develop and commercialize new therapies.

Unmet Medical Needs and Lack of Curative Treatments

Currently, there is a significant unmet medical need in the Huntington's disease treatment landscape, as existing therapies only manage symptoms and do not address the underlying cause or slow disease progression. This lack of curative treatments has driven extensive research and development efforts to explore innovative approaches, such as gene therapies, antisense oligonucleotides, and small molecule drugs targeting the root cause of the disease. The potential for breakthrough treatments that can modify the course of the disease or even provide a cure is a major driver fueling investment and growth in this market.

Advancements in Gene Therapy and Precision Medicine

Recent advancements in gene therapy and precision medicine have opened up new avenues for the development of targeted treatments for Huntington's disease. Gene editing technologies like CRISPR and antisense oligonucleotides hold the promise of modifying or silencing the mutated huntingtin gene responsible for the disease. Additionally, personalized medicine approaches, such as tailoring therapies based on genetic profiles and biomarkers, offer the potential for more effective and individualized treatment strategies. These cutting-edge technologies are driving significant research efforts and investments in the Huntington's disease treatment market.

Government Initiatives and Funding for Rare Disease Research

Governments and healthcare organizations worldwide have recognized the importance of supporting research and development efforts for rare diseases like Huntington's disease. Initiatives such as the Orphan Drug Act in the United States and similar legislations in other countries provide incentives, funding opportunities, and expedited regulatory pathways for the development of treatments for rare diseases. This government support and funding have played a crucial role in driving innovation and attracting pharmaceutical companies and researchers to invest in the Huntington's disease treatment market.

Market Opportunities:

Expansion into Emerging Markets

As awareness and diagnosis rates of Huntington's disease improve in emerging markets, there is a significant opportunity for pharmaceutical companies to expand their reach and tap into these untapped patient populations. Countries like China, India, and Brazil are witnessing a rise in healthcare expenditure and improved access to advanced medical treatments. By adapting their strategies and pricing models to cater to these markets, companies can unlock new revenue streams and contribute to improving patient outcomes in regions where the disease may have been previously underdiagnosed or undertreated.

Collaborative Partnerships and Strategic Alliances

The complexity and multifaceted nature of Huntington's disease research often necessitate collaborative efforts and strategic partnerships among pharmaceutical companies, academic institutions, and research organizations. By leveraging their respective expertise and resources, these collaborations can accelerate the development of novel therapies and facilitate the sharing of knowledge and data. Such partnerships not only enhance the chances of success but also provide opportunities for companies to gain access to cutting-edge technologies, expand their product pipelines, and diversify their portfolios.

Repurposing Existing Drugs

While the search for novel treatments continues, there is an opportunity to explore the repurposing of existing approved drugs for the management of Huntington's disease symptoms. By identifying drugs initially developed for other conditions but showing potential efficacy in Huntington's disease, companies can leverage existing safety and efficacy data, potentially shortening the development timeline and reducing costs. This approach can provide additional treatment options for patients while maximizing the value of existing drug portfolios.

Integration of Digital Health Technologies

The integration of digital health technologies presents an exciting opportunity in the Huntington's disease treatment market. Remote monitoring devices, wearable sensors, and mobile applications can be leveraged to track disease progression, monitor treatment outcomes, and facilitate better patient engagement and adherence. Additionally, the use of artificial intelligence and machine learning algorithms can assist in data analysis, biomarker discovery, and the development of personalized treatment plans. Embracing these digital health solutions can enhance the overall patient experience and improve the efficiency of clinical trials and treatment delivery.

Market Trends:

Focus on Early Intervention and Preventive Therapies

As our understanding of the genetic underpinnings and pathophysiology of Huntington's disease deepens, there is a growing trend towards developing therapies that can intervene early in the disease course, even before the onset of symptoms. This proactive approach aims to slow or prevent the progression of the disease by targeting the underlying molecular mechanisms. Ongoing research efforts are exploring gene therapies, antisense oligonucleotides, and other modalities that can potentially halt or reverse the disease process at its earliest stages, offering the prospect of improved patient outcomes and quality of life.

Personalized Medicine and Targeted Therapies

The Huntington's disease treatment market is witnessing a shift towards personalized medicine and targeted therapies. As our understanding of the genetic and molecular variations among patients grows, there is a trend towards developing treatments tailored to specific patient subgroups based on their genetic profiles, biomarkers, and disease characteristics. This approach holds the promise of optimizing treatment efficacy and minimizing adverse effects, ultimately improving patient outcomes and quality of life.

Emphasis on Patient-Centric Approaches

There is a growing emphasis on patient-centric approaches in the Huntington's disease treatment market. Pharmaceutical companies and researchers are increasingly involving patients and patient advocacy groups in the drug development process, seeking their input and feedback at various stages. This patient-centered approach aims to better understand the needs and priorities of those living with the disease, ultimately leading to the development of therapies that address their specific concerns and improve their overall quality of life.

Adoption of Innovative Clinical Trial Designs

To accelerate the development of new treatments and improve the efficiency of clinical trials, there is a trend towards adopting innovative clinical trial designs in the Huntington's disease market. These include adaptive trial designs, which allow for modifications based on interim data analysis, and platform trials, which enable the evaluation of multiple investigational therapies simultaneously. Additionally, the use of digital technologies and remote monitoring tools is gaining traction, facilitating more comprehensive data collection and reducing the burden on patients participating in clinical trials.

Market Restraints:

High Costs Associated with Research and Development

The development of novel therapies for Huntington's disease, particularly gene therapies and other advanced treatment modalities, is a complex and resource-intensive process. The high costs associated with research and development, including preclinical studies, clinical trials, and regulatory approvals, can act as a significant restraint for pharmaceutical companies, especially smaller players or those with limited financial resources. This financial burden may hinder the entry of new players into the market and potentially slow down the pace of innovation.

Stringent Regulatory Approval Process

The regulatory approval process for Huntington's disease treatments, especially those involving gene therapies or other cutting-edge technologies, can be rigorous and time-consuming. Regulatory agencies, such as the FDA and EMA, have stringent requirements to ensure the safety and efficacy of these novel therapies before granting approval. This stringent process, while necessary for patient safety, can delay the market entry of promising treatments and add to the overall development costs, potentially restraining the growth of the market.

Ethical Considerations and Social Stigma

Huntington's disease is a complex and devastating condition with significant ethical considerations and social stigma attached to it. The genetic nature of the disease and its impact on cognitive and behavioral functions can raise concerns related to genetic discrimination, informed consent, and patient autonomy. Additionally, the social stigma associated with the disease may discourage individuals from seeking diagnosis and treatment, further limiting the market potential. Addressing these ethical and societal challenges is crucial for promoting widespread access to and acceptance of Huntington's disease treatments.

Recent Developments :

|

Development |

Involved Company |

|

Roche's tominersen (an antisense oligonucleotide) received FDA Fast Track designation in March 2021 for the treatment of Huntington's disease. This therapy aims to reduce the production of the mutant huntingtin protein. |

Roche |

|

Wave Life Sciences announced positive interim data from its ongoing Phase 1b/2a clinical trial of WVE-120102 and WVE-120101, investigational therapies for Huntington's disease, in December 2022. These therapies target huntingtin messenger RNA. |

Wave Life Sciences |

|

Sangamo Therapeutics announced positive interim data from its Phase 1/2 clinical study of isodisenic huntingtin (ST-501) gene-editing therapy for Huntington's disease in January 2023. This therapy aims to disrupt the production of the mutant huntingtin protein. |

Sangamo Therapeutics |

|

Product Launch |

Company Name |

|

FDA approved Austedo (deutetrabenazine) tablets in April 2022 for the treatment of chorea associated with Huntington's disease. Austedo is a vesicular monoamine transporter 2 (VMAT2) inhibitor that helps manage involuntary movements. |

Teva Pharmaceutical Industries |

|

The European Commission approved Ongentys (opicapone) in April 2022 as an add-on treatment for Parkinson's disease patients experiencing "off" episodes. While not specific to Huntington's disease, it may provide symptomatic relief for some patients. |

Neurocrine Biosciences |

|

FDA approved Ingrezza (valbenazine) capsules in April 2022 for the treatment of chorea associated with Huntington's disease. Ingrezza is a selective VMAT2 inhibitor that helps manage involuntary movements. |

Neurocrine Biosciences |

|

Merger/Acquisition |

Involved Companies |

|

Pfizer announced a $1 billion collaboration agreement with Sangamo Therapeutics in July 2021 to develop a zinc finger protein transcription factor-based gene therapy for the treatment of Huntington's disease. This collaboration aims to develop a potential one-time treatment for the disease. |

Pfizer and Sangamo Therapeutics |

|

Biogen acquired global rights to Ionis' investigational antisense oligonucleotide therapy, IONIS-HTTRx, for the treatment of Huntington's disease in April 2021. The acquisition aims to accelerate the development of this potential disease-modifying therapy. |

Biogen and Ionis Pharmaceuticals |

|

Roche licensed Ionis' investigational antisense oligonucleotide, tominersen, for the treatment of Huntington's disease in April 2021. Roche obtained global rights to develop and commercialize this potential therapy targeting the underlying cause of the disease. |

Roche and Ionis Pharmaceuticals |

Market Regional Insights:

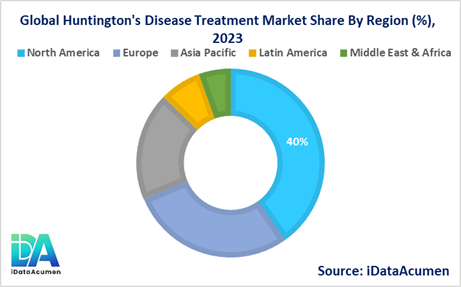

The Huntington's Disease Treatment Market is segmented across several key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each exhibiting unique market dynamics and growth prospects.

- North America is expected to be the largest market for the Huntington's Disease Treatment Market during the forecast period, accounting for over 40.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of leading pharmaceutical companies, well-established healthcare infrastructure, and a higher rate of disease diagnosis and awareness.

- Europe is expected to be the second-largest market for the Huntington's Disease Treatment Market, accounting for over 28.5% of the market share in 2024. The growth of the market in Europe is driven by increasing government initiatives, favorable reimbursement policies, and a strong focus on research and development activities in the region.

- The Asia Pacific market is expected to be the fastest-growing market for the Huntington's Disease Treatment Market, with a CAGR of over 19.2% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the rising prevalence of the disease, increasing healthcare expenditure, and improving access to advanced treatment options, especially in emerging economies like China and India. The region holds the third-largest share of 18.7%.

Market Segmentation:

- By Product Type

- Gene Therapies

- Antisense Oligonucleotides

- Small Molecule Drugs

- Others (Symptomatic Treatments, etc.)

- By Route of Administration

- Oral

- Parenteral

- Others (Intrathecal, etc.)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Direct Tenders, etc.)

- By End User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others (Research Institutes, etc.)

- By Mechanism of Action

- Huntingtin Lowering Therapies

- Neuroprotective Therapies

- Symptomatic Therapies

- Others

- By Stage of Disease

- Early-Stage

- Mid-Stage

- Late-Stage

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top companies in the Huntington's Disease Treatment Market

- Roche

- Ionis Pharmaceuticals

- Wave Life Sciences

- UniQure

- Sangamo Therapeutics

- Pfizer

- Teva Pharmaceutical Industries

- Novartis

- Valeant Pharmaceuticals

- Allergan