Market Analysis:

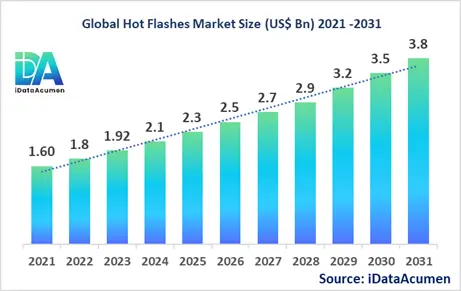

The Hot Flashes Market had an estimated market size worth US$ 2.1 billion in 2024, and it is predicted to reach a global market valuation of US$ 3.8 billion by 2031, growing at a CAGR of 8.7% from 2024 to 2031.

Hot flashes are sudden feelings of intense body heat, often accompanied by sweating, reddening of the skin, and a rapid heartbeat, experienced by women during menopause due to fluctuations in hormone levels, particularly estrogen. The hot flashes market comprises various treatment options, including hormone therapy, non-hormonal therapies, and alternative therapies, aimed at providing relief from these menopausal symptoms. These treatments offer advantages such as improved quality of life, reduced discomfort, and better sleep patterns for menopausal women. The market's growth is driven by factors like the increasing aging population, rising awareness about menopause, and the development of new therapeutic options.

The Hot Flashes Market is segmented by treatment type, product type, distribution channel, end-user, severity, and causative factor, as well as region. By treatment type, the market is segmented into hormone therapy, non-hormonal therapy, alternative therapies, and others (neuromodulation, SERMs). The non-hormonal therapy segment is witnessing significant growth due to the increasing preference for non-estrogen-based treatments and the development of new non-hormonal drugs to manage hot flashes.

A recent example of a product launch in this segment is Bijuva (estradiol and progesterone) by TherapeuticsMD Inc., which received FDA approval in October 2018 for the treatment of moderate to severe vasomotor symptoms due to menopause.

Epidemiology Insights:

- The disease burden of hot flashes is significant across major regions like North America, Europe, and Asia-Pacific, with varying prevalence rates. In the United States, it is estimated that up to 80% of menopausal women experience hot flashes.

- Key epidemiological trends and driving factors behind the changes in prevalence and incidence rates across major markets include aging populations, improved awareness and reporting of menopausal symptoms, and lifestyle factors such as obesity and smoking.

- According to a study published in the Journal of Clinical Endocrinology & Metabolism, the incidence of hot flashes in the United States ranges from 50% to 82% among perimenopausal women, while the prevalence is estimated to be around 70% in postmenopausal women.

- The increasing patient population of menopausal women, driven by the aging demographic, presents significant growth opportunities for the hot flashes market, as the demand for effective treatments continues to rise.

- Hot flashes are not considered a rare disease, as they are a common symptom experienced by a significant proportion of menopausal women worldwide.

Market Landscape:

- There are several unmet needs in the hot flashes market concerning treatment options, such as the need for more effective and well-tolerated therapies with fewer side effects, personalized treatment approaches, and improved patient adherence.

- Current treatment options include hormone therapy (e.g., estrogen therapy, combined estrogen-progestin therapy), non-hormonal therapies (e.g., antidepressants like paroxetine and venlafaxine, gabapentin), and alternative therapies (e.g., plant-based supplements like black cohosh and soy isoflavones, acupuncture).

- Upcoming therapies and technologies in development for hot flashes include selective estrogen receptor modulators (SERMs), neuromodulation techniques like transcranial magnetic stimulation, and novel non-hormonal drugs targeting specific pathways involved in hot flashes.

- Researchers are exploring breakthrough treatment options such as neurokinin 3 receptor antagonists, which have shown promising results in reducing the frequency and severity of hot flashes in clinical trials.

- The hot flashes market is dominated by branded drug manufacturers, with several major pharmaceutical companies offering approved hormone therapy and non-hormonal treatment options. However, there is also a significant presence of generic drug manufacturers, especially in the non-hormonal therapy segment.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 2.1 Bn |

|

CAGR (2024 - 2031) |

8.7% |

|

The revenue forecast in 2031 |

US$ 3.8 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Pfizer Inc., Novartis AG, Eli Lilly and Company, Hisamitsu Pharmaceutical Co., Inc., Merck & Co., Inc., Novo Nordisk A/S, Bayer AG, Amgen Inc., Mylan N.V., TherapeuticsMD, Inc., Kyowa Kirin Co., Ltd., Allergan plc, Noven Pharmaceuticals, Inc., Endoceutics, Inc., Astellas Pharma Inc., Ogeda SA, Catalent, Inc., Piramal Enterprises Ltd., Hologic, Inc., Biodelivery Sciences International, Inc. |

Market Drivers:

Rising Aging Population and Prevalence of Menopause

The global population is aging rapidly, with the number of women aged 50 and above expected to increase significantly in the coming decades. This demographic shift is a major driver for the hot flashes market, as menopause and its associated symptoms, including hot flashes, are primarily experienced by women in this age group. With more women entering menopause, the demand for effective treatments to manage hot flashes is likely to rise. Additionally, increased awareness and open discussions surrounding menopausal health have contributed to the growing recognition of hot flashes as a treatable condition, fueling the market's growth.

Expanding Therapeutic Options and R&D Efforts

The hot flashes market is witnessing continuous innovation and research and development efforts to introduce new and improved treatment options. Pharmaceutical companies are actively exploring novel non-hormonal therapies, alternative therapies, and targeted therapies to address the diverse needs of menopausal women. The development of new drugs and therapeutic approaches with improved efficacy, safety, and tolerability profiles is expected to drive market growth by providing women with a wider range of choices and personalized treatment options.

Increasing Healthcare Expenditure and Favorable Reimbursement Policies

As economies around the world continue to develop, healthcare expenditure is on the rise, particularly in emerging markets. This increased spending on healthcare services and products, coupled with favorable reimbursement policies for menopausal treatments in several countries, has made hot flashes therapies more accessible to a larger patient population. Furthermore, growing awareness and advocacy efforts have led to the inclusion of menopausal treatments in healthcare coverage plans, thereby reducing out-of-pocket expenses for patients and contributing to market growth.

Changing Societal Attitudes and Increased Awareness

Traditionally, menopause and its associated symptoms, such as hot flashes, were often considered taboo subjects and were not openly discussed. However, societal attitudes are shifting, and there is an increasing acceptance and awareness of menopausal health issues. This change has been driven by educational campaigns, patient advocacy groups, and open discussions in various media platforms. As a result, women are becoming more empowered to seek medical attention and treatment for hot flashes, driving the demand for effective therapies in the market.

Market Opportunities:

Personalized Medicine and Targeted Therapies

The hot flashes market presents an opportunity for the development of personalized medicine and targeted therapies. With advancements in genetic profiling, biomarker research, and precision medicine, there is potential to tailor treatment approaches based on individual patient characteristics, such as genetic makeup, hormonal levels, and symptom severity. By developing targeted therapies that address the specific underlying mechanisms of hot flashes, pharmaceutical companies can offer more effective and personalized solutions, potentially improving patient outcomes and compliance.

Integration of Digital Health Technologies

The integration of digital health technologies presents a significant opportunity for the hot flashes market. Mobile applications, wearable devices, and remote monitoring systems can be utilized to track and monitor hot flash episodes, providing valuable data for healthcare professionals and enabling more personalized treatment plans. Additionally, these technologies can improve patient engagement, adherence, and self-management, ultimately enhancing the overall effectiveness of hot flashes therapies.

Exploring Alternative and Complementary Therapies

As consumer preferences shift towards natural and holistic approaches, there is an opportunity to explore alternative and complementary therapies for managing hot flashes. These therapies may include herbal supplements, acupuncture, yoga, and mindfulness-based interventions. By incorporating these modalities into treatment plans, healthcare providers can offer a comprehensive and integrative approach, catering to the diverse needs and preferences of menopausal women.

Expansion into Emerging Markets

Emerging markets, particularly in regions such as Asia-Pacific and Latin America, represent a significant growth opportunity for the hot flashes market. With increasing urbanization, rising disposable incomes, and improving healthcare infrastructure, these markets are witnessing a growing demand for menopausal treatments. By developing affordable and accessible solutions tailored to the specific needs of these regions, pharmaceutical companies can tap into these untapped markets and drive future growth.

Market Trends:

Shift Towards Non-Hormonal Therapies

While hormone replacement therapy (HRT) has been a traditional treatment option for hot flashes, there is a growing trend towards non-hormonal therapies. This shift is driven by concerns over the potential risks associated with long-term HRT use, such as increased risk of breast cancer and cardiovascular events. As a result, pharmaceutical companies are focusing on developing non-hormonal alternatives, including selective serotonin reuptake inhibitors (SSRIs), gabapentin, and other novel compounds targeting specific pathways involved in hot flashes.

Emphasis on Patient-Centric Care

There is an increasing emphasis on patient-centric care in the hot flashes market, with healthcare providers and pharmaceutical companies recognizing the importance of considering individual patient preferences, lifestyles, and overall well-being. This trend has led to the development of patient education programs, support groups, and personalized treatment plans that address not only hot flashes but also other menopausal symptoms and their impact on quality of life.

Adoption of Telehealth and Remote Monitoring

The COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring technologies in various healthcare sectors, including the hot flashes market. Virtual consultations and remote monitoring devices enable healthcare providers to monitor and manage hot flashes remotely, improving access to care and ensuring continuity of treatment, particularly in areas with limited access to specialized healthcare facilities.

Focus on Product Differentiation

In a competitive market landscape, pharmaceutical companies are focusing on product differentiation strategies to gain a competitive edge. This trend involves developing innovative formulations, novel delivery methods, and combination therapies to address specific patient needs and preferences. For example, companies are exploring transdermal patches, extended-release formulations, and combination therapies that target multiple menopausal symptoms, offering patients more convenient and effective treatment options.

Market Restraints:

Adverse Effects and Safety Concerns

Despite the availability of various treatment options, the hot flashes market is restrained by concerns over the potential adverse effects and safety risks associated with certain therapies. Hormone replacement therapy, in particular, has been linked to an increased risk of breast cancer, cardiovascular events, and other health issues, especially with long-term use. These safety concerns have led to hesitancy among healthcare providers and patients, limiting the adoption of certain treatments and restraining market growth.

Limited Access to Healthcare and Affordability Issues

Access to healthcare services and the affordability of treatments remain significant barriers in many regions, particularly in developing and underdeveloped countries. Limited access to specialized healthcare facilities, lack of awareness, and high treatment costs can prevent women from seeking medical attention for hot flashes, hindering market growth. Additionally, inadequate insurance coverage and reimbursement policies for menopausal treatments in some regions further exacerbate the issue of affordability.

Stigma and Cultural Attitudes towards Menopause

Despite increasing awareness and open discussions, stigma and cultural attitudes towards menopause and its associated symptoms continue to persist in certain societies. In some communities, menopause is still considered a taboo topic, and women may feel reluctant to discuss their symptoms or seek medical treatment for hot flashes. This lack of openness and societal acceptance can impede market growth by discouraging women from accessing available treatment options.

Recent Developments:

|

Development |

Involved Company |

|

Astellas Pharma received FDA approval for Xtampza ER (oxycodone) extended-release capsules for the management of hot flashes in October 2022. This approval expands treatment options for menopausal women. |

Astellas Pharma |

|

Myovant Sciences and Pfizer announced positive top-line results from the SKYLIGHT 2 Phase 3 study of relugolix combination therapy for vasomotor symptoms in June 2022. This paves the way for a potential new treatment option. |

Myovant Sciences and Pfizer |

|

Astellas Pharma and Ogeda announced a strategic collaboration to develop and commercialize fezolinetant, a neurokinin-3 receptor antagonist for the treatment of vasomotor symptoms, in May 2021. This represents a novel therapeutic approach. |

Astellas Pharma and Ogeda |

|

Product Launch |

Company Name |

|

Bijuva (estradiol and progesterone) capsules by TherapeuticsMD Inc. received FDA approval in October 2018 for the treatment of moderate to severe vasomotor symptoms due to menopause. |

TherapeuticsMD Inc. |

|

Duavee (conjugated estrogens/bazedoxifene) by Pfizer was approved by the FDA in October 2013 for the treatment of moderate to severe hot flashes associated with menopause. |

Pfizer |

|

Brisdelle (paroxetine) by Noven Pharmaceuticals was approved by the FDA in June 2013 for the treatment of moderate to severe hot flashes associated with menopause. |

Noven Pharmaceuticals |

|

Merger/Acquisition |

Involved Companies |

|

Astellas Pharma acquired Ogeda SA, a drug discovery company focused on small molecule therapeutics, in December 2022. This acquisition strengthens Astellas' pipeline in women's healthcare. |

Astellas Pharma and Ogeda SA |

|

Pfizer acquired Arixa Pharmaceuticals, a clinical-stage company developing oral non-hormonal therapies for hot flashes, in September 2018. This expanded Pfizer's portfolio in women's health. |

Pfizer and Arixa Pharmaceuticals |

|

TherapeuticsMD Inc. acquired Vitrus Acquisition Corp. in October 2017, gaining access to Vitrus' pipeline of drug candidates for hot flashes and other menopausal indications. |

TherapeuticsMD Inc. and Vitrus Acquisition Corp. |

Market Regional Insights:

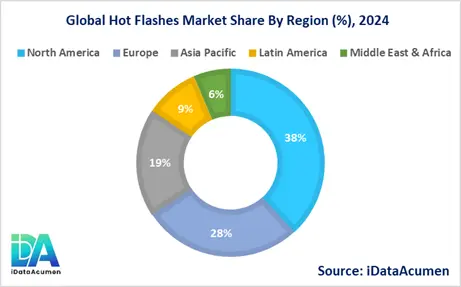

The hot flashes market exhibits significant regional variations in terms of market size, growth rates, and adoption of treatment options. North America is expected to be the largest market for Hot Flashes Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the well-established healthcare infrastructure, high awareness about menopausal symptoms, and the availability of advanced treatment options.

The European market is expected to be the second-largest market for Hot Flashes Market, accounting for over 27.5% of the market share in 2024. The growth of the market is attributed to the aging population, increasing prevalence of hot flashes, and favorable reimbursement policies for menopausal treatments in several European countries.

The Asia-Pacific market is expected to be the fastest-growing market for Hot Flashes Market, with a CAGR of over 18.7% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the rapidly aging population, rising awareness about menopausal health, and increasing healthcare expenditure in emerging economies like China and India, along with the third-largest market share of 9.2%.

Market Segmentation:

- By Treatment Type

- Hormone Therapy

- Non-hormonal Therapy

- Alternative Therapies

- Others (Neuromodulation, SERMs)

- By Product Type

- Oral

- Transdermal

- Vaginal

- Others (Injectables, Implants)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Clinics, Specialty Centers)

- By End User

- Hospitals

- Gynecology Clinics

- Ambulatory Surgical Centers

- Others (Home Care Settings, Wellness Centers)

- By Severity

- Mild Hot Flashes

- Moderate Hot Flashes

- Severe Hot Flashes

- By Causative Factor

- Natural Menopause

- Surgical Menopause

- Chemotherapy-induced Menopause

- Others (Radiotherapy, Hormonal Imbalances)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segmental Analysis:

- Treatment Type Segment:

- The non-hormonal therapy segment is projected to witness the highest growth in North America and Europe, with a CAGR of around 9-11% during the forecast period. This growth is attributed to the increasing preference for non-estrogen-based treatments and the development of new non-hormonal drugs to manage hot flashes.

- In terms of market size, the hormone therapy segment is expected to remain the largest segment in 2024, driven by the widespread use of estrogen-based therapies for hot flashes.

- The alternative therapies segment is anticipated to be the second-largest segment in 2024, particularly in the Asia-Pacific region, due to the growing acceptance of complementary and alternative medicine approaches.

- Product Type Segment:

- The oral product type segment is likely to maintain its dominance in 2024, owing to the convenience and patient preference for oral formulations.

- The transdermal product type segment is projected to experience significant growth in North America and Europe, with a CAGR of around 8-10%, due to the increasing adoption of transdermal patches and gels, which offer sustained drug delivery and improved patient compliance.

Top companies in the Hot Flashes Market:

- Pfizer Inc.

- Novartis AG

- Eli Lilly and Company

- Hisamitsu Pharmaceutical Co., Inc.

- Merck & Co., Inc.

- Novo Nordisk A/S

- Bayer AG

- Amgen Inc.

- Mylan N.V.

- TherapeuticsMD, Inc.

- Kyowa Kirin Co., Ltd.

- Allergan plc

- Noven Pharmaceuticals, Inc.

- Endoceutics, Inc.

- Astellas Pharma Inc.

- Ogeda SA

- Catalent, Inc.

- Piramal Enterprises Ltd.

- Hologic, Inc.

- Biodelivery Sciences International, Inc.