Market Analysis:

The X-ray Systems Market size is expected to reach US$ 17.0 billion by 2035, from US$ 10.1 billion in 2024, at a CAGR of 4.8% during the forecast period 2024-2035.

X-ray systems are medical imaging devices that utilize electromagnetic radiation to create visual representations of internal body structures. These systems work by emitting X-ray beams through the human body, where different tissues absorb varying amounts of radiation based on their density. The resulting images help healthcare professionals diagnose fractures, infections, tumors, and various other medical conditions. Modern X-ray systems offer significant advantages including non-invasive diagnosis, real-time imaging capabilities, digital image storage and sharing, reduced radiation exposure through advanced technologies, and cost-effective diagnostic solutions compared to other imaging modalities. Digital X-ray systems provide immediate image availability, enhanced image quality with adjustable contrast and brightness, elimination of chemical processing, and seamless integration with hospital information systems.

The primary drivers for market growth include the increasing prevalence of chronic diseases requiring frequent diagnostic imaging and the rapidly aging global population demanding more healthcare services.

X-ray Systems Market Overview:

The global X-ray systems market is experiencing steady growth driven by technological advancements in digital imaging and increasing healthcare infrastructure investments worldwide.

Market Segmentation:

The X-ray Systems Market is segmented by technology type, product type, application, end user, component, detector type, portability and region. By technology type, the market is segmented into Digital Radiography (DR), Computed Radiography (CR), Analog/Conventional X-ray, Mobile X-ray Systems, Mammography Systems, and Fluoroscopy Systems. Digital Radiography (DR) represents the largest and fastest-growing subsegment due to its superior image quality, immediate image availability, and reduced radiation exposure compared to traditional film-based systems. The segment is growing rapidly as healthcare facilities transition from analog to digital systems for improved workflow efficiency and better patient outcomes.

Recent product launches include Carestream Health's DRX-LC detector launched in May 2023 to increase image quality and patient comfort in orthopedics, and DeepTek.ai's introduction of Augmento X-Ray, an AI-based chest x-ray system, in February 2024.

Epidemiological Insights:

The disease burden requiring X-ray diagnostic imaging varies significantly across major regions, with North America and Europe showing higher incidences of age-related conditions like osteoporosis and cardiovascular diseases, while Asia Pacific regions experience growing rates of respiratory diseases and orthopedic injuries due to urbanization and lifestyle changes.

Key epidemiological trends driving X-ray demand include rising cardiovascular disease rates in developed markets like the US and EU5 countries, increasing bone fracture incidents among aging populations in Japan, growing cancer screening programs requiring mammography and chest X-rays, and higher rates of respiratory conditions necessitating regular chest imaging across all major markets.

Latest disease incidence data shows cardiovascular diseases affecting over 655 million people globally, with approximately 54 million bone fractures occurring annually worldwide, and lung cancer cases reaching 2.2 million new diagnoses per year, all requiring X-ray imaging for diagnosis and monitoring.

Growth opportunities are expanding with the increasing patient population, particularly in emerging markets where healthcare access is improving, driving demand for portable and mobile X-ray systems for point-of-care diagnosis and telemedicine applications.

While X-ray imaging addresses common conditions rather than rare diseases, specialized applications like pediatric imaging and veterinary X-ray systems represent niche but growing market segments with specific technological requirements.

Market Landscape:

Current unmet needs in the X-ray systems market include the demand for lower radiation dose exposure while maintaining image quality, portable systems for remote healthcare delivery, AI-integrated diagnosis assistance, and cost-effective solutions for emerging markets with limited healthcare budgets.

Current treatment and diagnostic options include digital radiography systems for general imaging, computed tomography for detailed cross-sectional imaging, mammography systems for breast cancer screening, fluoroscopy for real-time imaging during procedures, and mobile X-ray units for bedside imaging in critical care settings.

Upcoming technologies in development include AI-powered image analysis for automated diagnosis, quantum imaging sensors for ultra-low radiation exposure, wireless detector systems for enhanced portability, cloud-based image storage and sharing platforms, and 3D imaging capabilities integrated into traditional X-ray systems.

Breakthrough treatment options currently being developed include photon-counting detector technology for superior image quality, AI algorithms for early disease detection, robotic positioning systems for precise imaging, and hybrid imaging systems combining X-ray with other modalities like ultrasound.

The market composition is dominated by established branded manufacturers like Siemens Healthineers, GE Healthcare, and Philips, with limited generic alternatives due to the high-technology nature of medical imaging equipment and strict regulatory requirements for safety and efficacy.

Market Report Scope:

|

Description |

|

|

The market size in 2024 |

US$ 10.1 Bn |

|

CAGR (2024 - 2035) |

4.8% |

|

The revenue forecast in 2035 |

US$ 17.0 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2035 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Carestream Health Inc., Shimadzu Corporation, Agfa-Gevaert Group, Samsung Electronics Co., Ltd., Shanghai United Imaging Healthcare Co., Ltd., Mindray Bio-Medical Electronics Co., Ltd., Allengers Medical Systems Limited, Dentsply Sirona Inc., MinXray Inc., Konica Minolta Healthcare Americas Inc., Hitachi Healthcare Americas Corporation, Hologic Inc., Planmed Oy, Ziehm Imaging GmbH, Swissray Global Healthcare Holding Ltd. |

Market Drivers:

Technological Advancements in Digital Imaging Systems

The transition from traditional film-based X-ray systems to advanced digital imaging technologies represents one of the most significant drivers propelling the X-ray systems market forward. Digital X-ray systems provide high-resolution images that assist healthcare professionals in making accurate diagnoses, fundamentally transforming diagnostic capabilities across medical facilities worldwide. This technological evolution encompasses direct radiography (DR) and computed radiography (CR) systems that offer superior image quality, faster processing times, and enhanced diagnostic accuracy compared to conventional systems.

Direct Radiography (DR) has emerged as the dominant segment due to its superior features and benefits, offering faster imaging times and allowing healthcare professionals to obtain results more quickly. The integration of advanced imaging software and digital processing capabilities has revolutionized workflow efficiency in medical facilities, enabling healthcare providers to serve more patients while maintaining high-quality diagnostic standards. Recent developments in sensor technology have further enhanced image resolution and reduced noise levels, making digital systems increasingly attractive to healthcare facilities seeking to modernize their diagnostic capabilities.

The implementation of Picture Archiving and Communication Systems (PACS) alongside digital X-ray systems has created seamless integration possibilities within existing healthcare IT infrastructure. This connectivity enables instant image sharing between departments, remote consultation capabilities, and comprehensive patient record management. Healthcare facilities are increasingly recognizing the long-term operational benefits of digital systems, including reduced film costs, elimination of chemical processing requirements, and improved storage efficiency through digital archives.

Furthermore, the development of wireless digital detectors and portable digital X-ray systems has expanded the applications of X-ray technology beyond traditional radiology departments. These innovations enable bedside imaging in intensive care units, emergency departments, and even remote healthcare settings, significantly broadening the scope of X-ray system utilization and driving adoption across diverse healthcare environments.

Rising Prevalence of Chronic Diseases and Musculoskeletal Disorders

The rising patient population and incidence of musculoskeletal disorders and sports-related injuries serve as primary drivers for X-ray system adoption, creating sustained demand for diagnostic imaging services across healthcare facilities globally. The increasing prevalence of chronic conditions such as arthritis, osteoporosis, and degenerative joint diseases has created a substantial patient population requiring regular monitoring and diagnostic assessment through X-ray imaging. This demographic shift, combined with lifestyle factors contributing to musculoskeletal injuries, has established X-ray systems as essential diagnostic tools in modern healthcare delivery.

The aging global population presents particular challenges for healthcare systems, as elderly patients typically require more frequent diagnostic imaging due to age-related conditions affecting bones, joints, and cardiovascular systems. Orthopedic conditions, including fractures, joint degeneration, and bone density loss, necessitate regular X-ray examinations for proper diagnosis, treatment planning, and progress monitoring. Healthcare facilities are responding to this demographic trend by investing in advanced X-ray systems capable of providing detailed imaging for complex orthopedic cases.

Sports medicine and occupational health sectors have also contributed significantly to X-ray system demand, as athletes and workers in physically demanding industries frequently require diagnostic imaging for injury assessment and treatment planning. The emphasis on early diagnosis and preventive care has led healthcare providers to utilize X-ray systems for screening purposes, identifying potential issues before they develop into more serious conditions requiring extensive treatment interventions.

Additionally, the integration of bone densitometry capabilities into modern X-ray systems has expanded their utility in detecting and monitoring osteoporosis, a condition affecting millions of individuals worldwide. This dual-purpose functionality has made X-ray systems increasingly valuable investments for healthcare facilities seeking to address multiple diagnostic needs with single equipment purchases, driving adoption rates across various medical specialties.

Government Healthcare Infrastructure Investments and Favorable Policies

Favorable government initiatives and investments in healthcare infrastructure are significantly fueling market growth, creating opportunities for healthcare facilities to modernize their diagnostic imaging capabilities through advanced X-ray system installations. Government healthcare programs worldwide have recognized the critical importance of diagnostic imaging in delivering quality patient care, leading to substantial funding allocations for medical equipment procurement and facility upgrades. These initiatives have particularly benefited developing regions where healthcare infrastructure development is prioritized as part of national health improvement strategies.

Regulatory frameworks supporting the adoption of digital imaging technologies have created additional momentum for X-ray system upgrades. Health authorities have implemented guidelines encouraging the transition from film-based systems to digital alternatives, often providing financial incentives or regulatory advantages for facilities that comply with modern imaging standards. These policy measures have accelerated the replacement of outdated equipment while ensuring that healthcare facilities maintain compliance with evolving safety and quality standards.

Public health initiatives focusing on preventive care and early disease detection have increased the utilization of diagnostic imaging services, creating sustained demand for X-ray systems across public and private healthcare facilities. Government-sponsored screening programs for diseases such as tuberculosis, cancer, and cardiovascular conditions have established X-ray imaging as a cornerstone of public health strategies, driving systematic investments in imaging infrastructure.

International healthcare development programs and partnerships have also contributed to X-ray system market expansion, particularly in emerging economies where healthcare modernization efforts are supported by international funding and technical assistance. These collaborative initiatives have facilitated technology transfer and capacity building, creating new markets for X-ray system manufacturers while improving healthcare access in underserved regions.

Enhanced Patient Safety Features and Radiation Dose Reduction Technologies

The development of advanced radiation dose reduction technologies and enhanced patient safety features has become a primary driver for X-ray system adoption, addressing healthcare providers' growing concerns about patient welfare and regulatory compliance. Modern X-ray systems incorporate sophisticated dose management algorithms, automatic exposure control systems, and filtered beam technologies that significantly reduce patient radiation exposure while maintaining diagnostic image quality. These safety enhancements have made X-ray examinations safer for vulnerable populations, including pediatric patients and pregnant women, expanding the scope of safe diagnostic imaging applications.

Healthcare facilities are increasingly prioritizing equipment that demonstrates measurable improvements in patient safety metrics, driving demand for X-ray systems equipped with dose monitoring capabilities and real-time exposure tracking. The implementation of dose reference levels and regulatory requirements for radiation exposure documentation has created additional incentives for healthcare providers to invest in systems that provide comprehensive dose management and reporting capabilities.

The integration of artificial intelligence and machine learning algorithms into X-ray systems has further enhanced patient safety through automated image optimization, reduced retake rates, and improved diagnostic accuracy. These intelligent systems can automatically adjust exposure parameters based on patient characteristics and examination requirements, minimizing unnecessary radiation exposure while ensuring optimal image quality for accurate diagnosis. The reduction in examination retakes directly correlates with decreased patient radiation exposure and improved operational efficiency.

Additionally, ergonomic improvements in X-ray system design have enhanced both patient comfort and operator safety, creating a more favorable environment for diagnostic imaging procedures. Features such as adjustable patient positioning systems, wireless imaging detectors, and intuitive user interfaces have improved the overall examination experience while reducing the potential for positioning errors that might necessitate repeat exposures, further contributing to patient safety objectives.

Market Opportunities:

Artificial Intelligence Integration and Automated Diagnostic Capabilities

The integration of artificial intelligence and machine learning technologies into X-ray systems presents transformative opportunities for enhancing diagnostic accuracy, workflow efficiency, and clinical decision-making processes. AI-powered imaging systems can automatically detect abnormalities, assist in image interpretation, and provide preliminary diagnostic suggestions to healthcare professionals, significantly reducing interpretation time and improving diagnostic consistency. This technological convergence represents a paradigm shift from traditional imaging systems to intelligent diagnostic platforms capable of learning from vast datasets and continuously improving their analytical capabilities.

Recent developments in deep learning algorithms have demonstrated remarkable success in identifying specific pathologies from X-ray images, including pneumonia detection, fracture identification, and cardiovascular abnormalities. Healthcare facilities implementing AI-enhanced X-ray systems report improved diagnostic confidence, reduced interpretation variability between radiologists, and enhanced ability to prioritize urgent cases based on automated severity assessments. These capabilities are particularly valuable in emergency departments and urgent care facilities where rapid diagnostic decisions are critical for patient outcomes.

The opportunity extends beyond basic image analysis to comprehensive clinical decision support systems that can correlate X-ray findings with patient history, laboratory results, and other diagnostic information. AI integration enables the development of predictive analytics capabilities that can identify patients at risk for specific conditions based on subtle imaging patterns that might not be immediately apparent to human observers. This predictive capability opens new avenues for preventive care and early intervention strategies.

Furthermore, AI-powered X-ray systems can facilitate remote diagnostic capabilities through automated preliminary screenings and intelligent image routing to appropriate specialists. This functionality is particularly valuable for telemedicine applications and healthcare delivery in remote or underserved areas where specialist expertise may not be readily available. The scalability of AI-enhanced diagnostic capabilities presents significant opportunities for expanding healthcare access while maintaining high-quality diagnostic standards across diverse geographical locations.

Point-of-Care and Mobile X-ray System Expansion

The growing demand for point-of-care diagnostic imaging presents substantial opportunities for portable and mobile X-ray system development, driven by the need for immediate diagnostic capabilities in emergency situations, critical care environments, and remote healthcare settings. Digital mobile X-ray devices are experiencing significant growth driven by innovations in medical imaging technology, creating new market segments for compact, wireless, and battery-operated imaging systems that can be deployed rapidly in various clinical scenarios.

Emergency medical services and disaster response organizations represent significant opportunities for mobile X-ray system adoption, as these portable systems enable immediate diagnostic imaging at accident scenes, natural disaster sites, and in ambulatory care situations where traditional imaging facilities are not accessible. The development of ruggedized, weather-resistant mobile systems capable of operating in challenging environments has opened new applications in military medicine, humanitarian aid missions, and remote industrial healthcare support.

Home healthcare services and nursing facilities present additional opportunities for portable X-ray system deployment, particularly as healthcare systems shift toward patient-centered care models that prioritize convenience and accessibility. Mobile X-ray services can reduce patient transportation requirements, minimize infection risks, and provide timely diagnostic imaging for patients with mobility limitations or chronic conditions requiring regular monitoring.

The integration of wireless connectivity and cloud-based image processing capabilities into mobile X-ray systems has created opportunities for real-time consultation and remote diagnostic interpretation. These connected mobile systems can transmit images immediately to radiologists and specialists, enabling rapid diagnosis and treatment decisions regardless of the imaging location. This connectivity also facilitates integration with electronic health records and enables comprehensive documentation of mobile imaging services, creating value propositions for healthcare providers seeking to expand their service delivery capabilities.

Emerging Market Penetration and Healthcare Infrastructure Development

Emerging markets present significant opportunities for X-ray system expansion, driven by healthcare infrastructure development initiatives, increasing healthcare expenditure, and growing awareness of the importance of diagnostic imaging in modern medical care. Developing countries are investing heavily in healthcare facility construction and equipment modernization, creating substantial demand for X-ray systems across public and private healthcare sectors. These markets offer opportunities for both premium and cost-effective X-ray system solutions tailored to local healthcare needs and economic conditions.

Healthcare privatization trends in emerging markets have created opportunities for private medical facilities to differentiate themselves through advanced diagnostic capabilities, driving demand for state-of-the-art X-ray systems with enhanced features and connectivity options. International healthcare chains expanding into emerging markets are seeking standardized imaging solutions that can maintain consistent quality standards across multiple locations while adapting to local regulatory requirements and infrastructure limitations.

Medical tourism growth in developing countries has created additional opportunities for high-end X-ray system installations, as healthcare facilities seek to attract international patients through advanced diagnostic capabilities and superior service quality. Countries positioning themselves as medical tourism destinations are investing in premium imaging equipment to meet international standards and patient expectations, creating niche markets for advanced X-ray systems with comprehensive service and support packages.

Public-private partnerships in healthcare infrastructure development have created structured opportunities for X-ray system suppliers to participate in large-scale healthcare modernization projects. These partnerships often involve long-term service agreements, training programs, and technology transfer initiatives that provide sustainable business models for X-ray system providers while contributing to healthcare capacity building in emerging markets.

Specialized Applications and Niche Market Development

The development of specialized X-ray applications presents significant opportunities for market expansion beyond traditional medical imaging, including veterinary medicine, industrial inspection, security screening, and research applications. Veterinary healthcare represents a growing market segment as pet ownership increases and animal healthcare services become more sophisticated, creating demand for X-ray systems specifically designed for animal diagnostic imaging with appropriate sizing, positioning capabilities, and safety features.

Industrial non-destructive testing applications offer opportunities for X-ray system adaptation in manufacturing quality control, aerospace component inspection, and infrastructure assessment. These industrial applications require specialized X-ray systems capable of penetrating various materials while providing detailed internal structure imaging for defect detection and quality assurance purposes. The integration of automated inspection capabilities and real-time analysis features creates value propositions for industrial customers seeking to improve quality control processes and reduce inspection costs.

Food safety and agricultural applications present emerging opportunities for X-ray system deployment in contamination detection, quality assessment, and processing optimization. The food industry's increasing focus on safety and quality assurance has created demand for X-ray systems capable of detecting foreign objects, assessing product integrity, and ensuring compliance with food safety regulations without compromising product quality or processing efficiency.

Research and academic institutions represent additional opportunities for specialized X-ray system development, particularly in materials science, archaeology, and biological research applications. These specialized applications often require customized imaging capabilities, high-resolution sensors, and advanced image processing software tailored to specific research requirements, creating niche markets for innovative X-ray system solutions.

Market Trends:

Wireless Technology Integration and Detector Portability

The integration of wireless technology into X-ray detector systems represents a transformative trend that is revolutionizing imaging workflow efficiency and operational flexibility across healthcare facilities. Wireless detectors eliminate the constraints of traditional wired connections, enabling healthcare professionals to position patients more comfortably and access challenging anatomical areas without the limitations imposed by cable management. This technological advancement has significantly improved examination efficiency, reduced setup times, and enhanced image quality through optimal detector positioning capabilities that were previously impossible with tethered systems.

Healthcare facilities implementing wireless X-ray detectors report substantial improvements in patient throughput, reduced examination times, and enhanced staff satisfaction due to improved workflow dynamics. The elimination of cable-related equipment failures and maintenance issues has contributed to improved system reliability and reduced operational costs. Wireless detectors also facilitate easier cleaning and infection control procedures, which has become increasingly important in healthcare environments prioritizing patient safety and hygiene standards.

The trend toward detector portability extends beyond wireless connectivity to include lightweight, durable detector designs that can withstand frequent handling and transportation between examination rooms. Battery technology improvements have enabled longer operational periods between charging cycles, making wireless detectors practical for high-volume imaging facilities. Advanced power management systems automatically optimize battery consumption based on usage patterns, ensuring consistent performance throughout extended examination sessions.

Furthermore, the integration of wireless detectors with mobile X-ray systems has created new possibilities for bedside imaging, emergency response situations, and specialized clinical applications where traditional imaging setups are impractical. This convergence of wireless technology and system mobility has expanded the scope of X-ray imaging applications while improving patient care delivery in critical care environments.

Cloud-Based Image Storage and Telemedicine Integration

The adoption of cloud-based image storage and management systems represents a significant trend transforming how healthcare facilities handle diagnostic imaging data, enabling seamless integration with telemedicine platforms and remote consultation services. Cloud infrastructure provides scalable storage solutions that eliminate the limitations of on-premises storage systems while offering enhanced data security, backup capabilities, and accessibility from multiple locations. Healthcare facilities are increasingly recognizing the operational and financial benefits of cloud-based imaging solutions, particularly as data volumes continue to grow exponentially.

Telemedicine integration has become particularly important as healthcare delivery models evolve to accommodate remote consultation requirements and specialist access limitations. Cloud-based X-ray systems enable immediate image sharing with remote radiologists, specialists, and referring physicians, significantly reducing diagnosis and treatment delays. This capability has proven especially valuable in rural healthcare settings where specialist expertise may not be locally available, enabling high-quality diagnostic services regardless of geographical constraints.

The trend toward cloud-based systems has also facilitated the development of collaborative diagnostic platforms where multiple healthcare professionals can simultaneously access and review imaging studies, enhancing diagnostic accuracy through collective expertise. Advanced cloud platforms incorporate sophisticated image viewing tools, measurement capabilities, and annotation features that enable comprehensive remote image analysis comparable to traditional workstation-based reviews.

Additionally, cloud integration has enabled the development of artificial intelligence applications that can analyze imaging data at scale, providing automated screening capabilities and diagnostic assistance across multiple healthcare facilities. These AI-powered cloud services can process thousands of images simultaneously, identifying potential abnormalities and prioritizing cases based on urgency levels, significantly improving healthcare delivery efficiency and patient outcomes.

Dose Optimization and Radiation Safety Enhancement

The industry-wide focus on radiation dose optimization and enhanced safety protocols represents a crucial trend driving technological innovation and regulatory compliance across X-ray system development. Modern X-ray systems incorporate sophisticated dose management technologies, including automatic exposure control, beam filtration systems, and real-time dose monitoring capabilities that significantly reduce patient radiation exposure while maintaining diagnostic image quality. Healthcare facilities are increasingly prioritizing systems that demonstrate measurable dose reduction capabilities as part of their commitment to patient safety and regulatory compliance.

Advanced dose optimization algorithms analyze patient characteristics, examination requirements, and image quality objectives to automatically adjust exposure parameters for optimal diagnostic results with minimal radiation exposure. These intelligent systems continuously learn from imaging outcomes and adjust their optimization strategies based on clinical feedback and image quality assessments. The implementation of dose reference levels and standardized exposure protocols has created consistency in radiation safety practices across different healthcare facilities and examination types.

The trend toward enhanced radiation safety extends to operator protection through improved shielding designs, remote control capabilities, and automated positioning systems that minimize staff radiation exposure during imaging procedures. Modern X-ray systems incorporate lead-lined control rooms, wireless exposure controls, and automated patient positioning features that reduce the need for staff presence in radiation areas during image acquisition.

Furthermore, the integration of dose tracking and reporting systems enables healthcare facilities to monitor cumulative patient radiation exposure across multiple examinations and imaging modalities. These comprehensive dose management systems provide detailed documentation for regulatory compliance, quality assurance programs, and patient safety initiatives while identifying opportunities for further dose reduction through protocol optimization and equipment upgrades.

Integration with Electronic Health Records and Healthcare IT Systems

The seamless integration of X-ray systems with electronic health records (EHR) and comprehensive healthcare IT infrastructure represents a fundamental trend reshaping diagnostic imaging workflow and patient care coordination. Modern X-ray systems are designed with native integration capabilities that enable automatic patient identification, examination ordering, image acquisition, and results reporting through unified healthcare information systems. This integration eliminates manual data entry requirements, reduces administrative errors, and ensures comprehensive documentation of diagnostic imaging services within patient medical records.

Healthcare facilities implementing integrated X-ray and EHR systems report significant improvements in operational efficiency, reduced examination processing times, and enhanced communication between healthcare professionals involved in patient care. The automatic population of patient demographics, examination histories, and clinical indications streamlines the imaging workflow while ensuring accurate patient identification and appropriate examination protocols. Integration also enables automatic billing and coding processes that improve revenue cycle management and reduce administrative overhead.

The trend toward comprehensive healthcare IT integration extends to quality assurance and performance monitoring capabilities that provide healthcare administrators with detailed analytics regarding imaging system utilization, examination volumes, and operational efficiency metrics. These integrated reporting systems enable data-driven decision-making regarding equipment utilization, staffing requirements, and capacity planning initiatives.

Advanced integration capabilities also support clinical decision support systems that can recommend appropriate imaging protocols based on patient conditions, clinical indications, and evidence-based guidelines. These intelligent systems help ensure optimal examination quality while promoting standardized imaging practices and reducing variability in diagnostic imaging procedures across different healthcare providers and facilities.

Market Restraints:

High Equipment Acquisition and Maintenance Costs

The high cost associated with the installation and maintenance of advanced X-ray screening systems represents one of the primary challenges hindering market expansion, particularly for smaller healthcare facilities and developing market healthcare providers with limited capital budgets. The substantial initial investment required for premium X-ray systems, including digital detectors, advanced imaging software, and installation infrastructure, creates significant financial barriers for healthcare facilities seeking to modernize their diagnostic imaging capabilities. These high acquisition costs are often compounded by ongoing maintenance expenses, software licensing fees, and periodic equipment upgrades necessary to maintain optimal system performance.

Healthcare facilities must also consider additional infrastructure costs associated with X-ray system installation, including radiation shielding, electrical upgrades, HVAC modifications, and specialized flooring requirements that can substantially increase the total project investment. The complexity of modern X-ray systems requires specialized technical support and maintenance contracts that represent significant ongoing operational expenses, particularly for facilities located in remote areas where service technician travel costs are substantial.

The reduction in reimbursements for film-based X-rays and computed radiography propels healthcare providers to convert from traditional systems to digital alternatives, but this transition requires significant capital investment that many facilities struggle to justify given current financial constraints. Healthcare facilities operating on limited budgets often must prioritize essential patient care needs over equipment modernization, delaying X-ray system upgrades despite the long-term operational benefits of newer technologies.

The financial impact of X-ray system acquisition extends beyond the initial purchase to include staff training costs, workflow reconfiguration expenses, and potential revenue losses during system installation and staff adaptation periods. These comprehensive implementation costs create substantial barriers for healthcare facilities considering X-ray system upgrades, particularly when competing priorities demand limited financial resources and capital investment decisions require careful justification based on patient volume projections and operational improvements.

Regulatory Compliance and Safety Certification Challenges

The complex regulatory environment surrounding X-ray system approval, installation, and operation creates significant barriers for market expansion, particularly as safety standards and certification requirements continue to evolve and become more stringent. Healthcare facilities must navigate extensive regulatory frameworks that govern radiation safety, equipment performance standards, and operator certification requirements, creating administrative burdens and compliance costs that can delay system implementation and increase operational complexity.

Radiation safety regulations require comprehensive documentation of exposure levels, safety protocols, and staff training programs that demand significant administrative resources and ongoing compliance monitoring. Healthcare facilities must maintain detailed records of radiation exposure measurements, equipment calibration procedures, and safety inspection results while ensuring that all staff members receive appropriate radiation safety training and certification. These regulatory requirements create ongoing operational costs and administrative overhead that can be particularly challenging for smaller healthcare facilities with limited administrative resources.

International variations in regulatory standards and certification requirements create additional complexity for X-ray system manufacturers and healthcare facilities operating across multiple jurisdictions. Equipment that meets regulatory standards in one region may require modifications or additional certifications for use in other markets, creating barriers to standardization and increasing implementation costs for multi-location healthcare organizations.

The evolving nature of radiation safety regulations and equipment performance standards requires healthcare facilities to maintain current knowledge of changing requirements and adapt their operational procedures accordingly. Regulatory updates may necessitate equipment modifications, additional training programs, or upgraded safety protocols that create unexpected costs and operational disruptions, making long-term planning and budgeting more challenging for healthcare administrators.

Technical Complexity and Staff Training Requirements

The increasing sophistication of modern X-ray systems creates substantial challenges related to staff training, technical competency development, and operational complexity that can impede successful system implementation and utilization. Advanced digital X-ray systems incorporate complex software interfaces, multiple imaging modes, and sophisticated image processing capabilities that require comprehensive training programs for radiologic technologists, radiologists, and support staff. The learning curve associated with new X-ray technologies can result in reduced productivity during transition periods and potential image quality issues if staff members are not adequately trained on system capabilities and limitations.

Healthcare facilities must invest significant resources in staff training programs that address both technical operation procedures and clinical applications of advanced X-ray systems. These training requirements extend beyond initial system installation to include ongoing education programs that ensure staff members remain current with software updates, new features, and evolving best practices for optimal system utilization. The cost and time investment required for comprehensive staff training can be particularly challenging for healthcare facilities with high staff turnover rates or limited training budgets.

The technical complexity of modern X-ray systems also creates dependencies on specialized technical support and maintenance services that may not be readily available in all geographic locations. Healthcare facilities must ensure access to qualified service technicians, software support specialists, and application training experts who can provide timely assistance when technical issues arise. These support requirements can create operational vulnerabilities and increase dependency on external service providers.

Furthermore, the integration of X-ray systems with existing healthcare IT infrastructure requires technical expertise in system integration, network configuration, and data management that may exceed the capabilities of existing facility IT staff. Healthcare facilities may need to invest in additional technical personnel or external consulting services to ensure successful system integration and ongoing operational support, creating additional costs and complexity in system implementation and management.

Recent Developments:

|

Development |

Company Name |

|

Development - Siemens Healthineers announced in July 2024 that Multix Impact E digital radiography X-ray machine manufacturing in India, improving patient access to care and expanding local production capabilities |

Siemens Healthineers |

|

Development - DeepTek.ai introduced Augmento X-Ray AI-based chest x-ray system in February 2024 at RSNA Annual Meeting, enhancing diagnostic accuracy through artificial intelligence |

DeepTek.ai |

|

Development - GE HealthCare Technologies launched next-generation Definium 656 HD in August 2022, offering enhanced image quality and improved workflow efficiency |

GE HealthCare Technologies |

|

Product launch - Carestream Health launched DRX-LC detector in May 2023, designed to increase image quality, patient comfort, and capture efficiency in orthopedic applications |

Carestream Health |

|

Product launch - Canon Medical Systems introduced advanced digital radiography solutions with improved detector technology in 2023, enhancing image resolution and reducing examination times |

Canon Medical Systems |

|

Product launch - Fujifilm Holdings launched new portable X-ray systems in late 2023, targeting emergency care and remote healthcare applications with enhanced mobility features |

Fujifilm Holdings |

|

Merger/Acquisition - Radon Medical Imaging announced acquisition of Alpha Imaging in November 2024, expanding into seven new states and enhancing product portfolio |

Radon Medical Imaging / Alpha Imaging |

|

Merger/Acquisition - Samsung Electronics expanded medical imaging division through strategic partnerships in 2023, strengthening position in digital X-ray detector market |

Samsung Electronics |

|

Merger/Acquisition - Mindray Bio-Medical completed acquisition of imaging technology assets in 2023, enhancing capabilities in portable X-ray systems for emerging markets |

Mindray Bio-Medical |

Regional Analysis:

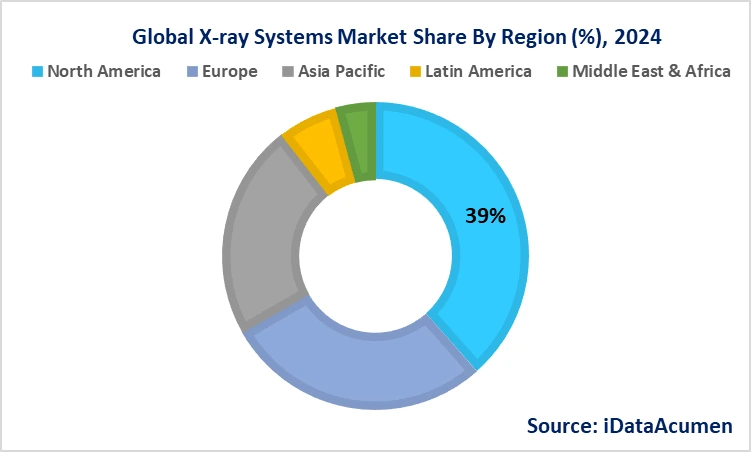

The X-ray systems market demonstrates distinct regional patterns with North America leading in market value while Asia Pacific shows the fastest growth trajectory.

North America is expected to be the largest market for X-ray Systems Market during the forecast period, accounting for over 38.5% of the market share in 2024. The growth of the market in North America is attributed to advanced healthcare infrastructure, high healthcare spending, and early adoption of cutting-edge digital imaging technologies.

The Europe market is expected to be the second-largest market for X-ray Systems Market, accounting for over 28.2% of the market share in 2024. The growth of the market is attributed to well-established healthcare systems, aging population demographics, and strong regulatory frameworks supporting medical device innovation.

The Asia Pacific market is expected to be the fastest-growing market for X-ray Systems Market, with a CAGR of over 22.8% during the forecast period 2024. The growth of the market in Asia Pacific is attributed to rapidly expanding healthcare infrastructure, increasing healthcare investments, and growing medical tourism industry.

X-ray Systems Market Segmentation:

- By Technology Type

- Digital Radiography (DR)

- Computed Radiography (CR)

- Analog/Conventional X-ray

- Mobile X-ray Systems

- Mammography Systems

- Fluoroscopy Systems

- By Product Type

- Stationary X-ray Systems

- Mobile X-ray Systems

- Dental X-ray Systems

- Mammography Systems

- Cardiovascular X-ray Systems

- Others (Veterinary, Industrial X-ray)

- By Application

- Orthopedic Imaging

- Cardiovascular Imaging

- Chest Imaging

- Dental Imaging

- Mammography Screening

- General Radiography

- Others (Emergency care, Sports medicine)

- By End User

- Hospitals

- Diagnostic Imaging Centers

- Dental Clinics

- Ambulatory Surgical Centers

- Orthopedic Clinics

- Others (Research institutes, Veterinary clinics)

- By Component

- X-ray Generators

- X-ray Detectors

- X-ray Tubes

- Collimators

- Workstations and Software

- Accessories and Consumables

- By Detector Type

- Flat Panel Detectors

- Computed Radiography Detectors

- Line-scan Detectors

- Charge-coupled Device (CCD) Detectors

- Complementary Metal-oxide Semiconductor (CMOS) Detectors

- By Portability

- Fixed/Stationary Systems

- Mobile Systems

- Handheld Systems

- Compact/Mini Systems

- Others (Portable dental units, Mobile C-arms)

- By Regions

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East

- North America

Top companies in the X-ray Systems Market

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Carestream Health Inc.

- Shimadzu Corporation

- Agfa-Gevaert Group

- Samsung Electronics Co., Ltd.

- Shanghai United Imaging Healthcare Co., Ltd.

- Mindray Bio-Medical Electronics Co., Ltd.

- Allengers Medical Systems Limited

- Dentsply Sirona Inc.

- MinXray Inc.

- Konica Minolta Healthcare Americas Inc.

- Hitachi Healthcare Americas Corporation

- Hologic Inc.

- Planmed Oy

- Ziehm Imaging GmbH

- Swissray Global Healthcare Holding Ltd.