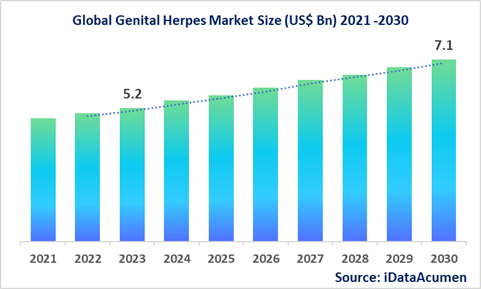

The Genital Herpes Market is projected to witness substantial growth, with an anticipated value of US$ 7.1 billion by the year 2030, marking a significant increase from its 2022 valuation of US$ 5.2 billion. This growth is expected to occur at a compound annual growth rate (CAGR) of 4.5% during the forecast period.

Genital herpes is a prevalent sexually transmitted viral infection resulting from the herpes simplex virus (HSV), which manifests as painful outbreaks of genital sores. The escalating global prevalence of genital herpes serves as a key driver for the expansion of this market. Segmentation within the Genital Herpes Market encompasses drug class, route of administration, distribution channel, end-use, and regional factors. Among these segments, nucleoside analogues hold a dominant position due to their remarkable efficacy. Notably, valacyclovir, an oral nucleoside analogue, stands out as the most commonly prescribed medication for managing genital herpes.

Genital herpes, caused by the herpes simplex virus (HSV), comprises two primary types: HSV-1 and HSV-2, with HSV-2 being the principal culprit behind genital herpes. This infection spreads through direct contact with sores or body fluids of an infected individual, and its initial outbreak typically manifests within 2-20 days following exposure to the virus. Symptoms include the emergence of small, painful blisters or ulcers around the genital, rectal, or oral areas. While no cure currently exists, antiviral medications have proven effective in mitigating outbreak duration and reducing the risk of transmission.

The prevalence of genital herpes infection remains notably high across various regions. In the United States, for instance, approximately 1 in 8 individuals aged 14-49 is estimated to be affected by genital HSV-2 infection. The proliferation of awareness and increased testing practices are generating opportunities for market growth. It is crucial to emphasize that genital herpes remains an incurable condition; however, the availability of medications offers a means to manage symptoms and lower the risk of transmission.

Epidemiology Insights:

- Genital herpes has a high global disease burden. As per WHO, in 2020 around 13% of the global population aged 15-49 years had HSV-2 infection. HSV-2 prevalence was highest in Africa at 25% in population aged 15-49 years.

- In the US, prevalence of HSV-2 was around 15.5% in people aged 14-49 years as of 2015-2016. Only ~10% of infected people recognize their infection. Europe has relatively lower HSV-2 prevalence at around 7%.

- Key trends driving epidemiological changes include high-risk sexual behaviors, poor medication adherence, lack of condom use, asymptomatic viral shedding etc. Among US adolescents, genital HSV-1 has increased.

- In Japan, HSV-1 seroprevalence has increased from 40% in 1992 to over 60% by 2006. HSV-2 rates are lower in Japan and was 1.3% as of 2010.

- Improved testing and diagnosis are providing growth opportunities. Increasing access to screening and antiviral therapy can lower transmission.

Market Landscape

- There are no vaccines available for genital herpes, presenting an unmet need. Current treatment focus on managing outbreaks using antivirals.

- Nucleoside analogues like valacyclovir, acyclovir and famciclovir are commonly prescribed for outbreak management. Penciclovir cream is available OTC.

- Upcoming therapies like pritelivir, brincidofovir and pipeline vaccines could transform the market. RNAi therapies and immunomodulators also show potential.

- Breakthrough options in development include a novel vaccine by Sanofi based on HSV-2 glycoproteins, as well as gene editing approaches to remove latent HSV from neural tissues.

- The market has a mix of branded drugs like Valtrex by GSK and generics from companies like Teva, Sandoz, Lupin etc.

Genital Herpes Market Drivers

Rising prevalence of genital herpes infections globally

The rising prevalence of genital herpes infections globally is a major factor driving growth in the genital herpes market. Genital herpes is one of the most common sexually transmitted infections worldwide. As per WHO estimates, around 536 million people aged 15-49 years were living with HSV-2 infection globally in 2020. In the US, around 1 in 8 people have HSV-2 infection. High prevalence across all regions provides a large patient pool needing treatment and diagnostic options, thereby fueling market growth. Widespread asymptomatic viral shedding also contributes to transmission. Growth is further driven by increasing awareness and testing.

Advancements in diagnostic techniques

Technological advancements in diagnostic techniques like the introduction of rapid point-of-care tests and improvements in polymerase chain reaction (PCR) are contributing to market growth. Easy accessibility, quick turnaround time and high accuracy of modern POC tests help in early diagnosis and prompt treatment initiation. Advances in Western Blot and ELISA have also enabled more reliable detection. Growing adoption of direct-to-consumer testing kits provides convenience. Improved diagnosis is enabling better disease monitoring and control.

Strong product pipeline

A strong product pipeline comprising novel antiviral drugs, vaccines and gene therapies is poised to propel market growth during the forecast period. Multiple drug candidates like pritelivir, brincidofovir, ASP2151 etc. are under development for improved symptomatic relief. Pipeline vaccines utilizing techniques like recombinant subunit and proteins offer potential prevention. Gene editing approaches to eliminate latent HSV virus also show promise. Favorable clinical trial results and approvals will broaden treatment options.

Growing public awareness and government efforts

Increasing public awareness about sexually transmitted infections and genital herpes coupled with growing government efforts to promote sexual health is fueling market growth. Educational campaigns, advertisements and social media engagement by public health agencies about risk factors, safe sexual practices and testing options encourages diagnosis and treatment. Favorable government policies like the US National STI Strategy also aim to reduce infections through improved screening access and counseling.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 5.2 Bn |

|

CAGR (2023 - 2030) |

4.5% |

|

The revenue forecast in 2030 |

US$ 7.1 Bn |

|

Base year for estimation |

2021 |

|

Historical data |

2017-2020 |

|

Forecast period |

2023-2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

By Type: HSV-1, HSV-2, Others (HSV-1/HSV-2) By Drug Class: Nucleoside analogues, Non-nucleoside polymerase inhibitors, Helicase-primase inhibitors, Others By Route of Administration: Oral, Topical, Injectable, Others By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

GlaxoSmithKline, Merck & Co., Abbott, Becton Dickinson and Company (BD), Danaher, Thermo Fisher Scientific, F. Hoffmann-La Roche, Diasorin, Quidel, Siemens Healthineers, Hologic, Cepheid, Trinity Biotech, Abcam, BioMerieux, Teco Diagnostics, Abott Laboratories, Bundi International Diagnostics, Chrono-Log Corp, Corgenix |

Genital Herpes Market Opportunities

High demand for effective therapeutic vaccines

The high unmet need and demand for effective therapeutic vaccines against genital herpes presents significant opportunities for market growth. Vaccines can help control outbreaks and transmission more effectively compared to currently available antiviral options. Several vaccine candidates utilizing different platforms are under development, with a few in late stage trials. Approval and launch of potential vaccines will boost growth. Increased industry focus and R&D spending on vaccines is opportunistic.

Combination treatment approaches

Combining antiviral drugs with immunomodulators or other novel molecules for improved symptomatic treatment provides growth opportunities. Combination approaches can lead to better clinical outcomes compared to monotherapies. For example, pritelivir is being evaluated with an immunomodulator. RNA interference drugs are also being assessed with existing nucleoside analogues. Favorable trial data and approvals will propel growth. Strategic collaborations between companies can accelerate development.

Emerging gene editing technologies

The emergence of gene editing approaches like CRISPR/Cas to eliminate latent HSV virus from neural ganglia provides promising new opportunities in the market. Gene editing has the potential to cure the infection as opposed to just managing outbreaks. Research is ongoing to improve delivery methods and test gene editing in vivo. Positive outcomes from preclinical and human trials will enable companies to capitalize on this opportunity.

Rising adoption of OTC medications

Increasing adoption of over-the-counter topical creams and antiviral medications for symptomatic outbreak relief is contributing to market growth. Easy availability, self-administration and lower costs of OTC drugs like Abreva are driving uptake. Switch of leading oral antivirals like acyclovir and famciclovir to OTC status after patent expiry also enables access. Further consumer health education by pharmaceutical companies will expand the OTC medications market segment.

Genital Herpes Market Trends

Direct-to-consumer testing services

The growing popularity of direct-to-consumer testing services for STIs including genital herpes is a key trend driving market growth. DTC kits allow confidential at-home sample collection and testing. Players like Everlywell, LetsGetChecked and myLAB Box are offering such services. Increased adoption supported by privacy, convenience and telemedicine counseling is being witnessed. DTC testing empowers patients to monitor infections and make informed decisions.

Increasing industry consolidation

The genital herpes market is undergoing consolidation, with mergers and acquisitions among key trends. Large pharmaceutical players are focused on acquiring smaller biotech firms and manufacturers to expand product portfolios. For instance, GSK acquired Tesaro in 2019 to gain its ovarian cancer drug. Consolidation allows access to new technologies and expands geographic presence. Combined resources can accelerate R&D and commercialization.

Strategic partnerships and collaborations

Pharmaceutical companies are entering strategic partnerships and collaborations to boost product development and commercialization. Collaborations span across R&D, clinical trials, manufacturing, regulatory activities and commercialization. For example, AiCuris partnered with myTomorrows for early pritelivir access. Deals leverage mutual expertise for accelerated time-to-market. As a result, a higher number of novel treatments are expected to emerge.

Digital health technologies

Growing adoption of digital health technologies such as apps, telehealth and data analytics software is a key trend in the market. Digital tools can facilitate remote patient monitoring, counselling, and medication adherence tracking. Digital health startup Teva Pharmaceuticals and Illumina are launching an app for managing chronic conditions including genital herpes. Integration of such tech will enhance care and outcomes.

Genital Herpes Market Restraints

Social stigma associated with STIs

The social stigma surrounding sexually transmitted infections including genital herpes is a major factor hampering market growth. Fear of judgment or embarrassment deters people from getting tested or seeking treatment. A lack of open communication and misconceptions associated with STIs also prevail. Additionally, mental health issues like anxiety and depression are common among those infected, which may discourage them from accessing proper care. Awareness campaigns are needed to address stigma.

Long duration of clinical trials

The long and uncertain duration of clinical trials required to test therapies slow down their approval and launch, posing challenges for market expansion. On average, clinical development of new drugs takes 10-15 years. Delayed enrollment and high placebo responses often prolong trial duration. The process of recruiting sufficient participants and demonstrating efficacy & safety data is time consuming. Expedited approval pathways could help shorten developmental timelines.

Side effects of drugs

Currently available oral antiviral drugs like acyclovir and valacyclovir can have side effects ranging from headaches, nausea, abdominal pain to serious adverse effects like neurotoxicity and nephrotoxicity in some groups. Fear of side effects makes patients reluctant to stick to treatment regimens, leading to low adherence. Concerns about drugs' effects on pregnancy also exist. Development of better tolerated drugs will help overcome this restrain. Patient education by healthcare providers is also essential.

Recent Developments in Genital Herpes Market:

|

Development |

Involved Company |

|

FDA approval of Sitavig buccal tablet for recurrent herpes labialis |

EpiPharma and Parion Sciences |

|

Partnership between AiCuris and myTomorrows to provide early access to pritelivir |

AiCuris and myTomorrows |

|

FDA approval for and launch of XELJANZ to treat occlusive vascular disease caused by chronic HSV-2 |

Pfizer |

|

Positive phase 2 results for brincidofovir HSV-2 prevention trial |

Chimerix |

|

FDA approval of PICATO gel to treat actinic keratosis on external genital warts |

LEO Pharma |

Product Launch

In December 2022, the FDA approved EpiPharma and Parion Sciences' Sitavig (acyclovir) buccal tablet for the treatment of recurrent herpes labialis. The new site-specific oral antiviral treatment is designed to deliver acyclovir directly to the source of viral replication.

In November 2021, the FDA approved Pfizer's XELJANZ (tofacitinib) to treat adults with chronic active ulcerative colitis when treatment with certain other medicines (corticosteroids or immunosuppressants) did not work well enough or could not be tolerated. XELJANZ is the first and only oral JAK inhibitor approved for ulcerative colitis.

In January 2020, LEO Pharma received FDA approval for PICATO (ingenol mebutate) gel for the topical treatment of actinic keratosis on the trunk and extremities. PICATO gel is now also approved for treatment of actinic keratosis on the external genital warts.

Merger/Acquisition

In April 2019, GSK completed the acquisition of Tesaro for approximately $5.1 billion. The acquisition added Zejula, an approved treatment for recurrent ovarian cancer, to GSK’s oncology portfolio.

In July 2018, Lupin acquired Symbiomix Therapeutics and its lead asset Solosec (secnidazole), an oral antibiotic for bacterial vaginosis. The deal was valued at over $150 million upfront payment.

Genital Herpes Market Regional Insights

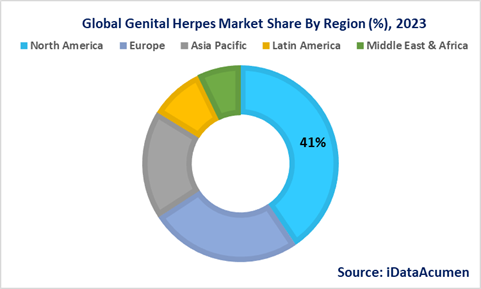

The Genital Herpes Market exhibits distinct regional trends and dynamics, reflecting varying levels of prevalence, healthcare infrastructure, awareness, and research and development (R&D) activity.

North America, comprising the United States and Canada, emerges as the leading market for genital herpes management, commanding a substantial share of over 40% in 2023. This dominance can be attributed to several factors. Firstly, North America experiences a notably high prevalence of herpes simplex virus (HSV), primarily HSV-2, contributing to the significant demand for genital herpes treatments and management. Secondly, the region boasts an advanced healthcare infrastructure, allowing for widespread access to diagnostic services and antiviral medications. Lastly, North America is characterized by a robust R&D landscape, which continually drives innovation in herpes management and treatment options. These factors collectively underpin the market's substantial presence in the region.

Europe follows as the second-largest market for genital herpes management, accounting for over 25% of the market share in 2023. This growth is propelled by the region's increasing focus on raising awareness about sexually transmitted infections (STIs) and the importance of regular screening. European nations have been actively working to educate their populations about safe sexual practices, leading to a growing demand for genital herpes treatments and preventive measures.

The Asia Pacific region is experiencing a significant rise in the genital herpes management market, with a projected impressive Compound Annual Growth Rate (CAGR) of more than 5% during the forecast period. This surge is primarily driven by collaborative endeavors to improve sexually transmitted infection (STI) screening and advance awareness of sexual health. Nations across the Asia Pacific region have acknowledged the critical need to address STIs and are actively implementing measures to curb their transmission. As a result, there is a substantial 17.8% increase in demand for genital herpes management solutions in this region, leading to strong market growth.

Latin America, accounting for 8.9% of the market share, and the Middle East & Africa, with a 7.1% share, also contribute to the global genital herpes market. While these regions have a relatively smaller market share compared to North America and Europe, they are not immune to the prevalence of genital herpes. However, factors such as varying healthcare access, awareness levels, and cultural attitudes towards STIs influence the market dynamics in these regions.

In summary, the regional distribution of the Genital Herpes Market highlights the significant impact of regional disparities in HSV prevalence, healthcare infrastructure, awareness campaigns, and efforts to improve sexual health. These factors collectively shape the market landscape and its growth trajectory across different parts of the world.

Genital Herpes Market Segmentation:

- By Type

- HSV-1

- HSV-2

- Others (HSV-1/HSV-2)

- By Drug Class

- Nucleoside analogues

- Non-nucleoside polymerase inhibitors

- Helicase-primase inhibitors

- Others

- By Route of Administration

- Oral

- Topical

- Injectable

- Others

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

- By Regions

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

- North America

Top companies in the Genital Herpes Market

- GlaxoSmithKline

- Merck & Co.

- Abbott

- Becton, Dickinson and Company (BD)

- Danaher

- Thermo Fisher Scientific

- F. Hoffmann-La Roche

- Diasorin

- Quidel

- Siemens Healthineers

- Hologic

- Cepheid

- Trinity Biotech

- Abcam

- BioMerieux

- Teco Diagnostics

- Abott Laboratories

- Bundi International Diagnostics

- Chrono-Log Corp

- Corgenix