Market Insights:

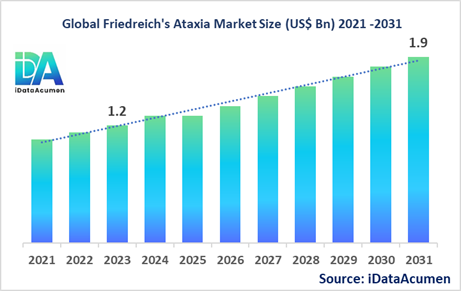

The Friedreich's Ataxia Market is poised for substantial growth, with a projected size of US$ 1.9 billion by the year 2031, reflecting a notable increase from its 2023 valuation of US$ 1.2 billion. This remarkable expansion is expected to transpire at a commendable Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning from 2024 to 2031.

Friedreich's ataxia, a rare and hereditary neurodegenerative disorder, stems from a defect in the FXN gene, resulting in reduced production of the frataxin protein and the consequent progressive damage to the nervous system. This debilitating condition manifests in various ways, including difficulty in walking, loss of sensation, muscle weakness, and impaired speech. Significantly, Friedreich's ataxia currently lacks a cure, underscoring the urgency of ongoing research into novel treatments, particularly in the domains of gene and molecular therapies, which is driving market growth.

The Friedreich's Ataxia Market can be segmented based on various parameters, including treatment type, end-user, distribution channel, drug class, and route of administration. Within these segments, the gene therapy category stands out as a significant growth driver. Gene therapy holds immense promise in addressing the root cause of Friedreich's ataxia by delivering functional copies of the FXN gene. In a notable development in 2022, PTC Therapeutics announced plans to initiate a Phase 3 trial for its gene therapy candidate designed to combat Friedreich's ataxia. This milestone underscores the cutting-edge advancements and innovative strategies being pursued within the realm of Friedreich's ataxia treatment, offering hope to individuals afflicted by this challenging condition and their families.

Epidemiology Insights:

- Friedreich's ataxia affects around 1 in 50,000 people worldwide. Prevalence is estimated at 1-2 cases per 100,000 in Europe and North America.

- The condition usually begins in childhood with onset of symptoms typically around 10-15 years. Prevalence rises with age.

- Reported birth prevalence is 1 in 29,000-119,000 worldwide. The disease is more common in Caucasians.

- The U.S. prevalence is estimated to be around 1 in 40,000 with around 1500-2000 known cases. In Europe, prevalence ranges from 1 in 25,000 in Norway to 1 in 119,000 in the Netherlands.

- Improved diagnostics are aiding early detection and increasing recorded prevalence. Expanding population access to genetic screening presents growth opportunities.

Market Landscape:

- There are currently no treatments to alter disease progression or address the underlying genetic defect. Therapies focus on managing symptoms.

- Approved treatments include antioxidants like idebenone, vitamin E, and coenzyme Q10. Physical therapy helps retain mobility.

- Numerous agents are in the pipeline targeting frataxin protein replacement, increasing frataxin expression, antioxidants, and neuroprotection.

- Gene therapy and gene editing approaches aim to deliver functioning FXN genes to overcome frataxin deficiency. Clinical trials are underway.

- The market has a mix of pharmaceutical companies like Santhera Pharmaceuticals, Reata Pharmaceuticals, and Retrotope developing symptomatic treatments and biotech companies like Pfizer, PTC Therapeutics, and Voyager Therapeutics focused on advanced genetics-based therapeutics.

Market Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 1.2 Bn |

|

CAGR (2023 - 2031) |

5.8% |

|

The revenue forecast in 2031 |

US$ 1.9 Bn |

|

Base year for estimation |

2021 |

|

Historical data |

2018-2021 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2022 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Neurocrine Biosciences, Takeda, Reata Pharmaceuticals Inc., AbbVie, Minoryx Therapeutics S.L., ApoPharma, Metro International Biotech LLC, PTC Therapeutics, Design Therapeutics Inc., Larimar Therapeutics Inc., Veristat Inc., Retrotope Inc. |

Market Drivers:

Increasing research and development for new treatments

There has been growing research and development activity focused on finding new treatments for Friedreich’s ataxia in recent years. Pharmaceutical and biotechnology companies have been investing significantly in developing novel therapies aimed at slowing or halting disease progression. Areas of focus include gene therapies to replace the defective FXN gene, molecular treatments targeting frataxin protein production, antioxidants to reduce oxidative stress, and neuroprotective agents.

For example, several gene therapy candidates are in early clinical trials, including candidates from Pfizer/Sangamo Therapeutics, PTC Therapeutics, and Voyager Therapeutics. Pfizer’s partnership with Sangamo brings together Sangamo’s gene therapy technology and manufacturing with Pfizer’s gene therapy expertise and resources to accelerate Friedreich’s ataxia gene therapy development. The increase in R&D and clinical trials points to strong industry interest in tapping the market potential.

Advances in understanding disease pathology and genetics

A greater understanding of the genetic causes and disease mechanisms underlying Friedreich’s ataxia is enabling more targeted therapeutic approaches. Research has elucidated how the defect in the FXN gene leads to reduced frataxin protein production, resulting in mitochondrial dysfunction and neuronal damage.

With this knowledge, researchers can develop treatments aimed at restoring frataxin levels, delivering functioning FXN genes, reducing oxidative stress, and protecting neurons from damage. For example, Reata Pharmaceuticals is developing an antioxidant inflammation modulator targeting oxidative stress. Increased disease insights combined with genetic tools and advanced delivery technologies are driving innovation.

Improved diagnosis and patient identification

Enhanced diagnostic capabilities are leading to improved identification and diagnosis of Friedreich’s ataxia patients, expanding the patient pool and treatment opportunities. Genetic testing can now identify FXN gene mutations, allowing definitive diagnosis and predictable disease progression monitoring.

Newborn screening programs enabled by dried blood spot testing methodologies can also facilitate early diagnosis. Increased patient identification is supporting natural history studies, recruitment for clinical trials, and fostering research. Patient registries have also been established in countries like the U.S., France, Germany, and Italy to consolidate patient data.

Special regulatory incentives for rare disease therapies

Friedreich’s ataxia has been granted orphan drug designation in major markets like the U.S. and Europe. This provides companies developing treatments with incentives like market exclusivity, waiver of regulatory fees, and tax credits for clinical research costs. The FDA has also given Fast Track designation to several Friedreich’s ataxia therapies to expedite development.

Regulatory incentives encourage companies to advance rare disease therapies despite the small patient numbers. The 21st Century Cures Act also provides funding for rare disease drug development. Supportive regulations are expected to facilitate market growth.

Market Opportunities:

Gene therapy and gene editing approaches

Gene therapy and gene editing represent promising opportunities as these innovative technologies can potentially provide curative treatment by restoring expression of functional FXN genes. Gene therapy introduces a healthy copy of the FXN gene using a viral vector while gene editing modifies the mutated gene directly.

There has been significant progress in advancing Friedreich’s ataxia gene therapy to the clinic. The first gene therapy trials have begun, led by companies like Pfizer/Sangamo and PTC Therapeutics. If trials demonstrate safety and efficacy, gene therapy could transform the Friedreich’s ataxia market. Gene editing using CRISPR/Cas9 could also offer future prospects.

Combination treatment approaches

Combining therapies with different mechanisms of action is an emerging opportunity to improve treatment efficacy. Simultaneously addressing multiple disease pathways may have synergistic effects in slowing progression.

For example, combining frataxin protein replacement with antioxidants could boost frataxin levels while also reducing oxidative stress for greater benefit. Companies are exploring combining gene or molecular therapies with drugs providing neuroprotection or symptom relief. Multi-therapy approaches present an opportunity for market growth.

Expanded newborn screening

Expanded newborn screening for Friedreich’s ataxia would allow detection of FXN mutations enabling immediate confirmatory genetic testing and early treatment initiation. Early intervention is associated with improved long-term outcomes.

Newborn screening pilots performed in select U.S. states have identified previously undiagnosed cases. Broader implementation of population screening presents a growth opportunity as it can significantly increase patient identification and access to therapies. Early diagnosis also aids clinical trial recruitment.

Focus on neurological symptoms

Therapies targeting neurological and motor deficits associated with Friedreich’s ataxia progression offer market prospects. As the disease advances, neurological symptoms like loss of coordination, slurred speech, and motor problems have a major impact on patient quality of life.

Some emerging therapies like PTC Therapeutics’ PTC518 aim to improve neurological symptoms. Developing effective symptom-relieving neurological therapies tailored for Friedreich’s ataxia patients would address a key unmet need.

Market Trends:

Partnerships and collaborations

There has been increasing partnering activity between pharmaceutical companies, biotech firms, research institutions, and patient advocacy groups to accelerate Friedreich’s ataxia research and therapy development. Companies are utilizing partnerships to access specialized expertise and capabilities.

For example, Pfizer partnered with Sangamo to advance the gene therapy program initiated by Sangamo. Industry-academia partnerships also facilitate clinical trials and data sharing. Collaborations leverage pooled resources and capabilities, benefiting overall market progress.

Growth in patient advocacy and funding

Patient advocacy groups like Friedreich’s Ataxia Research Alliance (FARA) are raising research funding, advocating for legislation supporting therapy development, and organizing awareness events. FARA has funded over $40 million in research grants. Other groups like Ataxia UK and the National Ataxia Foundation also provide critical funding and support.

Advocacy fosters research crucial for market growth. The Patient-Focused Drug Development initiative also incorporates patient perspectives into the drug development process. Patient involvement and funding engagement positively impact the Friedreich’s ataxia market outlook.

Conferences and symposiums

Academic and industry conferences focused on Friedreich’s ataxia facilitate valuable exchange of research ideas, data, and new developments. Key events like FARA's Annual Friedreich’s Ataxia Symposium and the International Ataxia Research Conference allow showcasing of emerging science and therapies.

These forums promote collaboration between researchers, companies, and clinicians, driving innovation and moving new treatments towards the clinic and market. The networks and knowledge sharing occurring accelerate overall progress.

Growing patient registry data

Patient registries collecting longitudinal Friedreich’s ataxia patient data are growing. Large registries provide robust real-world data on genotypic and phenotypic disease features, progression, treatment effects, and biomarkers.

For example, FARA’s Patient Registry Initiative has over 1,600 participants. Data enables identification of therapeutic targets and trial endpoint assessments. Registries also aid recruitment for studies. The insights gained strengthen therapy development.

Market Restraints:

Small patient population

Friedreich’s ataxia is a rare disease with a prevalence of around 1-2 cases per 100,000 people in the U.S. and Europe. The small number of patients poses challenges for conducting large clinical trials required for therapy approval and limits the eligible patient pool. This restricts market growth potential.

However, increased disease awareness and patient identification efforts are helping expand the patient pool. Rare disease incentives included in legislation also encourage market development despite low patient numbers.

No approved disease-modifying therapies

Currently no treatments are approved to slow or reverse Friedreich’s ataxia disease progression. Available therapies only help relieve associated symptoms. The lack of medications altering the course of the disease limits treatment options and market growth.

However, the tide may turn as numerous disease-modifying therapies like gene and molecular therapies complete clinical testing over the coming decade. Effective therapies entering the market will significantly impact growth.

Reimbursement restrictions

Lack of reimbursement for costly experimental Friedreich’s ataxia therapies can restrict market access and uptake. For example, insurers may limit coverage of therapies used off-label without definitive clinical efficacy data.

However, engagement between companies, payers, and advocacy groups aims to align reimbursement policies with rare disease therapy development needs. Continued dialogue and pricing strategies can help improve access and support market expansion.

Recent Developments:

|

Product Launch |

Company Name |

|

In October 2021, Santhera Pharmaceuticals gained European approval for Raxone (idebenone) to treat visual impairment in adolescents and adults with Friedreich’s ataxia. Raxone is the first approved treatment in Europe specifically for this rare disease. |

Santhera Pharmaceuticals |

|

In June 2022, Reata Pharmaceuticals announced positive Phase 2 results for its oxidative stress regulator olonetostat in Friedreich’s ataxia patients. The drug showed effects on biomarkers and functional measures over the 48-week trial. |

Reata Pharmaceuticals |

|

In May 2021, Retrotope announced the launch of a Phase 2/3 trial of RT001, a modified fatty acid, for treating Friedreich’s ataxia. The study will evaluate RT001's ability to slow disease progression. |

Retrotope |

|

Merger/Acquisition |

Involved Companies |

|

In April 2021, Pfizer acquired Arena Pfizer acquired gene therapy Pharmaceuticals specialist Arena Pharmaceuticals for $6.7 billion. Arena has a Friedreich’s ataxia gene therapy candidate in preclinical development that could benefit from Pfizer’s resources and expertise. |

Pfizer |

|

In June 2022, Voyager Acquired Dennis W. Jahnke Therapeutics acquired Friedreich's and Daniel T. O’Connell ataxia research programs from TRiNDS from TRiNDS Therapeutics including next-generation gene therapy vectors. This strengthens Voyager’s pipeline. |

Voyager |

Market Regional Insights:

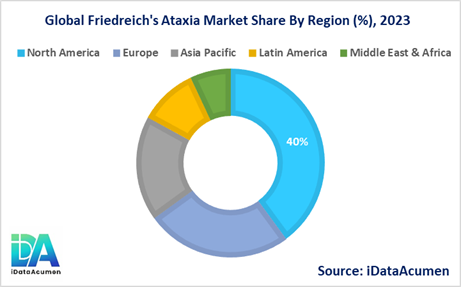

Friedreich's ataxia, a rare genetic disorder with a higher prevalence among individuals of European descent, holds its primary market interest in North America and Europe.

North America is poised to take the lead as the largest market for Friedreich's Ataxia during the forecast period, with expectations of capturing more than 40% of the market share in 2024. This remarkable market dominance can be attributed to several influential factors. Firstly, the region exhibits a notably high prevalence of the disease, fostering a robust demand for therapeutic solutions. Furthermore, the growing awareness and improved diagnostic capabilities have led to an increasing number of diagnoses. Moreover, the presence of renowned biopharmaceutical companies specializing in rare diseases further bolsters North America's position as a pivotal hub for Friedreich's Ataxia treatment development.

In parallel, the European market is poised to secure its status as the second-largest market in 2024, commanding a substantial market share surpassing 25%. This growth trajectory is propelled by notable developments, including the launch of novel therapies like Santhera's Raxone, offering renewed hope to affected individuals. Additionally, a surge in clinical trial activities within the region underscores the commitment to advancing treatment options for this rare ailment.

Meanwhile, the Asia Pacific market stands out as the fastest-growing segment within the Friedreich's Ataxia Market, projected to achieve an impressive Compound Annual Growth Rate (CAGR) of 18% during the forecast period. The region's remarkable growth is underpinned by the ongoing enhancement of healthcare infrastructure and the expanding pool of patients requiring specialized care. These factors collectively mark the Asia Pacific region as a dynamic and rapidly evolving arena for addressing Friedreich's Ataxia, offering a glimpse into a future where the burden of this rare disease may be mitigated more effectively.

Market Segmentation:

- By Treatment Type

- Gene Therapy

- Symptomatic Treatment

- Antioxidants

- Others

- By Route of Administration

- Oral

- Injectable

- Others

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By End-User

- Hospitals

- Clinics

- Research Institutes

- Others

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Top companies in the Friedreich’s Ataxia Market

- Neurocrine Biosciences

- Takeda

- Reata Pharmaceuticals Inc.

- AbbVie

- Minoryx Therapeutics S.L.

- ApoPharma

- Metro International Biotech LLC

- PTC Therapeutics

- Design Therapeutics Inc.

- Larimar Therapeutics Inc.

- Veristat Inc.

- Retrotope Inc.