Market Analysis:

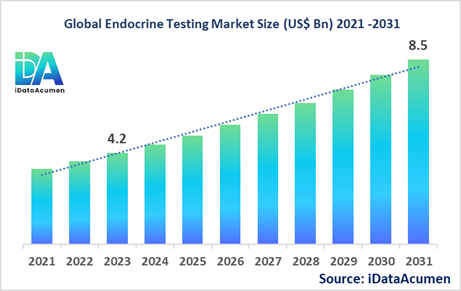

The Endocrine Testing Market had an estimated market size worth US$ 4.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 8.5 billion by 2031, growing at a CAGR of 9.2% from 2024 to 2031.

Endocrine testing refers to a range of diagnostic tests that measure the levels of hormones and other substances produced by the endocrine glands. These tests are used to diagnose and monitor various endocrine disorders, such as diabetes, thyroid disorders, growth disorders, and reproductive disorders. The advantages of endocrine testing include early detection of hormonal imbalances, personalized treatment plans, and better management of chronic conditions.

The drivers for the market include the rising prevalence of endocrine disorders, increasing geriatric population, technological advancements in diagnostics, and growing awareness about preventive care.

The Endocrine Testing Market involves the analysis of hormones and other substances produced by the endocrine glands to diagnose and monitor various endocrine disorders.

The Endocrine Testing Market is segmented by product type, technology, disease type, end-user, test type, sample type, and region. By product type, the market is segmented into assay kits and reagents, analyzers, software and services, and others (consumables, accessories). The assay kits and reagents segment is expected to witness significant growth due to the increasing demand for accurate and reliable diagnostic tests.

For example, in January 2022, Roche Diagnostics launched the Elecsys Anti-TSH Receptor Antibody assay for the diagnosis of Graves' disease, a type of autoimmune thyroid disorder.

Epidemiology Insights:

- The disease burden of endocrine disorders varies across major regions, with higher prevalence rates in developed nations like the United States and Europe due to factors such as sedentary lifestyles, obesity, and aging populations.

- Key epidemiological trends driving the increased incidence and prevalence of endocrine disorders include rising obesity rates, urbanization, and changing dietary patterns. For instance, in the US, the prevalence of diabetes has been steadily increasing, affecting approximately 11.3% of the population as of 2020, according to the Centers for Disease Control and Prevention (CDC).

- In major markets like the US, the EU5 (France, Germany, Italy, Spain, and the UK), and Japan, the incidence and prevalence rates of endocrine disorders, particularly diabetes and thyroid disorders, have been on the rise due to factors such as an aging population, sedentary lifestyles, and increased obesity rates.

- The growing patient population with endocrine disorders presents growth opportunities for the endocrine testing market, as early diagnosis and monitoring are crucial for effective disease management and treatment.

- While most endocrine disorders are not considered rare, some rare endocrine diseases do exist, such as congenital adrenal hyperplasia and multiple endocrine neoplasia syndromes. These conditions require specialized diagnostic and treatment approaches.

Market Landscape:

- Unmet needs in the endocrine testing market include the lack of accurate and reliable diagnostic tests for certain endocrine disorders, the need for earlier disease detection, and the development of personalized treatment approaches based on individual patient characteristics.

- Current treatment options for endocrine disorders include hormone replacement therapies, medications to manage hormone imbalances, and in some cases, surgery. Examples of approved therapies include levothyroxine for hypothyroidism, insulin for diabetes, and growth hormone replacement therapy for growth hormone deficiency.

- Upcoming therapies and technologies in the endocrine testing market include the development of novel biomarkers for earlier disease detection, the integration of artificial intelligence and machine learning for improved test interpretation, and the advancement of point-of-care testing devices for faster and more accessible diagnostics.

- Breakthrough treatment options currently being developed include gene therapies for certain genetic endocrine disorders, stem cell therapies for regenerative medicine approaches, and the use of CRISPR technology for precise genetic modifications in endocrine diseases.

- The market composition for endocrine testing is diverse, with both branded and generic drug manufacturers involved. However, the market is dominated by several large pharmaceutical and diagnostics companies that offer a wide range of endocrine testing products and services.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 4.2 Bn |

|

CAGR (2024 - 2031) |

9.2% |

|

The revenue forecast in 2031 |

US$ 8.5 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Sysmex Corporation, DiaSorin S.p.A., Quidel Corporation, bioMérieux SA, Ortho Clinical Diagnostics, Beckman Coulter, Inc., Randox Laboratories Ltd., Fujirebio Inc., Wallac Oy, Tosoh Corporation, Merck KGaA, Autobio Diagnostics Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

Market Drivers:

Rising Prevalence of Endocrine Disorders

The increasing prevalence of endocrine disorders, such as diabetes, thyroid disorders, and reproductive disorders, is a significant driver for the endocrine testing market. As these conditions become more widespread, the demand for accurate diagnostic tests and monitoring tools increases. Factors contributing to the rise in endocrine disorders include an aging population, sedentary lifestyles, poor dietary habits, and obesity. Early detection and effective management of these disorders rely heavily on endocrine testing, driving the growth of this market.

Technological Advancements in Diagnostic Testing

Continuous advancements in diagnostic technologies have revolutionized endocrine testing, driving market growth. The development of automated immunoassay analyzers, tandem mass spectrometry techniques, and point-of-care testing devices have improved the accuracy, speed, and accessibility of endocrine tests. These advancements have led to more precise hormone measurement, earlier disease detection, and better treatment monitoring, which in turn has increased the demand for endocrine testing services.

Growing Awareness and Focus on Preventive Care

There is a rising awareness among healthcare professionals and the general public about the importance of preventive care and early disease detection. Endocrine testing plays a crucial role in identifying hormonal imbalances and potential endocrine disorders before they progress to more severe stages. This increased emphasis on preventive care, coupled with regular health screenings, has driven the demand for endocrine testing services, contributing to market growth.

Increasing Healthcare Expenditure and Access to Healthcare Services

Many countries are investing in improving their healthcare infrastructure and increasing access to healthcare services, including diagnostic testing. As healthcare expenditure rises, more resources are being allocated to endocrine testing facilities, equipment, and personnel. This increased accessibility and availability of endocrine testing services have fueled market growth, particularly in developing regions where healthcare infrastructure is expanding.

Market Opportunities:

Emerging Markets in Developing Regions

Developing regions, such as Asia-Pacific, Latin America, and Africa, present significant growth opportunities for the endocrine testing market. These regions have witnessed a rapid increase in urbanization, changing lifestyles, and a rise in the prevalence of endocrine disorders like diabetes and thyroid conditions. Additionally, as these economies continue to grow and healthcare infrastructures improve, there is a growing demand for advanced diagnostic services, including endocrine testing. Companies that can effectively tap into these emerging markets and address the unique healthcare needs of these regions have the potential to capture a significant share of the market.

Development of Novel Biomarkers and Personalized Testing

The identification and development of novel biomarkers for endocrine disorders hold immense potential for the endocrine testing market. As research progresses, the discovery of new biomarkers can lead to more accurate and personalized diagnostic tests. Personalized testing approaches that take into account an individual's genetic profile, lifestyle, and other factors can revolutionize endocrine disorder management by providing tailored treatment plans. Companies that invest in biomarker research and develop personalized testing solutions can gain a competitive edge in the market.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies in endocrine testing presents a significant opportunity for market growth. AI and ML can aid in the interpretation of complex test results, identify patterns and correlations, and provide personalized recommendations for diagnosis and treatment. Additionally, these technologies can improve workflow efficiency, reduce human error, and enhance the overall accuracy of endocrine testing. Companies that successfully incorporate AI and ML into their endocrine testing solutions can differentiate themselves and gain a competitive advantage in the market.

Expansion of Direct-to-Consumer Testing

The direct-to-consumer (DTC) testing market has gained traction in recent years, offering individuals the ability to access diagnostic tests without the need for a healthcare provider's prescription. As consumer awareness about endocrine disorders and the importance of early detection increases, there is potential for the expansion of DTC endocrine testing services. Companies that can offer reliable and user-friendly DTC endocrine testing solutions can tap into this growing market and reach a wider consumer base.

Market Trends:

Adoption of Point-of-Care Testing (POCT) Devices

Point-of-care testing (POCT) devices are becoming increasingly popular in the endocrine testing market. These portable and user-friendly devices allow for rapid testing and on-site results, eliminating the need for samples to be sent to centralized laboratories. POCT devices are particularly useful in remote or resource-limited settings, enabling faster diagnosis and treatment. This trend towards decentralized testing has been driven by the need for more accessible and convenient diagnostic services, leading to the development of advanced POCT devices for endocrine testing.

Integration of Wearable Technology and Remote Monitoring

The integration of wearable technology and remote monitoring solutions is a growing trend in the endocrine testing market. Wearable devices can track various health parameters, such as glucose levels, heart rate, and physical activity, providing valuable data for endocrine disorder management. Remote monitoring systems allow healthcare providers to monitor patients' hormone levels and other biomarkers remotely, enabling more personalized and continuous care. This trend has gained momentum due to the increasing focus on telemedicine and the convenience it offers to patients and healthcare providers.

Development of Multiplex Assays and Combinatorial Testing

The development of multiplex assays and combinatorial testing approaches is a significant trend in the endocrine testing market. Multiplex assays allow for the simultaneous detection and quantification of multiple biomarkers from a single sample, providing a more comprehensive analysis of an individual's endocrine health. Combinatorial testing involves combining different testing methods, such as immunoassays and mass spectrometry, to improve diagnostic accuracy and provide a more complete picture of endocrine disorders. These advanced testing approaches enable more efficient and informative diagnostic processes.

Increasing Focus on Early Disease Detection and Preventive Care

There is a growing emphasis on early disease detection and preventive care in the healthcare industry, which has significantly impacted the endocrine testing market. Early detection of endocrine disorders through regular screening and testing can lead to more effective treatment and better patient outcomes. This trend has been driven by the rising awareness of the importance of preventive care and the potential long-term benefits of early intervention. As a result, there is increasing demand for endocrine testing services that can aid in the early identification of hormonal imbalances and potential endocrine disorders.

Market Restraints:

High Cost of Advanced Diagnostic Tests

One of the significant restraints in the endocrine testing market is the high cost associated with advanced diagnostic tests and equipment. Innovative technologies, such as tandem mass spectrometry and automated immunoassay analyzers, require substantial investment in infrastructure and skilled personnel. Additionally, the development and validation of new assays and biomarkers can be resource-intensive and time-consuming. These high costs can limit the accessibility of endocrine testing services, particularly in resource-constrained settings and developing regions, hindering market growth.

Stringent Regulatory Landscape and Compliance Requirements

The endocrine testing market is subject to stringent regulatory oversight and compliance requirements, which can act as a restraint for market growth. Diagnostic tests and medical devices must undergo rigorous approval processes to ensure their safety, efficacy, and quality. Compliance with regulatory standards, such as those set by the U.S. Food and Drug Administration (FDA) and other international bodies, can be a complex and time-consuming process for manufacturers and service providers. Additionally, variations in regulatory frameworks across different regions can create challenges for companies operating globally, potentially hindering market expansion.

Lack of Skilled Professionals and Specialized Training

The endocrine testing market relies on skilled professionals with specialized training in areas such as laboratory medicine, endocrinology, and pathology. However, there is often a shortage of qualified personnel, particularly in developing regions or rural areas. This lack of skilled professionals can hinder the widespread adoption and effective implementation of endocrine testing services, limiting market growth. Moreover, the continuous advancements in testing technologies and methodologies require ongoing training and education for healthcare professionals, which can be resource-intensive and challenging to maintain.

Recent Developments:

|

Development |

Involved Company |

|

In September 2022, Roche Diagnostics launched the Elecsys Anti-TSH Receptor Antibody assay for the diagnosis of Graves' disease, an autoimmune thyroid disorder. This assay aids in early disease detection. |

Roche Diagnostics |

|

In June 2021, Abbott Laboratories received FDA approval for its FreeStyle Libre 3 continuous glucose monitoring system for diabetes management. The system provides real-time glucose data without finger pricks. |

Abbott Laboratories |

|

In April 2020, Siemens Healthineers launched the Atellica IM Vitamin D Total assay for accurate measurement of vitamin D levels, essential for bone and mineral disorders. |

Siemens Healthineers |

|

Product Launch |

Company Name |

|

In November 2022, Danaher Corporation launched the Beckman Coulter DxA 5000 total laboratory automation system, enhancing efficiency and workflow for endocrine testing. |

Danaher Corporation |

|

In August 2021, Thermo Fisher Scientific introduced the Phadia 2500 Plus instrument for allergy and autoimmunity testing, including endocrine disorders like thyroid autoimmune diseases. |

Thermo Fisher Scientific |

|

In March 2020, Bio-Rad Laboratories launched the Bio-Plex Pro Human Diabetes Assays for simultaneous detection of multiple diabetes biomarkers, aiding in disease management. |

Bio-Rad Laboratories |

|

Merger/Acquisition |

Involved Companies |

|

In October 2021, Danaher Corporation acquired Cytiva, a life sciences company, for $21.4 billion, strengthening its position in the diagnostics and bioprocessing markets. |

Danaher Corporation and Cytiva |

|

In January 2020, Quidel Corporation acquired Ortho Clinical Diagnostics for $6 billion, expanding its product portfolio in the areas of immunoassay and molecular diagnostic testing. |

Quidel Corporation and Ortho Clinical Diagnostics |

|

In July 2019, Thermo Fisher Scientific acquired Brammer Bio, a gene therapy company, for $1.7 billion, strengthening its capabilities in the development and manufacturing of gene therapies. |

Thermo Fisher Scientific and Brammer Bio |

Market Regional Insights:

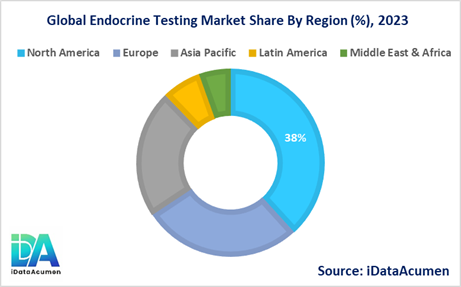

The Endocrine Testing Market is a global industry, with varying market dynamics across different regions. North America is expected to be the largest market for the Endocrine Testing Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of endocrine disorders, well-established healthcare infrastructure, and the presence of leading market players.

The European market is expected to be the second-largest market for the Endocrine Testing Market, accounting for over 27.5% of the market share in 2024. The growth of the market is attributed to the increasing adoption of advanced diagnostic technologies, rising awareness about preventive care, and favorable reimbursement policies in several European countries.

The Asia-Pacific market is expected to be the fastest-growing market for the Endocrine Testing Market, with a CAGR of over 22.1% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the rising prevalence of endocrine disorders, increasing healthcare expenditure, and growing focus on early disease detection and management. Latin America and the Middle East & Africa regions hold a combined market share of around 12.2%.

Market Segmentation:

- By Product Type

- Assay Kits and Reagents

- Analyzers

- Software and Services

- Others (Consumables, Accessories)

- By Technology

- Immunoassay

- Tandem Mass Spectrometry

- ELISA

- Clinical Chemistry

- Others (Radioimmunoassay, Sensor-Based Assays)

- By Disease Type

- Diabetes

- Thyroid Disorders

- Growth Hormone Disorders

- Reproductive Disorders

- Adrenal Disorders

- Bone and Mineral Disorders

- Others (Pituitary Disorders, Parathyroid Disorders)

- By End-User

- Hospitals and Clinics

- Diagnostic Laboratories

- Research Institutes

- Others (Home Care Settings, Ambulatory Care Centers)

- By Test Type

- Thyroid Tests

- Fertility Tests

- Diabetes Tests

- Growth Hormone Tests

- Others (Adrenal Tests, Bone and Mineral Tests)

- By Sample Type

- Blood

- Urine

- Saliva

- Others (Tissue, Cerebrospinal Fluid)

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segmentation Analysis:

- Product Type Segment: The assay kits and reagents segment is expected to witness significant growth across all regions due to the increasing demand for accurate and reliable diagnostic tests. In North America and Europe, this segment is likely to have a higher CAGR and market size due to the well-established healthcare infrastructure and adoption of advanced technologies. In the Asia-Pacific region, the assay kits and reagents segment is also projected to grow rapidly due to the increasing healthcare expenditure and focus on early disease detection.

- Technology Segment: The immunoassay segment is expected to be the largest segment in 2024, driven by its widespread use in endocrine testing and the development of advanced immunoassay techniques. The tandem mass spectrometry segment is anticipated to be the second-largest segment, with a higher growth rate due to its increasing adoption for accurate hormone measurement.

- Disease Type Segment: The diabetes segment is likely to be the largest segment in 2024, owing to the high prevalence of diabetes globally. The thyroid disorders segment is expected to be the second-largest segment, with a significant growth rate due to the increasing awareness and early diagnosis of thyroid-related conditions.

It is important to note that the growth rates and market sizes of these segments may vary across different regions due to factors such as healthcare infrastructure, disease prevalence, and economic conditions.

Top companies in the Endocrine Testing Market:

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories

- Sysmex Corporation

- DiaSorin S.p.A.

- Quidel Corporation

- bioMérieux SA

- Ortho Clinical Diagnostics

- Beckman Coulter, Inc.

- Randox Laboratories Ltd.

- Fujirebio Inc.

- Wallac Oy

- Tosoh Corporation

- Merck KGaA

- Autobio Diagnostics Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.