Dietary Supplements Market - Comprehensive Analysis Report

Market Analysis:

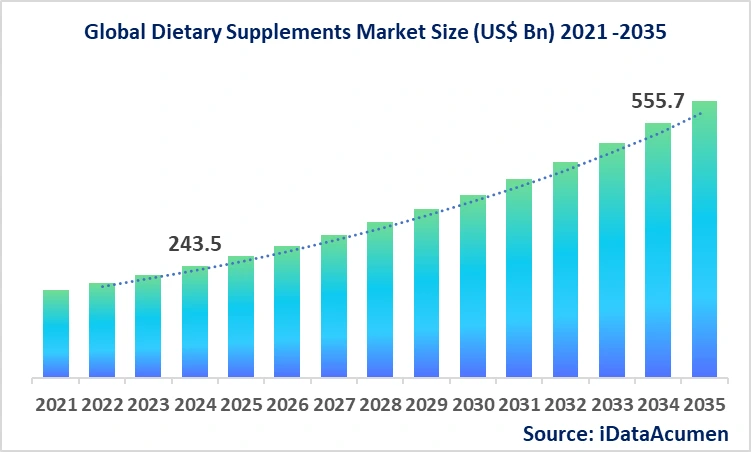

The Dietary Supplements Market size is expected to reach US$ 555.7 billion by 2034, from US$ 243.5 billion in 2024, at a CAGR of 8.60% during the forecast period by 2024-2035. Dietary supplements are products designed to supplement the diet and provide nutrients such as vitamins, minerals, herbs, amino acids, and enzymes that may be missing or insufficient in regular food intake. These products are available in various forms including tablets, capsules, powders, liquids, and gummies, making them accessible to diverse consumer preferences.

The usage of dietary supplements spans across multiple health objectives including immune system support, bone health maintenance, cardiovascular wellness, digestive health improvement, and cognitive function enhancement. The advantages include convenient nutrient delivery, targeted health support, filling nutritional gaps in modern diets, and providing concentrated doses of beneficial compounds that may be difficult to obtain through food alone.

The primary market drivers include increasing consumer awareness regarding health and wellness, rising healthcare costs prompting preventive care approaches, and growing aging population seeking nutritional support. The market is experiencing significant growth due to heightened health consciousness following the COVID-19 pandemic, which emphasized the importance of immune system support and overall wellness.

The Dietary Supplements Market is segmented by product type, form, end user, application, distribution channel, age group, and region. By product type, the market is segmented into vitamins, minerals, herbal/botanical supplements, amino acids, enzymes, probiotics, and others. Vitamin supplements accounted for a revenue market share of 27.7% in 2024, making it the largest subsegment. This segment is growing rapidly due to increased awareness of vitamin deficiencies and their role in maintaining optimal health, particularly vitamin D, B-complex, and vitamin C for immune support.

Recent product launches include O Positive's PREGGO conception support and sperm health support capsules launched in March 2024, targeting the growing women's wellness segment. Additionally, manufacturers are innovating with gummies, liquid shots, and functional beverages to address consumer preferences for more convenient and palatable delivery formats.

Epidemiology Insights:

The dietary supplements market addresses nutritional deficiencies and health maintenance rather than specific diseases. However, the burden of micronutrient deficiencies varies significantly across regions. North America and Europe show higher prevalence of vitamin D deficiency due to lifestyle factors and limited sun exposure, while Asia-Pacific regions face more complex nutritional challenges including iron deficiency anemia and vitamin B12 deficiency.

Key epidemiological trends driving market growth include increasing prevalence of lifestyle-related health conditions, rising awareness of preventive healthcare, and growing elderly populations in developed markets. In the US, EU5, and Japan, aging demographics are creating substantial demand for bone health supplements, cognitive support products, and cardiovascular wellness solutions.

Latest data indicates that approximately 70% of adults in developed countries regularly consume some form of dietary supplement, with vitamin D and multivitamin complexes being most commonly used. The prevalence of supplement usage is highest among women aged 50+ and individuals with higher education levels.

Growth opportunities are significant given the increasing patient population seeking preventive healthcare solutions rather than reactive treatment. The market benefits from the shift toward wellness-focused healthcare paradigms and the growing recognition of nutrition's role in disease prevention.

Unlike pharmaceutical markets, dietary supplements don't typically address rare diseases but rather common nutritional needs and wellness goals affecting large population segments, making market opportunities substantial and widespread.

Market Landscape:

The dietary supplements market faces several unmet needs including personalized nutrition solutions, improved bioavailability of nutrients, better quality standardization, and enhanced consumer education about appropriate supplementation. Many consumers struggle with determining optimal dosages and combinations for their specific health needs.

Current treatment options and approved therapies focus on evidence-based formulations addressing specific nutritional deficiencies. Popular categories include multivitamins, omega-3 fatty acids, probiotics, protein supplements, and targeted formulations for immune support, bone health, and cognitive function.

Upcoming therapies and technologies include personalized nutrition based on genetic testing, microbiome-targeted supplements, nanotechnology for improved absorption, and AI-driven recommendation systems. Advanced delivery systems such as liposomal encapsulation and slow-release formulations are becoming increasingly common.

Breakthrough treatment options currently in development include precision nutrition platforms, biomarker-guided supplementation, and next-generation probiotics with enhanced therapeutic potential. Smart packaging with QR codes for authenticity verification and dosage tracking represents another innovation frontier.

The market composition shows a balanced mix of branded and generic manufacturers. While major pharmaceutical companies like Pfizer, Bayer, and GSK maintain significant branded presence, numerous specialized supplement companies and private label manufacturers contribute to market diversity. The industry structure allows for both premium branded products and affordable generic alternatives, catering to diverse consumer segments.

Market Report Scope:

|

Description |

|

|

The market size in 2024 |

US$ 243.5 Bn |

|

CAGR (2024 - 2035) |

8.60% |

|

The revenue forecast in 2035 |

US$ 555.7 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2035 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Nestle S.A., Abbott Laboratories, Amway Corporation, Pfizer Inc., Bayer AG, Herbalife Nutrition Ltd., Glanbia Nutritionals, GlaxoSmithKline plc, Otsuka Holdings Co. Ltd., Nu Skin Enterprises Inc., USANA Health Sciences Inc., Reckitt Benckiser Group plc, Carlyle Group (Nature's Bounty), Pharmavite LLC, DSM Nutritional Products, Blackmores Limited, Swisse Wellness Pty Ltd., Vitabiotics Ltd., Solgar Inc., NOW Foods |

Market Drivers:

Rising Health Consciousness and Preventive Healthcare Adoption

The global shift toward preventive healthcare represents a fundamental transformation in consumer behavior, significantly driving the dietary supplements market. Modern consumers increasingly prioritize maintaining optimal health rather than merely treating diseases after they occur. This paradigm shift has been accelerated by mounting healthcare costs, making prevention more economically attractive than treatment. The COVID-19 pandemic particularly intensified this trend, as consumers became more aware of the importance of maintaining strong immune systems and overall health resilience.

Educational initiatives and increased access to health information through digital platforms have empowered consumers to make informed decisions about their nutritional needs. Social media, health blogs, and wellness influencers have created a culture where supplement consumption is normalized and often viewed as a responsible health practice. This cultural shift has moved supplements from niche health products to mainstream wellness essentials.

The growing awareness of nutritional deficiencies in modern diets has further fueled this driver. Busy lifestyles, processed food consumption, and declining soil nutrient content have created widespread recognition that regular food intake may not provide adequate nutrition. Consumers increasingly view supplements as necessary insurance against nutritional gaps, particularly for essential vitamins and minerals.

Healthcare professionals have also contributed to this trend by increasingly recommending supplements for specific health conditions and preventive care. The integration of nutritional supplementation into mainstream medical practice has provided legitimacy and professional endorsement that drives consumer confidence and adoption rates across diverse population segments.

Demographic Changes and Aging Population

The global demographic shift toward an aging population represents a powerful and sustained driver for the dietary supplements market. As populations age, particularly in developed countries, there is increasing recognition of age-related nutritional needs and the role of supplements in maintaining quality of life. Older adults often face challenges in nutrient absorption, decreased appetite, and increased metabolic demands that make supplementation particularly valuable.

Age-related health concerns such as bone density loss, cardiovascular health, cognitive function, and immune system decline have created targeted supplement categories with strong scientific backing. Calcium and vitamin D for bone health, omega-3 fatty acids for cardiovascular support, and antioxidants for cellular protection have become standard recommendations for aging populations.

The baby boomer generation, characterized by higher disposable income and health consciousness, represents a particularly influential demographic driving supplement consumption. This generation's approach to aging focuses on maintaining independence, vitality, and active lifestyles, making them willing to invest in preventive health measures including regular supplementation.

Additionally, the increasing prevalence of chronic conditions among aging populations has created awareness of the role nutrition plays in managing these conditions. Supplements targeting joint health, cognitive function, and energy levels have seen substantial growth as consumers seek natural approaches to maintain their health and complement traditional medical treatments.

Lifestyle and Dietary Pattern Changes

Modern lifestyle changes have created significant nutritional challenges that directly drive supplement consumption. The prevalence of processed foods, irregular meal patterns, and nutrient-poor diets has created widespread recognition of the need for nutritional supplementation. Busy lifestyles have led consumers to seek convenient alternatives to traditional tablets and capsules, with gummy formats and other innovative delivery methods gaining popularity.

The rise of specific dietary patterns such as veganism, vegetarianism, and specialized diets has created targeted supplement needs. Plant-based diets, while offering many health benefits, may lack certain nutrients like vitamin B12, iron, and omega-3 fatty acids, creating a reliable market for specialized supplements that address these specific nutritional gaps.

Athletic and fitness culture has also significantly contributed to supplement market growth. The expansion of fitness activities, sports participation, and body consciousness has created demand for protein supplements, pre-workout formulations, and recovery products. This trend extends beyond professional athletes to include recreational fitness enthusiasts and everyday consumers seeking to optimize their physical performance.

Environmental factors including soil depletion, food processing, and lengthy food supply chains have reduced the nutrient density of many foods, creating legitimate concerns about adequate nutrition from food alone. This awareness has driven consumers to view supplements as necessary to achieve optimal nutrient intake levels that were previously available through traditional diets.

Technological Advancement and Product Innovation

Technological innovations in supplement formulation, delivery systems, and personalization have significantly enhanced product effectiveness and consumer acceptance. Advanced manufacturing techniques have improved bioavailability, allowing for smaller doses and better absorption rates. Nanotechnology, microencapsulation, and time-release formulations have addressed traditional concerns about supplement effectiveness and convenience.

The integration of mobile apps and gamification for real-time consumption tracking has enhanced adherence and improved health literacy, creating stronger consumer engagement with supplement routines. These technological tools help consumers understand the value of consistent supplementation and provide measurable feedback on their health journey.

Personalized nutrition technology has emerged as a game-changing innovation, allowing consumers to receive supplement recommendations based on individual health assessments, genetic testing, and lifestyle factors. This customization addresses the one-size-fits-all limitations of traditional supplements and creates higher perceived value for consumers.

The development of clean-label products, sustainable sourcing, and transparent manufacturing processes has addressed consumer concerns about product quality and environmental impact. Third-party testing, certification programs, and blockchain technology for supply chain transparency have increased consumer trust and willingness to invest in premium supplement products.

Market Opportunities:

Personalized Nutrition and Precision Supplementation

The emergence of personalized nutrition represents a transformative opportunity in the dietary supplements market. Advanced technologies including genetic testing, microbiome analysis, and comprehensive health assessments enable the creation of customized supplement regimens tailored to individual needs. This approach addresses the fundamental limitation of generic supplementation by providing targeted nutrients based on personal health profiles, genetic predispositions, and lifestyle factors.

Companies are increasingly investing in direct-to-consumer platforms that combine health assessments with customized supplement delivery. These services typically include initial consultations, ongoing monitoring, and adjustment of supplement regimens based on health outcomes and changing needs. The subscription-based model provides predictable revenue streams while creating strong customer loyalty through personalized service.

The integration of wearable technology and health monitoring devices creates opportunities for real-time adjustment of supplement recommendations. Continuous monitoring of biomarkers, activity levels, and health metrics can inform dynamic supplementation strategies that adapt to changing health conditions and lifestyle factors.

Artificial intelligence and machine learning algorithms are being developed to analyze vast amounts of health data and provide increasingly sophisticated supplement recommendations. These technologies can identify patterns and correlations that human analysis might miss, leading to more effective and targeted supplementation strategies that deliver measurable health improvements.

Emerging Markets and Global Expansion

Developing economies present substantial growth opportunities for dietary supplement companies as rising middle-class populations gain disposable income and health consciousness. Countries in Asia-Pacific, Latin America, and Africa are experiencing rapid urbanization, changing dietary patterns, and increasing awareness of preventive healthcare, creating favorable conditions for supplement market development.

The globalization of health and wellness trends through social media and international communication has created demand for supplement products in markets that previously had limited exposure to these concepts. Western health and wellness practices are being adopted in emerging markets, creating opportunities for companies to introduce proven supplement categories to new consumer bases.

E-commerce and digital distribution channels have lowered barriers to entry in international markets, allowing supplement companies to reach global audiences without significant physical infrastructure investments. Online platforms enable direct-to-consumer sales, educational content distribution, and customer relationship management across geographic boundaries.

Local partnerships and cultural adaptation strategies provide opportunities to customize supplement offerings for regional preferences and needs. Understanding local health concerns, regulatory requirements, and cultural attitudes toward supplementation enables companies to develop targeted products that resonate with specific market segments while respecting local preferences and traditions.

Functional Foods and Supplement Convergence

The convergence of dietary supplements with functional foods represents a significant market opportunity as consumers seek convenient ways to incorporate health-promoting ingredients into their daily routines. This trend involves the development of food products fortified with supplement-level nutrients, creating a bridge between nutrition and convenience that appeals to busy consumers.

Beverage categories including functional waters, enhanced coffee products, and nutritional drinks provide platforms for delivering supplement benefits in familiar, convenient formats. These products can reach consumers who might not traditionally purchase supplements while providing additional revenue streams for supplement companies.

The snack food category offers opportunities to deliver targeted nutrition through convenient, portable formats. Protein bars, functional gummies, and fortified snacks can provide supplement benefits while satisfying consumer preferences for convenient, on-the-go nutrition solutions.

Ready-to-mix powders and meal replacement products represent growing opportunities to combine complete nutrition with targeted supplement benefits. These products appeal to consumers seeking comprehensive nutritional solutions while addressing time constraints and convenience preferences that characterize modern lifestyles.

Sustainability and Clean-Label Innovation

Growing consumer awareness of environmental impact and ingredient transparency creates opportunities for companies to differentiate through sustainable and clean-label product development. The emphasis on sustainable and ethical practices in supplement manufacturing reflects evolving consumer preferences and creates competitive advantages for companies that prioritize these values.

Plant-based supplement formulations address both environmental concerns and dietary preferences of growing vegan and vegetarian populations. The development of sustainable sourcing practices, renewable packaging materials, and carbon-neutral manufacturing processes can create premium positioning and justify higher price points.

Organic and non-GMO certifications provide opportunities to capture health-conscious consumers willing to pay premium prices for products that align with their values. These certifications create trust and differentiation in crowded market segments while addressing consumer concerns about agricultural practices and ingredient purity.

Transparency initiatives including blockchain technology for supply chain tracking, third-party testing results, and detailed ingredient sourcing information create opportunities to build consumer trust and loyalty. Companies that provide comprehensive transparency about their manufacturing processes, ingredient sources, and quality control measures can differentiate themselves in markets where consumer skepticism about supplement quality remains a concern.

Market Trends:

Alternative Delivery Formats and Consumer Convenience

The dietary supplements market is experiencing a significant shift away from traditional tablets and capsules toward innovative, consumer-friendly delivery formats. Gummy formats continue to grow in popularity as more consumers embrace non-pill formats that work for their lifestyles. This trend reflects broader consumer preferences for convenience, taste, and ease of consumption, particularly among younger demographics who may have difficulty swallowing traditional supplements.

Liquid formulations, including shots, drops, and powders that can be mixed into beverages, are gaining traction as they offer faster absorption and can be easily incorporated into daily routines. These formats also allow for precise dosing and can be combined with other beverages or foods for enhanced palatability.

Topical applications and transdermal delivery systems represent emerging trends that bypass digestive absorption challenges while providing targeted delivery of nutrients. These formats particularly appeal to consumers who experience digestive sensitivity or prefer alternative application methods.

The development of functional foods integrated with supplement-level nutrients has created a trend toward nutritional products that don't feel like traditional supplements. This approach makes supplementation more accessible to consumers who might otherwise avoid traditional supplement formats while providing familiar consumption experiences.

Mental Health and Cognitive Support Focus

The competition for our attention has surpassed a fever pitch, creating increased demand for mental energy, focus, and concentration support through dietary supplements. This trend reflects growing awareness of cognitive health and the impact of modern lifestyle stressors on mental performance and well-being.

Adaptogenic herbs and nootropic compounds have gained mainstream acceptance as consumers seek natural approaches to stress management and cognitive enhancement. Products containing ingredients like ashwagandha, rhodiola, and bacopa have moved from niche markets to mainstream supplement categories.

The normalization of mental health discussions has created opportunities for supplements targeting mood support, anxiety management, and stress reduction. Products containing omega-3 fatty acids, magnesium, and specialized herbal formulations are increasingly positioned as mental wellness support tools.

Sleep support supplements have emerged as a major category as consumers recognize the connection between quality sleep and overall health. Products containing melatonin, magnesium, and herbal sleep aids have seen substantial growth as sleep hygiene becomes a health priority for busy consumers.

Immune System Support and Wellness Integration

The sustained focus on immune system support following the COVID-19 pandemic has created lasting changes in consumer supplement preferences. Products containing vitamin C, vitamin D, zinc, and elderberry have maintained elevated demand as consumers prioritize immune health as part of their regular wellness routines.

Over-the-counter dietary supplements accounted for 75.6% of revenue in 2024, driven by rising consumer awareness regarding nutritional benefits and easy accessibility. This trend reflects the mainstream acceptance of supplements as essential health tools rather than optional add-ons.

Comprehensive wellness approaches that combine multiple health benefits in single products have gained popularity as consumers seek simplified supplement routines. Multi-functional products that address immune support, energy, and overall wellness in one formulation appeal to consumers who want comprehensive health support without multiple products.

The integration of probiotics and gut health support into immune-focused products reflects growing understanding of the gut-immune system connection. Products that combine traditional immune nutrients with digestive health support create comprehensive wellness solutions that address multiple health concerns simultaneously.

Demographic-Specific Formulations and Targeted Solutions

Millennials are the most dedicated supplement users, especially for supplements that are specifically positioned for their demographic needs. This trend toward demographic-specific formulations reflects recognition that different age groups, genders, and life stages have distinct nutritional requirements and health priorities.

Women's health supplements have expanded beyond traditional prenatal and reproductive health to include products addressing menopause, hormone balance, and female-specific nutritional needs. The proliferation of supplements targeting women's health issues beyond prenatal support, encompassing menopause, perimenopause, libido support, and digestive health, represents a significant regulatory and market trend.

Age-specific formulations targeting children, adults, and elderly populations have become increasingly sophisticated, with products designed for specific life stage requirements. Senior-focused supplements address age-related concerns while children's products focus on growth, development, and immune support.

Sports nutrition has expanded from professional athletes to include recreational fitness enthusiasts and everyday consumers seeking performance optimization. Products are increasingly tailored to specific activities, fitness goals, and performance needs rather than generic protein or energy support.

Market Restraints:

Regulatory Compliance and Quality Control Challenges

The dietary supplements market faces significant challenges related to regulatory compliance and quality control standards that vary dramatically across different countries and regions. Regulatory scientists face the challenge of ensuring that products are of high quality and safe, that any claims made are truthful and not misleading, and that there is reasonable and appropriate access to the marketplace. This complex regulatory environment creates barriers to entry and increases operational costs for companies operating in multiple markets.

Manufacturing standards and good manufacturing practices (GMP) requirements create significant compliance costs and operational complexity, particularly for smaller companies that may lack the resources to maintain comprehensive quality control systems. The need for third-party testing, certification programs, and documentation requirements increases operational expenses and extends product development timelines.

Label claim regulations and advertising restrictions limit how companies can communicate product benefits to consumers, creating challenges in marketing and education efforts. The need to substantiate health claims with scientific evidence requires significant investment in research and clinical studies, which may not be feasible for all companies or product categories.

The challenge of ensuring that safe upper levels of intake for nutrients or maximum dosages for other constituents are not exceeded while ensuring that toxic contaminants are absent requires improved accuracy and precision in manufacturing processes. These quality control requirements create ongoing operational challenges and potential liability concerns for manufacturers.

Consumer Skepticism and Market Saturation

Growing consumer skepticism about supplement effectiveness and safety creates significant market challenges, particularly in mature markets where negative publicity and quality concerns have affected consumer confidence. High-profile cases of contaminated products, misleading claims, and ineffective formulations have created lasting wariness among potential consumers who question the value and safety of supplementation.

Market saturation in developed countries has created intense competition and price pressure, making it difficult for new companies to establish market presence and for existing companies to maintain growth rates. The proliferation of similar products and me-too formulations has reduced differentiation opportunities and created consumer confusion about product selection.

The abundance of conflicting information about supplement benefits and safety creates consumer uncertainty and decision paralysis. Contradictory research findings, sensationalized media coverage, and varying expert opinions contribute to consumer confusion about which supplements are necessary, safe, and effective for their specific needs.

Price sensitivity among consumers, particularly in economic downturns, creates pressure on companies to reduce costs while maintaining quality standards. The perception that supplements are discretionary expenses rather than essential health products makes this market segment vulnerable to economic fluctuations and changing consumer priorities.

Scientific Evidence Gaps and Research Limitations

The lack of comprehensive scientific evidence for many supplement claims creates ongoing challenges for the industry in establishing credibility and consumer trust. While some supplements have strong research backing, many products lack rigorous clinical trials demonstrating effectiveness, safety, and optimal dosing parameters for specific health conditions.

The complexity and cost of conducting high-quality clinical research on dietary supplements creates barriers for companies seeking to substantiate product claims. Unlike pharmaceutical research, supplement studies often involve complex interactions between nutrients, individual variations in response, and long-term outcomes that are difficult to measure in controlled studies.

Bioavailability and absorption challenges mean that the amount of active ingredient in a supplement may not correspond to the amount actually utilized by the body. This disconnect between formulation and physiological effect creates uncertainty about product effectiveness and optimal dosing strategies.

The interaction between supplements and medications, other supplements, and individual health conditions creates complex safety considerations that are not fully understood or documented. This knowledge gap creates potential risks for consumers and liability concerns for manufacturers, particularly as supplement use becomes more widespread among populations taking multiple medications.

Recent Developments:

|

Development |

Company Name |

|

Development - O Positive launched PREGGO conception support and sperm health support capsules in March 2024, targeting women's wellness and fertility support segments with specialized formulations. |

O Positive |

|

Development - Manufacturers introduced innovative gummies, liquid shots, and functional beverages in 2024, addressing consumer demand for convenient and palatable supplement delivery formats. |

Various Manufacturers |

|

Development - NOW Foods discovered and addressed sales of 11 different counterfeit dietary supplements imitating its brand on Amazon in 2023, highlighting quality control challenges. |

NOW Foods |

|

Product Launch - Advanced probiotic formulations with enhanced strain diversity launched in early 2024, targeting digestive health and immune system support with improved stability and efficacy. |

Leading Probiotic Companies |

|

Product Launch - Plant-based protein supplements with complete amino acid profiles launched in 2024, catering to growing vegan and vegetarian consumer segments seeking alternative protein sources. |

Plant-Based Supplement Companies |

|

Product Launch - Personalized vitamin packs based on individual health assessments launched in 2024, offering customized supplementation solutions through direct-to-consumer channels. |

Personalized Nutrition Companies |

|

Merger/Acquisition - Pharmavite, IFF, ADM and Sanofi completed significant strategic acquisitions in 2024, consolidating market presence and expanding product portfolios. |

Pharmavite, IFF, ADM, Sanofi |

|

Merger/Acquisition - Private equity firms completed multiple platform acquisitions in 2024, with focus on specialty supplement companies and direct-to-consumer brands. |

Various Private Equity Firms |

|

Merger/Acquisition - Major pharmaceutical companies acquired specialized supplement manufacturers in 2024 to expand their consumer health portfolios and distribution capabilities. |

Major Pharmaceutical Companies |

Regional Analysis:

Dietary Supplements Market Regional Insights

Regional market dynamics vary significantly, with developed markets showing mature consumption patterns while emerging economies demonstrate rapid growth potential. Consumer preferences, regulatory frameworks, and distribution channels differ substantially across regions.

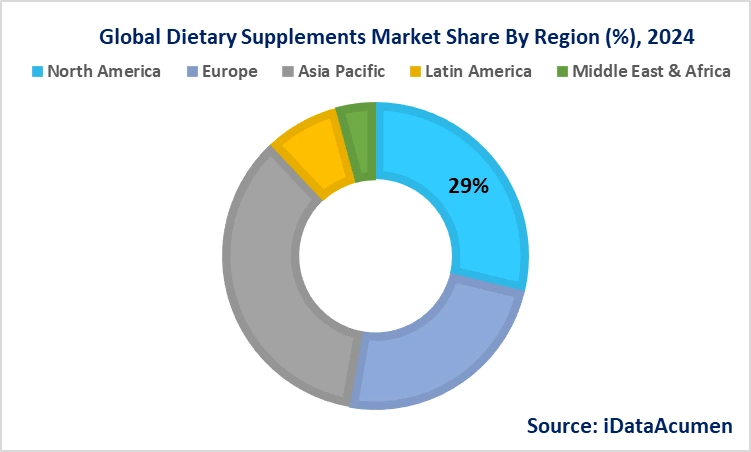

Asia Pacific is expected to be the largest market for Dietary Supplements Market during the forecast period, accounting for over 35.2% of the market share in 2024. The growth in Asia Pacific is attributed to increasing health consciousness, rising disposable incomes, and growing awareness of preventive healthcare approaches.

The North America market is expected to be the second-largest market for Dietary Supplements Market, accounting for over 28.7% of the market share in 2024. Growth is attributed to established healthcare infrastructure, high consumer awareness, and strong regulatory frameworks supporting product quality.

The Asia Pacific market is expected to be the fastest-growing market for Dietary Supplements Market, with a CAGR of over 8.5% during the forecast period 2024. Growth in Asia Pacific is attributed to urbanization, changing dietary patterns, and increasing adoption of Western wellness concepts.

Market Segmentation

Dietary Supplements Market Segmentation:

- By Product Type

- Vitamins

- Minerals

- Herbal/Botanical Supplements

- Amino Acids

- Enzymes

- Probiotics

- Others (Omega-3, CoQ10, Fiber supplements)

- By Form

- Tablets

- Capsules

- Powders

- Liquids

- Gummies

- Soft Gels

- Others (Chewables, Sprays)

- Regions

- By End User

- Adults

- Children

- Pregnant Women

- Elderly

- Athletes/Sports Enthusiasts

- By Application

- General Health

- Immune Support

- Bone Health

- Heart Health

- Digestive Health

- Cognitive Health

- Others (Weight management, Energy support, Beauty supplements)

- By Distribution Channel

- Pharmacies/Drug Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Direct Sales

- Others (Convenience stores, Health clubs)

- By Age Group

- Children (0-12 years)

- Teenagers (13-19 years)

- Adults (20-59 years)

- Elderly (60+ years)

- By Gender

- Male

- Female

- Unisex Products

- By Regions

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East

- North America

Top companies in the Dietary Supplements Market

The leading companies in the dietary supplements market include:

- Nestle S.A.

- Abbott Laboratories

- Amway Corporation

- Pfizer Inc.

- Bayer AG

- Herbalife Nutrition Ltd.

- Glanbia Nutritionals

- GlaxoSmithKline plc

- Otsuka Holdings Co. Ltd.

- Nu Skin Enterprises Inc.

- USANA Health Sciences Inc.

- Reckitt Benckiser Group plc

- Carlyle Group (Nature's Bounty)

- Pharmavite LLC

- DSM Nutritional Products

- Blackmores Limited

- Swisse Wellness Pty Ltd.

- Vitabiotics Ltd.

- Solgar Inc.

- NOW Foods