Market Analysis:

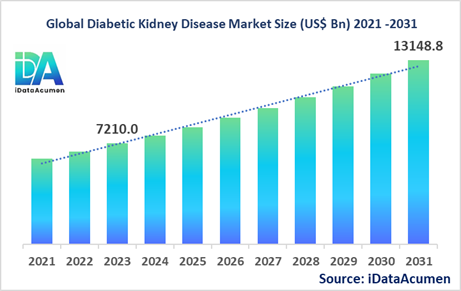

The Diabetic Kidney Disease (DKD) Market had an estimated market size worth US$ 7,210 million in 2023, and it is predicted to reach a global market valuation of US$ 13,148.8 million by 2031, growing at a CAGR of 7.8% from 2024 to 2031.

Diabetic kidney disease (DKD), also known as diabetic nephropathy, is a serious complication of diabetes that occurs when high blood sugar levels damage the kidneys' ability to filter waste and excess fluid from the body. This can lead to kidney failure and the need for dialysis or a kidney transplant. DKD is a leading cause of end-stage renal disease (ESRD) globally.

The key drivers for the growth of the DKD market include the rising prevalence of diabetes worldwide, increasing awareness of DKD, advancements in diagnostic tools, and the growing demand for effective treatments to manage the condition and slow its progression.

In summary, the Diabetic Kidney Disease (DKD) market is part of the pharmaceutical industry and is focused on developing and delivering therapies to treat this serious complication of diabetes.

The Diabetic Kidney Disease (DKD) Market is segmented by therapy type, drug class, route of administration, distribution channel, and end-user. By therapy type, the market is segmented into Angiotensin-Converting Enzyme (ACE) Inhibitors, Angiotensin II Receptor Blockers (ARBs), Sodium-Glucose Cotransporter-2 (SGLT2) Inhibitors, Glucagon-Like Peptide-1 (GLP-1) Agonists, Diuretics, and Others. One of the large and growing subsegments is SGLT2 inhibitors, which have shown promising results in delaying the progression of DKD.

For example, in 2022, the U.S. FDA approved Jardiance (empagliflozin) from Boehringer Ingelheim and Eli Lilly for the treatment of adults with chronic kidney disease, including DKD. This approval expanded the use of SGLT2 inhibitors in the management of DKD.

Epidemiological Insights:

Diabetic kidney disease (DKD) is a major public health concern globally, with a significant disease burden across major regions.

In North America, the prevalence of DKD is estimated to be around 30-40% among individuals with diabetes. The key epidemiological trends in the region include the rising prevalence of diabetes, increasing obesity rates, and the aging population, all of which contribute to the growing incidence of DKD.

In Europe, the prevalence of DKD is estimated to be around 20-30% in the diabetic population. The disease burden is particularly high in countries with a high prevalence of diabetes, such as Germany, France, and the United Kingdom.

In the Asia-Pacific region, the prevalence of DKD is rapidly increasing, driven by the surge in diabetes cases. For instance, in India, the prevalence of DKD is estimated to be around 20-30% among individuals with diabetes.

DKD is not considered a rare disease, as it affects a significant proportion of the diabetic population globally. The growing disease burden, coupled with the need for effective management strategies, presents opportunities for the development of novel therapies and diagnostic tools to improve patient outcomes.

Market Landscape

Despite the availability of various treatment options, there are still unmet needs in the Diabetic Kidney Disease (DKD) market. The current treatment options include ACE inhibitors, ARBs, SGLT2 inhibitors, and GLP-1 agonists, which aim to manage the condition and slow its progression. However, many patients still progress to end-stage renal disease, highlighting the need for more efficacious and targeted therapies.

Several companies are actively developing new therapies for DKD. For instance, Bayer's finerenone, a novel non-steroidal mineralocorticoid receptor antagonist, is currently in late-stage clinical trials for the treatment of DKD. Likewise, Novo Nordisk is researching new medications, such as semaglutide, to help delay the progression of DKD.

In addition to novel drug therapies, there are also ongoing efforts to develop breakthrough treatment options, such as gene therapies and cell-based therapies, which hold the potential to address the underlying mechanisms of DKD.

The DKD market is moderately consolidated, with a mix of branded and generic drug manufacturers. While large pharmaceutical companies, such as Novo Nordisk, Bayer, and AstraZeneca, dominate the market, there is also a presence of specialized biopharmaceutical companies focused on the development of innovative therapies for DKD.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 7,210 Mn |

|

CAGR (2024 - 2031) |

7.8% |

|

The revenue forecast in 2031 |

US$ 13,148.5 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Novo Nordisk A/S, Bayer AG, AstraZeneca plc, Boehringer Ingelheim International GmbH, Eli Lilly and Company, Merck & Co., Inc., Sanofi S.A., Johnson & Johnson, Mitsubishi Tanabe Pharma Corporation, Daiichi Sankyo Company, Limited, Abbvie Inc., Pfizer Inc., Takeda Pharmaceutical Company Limited, Otsuka Holdings Co., Ltd., Gilead Sciences, Inc. |

Market Drivers:

Rising Prevalence of Diabetes

The growing prevalence of diabetes worldwide is a major driver fueling the expansion of the Diabetic Kidney Disease (DKD) market. Diabetes is a chronic condition characterized by high blood sugar levels, which can lead to various complications, including DKD. According to the International Diabetes Federation, the global prevalence of diabetes is expected to rise from 463 million in 2019 to 700 million by 2045. This alarming increase in the diabetic population, coupled with the higher risk of developing DKD among individuals with uncontrolled diabetes, is a significant factor driving the demand for effective DKD management solutions. Healthcare providers and policymakers are focusing on early diagnosis and intervention to prevent or delay the onset of DKD, further propelling the growth of this market.

Advancements in Diagnostic Tools

The development of more advanced diagnostic tools and techniques has been a crucial driver for the Diabetic Kidney Disease (DKD) market. Traditional methods for diagnosing DKD, such as measuring urinary albumin and serum creatinine levels, have limitations in detecting early-stage kidney damage. However, the introduction of innovative biomarkers and imaging technologies has significantly improved the ability to identify DKD at earlier stages, allowing for timely intervention and management of the condition. For instance, the use of novel urinary and blood-based biomarkers, like kidney injury molecule-1 (KIM-1) and neutrophil gelatinase-associated lipocalin (NGAL), have demonstrated enhanced sensitivity and specificity in detecting DKD. These advancements in diagnostic capabilities have been instrumental in driving the adoption of DKD management strategies, ultimately contributing to the growth of the overall market.

Increasing Awareness and Education Initiatives

The growing awareness and education initiatives around Diabetic Kidney Disease (DKD) have been a significant driver for the market. In the past, DKD was often underdiagnosed and underreported, as many individuals with diabetes were unaware of the risk and importance of regular kidney function monitoring. However, various public health organizations, patient advocacy groups, and healthcare providers have been actively raising awareness about the importance of early detection and management of DKD. These efforts have resulted in increased patient and healthcare professional education, leading to improved screening practices and timely intervention. As people become more informed about the risks and available treatment options for DKD, the demand for effective management strategies has increased, positively impacting the growth of the Diabetic Kidney Disease market.

Unmet Medical Needs and Demand for Novel Therapies

The persistent unmet medical needs in the Diabetic Kidney Disease (DKD) treatment landscape have been a significant driver for the market's growth. Despite the availability of various treatment options, such as angiotensin-converting enzyme (ACE) inhibitors, angiotensin II receptor blockers (ARBs), and newer agents like sodium-glucose cotransporter-2 (SGLT2) inhibitors, many patients still progress to end-stage renal disease. This highlights the need for more effective and targeted therapies to manage DKD and delay its progression. The pharmaceutical industry has responded to this demand by investing heavily in research and development to introduce novel drug candidates and innovative treatment approaches, including gene therapies and cell-based therapies. The anticipated launch of these breakthrough therapies in the coming years is expected to further drive the growth of the Diabetic Kidney Disease market.

Market Opportunities:

Expanding Patient Pool in Developing Countries

One of the significant opportunities in the Diabetic Kidney Disease (DKD) market lies in the untapped potential of developing regions, such as Asia-Pacific and Latin America. These regions are experiencing a rapid rise in the prevalence of diabetes, which is a major risk factor for DKD. According to the International Diabetes Federation, the Asia-Pacific region is expected to have the highest number of individuals with diabetes by 2045. However, access to quality healthcare and awareness of DKD management strategies are often limited in these regions. Pharmaceutical and medical device companies have the opportunity to expand their reach and penetrate these emerging markets by developing affordable and accessible DKD management solutions, tailored to the specific needs of the local populations. Establishing partnerships with local healthcare providers, government agencies, and patient advocacy groups can help overcome barriers and capitalize on the growing demand for DKD treatment in developing countries.

Adoption of Digital Health Technologies

The increasing adoption of digital health technologies presents a significant opportunity in the Diabetic Kidney Disease (DKD) market. Digital solutions, such as mobile applications, wearable devices, and remote monitoring platforms, can play a crucial role in improving disease management and patient outcomes. These technologies can enable early detection of DKD, facilitate adherence to treatment regimens, and provide real-time data for healthcare providers to optimize patient care. By leveraging digital tools, patients can better monitor their condition, receive personalized guidance, and engage in their own healthcare, leading to improved self-management and better long-term outcomes. The integration of these digital health solutions within the DKD treatment ecosystem can enhance the overall quality of care, promote patient-centric approaches, and drive the growth of the market.

Collaborative Efforts and Partnerships

Collaborative efforts and strategic partnerships among various stakeholders in the healthcare industry present an opportunity to advance the Diabetic Kidney Disease (DKD) market. By fostering collaboration between pharmaceutical companies, medical device manufacturers, research institutions, and healthcare providers, the development and commercialization of innovative DKD management solutions can be accelerated. These partnerships can facilitate the sharing of expertise, resources, and data, leading to the development of more effective and comprehensive treatment approaches. Moreover, collaborative initiatives focused on improving patient education, supporting clinical research, and enhancing access to DKD care can contribute to the overall growth and expansion of the market.

Personalized Medicine Approaches

The increasing focus on personalized medicine offers a significant opportunity in the Diabetic Kidney Disease (DKD) market. By leveraging advancements in genomics, proteomics, and other biotechnologies, healthcare providers can gain a deeper understanding of the individual patient's genetic and molecular profiles. This knowledge can be used to develop tailored treatment strategies, optimize drug dosing, and predict the risk of DKD development or progression. Personalized medicine approaches can lead to more targeted therapies, improved patient outcomes, and reduced healthcare costs associated with the management of DKD. As the industry continues to embrace personalized medicine, the demand for customized DKD management solutions is expected to rise, presenting significant growth opportunities for market participants.

Market Trends:

Focus on Early Intervention and Prevention

A prominent trend in the Diabetic Kidney Disease (DKD) market is the increasing focus on early intervention and prevention strategies. Healthcare providers and researchers have recognized the importance of identifying DKD in its early stages, as timely intervention can help slow the progression of the disease and delay the onset of more severe complications. This shift towards early detection and proactive management has led to the development of advanced diagnostic tools, such as novel biomarkers and imaging techniques, that can identify DKD before the onset of overt kidney damage. Additionally, there is a growing emphasis on comprehensive diabetes management, including tight glycemic control, blood pressure management, and the use of specific medications like SGLT2 inhibitors, which have demonstrated the ability to prevent or delay the progression of DKD. This trend towards early intervention and prevention is expected to continue driving the growth of the DKD market as it improves patient outcomes and reduces the burden on healthcare systems.

Emergence of Novel Therapeutic Approaches

The Diabetic Kidney Disease (DKD) market is witnessing the emergence of novel therapeutic approaches that go beyond traditional pharmacological interventions. Companies are investing heavily in research and development to explore innovative treatment modalities, such as gene therapies, cell-based therapies, and regenerative medicine. These advanced therapeutic solutions aim to address the underlying pathophysiology of DKD, offering the potential for more targeted and effective management of the condition. For instance, gene therapy approaches are being investigated to manipulate genetic factors that contribute to the development and progression of DKD, while cell-based therapies are exploring the use of stem cells or engineered cells to promote kidney tissue repair and regeneration. The introduction of these novel therapies is expected to transform the DKD treatment landscape and provide new hope for patients with this debilitating complication of diabetes.

Adoption of Digital Health Technologies

The Diabetic Kidney Disease (DKD) market is embracing the integration of digital health technologies to enhance disease management and improve patient outcomes. The use of wearable devices, mobile applications, and remote monitoring platforms is gaining traction, as these tools enable patients to track their kidney function, monitor symptoms, and adhere to their treatment regimens more effectively. These digital solutions also provide healthcare providers with real-time data and insights, allowing for more personalized care and early intervention. Furthermore, the COVID-19 pandemic has accelerated the adoption of telemedicine and virtual care, which has been particularly beneficial for DKD patients, as it has facilitated access to healthcare services and enabled continuous monitoring during the pandemic. As the healthcare ecosystem continues to evolve, the integration of digital technologies within the DKD management paradigm is expected to become increasingly prevalent, driving market growth and improved patient outcomes.

Emphasis on Collaborative Initiatives

The Diabetic Kidney Disease (DKD) market is witnessing a trend towards collaborative initiatives among various stakeholders, including pharmaceutical companies, medical device manufacturers, research institutions, and healthcare providers. These collaborative efforts aim to address the complex challenges associated with DKD, such as the development of new therapies, the optimization of treatment protocols, and the improvement of patient education and access to care. By pooling resources, expertise, and data, these collaborative initiatives are accelerating the pace of innovation, driving the development of more effective management strategies, and fostering a more comprehensive approach to DKD care. Additionally, these collaborative efforts are facilitating the sharing of best practices, the establishment of clinical research networks, and the implementation of public-private partnerships, all of which contribute to the overall growth and advancement of the Diabetic Kidney Disease market.

Market Restraints:

Limited Access to Healthcare and Affordability Challenges

One of the key restraints in the Diabetic Kidney Disease (DKD) market is the limited access to healthcare and the affordability challenges faced by patients, particularly in developing and underdeveloped regions. In many parts of the world, the availability of specialized healthcare services, such as nephrology care and dialysis facilities, is often limited, especially in rural and remote areas. This lack of access to comprehensive DKD management services can hinder the timely diagnosis and treatment of the condition, leading to poor patient outcomes. Additionally, the high cost of DKD therapies, including medications, medical devices, and dialysis, can be a significant barrier for many patients, especially those with limited financial resources or inadequate health insurance coverage. These access and affordability challenges represent a major restraint in the DKD market, as they limit the reach and adoption of effective management solutions.

Side Effects and Adverse Events Associated with DKD Therapies

The potential side effects and adverse events associated with certain Diabetic Kidney Disease (DKD) therapies can also act as a restraint in the market. Some of the commonly prescribed medications for DKD, such as angiotensin-converting enzyme (ACE) inhibitors and angiotensin II receptor blockers (ARBs), can cause side effects like hypotension, hyperkalemia, and impaired kidney function, especially in patients with advanced DKD. Additionally, the long-term use of these medications may lead to other complications, such as gastrointestinal issues and increased risk of cardiovascular events. These safety concerns can discourage healthcare providers from prescribing certain DKD therapies or lead to patient non-compliance, ultimately hindering the adoption of these treatments and restraining the growth of the market. Ongoing research and the development of safer, more tolerable therapies are crucial to address this restraint and improve patient outcomes.

Lack of Awareness and Education about DKD

The lack of awareness and education about Diabetic Kidney Disease (DKD) among the general population and even some healthcare professionals can act as a restraint in the market. DKD is often underdiagnosed, as many individuals with diabetes may not be fully aware of the risk and importance of regular kidney function monitoring. Furthermore, some healthcare providers may not have adequate knowledge about the latest advancements in DKD management or the importance of early intervention. This lack of awareness and education can lead to delayed diagnosis, suboptimal treatment, and poor patient outcomes, ultimately hindering the adoption of DKD management solutions and restraining the growth of the market. Comprehensive educational campaigns, targeted training for healthcare professionals, and increased patient outreach efforts are essential to overcome this restraint and promote better disease management.

Recent Developments:

|

Development |

Company Name |

|

In January 2023, the FDA approved Jardiance (empagliflozin) for the treatment of adults with chronic kidney disease, including diabetic kidney disease. |

Boehringer Ingelheim and Eli Lilly |

|

In June 2022, Bayer announced positive results from the FIDELITY clinical trial program evaluating the efficacy and safety of finerenone in patients with diabetic kidney disease. |

Bayer AG |

|

In March 2021, Novo Nordisk received FDA approval for Rybelsus (semaglutide) for the treatment of diabetic kidney disease in adults with type 2 diabetes. |

Novo Nordisk A/S |

|

In September 2020, AstraZeneca's Farxiga (dapagliflozin) received FDA approval for the treatment of chronic kidney disease in patients with and without type 2 diabetes. |

AstraZeneca plc |

|

In December 2019, Mitsubishi Tanabe Pharma announced the FDA approval of Invokana (canagliflozin) for the treatment of diabetic kidney disease. |

Mitsubishi Tanabe Pharma Corporation |

Market Regional Insights:

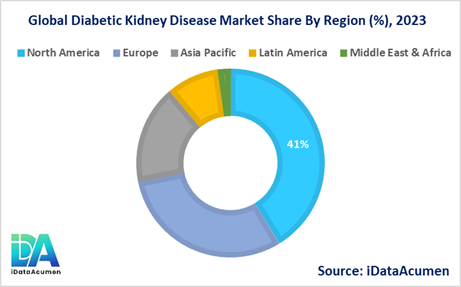

North America is expected to be the largest market for Diabetic Kidney Disease (DKD), accounting for over 41.2% of the global market share in 2024. The growth of the DKD market in North America is attributed to the high prevalence of diabetes, the availability of advanced healthcare infrastructure, and the presence of key market players in the region.

The European market is expected to be the second-largest for Diabetic Kidney Disease (DKD), accounting for over 30.4% of the global market share in 2024. The growth of the market in Europe is driven by the increasing awareness of the condition, the adoption of new therapies, and the strong healthcare system in countries like Germany, France, and the United Kingdom.

The Asia-Pacific region is expected to be the fastest-growing market for Diabetic Kidney Disease (DKD), with a CAGR of over 9.2% during the forecast period. The growth of the market in the Asia-Pacific region is attributed to the rising prevalence of diabetes, the expanding healthcare infrastructure, and the increasing focus on improving patient outcomes in countries like China, India, and Japan.

Market Segmentation:

- By Therapy Type

- Angiotensin-Converting Enzyme (ACE) Inhibitors

- Angiotensin II Receptor Blockers (ARBs)

- Sodium-Glucose Cotransporter-2 (SGLT2) Inhibitors

- Glucagon-Like Peptide-1 (GLP-1) Agonists

- Diuretics

- Others (Mineralocorticoid Receptor Antagonists, Dual RAAS Inhibitors, etc.)

- By Drug Class

- Renin-Angiotensin-Aldosterone System (RAAS) Inhibitors

- Antidiabetic Drugs

- Antiproteinuric Agents

- Diuretics

- Others (Immunosuppressants, Anticoagulants, etc.)

- Antihypertensive Agents

- Others (Erythropoiesis-Stimulating Agents, Calcium Channel Blockers, etc.)

- By Route of Administration

- Oral

- Injectable

- Others (Topical, Transdermal, etc.)

- By Distribution Channel

- Hospitals

- Retail Pharmacies

- Online Pharmacies

- Others (Long-term Care Facilities, Specialty Clinics, etc.)

- By End-User

- Hospitals and Clinics

- Dialysis Centers

- Home Care Settings

- Others (Long-term Care Facilities, Research Institutes, etc.)

Market Segment Analysis:

SGLT2 Inhibitors Segment:

- The SGLT2 Inhibitors segment is projected to grow at a CAGR of over 9.5% during the forecast period, making it one of the fastest-growing subsegments.

- This growth is primarily driven by the increasing adoption of SGLT2 inhibitors, such as Jardiance (empagliflozin) and Farxiga (dapagliflozin), for the management of DKD.

- The SGLT2 Inhibitors segment is expected to be the largest subsegment by 2024, capturing a significant market share due to their proven efficacy in slowing the progression of DKD.

Antidiabetic Drugs Segment:

- The Antidiabetic Drugs segment is also expected to witness robust growth, with a CAGR of around 8.2% during the forecast period.

- This growth is attributed to the increasing prevalence of diabetes globally and the need for effective therapies to manage both diabetes and its associated complications, such as DKD.

- The Antidiabetic Drugs segment is expected to be the second-largest subsegment by 2024, as it plays a crucial role in the overall management of DKD.

The growth of these two segments, SGLT2 Inhibitors and Antidiabetic Drugs, will be instrumental in driving the overall expansion of the Diabetic Kidney Disease (DKD) market during the forecast period.

Top companies in the Diabetic Kidney Disease (DKD) Market:

- Novo Nordisk A/S

- Bayer AG

- AstraZeneca plc

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- Merck & Co., Inc.

- Sanofi S.A.

- Johnson & Johnson

- Mitsubishi Tanabe Pharma Corporation

- Daiichi Sankyo Company, Limited

- Abbvie Inc.

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

- Otsuka Holdings Co., Ltd.

- Gilead Sciences, Inc.

- Sumitomo Dainippon Pharma Co., Ltd.

- Amgen Inc.

- Retrophin, Inc.

- Akebia Therapeutics, Inc.

- Chinook Therapeutics, Inc.