Market Insights:

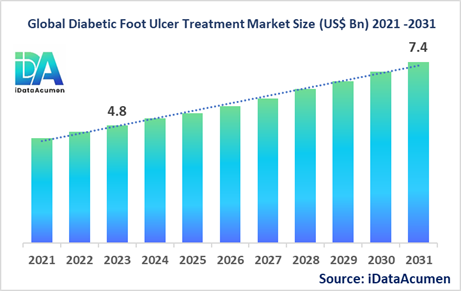

The Diabetic Foot Ulcer Treatment Market size is expected to reach USD 7.4 billion by 2031, from USD 4.8 billion in 2023, at a CAGR of 5.5% during the forecast period. Diabetic foot ulcers are open sores or wounds that occur in patients with diabetes, mostly due to peripheral neuropathy and peripheral arterial disease. If not properly treated, they can lead to infection, tissue death, and lower limb amputation.

Diabetic foot ulcer treatment involves products and therapies to heal the wound. Key drivers of the market include the growing global prevalence of diabetes, increasing geriatric population, rise in obesity levels, and technological advancements in wound care. The market is segmented by product type, ulcer type, end-user, and region. By product type, the market is categorized into wound care dressings, biologics, therapy devices, antibiotic medications, and others. Advanced wound care dressings is the largest and fastest growing segment, owing to higher adoption of innovative dressings such as foam, hydrocolloid, alginate, and collagen for diabetic foot ulcer treatment.

In June 2022, ConvaTec Group announced the launch of ConvaMax Super Absorbent Dressing for moderately to highly exuding wounds including diabetic foot ulcers.

Epidemiology Insights:

- Diabetes affects over 463 million people worldwide, of which around 33-35% will develop diabetic foot ulcers during their lifetime.

- The prevalence of diabetes has been rising steadily across developed regions like North America and Europe as well as developing countries. Key factors driving this include sedentary lifestyles, changing diets, obesity, and ageing populations.

- In the US, diabetes prevalence in adults was estimated to be 14.7% in 2021, with around 37.3 million people affected.

- Diabetes prevalence in 2023 stood at 9.5% in UK, 6.4% in Germany, 7.4% in France, and 7.6% in Italy among the adult population.

- Japan has the 10th highest diabetes prevalence rate worldwide, estimated at 7.5% in 2023. China and India have very high numbers given large populations.

- Rising diabetic populations globally will drive greater demand for diabetic foot ulcer therapies.

Market Landscape:

- There is a high unmet need for advanced treatments that can completely heal diabetic foot ulcers and prevent recurrence. Current options only provide symptomatic relief.

- Standard treatment involves wound dressings, debridement, pressure offloading, infection control, blood glucose management. Growth factors and skin grafts are also used.

- Emerging approaches include regenerative medicine, stem cell therapy, engineered skin products, extracellular matrices, shockwave therapy, hyperbaric oxygen therapy.

- Promising therapies like Orpyx Medical Technologies' SensiStep, could help prevent ulcer formation using pressure mapping insoles.

- RHEACELL's wound spray suspension of stem cells derived from umbilical cord is in clinical trials to evaluate safety and efficacy.

- The market has a mix of global wound care giants like Smith+Nephew, generic players, and small specialized companies.

Report Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 4.8 Bn |

|

CAGR (2024 - 2031) |

5.5% |

|

The revenue forecast in 2031 |

US$ 7.4 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Smith & Nephew, ConvaTec, Coloplast, 3M, Integra LifeSciences , Cardinal Health, B.Braun, Mölnlycke Health Care, Medtronic, Paul Hartmann, Medline Industries, Organogenesis, MiMedx Group, Tissue Regenix, Osiris Therapeutics, Derma Sciences, Solsys Medical, Acelity, C.R Bard, Kent Imaging |

Market Drivers:

Rising Global Prevalence of Diabetes

The growing prevalence of diabetes across the globe is a major factor driving the diabetic foot ulcer treatment market. Diabetes cases have increased sharply worldwide due to lifestyle changes, obesity, sedentary lifestyles, and ageing populations. Diabetes significantly raises the risk of foot ulcers due to issues like peripheral neuropathy and peripheral arterial disease. As per the IDF Diabetes Atlas, around 537 million adults were living with diabetes in 2021, which is expected to rise to 643 million by 2030. The soaring numbers of diabetic populations globally will propel the need for effective diabetic foot ulcer therapies.

Advancements in Wound Healing Technologies

Continuous advances in technologies for wound healing and ulcer treatment are boosting the diabetic foot ulcer market. Novel biologics, skin substitutes, growth factors, and regenerative medicine approaches are emerging for diabetic wound care. Wound imaging, pressure mapping sensors, and telemedicine also aid better ulcer diagnosis and monitoring. Such innovations are enabling faster healing, lower amputation risk, and reduced recurrence in diabetic foot ulcers. Players are focused on developing novel therapies to capture market share.

Increasing Adoption of Wound Care Products

The growing adoption of advanced wound dressings and active therapies is spurring market revenues. Advanced dressings such as foam, alginate, and collagen help maintain a moist wound environment, prevent trauma, and reduce risk of infection. Active healing approaches like skin grafts, extracellular matrices, hyperbaric oxygen therapy are being increasingly used along with standard ulcer treatment. Patients and physicians are more aware of the importance of timely and appropriate treatment of diabetic foot ulcers. This is contributing significantly to product demand.

Improving Reimbursement Scenario

Favorable reimbursement coverage for diabetic foot treatments in developed countries like the US, Germany, France is facilitating greater adoption of advanced therapeutics including growth factors and skin substitutes. For instance, some advanced wound care products for diabetic foot ulcers treatment are covered under Medicare Part B in the US. Such coverage of newer modalities is driving market growth.

Market Opportunities:

Large Underpenetrated Markets

Emerging economies such as China, India, Brazil, Mexico offer significant expansion opportunities for players in the diabetic foot ulcer market. Factors like massive diabetic populations, improving healthcare infrastructure, rise of medical tourism, and increasing healthcare spending are facilitating growth in these countries. For instance, China currently accounts for around 116 million diabetic patients, the highest in the world. Focus on enhancing rural access to diabetic ulcer treatment solutions will open new avenues.

Shifting Focus Towards Home Healthcare

The rise of home healthcare presents an opportunity for market players. Availability of user-friendly and easy-to-use wound care products such as smart bandages and patches allows patients to manage diabetic foot ulcers at home. Telehealth also enables remote ulcer monitoring. Players can focus on expanding home-based treatment options to help patients avoid hospital visits and reduce re-admission rates. This will provide significant cost savings for patients and payers.

Scope in Non-Healing Ulcer Treatment

A major opportunity lies in developing effective therapies for non-healing or hard-to-heal diabetic foot ulcers. Conventional treatments are unable to completely heal chronic DFUs in some patients, leading to recurrence and complications. Companies can focus R&D efforts on introducing targeted biologics, skin substitutes, and antibiotic medications to promote healing of non-healing diabetic ulcers. Gene therapies also hold potential.

Rising Demand for Combination Therapies

The potential of combination therapies presents an attractive prospect. Using skin grafts along with growth factors, or collagen with stem cell therapy can improve diabetic ulcer closure and healing rates compared to individual treatments. Companies can develop proprietary combinations of advanced modalities to provide better patient outcomes. This will give them an edge over competitors.

Market Trends:

Adoption of Regenerative Medicine

Regenerative approaches using stem cell and platelet-rich plasma therapy are emerging as promising treatment modalities for chronic diabetic foot ulcers. These stimulate tissue regeneration and natural healing. Several players such as Acelity, Smith & Nephew, and Integra LifeSciences have introduced commercial wound care products containing stem cell-derived molecules and growth factors. As research validates their efficacy, adoption of regenerative medicine will rise.

Strategic Industry Collaborations

Seeking synergistic partnerships with pharmaceutical companies, medical device makers, biotech firms, and academia is a key trend. Companies are collaborating to enhance their capabilities, pool expertise in ulcer treatment, and develop innovative pipeline therapies leveraging combined strengths. For instance, in 2021 MiMedx partnered with Dr. Reddy's Laboratories to expand the availability of advanced wound care products.

3D Printing Gaining Traction

3D bioprinting of living skin constructs, growth factors, and stem cells to generate functional grafts for diabetic foot ulcers is an emerging trend. It enables customization as per wound dimensions and specifics. In 2021, researchers from the U.S. and India bioprinted a 3D skin using human dermal fibroblasts and epidermal keratinocytes. Players are exploring 3D bioprinting to develop ‘smart’ patient-specific dressings and skin grafts.

Predictive Wound Surveillance

Using predictive analytics and AI for early wound detection and preventive interventions is gaining steam. Players are developing smart diabetic foot ulcer tracking solutions integrated with EHR systems and remote monitoring tools. This approach analyzes patient information to identify those at high risk and allows early intervention through targeted treatment before ulcers develop. It holds potential to significantly minimize amputation risk.

Market Restraints:

High Cost of Advanced Therapies

Despite good clinical effectiveness, the high cost of advanced biologics and skin substitutes makes adoption challenging, especially in low- and middle-income countries. These new modalities are much more expensive than traditional dressings and offloading. Limitations in insurance coverage also impacts uptake. Measures to lower production costs and expand reimbursement coverage for novel therapies will help expand the patient population.

Lack of Strong Clinical Evidence

Insufficient clinical evidence regarding the safety, efficacy and health economics of certain emerging approaches hinders uptake. Therapies like extracellular matrices, platelet-rich plasma, shockwave, and ozone therapy still lack robust clinical validation through large RCTs. Variability in treatment protocols also contributes to slower adoption. More well-designed controlled studies demonstrating the advantages of new modalities will aid adoption.

Treatment Non-Compliance

Lack of compliance to diabetic foot ulcer treatment regimens and recommendations remains an obstacle. Many patients fail to adhere to prescribed therapies, or avoid seeking timely treatment. Reasons include lack of awareness, high out-of-pocket costs, limited access in rural areas, negligence, misbeliefs and fear of amputation. Measures to improve treatment compliance through patient counseling and education programs will help counter this barrier.

Inadequate Access in Emerging Economies

Underdeveloped healthcare infrastructure and healthcare spending deficiencies in emerging economies affect access to advanced diabetic ulcer treatment. Limited availability of advanced wound care products, high costs, low insurance coverage hinder uptake of newer modalities. Players need to develop affordable treatment options and work with local healthcare systems to improve accessibility in developing regions. Awareness programs can also help.

Recent Developments:

|

Product Launch |

Company Name |

|

In May 2022, Organogenesis launched PuraPly and Novachor wound matrices for treatment of chronic non-healing wounds including diabetic foot ulcers. The naturally sourced products could significantly improve patient outcomes. |

Organogenesis Holdings Inc. |

|

In January 2023, URGO Medical launched UrgoStart Pro contact layer and UrgoStart Flex wound dressing in the US for management of diabetic foot ulcers. The dressings help kick start the healing process in the ulcer. |

Urgo Medical |

|

In June 2021, Cardinal Health launched Tielle foam dressings featuring Safetac soft silicone technology for diabetic foot ulcers and other chronic wounds. It helps prevent trauma and pain during dressing changes. |

Cardinal Health, Inc. |

|

Merger/Acquisition |

Involved Companies |

|

In April 2023, Smith & Nephew acquired Engage Surgical, expands expertise in cementless robotics-assisted total knee arthroplasty that helps diabetic patients at risk of poor healing. |

Smith & Nephew, Engage Surgical |

|

In August 2021, 3M acquired ConvienientMD to integrate their wound imaging capabilities and expertise into 3M’s chronic wound solutions portfolio including advanced diabetic ulcer treatment. |

3M Company, ConvenientMD |

Market Regional Analysis:

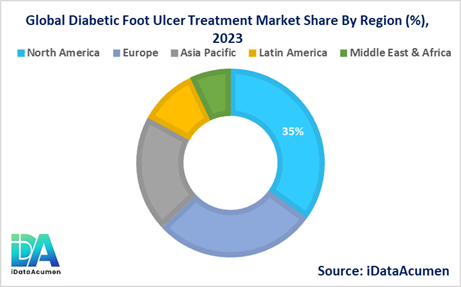

The prevalence of diabetes and diabetic foot ulcers is escalating globally, driving the need for advanced ulcer therapies. Growing geriatric populations and obesity rates are major factors increasing diabetes incidence across geographies.

- North America accounted for over 35% share of the global diabetic foot ulcer treatment market in 2023. High diabetes prevalence, developed healthcare infrastructure, early adoption of advanced treatments, and local presence of key players such as Integra Lifesciences and Organogenesis are key regional growth drivers.

- Europe represented around 28% revenue share in 2023, aided by rising healthcare spending, introduction of innovative wound care products, and government initiatives to improve diabetes care.

- Asia Pacific is expected to be the fastest growing region at a CAGR above 7% over 2023-2031, owing to vastly underpenetrated markets like China, India, growth of medical tourism, and local manufacturing by players like Smith & Nephew.

Market Segmentation:

- By Product Type

- Wound Care Dressings

- Biologics

- Therapy Devices

- Antibiotic Medications

- Others

- By Ulcer Type

- Neuropathic Ulcers

- Ischemic Ulcers

- Neuro-Ischemic Ulcers

- By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Home Care Settings

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top companies in the Diabetic Foot Ulcer Treatment Market:

- Smith & Nephew

- ConvaTec

- Coloplast

- 3M

- Integra LifeSciences

- Cardinal Health

- B.Braun

- Mölnlycke Health Care

- Medtronic

- Paul Hartmann

- Medline Industries

- Organogenesis

- MiMedx Group

- Tissue Regenix

- Osiris Therapeutics

- Derma Sciences

- Solsys Medical

- Acelity

- C.R Bard

- Kent Imaging