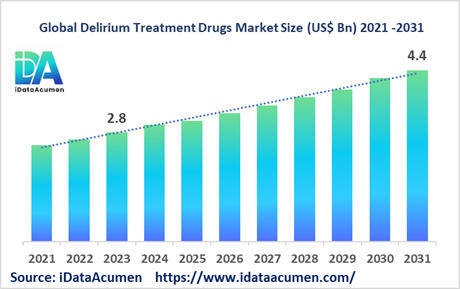

The Delirium Treatment Drugs Market had an estimated market size worth USD 2.8 billion in 2023, and it is predicted to reach a global market valuation of USD 4.4 billion by 2031, growing at a CAGR of 5.9% from 2024 to 2031. These drugs serve to alleviate symptoms related to delirium, such as agitation, hallucinations, and confusion, aiding in the restoration of cognitive function and reduction of delirium duration. Delirium manifests as a severe disruption in mental faculties, characterized by sudden-onset confusion and diminished environmental awareness, representing a significant neuropsychiatric challenge with core features including cognitive alteration and attention deficits.

The Delirium Treatment Drugs landscape revolves around pharmacological strategies aimed at mitigating the acute confusion inherent in delirium. The principal impetus behind market growth stems from the burgeoning elderly populace and the escalating incidence rates of dementia and Alzheimer's disease, underscoring the pressing need for effective treatments. Statistics project a stark rise in global dementia cases, from 57.4 million in 2019 to an estimated 152.8 million by 2050, emphasizing the urgency for therapeutic advancements.

Significant investments in research and development are underway to innovate and enhance pharmacological interventions for delirium. Notable pipeline drugs include LY33084, ITI-007, GT-021, among others, aiming to address the unmet medical needs in this domain. Moreover, technological advancements in biomarkers and electroencephalogram (EEG) monitoring facilitate early detection and management of delirium symptoms, promising improved patient outcomes.

Furthermore, there's a discernible shift towards non-pharmacological interventions, exemplified by modalities like music therapy and multicomponent approaches. These interventions complement traditional drug therapies, offering holistic management strategies for delirium. Notably, the recent FDA approval in March 2022 of Brexpiprazole (Rexulti) for treating agitation linked to dementia and schizophrenia underscores the ongoing efforts to expand treatment options and enhance patient care in this critical area.

Epidemiology Insights:

- The global prevalence of delirium is estimated to be around 20% in general hospitals. In ICUs and post-surgery, the prevalence can be as high as 80%.

- Key factors driving rising prevalence across regions include the aging population, dementia, alcohol abuse disorders, and increasing hospitalizations.

- The incidence of delirium in the US annually is estimated to be over 2.5 million cases per year. In the EU5, the incidence ranges from 10% to 30% among hospitalized patients.

- With growing geriatric populations globally, there are significant opportunities to address the rising patient pool through improved management and awareness.

- Delirium itself is not a rare condition. However, some subtypes like delirium tremens are less common.

Market Landscape

- There is a high unmet need for well-tolerated, effective pharmacological agents for managing delirium, as current options have limited efficacy and unfavorable risk profiles.

- First-generation antipsychotics like haloperidol are commonly used. Sedative-hypnotics and anesthetic drugs may also be used off-label to control agitation.

- Upcoming treatment approaches focus on novel drug targets like serotonin, acetylcholine, melatonin pathways. Multicomponent non-pharmacological interventions are also being adopted.

- Key pipeline drugs with potential breakthrough efficacy include LY33084 (Lundbeck), GT-021 (GT Medical Technologies), ITI-007 (Intra-Cellular Therapies).

- The market has a mix of branded and generic manufacturers. However, branded players like Pfizer, Johnson & Johnson lead in revenue share.

Market Drivers

The rising prevalence of delirium is a major factor driving growth in the delirium treatment drugs market. Delirium has an annual incidence of over 2.5 million cases per year in the US alone. The global prevalence in hospitals and ICUs can be as high as 80% in vulnerable groups like elderly and post-surgery patients. The exponential growth of the geriatric demographic and population aging in both developed and developing countries is significantly contributing to greater susceptibility to acute confusional states. This presents lucrative opportunities for pharmacological interventions that can effectively and safely manage delirium episodes.

Extensive research focused on unraveling the complex pathophysiology and etiology of delirium is enabling greater clinical recognition and spurring development of targeted therapies. Advances in biomarkers, genomics and neuroimaging have shed more light on the molecular mechanisms underlying neuronal dysfunction and neuroinflammation associated with delirium. There is also improved understanding regarding the role of various neurotransmitters like acetylcholine, dopamine and GABA in the condition’s onset. This growing insight can help direct drug discovery efforts towards novel treatment approaches with precision tactics to restore normal brain function.

Investments from public and private entities aimed at improving patient care and clinical outcomes related to delirium are providing an impetus to new product innovation while also fueling uptake. Government policies are stressing on enhanced awareness among medical professionals and standardized practices for early detection and management of delirious hospitalized patients to minimize risks of morbidity. Similarly, leading pharma players are channelizing resources into expanding their product portfolio for central nervous system disorders to capitalize on the demand for better delirium therapeutics.

The COVID-19 pandemic sharply elevated cases of infection-induced delirium, drawing greater attention towards the need for prompt identification and treatment. Reports indicate nearly 80% of ventilated ICU patients experience delirium, often delaying their recovery. Several research initiatives commenced during the crisis that evaluated various pharmacological options for mitigating virus-associated acute brain dysfunction. This created a renewed focus among drug makers regarding a long-overlooked condition, providing fresh growth avenues.

Market Opportunities

Multi-modal approaches combining pharmacological and non-pharmacological interventions for delirium management are gaining traction representing promising prospects for market expansion. These can encompass music/pet therapy, cognitive stimulation, sensory modulation etc coupled with short-term, judicious antipsychotic or sedative use where absolutely necessary. Building an evidence base supporting such strategies can pave the way for complementary treatment paradigms that leverage both drug and non-drug techniques for optimal patient outcomes.

The high costs associated with delirium treatment, extended ICU/hospital stays and poor prognosis is prompting healthcare stakeholders to focus their efforts on prevention. Development of risk stratification models through ML algorithms that trigger targeted prophylactic protocols for at-risk hospitalized patients before surgery can significantly curb incidence while decreasing associated expenditure. Pharma players can collaborate with tech startups and medical software companies to spearhead innovation in this space.

Specialized care units for delirium are beginning to emerge in some regions, catering specifically to the complex management needs of affected patients. Their treatment philosophy is centered around combined pharmacological, psychological and rehabilitative care plans tailored to individual requirements for complete recovery. Building an extensive network of such facilities can dramatically transform patient trajectories by enhancing both access and quality of care amidst a supportive, recovery-oriented environment.

The vast majority of low-middle income group economies do not have locally manufactured, affordable drug options to tackle delirium. This leads to substandard levels of care, limited awareness and gross underdiagnosis of cases. Local brand development and licensing deals with generic manufacturers can spur accessibility in cost-sensitive markets still struggling with appropriate delirium treatment avenues. Awareness programs directed at primary healthcare and community caregivers may also help uncover hidden incidence.

Market Trends

Greater indictments against antipsychotic prescribing patterns for elderly hospitalized patients and black box warnings on increased mortality risks have prompted changes in clinical practice. Doctors today are more cognizant regarding risks of overmedication. Approaches emphasize optimum, low-dose and short-term use only for severe behavioral instability where non-pharmacological strategies prove inadequate. This has fueled development of alternate drug classes with less adverse event potential.

Startups are foraying into digital solutions leveraging VR and AR environments for immersive sensory regulation therapy helping orient delirious patients. Visual, audio and touch stimuli are applied to ground perceptions and reduce disorientation. Some also employ AI for cognitive assessment and personalized treatment guidance. These innovations are garnering investor attention given their promising usefulness as an adjunctive aid alongside pharmacological measures.

Several leading pharmaceutical brands are actively probing potential new indications for their approved psychiatry drugs to treat delirium, given the synergistic pathways vis-à-vis mood disorders and schizophrenia. Examples include exploring the role of brexpiprazole, cariprazine, lumateperone among others in managing acute confusional states. This can pave the way for possibly safer, efficacious alternatives to conventional antipsychotics.

Companies are exploring olesoxime and other neuroprotective compounds that can shield neurons from damage inflicted by precipitating factors behind delirium episodes. They exert actions on mitochondria and cellular metabolism, bolstering resilience while attenuating inflammation and oxidative stress. Although still in early stages, this can open doors to disease modifying opportunities targeting the pathophysiological foundation of acute brain failure linked to surgery, trauma or sepsis.

Market Restraints

The complex, multifactorial nature of delirium with involvement of diverse neurological pathways makes development of targeted drugs extremely challenging. Manifestations can vary widely based on the underlying trigger ranging from medications, substance withdrawal, infections, metabolic issues or organ dysfunction. This heterogeneity and individualized nature of episodes poses difficulties designing therapies with consistent efficacy.

Diagnostic ambiguities, overlap of symptoms with other psychiatric conditions, lack of objective delirium biomarkers all contribute to significant underrecognition in clinical practice. Symptoms may be mild or assumed age-related with outcomes centered around managing the precipitating illness rather than the delirium itself. Poor awareness among frontline staff coupled with time constraints further perpetuate missed or delayed diagnosis.

Concerns related to anticholinergic burden and safety liabilities, lack of clinical evidence regarding dosing as well as duration of therapy have impeded regulatory approvals. Currently only antipsychotics are approved by governing agencies like FDA for delirium treatment, although substantial debate exists about appropriate use parameters. Presently Risperdal and Zyprexa are the only two atypical antipsychotics indicated for ICU sedation linked delirium.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 2.8 Bn |

|

CAGR (2024 - 2031) |

5.9% |

|

The revenue forecast in 2031 |

US$ 4.4 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Pfizer, Johnson & Johnson, Eli Lilly, AstraZeneca, Novartis, Otsuka Pharmaceutical, H. Lundbeck, Teva Pharmaceutical, Sunovion Pharmaceuticals, Avadel Pharmaceuticals |

Recent Developments:

|

Development |

Involved Company |

|

Sunovion Pharmaceuticals announced FDA approval for its atypical antipsychotic Latuda (lurasidone HCL) for the treatment of schizophrenia in children and adolescents in Nov 2022. This expanded Latuda's eligibility to pediatric patients. |

Sunovion Pharmaceuticals

|

|

Otsuka Pharmaceutical and Click Therapeutics launched a pilot clinical trial in Oct 2022 to evaluate a personalized software as a medical device for reducing post-operative delirium episodes. |

Otsuka Pharmaceutical and Click Therapeutics |

|

In Jan 2023, Intra-Cellular Therapies reported positive Phase 1 results for ITI-1284-ODT for residual symptoms of schizophrenia. This may expand ITI-1284's potential to also treat psychosis linked to delirium. |

Intra-Cellular Therapies |

|

The FDA granted Breakthrough Therapy designation in June 2021 to GT-021, an investigational nicotinic alpha-7 receptor agonist, for treating agitation in patients with delirium. |

GT Medical Technologies

|

|

In Dec 2021, FDA approved supplemental new drug application for Rexulti (brexpiprazole) to treat schizophrenia and as adjunct treatment for major depressive disorder, expanding its potential for psychiatric conditions related to delirium. |

Otsuka Pharmaceutical and Lundbeck

|

Market Regional Insights

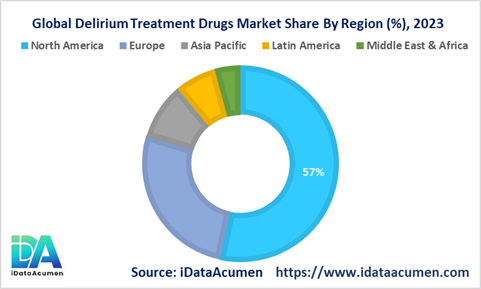

Delirium Treatment Drugs regional growth varies owing to epidemiology trends, awareness levels, research initiatives, access and affordability of treatment.

North America emerges as the dominant player in the Delirium Treatment Drugs market, projected to hold a commanding 57.3% share by 2023. This surge is primarily fueled by the region's heightened prevalence rates and growing consciousness surrounding delirium.

Europe constitutes the second-largest market share, anticipated to command 28.1% by 2023. The region's robust market growth is underpinned by the presence of renowned brands and favorable regulatory frameworks facilitating market expansion.

Meanwhile, the Asia Pacific region is poised to witness the most rapid growth, boasting a remarkable compound annual growth rate (CAGR) of 7.2% during the forecast period until 2023. This surge is propelled by factors such as burgeoning elderly populations and substantial investments in healthcare infrastructure across the region.

In addition to these leading regions, Latin America and the Middle East & Africa contribute to the global landscape, albeit to a lesser extent. Latin America holds a market share of 7.3%, while the Middle East & Africa accounts for 4.6%.

In summary, North America spearheads the Delirium Treatment Drugs market, Europe follows suit with significant market presence, and the Asia Pacific region showcases unparalleled growth potential. These regions collectively drive the global landscape of delirium treatment, each influenced by unique regional dynamics.

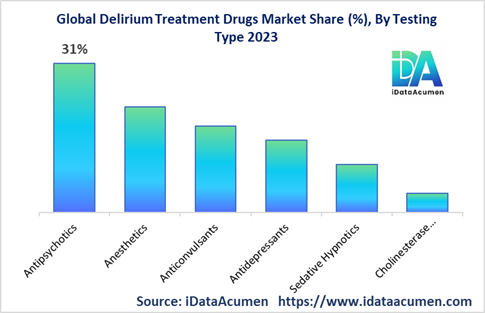

Delirium Treatment Drugs Market Segmentation:

By Drug Class

- Antipsychotics

- Anesthetics

- Anticonvulsants

- Antidepressants

- Sedative Hypnotics

- Cholinesterase inhibitors

By Diagnosis

- Subsyndromal delirium

- Delirium tremens

- Hypoactive delirium

- Hyperactive delirium

- Mixed delirium

- Others

By End User

- Hospitals

- Clinics

- Homecare

- Others (rehab centers, LTC facilities etc.)

By Route of Administration

- Oral

- Intravenous

- Intramuscular

- Others (sublingual, transdermal etc.)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

Segmentation Overview:

The antipsychotics segment is projected to grow at 8.1% CAGR, reaching over USD 2.1 billion by 2030. It will remain the dominant segment through 2030. North America will be the chief market accounting for 63% regional share owing to higher prevalence of conditions like dementia driving delirium episodes.

The hypoactive delirium diagnosis segment will expand at 6.4% CAGR to surpass USD 950 million by 2030. It is often underdiagnosed thereby presenting opportunities for improved detection. Europe is expected to majorly contribute to hypoactive delirium diagnosis demand.

Top Companies in the Delirium Treatment Drugs Market:

- Pfizer

- Johnson & Johnson

- Eli Lilly

- AstraZeneca

- Novartis

- Otsuka Pharmaceutical

- H. Lundbeck

- Teva Pharmaceutical

- Sunovion Pharmaceuticals

- Avadel Pharmaceuticals