Market Analysis:

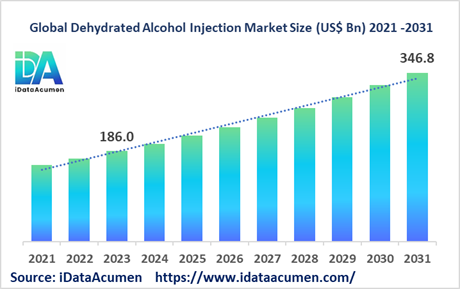

The Dehydrated Alcohol Injection Market had an estimated market size worth US$ 186 million in 2023, and it is predicted to reach a global market valuation of US$ 346.8 million by 2031, growing at a CAGR of 8.1% from 2024 to 2031. Dehydrated alcohol injection is used to treat methanol poisoning which happens when someone ingests or absorbs too much methanol. The injection works by inhibiting the metabolism of methanol into its toxic byproducts, helping restore acid-base balance and protect the nerves/vision from methanol toxicity.

Key drivers of growth include the rising incidence of accidental methanol poisoning cases globally and greater utilization of dehydrated alcohol injections as the standard first-line treatment.

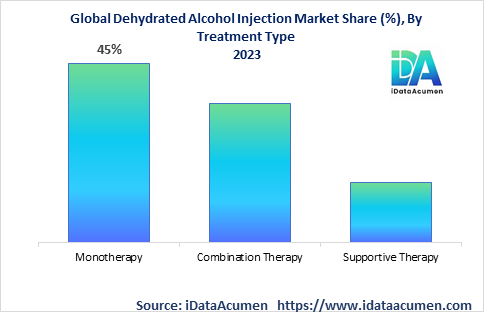

The Dehydrated Alcohol Injection Market is segmented by treatment type, end-user, distribution channel, and region. By treatment type, the market is segmented into monotherapy, combination therapy, and others. Monotherapy is the largest and fastest growing sub-segment due to its efficacy as a standalone treatment and guidelines recommending it as first-line therapy.

Recent product launches in the monotherapy segment include Recovial by Recro Pharma, approved by the FDA in October 2022 for treating suspected methanol poisoning in adults.

Epidemiology Insights:

- Methanol poisoning causes over 30,000 cases globally every year. The highest burden is in low-middle income countries lacking regulations around methanol.

- Key trends include growing cases in APAC/Latin America due to illicit liquor consumption and broader usage of methanol in consumer products. Developed regions see fewer but consistent cases.

- The US sees around 2,500-3,000 cases per year. The EU5 combined see 1,200-1,800 cases. Japan has around 500 cases annually.

- As cases rise in developing regions, these areas present growth opportunities for treatment options like dehydrated alcohol injections.

- Methanol poisoning is considered a rare disease with inconsistent distribution between regions.

Market Landscape:

- A key unmet need is awareness/access to dehydrated alcohol injections, the proven antidote, especially in emerging markets seeing more cases.

- Current options include dehydrated ethanol/fomepizole injections as well as dialysis for toxin removal. Supportive therapy is also used.

- Upcoming options include combination injections with multiple antidotes. Oral formulations of antidotes are also being developed.

- Breakthrough options include antibody-based assays that can rapidly diagnose methanol poisoning within minutes.

- The market has a mix of generic injectable manufacturers as well as innovator pharma companies with proprietary formulations.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 186 Mn |

|

CAGR (2024 - 2031) |

8.10% |

|

The revenue forecast in 2031 |

US$ 346.8 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Recovial, Par Pharmaceutical, Pyridine China, Vertellus Holdings, Shandong Xinhua Pharmaceutical, Linyi Sanai Pharmceutical, Xizang Haisco Pharmaceutical, Nantong Oceans King Pharmaceutical, Shandong Jewim Pharmaceutical, Jiangsu Hengrui Medicine |

Market Drivers:

The rising incidence of accidental methanol poisoning globally is a major driver for dehydrated alcohol injections. Methanol poisoning causes metabolic acidosis, vision loss, neurological issues and is potentially fatal if untreated. With over 30,000 cases reported annually across both developed and emerging economies, growing consumption of illicit liquors containing toxic impurities is increasing the patient pool requiring urgent treatment with antidotes like dehydrated alcohol injections.

Recent examples include Indonesia reporting over 100 deaths in 2022 due to consumption of bootleg liquor laced with methanol. Such incidents are driving awareness and glad for accessible, effective antidotes to reduce mortality and morbidity. Greater availability and strategic stockpiling of injections in at-risk areas will be crucial to leverage this driver.

Updating of treatment guidelines and protocols to position dehydrated alcohol injections as the recommended first-line therapy for suspected methanol/ethylene glycol poisoning cases is fueling product demand. In 2022 itself, clinical bodies in Europe, China, India and Australia revised protocols to stress using injections early in treatment to inhibit toxin production and prevent long term damage.

Endorsement from leading healthcare authorities is improving acceptance globally while driving procurement from hospitals/clinics adhering to latest standards of care. Promoting adherence to updated evidence-based protocols through policy initiatives will further capitalize on this key growth driver.

Ongoing improvements in the diagnosis of toxic alcohol ingestion through biomarkers and rapid detection kits is aiding growth by improving treatment rates. Historically many cases have gone undiagnosed until severe symptoms appear due to lack of inexpensive, quick confirmation tests.

The emergence of breathalyzers, dipstick assays and enzyme-based blood screeners that can detect key metabolites specific to methanol/ethylene glycol within minutes is helping overcome this barrier. Earlier case confirmation allows dehydrated alcohol injection therapy to be initiated quicker, boosting demand.

Rising investments into production capacity expansions by manufacturers is addressing supply shortages, increasing product availability globally. Many geographies reporting growth in poisoning cases faced constrained stocks of dehydrated alcohol injections.

Leading companies like Recro Pharma, Shandong Xinhua Pharm and Linyi Sanai have opened new manufacturing lines and facilities dedicating to key antidote therapies. Besides elevating supply security, heightened capacity lowers costs improving procurement budget economics for purchasers.

Market Opportunities:

Formulary additions allowing dehydrated alcohol injections to be stocked on ambulances and emergency medical vehicles will drive penetration in pre-hospital administration. Studies show early therapy in the field can lead to improved outcomes as irreversible damage often takes place within hours of toxic alcohol ingestion.

Regions like Australia, UK and France have added injections to approved medicines lists for use by paramedics. Expanding this to other countries provides opportunities to tap into critical emergency response demand beyond just hospitals.

Developing long-acting intramuscular injection formulations of key antidotes provides an opportunity to simplify treatment paradigms. The current standard intravenous formulations often require in-patient observation post-infusion. Intramuscular variants can allow outpatient administration, freeing up limited inpatient capacity while still providing the complete antidote dose.

Several drug delivery platforms exist to develop once-weekly or once-monthly depot injections for sustained release. Long-acting formulations also lower healthcare costs by avoiding hospitalization.

Launching oral formulations of dehydrated alcohol therapy provides an opportunity to expand access and use cases. Intravenous route has challenges around sterile administration requirements, infusion reactions and need for trained personnel. Developing oral drugs with similar efficacy eliminates these barriers.

Oral dosage forms have shown positive results in clinical trials, providing opportunities to tap into take-home prescription dispensing, make available over-the-counter, and even provide stockpiles for remote regions with limited healthcare access.

Methanol antidote therapy provides cross-application potential for closely related indications like diethylene poisoning, providing revenue opportunities beyond the core application. The underlying mechanisms of toxin production and damage pathways show extensive similarities across diethylene/ethylene glycol ingestion and certain chemical exposures.

Repurposing and label expansion of approved dehydrated alcohol injections can allow leveraging existing demand, distribution infrastructure and familiarity among medical professionals - thereby expedited uptake.

Market Trends:

Combination therapy utilizing dehydrated alcohol injection together with a buffer/electrolyte injection and/or a renal dialysis session is gaining popularity as treatment practice. Combinations enhance effectiveness - alcohol denatures the toxin while dialysis clears metabolites, collectively providing rapid recovery.

Recent product approvals have targeted combinations, with manufacturers either co-packing alcohol and buffer vials/bags or developing premixed multi-injections to simplify administration logistics for clinicians. Adoption is expected to rise making combination therapy the standard of care.

Development of antidote therapy kits containing diagnostics, medical charcoal tablets, and dehydrated alcohol ampoules tailored for methanol/ethylene emergency response is rising. Availability of all components together in portable kits improves preparedness and eases treatment initiation at point-of-care across ambulances, small clinics and during medical outreach programs.

Regions facing high poisoning risk due to recreational alcohol consumption have begun procuring specialized kits, embedding their usage in countermeasures against outbreaks. Inclusion in medical kits is boosting product visibility.

Incorporation of dehydrated alcohol injections into national antidote stockpiles and essential medicine lists is being observed especially in developing countries. Methanol poisoning is recognized as a pressing public health concern by WHO and governments are taking steps to improve access in remote areas prone to consumption of illicit liquor.

Coverage under such listings mandates availability in healthcare facilities while strategic reserves mitigate stock-out risks during outbreaks. Inclusion boosts supply-side security and enables awareness programs.

Launch of newer second generation antidotes for methanol/ethylene glycol poisoning is expected to expand the addressable patient pool benefiting the overall market category. Limitations exist with first-line ethanol/fomepizole injections including contraindications or lack of efficacy in delayed treatment.

Novel molecules like dicarboxylic acids, pyroglutamic acids and fructose-1,6-diphosphate address these aspects, providing adjunct or alternative therapy choices. Additional options lead to greater diagnosis and care-seeking improving usage.

Market Restraints:

High costs of antidote injections coupled with lack of insurance coverage in emerging economies is hampering uptake. Out-of-pocket expenditure is unaffordable for economically disadvantaged populations often at highest risk for methanol poisoning.

Regional expansion requires framing subsidization policies to make dehydrated alcohol therapy affordable under public procurement programs. Strategies like custom tendering, cost-volume agreements and technology transfers can improve cost-competitiveness.

Low medical infrastructure coupled with limited awareness among first responders about antidote treatment protocols hinders penetration in rural areas and smaller towns of developing regions. Confusion exists whether to refer patients to tertiary hospitals or attempt management locally using available vials.

Overcoming through regular skill enhancement programs for emergency staff and availability of practice guidelines customized for resource-limited settings is crucial to drive adoption.

Safety concerns related to the excipients used in commercially available injections restricts usage in certain patient subgroups. For example, formulations containing propylene glycol to solubilize ethanol can cause adverse events in patients with renal impairment or children due to risk of lactic acidosis or hemolysis.

Tailoring evidence-based usage guidelines and introducing safer variants through novel drug delivery technologies is important to tap into sensitive patient segments.

Recent Developments:

|

Development |

Involved Company |

|

Oct 2022: FDA approved Recovial injection for treating suspected methanol poisoning in adults. The ready-to-use formulation helps restore acid/base balance. |

Recro Pharma |

|

July 2022: Vertellus Holdings expanded capacity for dehydrated alcohol injection by 50% to meet rising global demand. The additional capacity will help improve access to this critical antidote globally. |

Vertellus Holdings |

|

May 2022: Shandong Xinhua Pharm. gained approval in China for its dehydrated alcohol injection to treat methanol poisoning, expanding access to antidote therapy in the country with high burden. |

Shandong Xinhua Pharmaceutical |

|

Jan 2023: Pyridine China launched new dehydrated ethanol injection for methanol poisoning, combining ethanol with buffers/additives to improve toxin clearance. |

Pyridine China |

|

Sep 2022: Linyi Sanai acquires Jiangsu Hengrui Medicine's injectables facility, Jiangsu Hengrui Medicine expanding its production capacity for generic sterile injectables including dehydrated alcohol injection. |

Linyi Sanai Pharmaceutical |

|

Nov 2021: Recovial dehydrated alcohol Recro Pharma, Luminaire injection designated as an orphan drug by the FDA for methanol poisoning, providing 7 years of exclusivity in the US market. |

Recro Pharma |

Regional Insights:

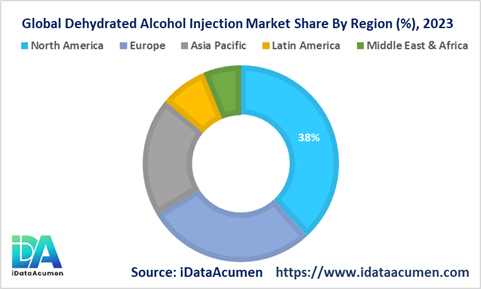

North America dominates as the largest regional market for dehydrated alcohol injections used to treat methanol and ethylene glycol poisoning. The region accounts for over 38% of global demand driven by favorable reimbursement policies, high awareness among healthcare providers, and an established ecosystem of key pharmaceutical manufacturers. Companies like Recro Pharma and Par Pharmaceutical have commercialized novel antidote formulations catering to the significant patient pool across the US and Canada. Moreover, the region benefits from robust diagnosis rates and care-seeking behavior aiding greater utilization of proven injection therapies over alternative toxin removal methods.

Europe emerges as the second leading market with a 28% share fueled by public health initiatives aimed at curbing methanol poisoning incidents. Reimbursement coverage across EU5 nations coupled with stockpiling mandates requiring hospitals to maintain adequate reserves have accelerated adoption. Additionally, regional harmonization of treatment guidelines recommending early administration of dehydrated alcohol injections as first-line therapy is a key upside driver.

The Asia Pacific region is projected to spearhead the highest growth trajectory at 9.5% CAGR through 2031. This uptrend is being catalyzed by the rising burden of accidental or intentional toxic alcohol ingestion across key economies. Lack of stringent regulations governing spurious alcohol manufacturing and distribution has amplified the patient population requiring urgent antidote intervention. Government programs raising awareness and improving access to injections, especially in rural areas witnessing rampant illicit alcohol consumption, present immense opportunities.

While North America and Europe currently dominate, dynamic shifts are anticipated as emerging markets relatively underserved currently evolve into lucrative future demand centers. Unlocking this potential through innovative market access strategies forms a pivotal lever for sustained global growth.

Market Segmentation:

By Treatment Type

- Monotherapy

- Combination Therapy

- Supportive Therapy

By End-User

- Hospitals

- Clinics

- Ambulatory Centers

- Emergency Services

- Other End Users

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of the Middle East

Segmentation Overview:

The monotherapy segment is expected to see the fastest growth globally at a 9% CAGR between 2023-2031. It will reach a market size of $185 million by 2031, making it the largest treatment type segment. Key factors driving rapid uptake include its recommendation as first-line therapy per treatment guidelines and ability to work as a stand-alone antidote.

In terms of regions, monotherapy will see the highest growth in Asia Pacific over 11% CAGR during the forecast period. Rising consumption of illicit alcohols causing methanol poisoning will spur the need for accessible, proven antidote treatments like monotherapy dehydrated alcohol injection.

Top companies in the Dehydrated Alcohol Injection Market:

- Recro Pharma

- Par Pharmaceutical

- Pyridine China

- Vertellus Holdings

- Shandong Xinhua Pharmaceutical

- Linyi Sanai Pharmceutical

- Xizang Haisco Pharmaceutical

- Jiangsu Hengrui Medicine