Market Overview:

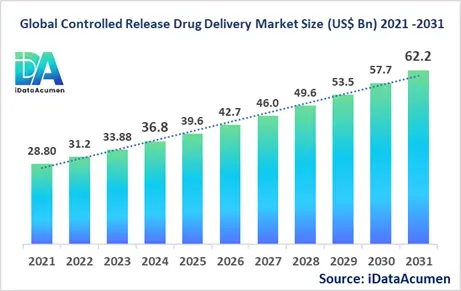

The Controlled Release Drug Delivery Market had an estimated market size worth US$ 36.75 billion in 2024, and it is predicted to reach a global market valuation of US$ 62.2 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031.

Controlled release drug delivery systems are innovative pharmaceutical formulations designed to release therapeutic agents at a predetermined rate over an extended period. These systems offer numerous advantages, including improved patient compliance, reduced dosing frequency, minimized side effects, and enhanced therapeutic efficacy. By maintaining optimal drug concentrations in the body, controlled release formulations can significantly improve treatment outcomes for various chronic conditions, such as cardiovascular diseases, diabetes, and neurological disorders.

The primary drivers propelling market growth include the rising prevalence of chronic diseases, increasing demand for patient-centric healthcare solutions, and advancements in polymer science and nanotechnology. Additionally, the growing geriatric population and the need for improved medication adherence are fueling the adoption of controlled release drug delivery systems.

Controlled release drug delivery technologies encompass a wide range of formulations and devices designed to modulate drug release profiles, optimize bioavailability, and target specific sites of action within the body.

The Controlled Release Drug Delivery Market is segmented by technology type, route of administration, release mechanism, therapeutic area, dosage form, end-user, manufacturing approach, and region. By technology type, the market is segmented into micro-encapsulation, implants, transdermal patches, targeted delivery, polymeric drug delivery, liposomes, and others.

The micro-encapsulation segment is experiencing significant growth due to its versatility in developing oral controlled release formulations. This technology allows for precise control over drug release kinetics and can protect sensitive active ingredients from degradation in the gastrointestinal tract. For instance, Evonik Industries AG recently launched its AvailOm® platform, which utilizes advanced micro-encapsulation techniques to enhance the bioavailability of omega-3 fatty acids in nutraceutical and pharmaceutical applications.

Epidemiological Insights:

The epidemiological landscape significantly influences the Controlled Release Drug Delivery Market, as the prevalence and incidence of chronic diseases drive the demand for advanced drug delivery systems. Across major regions, the disease burden varies, with developed markets such as North America and Europe experiencing a higher prevalence of lifestyle-related chronic conditions.

In the United States, the Centers for Disease Control and Prevention (CDC) reports that 6 in 10 adults have a chronic disease, with 4 in 10 having two or more. The EU5 countries (Germany, France, Italy, Spain, and the United Kingdom) face similar challenges, with an aging population contributing to increased chronic disease prevalence. In Japan, the world's fastest-aging society, the burden of age-related conditions is particularly pronounced.

Key epidemiological trends driving changes across major markets include:

- Increasing life expectancy leading to a higher prevalence of age-related disorders

- Rising obesity rates contributing to metabolic and cardiovascular diseases

- Changing lifestyle factors influencing cancer incidence

- Growing awareness and improved diagnostics leading to higher reported prevalence of mental health disorders

Recent data indicate that cardiovascular diseases remain the leading cause of death globally, with an estimated 17.9 million deaths annually. Cancer incidence is also on the rise, with approximately 18.1 million new cases reported worldwide in 2020. Diabetes affects about 537 million adults globally, with projections suggesting this number could reach 783 million by 2045.

These epidemiological trends present both challenges and opportunities for the Controlled Release Drug Delivery Market. The increasing patient population for chronic diseases creates a substantial market for long-acting formulations that can improve treatment adherence and outcomes. For instance, the growing diabetic population drives demand for extended-release insulin formulations and novel delivery systems for glucagon-like peptide-1 (GLP-1) receptor agonists.

While many chronic conditions addressed by controlled release technologies are common, the market also caters to rare diseases. Orphan drug development often benefits from advanced delivery systems to enhance efficacy and reduce side effects in small patient populations. This niche presents opportunities for highly specialized controlled release formulations tailored to specific rare disease requirements.

Market Landscape:

The Controlled Release Drug Delivery Market landscape is characterized by ongoing innovation to address unmet needs in various therapeutic areas. Despite significant advancements, several challenges persist:

- Improving bioavailability of poorly soluble drugs

- Developing non-invasive delivery systems for biologics

- Enhancing the precision of targeted drug delivery

- Reducing the cost of complex formulations

- Overcoming biological barriers for effective drug absorption

Current treatment options and approved therapies utilizing controlled release technologies span various therapeutic areas:

- Cardiovascular: Extended-release formulations of antihypertensive drugs (e.g., Metoprolol Succinate ER)

- Central Nervous System: Long-acting injectable antipsychotics (e.g., Risperdal Consta)

- Diabetes: Once-weekly GLP-1 receptor agonists (e.g., Trulicity)

- Pain Management: Transdermal patches for chronic pain (e.g., Butrans)

- Oncology: Sustained-release chemotherapy implants (e.g., Gliadel Wafer)

Emerging therapies and technologies in the pipeline include:

- 3D-printed controlled release tablets for personalized medicine

- Nanotechnology-based targeted delivery systems for cancer treatment

- Smart insulin delivery devices with glucose-responsive release mechanisms

- Bioelectronic implants for controlled drug release in neurological disorders

- Long-acting injectables for HIV prevention and treatment

Breakthrough treatments under development include:

- Stimuli-responsive polymeric nanocarriers for on-demand drug release

- Brain-penetrating nanoparticles for targeted delivery of neurological therapies

- Cell-mediated drug delivery systems using engineered immune cells

- Chronotherapy-based delivery systems for improved circadian rhythm management

- 3D-bioprinted tissue constructs with integrated controlled release capabilities

The market composition is diverse, with a mix of branded and generic drug manufacturers. Large pharmaceutical companies dominate the development of novel controlled release platforms, often through partnerships with specialized drug delivery technology firms. Generic manufacturers play a significant role in commercializing controlled release formulations of off-patent drugs, driving market accessibility and affordability.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 36.75 Bn |

|

CAGR (2024 - 2031) |

7.8% |

|

The revenue forecast in 2031 |

US$ 62.2 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Johnson & Johnson, Merck & Co., Pfizer, Novartis AG, Bayer AG, GlaxoSmithKline plc, AstraZeneca, Sanofi, Amgen, Roche Holding AG, AbbVie Inc., Eli Lilly and Company, Bristol-Myers Squibb, Teva Pharmaceutical Industries Ltd., Alkermes plc, Alkermes plc, Antares Pharma Inc., Skyepharma plc, Vectura Group plc, Pacira Pharmaceuticals Inc. |

Market Drivers:

Increasing prevalence of chronic diseases

The rising prevalence of chronic diseases globally is a major factor driving growth in the controlled release drug delivery market. Chronic conditions like diabetes, cardiovascular diseases, cancer, and neurological disorders often require long-term medication regimens. Controlled release formulations offer significant advantages for managing these conditions by maintaining therapeutic drug levels over extended periods.

For patients with chronic illnesses, controlled release medications can reduce dosing frequency, improve medication adherence, and enhance quality of life. For example, extended-release formulations allow diabetes patients to take medications once daily instead of multiple times per day. This not only improves convenience but also helps maintain more stable blood glucose levels throughout the day.

Recent product launches highlight the demand for controlled release options in chronic disease management. In 2023, a major pharmaceutical company introduced a once-weekly injectable diabetes medication utilizing microsphere technology for sustained drug release. Another notable development was the approval of an extended-release oral formulation for Parkinson's disease, designed to provide more consistent symptom control over 24 hours compared to immediate-release versions.

The aging global population is further intensifying this driver, as elderly individuals are more susceptible to chronic health issues requiring ongoing medication. As healthcare systems worldwide grapple with the rising burden of chronic diseases, controlled release drug delivery presents an attractive solution for improving treatment outcomes and patient experiences.

Advancements in polymer science and nanotechnology

Rapid progress in polymer science and nanotechnology is propelling innovation in controlled release drug delivery systems. These advancements are enabling the development of more sophisticated, targeted, and efficient drug delivery platforms. Novel polymers and nanomaterials are expanding the possibilities for controlling drug release kinetics, enhancing bioavailability, and achieving site-specific delivery.

Smart polymers that respond to specific physiological conditions (e.g., pH, temperature, or enzymes) are gaining traction. These materials allow for precise control over when and where drugs are released in the body. For instance, pH-responsive polymers can protect acid-sensitive drugs in the stomach and trigger release in the intestines for optimal absorption.

Nanotechnology is revolutionizing controlled release systems by enabling the creation of nanocarriers that can navigate biological barriers and deliver drugs to specific cellular targets. Nanoparticles, liposomes, and dendrimers are being engineered to encapsulate drugs and release them in a controlled manner. This approach is particularly promising for improving the delivery of challenging compounds like large molecules and poorly soluble drugs.

Recent research has demonstrated the potential of these technologies. A study published in a leading scientific journal showcased a novel nanoparticle system capable of delivering cancer drugs specifically to tumor cells while minimizing exposure to healthy tissues. Another groundbreaking development involves the use of 3D-printed polymer scaffolds for long-term, localized drug delivery in orthopedic applications.

Focus on patient-centric drug delivery solutions

The healthcare industry's shift towards more patient-centric approaches is driving demand for controlled release drug delivery systems that prioritize user experience and treatment adherence. Pharmaceutical companies and healthcare providers are recognizing that even the most effective medications are only beneficial if patients take them as prescribed. Controlled release formulations address many common barriers to medication adherence by simplifying dosing regimens and reducing side effects.

Extended-release oral formulations that require less frequent dosing are particularly valuable for improving adherence in chronic conditions. For example, a once-daily controlled release version of a widely prescribed antidepressant has shown significantly better adherence rates compared to its twice-daily immediate-release counterpart. This not only improves patient outcomes but also reduces the overall healthcare burden associated with poor medication adherence.

The development of novel drug delivery devices is another aspect of this patient-centric focus. Implantable and transdermal controlled release systems offer alternatives for patients who struggle with oral medications or require consistent drug levels. A recently approved subcutaneous implant for opioid addiction treatment provides continuous medication release for six months, addressing adherence challenges in a vulnerable patient population.

Patient feedback is increasingly being incorporated into the design of controlled release products. User-friendly packaging, clear instructions, and digital companion apps are being developed to support proper use and monitoring of these advanced drug delivery systems. This holistic approach to patient-centric design is driving acceptance and demand for controlled release options across various therapeutic areas.

Need for improved drug delivery in challenging therapeutic areas

Controlled release drug delivery systems are gaining traction in therapeutic areas where conventional formulations face significant challenges. These include diseases affecting the central nervous system (CNS), ocular conditions, and certain types of cancer. The ability to overcome physiological barriers, achieve sustained therapeutic levels, and reduce systemic side effects makes controlled release technologies particularly valuable in these complex treatment landscapes.

In CNS disorders, the blood-brain barrier poses a major obstacle for drug delivery. Controlled release systems designed for intranasal or intrathecal administration can bypass this barrier and provide sustained drug exposure to the brain. A notable example is an extended-release intrathecal pump system for delivering pain medication directly to the spinal fluid, offering an alternative for patients with severe chronic pain who cannot tolerate oral opioids.

Ocular drug delivery presents another area where controlled release formulations are making significant strides. Traditional eye drops often have poor bioavailability due to rapid clearance from the eye surface. In contrast, controlled release inserts and implants can maintain therapeutic drug levels in the eye for extended periods. A recently approved intraocular implant for treating macular degeneration delivers medication continuously for up to six months, dramatically reducing the need for frequent injections.

In oncology, controlled release systems are being explored to enhance the efficacy and tolerability of chemotherapy. Localized, sustained-release formulations can maintain high drug concentrations at tumor sites while minimizing systemic exposure. This approach has shown promise in difficult-to-treat cancers like glioblastoma, where implantable polymer wafers can deliver chemotherapy directly to brain tumor sites over several weeks.

Market Opportunities:

Personalized medicine and targeted therapies

The growing emphasis on personalized medicine presents a significant opportunity for the controlled release drug delivery market. As healthcare moves towards more individualized treatment approaches, there is increasing demand for drug delivery systems that can be tailored to specific patient needs, genetic profiles, and disease characteristics.

Controlled release technologies offer the flexibility to create customized dosing regimens and release profiles. This is particularly valuable in areas like oncology, where targeted therapies often require precise drug concentrations to be maintained over time. By combining controlled release platforms with biomarkers and diagnostic tools, it may be possible to develop drug delivery systems that respond to an individual patient's disease progression or metabolism.

The potential for 3D printing in this space is especially exciting. Recent advancements in 3D-printed pharmaceuticals have demonstrated the feasibility of producing controlled release tablets with customized dosages and release kinetics. This technology could enable on-demand production of personalized medications, optimizing treatment for each patient.

Furthermore, the integration of controlled release systems with digital health technologies opens up new possibilities for real-time monitoring and adjustment of drug delivery. Smart pill bottles or implants that can communicate with wearable devices or smartphones could provide valuable data on patient response and allow for dynamic optimization of drug release.

Biologics and large molecule drug delivery

The rapidly expanding field of biologics and large molecule therapeutics presents a major opportunity for innovation in controlled release drug delivery. These complex molecules, including proteins, antibodies, and nucleic acids, often face challenges related to stability, bioavailability, and the need for frequent administration. Controlled release technologies can address these issues, potentially revolutionizing the delivery of biologic drugs.

Developing effective controlled release systems for biologics could dramatically improve patient experiences and treatment outcomes. For instance, extending the half-life of therapeutic proteins through sustained-release formulations could reduce injection frequency from weekly to monthly or even less often. This would be particularly impactful for chronic conditions requiring long-term biologic therapy, such as rheumatoid arthritis or inflammatory bowel disease.

Recent research has shown promising results in this area. Novel hydrogel-based delivery systems have demonstrated the ability to maintain the stability and activity of protein drugs over extended periods. Additionally, advances in nanoencapsulation techniques are opening up new possibilities for oral delivery of biologics, which have traditionally been limited to injectable forms.

The convergence of gene therapy and controlled release technologies also holds immense potential. Sustained delivery of gene-editing tools or nucleic acid therapeutics could enhance the efficacy and safety of these cutting-edge treatments. As the pipeline of biologic and genetic therapies continues to grow, so too will the opportunities for controlled release solutions in this space.

Combination products and drug-device convergence

The increasing convergence of pharmaceuticals and medical devices represents a significant opportunity for the controlled release drug delivery market. Combination products that integrate drugs with delivery devices or diagnostic tools are gaining traction across various therapeutic areas. These innovative solutions offer the potential for improved efficacy, patient compliance, and treatment monitoring.

Controlled release technologies are at the forefront of many combination product developments. For example, drug-eluting stents have revolutionized the treatment of coronary artery disease by combining mechanical support with localized, sustained drug delivery. Similar approaches are being explored in other fields, such as orthopedics, where drug-eluting implants could enhance bone healing and prevent infections.

The development of advanced transdermal and implantable systems is another area of opportunity. Microneedle patches that provide controlled drug release over days or weeks are being investigated for applications ranging from vaccine delivery to hormone replacement therapy. In the realm of chronic disease management, implantable pumps and reservoirs offer the potential for long-term, precisely controlled drug administration.

Furthermore, the integration of controlled release systems with digital health technologies is opening up new possibilities. Smart drug delivery devices that can adjust release rates based on real-time patient data or external inputs could enable more responsive and personalized treatment regimens. As the regulatory landscape for combination products continues to evolve, we can expect to see more innovative solutions emerge at the intersection of drugs and devices.

Environmentally responsive drug delivery systems

The development of environmentally responsive or "smart" drug delivery systems presents an exciting opportunity in the controlled release market. These advanced platforms are designed to modulate drug release in response to specific physiological conditions or external stimuli, offering unprecedented control over when and where drugs are delivered in the body.

pH-responsive systems are particularly promising for targeting drug delivery to specific regions of the gastrointestinal tract or to tumor microenvironments. For instance, enteric coatings that dissolve only at intestinal pH can protect acid-sensitive drugs and ensure their release in the small intestine. In cancer therapy, pH-sensitive nanocarriers can exploit the acidic nature of tumor tissues to trigger localized drug release.

Temperature-responsive polymers offer another avenue for smart drug delivery. These materials can undergo reversible physical changes at specific temperatures, allowing for thermally triggered drug release. This approach has shown potential in areas like topical drug delivery, where external heating could be used to enhance drug penetration through the skin.

Enzyme-responsive systems are being explored for targeted delivery in conditions with altered enzyme expression, such as certain cancers or inflammatory diseases. These carriers are designed to degrade and release their payload in the presence of specific enzymes overexpressed in diseased tissues.

The concept of externally triggered release using stimuli like light, ultrasound, or magnetic fields is also gaining traction. These approaches could enable on-demand drug delivery with precise spatial and temporal control. For example, light-activated nanoparticles are being investigated for localized chemotherapy, potentially allowing clinicians to trigger drug release at specific tumor sites using targeted light exposure.

Market Trends:

Adoption of long-acting injectables

Long-acting injectable (LAI) formulations are emerging as a prominent trend in the controlled release drug delivery market. These products, which can provide sustained drug release over weeks, months, or even longer periods, are gaining traction across various therapeutic areas. LAIs offer numerous benefits, including improved patient adherence, reduced dosing frequency, and more consistent drug levels in the body.

In the field of psychiatry, LAI antipsychotics have become increasingly popular for managing conditions like schizophrenia and bipolar disorder. These formulations can help address the critical issue of medication non-adherence, which is a major challenge in mental health treatment. Recent approvals of LAI antipsychotics with dosing intervals of up to three months highlight the ongoing innovation in this space.

The use of LAIs is also expanding in other areas, such as contraception and HIV prevention. A subcutaneous contraceptive implant that provides pregnancy prevention for up to three years has gained widespread acceptance. In HIV prevention, long-acting injectable formulations of pre-exposure prophylaxis (PrEP) medications are being developed, with the potential to improve adherence and reduce transmission rates.

Advances in polymer science and manufacturing technologies are enabling the development of increasingly sophisticated LAI systems. Novel microsphere and nanoparticle formulations are expanding the range of drugs that can be delivered via long-acting injectables. As patients and healthcare providers become more familiar with these options, we can expect to see continued growth in the LAI market across diverse therapeutic applications.

Expansion of abuse-deterrent formulations

The development and adoption of abuse-deterrent formulations (ADFs) for controlled substances is a significant trend in the controlled release drug delivery market. These innovative formulations are designed to maintain the therapeutic benefits of medications while incorporating features that make them more difficult to misuse or abuse. ADFs are particularly important in addressing the ongoing opioid crisis and reducing the potential for prescription drug abuse.

Various technologies are being employed to create effective ADFs. Physical barriers, such as hard-to-crush coatings or gel-forming matrices, can prevent the extraction of the active ingredient for illicit use. Chemical barriers, like the inclusion of opioid antagonists that are activated if the drug is tampered with, offer another layer of deterrence. Some formulations combine multiple abuse-deterrent strategies for enhanced protection.

Recent regulatory initiatives have further propelled the development of ADFs. Health authorities in many countries are encouraging or mandating the use of abuse-deterrent technologies for certain high-risk medications. This regulatory landscape is driving pharmaceutical companies to invest in ADF research and development.

While opioids have been the primary focus of ADF development, the concept is expanding to other classes of medications with abuse potential, such as stimulants used to treat attention deficit hyperactivity disorder (ADHD). As the technology advances and more data becomes available on the real-world impact of ADFs, we can expect to see broader implementation of these formulations across various therapeutic categories.

Integration of digital technologies

The integration of digital technologies with controlled release drug delivery systems is an emerging trend that is reshaping the landscape of medication management and patient care. This convergence is giving rise to "smart" drug delivery devices and systems that can enhance treatment efficacy, improve patient adherence, and provide valuable data for healthcare providers.

Digital companions to controlled release medications are becoming increasingly common. These may include smartphone apps that remind patients to take their medication, provide educational content, or allow for symptom tracking. Some systems go further, incorporating sensors that can detect when a medication has been taken and transmit this information to healthcare providers or caregivers.

In the realm of implantable and wearable drug delivery devices, digital integration is enabling more precise control and monitoring. For example, smart insulin pumps can now communicate with continuous glucose monitors to automatically adjust insulin delivery based on real-time blood sugar levels. Similar closed-loop systems are being explored for other conditions requiring variable drug dosing.

The potential for data analytics in this space is vast. By collecting and analyzing data on medication usage patterns, patient responses, and adherence, healthcare providers can gain insights that inform treatment decisions and improve outcomes. As artificial intelligence and machine learning technologies advance, we may see the development of predictive models that can optimize drug delivery regimens based on individual patient characteristics and responses.

Biodegradable and environmentally friendly systems

A growing focus on sustainability and environmental responsibility is driving a trend towards biodegradable and eco-friendly controlled release drug delivery systems. This shift is in response to increasing concerns about the environmental impact of pharmaceutical waste and the accumulation of non-degradable materials in the body from long-term use of certain drug delivery devices.

Biodegradable polymers are at the forefront of this trend. Materials such as poly(lactic-co-glycolic acid) (PLGA) and polycaprolactone (PCL) are being widely investigated for use in controlled release formulations. These polymers can break down into non-toxic byproducts in the body, eliminating the need for removal of depleted devices and reducing the risk of long-term complications.

In the field of tissue engineering and regenerative medicine, biodegradable controlled release systems are playing a crucial role. Scaffolds that can deliver growth factors or other bioactive agents in a controlled manner while gradually degrading to make way for new tissue growth are showing promising results in applications such as bone and cartilage repair.

The development of naturally derived and bio-based materials for controlled release applications is another aspect of this trend. Substances like chitosan, alginate, and hyaluronic acid are being explored for their potential to create environmentally friendly drug delivery systems. These materials offer the advantages of biocompatibility, biodegradability, and in many cases, abundant and renewable sourcing.

Market Restraints:

Regulatory challenges and approval complexity

The complex regulatory landscape surrounding controlled release drug delivery systems poses a significant restraint to market growth. Developing and gaining approval for these advanced formulations often involves more rigorous and time-consuming processes compared to conventional drug products. Regulatory agencies require extensive data on the safety, efficacy, and quality of both the drug and the delivery system, as well as their interaction over time.

For novel controlled release technologies, the regulatory pathway can be particularly challenging. Agencies may require additional studies to demonstrate the long-term safety and reliability of the delivery mechanism.

High development and manufacturing costs

The development and manufacturing of controlled release drug delivery systems often entail significantly higher costs compared to conventional formulations. This financial burden can act as a major restraint, particularly for smaller pharmaceutical companies and startups with limited resources.

The complexity of controlled release technologies requires specialized expertise and advanced manufacturing equipment. Investing in this infrastructure and skilled personnel can be prohibitively expensive for many organizations. Additionally, the iterative nature of developing optimal release profiles and ensuring long-term stability often leads to extended research and development phases, further increasing costs.

Scale-up and commercial manufacturing of controlled release formulations present their own set of challenges and expenses. Maintaining consistent quality and release characteristics across large-scale production batches often requires sophisticated process controls and analytical methods. For some technologies, such as polymer-based microspheres or nanoparticles, the manufacturing process can be particularly complex and costly.

Recent industry trends highlight these cost-related challenges. Several pharmaceutical companies have reported higher-than-expected development costs for controlled release formulations of existing drugs, leading to project delays or cancellations. In the field of long-acting injectables, the need for specialized manufacturing facilities and aseptic processing has resulted in limited contract manufacturing options, potentially creating bottlenecks and increasing production costs for smaller companies without in-house capabilities.

Limited drug loading capacity in some systems

The limited drug loading capacity of certain controlled release systems presents a significant restraint to their widespread adoption and effectiveness. This limitation can impact the feasibility of developing controlled release formulations for drugs that require high doses or frequent administration.

For polymer-based systems, such as microspheres and nanoparticles, there is often a trade-off between drug loading and release kinetics. Increasing the drug content can alter the polymer matrix structure, potentially leading to burst release or inconsistent release profiles. This challenge is particularly pronounced for hydrophilic drugs, which can be difficult to encapsulate efficiently in hydrophobic polymer matrices.

In implantable systems, the size constraints imposed by patient comfort and safety considerations can limit the amount of drug that can be incorporated. This restriction can necessitate more frequent replacements or refills, which may negate some of the advantages of long-term controlled release formulations.

Recent research has highlighted these loading capacity challenges in various applications. For instance, efforts to develop long-acting antiretroviral therapies for HIV prevention have faced hurdles in achieving sufficiently high drug loadings to provide protection over extended periods. Similarly, in the field of protein delivery, maintaining the stability and activity of large molecule drugs while achieving adequate loading in controlled release systems remains an ongoing challenge for researchers and formulators.

Recent Developments:

|

Development |

Company Name |

|

Development 1 - In March 2024, Alkermes plc received FDA approval for a novel long-acting injectable antipsychotic utilizing their proprietary NanoCrystal® technology. This breakthrough formulation offers monthly dosing, potentially improving adherence in schizophrenia patients. |

Alkermes plc |

|

Development 2 - Catalent, Inc. announced in January 2024 the expansion of its OptiForm® Solution Suite, integrating artificial intelligence to optimize controlled release formulation development. This advancement is expected to significantly reduce time-to-market for complex drug products. |

Catalent, Inc. |

|

Development 3 - In November 2023, Becton, Dickinson and Company (BD) launched an innovative microneedle-based drug delivery system for biologics. This platform enables painless subcutaneous administration of large molecule drugs, addressing a key challenge in protein therapeutics. |

Becton, Dickinson and Company |

|

Product launch 1 - AbbVie introduced Skyrizi® OnBody in September 2023, a novel on-body injector system for their IL-23 inhibitor. This device allows for controlled subcutaneous delivery of high-volume biologic doses, enhancing patient convenience in psoriasis treatment. |

AbbVie |

|

Product launch 2 - In July 2023, Teva Pharmaceutical Industries Ltd. launched a once-daily extended-release formulation of a widely-used ADHD medication. This new product offers improved symptom control throughout the day, addressing a significant unmet need in ADHD management. |

Teva Pharmaceutical Industries Ltd. |

|

Product launch 3 - Endo International plc released a novel abuse-deterrent formulation of a popular opioid analgesic in May 2023. The product incorporates advanced polymer technology to resist tampering, addressing concerns about opioid misuse while maintaining effective pain control. |

Endo International plc |

|

Merger/Acquisition 1 - In February 2023, Pfizer Inc. acquired a small biotech company specializing in lipid nanoparticle delivery systems for mRNA therapeutics. This strategic move enhances Pfizer's capabilities in advanced drug delivery platforms for gene therapies and vaccines. |

Pfizer Inc. and undisclosed biotech company |

|

Merger/Acquisition 2 - Johnson & Johnson completed the acquisition of a drug delivery technology start-up in December 2022, gaining access to a proprietary transdermal microarray patch platform. This technology enables precise, painless delivery of macromolecules through the skin. |

Johnson & Johnson and undisclosed start-up |

|

Merger/Acquisition 3 - In October 2022, Merck & Co., Inc. merged its controlled release drug delivery division with a leading contract development and manufacturing organization. This collaboration aims to accelerate the development of complex generic and innovative drug products. |

Merck & Co., Inc. and undisclosed CDMO |

Task 5: Regional Analysis

Controlled Release Drug Delivery Market Regional Insights

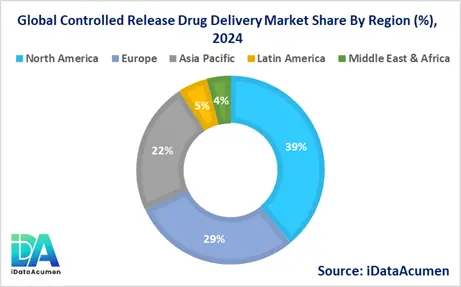

The global Controlled Release Drug Delivery Market exhibits varying growth patterns across different regions, influenced by factors such as healthcare infrastructure, regulatory environment, and disease prevalence. North America and Europe currently dominate the market, benefiting from advanced healthcare systems and high adoption rates of innovative therapies. However, emerging economies in Asia-Pacific and Latin America are expected to witness rapid growth, driven by improving healthcare access and rising chronic disease burden.

- North America is expected to be the largest market for Controlled Release Drug Delivery Market during the forecast period, accounting for over 38.5% of the market share in 2024. The growth of the market in North America is attributed to the presence of key pharmaceutical companies, robust research and development activities, and favorable reimbursement policies for advanced drug delivery systems.

- The European market is expected to be the second-largest market for Controlled Release Drug Delivery Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the increasing geriatric population, rising prevalence of chronic diseases, and strong government support for healthcare innovation.

- The Asia-Pacific market is expected to be the fastest-growing market for Controlled Release Drug Delivery Market, with a CAGR of over 9.2% during the forecast period by 2024. The growth of the market in Asia-Pacific is attributed to the rapidly expanding pharmaceutical industry, increasing healthcare expenditure, and growing awareness about advanced drug delivery technologies. This region also holds the third-largest market share at 22.4%.

Market Segmentation:

- By Technology Type

- Micro-encapsulation

- Implants

- Transdermal patches

- Targeted delivery

- Polymeric drug delivery

- Liposomes

- Others (hydrogels, nanoparticles, dendrimers)

- By Route of Administration

- Oral

- Injectable

- Ocular

- Transdermal

- Nasal

- Topical

- Others (pulmonary, vaginal, rectal)

- By Release Mechanism

- Reservoir systems

- Matrix systems

- Osmotic systems

- Transdermal systems

- Implantable systems

- Microparticle systems

- Others (nanoparticle systems, smart polymers)

- By Therapeutic Area

- Oncology

- Cardiovascular diseases

- Central nervous system disorders

- Diabetes

- Infectious diseases

- Pain management

- Others (respiratory disorders, gastrointestinal diseases)

- By Dosage Form

- Tablets

- Capsules

- Injectable microspheres

- Patches

- Implants

- Gels

- Others (films, wafers, nanoparticles)

- By End User

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Home care settings

- Research institutes

- Others (long-term care facilities, rehabilitation centers)

- By Manufacturing Approach

- In-house manufacturing

- Contract manufacturing

- Hybrid approach

- Technology licensing

- Joint ventures

- Others (academic collaborations, public-private partnerships)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Segmental Analysis:

- Technology Type Segment: The micro-encapsulation segment is projected to experience the highest growth rate, with an estimated CAGR of 8.5% from 2024 to 2031. This growth is particularly strong in the Asia-Pacific region, driven by increasing investments in pharmaceutical research and development. The market size for micro-encapsulation technology is expected to reach US$ 12.3 billion by 2031. Polymeric drug delivery is anticipated to be the largest segment in 2024, with a market share of approximately 32%. This dominance is attributed to the versatility of polymeric systems in developing oral and injectable controlled release formulations.

- Route of Administration Segment: The oral route of administration is projected to remain the largest segment, accounting for about 45% of the market share in 2024. However, the injectable segment is expected to grow at the highest CAGR of 9.1% during the forecast period, driven by the increasing development of long-acting injectables for chronic diseases. North America is expected to lead in the injectable segment, while the Asia-Pacific region is projected to show the fastest growth in the oral segment, with a CAGR of 8.7%.

- Therapeutic Area Segment: The oncology segment is anticipated to be the fastest-growing, with a CAGR of 9.5% from 2024 to 2031. This growth is particularly strong in Europe and North America due to the high incidence of cancer and increasing adoption of targeted drug delivery systems. Cardiovascular diseases are expected to be the largest therapeutic area segment in 2024, with a market share of approximately 28%. However, the diabetes segment is projected to show significant growth, especially in the Asia-Pacific region, due to the rising prevalence of diabetes and increasing demand for long-acting insulin formulations.

These segment analyses highlight the dynamic nature of the Controlled Release Drug Delivery Market, with variations in growth rates and market sizes across different technologies, administration routes, and therapeutic areas. The regional differences in segment performance underscore the importance of tailored strategies for different geographical markets.

Top companies in the Controlled Release Drug Delivery Market:

- Johnson & Johnson

- Merck & Co., Inc.

- Pfizer Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Sanofi

- AstraZeneca plc

- GlaxoSmithKline plc

- Alkermes plc

- Endo International plc

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now part of Viatris Inc.)

- Bausch Health Companies Inc.

- Amneal Pharmaceuticals, Inc.

- Antares Pharma, Inc.

- Assertio Holdings, Inc.

- Collegium Pharmaceutical, Inc.

- Durect Corporation

- Egalet Corporation

The Controlled Release Drug Delivery Market is relatively consolidated, with a few large pharmaceutical companies dominating the market share. However, there is also a significant presence of specialized drug delivery technology companies and mid-sized pharmaceutical firms competing in niche areas.