Market Overview:

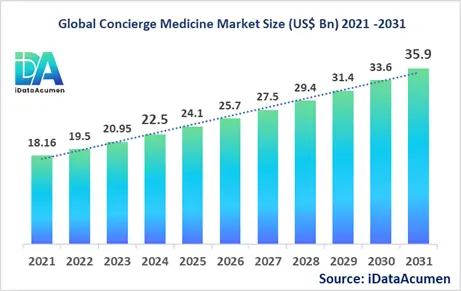

The Concierge Medicine Market has experienced significant growth in recent years, reflecting a shift towards more personalized and accessible healthcare services. With an estimated market size of US$ 22.5 billion in 2024, the industry is projected to reach a global market valuation of US$ 35.9 billion by 2031, growing at a CAGR of 6.9% from 2024 to 2031. This robust growth trajectory underscores the increasing demand for high-quality, patient-centric healthcare solutions.

Concierge medicine, also known as retainer medicine or boutique medicine, is a healthcare model where patients pay an annual or monthly fee to their primary care physician in exchange for enhanced access and personalized care. This model offers numerous advantages, including:

- Immediate or same-day appointments

- Extended consultation times (typically 30-60 minutes)

- 24/7 access to physicians via phone, email, or text

- Comprehensive annual physical exams

- Coordination of care with specialists

- Emphasis on preventive care and wellness

The primary drivers propelling the concierge medicine market include the growing dissatisfaction with traditional healthcare models, increasing healthcare costs, and a rising demand for personalized medical attention. Additionally, the aging population and the prevalence of chronic diseases have fueled the need for more attentive and accessible healthcare services.

The Concierge Medicine Market is segmented by service model, specialty, payment model, practice size, patient age group, service offering, technology integration, and region. By service model, the market is segmented into full-service concierge medicine, hybrid concierge medicine, fee-for-extra care, direct primary care (DPC), specialty concierge medicine, corporate concierge medicine, and others.

Among these segments, full-service concierge medicine is experiencing significant growth due to its comprehensive approach to patient care. This model typically offers unlimited access to physicians, same-day appointments, and a wide range of preventive and wellness services, making it particularly attractive to high-net-worth individuals and those with complex health needs.

In recent years, we've seen notable technological advancements in the concierge medicine space. For instance, in January 2023, One Medical, a leading concierge medicine provider, launched an AI-powered health assistant integrated into their patient app. This innovation allows members to receive personalized health recommendations and streamlined appointment scheduling, further enhancing the value proposition of concierge medicine.

Epidemiological Insights:

While concierge medicine is not directly tied to a specific disease, its growth and adoption are influenced by broader health trends and demographics across major regions. In North America, particularly the United States, the burden of chronic diseases has been a significant driver for concierge medicine. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the US have a chronic disease, and 4 in 10 have two or more. This high prevalence has created a demand for more personalized and comprehensive care models.

In Europe, particularly in countries like the UK, France, and Germany, the aging population has been a key epidemiological factor influencing the concierge medicine market. The European Union's statistical office, Eurostat, reports that by 2100, those aged 65 years and above will account for 31.3% of the total population, up from 20.8% in 2021. This demographic shift is driving the need for more attentive and accessible healthcare services.

In Japan, which has one of the world's oldest populations, the concierge medicine model is gaining traction as a solution to address the complex healthcare needs of seniors. The country's Ministry of Health, Labour and Welfare reports that as of 2020, 28.7% of the population was aged 65 or older, creating a substantial market for personalized healthcare services.

The latest information on disease incidence and prevalence in major markets further underscores the potential for concierge medicine. For instance, in the United States, the American Diabetes Association reports that 37.3 million people, or 11.3% of the population, had diabetes in 2019. Such high prevalence rates for chronic conditions create opportunities for concierge medicine practices to offer more comprehensive and continuous care.

Growth opportunities in the concierge medicine market are closely tied to these epidemiological trends. As the patient population with chronic diseases and complex health needs continues to grow, particularly in developed countries, the demand for more personalized and accessible healthcare services is expected to rise. This presents a significant opportunity for concierge medicine providers to expand their services and reach.

It's important to note that concierge medicine itself is not focused on rare diseases but rather on providing a higher level of care and access for a range of health conditions, from routine preventive care to managing complex chronic diseases. The model's flexibility allows it to adapt to the specific health needs of different patient populations, making it a versatile solution in the face of changing epidemiological landscapes across major markets.

Market Landscape:

In the concierge medicine market, several unmet needs persist despite the model's growing popularity. One significant gap is the limited accessibility of concierge services to a broader population due to high membership fees. This creates an opportunity for providers to develop more affordable models that maintain quality while reaching a wider patient base.

Current treatment options in concierge medicine encompass a wide range of services, including comprehensive annual physical exams, same-day or next-day appointments, extended consultation times, and 24/7 access to physicians. Some concierge practices also offer advanced diagnostic tests and personalized wellness plans as part of their service packages.

Upcoming therapies and technologies in concierge medicine are focusing on integrating digital health solutions to enhance patient care. Telemedicine platforms, wearable devices for continuous health monitoring, and AI-powered health assistants are being incorporated into concierge medicine practices to provide more comprehensive and proactive care.

Breakthrough treatment options currently being developed in the concierge medicine space include:

- Precision medicine approaches that utilize genetic testing and personalized treatment plans

- Advanced preventive care strategies leveraging AI and machine learning for early disease detection

- Integration of mental health and wellness services into primary care offerings

- Development of specialized concierge medicine programs for complex chronic disease management

The market composition of concierge medicine is unique compared to traditional healthcare models. Rather than being dominated by drug manufacturers, the market is primarily composed of individual physicians, small to medium-sized medical practices, and a growing number of larger concierge medicine networks. There's also an increasing presence of technology companies providing platforms and tools to support concierge medicine practices.

While not directly involved in drug manufacturing, concierge medicine practices often collaborate with both generic and branded drug manufacturers to provide their patients with the most appropriate and cost-effective treatment options. The focus in this market is more on service delivery and patient experience rather than drug development or distribution.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 22.5 Bn |

|

CAGR (2024 - 2031) |

6.9% |

|

The revenue forecast in 2031 |

US$ 35.9 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

MD2 International, MDVIP, Concierge Consultants & Cardiology, Castle Connolly Private Health Partners, Signature MD, Crossover Health, Parsley Health, Premise Health, PartnerMD, Peninsula Doctor, Priority Physicians, Cambell Family Medicine, Dedication Health, Boca VIPediatrics |

Market Drivers:

Increasing demand for personalized and preventive healthcare

The rising consumer preference for personalized and preventive healthcare is a major driver propelling the growth of the concierge medicine market. As patients become more health-conscious and proactive about managing their wellbeing, they are seeking out medical care models that offer individualized attention and focus on preventing illness rather than just treating symptoms.

Concierge medicine caters perfectly to this demand by providing patients with extended appointment times, 24/7 access to physicians, comprehensive health assessments, and customized wellness plans. This allows doctors to take a holistic view of each patient's health and develop tailored strategies for disease prevention and optimal wellness.

The COVID-19 pandemic has further accelerated this trend, with more people prioritizing their health and wanting greater access to medical guidance. A survey conducted in 2021 found that 68% of Americans were more likely to consider a concierge medicine practice following the pandemic. This highlights the growing appeal of the personalized care and enhanced doctor-patient relationships offered by the concierge model.

Additionally, the integration of advanced diagnostics and genetic testing into concierge practices is enabling even more personalized preventive care. Physicians can now create highly customized health plans based on a patient's unique genetic predispositions and risk factors. This level of personalization is driving more health-conscious consumers to opt for concierge medicine services.

Physician burnout and dissatisfaction with traditional practice models

Growing physician burnout and frustration with conventional healthcare delivery systems are driving more doctors to transition to concierge medicine practices. The demanding pace, administrative burdens, and declining reimbursements of traditional medical practices have left many physicians feeling overworked and unable to provide optimal patient care.

Concierge medicine offers an attractive alternative that allows doctors to dramatically reduce their patient loads, spend more time with each patient, and focus on delivering high-quality care rather than rushing through appointments. A typical concierge physician may have a panel of 400-600 patients compared to 2,500-4,000 in a traditional practice.

This reduced workload and improved work-life balance are highly appealing to physicians facing burnout. A 2022 survey found that 47% of doctors were feeling burned out, with administrative tasks and lack of time with patients cited as major contributors. Concierge medicine directly addresses these pain points by reducing paperwork and increasing meaningful patient interactions.

Furthermore, the concierge model often provides physicians with more stable and predictable income through annual membership fees, reducing reliance on insurance reimbursements. This financial stability, combined with greater professional satisfaction, is motivating more doctors to make the switch to concierge practice models, thereby expanding the market.

Growing affluence and willingness to pay for premium healthcare services

The increasing affluence of certain demographic segments, particularly in developed nations, is driving growth in the concierge medicine market. As disposable incomes rise, more consumers are willing and able to pay out-of-pocket for enhanced healthcare services that offer convenience, personalized attention, and a luxury experience.

Concierge medicine, with its promise of same-day appointments, extended visit times, and direct physician access, appeals strongly to affluent individuals who value their time and health. These consumers are often willing to pay annual membership fees ranging from $1,500 to $25,000 for the enhanced service and exclusivity offered by concierge practices.

This trend is particularly pronounced among high-net-worth individuals, executives, and entrepreneurs who prioritize efficiency and personalized service in all aspects of their lives, including healthcare. A 2023 survey of affluent consumers found that 72% would consider joining a concierge medical practice for improved access and personalized care.

Moreover, as healthcare costs continue to rise, even middle-income consumers are reassessing their healthcare spending. Many are finding that the comprehensive care and potential cost savings from avoided hospitalizations or specialist visits make concierge medicine a worthwhile investment. This broadening of the target market beyond just the ultra-wealthy is further driving the expansion of concierge medical services.

Advancements in telemedicine and digital health technologies

The rapid advancement and adoption of telemedicine and digital health technologies are significantly driving the growth of the concierge medicine market. These innovations enable concierge practices to offer enhanced services, improve patient monitoring, and extend their reach beyond geographical limitations.

Telemedicine platforms allow concierge physicians to provide round-the-clock virtual consultations, a key selling point for many patients. This 24/7 availability, combined with the personal relationship developed through concierge care, offers patients unparalleled access to medical advice and support. The convenience of video consultations for minor issues or follow-ups also adds significant value to concierge memberships.

Furthermore, digital health technologies such as wearable devices, remote monitoring tools, and health apps are being integrated into concierge care models. These tools enable continuous health tracking and early detection of potential issues, aligning perfectly with the preventive focus of concierge medicine. Physicians can use this real-time data to provide more proactive and personalized care.

The COVID-19 pandemic has accelerated the adoption of these technologies, with both patients and providers becoming more comfortable with virtual care delivery. A 2022 study found that 76% of patients who used telemedicine during the pandemic were highly satisfied with the experience and would continue using it. This growing acceptance of digital health solutions is expanding the potential client base for concierge practices, particularly among tech-savvy younger generations.

Market Opportunities:

Expansion into corporate wellness programs

A significant opportunity for growth in the concierge medicine market lies in partnering with corporations to provide executive health programs and employee wellness services. As companies increasingly recognize the importance of employee health in driving productivity and reducing healthcare costs, there is growing interest in comprehensive wellness solutions.

Concierge medicine practices are uniquely positioned to offer tailored corporate health programs that go beyond traditional employee health benefits. These could include on-site clinics, executive health assessments, personalized wellness plans, and 24/7 telemedicine access for employees. The high-touch, preventive approach of concierge medicine aligns well with corporate wellness goals of reducing absenteeism and improving overall employee health.

Moreover, offering concierge medicine services as part of executive compensation packages can be a powerful recruitment and retention tool for companies competing for top talent. A 2023 survey of C-suite executives found that 65% would consider changing jobs for better health benefits, including access to concierge medical services.

This corporate wellness opportunity allows concierge practices to secure large client bases through single contracts, potentially accelerating market growth. It also opens up the concierge model to a broader demographic of patients who might not otherwise be able to afford individual memberships.

Integration of advanced diagnostics and precision medicine

The integration of cutting-edge diagnostic technologies and precision medicine approaches presents a significant opportunity for concierge medicine practices to differentiate their services and deliver even more personalized care. By incorporating advanced genetic testing, biomarker analysis, and AI-driven health assessments, concierge physicians can offer patients unprecedented insights into their health and highly tailored treatment plans.

This opportunity aligns perfectly with the concierge model's focus on preventive care and personalization. For example, comprehensive genetic profiling can identify predispositions to certain diseases, allowing physicians to develop targeted prevention strategies. Advanced biomarker testing can detect diseases at very early stages, enabling more effective interventions.

The growing consumer interest in personalized health information is driving demand for these services. A recent study found that 71% of consumers are interested in taking a genetic test to understand their health risks. Concierge practices that offer these advanced diagnostics as part of their service can attract health-conscious clients willing to pay a premium for cutting-edge care.

Furthermore, the integration of AI and machine learning in analyzing patient data can help concierge physicians identify subtle health trends and make more accurate predictions about patient outcomes. This level of precision in healthcare delivery can significantly enhance the value proposition of concierge medicine services.

Expansion of specialty concierge services

While primary care has been the traditional focus of concierge medicine, there is a growing opportunity to expand the model into various medical specialties. This diversification can capture new market segments and cater to patients seeking specialized, high-touch care in areas such as cardiology, endocrinology, pediatrics, and mental health.

Specialty concierge services can offer patients with chronic conditions or complex health needs the dedicated attention and comprehensive management they require. For instance, a concierge endocrinology practice could provide diabetes patients with continuous glucose monitoring, personalized nutrition plans, and frequent check-ins to optimize their treatment.

This opportunity is particularly relevant given the rising prevalence of chronic diseases and the growing recognition of the importance of mental health. A 2022 survey found that 58% of patients with chronic conditions would be interested in a specialty concierge service if it meant better disease management and outcomes.

Moreover, specialty concierge practices can collaborate with primary care concierge physicians to offer a more integrated care experience. This interdisciplinary approach can lead to better health outcomes and higher patient satisfaction, further driving the growth of the concierge medicine market.

Concierge telemedicine for rural and underserved areas

The expansion of concierge telemedicine services into rural and underserved areas represents a significant growth opportunity for the market. By leveraging advanced telecommunication technologies, concierge practices can extend their reach to patients who traditionally have had limited access to high-quality, personalized healthcare.

This model could involve a hybrid approach where patients receive most of their care virtually, with periodic in-person visits for comprehensive check-ups or procedures. Such a service could be particularly appealing in areas with physician shortages, offering residents access to top-tier medical expertise without the need to travel long distances.

The potential market for this service is substantial. According to recent data, over 46 million Americans live in rural areas with limited healthcare access. A 2023 survey found that 63% of rural residents would be interested in a telemedicine-based concierge service if it meant better access to quality healthcare.

Furthermore, this opportunity aligns with broader healthcare policy goals of improving rural health outcomes and reducing disparities in healthcare access. Concierge telemedicine services could partner with local healthcare facilities to provide a more comprehensive care solution, potentially opening up new funding and support avenues.

Market Trends:

Integration of lifestyle medicine and holistic wellness

A prominent trend in the concierge medicine market is the increasing integration of lifestyle medicine and holistic wellness approaches into care models. Concierge practices are expanding beyond traditional medical treatments to incorporate nutrition counseling, fitness planning, stress management, and even alternative therapies like acupuncture or meditation.

This trend reflects a growing recognition of the role that lifestyle factors play in overall health and disease prevention. Concierge physicians are taking on the role of health coaches, working closely with patients to address all aspects of their wellbeing. For example, some practices are offering personalized exercise prescriptions, cooking classes, and mindfulness training as part of their services.

The demand for this holistic approach is evident in consumer preferences. A 2022 survey found that 76% of concierge medicine patients valued lifestyle and wellness guidance as much as traditional medical care. This trend is particularly strong among millennials and Gen Z, who tend to have a more holistic view of health.

Moreover, concierge practices are increasingly partnering with wellness professionals such as nutritionists, personal trainers, and mental health coaches to offer comprehensive health services under one roof. This integrated approach not only improves patient outcomes but also enhances the value proposition of concierge medicine memberships.

Adoption of value-based care models

A significant trend shaping the concierge medicine market is the adoption of value-based care models. While concierge practices have traditionally operated on a fee-for-service basis through membership fees, there's a growing movement towards tying compensation to patient outcomes and satisfaction.

This trend aligns with broader healthcare industry shifts towards value-based care, but concierge practices are uniquely positioned to implement these models effectively. The smaller patient panels and close doctor-patient relationships characteristic of concierge medicine allow for more accurate tracking of health outcomes and patient satisfaction.

Some concierge practices are experimenting with tiered membership models where patients can receive refunds or discounts if certain health goals are met. Others are incorporating performance guarantees into their contracts, promising specific health improvements or levels of service.

This trend is resonating with patients who want assurance of value for their membership fees. A 2023 study found that 68% of potential concierge medicine clients would be more likely to join a practice that offered some form of value-based pricing or guarantees. It's also attracting attention from employers and insurers looking for more accountable healthcare delivery models.

Increased focus on mental health and stress management

A notable trend in the concierge medicine market is the growing emphasis on mental health and stress management services. Recognizing the profound impact of mental wellbeing on overall health, many concierge practices are expanding their offerings to include comprehensive mental health support.

This trend goes beyond simply treating diagnosed mental health conditions. Concierge physicians are taking a proactive approach to mental wellness, incorporating stress assessment tools, mindfulness training, and resilience-building techniques into their regular care protocols. Some practices are even offering executive coaching and work-life balance consultations as part of their services.

The demand for these services is clearly evident. A 2022 survey of concierge medicine patients found that 82% considered mental health support a crucial component of their healthcare. This trend has been further accelerated by the COVID-19 pandemic, which has heightened awareness of mental health issues and the importance of psychological resilience.

Moreover, concierge practices are increasingly partnering with mental health professionals or bringing them in-house to offer a more integrated approach to mental and physical health. This holistic care model is particularly appealing to high-stress professionals and executives who make up a significant portion of the concierge medicine client base.

Leveraging AI and big data for personalized health insights

A cutting-edge trend in the concierge medicine market is the increasing use of artificial intelligence (AI) and big data analytics to provide highly personalized health insights and predictive care. Concierge practices are leveraging these technologies to analyze vast amounts of patient data, including genetic information, lifestyle factors, and real-time health metrics from wearable devices.

This trend enables concierge physicians to offer unprecedented levels of personalization in their care plans. AI algorithms can identify subtle patterns and risk factors that might be missed by human analysis alone, allowing for earlier interventions and more targeted prevention strategies. For example, AI could predict a patient's risk of developing a specific condition based on their unique health profile and suggest personalized preventive measures.

The appeal of this data-driven approach is strong among tech-savvy patients who value quantifiable health insights. A 2023 consumer survey found that 73% of respondents would be more likely to join a concierge practice that offered AI-powered health predictions and personalized recommendations.

Furthermore, these technologies are enhancing the efficiency of concierge practices, allowing physicians to spend more time on complex cases and patient interactions while AI handles routine data analysis. Some practices are even experimenting with AI-powered chatbots for initial symptom assessment and triage, further streamlining their services.

Market Restraints:

High costs and limited accessibility

A significant restraint on the growth of the concierge medicine market is the high cost associated with membership fees, which limits accessibility to a broader patient population. Annual fees for concierge medical services can range from $1,500 to over $25,000, putting it out of reach for many middle and lower-income individuals and families.

This cost barrier not only limits market penetration but also raises concerns about healthcare equity. Critics argue that concierge medicine creates a two-tiered healthcare system, where those who can afford it receive superior care while others are left with potentially overcrowded and under-resourced traditional practices.

The issue of accessibility is further compounded by the fact that many concierge practices do not accept insurance for their membership fees. While some services may still be billable to insurance, the core membership cost is typically an out-of-pocket expense. This can deter even some higher-income individuals who are accustomed to comprehensive insurance coverage.

Moreover, the limited number of patients that concierge physicians take on (typically 300-600 compared to 2,500-4,000 in traditional practices) means that even if more people could afford the service, there might not be enough concierge doctors to meet demand. This scarcity can lead to long waitlists for popular practices, further limiting accessibility.

Regulatory and ethical concerns

The concierge medicine model faces ongoing regulatory and ethical challenges that could potentially restrain market growth. One primary concern is the potential violation of Medicare laws, which prohibit physicians from charging beneficiaries extra for services already covered by Medicare.

While many concierge practices have found ways to structure their fees to comply with these regulations, the legal landscape remains complex and varies by state. This regulatory uncertainty can deter some physicians from transitioning to a concierge model and make investors wary of backing concierge medicine ventures.

Ethically, there are concerns about patient abandonment when physicians transition to a concierge model and reduce their patient panel size. This can leave many patients without access to their long-time doctor and potentially struggling to find new care in areas with physician shortages.

There are also debates about the professional ethics of providing different levels of care based on ability to pay. Some medical associations have expressed concern that concierge medicine conflicts with physicians' ethical obligation to care for all members of society, not just those who can afford premium services.

These ethical and regulatory issues can damage public perception of concierge medicine and lead to increased scrutiny from policymakers. Any future regulations restricting the practice of concierge medicine could significantly impact market growth.

Recent Developments:

|

Development |

Company Name |

|

In March 2023, One Medical expanded its concierge medicine services to include a specialized program for patients with complex chronic conditions. This program offers enhanced care coordination and personalized treatment plans, addressing a critical need in the market. |

One Medical |

|

PartnerMD launched a new telemedicine platform in January 2022, allowing members to have virtual consultations with their concierge physicians. This development significantly enhanced accessibility and convenience for patients, especially during the ongoing COVID-19 pandemic. |

PartnerMD |

|

In September 2021, Concierge Choice Physicians introduced a hybrid concierge model, allowing physicians to offer both traditional and concierge services within the same practice. This innovative approach has made concierge medicine more accessible to a broader patient base. |

Concierge Choice Physicians |

|

Forward Health unveiled its AI-powered primary care system in May 2023. This system uses machine learning algorithms to analyze patient data and provide personalized health insights, revolutionizing the concierge medicine approach to preventive care. |

Forward Health |

|

In November 2022, MDVIP expanded its network by adding 50 new physicians across the United States. This expansion has increased the availability of concierge medicine services in underserved areas, addressing the growing demand for personalized healthcare. |

MDVIP |

|

Castle Connolly Private Health Partners introduced a specialized concierge program for executive health in February 2023. This program offers comprehensive health assessments and personalized wellness plans tailored to the unique needs of corporate executives. |

Castle Connolly Private Health Partners |

|

In July 2022, Parsley Health launched a digital-first concierge medicine platform, combining telemedicine with functional medicine approaches. This innovative model has attracted younger demographics to concierge medicine, expanding the market's reach. |

Parsley Health |

|

SignatureMD merged with Cypress Membership Medicine in April 2021, creating one of the largest concierge medicine networks in the United States. This merger has strengthened the company's market position and expanded its service offerings. |

SignatureMD and Cypress Membership Medicine |

|

In January 2023, Amazon acquired One Medical for $3.9 billion, marking a significant entry of a major tech company into the concierge medicine space. This acquisition is expected to accelerate technological innovation in personalized healthcare delivery. |

Amazon and One Medical |

|

Crossover Health partnered with major tech companies in October 2022 to provide concierge-style primary care services to their employees. This collaboration has expanded the reach of concierge medicine into the corporate wellness sector. |

Crossover Health |

Market Regional Insights

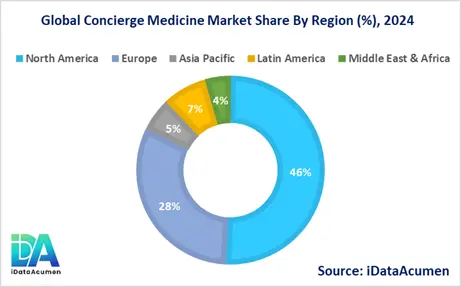

The global concierge medicine market exhibits varying levels of adoption and growth across different regions, influenced by factors such as healthcare infrastructure, economic conditions, and cultural attitudes towards personalized healthcare. North America, particularly the United States, leads the market due to its advanced healthcare system and high disposable income. Europe follows closely, driven by an aging population and increasing demand for premium healthcare services. Meanwhile, the Asia Pacific region is emerging as the fastest-growing market, fueled by rising healthcare expenditure and a growing middle class seeking higher quality medical care.

- North America is expected to be the largest market for Concierge Medicine Market during the forecast period, accounting for over 45.7% of the market share in 2024. The growth of the market in North America is attributed to the high healthcare spending, well-established healthcare infrastructure, and a strong presence of key market players. The United States, in particular, has been at the forefront of the concierge medicine movement, with a growing number of physicians transitioning to this model.

- The European market is expected to be the second-largest market for Concierge Medicine Market, accounting for over 28.3% of the market share in 2024. The growth of the market is attributed to the increasing adoption of private healthcare services, especially in countries like the United Kingdom, Germany, and Switzerland. The region's aging population and the strain on public healthcare systems have created a favorable environment for concierge medicine services.

- The Asia Pacific market is expected to be the fastest-growing market for Concierge Medicine Market, with a CAGR of over 8.5% during the forecast period by 2024. The growth of the market in Asia Pacific is attributed to the rapidly expanding middle class, increasing healthcare awareness, and the development of private healthcare infrastructure. Countries like China, Japan, and Singapore are witnessing a surge in demand for premium healthcare services, driving the growth of concierge medicine. This region holds the third largest share at 15.2% of the global market.

Market Segmentation:

- By Service Model

- Full-Service Concierge Medicine

- Hybrid Concierge Medicine

- Fee-for-Extra Care

- Direct Primary Care (DPC)

- Specialty Concierge Medicine

- Corporate Concierge Medicine

- Others (e.g., Telemedicine-based Concierge, Concierge Urgent Care)

- By Specialty

- Primary Care

- Internal Medicine

- Pediatrics

- Family Medicine

- Cardiology

- Endocrinology

- Others (e.g., Dermatology, Oncology, Neurology)

- By Payment Model

- Annual Fee

- Monthly Subscription

- Per-Visit Fee

- Tiered Pricing

- Corporate Contracts

- Hybrid Payment Models

- By Practice Size

- Solo Practitioners

- Small Group Practices (2-5 physicians)

- Medium Group Practices (6-20 physicians)

- Large Group Practices (21+ physicians)

- Concierge Medicine Networks

- By Patient Age Group

- Pediatric (0-17 years)

- Young Adults (18-34 years)

- Adults (35-54 years)

- Older Adults (55-64 years)

- Seniors (65+ years)

- By Service Offering

- Comprehensive Physical Exams

- 24/7 Physician Access

- Same-Day Appointments

- Preventive Care Services

- Wellness Programs

- Care Coordination

- Others (e.g., Home Visits, Travel Medicine)

- By Technology Integration

- Electronic Health Records (EHR)

- Telemedicine Platforms

- Patient Portals

- Wearable Device Integration

- AI-Powered Health Monitoring

- Mobile Health Apps

- Others (e.g., Virtual Reality for Patient Education)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segmental Analysis:

- By Service Model: The Full-Service Concierge Medicine segment is expected to be the largest in 2024, accounting for approximately 40% of the market share. This segment is projected to grow at a CAGR of 7.5% in North America, driven by the high demand for comprehensive, personalized care. The Hybrid Concierge Medicine model is anticipated to be the second-largest segment, with a market share of around 25% in 2024. This segment is expected to show the fastest growth, with a CAGR of 8.2% in the Asia Pacific region, as it offers a balance between traditional and concierge care models.

- By Specialty: Primary Care is projected to be the dominant segment, holding about 45% of the market share in 2024. This segment is expected to grow at a CAGR of 7.0% globally, with particularly strong growth in Europe. Internal Medicine is likely to be the second-largest specialty segment, with a market share of approximately 20% in 2024. This segment is projected to grow rapidly in the Asia Pacific region, with a CAGR of 8.5%, due to the increasing prevalence of chronic diseases in this area.

- By Payment Model: The Annual Fee model is expected to be the largest segment, accounting for about 50% of the market in 2024. This segment is projected to grow at a CAGR of 6.5% in North America. The Monthly Subscription model is anticipated to be the second-largest and fastest-growing segment, with a market share of approximately 30% in 2024 and a projected CAGR of 8.0% globally. This model is gaining particular traction in emerging markets due to its lower entry barrier for patients.

These projections highlight the dynamic nature of the concierge medicine market, with variations in growth rates and market sizes across different segments and regions. The trends suggest a continued shift towards more flexible and comprehensive care models, with technology integration playing an increasingly important role in service delivery.

Top Companies in the Concierge Medicine Market

- MDVIP

- PartnerMD

- SignatureMD

- Concierge Choice Physicians

- One Medical

- Parsley Health

- Forward Health

- Castle Connolly Private Health Partners

- Crossover Health

- Peninsula Doctor

- Specialdocs Consultants

- HealthSpring

- Latitudes Natural Medicine

- Priority Physicians

- Vitality Concierge Medicine

- Concierge Consultants & Cardiology

- WellcomeMD

- Cornerstone Private Practice

- Dedication Health

- Bluegrass Private Family Practice

The Concierge Medicine market is relatively fragmented, with numerous small to medium-sized practices operating alongside a few larger networks. While companies like MDVIP and One Medical have significant market share, there is still considerable room for independent practices and regional players.