Market Analysis:

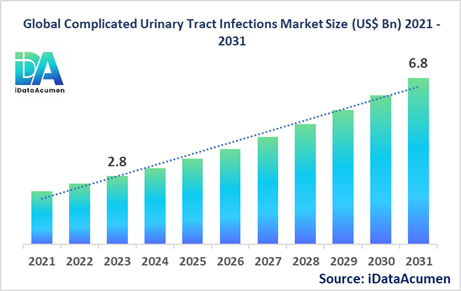

The Complicated Urinary Tract Infections Market had an estimated market size worth US$ 2.8 billion in 2023, and it is predicted to reach a global market valuation of US$ 6.8 billion by 2031, growing at a CAGR of 11.8% from 2024 to 2031.

Complicated Urinary Tract Infections (cUTIs) refer to urinary tract infections caused by bacteria resistant to multiple antibiotics, making them challenging to treat. cUTIs can affect both the upper and lower urinary tract and are typically caused by gram-negative bacteria such as Escherichia coli, Klebsiella pneumoniae, and Pseudomonas aeruginosa. The increasing prevalence of antimicrobial resistance and the rise in hospital-acquired infections are the key drivers for the growth of the cUTI market.

The Complicated Urinary Tract Infections Market is segmented by infection type, pathogen type, drug class, route of administration, distribution channel, and region. By infection type, the market is segmented into complicated pyelonephritis, complicated lower UTI, catheter-associated UTI, and others (urologic procedure-associated UTI, renal transplant-associated UTI). The catheter-associated UTI segment is expected to grow significantly due to the increasing number of hospitalized patients and the use of indwelling catheters, which can lead to infections.

Recent developments in the market include the launch of Merck & Co.'s imipenem/cilastatin/relebactam, a novel beta-lactam/beta-lactamase inhibitor combination, approved by the FDA in June 2022 for the treatment of complicated urinary tract infections, including catheter-associated UTIs.

Epidemiology Insights:

- The disease burden of complicated urinary tract infections (cUTIs) is significant across major regions, with higher rates reported in North America and Europe due to factors such as aging populations and increased use of indwelling catheters.

- Key epidemiological trends include the rising prevalence of antimicrobial resistance, which is driving the increasing incidence of cUTIs caused by multidrug-resistant pathogens. The overuse and misuse of antibiotics, both in healthcare settings and in agriculture, contribute to the development of antimicrobial resistance.

- According to the Centers for Disease Control and Prevention (CDC), approximately 25% of UTIs are hospital-acquired, and many are caused by multidrug-resistant pathogens. The CDC estimates that over 3 million cases of cUTIs occur annually in the United States.

- The increasing geriatric population, which is more susceptible to cUTIs due to age-related physiological changes and comorbidities, presents growth opportunities for the cUTI market as the demand for effective treatments rises.

- cUTIs are not considered rare diseases, as they are relatively common, particularly in healthcare settings and among individuals with underlying conditions or risk factors.

Market Landscape:

- Unmet needs in the cUTI market include the lack of novel antibiotics to combat the rising threat of antimicrobial resistance and the need for improved diagnostic tools to facilitate early and accurate identification of causative pathogens and their resistance profiles.

- Current treatment options for cUTIs primarily involve the use of various antibiotic classes, such as fluoroquinolones, cephalosporins, carbapenems, and aminoglycosides. However, the effectiveness of these treatments is being compromised by the increasing prevalence of multidrug-resistant pathogens.

- Upcoming therapies and technologies for cUTI treatment include novel antibiotics with unique mechanisms of action, alternative therapies such as bacteriophage therapy, and advanced diagnostic tools like molecular-based assays and next-generation sequencing.

- Breakthrough treatment options currently in development include novel antibiotics targeting specific resistance mechanisms, combination therapies, and targeted antimicrobial delivery systems.

- The cUTI market is dominated by branded drug manufacturers, particularly large pharmaceutical companies with established antibiotic portfolios. However, there is also a significant presence of generic drug manufacturers offering lower-cost alternatives.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 2.8 Bn |

|

CAGR (2024 - 2031) |

11.8% |

|

The revenue forecast in 2031 |

US$ 6.8 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Merck & Co., Pfizer Inc., GlaxoSmithKline plc, Novartis AG, Bayer AG, Allergan plc, Melinta Therapeutics, Achaogen, Inc., Tetraphase Pharmaceuticals, Iterum Therapeutics plc |

Market Drivers:

Rising Prevalence of Antimicrobial Resistance

The increasing prevalence of antimicrobial resistance is a significant driver for the growth of the Complicated Urinary Tract Infections (cUTI) market. As more and more bacteria develop resistance to commonly used antibiotics, the treatment of cUTIs becomes increasingly challenging. This resistance can arise due to various factors, such as the overuse and misuse of antibiotics, inadequate infection control practices, and the spread of resistant strains. As a result, there is a growing need for novel antibiotics and alternative therapies that can effectively combat multidrug-resistant pathogens responsible for cUTIs. This demand is driving research and development efforts in the pharmaceutical industry, fueling the growth of the cUTI market.

Increasing Incidence of Hospital-Acquired Infections

Hospital-acquired infections, including catheter-associated urinary tract infections (CAUTIs), are a significant driver for the cUTI market. Patients in healthcare settings are often more susceptible to infections due to their underlying medical conditions, compromised immune systems, and the use of invasive medical devices such as indwelling catheters. CAUTIs are a common type of hospital-acquired infection and can be particularly challenging to treat when caused by multidrug-resistant pathogens. The increasing incidence of hospital-acquired infections, coupled with the rising concern over antimicrobial resistance, is driving the demand for effective treatment options and contributing to the growth of the cUTI market.

Growing Aging Population and Prevalence of Chronic Diseases

The aging population is more susceptible to cUTIs due to age-related physiological changes, weakened immune systems, and the presence of comorbidities such as diabetes or urinary incontinence. Additionally, the increasing prevalence of chronic diseases like diabetes, which can impair the body's ability to fight infections, is also contributing to the rise in cUTI cases. As the geriatric population and the incidence of chronic diseases continue to grow, the demand for effective treatments for cUTIs is expected to increase, driving the market growth.

Advancements in Diagnostic Technologies

Advancements in diagnostic technologies play a crucial role in driving the growth of the cUTI market. Rapid and accurate identification of causative pathogens and their antimicrobial resistance profiles is essential for providing targeted and effective treatment. The development of molecular-based assays, next-generation sequencing, and other advanced diagnostic tools is enabling earlier and more precise diagnosis of cUTIs, leading to improved patient outcomes and potentially reducing the burden on healthcare systems. As these diagnostic technologies continue to evolve, they are expected to drive the demand for targeted therapies and contribute to the growth of the cUTI market.

Market Opportunities:

Development of Novel Antibiotics

The rise of antimicrobial resistance has created a significant opportunity for the development of novel antibiotics with unique mechanisms of action against multidrug-resistant pathogens. As existing antibiotics become less effective, there is a pressing need for new therapeutic options that can overcome resistance mechanisms and provide effective treatment for cUTIs. Pharmaceutical companies and research institutions are actively exploring various strategies, such as modifying existing antibiotic classes, developing synthetic antibiotics, or investigating alternative approaches like antimicrobial peptides or phage therapy. The successful development of novel antibiotics with potent activity against resistant pathogens could open up new market avenues and drive the growth of the cUTI market.

Combination Therapy Approaches

Combination therapy, which involves the use of multiple antibiotics or the combination of antibiotics with non-antibiotic agents, presents an opportunity to combat antimicrobial resistance in cUTIs. By combining agents with different mechanisms of action, combination therapy can increase the potency and effectiveness of treatment while reducing the risk of resistance development. This approach has shown promise in overcoming resistance mechanisms and enhancing treatment outcomes. As research continues to explore effective combination strategies, this opportunity could lead to the development of innovative treatment regimens and contribute to the growth of the cUTI market.

Targeted Antimicrobial Delivery Systems

The development of targeted antimicrobial delivery systems presents an opportunity to improve the efficacy and safety of cUTI treatments. These delivery systems aim to enhance the concentration of antibiotics at the site of infection while minimizing systemic exposure and potential side effects. Techniques such as liposomal encapsulation, nanoparticle-based delivery, or site-specific release mechanisms can potentially increase the bioavailability and targeted delivery of antibiotics to the urinary tract. By improving treatment outcomes and reducing potential adverse effects, targeted antimicrobial delivery systems could open new avenues for innovation and drive the growth of the cUTI market.

Personalized Medicine Approaches

The advent of personalized medicine approaches presents an opportunity to tailor cUTI treatments based on individual patient characteristics and the specific causative pathogen. By integrating genomic and molecular profiling technologies, healthcare providers can identify the most effective treatment regimen for each patient, reducing the risk of resistance development and improving treatment outcomes. Additionally, the development of companion diagnostics can facilitate the selection of appropriate therapies based on the pathogen's resistance profile. As personalized medicine approaches continue to evolve, they could contribute to the growth of the cUTI market by enabling more targeted and effective treatment strategies.

Market Trends:

Increasing Focus on Antimicrobial Stewardship Programs

There is a growing trend towards implementing antimicrobial stewardship programs in healthcare settings to combat the rise of antimicrobial resistance. These programs aim to promote the appropriate use of antibiotics by optimizing their selection, dosing, and duration of therapy, while minimizing unnecessary or inappropriate use. Antimicrobial stewardship programs have been shown to reduce the incidence of cUTIs caused by multidrug-resistant pathogens, improve patient outcomes, and potentially reduce healthcare costs. As healthcare institutions prioritize these programs, it is driving the demand for effective diagnostic tools and targeted therapies to support appropriate antimicrobial use in the treatment of cUTIs.

Shift Towards Alternative Therapies

With the increasing challenge of antimicrobial resistance, there is a growing trend towards exploring alternative therapies for the treatment of cUTIs. These alternative approaches include bacteriophage therapy, which utilizes viruses that specifically target and kill bacteria; antimicrobial peptides, which are naturally occurring molecules with antimicrobial properties; and other non-antibiotic strategies. As the limitations of traditional antibiotics become more apparent, the search for novel and innovative treatment options is gaining momentum. This trend is driving research and development efforts in the cUTI market, with the potential to introduce new therapeutic modalities in the future.

Emphasis on Rapid Diagnostic Testing

The trend towards rapid diagnostic testing is gaining importance in the cUTI market. Timely and accurate identification of causative pathogens and their resistance profiles is crucial for initiating appropriate treatment and improving patient outcomes. Rapid diagnostic tests, such as molecular-based assays and point-of-care testing, are becoming increasingly adopted in healthcare settings to facilitate prompt diagnosis and guide antibiotic selection. This trend is driven by the need to reduce the time to effective treatment and minimize the risk of resistance development. As rapid diagnostic testing becomes more widespread, it is expected to drive the demand for targeted therapies and contribute to the growth of the cUTI market.

Increasing Collaboration and Partnerships

The complexity of addressing antimicrobial resistance and developing effective treatments for cUTIs has led to an increasing trend of collaboration and partnerships within the industry. Pharmaceutical companies, biotechnology firms, academic institutions, and government agencies are forming strategic alliances to pool resources, share expertise, and accelerate the development of novel therapies and diagnostic tools. These collaborations aim to leverage complementary strengths, share the financial burden of research and development, and expedite the translation of innovative solutions into clinical practice. This trend is expected to drive innovation and contribute to the growth of the cUTI market.

Market Restraints:

Stringent Regulatory Requirements

The development and commercialization of new antibiotics and therapies for cUTIs are subject to stringent regulatory requirements, which can act as a significant restraint for the market growth. The regulatory approval process for new antimicrobial agents is rigorous, involving extensive clinical trials and data submissions to demonstrate safety and efficacy. These stringent regulatory requirements can prolong the development timeline, increase costs, and create barriers for companies, particularly smaller players or those with limited resources.

High Cost of Research and Development

The research and development of novel antibiotics and therapies for cUTIs is a costly and resource-intensive endeavor. The process of drug discovery, preclinical testing, and clinical trials requires significant financial investment and a long development timeline. Additionally, the rising complexity of antimicrobial resistance and the need for innovative approaches further increase the costs associated with developing effective treatments. This high cost of research and development can be a significant restraint, particularly for smaller companies or those with limited funding resources, potentially hindering the introduction of new therapies in the market.

Challenges in Addressing Antimicrobial Resistance

The growing problem of antimicrobial resistance poses a significant challenge for the cUTI market. As more and more bacteria develop resistance to existing antibiotics, it becomes increasingly difficult to find effective treatment options. The emergence of multidrug-resistant pathogens, such as extended-spectrum beta-lactamase (ESBL)-producing Enterobacteriaceae and carbapenem-resistant Enterobacteriaceae (CRE), has made the treatment of cUTIs even more challenging. Overcoming these resistance mechanisms requires innovative approaches and the development of novel therapeutic strategies, which can be a restraint for the market growth due to the complexity and resources required.

Recent Developments:

|

Development |

Involved Company |

|

FDA approved Vabomere (meropenem and vaborbactam) in August 2022 for complicated urinary tract infections, including pyelonephritis. |

Melinta Therapeutics |

|

FDA approved Recarbrio (imipenem/cilastatin/relebactam) in July 2022 for complicated urinary tract infections. |

Merck & Co. |

|

Announced positive Phase 3 results for novel antibiotic cefiderocol for cUTI in December 2021. |

Shionogi & Co. |

|

Product Launch |

Company Name |

|

Launched Fetroja (cefiderocol) for cUTI in November 2021, after FDA approval. |

Shionogi & Co. |

|

Launched Zemdri (plazomicin) for cUTI in July 2020, after FDA approval. |

Achaogen, Inc. |

|

Launched Vabomere (meropenem and vaborbactam) for cUTI in September 2019, after FDA approval. |

Melinta Therapeutics |

|

Merger/Acquisition |

Involved Companies |

|

Acquired Achaogen, Inc. in July 2019, gaining rights to Zemdri (plazomicin) for cUTI. |

Cipla Limited |

|

Acquired Melinta Therapeutics in January 2023, gaining rights to Vabomere (meropenem and vaborbactam) for cUTI. |

Solara Active Pharma |

|

Acquired Zavante Therapeutics in July 2018, gaining rights to ZAVEN-CF, a novel cephalosporin for cUTI. |

Nabriva Therapeutics |

Market Regional Insights:

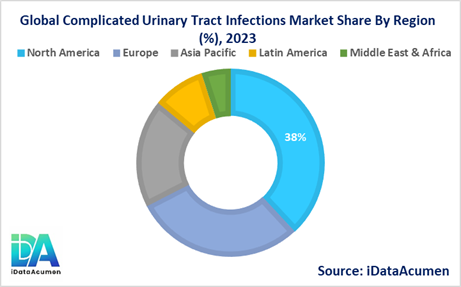

The Complicated Urinary Tract Infections Market is expected to witness significant growth across various regions due to the increasing prevalence of antimicrobial resistance and the rising demand for effective treatments.

- North America is expected to be the largest market for the Complicated Urinary Tract Infections Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of well-established healthcare infrastructure, increasing adoption of advanced diagnostic tools, and the rising prevalence of comorbidities such as diabetes and obesity, which are risk factors for cUTIs.

- Europe is expected to be the second-largest market for the Complicated Urinary Tract Infections Market, accounting for over 29.5% of the market share in 2024. The growth of the market is attributed to the increasing geriatric population, which is more susceptible to cUTIs, and the availability of advanced healthcare facilities.

- The Asia Pacific market is expected to be the fastest-growing market for the Complicated Urinary Tract Infections Market, with a CAGR of over 18.7% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the improving healthcare infrastructure, rising awareness about antimicrobial resistance, and the growing prevalence of chronic diseases such as diabetes, which increase the risk of cUTIs.

Market Segmentation:

- By Infection Type

- Complicated Pyelonephritis

- Complicated Lower UTI

- Catheter-associated UTI

- Others (Urologic Procedure-associated UTI, Renal Transplant-associated UTI)

- By Pathogen Type

- Escherichia coli

- Klebsiella pneumoniae

- Pseudomonas aeruginosa

- Enterobacter spp.

- Proteus spp.

- Acinetobacter baumannii

- Others (Enterococcus spp., Staphylococcus spp.)

- By Drug Class

- Aminoglycosides

- Cephalosporins

- Carbapenems

- Fluoroquinolones

- Others (Polymyxins, Tetracyclines)

- By Route of Administration

- Intravenous

- Oral

- Others (Intramuscular, Topical)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Clinics, Medical Stores)

- By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others (Long-term Care Facilities, Home Healthcare)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segmentation Analysis:

- By Infection Type: The catheter-associated UTI segment is projected to grow at a higher CAGR in regions like North America and Europe due to the increasing number of hospitalized patients and the use of indwelling catheters. This segment is expected to be the largest in terms of market size in 2024.

- By Pathogen Type: The Escherichia coli segment is likely to remain the largest segment in 2024, as it is the most common causative pathogen for cUTIs. However, the Klebsiella pneumoniae and Pseudomonas aeruginosa segments may witness higher growth rates due to the increasing prevalence of multidrug-resistant strains.

- By Drug Class: The cephalosporins and carbapenems segments are expected to grow at a higher CAGR in regions like North America and Europe, driven by the demand for effective treatments against multidrug-resistant pathogens. The fluoroquinolones segment may face slower growth due to concerns over resistance.

- By Route of Administration: The intravenous segment is projected to be the largest and fastest-growing segment in 2024, as it is the preferred route for the treatment of severe cUTIs, particularly in hospital settings.

- By Distribution Channel: The hospital pharmacies segment is expected to remain the largest and fastest-growing segment in 2024, as most cUTI treatments are administered in hospital settings.

- By End User: The hospitals segment is likely to be the largest and fastest-growing segment in 2024, driven by the increasing prevalence of hospital-acquired cUTIs and the need for effective treatments in inpatient settings.

Top companies in the Complicated Urinary Tract Infections Market:

- Merck & Co.

- Pfizer Inc.

- GlaxoSmithKline plc

- Novartis AG

- Bayer AG

- Allergan plc

- Melinta Therapeutics

- Achaogen, Inc.

- Tetraphase Pharmaceuticals

- Iterum Therapeutics plc