Market Analysis:

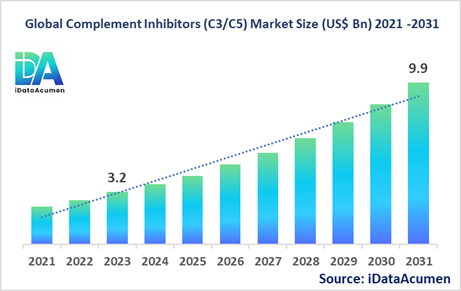

The Complement Inhibitors (C3/C5) Market had an estimated market size worth US$ 3.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 9.9 billion by 2031, growing at a CAGR of 15.2% from 2024 to 2031.

Complement inhibitors are a class of drugs that target specific components of the complement system, such as C3 and C5, to regulate excessive activation and inflammation. These drugs are used to treat various complement-mediated diseases like paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), myasthenia gravis, neuromyelitis optica spectrum disorder (NMOSD), and others. The advantages of complement inhibitors include their ability to effectively control inflammation, prevent tissue damage, and improve patient outcomes in these debilitating disorders. Key drivers of the market include the increasing prevalence of complement-mediated diseases, unmet medical needs for effective treatments, and a favorable regulatory environment for novel therapies.

The Complement Inhibitors (C3/C5) Market is segmented by product type, route of administration, indication, mechanism of action, distribution channel, and region. By product type, the market is segmented into C3 inhibitors, C5 inhibitors, C5a inhibitors, and others (C3a inhibitors, C5b inhibitors, etc.). The C5 inhibitors segment is expected to witness significant growth due to the increasing adoption of approved therapies like Soliris (eculizumab) and Ultomiris (ravulizumab) for the treatment of PNH and aHUS.

Epidemiological Insights:

- The disease burden of complement-mediated disorders varies across major regions. For instance, the prevalence of PNH is higher in North America and Europe compared to other regions, while aHUS has a more uniform global distribution.

- Key epidemiological trends include an increasing awareness and early diagnosis of these disorders, as well as improvements in diagnostic techniques like genetic testing and biomarker analysis, driving the identification of more cases.

- In the United States, the estimated prevalence of PNH is around 1-1.5 cases per million individuals, while the incidence of aHUS ranges from 0.2 to 2 cases per million population. In Europe, the prevalence of PNH is estimated to be around 1.3 cases per million.

- As the patient population for these rare diseases continues to be identified and diagnosed, there are growth opportunities for complement inhibitors to address the unmet medical needs.

- Most complement-mediated disorders, such as PNH, aHUS, and NMOSD, are considered rare diseases, with a low prevalence but a significant burden on patients and healthcare systems.

Market Landscape:

- There are significant unmet needs in the complement inhibitors market, as many complement-mediated diseases still lack effective and safe treatment options.

- Current approved treatment options for PNH and aHUS include Soliris (eculizumab) and Ultomiris (ravulizumab), both developed by Alexion Pharmaceuticals (now part of AstraZeneca). However, these treatments have limitations, such as the need for frequent intravenous infusions and high costs.

- Several pharmaceutical companies are developing next-generation complement inhibitors with improved efficacy, safety, and dosing regimens. For example, Apellis Pharmaceuticals is developing pegcetacoplan, an investigational C3 inhibitor, for the treatment of PNH, aHUS, and other complement-mediated diseases.

- Gene therapy and RNA-based approaches are emerging as potential breakthrough treatment options, aiming to provide long-lasting and targeted modulation of the complement system.

- The market composition is currently dominated by a few branded drug manufacturers, such as Alexion Pharmaceuticals (AstraZeneca), Apellis Pharmaceuticals, and Novartis AG. However, with the anticipated entry of biosimilars and generic alternatives, the market dynamics may shift in the coming years.

Market Report Scope:

| Key Insights |

Description |

|

The market size in 2023 |

US$ 3.2 Bn |

|

CAGR (2024 - 2031) |

15.2% |

|

The revenue forecast in 2031 |

US$ 9.9 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Alexion Pharmaceuticals (AstraZeneca), Apellis Pharmaceuticals, Novartis AG, Chugai Pharmaceutical Co., Ltd., Omeros Corporation, Regeneron Pharmaceuticals, Shire (Takeda Pharmaceutical Company Limited), Genentech (Roche), Amyndas Pharmaceuticals, Akari Therapeutics, Achillion Pharmaceuticals, Bio-Thera Solutions, Biocryst Pharmaceuticals, Gemini Therapeutics, Catalyst Biosciences, Morphic Therapeutic, Pieris Pharmaceuticals, Viela Bio (Horizon Therapeutics), Alnylam Pharmaceuticals, Visterra (Subsidiary of Otsuka Pharmaceutical Co., Ltd.) |

Market Drivers:

Increasing Prevalence of Complement-Mediated Diseases

The growing prevalence of complement-mediated diseases, such as paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), myasthenia gravis, and neuromyelitis optica spectrum disorder (NMOSD), is driving the demand for complement inhibitors. These rare and debilitating conditions have a significant impact on patients' quality of life and represent a substantial unmet medical need. With increasing awareness and improved diagnostic techniques, more cases are being identified, fueling the need for effective treatment options. Furthermore, the rising incidence of age-related macular degeneration (AMD) and other complement-mediated disorders in aging populations is also contributing to the market growth.

Favorable Regulatory Environment and Orphan Drug Designations

Regulatory authorities have recognized the importance of addressing rare and life-threatening diseases, leading to a favorable environment for the development and approval of complement inhibitors. Many of these drugs have received Orphan Drug Designations, which provide various incentives to pharmaceutical companies, such as tax credits, fee waivers, and extended market exclusivity periods. This supportive regulatory landscape has encouraged investment in research and development, facilitating the introduction of novel therapies to the market.

Expanding Indications and Label Expansions

Existing complement inhibitors are being explored for additional indications beyond their initial approvals, expanding their potential market reach. For instance, Soliris (eculizumab) and Ultomiris (ravulizumab), initially approved for PNH and aHUS, have recently gained approval for the treatment of generalized myasthenia gravis and neuromyelitis optica spectrum disorder (NMOSD), respectively. This expansion of approved indications allows these drugs to target a broader patient population, driving market growth.

Strategic Partnerships and Collaborations

Pharmaceutical companies are actively engaging in strategic partnerships and collaborations to accelerate the development and commercialization of complement inhibitors. These collaborations leverage the expertise and resources of multiple organizations, enabling more efficient research and development efforts, as well as global market access strategies. Such partnerships not only facilitate the introduction of new therapies but also help in expanding the reach of existing treatments to underserved regions.

Market Opportunities:

Development of Next-Generation Complement Inhibitors

The development of next-generation complement inhibitors with improved efficacy, safety, and dosing regimens presents a significant opportunity for market growth. Researchers are exploring novel mechanisms of action, alternative routes of administration (such as subcutaneous or oral formulations), and targeted therapies to address the limitations of current treatments. These advancements have the potential to offer better patient outcomes, improved adherence, and expanded therapeutic applications, driving market adoption and revenue growth.

Personalized Medicine and Companion Diagnostics

The integration of personalized medicine and companion diagnostics into the development of complement inhibitors holds promise for optimizing treatment outcomes. By identifying biomarkers or genetic markers associated with disease progression or response to therapy, healthcare providers can tailor treatment plans for individual patients. This precision medicine approach not only improves efficacy but also reduces the risk of adverse events, ultimately enhancing patient care and driving market adoption.

Emergence of Biosimilars and Generic Alternatives

As patents for existing complement inhibitors expire, the market is expected to witness the entry of biosimilars and generic alternatives. These lower-cost versions of branded drugs can increase accessibility and affordability for patients, particularly in regions with limited healthcare resources. Additionally, the availability of biosimilars may foster competition and drive innovation in the development of more cost-effective treatment options, further expanding market reach.

Untapped Potential in Emerging Markets

Emerging markets, such as those in Asia-Pacific, Latin America, and certain regions of Africa, represent significant untapped potential for the complement inhibitors market. As healthcare infrastructures continue to improve and awareness of rare diseases increases, there will be a growing demand for these therapies. Pharmaceutical companies that establish early presence and strategic partnerships in these markets can gain a competitive advantage and capitalize on the expanding patient populations.

Market Trends:

Combination Therapies and Synergistic Approaches

There is an emerging trend towards exploring combination therapies and synergistic approaches in the treatment of complement-mediated diseases. By combining complement inhibitors with other therapeutic modalities, such as immunosuppressants or targeted therapies, researchers aim to achieve enhanced efficacy and potentially address resistance mechanisms. This holistic approach has the potential to improve patient outcomes and drive market growth as more effective treatment regimens become available.

Focus on Rare and Orphan Diseases

The complement inhibitors market is closely tied to the growing interest and investment in addressing rare and orphan diseases. Pharmaceutical companies are recognizing the significant unmet medical needs and the potential for market growth in these niche areas. This trend is driving research and development efforts, as well as collaborations with patient advocacy groups and regulatory agencies, to facilitate the development and approval of novel therapies for rare complement-mediated disorders.

Advancements in Diagnostic Technologies

Improvements in diagnostic technologies, such as genetic testing and biomarker analysis, are contributing to the early and accurate identification of complement-mediated diseases. This trend is enabling healthcare professionals to initiate appropriate treatment interventions promptly, leading to better patient outcomes. As diagnostic capabilities continue to evolve, more patients are likely to be diagnosed and treated, driving the demand for complement inhibitors.

Patient-Centric Approaches and Improved Patient Support

Pharmaceutical companies are increasingly adopting patient-centric approaches and providing enhanced patient support services to improve treatment adherence and overall patient experience. These initiatives include patient education programs, disease awareness campaigns, and personalized support services. By addressing patient needs holistically, companies aim to build stronger relationships with patients and caregivers, ultimately driving market growth and patient retention.

Market Restraints:

High Costs and Reimbursement Challenges

One of the major restraints for the complement inhibitors market is the high cost of these therapies, which can be a significant financial burden for patients and healthcare systems. The complex manufacturing processes and specialized formulations contribute to the elevated prices. Additionally, reimbursement policies and coverage decisions can vary across regions, limiting access to these treatments for some patient populations, particularly in resource-constrained settings.

Stringent Regulatory Requirements and Clinical Trial Challenges

The development of complement inhibitors is subject to stringent regulatory requirements and clinical trial challenges. Demonstrating safety and efficacy in rare disease populations can be complex due to factors such as small patient pools, heterogeneous disease manifestations, and limited understanding of disease pathways. Furthermore, regulatory agencies have rigorous standards for approving therapies targeting rare and life-threatening conditions, which can prolong the development timelines and increase costs.

Potential Side Effects and Safety Concerns

While complement inhibitors offer therapeutic benefits, there are potential side effects and safety concerns associated with their use. These drugs can increase the risk of serious infections due to their immunosuppressive effects, and some patients may experience adverse reactions or develop resistance over time. Ongoing monitoring and management of these risks are crucial, which can add to the overall treatment burden and potentially impact patient adherence and market adoption.

Recent Developments:

|

Development |

Involved Company |

|

FDA approved Ultomiris (ravulizumab) in October 2022 for the treatment of generalized myasthenia gravis in adults. |

Alexion Pharmaceuticals (AstraZeneca) |

|

FDA granted Orphan Drug Designation to APL-1011 in June 2022 for the treatment of paroxysmal nocturnal hemoglobinuria (PNH). |

Apellis Pharmaceuticals |

|

FDA approved Soliris (eculizumab) in June 2021 for the treatment of neuromyelitis optica spectrum disorder (NMOSD). |

Alexion Pharmaceuticals (AstraZeneca) |

|

Product Launch |

Company Name |

|

Launched Ultomiris (ravulizumab) in January 2023 for the treatment of atypical hemolytic uremic syndrome (aHUS) in adults. |

Alexion Pharmaceuticals (AstraZeneca) |

|

Launched Empaveli (pegcetacoplan) in May 2022 for the treatment of paroxysmal nocturnal hemoglobinuria (PNH). |

Apellis Pharmaceuticals |

|

Launched Uplizna (inebilizumab) in June 2020 for the treatment of neuromyelitis optica spectrum disorder (NMOSD). |

Horizon Therapeutics |

|

Merger/Acquisition |

Involved Companies |

|

Acquired Alexion Pharmaceuticals in July 2021 for $39 billion, gaining access to its complement inhibitor portfolio. |

AstraZeneca |

|

Acquired Viela Bio in March 2021 for $3.1 billion, adding Uplizna (inebilizumab) for NMOSD to its portfolio. |

Horizon Therapeutics |

|

Acquired Ra Pharmaceuticals in April 2020 for $2.1 billion, gaining access to its complement inhibitor pipeline. |

UCB |

Market Regional Insights:

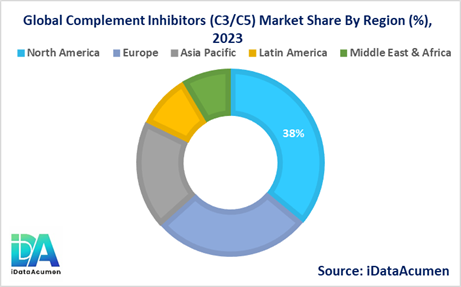

The Complement Inhibitors (C3/C5) Market is segmented across various regions, including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- North America is expected to be the largest market for the Complement Inhibitors (C3/C5) Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of key players, a well-established healthcare infrastructure, and a high adoption rate of innovative therapies.

- Europe is expected to be the second-largest market for the Complement Inhibitors (C3/C5) Market, accounting for over 29.1% of the market share in 2024. The growth of the market is attributed to the increasing prevalence of complement-mediated diseases, favorable reimbursement policies, and a strong focus on research and development activities.

- The Asia Pacific market is expected to be the fastest-growing market for the Complement Inhibitors (C3/C5) Market, with a CAGR of over 19.9% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the increasing healthcare expenditure, improving healthcare infrastructure, and rising awareness about rare diseases.

Market Segmentation:

- By Product Type

- C3 Inhibitors

- C5 Inhibitors

- C5a Inhibitors

- C3a Inhibitors

- C5b Inhibitors

- By Route of Administration

- Intravenous

- Subcutaneous

- Oral

- Intravitreal

- Intrathecal

- Inhalation

- Others (Topical, Transdermal, etc.)

- By Indication

- Paroxysmal Nocturnal Hemoglobinuria (PNH)

- Atypical Hemolytic Uremic Syndrome (aHUS)

- Myasthenia Gravis

- Neuromyelitis Optica Spectrum Disorder (NMOSD)

- Age-related Macular Degeneration (AMD)

- Lupus Nephritis

- Others (Glomerulonephritis, Antineutrophil Cytoplasmic Antibody-Associated Vasculitis, etc.)

- By Mechanism of Action

- Terminal Complement Inhibitors

- Upstream Complement Inhibitors

- Lectin Pathway Inhibitors

- Alternative Pathway Inhibitors

- Anaphylatoxin Inhibitors

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Specialty Pharmacies

- Mail-order Pharmacies

- By End-User

- Hospitals

- Clinics

- Homecare Settings

- Research Institutes

- Academic Organizations

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Segment Analysis:

To analyze the segments provided in Task 6, we will focus on three key segments: By Product Type, By Indication, and By Region.

- By Product Type:

- The C5 Inhibitors segment is projected to experience significant growth across all regions, driven by the increasing adoption of approved therapies like Soliris (eculizumab) and Ultomiris (ravulizumab) for PNH and aHUS.

- In North America and Europe, the C5 Inhibitors segment is expected to maintain its leading position, with a CAGR of around 12-15% during the forecast period.

- The C3 Inhibitors segment is anticipated to witness the highest growth, particularly in the Asia Pacific region, with a CAGR of around 20-25%, owing to the increasing investment in research and development of novel therapies.

- By Indication:

- The Paroxysmal Nocturnal Hemoglobinuria (PNH) segment is likely to remain the largest segment in 2024, driven by the high prevalence of the disease and the availability of approved treatments.

- The Atypical Hemolytic Uremic Syndrome (aHUS) segment is expected to be the second-largest segment in 2024, with a CAGR of around 15-18% in North America and Europe.

- The Neuromyelitis Optica Spectrum Disorder (NMOSD) segment is projected to experience the highest growth, with a CAGR of around 20-25% in the Asia Pacific region, due to increasing awareness and improving diagnostic capabilities.

- By Region:

- North America is expected to remain the largest market for Complement Inhibitors (C3/C5) in 2024, accounting for around 38% of the global market share.

- Europe is anticipated to be the second-largest market, with a CAGR of around 12-15% during the forecast period.

- The Asia Pacific region is projected to be the fastest-growing market, with a CAGR of around 18-22%, driven by factors such as increasing healthcare expenditure, improving infrastructure, and rising awareness about rare diseases.

Top Companies in the Complement Inhibitors (C3/C5) Market:

- Alexion Pharmaceuticals (AstraZeneca)

- Apellis Pharmaceuticals

- Novartis AG

- Chugai Pharmaceutical Co., Ltd.

- Omeros Corporation

- Regeneron Pharmaceuticals

- Shire (Takeda Pharmaceutical Company Limited)

- Genentech (Roche)

- Amyndas Pharmaceuticals

- Akari Therapeutics

- Achillion Pharmaceuticals

- Bio-Thera Solutions

- Biocryst Pharmaceuticals

- Gemini Therapeutics

- Catalyst Biosciences

- Morphic Therapeutic

- Pieris Pharmaceuticals

- Viela Bio (Horizon Therapeutics)

- Alnylam Pharmaceuticals

- Visterra (Subsidiary of Otsuka Pharmaceutical Co., Ltd.)