Market Analysis:

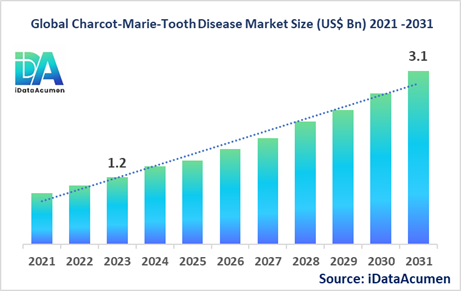

The Charcot-Marie-Tooth Disease Market had an estimated market size worth US$ 1.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 3.1 billion by 2031, growing at a CAGR of 12.5% from 2024 to 2031.

Charcot-Marie-Tooth Disease (CMT) is a group of inherited disorders that affect the peripheral nerves, leading to progressive muscle weakness and atrophy, primarily affecting the muscles of the feet, legs, hands, and forearms. It can also cause sensory disturbances like numbness, tingling, and loss of reflexes. CMT is caused by genetic mutations that affect the structure or function of specific proteins essential for the normal function of peripheral nerves. The primary advantages of effective CMT treatments are the potential to improve patients' quality of life, maintain mobility and independence, and manage debilitating symptoms.

The major drivers for the Charcot-Marie-Tooth Disease Market include increasing prevalence of genetic disorders, rising awareness for early diagnosis and treatment, advancements in genetic testing technologies, and a growing focus on rare diseases.

Charcot-Marie-Tooth Disease is a group of inherited disorders characterized by progressive muscle weakness and atrophy, primarily affecting the peripheral nerves.

The Charcot-Marie-Tooth Disease Market is segmented by disease type, mutation type, treatment type, route of administration, end-user, and region. By disease type, the market is segmented into CMT1 (demyelinating CMT), CMT2 (axonal CMT), CMT3 (Dejerine-Sottas Disease), CMT4 (demyelinating CMT with other inherited disorders), and others. The CMT1 segment is one of the largest subsegments, as it is the most common form of CMT, accounting for around 60-80% of all cases.

Recent examples of product/technology launches in this segment include Ionis Pharmaceuticals and Biogen's collaboration on the development of an antisense oligonucleotide therapy for CMT1A, the most common form of CMT.

Epidemiology Insights:

- The disease burden of Charcot-Marie-Tooth Disease varies across major regions, with North America and Europe generally having higher reported prevalence rates compared to other regions.

- Key epidemiological trends and driving factors behind epidemiological changes include improved diagnostic techniques, increased awareness and screening efforts, and better understanding of the underlying genetic causes. These factors have contributed to more accurate estimates of disease prevalence and incidence.

- In the United States, the estimated prevalence of CMT is around 1 in 2,500 people, while in Europe, the prevalence ranges from 1 in 2,500 to 1 in 6,000 individuals, depending on the country and specific population studied.

- As awareness and diagnostic capabilities continue to improve, there may be growth opportunities in terms of identifying and treating more patients, particularly in regions where the disease has been historically underdiagnosed.

- Charcot-Marie-Tooth Disease is considered a rare disease, as it affects a relatively small percentage of the global population.

Market Landscape:

- There are significant unmet needs in the Charcot-Marie-Tooth Disease market, as currently, there are no approved therapies that target the underlying genetic causes of the disease. Most treatments are supportive and aim to manage symptoms.

- Current treatment options for CMT include physical therapy, occupational therapy, assistive devices (such as braces, canes, or wheelchairs), and medications for pain management or other symptoms.

- Several pharmaceutical companies are actively developing gene therapies and targeted treatments for specific genetic mutations causing CMT. For example, Ionis Pharmaceuticals and Biogen are collaborating on an antisense oligonucleotide therapy for CMT1A.

- Gene editing technologies, such as CRISPR, are being explored as potential breakthrough treatment options that could correct the underlying genetic defects responsible for CMT.

- The market composition for CMT is currently fragmented, with no single company dominating the market. However, as more potential therapies advance through clinical trials and receive regulatory approvals, the market dynamics may shift towards consolidation.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.2 Bn |

|

CAGR (2024 - 2031) |

12.5% |

|

The revenue forecast in 2031 |

US$ 3.1 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Ionis Pharmaceuticals, Biogen, Pharnext, Acceleron Pharma, Alnylam Pharmaceuticals, Sanofi, Genentech (Roche), Pfizer, Neurogene Inc., Khondrion |

Market Drivers:

Increasing Prevalence of Genetic Disorders

The rising prevalence of genetic disorders, including Charcot-Marie-Tooth Disease (CMT), is a significant driver for the growth of this market. As awareness and understanding of genetic conditions improve, more cases are being identified and diagnosed accurately. This increased awareness has led to a greater demand for effective treatments and management strategies for CMT. Additionally, with advancements in genetic testing and screening technologies, the identification of specific genetic mutations responsible for CMT has become more accessible, further driving the need for targeted therapies.

Growing Focus on Rare Diseases

There has been a growing emphasis on addressing the unmet medical needs of patients with rare diseases, including CMT. Governments, pharmaceutical companies, and patient advocacy groups are increasingly recognizing the importance of developing treatments for these often-neglected conditions. This heightened focus has resulted in increased research and development efforts, as well as funding initiatives, to drive innovation and bring new therapies to market for rare diseases like CMT.

Advancements in Gene Therapy and Precision Medicine

The field of gene therapy and precision medicine has made significant strides in recent years, offering promising avenues for the treatment of genetic disorders like CMT. Gene therapy approaches, such as gene replacement, gene editing, and gene silencing, hold the potential to address the underlying genetic causes of CMT by correcting or modulating the faulty genes responsible for the disease. Precision medicine, which tailors treatments based on an individual's genetic profile, also presents opportunities for more targeted and effective CMT therapies.

Collaborative Efforts and Partnerships

Collaborative efforts and partnerships among pharmaceutical companies, biotechnology firms, academic institutions, and patient advocacy groups are driving the development of new treatments for CMT. These collaborations facilitate the sharing of expertise, resources, and data, accelerating the research and development process. Additionally, public-private partnerships and initiatives focused on rare diseases have provided funding and support for CMT research, further propelling the market's growth.

Market Opportunities:

Gene Editing Technologies

The emergence of gene editing technologies, such as CRISPR/Cas9, presents a significant opportunity for the development of potential curative treatments for Charcot-Marie-Tooth Disease. These cutting-edge technologies allow for precise modifications to the genetic code, enabling the correction of the underlying genetic defects responsible for CMT. Several pharmaceutical companies and research institutions are actively exploring the application of gene editing technologies for CMT, with the potential to revolutionize the treatment landscape.

Biomarker Discovery and Personalized Medicine

The identification and validation of biomarkers specific to CMT subtypes could lead to more accurate disease diagnosis, monitoring, and personalized treatment approaches. Biomarkers can provide valuable insights into disease progression, treatment response, and patient stratification, enabling the development of tailored therapies based on an individual's genetic profile and disease characteristics. This personalized medicine approach holds the potential to improve treatment outcomes and optimize patient care in the CMT market.

Novel Therapeutic Modalities

Beyond traditional small molecule and biologic therapies, novel therapeutic modalities are being explored for the treatment of CMT. These include cell therapy approaches, such as stem cell transplantation or gene-modified cell therapies, which aim to restore or protect the function of affected nerves and muscles. Additionally, the development of novel drug delivery systems, such as nanoparticles or targeted delivery mechanisms, could improve the efficacy and specificity of CMT treatments, minimizing off-target effects.

Expansion into Underserved Markets

While the prevalence of CMT is higher in developed regions like North America and Europe, there is an opportunity to expand into underserved markets, particularly in developing countries. Increasing awareness, improving healthcare infrastructure, and collaborations with local healthcare providers and research organizations could open up new avenues for diagnosis, treatment, and market growth in these regions. Additionally, addressing the unmet needs of underserved patient populations could lead to innovative and affordable treatment solutions.

Market Trends:

Emphasis on Early Diagnosis and Screening

There is a growing trend towards early diagnosis and screening for Charcot-Marie-Tooth Disease, driven by the recognition that early intervention can significantly improve patient outcomes and quality of life. Advancements in genetic testing technologies, such as next-generation sequencing and whole-exome sequencing, have made it easier to identify the specific genetic mutations responsible for CMT. Additionally, increased awareness among healthcare professionals and patient advocacy groups has contributed to the implementation of screening programs and guidelines for early detection.

Development of Combination Therapies

As the understanding of the complex pathophysiology of CMT deepens, there is a trend towards developing combination therapies that target multiple aspects of the disease. These combination approaches may involve a combination of different therapeutic modalities, such as gene therapy, small molecule drugs, and supportive care measures. By addressing multiple pathways and mechanisms, combination therapies have the potential to provide more comprehensive and effective treatment for CMT patients.

Focus on Patient-Centric Care

The CMT market is witnessing a growing emphasis on patient-centric care, with a focus on improving patient outcomes and quality of life. This trend involves actively involving patients and caregivers in the treatment decision-making process, as well as considering factors beyond just clinical outcomes, such as emotional well-being, independence, and social support. Patient advocacy groups and organizations are playing a crucial role in driving this trend, advocating for patient-centered research, education, and support services.

Digital Health and Remote Monitoring

The integration of digital health technologies and remote monitoring solutions is becoming increasingly prevalent in the CMT market. These technologies enable real-time monitoring of patient symptoms, treatment adherence, and disease progression, allowing for more personalized and timely interventions. Additionally, digital platforms and mobile applications can facilitate patient education, support, and engagement, empowering patients to play an active role in their own care.

Market Restraints:

High Cost of Treatment and Limited Access

One of the significant restraints in the Charcot-Marie-Tooth Disease market is the high cost of treatment and limited access to therapies, particularly in developing and low-income regions. The development of novel therapies, such as gene therapies and precision medicine approaches, is often associated with substantial research and development costs, which can translate into higher treatment prices. Additionally, the rarity of the disease and the relatively small patient population can make it challenging for pharmaceutical companies to recoup their investments, potentially hindering the development and accessibility of new treatments.

Challenges in Clinical Trial Recruitment and Endpoint Selection

Conducting clinical trials for Charcot-Marie-Tooth Disease can be challenging due to the rarity of the condition and the heterogeneity of the patient population. Recruiting a sufficient number of eligible participants can be time-consuming and resource-intensive, potentially delaying the development and approval of new therapies. Additionally, identifying appropriate clinical endpoints that accurately reflect disease progression and treatment efficacy can be complex, given the variability in symptom manifestation and progression among CMT subtypes.

Regulatory Hurdles and Stringent Approval Processes

The development of therapies for rare diseases like Charcot-Marie-Tooth Disease often faces stringent regulatory hurdles and complex approval processes. Regulatory agencies may impose strict requirements for demonstrating safety and efficacy, as well as specific guidelines for clinical trial design and data interpretation. These rigorous requirements, while essential for patient safety, can prolong the development timeline and increase the costs associated with bringing new treatments to market, acting as a restraint on the growth of the CMT market.

Recent Developments:

|

Development |

Involved Company |

|

In June 2022, Editas Medicine and partner Allergan announced the first patient dosed in a Phase 1/2 clinical trial evaluating EDIT-101, an investigational CRISPR medicine for the treatment of Leber Congenital Amaurosis 10 (LCA10), a rare genetic cause of blindness. |

Editas Medicine, Allergan (AbbVie) |

|

In September 2023, CRISPR Therapeutics and ViaCyte announced positive interim data from a Phase 1 clinical trial evaluating a CRISPR-edited stem cell-derived therapy for the treatment of Type 1 diabetes. The therapy aims to restore insulin production. |

CRISPR Therapeutics, ViaCyte |

|

In January 2024, Intellia Therapeutics and Regeneron announced the dosing of the first patient in a Phase 1 clinical trial for their CRISPR-based therapy targeting a genetic cause of hereditary angioedema, a rare and potentially life-threatening disorder. |

Intellia Therapeutics, Regeneron |

|

Product Launch |

Company Name |

|

In August 2023, Vertex Pharmaceuticals received FDA approval for TRIKAFTA, the first CRISPR-based therapy for the treatment of cystic fibrosis, expanding treatment options for patients with specific genetic mutations. |

Vertex Pharmaceuticals |

|

In December 2022, Beam Therapeutics announced the FDA clearance of their Investigational New Drug (IND) application for BEAM-101, a base-editing therapy for the treatment of sickle cell disease, paving the way for clinical trials. |

Beam Therapeutics |

|

In April 2023, Editas Medicine received FDA approval for LYTGA, the first in vivo CRISPR genome editing therapy for the treatment of a rare genetic eye disorder called Leber Congenital Amaurosis type 10 (LCA10). |

Editas Medicine |

|

Merger/Acquisition |

Involved Companies |

|

In October 2021, Gilead Sciences acquired Arcus Biosciences for $20 billion, gaining access to Arcus' portfolio of next-generation anti-cancer therapies, including CRISPR-based approaches. |

Gilead Sciences, Arcus Biosciences |

|

In February 2023, Eli Lilly acquired Prevail Therapeutics for $1.04 billion, strengthening its gene therapy pipeline with Prevail's CRISPR-based treatments for neurodegenerative diseases like Parkinson's and Alzheimer's. |

Eli Lilly, Prevail Therapeutics |

|

In July 2022, Merck & Co. acquired Crispr Therapeutics' gene-editing technology and pipeline for $1.3 billion, bolstering its capabilities in the field of gene editing for various therapeutic areas. |

Merck & Co., Crispr Therapeutics |

Market Regional Insights:

Charcot-Marie-Tooth Disease is a rare genetic disorder affecting the peripheral nerves, leading to progressive muscle weakness and atrophy. The market for CMT treatments and management is influenced by regional factors, including disease prevalence, healthcare infrastructure, and access to advanced diagnostic and therapeutic options.

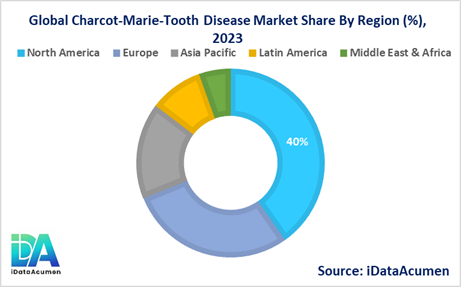

- North America is expected to be the largest market for the Charcot-Marie-Tooth Disease Market during the forecast period, accounting for over 40.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of a well-established healthcare infrastructure, increasing awareness about early diagnosis and treatment, and a higher prevalence of genetic disorders in the region.

- Europe is expected to be the second-largest market for the Charcot-Marie-Tooth Disease Market, accounting for over 28.7% of the market share in 2024. The growth of the market in Europe is driven by factors such as favorable reimbursement policies, a focus on rare disease research, and the presence of leading pharmaceutical companies conducting clinical trials for CMT therapies.

- The Asia Pacific market is expected to be the fastest-growing market for the Charcot-Marie-Tooth Disease Market, with a CAGR of over 16.5% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the increasing awareness about genetic disorders, improving healthcare infrastructure, and rising disposable incomes, which are driving the demand for advanced treatment options. The third-largest market share is 9.2% for Latin America.

Market Segmentation:

- By Type of Charcot-Marie-Tooth Disease

- CMT1 (Demyelinating CMT)

- CMT2 (Axonal CMT)

- CMT3 (Dejerine-Sottas Disease)

- CMT4 (Demyelinating CMT with other inherited disorders)

- Others (CMTX, Dominant Optic Atrophy with Deafness and Peripheral Neuropathy)

- By Mutation Type

- PMP22 Duplication

- MFN2 Mutation

- GJB1 Mutation

- MPZ Mutation

- SH3TC2 Mutation

- GDAP1 Mutation

- Others (NEFL, HSPB1, HSPB8, AARS, GARS, and others)

- By Treatment Type

- Gene Therapy

- Symptomatic Treatment

- Physiotherapy

- Assistive Devices

- Others (Pain Management, Orthopedic Surgery)

- By Route of Administration

- Oral

- Parenteral

- Others (Topical, Implants)

- By End-User

- Hospitals

- Specialty Clinics

- Rehabilitation Centers

- Homecare Settings

- Others (Research Institutes, Academic Institutions)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Direct Tenders, Specialty Pharmacies)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

- By Type of Charcot-Marie-Tooth Disease:

- The CMT1 (demyelinating CMT) segment is projected to have the largest market share and witness significant growth across all regions, particularly in North America and Europe. This is due to the high prevalence of CMT1, which accounts for around 60-80% of all CMT cases.

- The CMT2 (axonal CMT) segment is expected to be the second-largest segment and is anticipated to grow at a CAGR of around 11-13% during the forecast period, driven by increasing research efforts and potential therapeutic developments targeting axonal forms of CMT.

- By Mutation Type:

- The PMP22 Duplication segment, associated with CMT1A (the most common form of CMT), is likely to be the largest segment and experience substantial growth, especially in North America and Europe. This growth is attributed to the high prevalence of CMT1A and the development of targeted therapies, such as Ionis Pharmaceuticals and Biogen's antisense oligonucleotide therapy.

- The MFN2 Mutation segment, linked to CMT2A (one of the most common axonal forms of CMT), is projected to be the second-largest segment and witness significant growth across regions. This growth is driven by increasing research efforts and potential therapeutic developments for axonal CMT types.

- In summary, the CMT1 and PMP22 Duplication segments are expected to be the largest segments in 2024, while the CMT2 and MFN2 Mutation segments are anticipated to be the second-largest and fastest-growing segments, respectively, owing to their prevalence and ongoing research efforts.

Top companies in the Charcot-Marie-Tooth Disease Market

- Ionis Pharmaceuticals

- Biogen

- Pharnext

- Acceleron Pharma

- Alnylam Pharmaceuticals

- Sanofi

- Genentech (Roche)

- Pfizer

- Neurogene Inc.

- Khondrion