A Comprehensive Analysis:

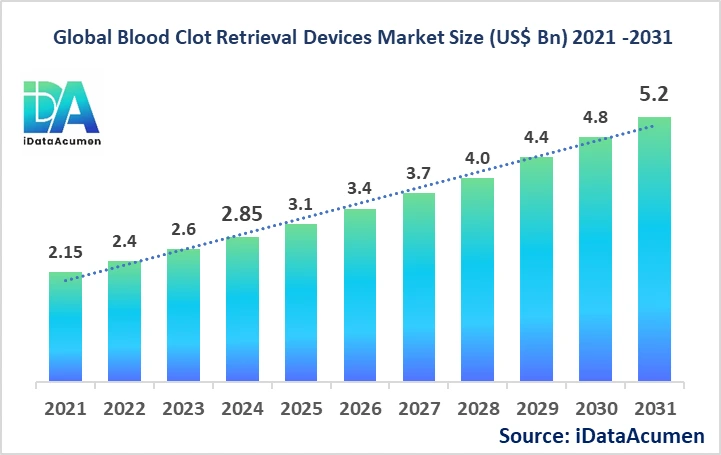

The Blood Clot Retrieval Devices Market has shown significant growth in recent years, with an estimated market size of US$ 2.85 billion in 2024. Industry experts project this market to reach a global valuation of US$ 5.2 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2031. This robust growth trajectory underscores the increasing importance and adoption of blood clot retrieval devices in modern healthcare.

Blood clot retrieval devices, also known as mechanical thrombectomy devices, are specialized medical tools designed to remove blood clots from blood vessels, particularly in cases of acute ischemic stroke. These devices are typically catheter-based and are inserted through a small incision, usually in the groin, and navigated through the blood vessels to the site of the clot. Once in position, the device either captures and removes the clot or breaks it up, restoring blood flow to the affected area. The primary advantage of these devices is their ability to quickly and effectively remove large clots that may not respond well to traditional clot-busting drugs, potentially reducing the risk of long-term disability or death in stroke patients.

The market's growth is primarily driven by the rising incidence of ischemic stroke worldwide, coupled with an aging global population more susceptible to such events. Additionally, advancements in device technology, increasing healthcare expenditure, and growing awareness of the benefits of mechanical thrombectomy are contributing to market expansion.

Blood clot retrieval devices represent a critical advancement in stroke treatment, offering hope for improved outcomes in cases where traditional therapies may fall short. These devices have revolutionized the management of large vessel occlusions, providing interventional neurologists and radiologists with powerful tools to combat one of the leading causes of disability and death globally.

The Blood Clot Retrieval Devices Market is segmented by device type, end-user, application, material, technique, distribution channel, patient age group, and region. By device type, the market is segmented into stent retrievers, aspiration catheters, combination devices, coil retrievers, and others. Among these, stent retrievers have emerged as a dominant subsegment, showing significant growth due to their high efficacy in clot removal and relatively lower risk of vessel damage compared to other device types. The success of stent retrievers in clinical trials and real-world settings has led to their widespread adoption, driving the growth of this subsegment.

In terms of recent product launches, Stryker Corporation introduced its Trevo NXT Stent Retriever in May 2023. This next-generation device features enhanced navigability and improved clot integration capabilities, potentially offering better outcomes for patients with challenging vascular anatomies. Such innovations continue to shape the competitive landscape and drive market growth.

Epidemiological Insights:

The epidemiology of conditions requiring blood clot retrieval devices, particularly ischemic stroke, varies across major regions but generally shows an increasing trend. In North America, the incidence of ischemic stroke remains high, with approximately 700,000 new cases reported annually in the United States alone. Europe faces a similar burden, with an estimated 1.1 million new stroke cases each year, of which about 85% are ischemic. The Asia-Pacific region, particularly countries like China and Japan, is experiencing a rising stroke incidence due to lifestyle changes and an aging population.

Key epidemiological trends driving changes across major markets such as the US, EU5 (France, Germany, Italy, Spain, UK), and Japan include:

- Aging populations: As the proportion of elderly individuals increases, so does the risk of stroke and other thrombotic events.

- Rising prevalence of risk factors: Hypertension, diabetes, obesity, and smoking continue to contribute to higher stroke rates.

- Improved detection and diagnosis: Advanced imaging techniques and increased awareness are leading to more accurate and timely diagnoses.

The latest information on disease incidence and prevalence in major markets indicates a steady increase. In the United States, the prevalence of stroke among adults is approximately 3%, translating to about 7 million individuals. In Europe, the prevalence varies by country but averages around 1.5% of the adult population. Japan reports a stroke prevalence of about 2.5% among adults.

Growth opportunities in the blood clot retrieval devices market are closely tied to the increasing patient population. As the number of individuals at risk for or experiencing ischemic stroke grows, so does the potential market for these devices. This trend is particularly pronounced in emerging economies where healthcare infrastructure is rapidly developing, and access to advanced stroke treatments is expanding.

While ischemic stroke is not considered a rare disease, certain subtypes of stroke and other conditions requiring blood clot retrieval (such as cerebral venous thrombosis) are less common. The ability of these devices to address both common and rarer thrombotic events enhances their market potential and clinical utility.

The evolving epidemiological landscape underscores the critical need for effective blood clot retrieval devices and highlights the potential for market growth as healthcare systems worldwide strive to address the increasing burden of stroke and related conditions.

Market Landscape:

The Blood Clot Retrieval Devices market landscape is characterized by ongoing innovation and a focus on addressing unmet needs in stroke treatment. Despite significant advancements, several unmet needs persist:

- Improved device navigability in complex vascular anatomies

- Reduction of procedure-related complications, such as vessel perforation or distal embolization

- Devices suitable for smaller, more distal vessels

- Enhanced clot retrieval efficiency to minimize the number of passes required

- Solutions for patients with contraindications to current treatments

Current treatment options and approved therapies include:

- Intravenous thrombolysis (tPA)

- Mechanical thrombectomy using stent retrievers

- Aspiration thrombectomy

- Combination approaches (stent retriever + aspiration)

- Antiplatelet and anticoagulant medications for secondary prevention

Upcoming therapies and technologies in development include:

- Neuroprotective agents to be used in conjunction with mechanical thrombectomy

- Advanced imaging techniques for better patient selection and outcome prediction

- Artificial intelligence-assisted triage and treatment planning systems

- Novel stent retriever designs with improved clot integration capabilities

- Expandable tip aspiration catheters for more efficient clot removal

Breakthrough treatment options currently being developed include:

- Magnetically-steerable microcatheters for improved navigation

- Biodegradable stent retrievers to reduce the risk of long-term complications

- Targeted drug delivery systems combined with mechanical thrombectomy

- Ultrasound-enhanced thrombolysis in combination with mechanical retrieval

- Endovascular cooling systems for neuroprotection during thrombectomy procedures

The market composition is primarily dominated by branded device manufacturers, with key players like Medtronic, Stryker, and Johnson & Johnson holding significant market share. While there is some presence of generic device manufacturers, particularly in aspiration catheters and accessory devices, the complexity and continuous innovation in stent retrievers and combination devices maintain a strong position for branded products. The high barriers to entry, including regulatory requirements and the need for extensive clinical evidence, contribute to the market's consolidation among established players.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 2.85 Bn |

|

CAGR (2024 - 2031) |

8.9% |

|

The revenue forecast in 2031 |

US$ 5.2 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Medtronic, Stryker Corporation, Penumbra Inc., Teleflex Incorporated, AngioDynamics, Terumo Corporation, Johnson & Johnson, Boston Scientific Corporation, Acandis GmbH, Balt Extrusion, Phenox GmbH, Neuravi Limited, Capture Vascular Inc., Vesalio, MIVI Neuroscience Inc. |

Market Drivers:

Rising Incidence of Ischemic Stroke

The increasing prevalence of ischemic stroke worldwide is a major driver propelling the growth of the blood clot retrieval devices market. Ischemic stroke, caused by a blood clot obstructing blood flow to the brain, accounts for approximately 87% of all stroke cases globally. This rising incidence has created an urgent need for effective treatment options, positioning blood clot retrieval devices as crucial tools in stroke management.

Recent epidemiological data underscores the magnitude of this driver. In the United States alone, someone experiences a stroke every 40 seconds, with ischemic strokes being the predominant type. The aging population and the growing prevalence of risk factors such as hypertension, diabetes, and obesity contribute to this trend. As the at-risk population expands, healthcare systems are increasingly adopting advanced blood clot retrieval technologies to improve patient outcomes.

The effectiveness of blood clot retrieval devices in treating ischemic stroke has been well-documented in clinical trials. Studies have shown that mechanical thrombectomy using these devices can significantly reduce disability and improve functional outcomes in eligible patients. This growing body of evidence has led to updates in stroke treatment guidelines, recommending the use of blood clot retrieval devices as a first-line treatment for certain types of ischemic strokes.

Furthermore, advancements in imaging technologies have enhanced the ability to identify suitable candidates for blood clot retrieval procedures. This has expanded the potential patient pool and driven the adoption of these devices in stroke centers worldwide. As awareness of the benefits of timely intervention with blood clot retrieval devices grows among healthcare providers and patients, the market continues to experience robust growth.

Technological Advancements in Device Design

Continuous innovation in blood clot retrieval device design is a significant driver fueling market expansion. Manufacturers are investing heavily in research and development to create more efficient, safer, and user-friendly devices. These technological advancements are enhancing the effectiveness of clot removal procedures and broadening the applicability of these devices across various patient populations.

One notable area of innovation is the development of stent retrievers with improved navigability and clot capture capabilities. These next-generation devices feature optimized designs that allow for easier access to distal vessels and more effective engagement with clots of varying compositions. For instance, some newer stent retrievers incorporate dual-layer technology, combining an inner nitinol scaffold with an outer nitinol mesh. This design enhances clot integration and reduces the risk of fragmentation during retrieval.

Another significant advancement is the introduction of aspiration catheters with larger internal diameters and improved trackability. These innovations enable faster and more complete clot removal, potentially reducing procedure times and improving outcomes. Some recently developed aspiration systems also feature advanced pump technologies that provide consistent suction power, enhancing the efficiency of clot extraction.

Furthermore, the integration of advanced materials in device construction has led to improved device performance and safety profiles. The use of shape-memory alloys and specialized coatings has resulted in devices with enhanced flexibility, radiopacity, and reduced friction. These improvements contribute to more precise navigation through tortuous vasculature and minimize the risk of vessel damage during procedures.

Expanding Indications for Blood Clot Retrieval Procedures

The broadening of indications for blood clot retrieval procedures is a crucial driver propelling market growth. Initially primarily used for acute ischemic stroke treatment within a limited time window, these devices are now finding applications in extended time frames and diverse clinical scenarios. This expansion of indications is significantly increasing the potential patient population that can benefit from blood clot retrieval interventions.

Recent clinical trials have demonstrated the efficacy of blood clot retrieval procedures in patients presenting beyond the traditional treatment window. For instance, studies have shown positive outcomes in select patients treated up to 24 hours after symptom onset, a significant extension from the previous 6-hour window. This expanded time frame has led to updated guidelines, allowing more patients to access these life-saving interventions.

Moreover, blood clot retrieval devices are increasingly being utilized in other vascular territories beyond the brain. Their application in treating pulmonary embolism, deep vein thrombosis, and peripheral arterial occlusions is gaining traction. This diversification of use cases is driving demand for specialized devices tailored to different anatomical locations and clot characteristics.

The growing adoption of these devices in comprehensive stroke centers and the establishment of specialized thrombectomy-capable stroke centers have also contributed to expanding indications. As more healthcare facilities develop the necessary infrastructure and expertise to perform these procedures, a larger patient population gains access to this treatment option, further driving market growth.

Increasing Healthcare Expenditure and Infrastructure Development

Rising healthcare expenditure and ongoing infrastructure development in both developed and emerging economies are significant drivers for the blood clot retrieval devices market. Governments and healthcare systems worldwide are investing in stroke care facilities, including the establishment of comprehensive stroke centers equipped with advanced imaging and interventional capabilities.

In developed countries, there is a focus on upgrading existing healthcare facilities to accommodate the latest blood clot retrieval technologies. This includes investments in hybrid operating rooms, advanced imaging systems, and specialized training programs for interventional neuroradiologists and stroke specialists. These initiatives are enhancing the capacity to perform complex endovascular procedures, driving the adoption of blood clot retrieval devices.

Emerging economies are also making substantial investments in healthcare infrastructure, recognizing the growing burden of stroke and other cardiovascular diseases. Countries in Asia, Latin America, and the Middle East are establishing new stroke centers and training programs to address the increasing demand for advanced stroke treatments. This expansion of healthcare infrastructure in these regions is creating new market opportunities for blood clot retrieval device manufacturers.

Furthermore, public and private insurance coverage for blood clot retrieval procedures is improving in many countries, making these treatments more accessible to a broader patient population. As reimbursement policies evolve to recognize the cost-effectiveness of these interventions in reducing long-term disability and healthcare costs, the market for blood clot retrieval devices continues to expand.

Market Opportunities:

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies presents a significant opportunity in the blood clot retrieval devices market. These advanced computational techniques have the potential to revolutionize various aspects of stroke care, from diagnosis to treatment planning and device optimization.

AI algorithms can be developed to analyze imaging data rapidly and accurately, helping to identify suitable candidates for blood clot retrieval procedures. This could lead to faster decision-making and reduced time to treatment, critical factors in improving outcomes for stroke patients. Machine learning models could also assist in predicting procedural success rates and potential complications, allowing for more personalized treatment approaches.

In device design, AI and ML could be leveraged to create "smart" blood clot retrieval devices that adapt to individual patient anatomy and clot characteristics. These technologies could enable real-time adjustments during procedures, optimizing clot engagement and retrieval while minimizing the risk of complications.

Furthermore, the application of AI in post-procedure analysis and patient monitoring could provide valuable insights for improving device performance and refining treatment protocols. This data-driven approach could lead to continuous improvements in device design and clinical outcomes, driving further market growth and innovation.

Expansion into Emerging Markets

The expansion of blood clot retrieval devices into emerging markets represents a substantial opportunity for market growth. As healthcare infrastructure and economic conditions improve in developing countries, there is an increasing demand for advanced medical technologies, including state-of-the-art stroke treatment options.

Countries in Asia, Africa, and Latin America are experiencing a rising incidence of stroke due to changing lifestyles and aging populations. However, many of these regions currently lack widespread access to advanced endovascular treatments. This gap in care presents a significant opportunity for blood clot retrieval device manufacturers to enter these markets and establish a strong presence.

Tailoring devices and treatment protocols to meet the specific needs and constraints of emerging markets could drive adoption. This might include developing more cost-effective devices or creating training programs to build local expertise in endovascular procedures. Collaborations with local healthcare providers and institutions could facilitate market entry and help overcome regulatory and cultural barriers.

Moreover, as awareness of the benefits of blood clot retrieval procedures grows in these regions, there is potential for rapid market expansion. Governments and healthcare systems in emerging economies are increasingly prioritizing stroke care, creating a favorable environment for the introduction of advanced treatment options.

Development of Combination Therapies

The development of combination therapies that integrate blood clot retrieval devices with other treatment modalities presents an exciting opportunity for market expansion. Combining mechanical thrombectomy with pharmacological treatments or other innovative approaches could enhance overall treatment efficacy and broaden the applicability of these devices.

One promising area is the combination of blood clot retrieval procedures with targeted drug delivery systems. Devices could be designed to not only remove clots but also deliver thrombolytic agents or neuroprotective drugs directly to the affected area. This approach could potentially improve outcomes, reduce systemic side effects, and extend the treatment window for certain patients.

Another avenue for combination therapy is the integration of blood clot retrieval devices with advanced imaging technologies. For instance, devices equipped with intravascular ultrasound or optical coherence tomography capabilities could provide real-time visualization of clot composition and vessel wall characteristics. This enhanced imaging could guide more precise and effective clot removal procedures.

Furthermore, exploring synergies between blood clot retrieval devices and emerging therapies such as stem cell treatments or gene therapies for stroke recovery could open new frontiers in stroke care. These combination approaches could address not only the acute phase of stroke but also contribute to long-term recovery and rehabilitation.

Miniaturization and Improved Navigation

The ongoing trend towards miniaturization and improved navigation capabilities in blood clot retrieval devices presents a significant opportunity for market growth. As device manufacturers continue to refine their technologies, there is potential to develop smaller, more maneuverable devices that can access previously unreachable areas of the vasculature.

Miniaturization of blood clot retrieval devices could enable treatment of occlusions in smaller, more distal vessels that are currently challenging to access. This advancement would expand the range of treatable stroke cases, potentially improving outcomes for patients with occlusions in branch vessels or perforators.

Improved navigation capabilities, such as enhanced flexibility and trackability, could reduce procedure times and minimize the risk of vessel damage during device deployment. This could lead to better safety profiles and potentially expand the use of these devices to a broader patient population, including those with more complex vascular anatomies.

Additionally, the development of devices with integrated sensing technologies could provide real-time feedback on clot composition, vessel wall interactions, and blood flow dynamics. This information could guide more precise and effective clot removal strategies, potentially improving procedural success rates and patient outcomes.

Market Trends:

Shift Towards Direct-to-Angiography Approach

A significant trend in the blood clot retrieval devices market is the growing adoption of a direct-to-angiography approach for certain stroke patients. This strategy involves bypassing initial CT imaging and proceeding directly to the angiography suite for evaluation and treatment. The trend is driven by the recognition that time is critical in stroke treatment, and reducing delays can significantly improve patient outcomes.

Recent studies have demonstrated the potential benefits of this approach in select patient populations. For instance, research has shown that for patients with a high likelihood of large vessel occlusion based on clinical assessment, direct transfer to an angiography-capable center can reduce time to treatment and improve functional outcomes.

This trend is influencing the design of blood clot retrieval devices, with manufacturers focusing on creating tools that are compatible with rapid deployment in an angiography setting. Devices that can be quickly prepared and easily navigated through the vasculature are gaining prominence.

Furthermore, this shift is driving changes in stroke center protocols and infrastructure. Many comprehensive stroke centers are optimizing their workflows to accommodate direct-to-angiography pathways, including staff training and reorganization of physical spaces to minimize transfer times between entry and the angiography suite.

Rise of Mobile Stroke Units

The increasing deployment of mobile stroke units (MSUs) is a notable trend impacting the blood clot retrieval devices market. These specialized ambulances, equipped with CT scanners and telemedicine capabilities, allow for on-site diagnosis and initiation of treatment for stroke patients. While MSUs primarily focus on administering intravenous thrombolysis, they are increasingly being viewed as a potential platform for early triage of patients suitable for mechanical thrombectomy.

Recent pilot studies have explored the feasibility of integrating blood clot retrieval device assessment into MSU protocols. These initiatives aim to identify candidates for mechanical thrombectomy at the pre-hospital stage, potentially reducing time to definitive treatment.

The trend towards MSU utilization is driving innovation in portable imaging technologies and telemedicine solutions that can interface with blood clot retrieval procedures. Device manufacturers are exploring ways to make their products more compatible with pre-hospital assessment and triage systems.

Moreover, the data collected from MSU deployments is contributing to a better understanding of stroke presentation and early treatment dynamics. This information is valuable for refining blood clot retrieval device designs and treatment protocols, potentially leading to more targeted and effective interventions.

Focus on First-Pass Effect

A growing trend in the blood clot retrieval devices market is the emphasis on achieving complete revascularization with a single pass of the device, known as the "first-pass effect." This approach aims to minimize procedural time, reduce the risk of complications, and improve patient outcomes.

Recent clinical studies have highlighted the benefits of achieving complete or near-complete revascularization on the first attempt. Patients who experience successful first-pass reperfusion tend to have better functional outcomes and lower rates of mortality compared to those requiring multiple passes.

This trend is driving innovation in device design, with manufacturers focusing on features that enhance first-pass success rates. New stent retriever designs with improved clot integration capabilities and aspiration catheters with optimized suction power are being developed to address this need.

Furthermore, there is an increasing focus on understanding the factors that contribute to first-pass success. Research into clot composition, occlusion location, and patient-specific vascular anatomy is informing more tailored approaches to device selection and deployment techniques.

Integration of Robotics and Remote Operation

The integration of robotics and remote operation capabilities is an emerging trend in the blood clot retrieval devices market. This technology has the potential to enhance precision, reduce radiation exposure for operators, and potentially enable treatment in underserved areas through telemedicine platforms.

Early studies exploring robotic-assisted mechanical thrombectomy have shown promising results in terms of technical feasibility and safety. These systems allow for fine control of catheter movements and device deployment, potentially improving navigation through complex vascular anatomies.

The trend towards robotics is also driving developments in haptic feedback technologies and advanced visualization systems. These innovations aim to provide operators with a more immersive and intuitive control experience, potentially enhancing procedural outcomes.

Moreover, the potential for remote operation of blood clot retrieval devices is gaining attention as a means to address the shortage of neurointerventional specialists in rural or underserved areas. While still in early stages, this concept could revolutionize access to advanced stroke care in regions with limited resources.

Market Restraints:

High Procedural Costs and Limited Reimbursement

A significant restraint in the blood clot retrieval devices market is the high cost associated with these procedures and the challenges related to reimbursement. The advanced nature of blood clot retrieval devices and the specialized skills required to perform mechanical thrombectomy contribute to the overall expense of the treatment.

In many healthcare systems, particularly in emerging markets, the cost of these procedures can be prohibitive for patients and healthcare providers alike. The devices themselves represent a substantial capital investment for hospitals, and the procedure requires a team of highly trained specialists, further adding to the overall cost.

Reimbursement policies for blood clot retrieval procedures vary widely across different countries and healthcare systems. In some regions, inadequate reimbursement rates can discourage hospitals from adopting these technologies or limit their use to only the most severe cases. This situation creates a barrier to widespread adoption and can result in inequitable access to this potentially life-saving treatment.

Furthermore, the complex nature of stroke care, which often involves multiple specialties and extended hospital stays, can complicate reimbursement processes. Some healthcare systems struggle to develop comprehensive reimbursement models that adequately cover the full spectrum of care required for stroke patients undergoing mechanical thrombectomy.

Limited Availability of Skilled Specialists

The shortage of skilled neurointerventional specialists capable of performing blood clot retrieval procedures represents a significant restraint on market growth. Mechanical thrombectomy is a complex procedure that requires extensive training and experience in endovascular techniques, as well as a deep understanding of neurovascular anatomy and stroke pathophysiology.

The limited number of specialists trained in these procedures can lead to long wait times for treatment, potentially impacting patient outcomes. This shortage is particularly acute in rural areas and developing countries, where access to specialized stroke care is often limited.

Training new specialists is a time-consuming process that requires significant investment in education and practical experience. Many healthcare systems struggle to establish and maintain comprehensive training programs for neurointerventional procedures, further exacerbating the shortage of qualified professionals.

Moreover, the high-stress nature of emergency stroke care and the demands of on-call schedules can lead to burnout among existing specialists, potentially reducing the available workforce. This situation creates challenges in maintaining adequate coverage for 24/7 stroke care services, which is essential for effective implementation of blood clot retrieval programs.

Technological Limitations and Procedural Risks

Despite significant advancements, blood clot retrieval devices still face technological limitations and are associated with certain procedural risks, which can act as a restraint on market growth. These factors can impact the widespread adoption of these devices and influence treatment decisions in certain patient populations.

One technological limitation is the challenge of accessing and treating clots in smaller, more distal blood vessels. Current devices may struggle to navigate through tortuous vasculature or may be too large for use in smaller vessels. This limitation can reduce the effectiveness of the procedure in certain anatomical locations and potentially exclude some patients from receiving this treatment.

Procedural risks associated with blood clot retrieval include the potential for vessel perforation, dissection, or rupture during device deployment or clot removal. There is also a risk of distal embolization, where fragments of the clot may break off and travel further downstream, potentially causing new areas of ischemia. These risks, while generally manageable, can lead to complications that impact patient outcomes and increase healthcare costs.

The effectiveness of blood clot retrieval procedures can also be limited by factors such as clot composition and location. Some types of clots may be more resistant to capture and removal, reducing the success rate of the procedure. Additionally, the time window for effective treatment remains a constraint, as the benefits of the procedure diminish with increasing time from symptom onset. This time sensitivity can limit the number of patients who can benefit from the treatment, particularly in areas with limited access to specialized stroke centers.

Recent Developments:

|

Development |

Company Name |

|

In June 2023, Medtronic received FDA clearance for its Solitaire X revascularization device, an advanced stent retriever designed to treat acute ischemic stroke. The device features improved trackability and clot engagement, potentially leading to better clinical outcomes. |

Medtronic |

|

Stryker launched its Trevo NXT Stent Retriever in May 2023, offering enhanced navigability and improved clot integration. This next-generation device aims to address challenges in complex vascular anatomies, expanding treatment options for a wider range of stroke patients. |

Stryker Corporation |

|

In April 2023, Penumbra introduced the RED 072 Reperfusion Catheter, an advanced aspiration device for stroke treatment. The catheter's larger lumen and optimized tracking profile aim to improve clot removal efficiency and reduce procedure time. |

Penumbra, Inc. |

|

Johnson & Johnson's Cerenovus division received FDA clearance for its EMBOTRAP III Revascularization Device in March 2023. This third-generation stent retriever features an innovative dual-layer design for improved clot retention and removal. |

Johnson & Johnson (Cerenovus) |

|

In January 2023, Rapid Medical announced the FDA clearance of its TIGERTRIEVER XL device, the first thrombectomy system designed specifically for large vessel occlusions in the intracranial ICA. This expanded the treatment options for complex stroke cases. |

Rapid Medical |

|

Medtronic launched its Reef HP Balloon Guide Catheter in November 2022, designed to work in conjunction with stent retrievers. The device offers improved support and flow control during thrombectomy procedures, potentially enhancing first-pass success rates. |

Medtronic |

|

In September 2022, Stryker received FDA clearance for its FlowGate2 Balloon Guide Catheter, featuring an optimized balloon design for improved vessel occlusion during thrombectomy. This development aims to enhance procedural efficiency and outcomes. |

Stryker Corporation |

|

Terumo Corporation acquired Quirem Medical B.V. in July 2022, expanding its interventional oncology portfolio. While not directly related to stroke care, this acquisition strengthens Terumo's position in the broader endovascular therapy market. |

Terumo Corporation |

|

In May 2022, Penumbra and Sixense Enterprises completed a merger, integrating Sixense's virtual reality technology into Penumbra's healthcare portfolio. This merger aims to enhance rehabilitation solutions for stroke patients, complementing Penumbra's acute care devices. |

Penumbra, Inc. and Sixense Enterprises |

Market Regional Insights:

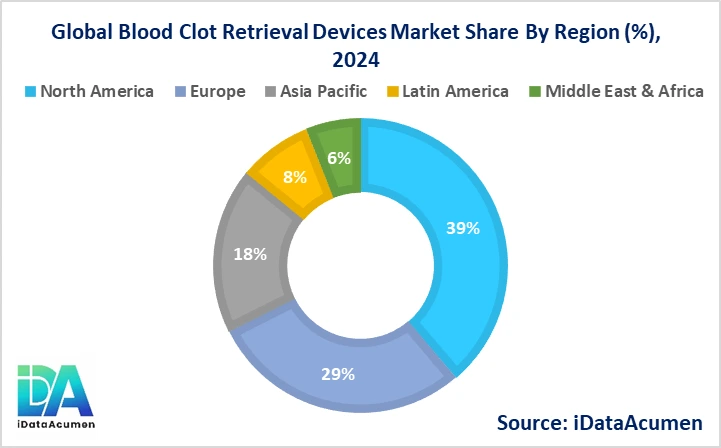

The global Blood Clot Retrieval Devices market exhibits varying growth patterns across different regions, influenced by factors such as healthcare infrastructure, stroke incidence rates, and regulatory landscapes. North America and Europe currently dominate the market, while the Asia-Pacific region is emerging as a high-growth area. The market's regional distribution reflects both the prevalence of stroke and the accessibility of advanced medical technologies in different parts of the world.

- North America is expected to be the largest market for Blood Clot Retrieval Devices during the forecast period, accounting for over 38.5% of the market share in 2024. The growth of the market in North America is attributed to the high incidence of stroke, well-established healthcare infrastructure, and favorable reimbursement policies. Additionally, the presence of key market players and ongoing research and development activities contribute to the region's market dominance.

- The European market is expected to be the second-largest market for Blood Clot Retrieval Devices, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the increasing adoption of mechanical thrombectomy as a standard of care for acute ischemic stroke, supported by positive clinical evidence and guidelines from professional medical societies.

- The Asia-Pacific market is expected to be the fastest-growing market for Blood Clot Retrieval Devices, with a CAGR of over 10.5% during the forecast period by 2024. The growth of the market in Asia-Pacific is attributed to the rapidly improving healthcare infrastructure, rising awareness about stroke treatment options, and the increasing prevalence of stroke in countries like China and Japan. This region also represents the third-largest share, accounting for approximately 18.2% of the global market.

Market Segmentation:

- By Device Type

- Stent Retrievers

- Aspiration Catheters

- Combination Devices

- Coil Retrievers

- Others (e.g., balloon guides, flow restoration devices)

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Academic and Research Institutes

- Others (e.g., emergency care centers)

- By Application

- Ischemic Stroke

- Coronary Embolism

- Peripheral Artery Embolism

- Others (e.g., pulmonary embolism, cerebral venous thrombosis)

- By Material

- Nitinol

- Platinum

- Stainless Steel

- Other Alloys

- Polymers

- By Technique

- Stentriever Thrombectomy

- Direct Aspiration

- Combined Approach

- Others (e.g., mechanical fragmentation, rheolytic thrombectomy)

- By Distribution Channel

- Direct Sales

- Distributors

- Online Channels

- Others (e.g., group purchasing organizations)

- By Patient Age Group

- Pediatric

- Adult (18-65 years)

- Geriatric (Above 65 years)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segmental Analysis:

- Device Type Segment:

- Stent Retrievers are expected to remain the largest subsegment, with a projected market share of around 45% in 2024 and a CAGR of 9.5% through 2031.

- Aspiration Catheters are anticipated to be the fastest-growing subsegment, with a CAGR of 10.2% from 2024 to 2031, driven by technological advancements and increasing adoption of the ADAPT technique.

- End User Segment:

- Hospitals are projected to be the largest subsegment, accounting for approximately 60% of the market share in 2024, growing at a CAGR of 8.7% through 2031.

- Ambulatory Surgical Centers are expected to show the highest growth rate, with a CAGR of 11.3% from 2024 to 2031, due to the increasing trend towards outpatient procedures and cost-effectiveness.

- Application Segment:

- Ischemic Stroke is forecasted to be the dominant subsegment, representing about 75% of the market share in 2024 and growing at a CAGR of 9.1% through 2031.

- Peripheral Artery Embolism is anticipated to be the fastest-growing subsegment, with a CAGR of 10.8% from 2024 to 2031, due to the expanding application of retrieval devices beyond cerebral vessels.

Regional growth projections for these segments:

- North America is expected to maintain its leadership across all segments, with the Stent Retrievers and Hospitals subsegments showing particularly strong growth in this region.

- The Asia-Pacific region is projected to exhibit the highest growth rates across most segments, especially in the Aspiration Catheters and Ambulatory Surgical Centers subsegments.

- Europe is anticipated to see significant growth in the Ischemic Stroke application subsegment, driven by increasing adoption of mechanical thrombectomy in stroke treatment protocols.

Top Companies in the Blood Clot Retrieval Devices Market:

- Medtronic plc

- Stryker Corporation

- Johnson & Johnson

- Penumbra, Inc.

- Terumo Corporation

- Boston Scientific Corporation

- Acandis GmbH

- Phenox GmbH

- Neuravi Limited (acquired by Johnson & Johnson)

- Rapid Medical

- Capture Vascular Inc.

- Anaconda Biomed S.L.

- MIVI Neuroscience Inc.

- Perflow Medical Ltd.

- Vesalio, LLC

- CERENOVUS (Johnson & Johnson)

- Imperative Care, Inc.

- Shape Memory Medical Inc.

- Balt Extrusion

- MicroVention, Inc. (Terumo Corporation)