Market Analysis:

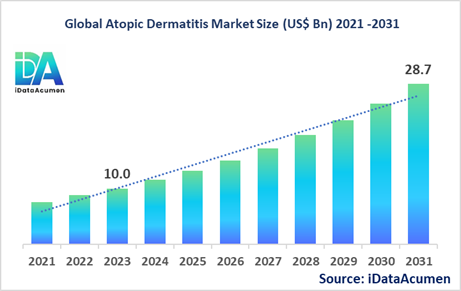

The Atopic Dermatitis Market had an estimated market size of USD 10.2 billion in 2023, and it is predicted to reach a global market valuation of USD 28.7 billion by 2031, growing at a CAGR of 13.8% from 2024 to 2031. Atopic dermatitis, also known as eczema, is a chronic inflammatory skin condition that causes dry, itchy, and inflamed skin. It is a type of skin disease that falls under the pharmaceutical industry. Atopic dermatitis occurs when the skin's protective barrier is compromised, allowing moisture to escape and irritants to penetrate. This leads to inflammation, itching, and redness. The condition is often associated with a family history of allergies or asthma. Treatment typically involves topical medications, systemic therapies, and lifestyle changes. The rising prevalence of atopic dermatitis, increasing awareness, and robust pipeline of new treatments are major drivers for this market.

Atopic dermatitis is a chronic inflammatory skin condition characterized by dry, itchy, and inflamed skin.

The Atopic Dermatitis Market is segmented by disease type, treatment type, route of administration, distribution channel, drug class, and end-user, and by region. By treatment type, the market is segmented into topical treatments, systemic treatments, phototherapy, biologics, and others. The topical treatments segment is expected to dominate the market due to its widespread use as first-line therapy and the availability of various formulations like creams, ointments, and lotions.

Recent product launches in the market include Opzelura (ruxolitinib cream) by Incyte Corporation in July 2022 for the treatment of atopic dermatitis, which offers a novel targeted therapy option.

Epidemiology Insights:

- The disease burden of atopic dermatitis is significant across major regions, with a higher prevalence in developed countries like the United States, Canada, and Western European nations.

- Key epidemiological trends and driving factors behind the increasing prevalence include urbanization, pollution, changing lifestyles, and rising awareness and diagnosis rates.

- In the United States, atopic dermatitis affects around 31.6 million people, including up to 25% of children. In Europe, the prevalence ranges from 10% to 20% in children and 1% to 3% in adults.

- The increasing patient population, particularly in emerging markets, presents growth opportunities for developing targeted therapies and improving access to treatment.

- Atopic dermatitis is not considered a rare disease, but its chronic nature and potential for severe cases create a significant burden on healthcare systems and patient quality of life.

Market Landscape:

- There are significant unmet needs in the atopic dermatitis market, particularly for safe and effective long-term treatment options, targeted therapies for severe cases, and improved patient adherence.

- Current treatment options include topical corticosteroids, calcineurin inhibitors, systemic immunosuppressants, and biologic therapies like Dupixent (dupilumab), Cibinqo (abrocitinib), and Rinvoq (upadacitinib).

- Upcoming therapies and technologies for atopic dermatitis treatment include new biologic drugs targeting specific cytokines and immune pathways, JAK inhibitors, and innovative drug delivery systems for improved efficacy and patient compliance.

- Breakthrough treatment options currently in development include gene therapies, stem cell therapies, and precision medicine approaches targeting the underlying genetic and immunological causes of atopic dermatitis.

- The market composition is diverse, with a mix of branded and generic drug manufacturers, as well as emerging biotech companies focusing on innovative therapies.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 10.2 Bn |

|

CAGR (2024 - 2031) |

13.8% |

|

The revenue forecast in 2031 |

US$ 28.7 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Sanofi, Regeneron Pharmaceuticals, Pfizer, AbbVie, Eli Lilly and Company, Novartis, LEO Pharma, Bausch Health Companies, Galderma, Mayne Pharma, Mylan, GlaxoSmithKline, Bayer, Almirall, Astellas Pharma, Anaptys Bio, Incyte Corporation, BioVersys, Sienna Biopharmaceuticals, Arcutis Biotherapeutics |

Market Drivers:

Rising Prevalence of Atopic Dermatitis

The increasing prevalence of atopic dermatitis, particularly in developed countries, is a significant driver for the growth of the atopic dermatitis market. According to the National Eczema Association, atopic dermatitis affects around 31.6 million people in the United States, including up to 25% of children. This high disease burden has led to a growing demand for effective treatment options. Additionally, factors such as urbanization, pollution, and changing lifestyles are contributing to the rising prevalence, further fueling the need for innovative therapies.

Increasing Awareness and Early Diagnosis

Awareness campaigns and educational initiatives by healthcare organizations and patient advocacy groups have played a crucial role in driving the atopic dermatitis market. These efforts have helped raise awareness about the condition, its symptoms, and the importance of early diagnosis and treatment. As more individuals become aware of atopic dermatitis, the demand for effective therapies is expected to increase, driving market growth.

Robust Pipeline of New Treatments

Pharmaceutical companies are actively investing in research and development to bring new and innovative treatments to the market. The pipeline for atopic dermatitis therapies is robust, with several promising candidates in various stages of clinical development. These include biologic drugs targeting specific immune pathways, JAK inhibitors, and novel drug delivery systems. The introduction of these new treatments is expected to drive market growth by providing more effective and targeted therapeutic options.

Advancements in Diagnostic and Treatment Monitoring Tools

Advancements in diagnostic tools, such as biomarker testing and skin imaging techniques, are helping in early detection and personalized treatment of atopic dermatitis. Additionally, improvements in treatment monitoring tools, such as patient-reported outcome measures and wearable devices, are enabling better management and adherence to therapy. These advancements are expected to drive market growth by improving patient outcomes and increasing the demand for effective treatments.

Market Opportunities:

Personalized Medicine and Targeted Therapies

The atopic dermatitis market presents a significant opportunity for the development of personalized medicine and targeted therapies. As our understanding of the underlying genetic and immunological factors contributing to atopic dermatitis deepens, there is potential for the development of therapies tailored to individual patients' genetic profiles and disease mechanisms. This could lead to more effective and precise treatment options, improving patient outcomes and driving market growth.

Expansion into Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, represent a significant opportunity for the atopic dermatitis market. As these regions undergo economic development and improvements in healthcare infrastructure, the demand for effective atopic dermatitis treatments is expected to rise. Companies that can strategically enter and establish a presence in these markets have the potential to capture a substantial market share and drive growth.

Development of Novel Drug Delivery Systems

The atopic dermatitis market presents opportunities for the development of novel drug delivery systems that could improve treatment effectiveness and patient compliance. These could include innovative topical formulations, transdermal patches, and long-acting injectable formulations. By addressing challenges such as treatment adherence and improving bioavailability, these delivery systems could provide a competitive advantage and drive market growth.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations between pharmaceutical companies, biotechnology firms, and academic institutions present opportunities for accelerating research and development in the atopic dermatitis market. By combining expertise, resources, and complementary technologies, these collaborations could lead to the development of innovative therapies, expedited clinical trials, and improved market access strategies, ultimately driving market growth.

Market Trends:

Emergence of Biologic Therapies

The atopic dermatitis market is witnessing a significant trend towards the development and adoption of biologic therapies. These innovative treatments target specific immune pathways and cytokines involved in the pathogenesis of atopic dermatitis, offering more targeted and effective treatment options. Biologic drugs like Dupixent (dupilumab) have already gained approval and shown promising results in clinical trials, driving market growth and setting the stage for further advancements in this area.

Focus on Patient-Centric Approaches

There is a growing trend towards patient-centric approaches in the atopic dermatitis market. Pharmaceutical companies are increasingly focusing on developing treatments that not only address the clinical aspects of the disease but also improve patients' quality of life. This includes efforts to improve treatment adherence, minimize side effects, and address the psychosocial impact of atopic dermatitis. By prioritizing patient-reported outcomes and incorporating patient perspectives, companies can better meet the needs of individuals with atopic dermatitis and drive market growth.

Digital Health and Remote Monitoring

The integration of digital health technologies and remote monitoring solutions is emerging as a trend in the atopic dermatitis market. These technologies enable patients to track their symptoms, monitor treatment progress, and share data with healthcare providers in real-time. Additionally, telehealth services and virtual consultations are becoming more prevalent, improving access to care and facilitating better disease management. This trend towards digitalization and remote monitoring is expected to drive market growth by enhancing treatment outcomes and patient engagement.

Increasing Focus on Combination Therapies

There is a growing trend towards exploring combination therapies for the treatment of atopic dermatitis. By combining different therapeutic modalities, such as topical treatments, systemic therapies, and biologic agents, healthcare providers aim to achieve synergistic effects and improve treatment outcomes. This approach not only addresses the multi-faceted nature of atopic dermatitis but also has the potential to enhance efficacy and reduce side effects. The increasing focus on combination therapies is expected to drive market growth by providing more comprehensive and tailored treatment options.

Market Restraints:

High Treatment Costs

One of the significant restraints for the atopic dermatitis market is the high cost of treatment, particularly for biologic therapies and novel targeted therapies. These advanced treatments often come with substantial price tags, making them inaccessible to many patients, especially in regions with limited healthcare resources or inadequate insurance coverage. The high treatment costs can pose a significant barrier to market growth, as patients may opt for more affordable but less effective options or forego treatment altogether.

Stringent Regulatory Approvals

The atopic dermatitis market is subject to stringent regulatory approvals for new therapies, which can be a significant restraint on market growth. Regulatory bodies, such as the Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have rigorous standards for safety, efficacy, and quality control. The lengthy and complex approval processes can delay the introduction of new treatments to the market, hindering innovation and limiting patient access to potentially promising therapies.

Side Effects and Safety Concerns

While advancements in atopic dermatitis treatments have led to more effective therapies, there are still concerns regarding potential side effects and safety issues associated with some medications. For example, some systemic treatments and biologic agents may have an increased risk of infections, malignancies, or other adverse events. These safety concerns can impact patient adherence and limit the widespread adoption of certain therapies, thereby restraining market growth.

Recent Developments:

|

Development |

Involved Company |

|

Opzelura (ruxolitinib) cream received FDA approval in July 2022 for the treatment of atopic dermatitis, offering a novel targeted therapy. |

Incyte Corporation |

|

Pfizer's Cibinqo (abrocitinib) received FDA approval in January 2022 for moderate-to-severe atopic dermatitis, providing a new oral option. |

Pfizer |

|

Dupixent (dupilumab) received FDA approval in June 2022 for children as young as 6 months with atopic dermatitis, expanding its patient base. |

Sanofi and Regeneron |

|

Product Launch |

Company Name |

|

Rinvoq (upadacitinib) received FDA approval in January 2022 for atopic dermatitis, offering an oral JAK inhibitor treatment option. |

AbbVie |

|

Adbry (tralokinumab) was approved in the EU in June 2021 for moderate-to-severe atopic dermatitis, providing a new biologic option. |

LEO Pharma |

|

Olumiant (baricitinib) received FDA approval in June 2022 for atopic dermatitis, offering another oral JAK inhibitor option. |

Eli Lilly and Company |

|

Merger/Acquisition |

Involved Companies |

|

Pfizer acquired Anacor Pharmaceuticals in June 2016 for $5.2 billion, gaining access to its atopic dermatitis pipeline. |

Pfizer and Anacor Pharmaceuticals |

|

Sanofi and Regeneron expanded their partnership in January 2022 to develop new treatments for atopic dermatitis and other diseases. |

Sanofi and Regeneron |

|

AbbVie acquired Allergan in May 2020 for $63 billion, gaining access to its atopic dermatitis pipeline and products. |

AbbVie and Allergan |

Market Regional Insights:

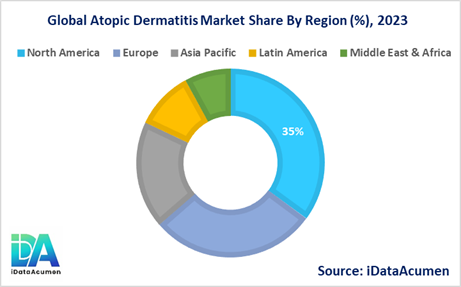

The atopic dermatitis market is characterized by regional variations in prevalence, treatment patterns, and market dynamics. North America and Europe are currently the leading markets, while Asia-Pacific is expected to witness significant growth due to increasing awareness, economic development, and healthcare infrastructure improvements.

- North America is expected to be the largest market for the Atopic Dermatitis Market during the forecast period, accounting for over 35.2% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of atopic dermatitis, advanced healthcare infrastructure, and the presence of major pharmaceutical companies.

- Europe is expected to be the second-largest market for the Atopic Dermatitis Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the increasing awareness, adoption of innovative therapies, and favorable reimbursement policies in several European countries.

- The Asia-Pacific market is expected to be the fastest-growing market for the Atopic Dermatitis Market, with a CAGR of over 18.5% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the rising prevalence of atopic dermatitis, improving healthcare infrastructure, and increasing disposable incomes, driving the demand for effective treatments.

Market Segmentation:

- By Disease Type

- Atopic Dermatitis

- Contact Dermatitis

- Seborrheic Dermatitis

- Neurodermatitis

- Nummular Dermatitis

- By Treatment Type

- Topical Treatments

- Systemic Treatments

- Phototherapy

- Biologics

- Others (Complementary and Alternative Therapies)

- Immunosuppressants

- Others (Antihistamines, Emollients)

- By Route of Administration

- Oral

- Parenteral

- Topical

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Direct Tenders, Mail Order)

- By Drug Class

- Corticosteroids

- Calcineurin Inhibitors

- Immunomodulators

- Interleukin Inhibitors

- JAK Inhibitors

- By End User

- Hospitals

- Specialty Clinics

- Homecare Settings

- Others (Research Institutes, etc.)

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

The topical treatments segment is expected to remain the largest segment in the atopic dermatitis market during the forecast period, driven by its widespread use as first-line therapy and the availability of various formulations like creams, ointments, and lotions. This segment is projected to grow at a CAGR of around 10-12% during the forecast period, with a market size of approximately USD 8 billion in 2024.

The biologics segment is anticipated to be the fastest-growing segment, with a CAGR of 15-18% during the forecast period. This growth is attributed to the increasing adoption of biologic therapies like Dupixent (dupilumab) and the development of novel biologic agents targeting specific immune pathways. The biologics segment is expected to reach a market size of around USD 5 billion in 2024.

In terms of regional growth, the Asia-Pacific market is expected to witness the highest CAGR of around 20% for the atopic dermatitis market during the forecast period, driven by factors such as increasing awareness, economic development, and improving healthcare infrastructure. The topical treatments and biologics segments are likely to experience significant growth in this region.

Top companies in the Atopic Dermatitis Market

- Sanofi

- Regeneron Pharmaceuticals

- Pfizer

- AbbVie

- Eli Lilly and Company

- Novartis

- LEO Pharma

- Bausch Health Companies

- Galderma

- Mayne Pharma

- Mylan

- GlaxoSmithKline

- Bayer

- Almirall

- Astellas Pharma

- Anaptys Bio

- Incyte Corporation

- BioVersys

- Sienna Biopharmaceuticals

- Arcutis Biotherapeutics