Market Analysis:

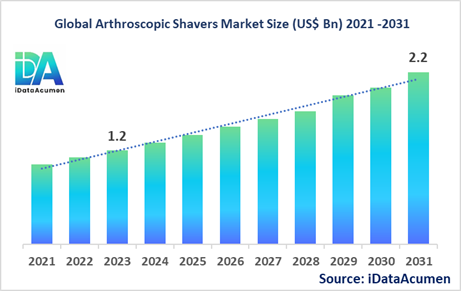

The Arthroscopic Shavers Market had an estimated market size worth US$ 1.2 billion in 2023, and it is predicted to reach a global market valuation of US$ 2.2 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031.

Arthroscopic shavers are surgical instruments used in minimally invasive arthroscopic procedures to remove or debride (smooth) damaged cartilage, bone, or soft tissue within joints such as the knee, shoulder, hip, and ankle. These devices offer advantages like smaller incisions, reduced pain, faster recovery times, and improved visualization compared to traditional open surgeries. Key drivers for the market include the rising prevalence of orthopedic disorders, increasing sports-related injuries, and the growing adoption of minimally invasive surgical techniques.

Arthroscopic shavers are specialized surgical devices designed to facilitate precise tissue removal and provide improved access within the joint during arthroscopic procedures.

The Arthroscopic Shavers Market is segmented by product type, application, end-user, technology, and region. By product type, the market is segmented into shaver handpieces, shaver blades, shaver consoles, and accessories (e.g., cannulas, fluid management systems). The shaver handpieces segment is expected to witness significant growth due to their essential role in arthroscopic procedures and the increasing demand for advanced, ergonomic handpieces that offer better control and precision.

Recent product launches in this segment include Stryker's IntelliSense Ultra Shaver Handpiece (launched in 2021), which features real-time adaptive control and enhanced visualization capabilities.

Epidemiology Insights:

- The disease burden of orthopedic disorders, such as osteoarthritis, rheumatoid arthritis, and sports-related injuries, varies across major regions. North America and Europe have a higher prevalence due to factors like an aging population, sedentary lifestyles, and increased participation in sports activities.

- Key epidemiological trends driving the demand for arthroscopic procedures include the rising incidence of obesity, which increases the risk of joint disorders, and the growing elderly population, as aging is a significant risk factor for conditions like osteoarthritis.

- In the United States, it is estimated that over 54 million adults suffer from arthritis, with knee osteoarthritis being the most prevalent form. In Europe, the prevalence of osteoarthritis ranges from 10% to 15% among adults aged 60 years and above.

- The increasing patient population with orthopedic disorders and sports-related injuries presents growth opportunities for the arthroscopic shavers market, as these conditions often require surgical interventions, including arthroscopic procedures.

- Osteoarthritis and rheumatoid arthritis are not considered rare diseases, but their prevalence and disease burden are significant, contributing to the demand for arthroscopic procedures and related medical devices.

Market Landscape:

- There are unmet needs in the arthroscopic shavers market regarding the precision, efficiency, and safety of these devices. Surgeons often require improved visualization, better control, and advanced cutting capabilities to enhance the surgical outcomes and minimize complications.

- Current treatment options for orthopedic disorders include conservative management (physical therapy, medication, lifestyle modifications) and surgical interventions, such as arthroscopic procedures using shavers, arthroscopic radiofrequency ablation, and traditional open surgeries.

- Upcoming therapies and technologies in the market include the development of robotic-assisted arthroscopic systems, which aim to improve surgical precision and reduce surgeon fatigue. Additionally, advancements in imaging technologies, such as 4K ultra-high-definition (UHD) and 3D visualization systems, are enhancing surgeons' ability to perform precise arthroscopic procedures.

- Breakthrough treatment options currently in development include regenerative medicine approaches, such as stem cell therapies and tissue engineering, which aim to promote cartilage regeneration and potentially reduce the need for invasive surgical procedures in some cases.

- The arthroscopic shavers market is dominated by major medical device manufacturers offering branded products. While generic or private-label products may exist, the market is primarily driven by established players with proprietary technologies and a strong focus on research and development.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.2 Bn |

|

CAGR (2024 - 2031) |

7.8% |

|

The revenue forecast in 2031 |

US$ 2.2 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Stryker Corporation, Arthrex, Inc., Smith & Nephew plc, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Conmed Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, Medtronic plc, Olympus Corporation, Mitek Sports Medicine (Subsidiary of Johnson & Johnson), Hygia Health Services, Inc., Ceterix Orthopaedics, Inc., Integra LifeSciences Corporation, NuVasive, Inc., Globus Medical, Inc., Smith & Nephew plc, Aesculap, Inc. (Subsidiary of B. Braun Melsungen AG), Tissue Regenix Group plc, Biocomposites Ltd. |

Market Drivers:

Rising Prevalence of Orthopedic Disorders and Sports-Related Injuries

The increasing prevalence of orthopedic disorders, such as osteoarthritis, rheumatoid arthritis, and sports-related injuries, is a significant driver for the arthroscopic shavers market. As the global population ages and the incidence of chronic conditions rises, the demand for minimally invasive procedures, including arthroscopic surgeries, has surged. Arthroscopic shavers play a crucial role in these procedures, enabling surgeons to precisely remove or debride damaged cartilage, bone, or soft tissue within joints.

Additionally, the growing participation in sports activities and the associated risk of injuries have fueled the need for advanced arthroscopic interventions. Sports-related injuries often require arthroscopic procedures for diagnosis, repair, and rehabilitation, thereby driving the demand for arthroscopic shavers and related instruments.

Technological Advancements in Arthroscopic Devices and Imaging Systems

Continuous technological advancements in arthroscopic devices and imaging systems have significantly contributed to the growth of the arthroscopic shavers market. Manufacturers are actively investing in research and development to introduce advanced shaver systems with improved cutting efficiency, better visualization, and enhanced safety features. These innovative solutions aim to enhance surgical precision, reduce operating time, and improve overall patient outcomes.

Recent advancements include the development of 4K ultra-high-definition (UHD) and 3D visualization systems, providing surgeons with superior image quality and clarity during arthroscopic procedures. Additionally, the integration of robotics and advanced control systems in shaver handpieces has enabled greater precision and control during tissue removal and debridement.

Increasing Adoption of Minimally Invasive Surgical Techniques

The growing preference for minimally invasive surgical techniques has significantly driven the arthroscopic shavers market. Compared to traditional open surgeries, arthroscopic procedures offer numerous advantages, including smaller incisions, reduced pain and scarring, faster recovery times, and lower risk of complications. As healthcare providers and patients alike recognize these benefits, the adoption of minimally invasive arthroscopic procedures has increased substantially.

Arthroscopic shavers are essential tools in these minimally invasive procedures, enabling surgeons to access and operate within joints through small incisions while minimizing trauma to surrounding tissues. The growing demand for minimally invasive techniques has directly fueled the market for arthroscopic shavers and related instruments.

Expanding Geriatric Population and Increased Healthcare Expenditure

The global aging population and the associated increase in healthcare expenditure have contributed to the growth of the arthroscopic shavers market. As people age, the risk of developing orthopedic disorders, such as osteoarthritis, increases significantly. This demographic shift has led to a higher demand for arthroscopic procedures, which often involve the use of arthroscopic shavers for tissue removal and debridement.

Additionally, the rising healthcare expenditure in developed and emerging economies has enabled greater access to advanced medical technologies and procedures, including arthroscopic surgeries. Governments and healthcare organizations are investing in improving healthcare infrastructure and adopting cutting-edge medical devices, further driving the demand for arthroscopic shavers and related instruments.

Market Opportunities:

Integration of Robotic-Assisted Arthroscopic Systems

The integration of robotic-assisted arthroscopic systems presents a significant opportunity for the arthroscopic shavers market. Robotic technology has the potential to revolutionize arthroscopic procedures by providing enhanced precision, improved ergonomics, and reduced surgeon fatigue. Robotic-assisted arthroscopic systems can precisely control the movement and positioning of arthroscopic instruments, including shavers, enabling more accurate tissue removal and debridement.

Furthermore, these systems can offer advanced visualization capabilities, such as augmented reality overlays and real-time guidance, enhancing the surgeon's ability to navigate complex anatomical structures. As the adoption of robotic-assisted arthroscopic systems continues to grow, the demand for compatible and integrated arthroscopic shavers is expected to increase significantly.

Development of Single-Use Disposable Shaver Systems

The development of single-use disposable shaver systems presents an opportunity for improved cost-effectiveness and patient safety in the arthroscopic shavers market. Traditional reusable shaver systems require stringent sterilization and reprocessing procedures, which can be time-consuming and costly. Single-use disposable shaver systems can eliminate the need for these processes, reducing the risk of cross-contamination and ensuring a consistently sterile device for each procedure.

Additionally, disposable shaver systems can potentially lower the overall cost of ownership for healthcare facilities by eliminating the need for expensive reprocessing equipment and reducing the associated labor costs. As healthcare providers seek cost-effective solutions and prioritize patient safety, the demand for single-use disposable shaver systems is expected to grow.

Emerging Markets and Medical Tourism

The growth of emerging markets and the rise of medical tourism present significant opportunities for the arthroscopic shavers market. Countries in regions such as Asia-Pacific, Latin America, and the Middle East are experiencing rapid economic development and increasing healthcare expenditure. As these markets expand and healthcare infrastructure improves, the demand for advanced medical technologies, including arthroscopic shavers, is expected to rise.

Furthermore, the trend of medical tourism, where individuals travel to other countries to receive medical treatments, has gained traction globally. Countries with advanced healthcare facilities and skilled medical professionals are attracting patients seeking high-quality arthroscopic procedures at competitive costs. This influx of medical tourists can drive the demand for arthroscopic shavers and related instruments in these destinations.

Integration of Advanced Imaging and Data Analytics

The integration of advanced imaging and data analytics presents an opportunity for enhancing the performance and capabilities of arthroscopic shavers. By incorporating advanced imaging technologies, such as artificial intelligence (AI)-powered image recognition and analysis, surgeons can gain deeper insights into the anatomical structures and tissue characteristics during arthroscopic procedures.

Furthermore, the integration of data analytics can enable real-time monitoring and optimization of shaver performance, allowing for more efficient tissue removal and debridement. Manufacturers can leverage data analytics to identify areas for improvement and develop more intelligent and adaptive shaver systems, providing surgeons with enhanced control and precision during arthroscopic procedures.

Market Trends:

Shift Towards Minimally Invasive Surgical Techniques

The healthcare industry has witnessed a significant shift towards minimally invasive surgical techniques, driven by the benefits they offer, such as smaller incisions, reduced pain and scarring, faster recovery times, and lower risk of complications. This trend has directly impacted the arthroscopic shavers market, as arthroscopic procedures are minimally invasive by nature and rely heavily on these specialized instruments. The growing demand for minimally invasive surgeries has led to increased adoption of arthroscopic procedures for various orthopedic conditions, including joint disorders, sports-related injuries, and arthritis. As a result, the demand for arthroscopic shavers and related instruments has surged, as they are essential tools for tissue removal and debridement during these procedures.

Development of Advanced Visualization Systems

The development of advanced visualization systems has emerged as a key trend in the arthroscopic shavers market. Manufacturers are continuously investing in innovative imaging technologies to enhance the visualization capabilities of arthroscopic procedures. These advancements include the introduction of 4K ultra-high-definition (UHD) and 3D visualization systems, providing surgeons with superior image quality and clarity during arthroscopic surgeries. Improved visualization not only aids in accurate tissue removal and debridement but also enhances surgical precision and patient outcomes. As arthroscopic procedures become more complex and demand higher levels of precision, the integration of advanced visualization systems with arthroscopic shavers has become increasingly important, driving the adoption of these technologies in the market.

Focus on Ergonomic and User-Friendly Designs

Manufacturers in the arthroscopic shavers market are placing a strong emphasis on ergonomic and user-friendly designs for their products. Arthroscopic procedures can be physically demanding for surgeons, often requiring prolonged periods of precise hand movements and control. To address this challenge, companies are developing shaver handpieces and consoles with improved ergonomics, featuring lightweight and well-balanced designs, as well as intuitive controls and interfaces. These ergonomic enhancements aim to reduce surgeon fatigue, improve comfort, and enhance overall control during arthroscopic procedures. By prioritizing user-friendly designs, manufacturers are not only improving the surgical experience but also contributing to better patient outcomes by facilitating precise and efficient tissue removal and debridement.

Integration of Advanced Control Systems

The integration of advanced control systems is a notable trend in the arthroscopic shavers market. Manufacturers are incorporating sophisticated control mechanisms into their shaver systems to enhance precision, efficiency, and safety during arthroscopic procedures. These control systems may include features such as adaptive speed control, torque limiting, and real-time feedback, allowing surgeons to fine-tune the shaver's performance based on the specific tissue characteristics and surgical requirements. Additionally, some control systems are designed to minimize the risk of tissue damage or inadvertent injury, further enhancing patient safety. As arthroscopic procedures become more complex and demanding, the integration of advanced control systems is expected to continue driving the adoption of innovative shaver systems in the market.

Market Restraints:

High Costs Associated with Arthroscopic Procedures

One of the significant restraints affecting the growth of the arthroscopic shavers market is the high cost associated with arthroscopic procedures. These minimally invasive surgeries often involve the use of specialized equipment, including arthroscopic shavers, which can contribute to the overall procedural costs. The high costs can be attributed to factors such as the advanced technology involved, the need for specialized training for healthcare professionals, and the expenses related to operating room setup and post-operative care.

Additionally, the cost of arthroscopic shavers themselves can be substantial, particularly for advanced models with innovative features and capabilities. This financial burden can deter some healthcare providers, especially in regions with limited healthcare budgets or inadequate reimbursement policies, from adopting these procedures and investing in the latest arthroscopic shaver systems.

Risk of Surgical Complications and Potential Adverse Events

Despite the numerous advantages of arthroscopic procedures, there is a risk of surgical complications and potential adverse events associated with their use. These risks can act as a restraint on the growth of the arthroscopic shavers market, as healthcare providers and patients may opt for alternative treatment options perceived as safer or less invasive.

Potential complications arising from arthroscopic procedures include infection, nerve damage, blood clots, and joint stiffness or instability. Additionally, the use of arthroscopic shavers carries the risk of inadvertent tissue damage or imprecise tissue removal, which can lead to prolonged recovery times or suboptimal surgical outcomes.

To mitigate these risks, healthcare professionals require extensive training and experience in the use of arthroscopic shavers and related instruments, which can be time-consuming and resource-intensive. The need for specialized training and the potential risks associated with these procedures may deter some healthcare providers from adopting arthroscopic techniques and the associated devices.

Regulatory Challenges and Stringent Approval Processes

The arthroscopic shavers market is subject to stringent regulatory requirements and approval processes, which can act as a restraint on its growth and development. Medical devices, including arthroscopic shavers, must undergo rigorous evaluation and testing to ensure their safety, efficacy, and compliance with regulatory standards before they can be marketed and sold.

The approval processes for new arthroscopic shaver systems or significant modifications to existing products can be lengthy and complex, involving extensive clinical trials, documentation, and regulatory submissions. This can delay the introduction of innovative products to the market, potentially hindering the adoption of new technologies and limiting the growth opportunities for manufacturers.

Furthermore, different regulatory bodies across various regions may have varying requirements and standards, adding an additional layer of complexity for companies operating in multiple markets. Compliance with these diverse regulatory frameworks can be resource-intensive and time-consuming, potentially slowing down the development and commercialization of new arthroscopic shaver systems.

Recent Developments:

|

Development |

Involved Company |

|

Introduced the Gemini Shaver Blade, designed for improved cutting efficiency and tissue removal during arthroscopic procedures. Launched in October 2022, this blade aims to enhance surgical precision and reduce operating time. |

Arthrex, Inc. |

|

Received FDA clearance for the ArthroSamurai Shaver System, a next-generation arthroscopic shaver system featuring advanced cutting technology and improved visualization capabilities. Launched in June 2021, it aims to facilitate precise tissue removal and enhance surgical outcomes. |

Arthrex, Inc. |

|

Launched the IntelliSense Ultra Shaver Handpiece, featuring real-time adaptive control and enhanced visualization capabilities. Introduced in August 2021, it aims to provide surgeons with better control and precision during arthroscopic procedures. |

Stryker Corporation |

|

Product Launch |

Company Name |

|

Introduced the SERFAS Energy Shaver System, a radiofrequency-based arthroscopic shaver system designed for efficient tissue removal and hemostasis. Launched in March 2022, it aims to improve surgical outcomes and reduce complications. |

Mitek Sports Medicine (Johnson & Johnson) |

|

Launched the APS 3 Arthroscopic Shaver System, featuring improved ergonomics, enhanced visualization, and advanced cutting capabilities. Introduced in September 2021, it aims to provide surgeons with greater control and precision during arthroscopic procedures. |

Zimmer Biomet Holdings, Inc. |

|

Introduced the OrthoVision 4K Arthroscopic Imaging System, a high-definition visualization system designed to enhance surgical precision and improve patient outcomes during arthroscopic procedures. Launched in February 2023, it aims to provide surgeons with superior image quality and clarity. |

Smith & Nephew plc |

|

Merger/Acquisition |

Involved Companies |

|

Acquired OrthoSensor, a company specializing in sensor-assisted technology for orthopedic procedures, including arthroscopic surgeries. The acquisition, completed in November 2022, aims to enhance Stryker's portfolio of orthopedic products and technologies. |

Stryker Corporation |

|

Acquired Apex Surgical, a company focused on developing advanced arthroscopic devices and surgical instruments. The acquisition, completed in March 2021, aims to strengthen Zimmer Biomet's arthroscopic product portfolio and expand its presence in the sports medicine market. |

Zimmer Biomet Holdings, Inc. |

|

Acquired Pantor Engineering, a developer of advanced surgical visualization systems, including arthroscopic imaging technologies. The acquisition, completed in August 2020, aims to enhance Smith & Nephew's portfolio of visualization solutions for orthopedic procedures. |

Smith & Nephew plc |

Market Regional Insights:

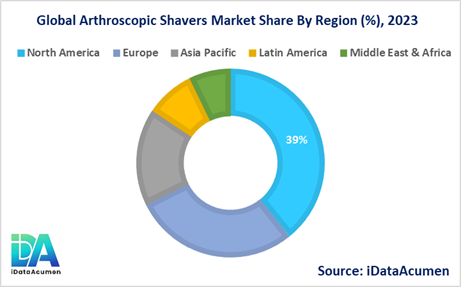

The arthroscopic shavers market exhibits varying regional dynamics, with North America currently leading the way, followed by Europe and the Asia-Pacific region as potential growth hotspots. The regional landscape is influenced by factors such as the prevalence of orthopedic disorders, healthcare infrastructure, and adoption rates of minimally invasive surgical techniques.

- North America is expected to be the largest market for the Arthroscopic Shavers Market during the forecast period, accounting for over 39.2% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of orthopedic disorders, advanced healthcare infrastructure, and the widespread adoption of minimally invasive surgical techniques.

- The European market is expected to be the second-largest market for the Arthroscopic Shavers Market, accounting for over 28.5% of the market share in 2024. The growth of the market is attributed to the increasing aging population, rising incidence of sports-related injuries, and the presence of well-established healthcare systems that support the adoption of advanced medical technologies.

- The Asia-Pacific market is expected to be the fastest-growing market for the Arthroscopic Shavers Market, with a CAGR of over 16.7% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the expanding geriatric population, increasing healthcare expenditure, and the rapid adoption of minimally invasive surgical techniques. This region holds the third-largest market share of 9.6%.

Market Segmentation:

- By Product Type

- Shaver Handpieces

- Shaver Blades

- Shaver Consoles

- Accessories (e.g., cannulas, fluid management systems)

- Others (e.g., disposables, shaver burrs)

- By Application

- Knee Arthroscopy

- Shoulder Arthroscopy

- Hip Arthroscopy

- Ankle Arthroscopy

- Wrist Arthroscopy

- Elbow Arthroscopy

- Others (e.g., foot, spine arthroscopy)

- By End-user

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Others (e.g., specialty clinics, research institutes)

- By Technology

- Powered Shaver Systems

- Radiofrequency (RF) Shaver Systems

- Others (e.g., ultrasonic shaver systems, plasma shaver systems)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

- By Product Type

- By Application

- By End-user

By Product Type Segment:

- The shaver handpieces segment is expected to witness significant growth across all regions due to the increasing demand for advanced, ergonomic handpieces that offer better control and precision during arthroscopic procedures.

- In North America and Europe, the shaver handpieces segment is projected to grow at a CAGR of around 8-10% during the forecast period, driven by the adoption of technologically advanced handpieces and the high volume of arthroscopic procedures performed in these regions.

- The Asia-Pacific region is expected to experience the highest growth rate for the shaver handpieces segment, with a CAGR of around 12-14%, owing to the improving healthcare infrastructure, rising medical tourism, and increasing investments by global players in this region.

- In 2024, the shaver handpieces segment is likely to be the largest segment within the arthroscopic shavers market, followed by shaver blades.

By Application Segment:

- The knee arthroscopy segment is expected to remain the largest application segment due to the high prevalence of knee-related orthopedic disorders and sports-related injuries.

- The shoulder arthroscopy segment is projected to experience rapid growth, with a CAGR of around 9-11% in North America and Europe, driven by the increasing incidence of rotator cuff injuries and the rising adoption of arthroscopic shoulder surgeries.

- In the Asia-Pacific region, the hip arthroscopy segment is anticipated to grow at a CAGR of around 12-14%, owing to the increasing awareness of hip preservation techniques and the growing adoption of minimally invasive hip arthroscopic procedures.

By End-user Segment:

- The hospitals segment is expected to retain its position as the largest end-user segment due to the availability of advanced surgical facilities and the concentration of orthopedic surgeons in hospitals.

- The ambulatory surgical centers (ASCs) segment is projected to witness the highest growth rate, with a CAGR of around 10-12% in North America and Europe, driven by the increasing preference for outpatient arthroscopic procedures and the cost-effectiveness of ASCs.

- In the Asia-Pacific region, the orthopedic clinics segment is anticipated to grow at a CAGR of around 9-11%, owing to the increasing investment in specialized orthopedic clinics and the growing demand for minimally invasive procedures.

Top companies in the Arthroscopic Shavers Market:

- Stryker Corporation

- Arthrex, Inc.

- Smith & Nephew plc

- Zimmer Biomet Holdings, Inc.

- DePuy Synthes (Johnson & Johnson)

- Conmed Corporation

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- Medtronic plc

- Olympus Corporation

- Mitek Sports Medicine (Subsidiary of Johnson & Johnson)

- Hygia Health Services, Inc.

- Ceterix Orthopaedics, Inc.

- Integra LifeSciences Corporation

- NuVasive, Inc.

- Globus Medical, Inc.

- Aesculap, Inc. (Subsidiary of B. Braun Melsungen AG)

- Tissue Regenix Group plc

- Biocomposites Ltd.

The arthroscopic shavers market is moderately consolidated, with a few major players holding a significant market share. Companies like Stryker, Arthrex, Smith & Nephew, and Zimmer Biomet are among the leading players in this market.