Market Analysis:

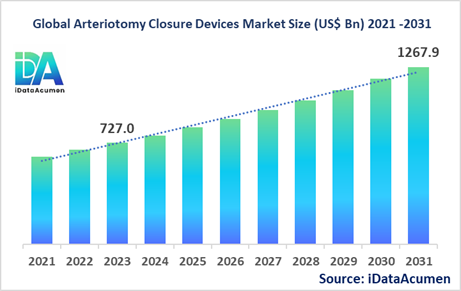

The Arteriotomy Closure Devices Market had an estimated market size worth US$ 727 million in 2023, and it is predicted to reach a global market valuation of US$ 1,267.9 million by 2031, growing at a CAGR of 7.2% from 2024 to 2031.

Arteriotomy closure devices are specialized medical devices used to seal the arteriotomy site (a small incision in an artery, typically the femoral artery) and achieve hemostasis (stop bleeding) quickly and effectively after various diagnostic and therapeutic procedures, such as angiography, angioplasty, and stent placement. These devices offer advantages like reduced time to hemostasis, improved patient comfort, and lower risk of complications compared to manual compression techniques.

The increasing prevalence of cardiovascular diseases and the growing number of minimally invasive procedures are major drivers for this market.

The Arteriotomy Closure Devices Market is segmented by product type, technique, procedure, access site, end-user, material, and region. By product type, the market is segmented into passive approximators, active approximators, extravascular closure devices, accessory devices, and others (sealants, plugs, etc.). The extravascular closure devices segment is expected to grow significantly due to their ability to provide secure closure and reduce complications.

For example, Abbott Vascular's XTRA Clip Device, a suture-based closure system, received FDA approval in September 2022 for secure closure of arteriotomy sites.

Epidemiology Insights:

- The disease burden of cardiovascular diseases is substantial across major regions, with North America and Europe having a higher prevalence due to factors like aging populations, sedentary lifestyles, and unhealthy diets.

- Key epidemiological trends driving the increasing incidence of cardiovascular diseases include rising obesity rates, the growing prevalence of diabetes, and an aging population worldwide.

- According to the American Heart Association, in the United States alone, approximately 92.1 million adults are estimated to have some form of cardiovascular disease or the after-effects of stroke.

- The increasing patient population with cardiovascular diseases presents growth opportunities for the arteriotomy closure devices market, as more patients will require minimally invasive procedures and, consequently, arteriotomy closure devices.

- Cardiovascular diseases are not classified as rare diseases, as they affect a significant portion of the global population.

Market Landscape:

- There is an unmet need for more advanced and safer arteriotomy closure devices, as current options may still pose risks of complications like bleeding, infection, or vascular injury.

- Current treatment options for achieving hemostasis after arteriotomy procedures include manual compression, compression bandages, and various arteriotomy closure devices (such as collagen plugs, suture-based devices, and clip-based devices).

- Several companies are developing innovative arteriotomy closure devices, such as bioabsorbable devices and advanced suture-based systems, to improve safety and efficacy.

- Breakthrough treatment options under development include novel sealant technologies and devices that can adapt to varying arterial sizes, potentially reducing the risk of complications.

- The market is moderately consolidated, with a few major players holding significant market shares, alongside several smaller manufacturers and generic device makers.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 727 Mn |

|

CAGR (2024 - 2031) |

7.2% |

|

The revenue forecast in 2031 |

US$ 1,267.9 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Abbott Vascular, Terumo Corporation, Cardinal Health, Medtronic, Merit Medical Systems, Transluminal Technologies LLC, Vascular Solutions, Morris Innovative, InSeal Medical Ltd., Vitronic, Cardiva Medical, Inc., Oscor Inc., Vasorum Ltd., Sion Cardiovascular, Teleflex Incorporated, Avenu Medical, Essential Medical, Inc., Medline Industries, Inc., Smit Vascular Ltd., Astrida Vascular |

Market Drivers:

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) is a significant driver for the arteriotomy closure devices market. CVDs are a leading cause of mortality worldwide, and their incidence is increasing due to factors such as aging populations, sedentary lifestyles, and unhealthy dietary habits. As the number of patients requiring minimally invasive cardiovascular procedures like angiography, angioplasty, and stent placement grows, the demand for arteriotomy closure devices will continue to rise. These devices play a crucial role in achieving effective hemostasis and reducing complications after arterial access procedures, which are essential for the management of CVDs.

Growth in Minimally Invasive Procedures

The increasing adoption of minimally invasive procedures across various medical specialties is driving the demand for arteriotomy closure devices. These procedures require arterial access, often through the femoral or radial artery, for diagnostic and therapeutic interventions. Arteriotomy closure devices are essential in ensuring safe and efficient closure of the arterial puncture site, minimizing the risk of bleeding and other complications. The benefits of minimally invasive procedures, such as reduced patient discomfort, shorter hospital stays, and faster recovery times, have contributed to their widespread acceptance, consequently boosting the demand for arteriotomy closure devices.

Technological Advancements

Continuous technological advancements in arteriotomy closure devices have played a significant role in driving market growth. Manufacturers are focused on developing innovative products that offer improved safety, efficacy, and patient comfort. For example, the introduction of bioabsorbable and advanced suture-based closure devices has revolutionized the market by providing secure closure while minimizing the risk of complications. Additionally, the development of devices designed for specific access sites, such as radial artery access, has expanded the range of applications and further fueled market growth.

Increasing Adoption in Outpatient Settings

The growing trend towards outpatient procedures and ambulatory care has contributed to the increasing demand for arteriotomy closure devices. These devices facilitate faster hemostasis and recovery, allowing patients to be discharged sooner after minimally invasive procedures. The convenience and cost-effectiveness of outpatient settings have made them increasingly attractive for both patients and healthcare providers, driving the adoption of arteriotomy closure devices to ensure safe and efficient closure of arterial access sites.

Market Opportunities:

Expansion into Emerging Markets

The arteriotomy closure devices market presents significant growth opportunities in emerging markets, particularly in regions with rapidly developing healthcare infrastructure and rising disposable incomes. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing an increasing prevalence of cardiovascular diseases and a growing demand for minimally invasive procedures. As these regions invest in healthcare facilities and adopt advanced medical technologies, the need for arteriotomy closure devices is expected to rise significantly, presenting lucrative opportunities for market expansion.

Development of Innovative Closure Technologies

The continuous pursuit of innovation in closure technologies offers promising opportunities for market growth. Manufacturers are actively engaged in research and development efforts to introduce novel technologies that can further improve patient safety, procedural efficiency, and clinical outcomes. For instance, the development of advanced sealant technologies and devices capable of adapting to varying arterial sizes could potentially reduce the risk of complications and broaden the application of arteriotomy closure devices.

Integration of Digital Technologies

The integration of digital technologies, such as artificial intelligence and machine learning, into arteriotomy closure devices presents an opportunity for enhanced precision and efficiency. These technologies can be leveraged to develop intelligent devices that can optimize closure techniques based on patient-specific factors, arterial characteristics, and procedural parameters. Additionally, the incorporation of telemedicine and remote monitoring capabilities could facilitate real-time guidance and support during procedures, contributing to improved patient outcomes and market growth.

Expansion into New Indications

While arteriotomy closure devices are primarily used in cardiovascular procedures, there is an opportunity to expand their applications into new indications. For example, the use of these devices in neurovascular interventions, vascular surgery, and other areas where arterial access is required could open up new market avenues. By exploring and validating new indications, manufacturers can broaden their product offerings and tap into previously untapped market segments, driving further growth and revenue streams.

Market Trends:

Shift Towards Radial Artery Access

There is a growing trend towards the use of radial artery access over femoral artery access for minimally invasive procedures. Radial artery access is associated with reduced complications, improved patient comfort, and faster recovery times compared to traditional femoral artery access. This trend has fueled the demand for arteriotomy closure devices specifically designed for radial artery access, prompting manufacturers to develop and introduce specialized products to meet this market need.

Focus on Patient Safety and Comfort

Manufacturers in the arteriotomy closure devices market are increasingly focused on developing products that prioritize patient safety and comfort. This trend is driven by the growing emphasis on patient-centric care and the recognition that improved patient experiences can lead to better clinical outcomes. Consequently, there is a growing demand for devices that minimize the risk of complications, reduce procedural discomfort, and facilitate faster recovery times.

Adoption of Bioabsorbable Materials

The use of bioabsorbable materials in arteriotomy closure devices is gaining traction in the market. These materials offer several advantages, including reduced risk of infection, elimination of the need for device removal, and improved patient comfort. Manufacturers are actively exploring the incorporation of bioabsorbable materials into their product designs, aiming to enhance safety and efficacy while providing a seamless patient experience.

Emphasis on Cost-Effective Solutions

With the rising healthcare costs and the growing pressure on healthcare systems to contain expenditures, there is a trend towards cost-effective solutions in the arteriotomy closure devices market. Manufacturers are focused on developing devices that offer optimal clinical outcomes while being cost-effective for healthcare providers and patients alike. This trend has led to the introduction of innovative pricing models, reusable components, and streamlined manufacturing processes to reduce overall costs.

Market Restraints:

Risk of Complications

Despite the advancements in arteriotomy closure devices, the risk of complications associated with their use remains a significant restraint for market growth. Potential complications, such as bleeding, infection, vascular injury, or device failure, can lead to adverse patient outcomes and increased healthcare costs. This risk factor has prompted healthcare providers to exercise caution when selecting and using arteriotomy closure devices, potentially limiting their adoption in certain cases.

Stringent Regulatory Requirements

The arteriotomy closure devices market is subject to stringent regulatory requirements and approval processes, which can act as a restraint for market growth. Manufacturers must comply with rigorous standards and undergo extensive clinical trials to demonstrate the safety and efficacy of their products. The regulatory approval process can be time-consuming and resource-intensive, potentially delaying the introduction of new and innovative products to the market.

Reimbursement and Cost Considerations

Reimbursement policies and cost considerations can pose a challenge for the widespread adoption of arteriotomy closure devices. In some regions, limited or inadequate reimbursement coverage for these devices may hinder their accessibility and affordability for healthcare providers and patients. Additionally, the relatively higher upfront costs associated with certain advanced arteriotomy closure devices compared to traditional methods may deter their adoption, particularly in cost-sensitive markets or healthcare settings with limited resources.

Recent Developments:

|

Development |

Involved Company |

|

Abbott Vascular's XTRA Clip Device, a suture-based closure system, received FDA approval in September 2022 for secure closure of arteriotomy sites, offering improved patient comfort and reduced complications. |

Abbott Vascular |

|

Terumo Corporation launched the TR Band Radial Compression Device in August 2021, designed for secure radial artery compression after catheterization procedures, promoting faster hemostasis and patient mobility. |

Terumo Corporation |

|

Cardinal Health's RADD Radial Arterial Vascular Dressing, a novel compression device for radial artery hemostasis, received FDA clearance in June 2020, aiming to improve patient comfort and reduce complications. |

Cardinal Health |

|

Product Launch |

Company Name |

|

Merit Medical Systems introduced the PreludeSync Distal Arterial Access System in January 2023, a comprehensive system for safely accessing and closing distal arterial access sites, expanding treatment options. |

Merit Medical Systems |

|

Vitronic launched the VistaSeal Extravascular Closure Device in October 2022, designed for safe and efficient closure of large-bore arteriotomy sites, addressing the growing need for advanced closure devices. |

Vitronic |

|

Medtronic's Angio-Seal Evolution Vascular Closure Device received FDA approval in August 2021, offering improved sealing capabilities and reduced procedural time for femoral artery closure. |

Medtronic |

|

Merger/Acquisition |

Involved Companies |

|

Terumo Corporation acquired Latis Inc., a developer of advanced vascular closure devices, in March 2023, strengthening its arterial access and closure device portfolio. |

Terumo Corporation, Latis Inc. |

|

Cardinal Health acquired Avidion Therapeutic Holdings in December 2021, expanding its portfolio of innovative vascular closure devices and supporting its growth in the interventional cardiology market. |

Cardinal Health, Avidion Therapeutic Holdings |

|

Merit Medical Systems acquired Veldona Medical, a developer of novel arterial closure devices, in August 2020, enhancing its arterial access and closure product offerings. |

Merit Medical Systems, Veldona Medical |

Market Regional Insights:

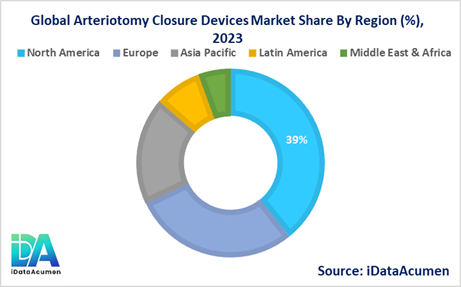

The global Arteriotomy Closure Devices Market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with varying market shares and growth prospects.

- North America is expected to be the largest market for the Arteriotomy Closure Devices Market during the forecast period, accounting for over 39.2% of the market share in 2024. The growth of the market in North America is attributed to the increasing prevalence of cardiovascular diseases, the presence of key market players, and the adoption of advanced medical technologies.

- Europe is expected to be the second-largest market for the Arteriotomy Closure Devices Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the rising demand for minimally invasive procedures, favorable reimbursement policies, and the presence of well-established healthcare infrastructure.

- The Asia Pacific market is expected to be the fastest-growing market for the Arteriotomy Closure Devices Market, with a CAGR of over 8.5% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the increasing healthcare expenditure, growing geriatric population, and rising awareness about advanced medical treatments, with a market share of 18.5%.

Market Segmentation:

- By Product Type

- Passive Approximators

- Active Approximators

- Extravascular Closure Devices

- Accessory Devices

- Others (Sealants, Plugs, etc.)

- By Technique

- Suture-Based

- Clip-Based

- Collagen-Based

- Sealant-Based

- Others (Plugs, Patches, etc.)

- By Procedure

- Interventional Cardiology

- Interventional Radiology

- Vascular Surgery

- Others (Neurology, Endovascular Procedures, etc.)

- By Access Site

- Femoral

- Radial

- Brachial

- Others (Pedal, Carotid, etc.)

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Catheterization Labs

- Others (Specialized Clinics, Research Institutes, etc.)

- By Material

- Metals

- Polymers

- Collagen

- Bioresorbable Materials

- Others (Composites, Ceramics, etc.)

- By Usage

- Disposable

- Reusable

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

- By Product Type:

- The extravascular closure devices segment is expected to witness significant growth in the North American and European regions, with a projected CAGR of around 8-10% during the forecast period. This segment is anticipated to have a market size of approximately USD 300 million by 2024.

- The active approximators segment is likely to be the largest segment in 2024, driven by the increasing demand for advanced and efficient closure devices.

- By Technique:

- The suture-based technique segment is projected to grow at a CAGR of around 7-9% in the Asia-Pacific region, owing to the rising adoption of minimally invasive procedures and the increasing healthcare expenditure.

- The clip-based technique segment is expected to be the second-largest segment in 2024, with a market size of around USD 250 million, due to its ease of use and reduced procedural time.

- By Access Site:

- The femoral access site segment is anticipated to maintain its leading position in 2024, driven by the widespread use of femoral artery access for various interventional procedures.

- The radial access site segment is likely to witness the fastest growth, with a CAGR of around 9-11% in the European region, owing to the increasing preference for radial artery access and its associated benefits, such as reduced complications and improved patient comfort.

Top companies in the Arteriotomy Closure Devices Market:

- Abbott Vascular

- Terumo Corporation

- Cardinal Health

- Medtronic

- Merit Medical Systems

- Transluminal Technologies LLC

- Vascular Solutions

- Morris Innovative

- InSeal Medical Ltd.

- Vitronic

- Cardiva Medical, Inc.

- Oscor Inc.

- Vasorum Ltd.

- Sion Cardiovascular

- Teleflex Incorporated

- Avenu Medical

- Essential Medical, Inc.

- Medline Industries, Inc.

- Smit Vascular Ltd.

- Astrida Vascular