Market Analysis:

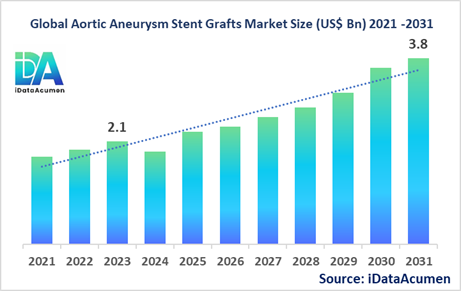

The Aortic Aneurysm Stent Grafts Market had an estimated market size worth US$ 2.1 billion in 2023, and it is predicted to reach a global market valuation of US$ 3.8 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031.

Aortic aneurysm stent grafts are medical devices used in the minimally invasive treatment of aortic aneurysms, which are bulges or swellings in the aorta, the main blood vessel carrying blood from the heart to the rest of the body. Stent grafts are inserted through a small incision in the groin or arm and guided to the site of the aneurysm, where they are deployed to reinforce the weakened aortic wall and prevent rupture. This procedure, called endovascular aneurysm repair (EVAR), is less invasive than open surgical repair and offers faster recovery times and reduced complications.

The primary drivers for the growth of the aortic aneurysm stent grafts market include the increasing prevalence of aortic aneurysms due to an aging population and lifestyle factors such as smoking and obesity, as well as the growing preference for minimally invasive procedures.

The Aortic Aneurysm Stent Grafts Market is segmented by product type, aneurysm type, end-user, anatomy, material, and delivery system, and region. By product type, the market is segmented into abdominal aortic aneurysm stent grafts, thoracic aortic aneurysm stent grafts, fenestrated stent grafts, branched stent grafts, and others. The abdominal aortic aneurysm stent grafts segment is expected to dominate the market due to the higher prevalence of abdominal aortic aneurysms compared to thoracic aneurysms. This segment is growing due to the increasing adoption of minimally invasive endovascular repair procedures and technological advancements in stent graft design and delivery systems.

Recent product launches in this segment include Endologix's Ovation Alto Abdominal Stent Graft System, approved in September 2022, which features a low-profile delivery system and improved graft conformability for better anatomical fit.

Epidemiology Insights:

- The disease burden of aortic aneurysms is highest in developed regions like North America and Europe due to the aging population and higher prevalence of risk factors like smoking and hypertension.

- Key epidemiological trends and driving factors include the increasing incidence of aortic aneurysms among the elderly population, rising obesity rates, and the growing prevalence of smoking, particularly in developing countries.

- In the United States, the prevalence of abdominal aortic aneurysms is estimated to be around 1.3% in men aged 65 to 75 years and 0.6% in women of the same age group (CDC data).

- In Europe, the incidence of abdominal aortic aneurysms is estimated to be around 20 to 40 per 100,000 population per year, with higher rates observed in countries like the United Kingdom and Sweden.

- The increasing patient population, particularly in emerging markets like China and India, presents growth opportunities for the aortic aneurysm stent grafts market as access to healthcare improves and awareness about the condition increases.

- Aortic aneurysms are not considered a rare disease, but early detection and treatment are crucial to prevent life-threatening complications like rupture.

Market Landscape:

- There are still unmet needs in the aortic aneurysm stent grafts market, particularly in the treatment of complex anatomies and challenging cases where traditional stent grafts may not be suitable.

- Current treatment options include open surgical repair, which is highly invasive, and endovascular aneurysm repair (EVAR) using stent grafts, which is a minimally invasive approach. Approved stent graft systems include Medtronic's Endurant Stent Graft System and Cook Medical's Zenith Fenestrated Stent Graft.

- Upcoming therapies and technologies in development include patient-specific stent grafts tailored to individual patient anatomy, biodegradable stent grafts that can potentially reduce long-term complications, and advanced imaging and guidance systems for improved procedural accuracy.

- Breakthrough treatment options currently being developed include endovascular aneurysm sealing (EVAS) systems, which use a polymer-filled endobag to seal the aneurysm sac, and fenestrated and branched stent grafts for treating complex aneurysms involving branch vessels.

- The aortic aneurysm stent grafts market is dominated by a few major players, such as Medtronic, Endologix, and W. L. Gore & Associates, who offer a range of branded stent graft systems. However, there is also a presence of smaller companies and generic manufacturers, particularly in emerging markets.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 2.1 Bn |

|

CAGR (2024 - 2031) |

7.8% |

|

The revenue forecast in 2031 |

US$ 3.8 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Medtronic, Endologix, W. L. Gore & Associates, Cook Medical, Terumo Corporation, Cardinal Health, MicroPort Scientific Corporation, Lombard Medical, Jotec GmbH, TriVascular Technologies, Inc., Braile Biomédica, Vascutek Ltd., Nellix, Inc., Cardiatis, Aptus Endosystems, Inc., Vascutek Ltd., Lifetech Scientific Corporation, Nano Endoluminal, Bard Peripheral Vascular, Inc., Terumo Aortic |

Market Drivers:

Increasing Prevalence of Aortic Aneurysms

The rising prevalence of aortic aneurysms, particularly among the elderly population, is a significant driver for the growth of the aortic aneurysm stent grafts market. Aortic aneurysms are associated with several risk factors, including advanced age, smoking, hypertension, and genetic predisposition. As the global population ages, the incidence of aortic aneurysms is expected to increase, thereby driving the demand for minimally invasive treatment options like stent grafts. Additionally, ongoing public awareness campaigns and improved diagnostic techniques contribute to the early detection of aortic aneurysms, further fueling the need for effective treatment solutions.

Preference for Minimally Invasive Procedures

There is a growing preference among patients and healthcare providers for minimally invasive procedures, as they offer several advantages over traditional open surgical methods. Endovascular aneurysm repair (EVAR) using stent grafts is a minimally invasive procedure that involves smaller incisions, reduced blood loss, shorter hospital stays, and faster recovery times. This approach aligns with the current trend of reducing healthcare costs and improving patient outcomes, driving the adoption of aortic aneurysm stent grafts.

Technological Advancements in Stent Graft Design

Continuous technological advancements in stent graft design and delivery systems have significantly contributed to the growth of the aortic aneurysm stent grafts market. Improved graft conformability, lower profile delivery systems, and enhanced imaging guidance have made the procedure more effective and accessible for a wider range of patient anatomies. Additionally, the development of fenestrated and branched stent grafts has expanded the treatment options for complex aortic aneurysms involving branch vessels, further driving market growth.

Rising Healthcare Expenditure and Improving Access

Increasing healthcare expenditure and improving access to advanced medical treatments, particularly in emerging economies, are driving the growth of the aortic aneurysm stent grafts market. As healthcare infrastructure and reimbursement policies continue to evolve in these regions, more patients are gaining access to minimally invasive procedures like endovascular aneurysm repair. This, in turn, is creating new market opportunities for stent graft manufacturers and driving overall market growth.

Market Opportunities:

Development of Patient-Specific Stent Grafts

The development of patient-specific stent grafts represents a significant opportunity in the aortic aneurysm stent grafts market. Leveraging advanced imaging techniques and 3D printing technology, manufacturers are exploring the possibility of creating customized stent grafts tailored to individual patient anatomies. These patient-specific devices could potentially improve procedural accuracy, reduce complications, and enhance treatment outcomes, particularly in cases of complex aortic aneurysms with challenging anatomies.

Emergence of Biodegradable Stent Grafts

The emergence of biodegradable stent grafts presents an exciting opportunity in the aortic aneurysm stent grafts market. These innovative devices are designed to degrade over time, potentially reducing the long-term risks associated with permanent implants, such as material fatigue, endoleaks, and the need for follow-up procedures. Biodegradable stent grafts could offer a more physiological solution for aortic aneurysm repair, potentially leading to improved patient outcomes and reduced healthcare costs in the long run.

Expansion in Emerging Markets

Emerging markets, such as China, India, and Brazil, represent significant growth opportunities for the aortic aneurysm stent grafts market. As these economies continue to develop and healthcare expenditure rises, the demand for advanced medical technologies is expected to increase. Additionally, the rising prevalence of risk factors like obesity and smoking in these regions could contribute to a higher incidence of aortic aneurysms, further driving the need for effective treatment options like stent grafts.

Integration of Advanced Imaging and Guidance Systems

The integration of advanced imaging and guidance systems presents an opportunity for improving the accuracy and safety of endovascular aneurysm repair procedures. Techniques like augmented reality, real-time 3D imaging, and advanced navigation systems can enhance procedural guidance, enabling more precise stent graft placement and reducing the risk of complications. As these technologies continue to evolve, they can potentially improve patient outcomes and drive the adoption of aortic aneurysm stent grafts.

Market Trends:

Shift towards Low-Profile Delivery Systems

One of the key trends in the aortic aneurysm stent grafts market is the shift towards low-profile delivery systems. These systems allow for smaller incisions and easier access to challenging anatomies, reducing the risk of complications and improving patient comfort during the procedure. Manufacturers are actively developing stent grafts with lower profile delivery systems, enabling minimally invasive access and expanding the range of treatable patient populations.

Focus on Improving Graft Conformability

Another notable trend in the aortic aneurysm stent grafts market is the focus on improving graft conformability. Manufacturers are actively working on developing stent grafts with enhanced flexibility and conformability to better adapt to the unique anatomical structures of individual patients. This trend aims to improve the accuracy of stent graft placement, reduce the risk of endoleaks, and ultimately enhance treatment outcomes for aortic aneurysm patients.

Adoption of Advanced Imaging Techniques

The adoption of advanced imaging techniques, such as computed tomography angiography (CTA) and magnetic resonance angiography (MRA), is a growing trend in the aortic aneurysm stent grafts market. These imaging modalities provide detailed visualization of the aortic anatomy, enabling more accurate pre-procedural planning and improved procedural guidance. The integration of these imaging techniques with stent graft systems can potentially enhance procedural accuracy and patient outcomes.

Emphasis on Post-Procedural Monitoring and Follow-Up

There is an increasing emphasis on post-procedural monitoring and follow-up in the aortic aneurysm stent grafts market. Regular monitoring is crucial to detect potential complications, such as endoleaks or stent graft migration, and to ensure the long-term success of the repair. Manufacturers are developing advanced imaging protocols and follow-up strategies to improve the monitoring of patients who have undergone endovascular aneurysm repair, aiming to enhance patient safety and long-term outcomes.

Market Restraints:

High Procedural Costs

One of the significant restraints in the aortic aneurysm stent grafts market is the high procedural cost associated with endovascular aneurysm repair. The stent grafts themselves are expensive medical devices, and the procedure requires advanced imaging equipment, specialized facilities, and highly skilled healthcare professionals. These factors contribute to the overall high cost of the procedure, which can limit access and adoption, particularly in regions with limited healthcare resources or inadequate reimbursement policies.

Risks and Complications Associated with Endovascular Repair

While endovascular aneurysm repair using stent grafts is a minimally invasive procedure, it is not without risks and potential complications. Complications such as endoleaks, stent graft migration, access site complications, and the need for secondary interventions can occur. These risks, although generally lower than open surgical repair, can still be a concern for patients and healthcare providers, potentially restraining the growth of the aortic aneurysm stent grafts market.

Stringent Regulatory Approval Process

The stringent regulatory approval process for aortic aneurysm stent grafts can act as a restraint for market growth. Manufacturers must navigate rigorous clinical trials and regulatory requirements to obtain approval for their devices, which can be a time-consuming and resource-intensive process. Additionally, variations in regulatory frameworks across different regions can create additional challenges for manufacturers, potentially slowing down the introduction of new and innovative stent graft technologies to the market.

Recent Developments:

|

Development |

Involved Company |

|

In October 2022, Medtronic received FDA approval for its Valiant Navion Thoracic Stent Graft System for the minimally invasive repair of thoracic aortic aneurysms. The device features a low-profile delivery system and improved graft conformability. |

Medtronic |

|

In September 2022, Endologix received FDA approval for its Ovation Alto Abdominal Stent Graft System, designed for the treatment of abdominal aortic aneurysms. The device features a low-profile delivery system and improved graft conformability. |

Endologix |

|

In July 2021, W. L. Gore & Associates received FDA approval for its GORE Excluder Conformable AAA Endoprosthesis, a stent graft designed to conform to the unique anatomy of each patient's abdominal aortic aneurysm. |

W. L. Gore & Associates |

|

Product Launch |

Company Name |

|

In October 2021, Cook Medical launched the Zenith Alpha Thoracic Endovascular Graft for the treatment of thoracic aortic aneurysms. The device features a low-profile delivery system and improved graft conformability. |

Cook Medical |

|

In May 2020, Terumo Aortic launched the Treo Abdominal Aortic Stent Graft System for the treatment of abdominal aortic aneurysms. The device features a low-profile delivery system and improved graft conformability. |

Terumo Aortic |

|

In March 2019, MicroPort Scientific Corporation launched the Xtower Abdominal Aortic Stent Graft System for the treatment of abdominal aortic aneurysms. The device features a low-profile delivery system and improved graft conformability. |

MicroPort Scientific Corporation |

|

Merger/Acquisition |

Involved Companies |

|

In September 2021, Terumo Corporation acquired Incraft Holdings Corporation, a manufacturer of endovascular stent grafts for the treatment of aortic aneurysms. The acquisition strengthened Terumo's position in the aortic aneurysm stent grafts market. |

Terumo Corporation, Incraft Holdings Corporation |

|

In June 2020, Endologix acquired Nellix, Inc., a company developing a novel endovascular aneurysm sealing system for the treatment of abdominal aortic aneurysms. The acquisition expanded Endologix's product portfolio in the aortic aneurysm market. |

Endologix, Nellix, Inc. |

|

In April 2019, Medtronic acquired Rezolut Technologies, Inc., a company developing a novel polymer-based technology for the treatment of aortic aneurysms. The acquisition expanded Medtronic's research and development efforts in the aortic aneurysm field. |

Medtronic, Rezolut Technologies, Inc. |

Market Regional Insights:

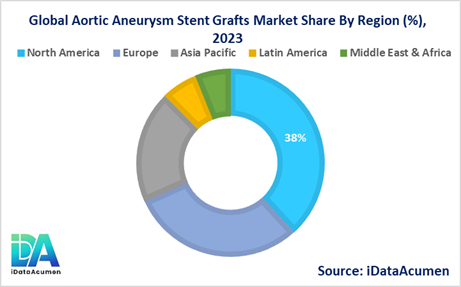

The Aortic Aneurysm Stent Grafts Market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America is expected to be the largest market for the Aortic Aneurysm Stent Grafts Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the increasing prevalence of aortic aneurysms, advanced healthcare infrastructure, and the presence of major market players in the region.

The Europe market is expected to be the second-largest market for the Aortic Aneurysm Stent Grafts Market, accounting for over 30.1% of the market share in 2024. The growth of the market in Europe is attributed to the aging population, favorable reimbursement policies, and the adoption of minimally invasive endovascular procedures.

The Asia Pacific market is expected to be the fastest-growing market for the Aortic Aneurysm Stent Grafts Market, with a CAGR of over 9.2% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the increasing prevalence of aortic aneurysms, rising healthcare expenditure, and improving access to advanced medical treatments, with a market share of 19.4%.

Market Segmentation:

- By Product Type

- Abdominal Aortic Aneurysm Stent Grafts

- Thoracic Aortic Aneurysm Stent Grafts

- Fenestrated Stent Grafts

- Branched Stent Grafts

- Others (Aorto-Uni-Iliac Stent Grafts, Aorto-Bi-Iliac Stent Grafts)

- By Aneurysm Type

- Abdominal Aortic Aneurysm

- Thoracic Aortic Aneurysm

- Others (Thoracoabdominal Aortic Aneurysm, Aortic Arch Aneurysm)

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others (Catheterization Laboratories, Research Institutes)

- By Anatomy

- Infrarenal Aneurysms

- Pararenal Aneurysms

- Suprarenal Aneurysms

- Others (Thoracoabdominal Aneurysms, Aortic Arch Aneurysms)

- By Material

- Polyester

- Polytetrafluoroethylene (PTFE)

- Nitinol

- Others (Dacron, ePTFE)

- By Delivery System

- Bifurcated Delivery Systems

- Aorto-Uni-Iliac Delivery Systems

- Aorto-Bi-Iliac Delivery Systems

- Others (Fenestrated Delivery Systems, Branched Delivery Systems)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Segment Analysis:

The abdominal aortic aneurysm stent grafts segment is expected to dominate the market and grow at a CAGR of around 8.5% during the forecast period. This segment is projected to have a market size of approximately $1.8 billion by 2024. The growth is driven by the higher prevalence of abdominal aortic aneurysms compared to thoracic aneurysms, as well as the increasing adoption of minimally invasive endovascular repair procedures.

In terms of regional growth, the Asia Pacific market is expected to witness significant growth for the abdominal aortic aneurysm stent grafts segment, with a CAGR of around 10.2% during the forecast period. This growth can be attributed to the improving healthcare infrastructure, rising awareness, and increasing adoption of advanced medical technologies in countries like China and India.

The fenestrated stent grafts segment is also expected to grow at a substantial rate, with a projected CAGR of around 9.7% during the forecast period. This segment is anticipated to be the second-largest by 2024, driven by the increasing demand for treating complex aortic aneurysms involving branch vessels. The North American and European markets are expected to be significant contributors to the growth of this segment due to the presence of well-established healthcare systems and the availability of advanced surgical techniques.

Top companies in the Aortic Aneurysm Stent Grafts Market:

- Medtronic

- Endologix

- W. L. Gore & Associates

- Cook Medical

- Terumo Corporation

- Cardinal Health

- MicroPort Scientific Corporation

- Lombard Medical

- Jotec GmbH

- TriVascular Technologies, Inc.

- Braile Biomédica

- Vascutek Ltd.

- Nellix, Inc.

- Cardiatis

- Aptus Endosystems, Inc.

- Vascutek Ltd.

- Lifetech Scientific Corporation

- Nano Endoluminal

- Bard Peripheral Vascular, Inc.

- Terumo Aortic