Market Analysis:

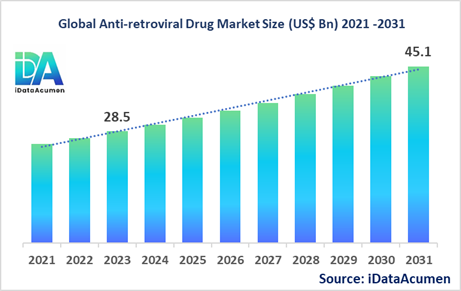

The Anti-retroviral Drug Market had an estimated market size worth US$ 28.5 billion in 2023, and it is predicted to reach a global market valuation of US$ 45.1 billion by 2031, growing at a CAGR of 5.9% from 2024 to 2031. Anti-retroviral drugs are medications used to treat HIV (Human Immunodeficiency Virus), which is a virus that attacks the body's immune system, specifically the CD4 cells, which help the immune system fight off infections. These drugs work by preventing the replication of HIV in the body, thereby reducing the viral load and allowing the immune system to recover and function properly. The advantages of anti-retroviral drugs include prolonging the lives of people living with HIV, reducing the risk of HIV transmission, and preventing the progression of HIV to AIDS (acquired immunodeficiency syndrome).

The drivers for the growth of the anti-retroviral drug market include the increasing prevalence of HIV/AIDS worldwide, government initiatives and funding for HIV/AIDS treatment programs, and advancements in research and development of new and improved anti-retroviral drugs.

The Anti-retroviral Drug Market is segmented by drug class, drug combination, route of administration, dosage form, distribution channel, and end-user, as well as by region. By drug class, the market is segmented into Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, Entry/Fusion Inhibitors, and others. One of the largest subsegments within the drug class segment is the Integrase Inhibitors, as these drugs are highly effective in suppressing viral replication and have a higher genetic barrier to resistance compared to other drug classes. In recent years, there has been a notable increase in the development and adoption of Integrase Inhibitors, contributing to the growth of this segment.

An example of a recent product launch in this segment is Cabenuva, a long-acting injectable regimen developed by ViiV Healthcare, which received FDA approval in January 2021. This regimen combines the integrase inhibitor cabotegravir and the non-nucleoside reverse transcriptase inhibitor rilpivirine, and it is the first complete long-acting regimen for the treatment of HIV-1 infection in virologically suppressed adults.

Epidemiology Insights:

- The disease burden of HIV/AIDS varies across major regions. According to UNAIDS, in 2021, the highest prevalence of HIV was in Sub-Saharan Africa, where approximately 25.6 million people were living with HIV, accounting for nearly 67% of the global HIV burden.

- Key epidemiological trends and driving factors behind epidemiological changes across major markets include the adoption of antiretroviral therapy (ART), which has significantly improved survival rates and reduced transmission rates. However, factors such as limited access to healthcare services, stigma, and discrimination continue to hamper efforts to control the epidemic in certain regions.

- In the United States, the Centers for Disease Control and Prevention (CDC) estimated that approximately 1.2 million people were living with HIV at the end of 2019. In the European Union and European Economic Area, around 810,000 people were living with HIV in 2020, according to the European Centre for Disease Prevention and Control (ECDC).

- Growth opportunities in the anti-retroviral drug market are driven by the increasing patient population, particularly in developing regions where access to treatment remains limited.

- HIV/AIDS is not considered a rare disease, as it affects millions of people globally.

Market Landscape:

- Despite the availability of several anti-retroviral drugs, there remain unmet needs in the market, such as the development of therapies with improved safety profiles, reduced pill burden, and better efficacy against drug-resistant strains of HIV.

- Current treatment options for HIV/AIDS typically involve a combination of anti-retroviral drugs from different drug classes, such as Nucleoside Reverse Transcriptase Inhibitors (NRTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Protease Inhibitors (PIs), Integrase Inhibitors, and Entry/Fusion Inhibitors. Examples of approved therapies include Biktarvy (bictegravir, emtricitabine, and tenofovir alafenamide), Genvoya (elvitegravir, cobicistat, emtricitabine, and tenofovir alafenamide), and Triumeq (abacavir, dolutegravir, and lamivudine).

- Upcoming therapies and technologies for HIV treatment include long-acting injectable formulations, which can be administered less frequently than daily pills, potentially improving patient compliance and treatment outcomes. Additionally, researchers are exploring new drug targets and mechanisms of action, such as capsid inhibitors and maturation inhibitors, to address drug resistance.

- Several breakthrough treatment options are currently being developed, including broadly neutralizing antibodies (bNAbs) and gene therapies. bNAbs are engineered antibodies that can neutralize a wide range of HIV strains, potentially offering a new approach to HIV treatment and prevention. Gene therapies aim to modify or remove the CCR5 co-receptor, which HIV uses to enter and infect cells, potentially providing a functional cure for HIV.

- The anti-retroviral drug market is predominantly composed of branded drug manufacturers, with a few large pharmaceutical companies dominating the market share. However, there is also a presence of generic drug manufacturers, particularly in developing regions, as patents for some older anti-retroviral drugs have expired.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 28.5 Bn |

|

CAGR (2024 - 2031) |

5.9% |

|

The revenue forecast in 2031 |

US$ 45.1 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Gilead Sciences, Inc., ViiV Healthcare, Bristol-Myers Squibb Company, Janssen Pharmaceuticals, Inc. (Johnson & Johnson), Merck & Co., Inc., AbbVie Inc., Theratechnologies Inc., Cipla Limited, Mylan N.V., Hetero Drugs Limited, Aurobindo Pharma Limited, Laurus Labs Limited, Emcure Pharmaceuticals Limited, Strides Pharma Science Limited, Macleods Pharmaceuticals Ltd., Micro Labs Ltd., Lupin Limited, Zydus Cadila, Alkem Laboratories Ltd., Sun Pharmaceutical Industries Ltd. |

Market Drivers:

Increasing Prevalence of HIV/AIDS

The rising prevalence of HIV/AIDS worldwide is a significant driver for the anti-retroviral drug market's growth. According to UNAIDS, in 2021, approximately 38.4 million people were living with HIV globally. The high disease burden, particularly in developing regions, necessitates the availability and accessibility of effective anti-retroviral therapies. As the number of people living with HIV continues to rise, the demand for anti-retroviral drugs is expected to increase correspondingly. Moreover, initiatives aimed at early detection and treatment of HIV further contribute to the market's growth by expanding the patient pool requiring anti-retroviral therapy.

Government Initiatives and Funding

Governments around the world have recognized the importance of addressing the HIV/AIDS epidemic and have implemented various initiatives and funding programs to improve access to anti-retroviral drugs. For instance, the U.S. President's Emergency Plan for AIDS Relief (PEPFAR) has provided significant funding and support for HIV/AIDS treatment programs in developing countries. Similarly, the Global Fund to Fight AIDS, Tuberculosis, and Malaria has played a crucial role in increasing access to anti-retroviral drugs in resource-limited settings. These initiatives not only improve treatment accessibility but also raise awareness about the importance of early diagnosis and adherence to anti-retroviral therapy, driving market growth.

Advancements in Research and Development

Ongoing research and development efforts by pharmaceutical companies have led to the introduction of new and improved anti-retroviral drugs with better efficacy, improved safety profiles, and enhanced resistance to viral mutations. These advancements have expanded treatment options for patients, enabling more personalized and effective therapy approaches. Additionally, the development of long-acting injectable formulations and fixed-dose combinations has the potential to improve patient adherence and treatment outcomes, further driving market growth.

Improving Healthcare Infrastructure and Access

In many developing regions, the healthcare infrastructure and access to anti-retroviral drugs have been improving, driven by initiatives from governments, non-governmental organizations, and international aid programs. The establishment of HIV/AIDS treatment centers, the availability of trained healthcare professionals, and the implementation of robust supply chain systems have all contributed to improving access to anti-retroviral therapies. As access improves, more patients can receive the treatment they need, leading to increased demand for anti-retroviral drugs and driving market growth.

Market Opportunities:

Development of Novel Therapeutic Approaches

The anti-retroviral drug market presents opportunities for the development of novel therapeutic approaches that can address unmet needs and overcome challenges such as drug resistance and adverse effects. Researchers are exploring new drug targets and mechanisms of action, including capsid inhibitors, maturation inhibitors, and broadly neutralizing antibodies (bNAbs). These innovative approaches have the potential to offer more effective and durable treatments for HIV/AIDS, opening up new avenues for market growth.

Personalized Medicine and Precision Therapy

Advancements in genomics and pharmacogenomics have paved the way for personalized medicine and precision therapy in the anti-retroviral drug market. By understanding the genetic variations and individual characteristics of patients, healthcare providers can tailor treatment regimens to optimize efficacy and minimize adverse effects. This approach not only improves treatment outcomes but also enhances patient adherence, potentially driving market growth by increasing the demand for personalized anti-retroviral therapies.

Expansion in Emerging Markets

Emerging markets, particularly in regions such as Asia, Africa, and Latin America, represent significant growth opportunities for the anti-retroviral drug market. As healthcare systems in these regions continue to develop and access to anti-retroviral drugs improves, the demand for these medications is expected to rise. Additionally, initiatives by international organizations and partnerships with local pharmaceutical companies can further facilitate the expansion of anti-retroviral drug access in these markets.

Combination Therapies and Long-acting Formulations

The development of innovative combination therapies and long-acting formulations of anti-retroviral drugs presents opportunities for improved patient adherence and treatment outcomes. Combination therapies that simplify dosing regimens and reduce pill burden can enhance patient compliance, while long-acting injectable formulations can provide extended dosing intervals, potentially improving adherence and minimizing the risk of missed doses. These advancements can drive market growth by offering more convenient and effective treatment options.

Market Trends:

Increasing Adoption of Single-Tablet Regimens

One of the significant trends in the anti-retroviral drug market is the growing adoption of single-tablet regimens (STRs). These formulations combine multiple anti-retroviral drugs into a single pill, simplifying dosing regimens and potentially improving patient adherence. STRs have gained popularity due to their convenience, reduced pill burden, and the potential for better treatment outcomes. Major pharmaceutical companies have introduced several STR products, contributing to the market's growth and aligning with the trend towards more patient-centric treatment approaches.

Focus on Pediatric HIV Treatment

The anti-retroviral drug market is witnessing a growing focus on developing and expanding treatment options for pediatric HIV patients. Children living with HIV often require specialized formulations and dosing regimens tailored to their specific needs. Pharmaceutical companies and researchers are dedicating efforts to develop child-friendly formulations, such as chewable tablets or dispersible tablets, to improve adherence and treatment outcomes in this vulnerable population. This trend is driven by the recognition of the unique challenges faced in treating pediatric HIV and the need to address this unmet medical need.

Emphasis on Long-acting Injectable Formulations

The development of long-acting injectable formulations of anti-retroviral drugs is a major trend shaping the market. These formulations allow for less frequent dosing, typically administered monthly or every few months, compared to daily oral medications. Long-acting injectables have the potential to improve patient adherence and reduce the risk of missed doses, thereby enhancing treatment outcomes. Several pharmaceutical companies have ongoing clinical trials and initiatives focused on developing long-acting injectable anti-retroviral therapies, driven by the potential benefits for patient convenience and treatment effectiveness.

Increasing Collaboration and Partnerships

Collaborations and partnerships between pharmaceutical companies, research institutions, and non-governmental organizations are becoming more prevalent in the anti-retroviral drug market. These collaborations aim to accelerate research and development efforts, improve access to anti-retroviral drugs in underserved regions, and address challenges such as drug resistance and treatment adherence. By pooling resources and expertise, these partnerships can drive innovation, facilitate knowledge sharing, and ultimately contribute to the market's growth and the goal of improving global access to HIV/AIDS treatment.

Market Restraints:

High Treatment Costs and Affordability Issues

One of the major restraints in the anti-retroviral drug market is the high cost of treatment, which can limit access and affordability, particularly in resource-limited settings. Anti-retroviral therapies often involve lifelong treatment regimens, and the associated costs can be a significant financial burden for patients and healthcare systems. Despite efforts to increase access, many individuals and communities still struggle to afford these essential medications, hindering market growth and limiting the potential for widespread treatment coverage.

Drug Resistance and Development of Resistant Strains

The emergence of drug-resistant strains of HIV is a significant challenge in the anti-retroviral drug market. As the virus replicates and evolves, it can develop mutations that confer resistance to certain anti-retroviral drugs, rendering them less effective or ineffective. This drug resistance can limit treatment options and require the development of new and more potent anti-retroviral therapies. The ongoing battle against drug resistance requires continuous research and development efforts, which can be resource-intensive and time-consuming, potentially restraining market growth.

Adverse Effects and Toxicity Concerns

While anti-retroviral drugs have significantly improved the management of HIV/AIDS, some of these medications can have adverse effects and toxicity concerns. Side effects such as nausea, fatigue, diarrhea, and metabolic complications can impact patient adherence and quality of life. Additionally, long-term use of certain anti-retroviral drugs may increase the risk of cardiovascular or renal complications. These potential adverse effects and toxicity concerns can discourage patients from initiating or continuing treatment, ultimately restraining market growth and underscoring the need for safer and more tolerable treatment options.

Recent Developments:

|

Development |

Involved Company |

|

Cabenuva, a long-acting injectable regimen for HIV-1 treatment, received FDA approval in January 2021. It combines cabotegravir and rilpivirine, allowing monthly or every-other-month dosing. |

ViiV Healthcare |

|

Sunlenca, a two-drug regimen containing lenacapavir and other antiretrovirals, received FDA approval in December 2022 for treating HIV-1 infection in heavily treatment-experienced adults with multi-drug resistant HIV-1 infection. |

Gilead Sciences, Inc. |

|

Islatravir, an investigational nucleoside reverse transcriptase translocation inhibitor, showed promising results in clinical trials for both treatment and prevention of HIV. It is being developed as a once-monthly oral or injectable formulation. |

Merck & Co., Inc. |

|

Product Launch |

Company Name |

|

Biktarvy, a once-daily single-tablet regimen for HIV-1 treatment, was approved by the FDA in February 2018 and has since become one of the most prescribed HIV regimens globally. |

Gilead Sciences, Inc. |

|

Dovato, a two-drug regimen containing dolutegravir and lamivudine, was approved by the FDA in April 2019 for the treatment of HIV-1 infection in adults with no antiretroviral treatment history. |

ViiV Healthcare |

|

Rukobia, a novel HIV attachment inhibitor, was approved by the FDA in July 2022 for the treatment of HIV-1 infection in heavily treatment-experienced adults with multidrug-resistant HIV-1 infection. |

GlaxoSmithKline plc |

|

Merger/Acquisition |

Involved Companies |

|

In January 2022, Gilead Sciences acquired Immunocore, a biotechnology company focused on immune-oncology therapies, for $21 billion, expanding Gilead's portfolio into cancer treatments. |

Gilead Sciences, Inc. and Immunocore |

|

In December 2022, ViiV Healthcare, a global specialist HIV company majority-owned by GlaxoSmithKline, acquired a majority stake in Halozyme Therapeutics, a biotechnology company developing novel drug delivery technologies. |

ViiV Healthcare and Halozyme Therapeutics |

|

In July 2022, Merck & Co. acquired Pandion Therapeutics, a biotechnology company developing therapies for autoimmune diseases, for $1.85 billion, strengthening Merck's pipeline in immunology. |

Merck & Co., Inc. and Pandion Therapeutics |

Regional Analysis:

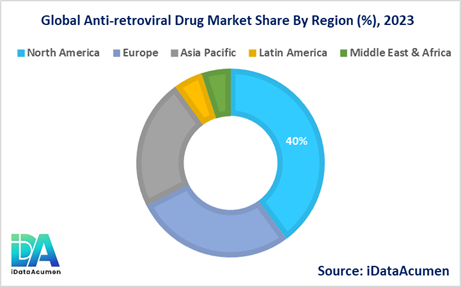

North America is expected to be the largest market for the Anti-retroviral Drug Market during the forecast period, accounting for over 39.8% of the market share in 2023. The growth of the market in North America is attributed to the well-established healthcare infrastructure, high adoption rates of advanced anti-retroviral therapies, and the presence of major pharmaceutical companies in the region.

Europe is expected to be the second-largest market for the Anti-retroviral Drug Market, accounting for over 27.6% of the market share in 2023. The growth of the market in Europe is driven by factors such as government initiatives to improve access to HIV/AIDS treatment, increasing awareness about the importance of early diagnosis and treatment, and the availability of reimbursement policies for anti-retroviral drugs in many European countries.

The Asia-Pacific region is expected to be the fastest-growing market for the Anti-retroviral Drug Market, with a CAGR of over 18.2% during the forecast period by 2023. The growth of the market in the Asia-Pacific region is attributed to the increasing prevalence of HIV/AIDS, particularly in countries like India and China, rising healthcare expenditure, and improving access to anti-retroviral drugs through government initiatives and international aid programs.

Market Segmentation:

- By Drug Class

- Nucleoside Reverse Transcriptase Inhibitors (NRTIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- Protease Inhibitors (PIs)

- Integrase Inhibitors

- Entry/Fusion Inhibitors

- Others (CCR5 Antagonists, Boosting Agents)

- By Drug Combination

- Single-Tablet Regimens (STRs)

- Multi-Tablet Regimens (MTRs)

- Others (Monotherapies)

- By Route of Administration

- Oral

- Parenteral

- By Dosage Form

- Tablets

- Capsules

- Oral Solutions/Syrups

- Injections

- Others (Granules, Powders)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Government Agencies

- Others (Mail Order Pharmacies)

- By End-User

- Hospitals

- Clinics

- Homecare Settings

- Others (Research Institutes, Pharmaceutical Companies)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Segment Analysis:

- By Drug Class Segment:

- The Integrase Inhibitors segment is projected to experience significant growth in the anti-retroviral drug market, driven by the increasing adoption of these drugs due to their high efficacy and better resistance profiles compared to other drug classes.

- In the North American and European regions, the Integrase Inhibitors segment is expected to grow at a CAGR of around 8-10% during the forecast period, owing to the widespread availability and reimbursement policies for these advanced anti-retroviral therapies.

- In the Asia-Pacific region, the Integrase Inhibitors segment is likely to witness the highest growth, with a projected CAGR of 12-15%, as developing countries in this region aim to improve access to the latest anti-retroviral treatments.

- Based on market projections, the Integrase Inhibitors segment is expected to be the second-largest segment in the anti-retroviral drug market by 2024, after the Nucleoside Reverse Transcriptase Inhibitors (NRTIs) segment.

- By Drug Combination Segment:

- The Single-Tablet Regimens (STRs) segment is anticipated to grow significantly across all regions, driven by the convenience and improved adherence associated with these formulations.

- The North American and European markets are likely to lead the growth of the STRs segment, with a projected CAGR of around 7-9% during the forecast period.

- In the Asia-Pacific region, the STRs segment is expected to witness rapid growth, with a CAGR of 10-12%, as healthcare systems in this region prioritize improving patient compliance and treatment outcomes.

- The STRs segment is projected to be the largest segment in the anti-retroviral drug market by 2024, surpassing the Multi-Tablet Regimens (MTRs) segment.

- By Distribution Channel Segment:

- The Hospital Pharmacies segment is expected to maintain its leading position in the anti-retroviral drug market, driven by the increasing number of hospital-based HIV/AIDS treatment centers and the availability of specialized healthcare professionals.

- In developed regions like North America and Europe, the Hospital Pharmacies segment is likely to grow at a moderate CAGR of 5-7%, reflecting the well-established healthcare infrastructure and patient access.

- In the Asia-Pacific and other developing regions, the Hospital Pharmacies segment is projected to experience higher growth, with a CAGR of 8-10%, as governments and healthcare organizations focus on improving access to anti-retroviral drugs through hospital-based programs.

These segment analyses provide insights into the potential growth areas and regional dynamics within the anti-retroviral drug market, enabling stakeholders to make informed decisions and develop targeted strategies.

Top companies in the Anti-retroviral Drug Market:

- Gilead Sciences, Inc.

- ViiV Healthcare

- Bristol-Myers Squibb Company

- Janssen Pharmaceuticals, Inc. (Johnson & Johnson)

- Merck & Co., Inc.

- AbbVie Inc.

- Theratechnologies Inc.

- Cipla Limited

- Mylan N.V.

- Hetero Drugs Limited

- Aurobindo Pharma Limited

- Laurus Labs Limited

- Emcure Pharmaceuticals Limited

- Strides Pharma Science Limited

- Macleods Pharmaceuticals Ltd.

- Micro Labs Ltd.

- Lupin Limited

- Zydus Cadila

- Alkem Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.