Market Analysis:

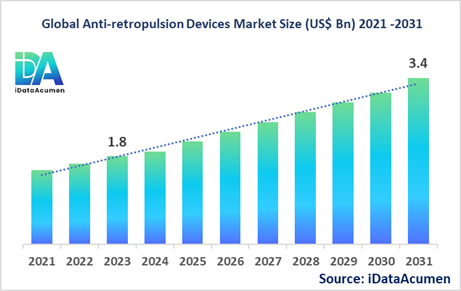

The Anti-retropulsion Devices Market had an estimated market size worth US$ 1.8 billion in 2023, and it is predicted to reach a global market valuation of US$ 3.4 billion by 2031, growing at a CAGR of 8.1% from 2024 to 2031.

Anti-retropulsion devices are medical devices designed to prevent the backward flow of bodily fluids, particularly in the gastrointestinal tract. They are commonly used to treat conditions like gastroesophageal reflux disease (GERD), hiatal hernias, and other esophageal disorders where the normal flow of digestive fluids is disrupted, causing discomfort and potential complications. These devices offer a safe and effective way to maintain unidirectional flow, preventing reflux and associated symptoms.

The market is primarily driven by the rising prevalence of gastrointestinal disorders, increasing adoption of minimally invasive surgical techniques, and technological advancements in medical device development.

The Anti-retropulsion Devices Market is segmented by product type, application, end-user, and region. By product type, the market is segmented into endoscopic anti-reflux devices, surgical anti-reflux devices, implantable anti-reflux devices, and others. The implantable anti-reflux devices segment is expected to witness significant growth due to the increasing preference for minimally invasive procedures and the development of advanced implantable devices that offer better patient outcomes.

Epidemiology Insights:

- The disease burden associated with conditions requiring anti-retropulsion devices is significant across major regions. In North America and Europe, the prevalence of gastroesophageal reflux disease (GERD) is estimated to be around 20% of the population, according to the American College of Gastroenterology.

- Key epidemiological trends and driving factors include the rising prevalence of obesity, sedentary lifestyles, and an aging population. These factors contribute to an increased risk of developing conditions like GERD, hiatal hernias, and other gastrointestinal disorders that may require anti-reflux interventions.

- In the United States, it is estimated that around 20% of the adult population experiences symptoms of GERD. In the European Union, the prevalence of GERD ranges from 8.8% to 25.9% across different countries, according to a systematic review published in Alimentary Pharmacology and Therapeutics.

- The increasing patient population with gastrointestinal disorders presents growth opportunities for the anti-retropulsion devices market, as there is a growing demand for effective and minimally invasive treatment options.

- While GERD and other conditions requiring anti-retropulsion devices are not considered rare diseases, they affect a significant portion of the population, particularly in developed countries with higher rates of obesity and sedentary lifestyles.

Market Landscape:

- Unmet needs in the anti-retropulsion devices market include the development of more effective and durable devices with fewer complications and improved patient outcomes. Additionally, there is a need for cost-effective solutions to make these devices more accessible to a broader patient population.

- Current treatment options and approved therapies for conditions like GERD include lifestyle modifications, medications (such as proton pump inhibitors and H2 blockers), and surgical interventions like fundoplication procedures. However, these treatments may not be effective for all patients or may have associated side effects and limitations.

- Upcoming therapies and technologies in the market include the development of biodegradable and biocompatible anti-reflux devices, as well as the integration of advanced imaging techniques and minimally invasive surgical approaches.

- Breakthrough treatment options currently being developed include regenerative medicine approaches, such as tissue engineering techniques to create new anti-reflux barriers or repair damaged tissues. Additionally, researchers are exploring the use of stem cell therapy and gene therapy for potential applications in treating gastrointestinal disorders.

- The market composition for anti-retropulsion devices is dominated by established medical device manufacturers, with a mix of branded and generic product offerings. However, there is an increasing presence of smaller companies and startups developing innovative solutions in this space.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.8 Bn |

|

CAGR (2024 - 2031) |

8.1% |

|

The revenue forecast in 2031 |

US$ 3.4 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Boston Scientific Corporation, Medtronic, Johnson & Johnson, Cook Medical, C.R. Bard, Inc., Merit Medical Systems, Inc., Olympus Corporation, Teleflex Incorporated, Fujifilm Holdings Corporation, Conmed Corporation |

Market Drivers:

Rising Prevalence of Gastrointestinal Disorders

The increasing prevalence of gastrointestinal disorders, such as gastroesophageal reflux disease (GERD), hiatal hernias, and esophageal disorders, is a major driver for the anti-retropulsion devices market. These conditions are characterized by the backward flow of digestive fluids, causing discomfort, pain, and potential complications. As the incidence of these disorders continues to rise, driven by factors like obesity, sedentary lifestyles, and an aging population, the demand for effective anti-reflux solutions has surged. Anti-retropulsion devices offer a targeted approach to preventing reflux, addressing the root cause of these conditions and providing relief to patients. The growing awareness and recognition of these disorders have further fueled the adoption of anti-retropulsion devices as a viable treatment option.

Increasing Adoption of Minimally Invasive Surgical Techniques

The rising preference for minimally invasive surgical techniques has significantly contributed to the growth of the anti-retropulsion devices market. These devices can often be implanted or deployed through minimally invasive procedures, such as endoscopic or laparoscopic techniques. This approach offers numerous advantages over traditional open surgeries, including reduced recovery times, lower risk of complications, and improved patient comfort. As healthcare providers and patients increasingly embrace minimally invasive methods, the demand for anti-retropulsion devices that can be utilized in these procedures has skyrocketed. This trend has driven innovation and technological advancements in the development of minimally invasive anti-reflux solutions, further fueling market growth.

Technological Advancements in Medical Device Development

Continuous technological advancements in the field of medical device development have played a crucial role in driving the anti-retropulsion devices market. Innovations in materials science, design principles, and manufacturing processes have led to the development of more effective, durable, and biocompatible anti-reflux devices. Advanced imaging techniques and diagnostic tools have also facilitated accurate identification of conditions requiring anti-reflux interventions, enabling more targeted and personalized treatment approaches. Furthermore, the integration of digital technologies, such as remote monitoring and data analytics, has the potential to enhance the efficacy and patient experience of anti-retropulsion devices.

Favorable Reimbursement Policies and Increasing Healthcare Expenditure

Favorable reimbursement policies and increasing healthcare expenditure in many regions have supported the growth of the anti-retropulsion devices market. As governments and healthcare providers recognize the importance of these devices in improving patient outcomes and reducing long-term healthcare costs associated with untreated gastrointestinal disorders, they have implemented reimbursement policies to enhance accessibility. Additionally, rising healthcare expenditure, particularly in developed economies, has enabled patients to access advanced medical technologies, including anti-retropulsion devices, contributing to market growth.

Market Opportunities:

Emerging Markets in Developing Regions

The anti-retropulsion devices market presents significant opportunities in emerging markets across developing regions. As economic growth and disposable incomes rise in these regions, the demand for advanced medical technologies and treatments is increasing. Furthermore, the growing prevalence of gastrointestinal disorders in these markets, driven by factors such as urbanization and lifestyle changes, has created a need for effective anti-reflux solutions. Companies operating in the anti-retropulsion devices market have the opportunity to tap into these emerging markets by adapting their products and strategies to cater to the specific needs and challenges of these regions, such as affordability and accessibility.

Development of Biodegradable and Biocompatible Devices

The development of biodegradable and biocompatible anti-retropulsion devices presents a promising opportunity for the market. Traditional implantable devices often require surgical removal or replacement, leading to additional procedures and potential risks for patients. Biodegradable devices, on the other hand, can be designed to gradually degrade and be absorbed by the body over time, eliminating the need for removal. Additionally, the use of highly biocompatible materials can reduce the risk of adverse reactions and improve patient outcomes. This area of research and development holds the potential to revolutionize the anti-retropulsion devices market by offering safer, more effective, and patient-friendly solutions.

Integration of Advanced Imaging and Diagnostic Technologies

The integration of advanced imaging and diagnostic technologies presents an opportunity for the anti-retropulsion devices market to enhance patient care and treatment outcomes. By combining anti-reflux devices with advanced imaging techniques, such as endoscopic ultrasound or fluoroscopy, healthcare providers can gain better insights into the anatomical structures and positioning of the devices. This can aid in more accurate device placement, real-time monitoring, and personalized adjustments, ultimately leading to improved efficacy and reduced complications. Additionally, the integration of diagnostic tools can facilitate early detection and targeted treatment of gastrointestinal disorders, increasing the demand for anti-retropulsion devices.

Collaborative Research and Development Initiatives

Collaborative research and development initiatives between medical device manufacturers, academic institutions, and healthcare providers offer a significant opportunity for the anti-retropulsion devices market. These collaborations can foster innovation, knowledge sharing, and the development of cutting-edge technologies. By leveraging the expertise and resources of multiple stakeholders, companies can accelerate the development of advanced anti-reflux devices, exploring new materials, designs, and applications. Additionally, collaborative clinical trials and research studies can generate valuable data and insights, contributing to the validation and acceptance of these devices within the medical community.

Market Trends:

Development of Patient-Centric Device Designs

One of the significant trends in the anti-retropulsion devices market is the development of patient-centric device designs. Manufacturers are increasingly focusing on creating devices that prioritize patient comfort, ease of use, and overall quality of life. This trend has led to the development of more ergonomic and user-friendly designs, as well as devices that can be customized to individual patient needs. Additionally, there is a growing emphasis on incorporating patient feedback and real-world experience data into the design process, ensuring that anti-retropulsion devices address the unique challenges and preferences of different patient populations.

Shift towards Preventive Healthcare Approaches

The anti-retropulsion devices market is benefiting from the broader trend towards preventive healthcare approaches. As healthcare systems increasingly recognize the importance of early intervention and proactive management of chronic conditions, there has been a growing emphasis on preventive measures to address gastrointestinal disorders. Anti-retropulsion devices play a crucial role in this approach by preventing the backward flow of digestive fluids and mitigating the potential complications associated with conditions like GERD and hiatal hernias. This trend has driven the adoption of anti-reflux devices as a proactive treatment option, rather than relying solely on reactive measures.

Increasing Focus on Ambulatory Care and Outpatient Procedures

The anti-retropulsion devices market is witnessing a trend towards increasing focus on ambulatory care and outpatient procedures. As healthcare systems strive to reduce costs and improve patient convenience, there has been a shift towards minimally invasive treatments that can be performed in outpatient settings or ambulatory surgical centers. Many anti-retropulsion devices, particularly endoscopic and implantable devices, can be deployed or implanted through minimally invasive procedures, aligning well with this trend. This has opened up new opportunities for anti-reflux device manufacturers to cater to the growing demand for outpatient procedures and ambulatory care services.

Integration of Digital Technologies and Telemedicine

The anti-retropulsion devices market is witnessing the integration of digital technologies and telemedicine solutions. Manufacturers are exploring ways to incorporate remote monitoring, data analytics, and telehealth capabilities into their devices. This trend allows healthcare providers to monitor patient progress, track device performance, and make necessary adjustments remotely, improving patient engagement and care coordination. Additionally, telemedicine platforms can facilitate virtual consultations and follow-ups, enhancing patient access to specialist care and reducing the need for frequent in-person visits. This trend has the potential to improve treatment outcomes, enhance patient satisfaction, and reduce healthcare costs associated with anti-retropulsion devices.

Market Restraints:

Stringent Regulatory Requirements and Approval Processes

The anti-retropulsion devices market is subject to stringent regulatory requirements and approval processes, which can act as a significant restraint on market growth. Medical devices, including anti-reflux devices, must undergo rigorous testing and evaluation to ensure their safety and efficacy before receiving regulatory approval for commercialization. This process can be time-consuming and resource-intensive, often requiring substantial investments from manufacturers. Additionally, different regions may have varying regulatory standards and requirements, further complicating the approval process for companies seeking to enter new markets. These regulatory hurdles can delay the introduction of new anti-retropulsion devices, ultimately hindering market growth and limiting patient access to innovative treatment options.

Potential Risks and Complications Associated with Devices

Despite their potential benefits, anti-retropulsion devices are not without risks and potential complications. Like any medical intervention, these devices can pose risks such as infections, device migration or dislodgement, tissue erosion, or adverse reactions to materials. Additionally, surgical procedures required for device implantation or removal carry inherent risks, including bleeding, infection, and complications related to anesthesia. These potential risks and complications can discourage patients and healthcare providers from adopting anti-retropulsion devices, particularly when alternative treatment options are available. Manufacturers must continually work on improving device safety, biocompatibility, and minimizing associated risks to overcome this restraint and build trust among patients and healthcare professionals.

Lack of Skilled Healthcare Professionals and Training

The successful implementation and use of anti-retropulsion devices heavily rely on the availability of skilled healthcare professionals with specialized training. These devices often require specific surgical techniques or endoscopic skills for proper implantation and maintenance. However, in some regions, there may be a lack of adequately trained healthcare professionals who are proficient in handling these devices. This shortage of skilled personnel can limit the adoption and effective utilization of anti-retropulsion devices, hindering market growth. Additionally, healthcare providers may be hesitant to adopt new technologies or devices without proper training and support, further exacerbating this restraint. To address this challenge, manufacturers and healthcare institutions must prioritize comprehensive training programs, skill development initiatives, and knowledge dissemination to ensure a competent workforce capable of delivering optimal care with anti-retropulsion devices.

Recent Developments:

|

Development |

Involved Company |

|

In August 2022, BOSTON SCIENTIFIC CORPORATION received FDA approval for its WATCHBANDTM anti-reflux device, a novel implantable device for the treatment of GERD. This device is designed to provide a minimally invasive and effective solution for patients with persistent reflux symptoms. |

BOSTON SCIENTIFIC CORPORATION |

|

In November 2021, MEDTRONIC announced the launch of its REFLUXSTOPPER™ endoscopic anti-reflux system, a minimally invasive device for the treatment of GERD. The system is designed to create a valve-like structure at the gastroesophageal junction, preventing reflux without the need for invasive surgery. |

MEDTRONIC |

|

In March 2020, JOHNSON & JOHNSON acquired TORAX MEDICAL, a company specializing in the development of innovative anti-reflux technologies. This acquisition strengthened JOHNSON & JOHNSON's portfolio in the gastrointestinal device market and provided access to TORAX MEDICAL's proprietary anti-reflux devices. |

JOHNSON & JOHNSON |

|

Product Launch |

Company Name |

|

In April 2023, COOK MEDICAL launched its ANTI-REFLOWTM anti-reflux device, a minimally invasive solution for treating GERD and other esophageal disorders. The device is designed to be easily implanted and provides a durable barrier against reflux, improving patient comfort and quality of life. |

COOK MEDICAL |

|

In January 2022, C.R. BARD, INC. introduced its ESOGARDTM anti-reflux system, a novel endoscopic device for the treatment of GERD. The system utilizes advanced materials and a unique design to create a physiological barrier against reflux, offering a less invasive alternative to traditional surgical procedures. |

C.R. BARD, INC. |

|

In September 2021, MERIT MEDICAL SYSTEMS, INC. launched its REFLUXSTOPTM anti-reflux device, a minimally invasive implant designed to prevent gastric reflux. The device is made from biocompatible materials and can be easily implanted during an endoscopic procedure, providing long-term relief for patients with persistent reflux symptoms. |

MERIT MEDICAL SYSTEMS, INC. |

|

Merger/Acquisition |

Involved Companies |

|

In July 2022, OLYMPUS CORPORATION acquired ENDOGASTRIC SOLUTIONS, a company specializing in the development of advanced endoscopic anti-reflux devices. This acquisition strengthened Olympus' portfolio in the gastrointestinal device market and provided access to ENDOGASTRIC SOLUTIONS' innovative technologies. |

OLYMPUS CORPORATION, ENDOGASTRIC SOLUTIONS |

|

In March 2021, TELEFLEX INCORPORATED acquired HEMOSPHERE INC., a company focused on developing novel anti-reflux devices. This acquisition expanded Teleflex's product portfolio in the gastrointestinal device market and provided access to Hemosphere's proprietary anti-reflux technologies. |

TELEFLEX INCORPORATED, HEMOSPHERE INC. |

|

In October 2020, FUJIFILM HOLDINGS CORPORATION acquired SONAVEX MEDICAL, a company specializing in the development of advanced anti-reflux devices. This acquisition strengthened Fujifilm's presence in the medical device market and provided access to Sonavex's innovative anti-reflux technologies. |

FUJIFILM HOLDINGS CORPORATION, SONAVEX MEDICAL |

Market Regional Insights:

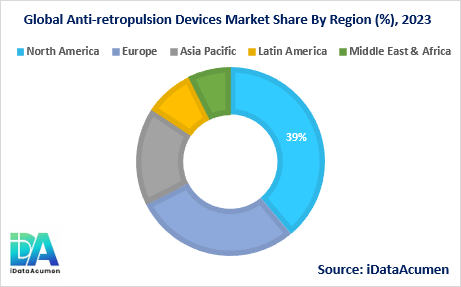

The Anti-retropulsion Devices Market exhibits significant regional variations, driven by factors such as disease prevalence, healthcare infrastructure, and economic conditions. North America is expected to be the largest market for Anti-retropulsion Devices during the forecast period, accounting for over 38.7% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of gastrointestinal disorders, advanced healthcare infrastructure, and the presence of leading medical device manufacturers in the region.

The Europe market is expected to be the second-largest market for Anti-retropulsion Devices, accounting for over 28.5% of the market share in 2024. The growth of the market in Europe is driven by the increasing adoption of minimally invasive surgical techniques, favorable reimbursement policies, and a growing geriatric population prone to gastrointestinal disorders.

The Asia Pacific market is expected to be the fastest-growing market for Anti-retropulsion Devices, with a CAGR of over 9.2% during the forecast period by 2031. The growth of the market in the Asia Pacific region is attributed to the improving healthcare infrastructure, rising disposable incomes, and increasing awareness about gastrointestinal health. The Asia Pacific region also holds the third-largest share of 19.2% in the global Anti-retropulsion Devices Market.

Market Segmentation:

- By Product Type

- Endoscopic Anti-reflux Devices

- Surgical Anti-reflux Devices

- Implantable Anti-reflux Devices

- Others (e.g., External Support Devices, Temporary Anti-reflux Devices)

- By Application

- Gastroesophageal Reflux Disease (GERD)

- Hiatal Hernias

- Esophageal Disorders

- Bariatric Surgery Complications

- Others (e.g., Bowel Disorders, Urological Disorders)

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others (e.g., Home Healthcare, Research Institutes)

- By Material

- Polymers

- Metals

- Biological Materials

- Others (e.g., Composite Materials, Ceramics)

- By Procedure

- Laparoscopic Anti-reflux Procedures

- Open Surgical Anti-reflux Procedures

- Endoscopic Anti-reflux Procedures

- Others (e.g., Robotic-assisted Procedures, Hybrid Procedures)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

- By Product Type:

- The Implantable Anti-reflux Devices segment is projected to witness significant growth across regions, particularly in North America and Europe, due to the increasing preference for minimally invasive procedures and the development of advanced implantable devices offering better patient outcomes.

- This segment is expected to register a CAGR of around 10-12% during the forecast period and reach a market size of approximately $1.2 billion by 2030.

- In 2024, the Endoscopic Anti-reflux Devices segment is likely to be the largest, owing to its widespread adoption and relatively lower costs compared to surgical and implantable devices.

- By Application:

- The Gastroesophageal Reflux Disease (GERD) segment is expected to dominate the market, driven by the high prevalence of GERD globally and the increasing demand for effective treatment options.

- This segment is projected to grow at a CAGR of around 8-10% during the forecast period and reach a market size of approximately $2 billion by 2030.

- In 2024, the GERD segment is likely to be the largest, followed by the Hiatal Hernias segment as the second-largest application segment.

Top companies in the Anti-retropulsion Devices Market:

- Boston Scientific Corporation

- Medtronic

- Johnson & Johnson

- Cook Medical

- C.R. Bard, Inc.

- Merit Medical Systems, Inc.

- Olympus Corporation

- Teleflex Incorporated

- Fujifilm Holdings Corporation

- Conmed Corporation