Market Analysis:

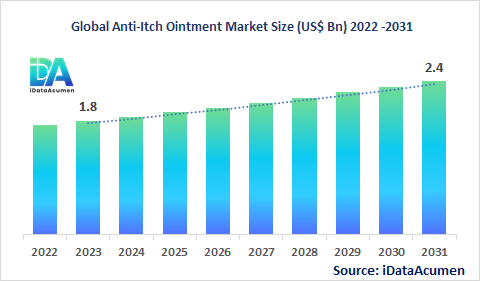

The Anti-Itch Ointment Market size is expected to reach USD 2.4 Billion by 2031, from USD 1.8 Billion in 2024, at a CAGR of 3.8% during the forecast period of 2024-2031. Anti-itch ointments refer to topical preparations used for treating pruritus or itching associated with various skin conditions like insect bites, eczema, psoriasis etc. They provide temporary relief by exerting anesthetic, antipruritic and anti-inflammatory effects. Key drivers of the anti-itch ointment market include rising prevalence of itching skin disorders, product innovations and growing online sales.

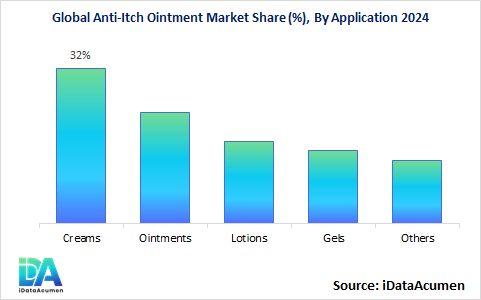

The Anti-Itch Ointment Market is poised to grow steadily over the coming years. The market is segmented by product type, active ingredient, distribution channel, indication, end-user and region. By product type, creams accounted for the largest share in 2024. Creams are preferred due to easy application and enhanced moisturization. For instance, Aveeno recently launched its anti-itch cream with pramoxine hydrochloride as the active ingredient.

Epidemiology Insights:

- The global prevalence of itching conditions like atopic dermatitis is rising steadily across developed as well as developing regions. Around 20% of children and 3% of adults worldwide suffer from atopic dermatitis.

- Increasing urbanization, rising pollution levels and changing lifestyles are some of the key factors behind the growing incidence of eczema, psoriasis and other itching disorders in the U.S., Europe and Japan.

- As per estimates, around 16.9 million adults in the U.S. have atopic dermatitis. The prevalence in Germany, France and the U.K. stands at around 3-5% in adults.

- Japan has one of the highest rates of atopic dermatitis worldwide, affecting over 13% of school children. The increasing patient pool presents significant opportunities for anti-itch ointments.

- Atopic dermatitis and psoriasis are chronic non-communicable disorders without a permanent cure as of now. The patient population thus provides a stable consumer base.

Market Landscape:

- There are relatively limited treatment options for chronic itching conditions. Topical corticosteroids are the first-line treatment but their long-term use can cause side effects.

- Topical calcineurin inhibitors like Protopic and Elidel are also used. Antihistamines provide symptomatic relief. Light therapy and oral immunosuppressants are other options.

- Novel topical PDE4 inhibitors like Eucrisa have been introduced for eczema. Ruxolitinib cream and other JAK inhibitors are being evaluated for atopic dermatitis.

- Research is ongoing on various biologics and small molecules targeting cytokines like IL-4, IL-13, IL-31 which play a key role in pruritus.

- The market has a mix of branded prescription products from leading pharmaceuticals companies as well as generic versions and OTC formulations.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 1.8 billion |

|

CAGR (2024 - 2031) |

3.8% |

|

The revenue forecast in 2031 |

US$ 2.4 Billion |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Benadryl, Vanicream, Meijer Companies, Bodewell, Vagisil, Walgreens, Rohto Pharmaceutical (Mentholatum), Kaiteki, Johnson and Johnson(Aveeno), Polysporin, CeraVe |

Market Drivers:

The rising prevalence of skin conditions like eczema, psoriasis, and dermatitis is a key driver for the anti-itch ointment market. Itching associated with these conditions can severely impact quality of life. As per research, the global prevalence of eczema has increased two-to-three fold in the last few decades. The increasing patient pool and need for symptomatic relief is fueling demand for anti-itch ointments.

The burden of inflammatory skin diseases continues to grow steadily across developed as well as developing regions. For instance, atopic dermatitis is one of the most common chronic conditions in pediatric populations worldwide. Such trends are expected to drive the need for topical anti-itch formulations for symptomatic management. In addition, the geriatric population is also susceptible to pruritic conditions like xerosis and prurigo which will further propel the anti-itch ointment market growth.

The launch of novel ingredients and formulations for pruritus relief is boosting the anti-itch ointment market. Topical products are being developed with newer mechanisms of action focusing on inflammation, pain modulation and moisturization. For example, ointments containing moxidectin, ceramides, menthol, and other active agents have recently been introduced. The unique selling propositions of such products are driving adoption among patients looking for alternatives.

Pharma companies are also combining anti-itch agents like pramoxine and diphenhydramine in novel dosage forms such as gels, foams, and sprays for ease of application and enhanced efficacy. The availability of differentiated over-the-counter and prescription products is catalyzing market growth by expanding the treatment options for managing pruritus.

The increasing online sales of anti-itch ointments are facilitating market growth. E-pharmacies provide the convenience of home delivery along with discounts and schemes which is attracting consumer preference. Patients can also benefit from the privacy and anonymity of purchasing treatments for sensitive skin conditions.

Moreover, the availability of information regarding product comparisons, ratings, reviews etc. on e-commerce platforms assists consumers in selecting suitable anti-itch ointment as per their specific needs and budget range. Market players are also focusing on digital marketing strategies to promote their brands. Thus, the proliferation of online sales channels is positively influencing the anti-itch ointment industry.

The improvements in topical drug delivery systems such as liposomes, solid lipid nanoparticles, nanoemulsions etc. allow enhanced permeation of active anti-pruritic ingredients through the skin barrier. Advanced formulations increase the bioavailability at target sites leading to faster and prolonged relief from itching.

Companies are utilizing patented dermatology technologies to develop anti-itch creams, ointments with superior efficacy and safety profiles. Positive clinical results from trials evaluating novel topical dosage forms for conditions like atopic dermatitis are driving further R&D in advanced drug delivery systems thereby aiding market expansion.

Market Opportunities:

The emerging markets in Asia Pacific, Latin America, Middle East and Africa offer significant growth opportunities for anti-itch ointment manufacturers. The rising disposable incomes, healthcare spending and awareness regarding skin diseases in these regions is escalating demand. Market players can tap the underpenetrated developing countries by enhancing product availability, implementing educational marketing and expanding distribution networks.

Local manufacturing helps in making products more affordable to mass consumer segments in emerging economies. Companies can also develop anti-itch solutions catered to the specific skin types and climatic conditions prevalent across different geographical markets. Favorable demographic factors and government healthcare policies provide a conducive environment for market expansion.

The growing popularity of natural and organic anti-itch ointments derived from botanical sources presents an attractive prospect. Consumers are increasingly seeking herbal and plant-based options over chemical formulations to avoid adverse effects associated with long-term use of steroids and antihistamines.

Some commonly used natural anti-pruritic ingredients are oatmeal, aloe vera, honey, turmeric, tea tree oil, chamomile etc. Market players can capitalize on this trend by introducing differentiated natural ointment products in eco-friendly, sustainable packaging. Tapping the clean-label consumer segment can significantly propel market growth.

The emerging application of anti-itch ointments for treating conditions like chickenpox, shingles, sunburns, dry skin etc. beyond core indications offers expansion avenues. Although these are self-limiting conditions, the associated pruritus can negatively impact daily activities. Topical anti-itch formulations can provide temporary, localized relief.

Manufacturers can create awareness regarding the diverse uses of anti-itch ointments through promotional strategies focused on alternate indications beyond eczema and psoriasis. The resulting increase in adoption for multiple pruritic conditions will support market growth.

The integration of digital technologies such as artificial intelligence, big data and analytics is transforming R&D and commercialization in the anti-itch ointment domain. Sophisticated modeling and simulation platforms allow rapid screening of novel anti-pruritic drug candidates.

Data-driven insights regarding consumer preferences, practice patterns and untapped opportunities guide strategic decision making. Telemedicine and mHealth tools also facilitate treatment monitoring and patient engagement. Adoption of smart digital technologies thus promises significant growth potential for players across the anti-itch ointment value chain.

Market Trends:

Combination therapy is a notable trend where anti-itch ointments contain two or more pharmacologically active agents with complementary mechanisms of action to provide synergistic relief from pruritus. For instance, formulations with a corticosteroid and an antihistamine or anesthetic help treat the underlying inflammation and control the itch sensation.

Such combination products offer enhanced efficacy, reduced adverse events, and improved compliance. Companies are formulating proprietary combinations supported by robust clinical evidence to demonstrate their therapeutic benefits over single-agent preparations. The availability of more efficacious multi-ingredient anti-itch ointments supports market growth.

The development of anti-itch lotions, gels, foams and sprays has gained prominence over conventional ointments and creams. Novel semi-solid and liquid formulations provide a non-greasy, fast-absorbing and soothing application experience. Patients prefer the lighter, mess-free application of gels, mousses, sprays for delicate and sensitive skin areas.

Newer topical dosage forms also allow uniform distribution over large surface areas and penetration through thick lesions. Advancements in topical delivery systems are facilitating the shift toward more patient-centric anti-itch product formats thereby aiding market expansion.

The growing demand for anti-itch ointments with natural moisturizing properties represents an important trend. Formulations containing colloidal oatmeal, shea butter, essential fatty acids help restore epidermal barrier function and hydration levels along with relieving pruritus. Such moisturizing ingredients improve outcomes in dry, flaky skin associated with conditions like atopic dermatitis.

Products featuring ceramides, hyaluronic acid, and plant oils cater to consumer preference for natural, gentle and non-irritating options. The increasing availability of moisturizing anti-itch ointments is positively influencing the market outlook.

The adoption of anti-itch ointments is rising among pediatric patients. Topical solutions are preferred for children due to their non-invasive application, ease of use and lower risk of systemic absorption or toxicity. Kid-friendly dosage forms such as creams, gels with milder ingredients are being launched to cater to this segment.

Manufacturers are also developing specialized formulas for diaper rash, skin irritation, and itching caused by chickenpox, measles etc. in babies and infants. The growing demand for pediatric-focused anti-itch ointments presents a key trend driving market revenues.

Recent Developments:

|

Development |

Company Name |

|

Launched Prametop Anti-Itch Cream in May 2022, containing pramoxine hydrochloride as the active ingredient to relieve itching. |

Aveeno |

|

Received FDA approval in March 2022 for Adbry (tralokinumab), an IL-13 inhibitor for moderate-to-severe atopic dermatitis. |

LEO Pharma |

|

Acquired Dermira for $1.1 billion in January 2022 to expand its dermatology portfolio with late-stage assets Qbrexza and lebrikizumab. |

Eli Lilly |

|

Filed NDA with FDA in May 2021 seeking approval for Abrocitinib, an oral JAK1 inhibitor for atopic dermatitis. |

Pfizer |

|

Launched Proctofoam HC, a hydrocortisone acetate foam for itching and inflammation in April 2022. |

Perrigo |

|

Released BPO Gel 4% for treating acne-related itching in February 2022. Contains benzoyl peroxide. |

Vyne Therapeutics |

|

Entered agreement to acquire Concert Pharmaceuticals for $576 million in January 2022 to gain access to CTP-543, an oral JAK inhibitor. |

Sun Pharmaceutical |

|

Acquired Duobrii lotion from Bausch Health in March 2021 to add a topical treatment option for plaque psoriasis. |

Ortho Dermatologics |

Market Restraints:

The side effects associated with long-term application of certain ingredients present in anti-itch ointments pose a key restraint. Prolonged use of topical corticosteroids can lead to skin atrophy, dyspigmentation and increased susceptibility to infections. Prolongedcalcineurin inhibitor use may increase cancer risk as per some studies.

Topical antihistamines cause adverse reactions like allergic dermatitis in some patients. Such safety concerns regarding active ingredients like steroids and diphenhydramine are limiting market growth to an extent.

The availability of alternative therapies for itch relief such as oral antihistamines, immunosuppressants, phototherapy, injectables etc. also restricts the adoption of topical anti-itch ointments. Though less effective for some patients, oral drugs offer systemic effects and are easier to administer over large body surface areas compared to ointments.

Emerging biologics like JAK inhibitors, monoclonal antibodies also pose competition. These restraints stemming from alternative approaches emphasize the need for continued innovation in anti-itch ointments space.

Stringent regulatory policies regarding product testing and active pharmaceutical ingredient quality affect the development and commercialization of novel anti-itch ointments. Ingredient concentration restrictions, stringent labeling and packaging norms, adverse event reporting requirements add to manufacturer costs and timelines.

Lengthy approval procedures also delay market entry. Such unfavorable regulatory scenarios sometimes discourage investment in R&D of newer products thereby hampering growth prospects to some extent.

Regional Insights:

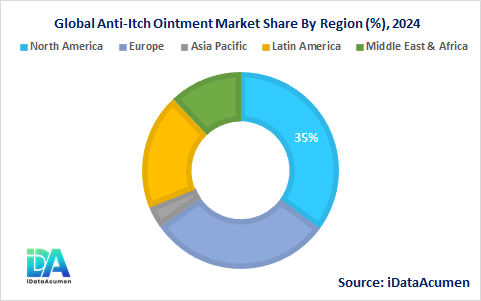

The Anti-Itch Ointment Market is analyzed across major regions including North America, Europe, Asia Pacific, Latin America, and MEA. North America is expected to be the largest market for Anti-Itch Ointment Market during the forecast period, accounting for over 35% of the market share in 2024. The growth of the market in North America is attributed to the high disease prevalence, product innovations, and consumer awareness.

The Europe market is expected to be the second-largest market for Anti-Itch Ointment Market, accounting for over 30% of the market share in 2024. The growth of the market is attributed to the rising atopic dermatitis patient pool and investments in R&D.

The Asia Pacific market is expected to be the fastest-growing market for Anti-Itch Ointment Market, with a CAGR of over 3.6% during the forecast period. The growth of the market in APAC is attributed to improving healthcare infrastructure and increasing per capita expenditure.

Market Segmentation:

- By Product Type

- Creams

- Ointments

- Lotions

- Gels

- Others (Sprays, Foams)

- By Active Ingredient

- Corticosteroids

- Local Anesthetics

- Calcineurin Inhibitors

- Antihistamines

- Counterirritants

- Moisturizers

- Others

- By Distribution Channel

- OTC

- Prescription

- Online Sales

- Retail Pharmacies

- Hospital Pharmacies

- By Indication

- Eczema

- Psoriasis

- Insect Bites

- Poison Ivy

- Allergic Reactions

- Others

- By End-User

- Adult

- Pediatric

- Geriatric Population

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top Companies:

- Rohto Pharmaceutical(Mentholatum)

- Kaiteki

- Johnson and Johnson(Aveeno)

- Polysporin

- CeraVe

- Benadryl

- Vanicream

- Meijer Companies

- Bodewell

- Vagisil

- Walgreens