Market Analysis:

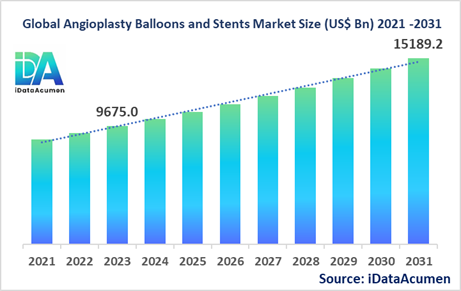

The Angioplasty Balloons and Stents Market had an estimated market size worth US$ 9,675 million in 2023, and it is predicted to reach a global market valuation of US$ 15,189.2 million by 2030, growing at a CAGR of 5.8% from 2024 to 2031.

Angioplasty is a medical procedure used to open narrowed or blocked blood vessels, typically in the heart, by inflating a small balloon-tipped catheter. Stents, which are small, expandable tubes, are often placed during the procedure to help keep the artery open and improve blood flow. This procedure is commonly used to treat conditions like coronary artery disease, which can lead to chest pain, shortness of breath, and even heart attacks.

Key drivers of the Angioplasty Balloons and Stents market include the increasing prevalence of cardiovascular diseases, the growing adoption of minimally invasive procedures, advancements in stent and balloon technology, and the aging global population. The market is segmented by product type, end-user, material, coating, and application. One of the largest and fastest-growing subsegments is drug-eluting balloons, which are designed to deliver medication directly to the treatment site to prevent the recurrence of blockages.

Epidemiology Insights:

- The burden of cardiovascular diseases is significant globally, with the World Health Organization reporting that these conditions were responsible for an estimated 17.9 million deaths in 2019. The prevalence of coronary artery disease, a leading cause of the need for angioplasty, is particularly high in North America and Europe.

- Key epidemiological trends include the rising incidence of risk factors such as obesity, diabetes, and sedentary lifestyles, which are contributing to the growing burden of cardiovascular diseases. In the United States, for example, the prevalence of coronary artery disease has remained relatively stable in recent years, affecting around 6.7% of the adult population.

- Disease incidence and prevalence vary across major markets, with the United States and European Union countries generally reporting higher rates compared to other regions. However, the Asia-Pacific region is expected to experience faster growth in the number of patients requiring angioplasty procedures due to the increasing adoption of Western diets and lifestyle changes.

- The growing elderly population, who are at higher risk of cardiovascular diseases, presents significant growth opportunities for the Angioplasty Balloons and Stents market. Additionally, improved access to healthcare and the development of advanced diagnostic tools are expected to contribute to the early detection and treatment of these conditions.

Market Landscape:

- Despite the availability of various treatment options, including medications and surgical interventions, there is still an unmet need for more effective and less invasive therapies to address the growing burden of cardiovascular diseases.

- Current treatment options for angioplasty include plain old balloon angioplasty (POBA), drug-eluting stents, and bioresorbable stents. These technologies have been approved for use and are widely adopted in clinical practice.

- Upcoming therapies and technologies in the pipeline include the development of novel drug-eluting balloons, advanced stent designs, and the integration of artificial intelligence and machine learning to enhance the accuracy of diagnosis and treatment planning.

- Breakthrough treatment options currently being developed include the use of stem cell therapies and gene therapies to address the underlying causes of cardiovascular diseases and promote the regeneration of damaged heart tissue.

- The Angioplasty Balloons and Stents market is characterized by the presence of both generic and branded manufacturers, with the latter dominating the market due to their focus on innovation and the introduction of technologically advanced products.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 9,675 Mn |

|

CAGR (2024 - 2031) |

5.8% |

|

The revenue forecast in 2031 |

US$ 15,189.2 Mn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Cordis (a Cardinal Health company), Terumo Corporation, B. Braun Melsungen AG, Biotronik SE & Co. KG, Cook Medical, Meril Life Sciences Pvt. Ltd., Biosensors International Group, Ltd., Microport Scientific Corporation, Spectranetics Corporation, Alvimedica Medical Devices, Endologix, Inc., Translumina GmbH, Hexacath, Clearstream Technologies Ltd., Rontis Medical, Bentley (subsidiary of B. Braun Melsungen AG), Elixir Medical Corporation |

Market Drivers:

Rising Prevalence of Cardiovascular Diseases

The growing incidence of cardiovascular diseases, such as coronary artery disease and peripheral artery disease, is a significant driver fueling the demand for Angioplasty Balloons and Stents. According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, accounting for an estimated 17.9 million deaths in 2019. The rising prevalence of risk factors like obesity, diabetes, and an aging population are contributing to the surge in the number of patients requiring interventional procedures to address blocked or narrowed arteries. Healthcare providers are increasingly turning to angioplasty and stenting as effective treatment options to improve blood flow and reduce the risk of life-threatening complications. As the burden of cardiovascular diseases continues to escalate, the need for advanced medical devices like Angioplasty Balloons and Stents will correspondingly grow, driving the expansion of this market.

Technological Advancements in Angioplasty Devices

The rapid pace of technological innovation in the medical device industry has been a key driver of the Angioplasty Balloons and Stents market. Manufacturers are continuously investing in research and development to introduce novel products that enhance clinical outcomes and improve patient experiences. The advent of drug-eluting balloons and stents, for instance, has revolutionized the treatment of cardiovascular diseases by delivering targeted medications directly to the site of the blockage, reducing the risk of restenosis (the re-narrowing of the treated artery). Similarly, the development of bioresorbable stents, which are designed to be gradually absorbed by the body, have emerged as a promising alternative to traditional metal stents. These technological advancements not only improve the efficacy of angioplasty procedures but also expand the available treatment options for healthcare providers, driving the growth of the overall market.

Increasing Adoption of Minimally Invasive Procedures

The growing preference for minimally invasive medical procedures is another key driver fueling the Angioplasty Balloons and Stents market. Angioplasty, which involves the insertion of a small balloon-tipped catheter through a small incision, is considered a less invasive alternative to traditional open-heart surgery. This approach offers numerous benefits, including reduced patient recovery time, lower risk of complications, and improved cosmetic outcomes. As healthcare providers and patients alike continue to prioritize minimally invasive treatments, the demand for Angioplasty Balloons and Stents is expected to rise, driving the growth of this market.

Favorable Reimbursement Policies

The availability of favorable reimbursement policies for angioplasty procedures in many developed countries has been a crucial factor supporting the growth of the Angioplasty Balloons and Stents market. In the United States, for example, Medicare and private insurance providers typically cover the cost of angioplasty and stenting for eligible patients, making these treatments more accessible to a wider population. Similarly, healthcare systems in Europe and other regions have implemented comprehensive coverage policies, ensuring that patients can access these life-saving interventions without facing prohibitive out-of-pocket expenses. As the availability of reimbursement continues to expand, it will further drive the adoption of Angioplasty Balloons and Stents, contributing to the overall market expansion.

Market Opportunities:

Emerging Markets in Developing Countries

The Angioplasty Balloons and Stents market presents significant growth opportunities in emerging markets, particularly in developing countries. As healthcare infrastructure improves and the prevalence of cardiovascular diseases increases in these regions, the demand for advanced medical technologies like Angioplasty Balloons and Stents is expected to surge. For instance, the Asia-Pacific region is poised to be the fastest-growing market, driven by factors such as the rising incidence of lifestyle-related diseases, the growing geriatric population, and the increasing awareness of the importance of early diagnosis and treatment. Manufacturers can capitalize on this opportunity by expanding their sales and distribution networks, tailoring their product offerings to meet the specific needs of these markets, and collaborating with local healthcare providers to improve access to care.

Integration of Digital Technologies

The integration of digital technologies, such as artificial intelligence (AI) and machine learning, presents a significant opportunity for the Angioplasty Balloons and Stents market. These advanced technologies can be leveraged to enhance the accuracy of diagnostic imaging, optimize treatment planning, and improve patient monitoring and outcomes. For example, AI-powered software can analyze angiographic images to assist healthcare providers in identifying the precise location and severity of arterial blockages, enabling them to select the most appropriate device and treatment strategy. Additionally, the integration of remote patient monitoring solutions can facilitate the early detection of complications and allow for timely interventions, leading to better long-term outcomes. As the healthcare industry continues to embrace digital transformation, the adoption of these innovative technologies will create new avenues for growth in the Angioplasty Balloons and Stents market.

Expansion into Peripheral Artery Disease Treatment

While the Angioplasty Balloons and Stents market has traditionally been dominated by the treatment of coronary artery disease, the growing prevalence of peripheral artery disease (PAD) presents a significant opportunity for market expansion. PAD, which affects the arteries in the legs and other extremities, is a common and often underdiagnosed condition that can lead to severe complications, including limb amputation. The development of specialized Angioplasty Balloons and Stents designed for the treatment of PAD can enable healthcare providers to address this unmet need and improve patient outcomes. Manufacturers can capitalize on this opportunity by investing in research and development to expand their product portfolios, establishing partnerships with healthcare providers, and raising awareness about the importance of early PAD diagnosis and treatment.

Advancements in Biodegradable and Bioabsorbable Materials

The ongoing advancements in the development of biodegradable and bioabsorbable materials for medical devices represent a promising opportunity in the Angioplasty Balloons and Stents market. These innovative materials, which are designed to be gradually absorbed by the body, can address some of the long-term complications associated with traditional metal stents, such as the risk of restenosis and the need for long-term antiplatelet therapy. The introduction of bioresorbable stents and balloons can offer healthcare providers a new therapeutic option that combines the benefits of temporary support and the elimination of permanent implants. As these novel technologies continue to evolve and demonstrate improved clinical outcomes, they will likely gain greater acceptance and drive the growth of the Angioplasty Balloons and Stents market.

Market Trends:

Focus on Personalized and Precision Medicine

The Angioplasty Balloons and Stents market is witnessing a growing trend towards personalized and precision medicine, where treatment strategies are tailored to the unique needs and characteristics of individual patients. This shift is driven by the increasing availability of advanced diagnostic tools, such as intravascular imaging and genetic testing, which can provide detailed insights into the underlying causes and severity of cardiovascular diseases. Manufacturers are responding to this trend by developing customizable devices and treatment algorithms that consider factors like vessel anatomy, plaque composition, and genetic predisposition. By offering more personalized solutions, healthcare providers can optimize the effectiveness of angioplasty procedures and improve patient outcomes. As the demand for personalized medicine continues to grow, this trend will become increasingly important in the Angioplasty Balloons and Stents market.

Emphasis on Minimally Invasive Procedures

The growing preference for minimally invasive medical procedures is a dominant trend in the Angioplasty Balloons and Stents market. Patients and healthcare providers alike are increasingly favoring less-invasive treatment options that offer reduced recovery times, lower risks of complications, and improved cosmetic outcomes. Manufacturers are responding to this trend by developing innovative Angioplasty Balloons and Stents that can be delivered through smaller incisions, using advanced delivery systems and specialized catheters. The introduction of drug-eluting balloons and bioresorbable stents, which offer targeted therapy and eliminate the need for permanent implants, have further reinforced the shift towards minimally invasive approaches. As the demand for these advanced devices continues to rise, the Angioplasty Balloons and Stents market will likely see sustained growth in the coming years.

Advancements in Material Science and Coatings

The Angioplasty Balloons and Stents market is also witnessing significant advancements in material science and coatings, which are driving innovation and improving clinical outcomes. Manufacturers are exploring the use of novel materials, such as polymers and bioabsorbable compounds, to develop next-generation devices that are more flexible, durable, and compatible with the body's natural processes. Additionally, the development of specialized coatings, including drug-eluting and anti-thrombotic coatings, has enabled the targeted delivery of therapeutic agents and the reduction of complications like restenosis and thrombosis. These advancements not only enhance the performance of angioplasty devices but also address unmet clinical needs, making them an attractive option for healthcare providers and patients. As the research and development in material science and coatings continue to progress, the Angioplasty Balloons and Stents market will likely see further improvements in device safety, efficacy, and user-friendliness.

Integration of Digital Technologies

The integration of digital technologies, such as artificial intelligence (AI) and machine learning, is an emerging trend in the Angioplasty Balloons and Stents market. These advanced technologies are being leveraged to enhance various aspects of angioplasty procedures, from diagnosis to treatment planning and post-operative care. For example, AI-powered software can analyze angiographic images to assist healthcare providers in identifying the precise location and severity of arterial blockages, enabling them to select the most appropriate device and treatment strategy. Additionally, the integration of remote patient monitoring solutions can facilitate the early detection of complications and allow for timely interventions, leading to better long-term outcomes. As the healthcare industry continues to embrace digital transformation, the adoption of these innovative technologies will become increasingly important in the Angioplasty Balloons and Stents market, driving improvements in clinical performance and patient care.

Market Restrain:

High Cost of Advanced Angioplasty Devices

One of the primary restraints in the Angioplasty Balloons and Stents market is the high cost of advanced medical devices, which can limit their accessibility and adoption, particularly in resource-constrained healthcare systems. The development of innovative technologies, such as drug-eluting balloons and bioresorbable stents, often involves significant research and development investments, leading to higher manufacturing costs that are ultimately passed on to patients and healthcare providers. Additionally, the necessary specialized training and equipment required for these advanced procedures can further increase the overall costs associated with angioplasty treatments. This financial burden can pose a significant barrier to widespread adoption, particularly in developing countries where healthcare budgets are more limited. Manufacturers and policymakers will need to explore strategies to improve the affordability of these life-saving technologies, such as exploring alternative reimbursement models and optimizing production processes, in order to drive greater accessibility and utilization.

Stringent Regulatory Requirements

The Angioplasty Balloons and Stents market is subject to stringent regulatory requirements, which can pose a significant restraint to the development and commercialization of new products. Medical device manufacturers must navigate a complex approval process, involving extensive clinical trials, safety evaluations, and compliance with various national and international standards, before their products can be brought to market. This regulatory landscape, which is designed to ensure the safety and efficacy of medical devices, can often result in lengthy timelines and significant financial investments, potentially slowing down the pace of innovation in the Angioplasty Balloons and Stents market. Furthermore, the evolving regulatory landscape, with the introduction of new guidelines and standards, can require manufacturers to continually adapt their products and manufacturing processes, adding to the operational complexity and costs. Navigating these regulatory hurdles can be a significant challenge for both established players and new entrants, potentially limiting the availability of innovative angioplasty devices and solutions.

Risks Associated with Angioplasty Procedures

Despite the advancements in angioplasty technology, there are still inherent risks associated with these medical procedures that can act as a restraint in the Angioplasty Balloons and Stents market. Complications such as bleeding, blood clots, heart attacks, and restenosis (the re-narrowing of the treated artery) can occur, and these risks can be heightened in patients with complex medical histories or anatomical conditions. The potential for these adverse events, even though they are relatively rare, can make healthcare providers and patients hesitant to opt for angioplasty, particularly if alternative treatment options are available. Manufacturers are continuously working to mitigate these risks through the development of safer and more reliable devices, as well as the implementation of robust training and education programs for healthcare providers. However, the inherent risks associated with angioplasty procedures will continue to be a restraint that the market must address to drive greater adoption and utilization of these life-saving technologies.

Recent Developments:

|

Development |

Company Name |

|

In January 2023, Medtronic plc received FDA approval for its Resolute Onyx drug-eluting stent system, a next-generation device designed to improve deliverability and expand treatment options for patients with complex coronary artery disease. |

Medtronic plc |

|

In September 2022, Boston Scientific Corporation announced the launch of its Eluvia Drug-Eluting Vascular Stent System in Japan, expanding the availability of this innovative technology for the treatment of peripheral artery disease in the Asia-Pacific region. |

Boston Scientific Corporation |

|

In May 2022, Abbott Laboratories received CE Mark approval for its Xience Skypoint drug-eluting stent, a device that combines a thin, flexible stent platform with a novel polymer coating to improve clinical outcomes for patients. |

Abbott Laboratories |

|

In April 2021, Terumo Corporation acquired Quirem Medical, a Netherlands-based company focused on the development of microsphere technologies for the treatment of liver cancer, strengthening Terumo's position in the interventional oncology market. |

Terumo Corporation |

|

In February 2021, Biotronik SE & Co. KG received FDA approval for its Pulsar-18 T3 self-expanding nitinol stent system, designed to treat peripheral artery disease in the superficial femoral and popliteal arteries. |

Biotronik SE & Co. KG |

Market Regional Insights:

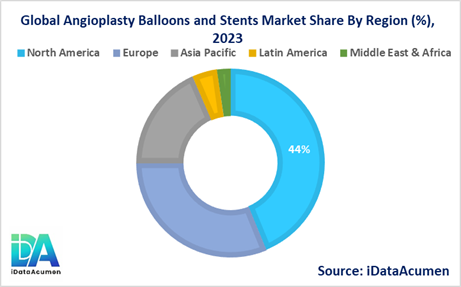

The Angioplasty Balloons and Stents market is a global industry with significant regional variations in market size and growth prospects. North America is expected to be the largest market, accounting for over 43.8% of the global market share in 2024. The growth of the market in North America is attributed to the high prevalence of cardiovascular diseases, the presence of a well-established healthcare infrastructure, and the availability of advanced medical technologies.

The European market is the second-largest, representing 31.2% of the global market share in 2024. The growth of the market in Europe is driven by factors such as the aging population, the increasing incidence of lifestyle-related diseases, and the rising awareness of the importance of early diagnosis and treatment.

The Asia-Pacific region is expected to be the fastest-growing market for Angioplasty Balloons and Stents, with a CAGR of over 7.4% during the forecast period. The growth of the market in this region is attributed to the increasing prevalence of cardiovascular diseases, the improving healthcare infrastructure, and the rising demand for advanced medical technologies.

The Latin American and Middle East & Africa regions hold relatively smaller market shares of 4.3% and 2.3%, respectively, in 2024. However, these regions are also expected to experience growth in the coming years due to the increasing awareness of cardiovascular diseases and the expansion of healthcare services.

Market Segmentation:

- By Product Type

- Angioplasty Balloons

- Plain Old Balloon Angioplasty (POBA) Balloons

- Drug-Eluting Balloons

- Cutting/Scoring Balloons

- Others (e.g., Specialty Balloons)

- Coronary Stents

- Bare-Metal Stents

- Drug-Eluting Stents

- Bioresorbable Stents

- Peripheral Stents

- Nitinol Stents

- Balloon-Expandable Stents

- Others (e.g., Covered Stents)

- Angioplasty Balloons

- By End-User

- Hospitals

- Cardiac Catheterization Laboratories

- Ambulatory Surgical Centers

- Others (e.g., Private Clinics)

- By Material

- Metallic

- Stainless Steel

- Cobalt-Chromium

- Platinum-Chromium

- Polymer

- Polyethylene Terephthalate (PET)

- Polyurethane

- Others (e.g., Nylon, PEBAX)

- Metallic

- By Coating

- Drug-Eluting

- Paclitaxel-Eluting

- Sirolimus-Eluting

- Everolimus-Eluting

- Non-Drug-Eluting

- Heparin-Coated

- Hydroxy-Apatite Coated

- Others (e.g., Polyzene-F Coated)

- Drug-Eluting

- By Application

- Coronary Artery Disease

- Peripheral Artery Disease

- Carotid Artery Disease

- Others (e.g., Renal Artery Disease)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segment Analysis:

Among the segments outlined in Task 6, the Drug-Eluting Balloons segment is expected to be one of the fastest-growing in the Angioplasty Balloons and Stents market. This segment is projected to grow at a CAGR of around 7.9% during the forecast period, reaching a market size of approximately US$ 4,250 million by 2030.

The growth of the Drug-Eluting Balloons segment is primarily driven by the increasing adoption of these advanced devices in the treatment of coronary and peripheral artery diseases. Drug-eluting balloons are designed to deliver targeted medication directly to the treatment site, which can help prevent the recurrence of blockages and improve patient outcomes.

In terms of regional performance, the Drug-Eluting Balloons segment is expected to experience the highest growth in the Asia-Pacific region, with a CAGR of around 8.5% during the forecast period. This can be attributed to the rising prevalence of cardiovascular diseases, the improving healthcare infrastructure, and the increasing awareness of advanced treatment options in countries like China, India, and Japan.

The Coronary Stents segment, particularly the Drug-Eluting Stents subsegment, is projected to be the largest in the Angioplasty Balloons and Stents market, accounting for around 45% of the overall market share by 2030. The growing demand for these advanced stent technologies, which are designed to reduce the risk of restenosis (the re-narrowing of the treated artery), is expected to drive the growth of this segment.

Top Companies in the Angioplasty Balloons and Stents Market:

- Abbott Laboratories

- Medtronic plc

- Boston Scientific Corporation

- Cordis (a Cardinal Health company)

- Terumo Corporation

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Cook Medical

- Meril Life Sciences Pvt. Ltd.

- Biosensors International Group, Ltd.

- Microport Scientific Corporation

- Spectranetics Corporation

- Alvimedica Medical Devices

- Endologix, Inc.

- Translumina GmbH

- Hexacath

- Clearstream Technologies Ltd.

- Rontis Medical

- Bentley (subsidiary of B. Braun Melsungen AG)

- Elixir Medical Corporation