Market Analysis:

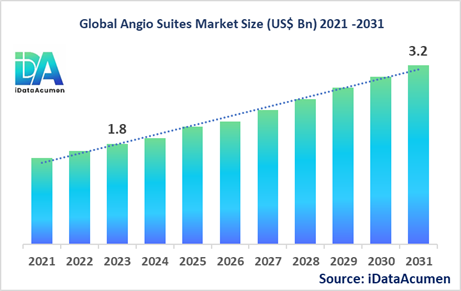

The Angio Suites Market had an estimated market size worth US$ 1.8 billion in 2023, and it is predicted to reach a global market valuation of US$ 3.2 billion by 2031, growing at a CAGR of 7.5% from 2024 to 2031.

Angio suites, also known as angiography rooms or cath labs, are specialized medical imaging systems used to visualize the vascular system and organs by injecting a contrast agent into the bloodstream and capturing images using X-ray or other imaging modalities. These suites are essential for diagnosing and treating various cardiovascular and vascular diseases, as well as performing interventional procedures. The advantages of angio suites include high-resolution imaging, real-time visualization, and the ability to perform minimally invasive procedures.

The market is primarily driven by the increasing prevalence of cardiovascular diseases, technological advancements in imaging modalities, and the growing adoption of minimally invasive procedures.

The Angio Suites Market is segmented by product type, technology, application, end-user, and region. By product type, the market is segmented into fixed angio suites, mobile angio suites, biplane angio suites, and others (floor-mounted, ceiling-mounted). The fixed angio suites segment is expected to dominate the market due to its widespread adoption in hospitals and large diagnostic centers, offering superior image quality and advanced features.

Epidemiology Insights:

- The disease burden associated with cardiovascular diseases (CVDs) and other vascular conditions is substantial across major regions, including North America, Europe, Asia-Pacific, and Latin America. According to the World Health Organization (WHO), CVDs are the leading cause of death globally, accounting for an estimated 17.9 million deaths annually.

- Key epidemiological trends and driving factors behind the increased prevalence of CVDs include aging populations, sedentary lifestyles, unhealthy diets, and the rising incidence of obesity and diabetes. In developed markets like the US and EU5 (France, Germany, Italy, Spain, and the UK), the aging population and higher rates of obesity contribute significantly to the disease burden.

- The latest data from the American Heart Association (AHA) suggests that in the US, around 92.1 million adults are living with some form of cardiovascular disease or the after-effects of stroke. In Europe, according to the European Society of Cardiology (ESC), CVDs account for over 3.9 million deaths each year, representing 45% of all deaths.

- The increasing patient population suffering from CVDs and vascular diseases presents significant growth opportunities for the angio suites market, as these imaging systems play a crucial role in diagnosis and treatment.

- While cardiovascular diseases are not considered rare diseases, certain conditions like pulmonary arterial hypertension (PAH) and certain congenital heart defects are classified as rare diseases, affecting a smaller portion of the population.

Market Landscape:

- There are several unmet needs in the angio suites market with respect to treatment options. These include the need for more advanced imaging techniques to improve diagnostic accuracy, the development of less invasive and safer procedures, and the availability of cost-effective solutions, particularly in emerging markets.

- Current treatment options for cardiovascular and vascular diseases include surgical interventions, such as bypass surgeries, stent placements, and angioplasties, which often involve the use of angio suites for imaging and guidance.

- Upcoming therapies and technologies in the market include the development of hybrid angio suites that combine multiple imaging modalities (e.g., CT, MRI, and angiography) for more comprehensive diagnosis and treatment planning. Additionally, there is ongoing research into advanced imaging techniques like 3D rotational angiography and the integration of artificial intelligence (AI) for improved image analysis and procedure guidance.

- Some breakthrough treatment options currently in development include the use of regenerative medicine approaches, such as stem cell therapies, for the treatment of cardiovascular diseases. Additionally, researchers are exploring the use of nanotechnology and targeted drug delivery systems for more precise and effective treatments.

- The angio suites market is dominated by a few major players, primarily large medical device manufacturers. However, there is also a presence of smaller companies and startups developing innovative technologies and solutions in this space.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.8 Bn |

|

CAGR (2024 - 2031) |

7.5% |

|

The revenue forecast in 2031 |

US$ 3.2 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, Shimadzu Corporation, Hitachi, Ltd., Carestream Health, Inc., NeuroLogica Corp., Elekta AB, Toshiba Medical Systems Corporation |

Market Drivers:

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) worldwide is a significant driver for the angio suites market. According to the World Health Organization (WHO), CVDs are the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. The growing burden of conditions such as coronary artery disease, peripheral artery disease, and stroke necessitates accurate and timely diagnosis and treatment, fueling the demand for advanced imaging technologies like angio suites.

Recent studies have shown a surge in risk factors associated with CVDs, including obesity, diabetes, and sedentary lifestyles, particularly in developed nations. This trend has led to an increased need for early detection and interventional procedures, contributing to the growth of the angio suites market. Furthermore, the aging population worldwide has also contributed to the rising incidence of CVDs, further driving the demand for angio suites in healthcare facilities.

Technological Advancements in Imaging Modalities

Continuous technological advancements in imaging modalities have significantly contributed to the growth of the angio suites market. Manufacturers are constantly innovating and introducing new features and functionalities to enhance image quality, reduce radiation exposure, and improve procedural accuracy and efficiency.

For instance, the development of hybrid angio suites that combine multiple imaging modalities, such as computed tomography (CT) and magnetic resonance imaging (MRI), has revolutionized the diagnostic and interventional capabilities of these systems. These advanced hybrid solutions provide comprehensive anatomical and functional information, enabling more accurate diagnoses and treatment planning.

Additionally, the integration of artificial intelligence (AI) and machine learning algorithms has introduced new possibilities for image analysis, procedural guidance, and decision support, further driving the adoption of cutting-edge angio suites in healthcare facilities.

Growing Adoption of Minimally Invasive Procedures

The increasing preference for minimally invasive procedures has been a significant driver for the angio suites market. Angio suites play a crucial role in guiding and performing minimally invasive interventions, such as angioplasty, stent placement, and embolization procedures.

Minimally invasive procedures offer numerous advantages over traditional open surgeries, including reduced patient trauma, faster recovery times, and lower healthcare costs. As a result, there has been a growing demand for advanced imaging technologies like angio suites to facilitate these procedures accurately and safely.

The adoption of minimally invasive techniques has been fueled by factors such as improved patient outcomes, increased awareness among healthcare professionals, and the development of advanced interventional devices compatible with angio suite systems.

Rising Healthcare Expenditure and Investments

The growth of the angio suites market is also driven by increasing healthcare expenditure and investments in medical infrastructure globally. Governments and healthcare organizations are allocating substantial resources to upgrade and expand their medical facilities, including the installation of advanced imaging technologies like angio suites.

In developed nations, the focus on improving patient care and providing access to cutting-edge medical technologies has led to significant investments in angio suites. Meanwhile, in emerging markets, the rapid expansion of healthcare infrastructure and the growing disposable incomes of populations have created new opportunities for the adoption of angio suites.

Furthermore, private healthcare providers and investors have recognized the potential of the angio suites market, leading to increased investments in research and development, as well as the establishment of specialized diagnostic and interventional centers equipped with state-of-the-art angio suite systems.

Market Opportunities:

Emerging Markets and Increasing Healthcare Access

The angio suites market presents a significant opportunity in emerging markets, particularly in regions such as Asia-Pacific, Latin America, and Africa. These regions are witnessing rapid economic growth, urbanization, and an expanding middle-class population with increasing access to healthcare services.

As healthcare infrastructure continues to develop and investments in medical facilities rise, there is a growing demand for advanced medical technologies, including angio suites. The need for accurate diagnostic and interventional capabilities, combined with the increasing prevalence of cardiovascular diseases in these regions, presents a lucrative opportunity for market expansion.

Additionally, initiatives by governments and healthcare organizations to improve access to quality healthcare services and address the rising burden of non-communicable diseases have created favorable conditions for the adoption of angio suites in emerging markets.

Development of Portable and Mobile Angio Suites

The development of portable and mobile angio suites represents a significant opportunity in the market. These systems offer enhanced flexibility and mobility, enabling healthcare providers to extend their services to remote or underserved areas where access to advanced medical facilities may be limited.

Portable angio suites are particularly beneficial in emergency situations, such as natural disasters or military operations, where rapid deployment and on-site imaging capabilities are crucial. Furthermore, they can be valuable assets in rural or community healthcare settings, bridging the gap in access to advanced diagnostic and interventional procedures.

As technology continues to evolve, manufacturers are focusing on developing compact, lightweight, and easy-to-transport angio suite solutions, while maintaining high-quality imaging capabilities and operational efficiency. This trend presents significant growth opportunities for companies operating in the angio suites market.

Integration of Artificial Intelligence and Advanced Analytics

The integration of artificial intelligence (AI) and advanced analytics into angio suite systems presents a promising opportunity for the market. AI algorithms can enhance various aspects of angio suite operations, including image analysis, procedure planning, and real-time guidance during interventions.

For instance, AI-powered image recognition and segmentation algorithms can assist in identifying and characterizing vascular structures, lesions, and anatomical landmarks with greater accuracy and efficiency. This can aid in streamlining diagnostic processes and improving treatment planning.

Additionally, AI-based decision support systems can provide real-time guidance during interventional procedures, assisting healthcare professionals in optimizing device positioning, minimizing radiation exposure, and improving overall procedural outcomes.

As the field of AI and machine learning continues to advance, the incorporation of these technologies into angio suite systems holds the potential to revolutionize diagnostic and interventional practices, offering improved patient care and operational efficiencies.

Expansion of Interventional Radiology and Hybrid Operating Rooms

The growing field of interventional radiology and the increasing adoption of hybrid operating rooms present significant opportunities for the angio suites market. Interventional radiology procedures, such as embolizations, biopsies, and ablations, often require advanced imaging guidance provided by angio suites.

Hybrid operating rooms, which combine traditional surgical capabilities with advanced imaging technologies like angio suites, enable seamless integration of diagnostic and interventional procedures. These multidisciplinary facilities cater to complex cases requiring real-time imaging guidance during surgical interventions, such as neurovascular, cardiovascular, and oncological procedures.

The demand for these specialized facilities is driven by the need for improved patient outcomes, streamlined workflows, and cost-effective healthcare delivery. As the adoption of interventional radiology and hybrid operating rooms continues to grow, the angio suites market is well-positioned to meet the increasing demand for advanced imaging solutions in these settings.

Market Trends:

Adoption of Hybrid Angio Suites

The trend of adopting hybrid angio suites has been gaining significant momentum in the market. These advanced systems combine multiple imaging modalities, such as X-ray angiography, computed tomography (CT), and magnetic resonance imaging (MRI), into a single platform. Hybrid angio suites offer comprehensive anatomical and functional imaging capabilities, improved diagnostic accuracy, and the ability to perform complex interventional procedures with greater precision.

These systems enable healthcare professionals to obtain detailed visualizations of vascular structures, surrounding tissues, and organ systems, facilitating more informed treatment decisions. Major manufacturers have been actively developing and introducing hybrid solutions to meet the growing demand for integrated imaging capabilities, which are finding widespread adoption in leading healthcare facilities.

Integration of Artificial Intelligence and Advanced Visualization

The integration of artificial intelligence (AI) and advanced visualization technologies is another significant trend shaping the angio suites market. AI algorithms are being leveraged to enhance various aspects of angio suite operations, including image analysis, procedure planning, and real-time guidance during interventions. AI-powered image recognition and segmentation algorithms can assist in identifying and characterizing vascular structures, lesions, and anatomical landmarks with greater accuracy and efficiency.

Additionally, advanced visualization techniques, such as 3D rendering and virtual reality (VR), are being incorporated into angio suite systems to provide immersive and detailed visualizations of anatomical structures. These technologies enable healthcare professionals to better understand complex anatomical relationships, plan interventions more effectively, and improve communication with patients and colleagues.

Focus on Radiation Dose Reduction

Another notable trend in the angio suites market is the increasing focus on reducing radiation exposure during imaging and interventional procedures. Concerns over the potential health risks associated with ionizing radiation exposure have driven manufacturers and healthcare providers to prioritize the development and adoption of advanced dose management solutions.

Manufacturers are incorporating various technologies into their angio suite systems to minimize radiation exposure while maintaining image quality. These technologies include advanced image reconstruction algorithms, real-time dose monitoring and feedback systems, and the integration of novel imaging modalities that do not rely on ionizing radiation, such as optical coherence tomography (OCT) and photoacoustic imaging.

Healthcare facilities are also implementing comprehensive radiation safety protocols and training programs to ensure the judicious use of imaging modalities and adherence to radiation protection guidelines.

Miniaturization and Portability

The trend towards miniaturization and increased portability of angio suite systems is gaining traction in the market. As healthcare providers seek to expand their services and reach underserved or remote areas, the demand for compact and mobile angio suite solutions has risen.

Manufacturers are focusing on developing smaller, lightweight, and easy-to-transport angio suite systems while maintaining high-quality imaging capabilities and operational efficiency. These portable solutions offer enhanced flexibility and mobility, enabling healthcare providers to extend their services to areas where access to advanced medical facilities may be limited.

Additionally, portable angio suites are particularly beneficial in emergency situations, such as natural disasters or military operations, where rapid deployment and on-site imaging capabilities are crucial.

Market Restraints

High Initial Investment and Operating Costs

One of the significant restraints in the angio suites market is the high initial investment and operating costs associated with these advanced imaging systems. Angio suites are complex and technologically sophisticated equipment, requiring substantial capital expenditure for acquisition, installation, and maintenance.

The costs of angio suite systems can range from several hundred thousand dollars to millions, depending on the specific features and capabilities. Additionally, the ongoing costs of consumables, service contracts, and personnel training can further add to the financial burden for healthcare facilities.

For smaller hospitals, clinics, or healthcare providers with limited budgets, the high costs associated with angio suites can be a significant barrier to entry, potentially limiting market growth and adoption.

Shortage of Skilled Personnel

The angio suites market is also restrained by the shortage of skilled personnel capable of operating and maintaining these advanced imaging systems. Angio suites require specialized knowledge and training in various areas, including imaging techniques, interventional procedures, radiation safety, and equipment operation and maintenance.

The demand for trained professionals, such as interventional radiologists, cardiac catheterization technologists, and biomedical engineers, often exceeds the available supply. This shortage can lead to operational challenges, potential procedural delays, and increased healthcare costs associated with recruitment and training.

To address this issue, healthcare institutions and manufacturers are investing in comprehensive training programs and educational initiatives to develop a skilled workforce capable of effectively utilizing and supporting angio suite technologies.

Regulatory Challenges and Patient Safety Concerns

The angio suites market is subject to stringent regulatory guidelines and patient safety concerns, which can act as restraints on market growth. Regulatory bodies, such as the Food and Drug Administration (FDA) in the United States and the European Medicines Agency (EMA), have established strict requirements for the approval, manufacturing, and use of medical devices, including angio suite systems.

Compliance with these regulations can be time-consuming and resource-intensive, potentially delaying the introduction of new technologies or limiting the adoption of existing systems in certain regions.

Furthermore, patient safety concerns related to radiation exposure and the use of contrast agents during angiographic procedures can influence the adoption and utilization of angio suites. Healthcare providers must carefully balance the benefits of these imaging modalities with the potential risks, adhering to radiation protection guidelines and implementing comprehensive safety protocols.

Manufacturers and healthcare institutions must continuously address these regulatory challenges and patient safety concerns to ensure the responsible and effective use of angio suite technologies.

Recent Developments:

|

Development |

Company Name |

|

In March 2023, Siemens Healthineers launched the ARTIS icono biplane angio suite, featuring advanced imaging capabilities and improved workflow for complex interventional procedures. |

Siemens Healthineers |

|

In September 2022, GE Healthcare received FDA clearance for its Revolution Apex Angio Suite, a premium angiography system designed for minimally invasive procedures and enhanced imaging capabilities. |

GE Healthcare |

|

In June 2022, Philips announced the launch of its Azurion 7 C20 angio suite, featuring advanced 3D imaging and AI-powered tools for improved procedural guidance and patient outcomes. |

Philips Healthcare |

|

In December 2022, Canon Medical Systems Corporation introduced the Alphenix Sky+ angio suite, offering advanced imaging capabilities and cybersecurity features for interventional procedures. |

Canon Medical Systems Corporation |

|

In October 2021, Shimadzu Corporation launched the BRANSIST safire angio suite, featuring advanced imaging technologies and dose management solutions for interventional radiology procedures. |

Shimadzu Corporation |

|

In August 2022, Hitachi, Ltd. received FDA clearance for its SCENARIA View64 CT angio system, designed for comprehensive cardiovascular imaging and interventional procedures. |

Hitachi, Ltd. |

|

In January 2023, Siemens Healthineers acquired Corindus Vascular Robotics, a leading developer of robotic-assisted systems for minimally invasive vascular procedures, strengthening its portfolio in the angio suites market. |

Siemens Healthineers (Acquirer), Corindus Vascular Robotics (Acquired) |

|

In November 2021, Philips acquired Cardiovascular Systems, Inc., a medical device company focused on interventional treatment of peripheral and coronary artery disease, complementing Philips' angio suites offerings. |

Philips Healthcare (Acquirer), Cardiovascular Systems, Inc. (Acquired) |

|

In April 2022, GE Healthcare announced a strategic partnership with Prismatic Sensors AB, a Swedish medical technology company, to develop advanced imaging solutions for interventional procedures using angio suites. |

GE Healthcare, Prismatic Sensors AB |

Market Regional Insights:

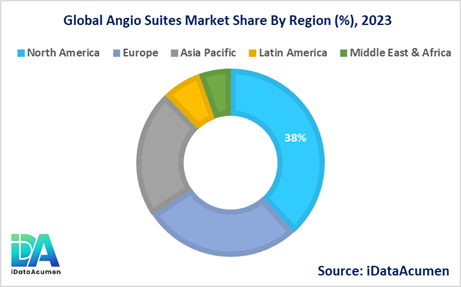

The angio suites market is witnessing significant growth across various regions due to the increasing prevalence of cardiovascular diseases, technological advancements, and the adoption of minimally invasive procedures.

North America is expected to be the largest market for the Angio Suites Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the well-established healthcare infrastructure, the presence of major market players, and the high adoption of advanced medical technologies.

The Europe market is expected to be the second-largest market for the Angio Suites Market, accounting for over 27.5% of the market share in 2024. The growth of the market is attributed to the increasing focus on early disease diagnosis and the adoption of minimally invasive procedures, as well as the availability of reimbursement policies supporting the use of advanced imaging technologies.

The Asia-Pacific market is expected to be the fastest-growing market for the Angio Suites Market, with a CAGR of over 9.2% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the rapidly improving healthcare infrastructure, rising disposable incomes, and the increasing prevalence of cardiovascular diseases due to changing lifestyles and an aging population.

Market Segmentation:

- By Product Type

- Fixed Angio Suites

- Mobile Angio Suites

- Biplane Angio Suites

- Others (Floor-mounted, Ceiling-mounted)

- By Technology

- X-ray Angiography

- Computed Tomography (CT) Angiography

- Magnetic Resonance Angiography (MRA)

- Others (Positron Emission Tomography, Ultrasound)

- By Application

- Cardiac Angiography

- Neurology Angiography

- Oncology Angiography

- Peripheral Vascular Angiography

- Others (Pediatric, Obstetrics/Gynecology)

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Imaging Centers

- Others (Research Institutes, Academic & Teaching Hospitals)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segmentation Analysis:

The angio suites market is highly dynamic, and different segments are expected to exhibit varying growth rates across different regions. Here's an analysis of a few key segments:

- By Product Type:

- The fixed angio suites segment is projected to remain the largest segment in 2024, with a market size of around $1.5 billion. This segment is expected to witness steady growth, driven by the increasing adoption of advanced imaging technologies in hospitals and larger healthcare facilities.

- The mobile angio suites segment is anticipated to be the second-largest segment in 2024 and is projected to grow at a CAGR of around 8-10% during the forecast period. The Asia-Pacific region is expected to be a significant contributor to this growth, driven by the expanding healthcare infrastructure and the need for cost-effective and portable imaging solutions.

- By Technology:

- The X-ray angiography segment is expected to remain the largest segment in 2024, with a market size of around $1.8 billion. This segment is well-established and widely adopted across various healthcare settings.

- The computed tomography (CT) angiography segment is projected to be the fastest-growing segment, with a CAGR of around 9-11% during the forecast period. The growth is attributed to the increasing demand for advanced imaging techniques, particularly in developed regions like North America and Europe.

- By Application:

- The cardiac angiography segment is expected to remain the largest application segment in 2024, with a market size of around $1.2 billion. The increasing prevalence of cardiovascular diseases and the need for accurate diagnosis and treatment are driving the growth of this segment.

- The neurology angiography segment is projected to be the second-largest segment in 2024 and is anticipated to grow at a CAGR of around 8-10% during the forecast period. The growth is driven by the rising incidence of neurological disorders and the demand for advanced imaging techniques in neurovascular interventions.

It's important to note that these projections are based on current market trends and may vary depending on factors such as technological advancements, regulatory changes, and shifts in healthcare practices.

Top companies in the Angio Suites Market:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems Corporation

- Shimadzu Corporation

- Hitachi, Ltd.

- Carestream Health, Inc.

- NeuroLogica Corp.

- Elekta AB

- Toshiba Medical Systems Corporation