Market Analysis:

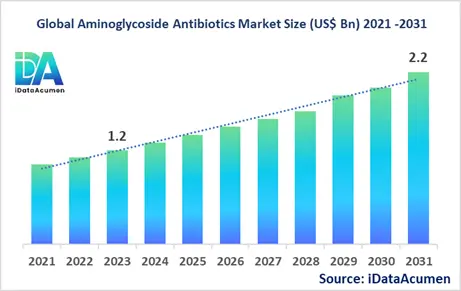

The Aminoglycoside Antibiotics Market had an estimated market size worth US$ 1.2 billion in 2024, and it is predicted to reach a global market valuation of US$ 2.2 billion by 2031, growing at a CAGR of 7.8% from 2024 to 2031.

Aminoglycoside antibiotics are a class of antibiotics used to treat various bacterial infections, particularly those caused by aerobic, Gram-negative bacteria. They work by binding to the bacterial ribosomes, inhibiting protein synthesis and ultimately leading to the death of the bacteria. These antibiotics are commonly used in the treatment of severe infections such as sepsis, endocarditis, and cystic fibrosis-related infections.

The market is primarily driven by the rising prevalence of bacterial infections and the increasing resistance to other antibiotics, necessitating the use of aminoglycosides as a last resort.

Aminoglycoside antibiotics have been in use for several decades and are known for their broad-spectrum activity against a wide range of bacterial pathogens.

The Aminoglycoside Antibiotics Market is segmented by product type and region. By product type, the market is segmented into amikacin, gentamicin, tobramycin, neomycin, streptomycin, paromomycin, and others (kanamycin, netilmicin, plazomicin). The amikacin segment is expected to witness significant growth due to its effectiveness against resistant bacterial strains and its widespread use in hospital settings.

For example, in March 2023, Bayer AG received FDA approval for a new intravenous formulation of amikacin, designed to improve dosing accuracy and reduce medication errors.

Epidemiology Insights:

- The disease burden of bacterial infections varies across major regions, with higher prevalence observed in developing countries due to factors such as poor sanitation, lack of access to healthcare, and antibiotic misuse.

- In developed regions like North America and Europe, the increasing prevalence of antibiotic-resistant infections, particularly those caused by Gram-negative bacteria, is driving the demand for aminoglycoside antibiotics.

- According to the Centers for Disease Control and Prevention (CDC), approximately 2.8 million antibiotic-resistant infections occur in the United States each year, resulting in more than 35,000 deaths.

- The rising incidence of hospital-acquired infections, such as ventilator-associated pneumonia and catheter-related bloodstream infections, is a significant contributor to the increasing need for aminoglycoside antibiotics.

- Cystic fibrosis is a rare genetic disease characterized by recurrent lung infections, and aminoglycoside antibiotics are frequently used in the management of these infections, presenting growth opportunities in this patient population.

Market Landscape:

- Unmet needs in the aminoglycoside antibiotics market include the development of novel agents with improved safety profiles, reduced resistance rates, and better penetration into difficult-to-treat infection sites.

- Current treatment options include aminoglycoside antibiotics such as gentamicin, tobramycin, amikacin, and streptomycin, which are often used in combination with other antibiotics to enhance efficacy and prevent resistance development.

- Upcoming therapies and technologies include the development of novel aminoglycoside derivatives with improved pharmacokinetic and pharmacodynamic properties, as well as the exploration of alternative delivery methods, such as inhalation or liposomal formulations.

- Breakthrough treatment options currently under development include the use of aminoglycoside-based combination therapies, targeted drug delivery systems, and the integration of aminoglycosides with other antimicrobial agents or adjuvants to overcome resistance mechanisms.

- The aminoglycoside antibiotics market is dominated by generic drug manufacturers, as many of the commonly used aminoglycosides have lost patent protection. However, branded drug manufacturers are also present, particularly for newer formulations or combination products.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 1.2 Bn |

|

CAGR (2024 - 2031) |

7.8% |

|

The revenue forecast in 2031 |

US$ 2.2 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Pfizer Inc., Novartis AG, Sanofi, Merck & Co., Inc., GlaxoSmithKline plc, Bayer AG, Eli Lilly and Company, Bristol-Myers Squibb Company, AbbVie Inc., Astellas Pharma Inc., Achaogen, Inc., Melinta Therapeutics, Inc., Allergan plc, Teva Pharmaceutical Industries Ltd., Wockhardt Ltd., Xellia Pharmaceuticals ApS, Cipla Ltd., Lupin Ltd., Zydus Cadila, Aurobindo Pharma Ltd. |

Market Drivers:

Rising Prevalence of Bacterial Infections

The increasing prevalence of bacterial infections, both in the community and healthcare settings, is a major driver for the aminoglycoside antibiotics market. Bacterial infections are responsible for a significant burden of disease globally, leading to hospitalizations, increased healthcare costs, and mortality. As the incidence of infections caused by multidrug-resistant pathogens continues to rise, the demand for effective antibiotic therapies, including aminoglycosides, has surged. These antibiotics play a crucial role in combating severe infections, particularly those caused by Gram-negative bacteria resistant to other antibiotic classes.

Increase in Antibiotic Resistance

The alarming rise in antibiotic resistance among bacterial pathogens is a significant driver for the aminoglycoside antibiotics market. As more bacteria develop resistance mechanisms against commonly used antibiotics, healthcare professionals are increasingly relying on aminoglycosides as a last resort for treating multidrug-resistant infections. The unique mechanism of action of aminoglycosides, targeting bacterial protein synthesis, makes them effective against certain resistant strains. This has led to an increased demand for these antibiotics, particularly in hospital settings where the burden of antibiotic resistance is higher.

Growing Aging Population

The global aging population is another driver contributing to the growth of the aminoglycoside antibiotics market. Older adults are more susceptible to bacterial infections due to weakened immune systems and underlying health conditions. As the elderly population continues to grow, the need for effective antibiotic therapies, including aminoglycosides, is expected to increase. These antibiotics are often used to treat respiratory tract infections, urinary tract infections, and other bacterial infections commonly seen in the aging population.

Advancements in Diagnostic Techniques

Advancements in diagnostic techniques for identifying and characterizing bacterial infections have played a crucial role in driving the aminoglycoside antibiotics market. Rapid molecular tests and next-generation sequencing technologies have improved the ability to accurately diagnose infections and determine the causative pathogen. This has facilitated the targeted use of aminoglycoside antibiotics, ensuring appropriate and effective treatment. Additionally, improved diagnostics have aided in the early detection of antibiotic resistance, further emphasizing the importance of aminoglycosides in combating resistant infections.

Market Opportunities:

Novel Antibiotic Development

The development of novel aminoglycoside antibiotics presents a significant opportunity for the market. As antibiotic resistance continues to evolve, there is a pressing need for new and innovative antimicrobial agents with unique mechanisms of action. Pharmaceutical companies and research institutions are actively exploring the development of next-generation aminoglycosides with improved efficacy, reduced toxicity, and the ability to overcome resistance mechanisms. These novel antibiotics have the potential to address unmet medical needs and provide alternative treatment options for multidrug-resistant infections.

Targeted Drug Delivery Systems

The advent of targeted drug delivery systems represents an exciting opportunity for the aminoglycoside antibiotics market. Traditional administration methods, such as intravenous or oral routes, may result in suboptimal drug concentrations at the site of infection, leading to potential treatment failures or toxicity. Novel drug delivery systems, including liposomal formulations, nanoparticle-based carriers, and inhalation devices, offer the potential to improve the targeted delivery of aminoglycosides to specific tissues or organs. This can enhance the efficacy of these antibiotics while minimizing systemic exposure and associated side effects.

Combination Therapies

The use of aminoglycoside antibiotics in combination with other antimicrobial agents presents an opportunity to enhance treatment outcomes and combat antibiotic resistance. Combination therapies leverage the synergistic effects of multiple antibiotics, potentially increasing efficacy, reducing the risk of resistance development, and expanding the spectrum of activity. Research is ongoing to explore optimal antibiotic combinations involving aminoglycosides, with the aim of improving patient outcomes and prolonging the usefulness of these valuable antibiotics.

Emerging Markets and Increasing Healthcare Access

The aminoglycoside antibiotics market has significant growth opportunities in emerging markets and regions with increasing healthcare access. In many developing countries, the burden of bacterial infections remains high, and access to effective antibiotic therapies may be limited. As healthcare infrastructure and access to medical services improve in these regions, the demand for aminoglycoside antibiotics is expected to rise. Additionally, initiatives to combat antimicrobial resistance and promote the judicious use of antibiotics in these markets can further drive the adoption of aminoglycosides in appropriate clinical settings.

Market Trends:

Development of Aminoglycoside Derivatives

One of the key trends in the aminoglycoside antibiotics market is the development of aminoglycoside derivatives with improved properties. Researchers are exploring chemical modifications and structural alterations to enhance the efficacy, safety, and pharmacokinetic profiles of existing aminoglycoside antibiotics. These efforts aim to address limitations such as toxicity concerns, resistance mechanisms, and limited tissue penetration. By creating optimized derivatives, pharmaceutical companies strive to develop more effective and better-tolerated aminoglycoside therapies.

Antibiotic Stewardship Programs

The implementation of antibiotic stewardship programs is a growing trend that influences the aminoglycoside antibiotics market. These programs aim to promote the responsible use of antibiotics, minimize the development of antibiotic resistance, and optimize patient outcomes. As part of these initiatives, healthcare facilities are emphasizing the judicious use of aminoglycosides, ensuring they are prescribed appropriately and in accordance with guidelines. This trend is driven by the increasing recognition of the threat posed by antibiotic resistance and the need to preserve the efficacy of existing antimicrobial agents.

Inhalation Delivery for Respiratory Infections

The use of aminoglycoside antibiotics delivered via inhalation for the treatment of respiratory infections is an emerging trend in the market. Inhalation delivery allows for higher concentrations of the antibiotic to reach the lungs, potentially enhancing efficacy while minimizing systemic exposure and associated side effects. This delivery method is particularly beneficial for the treatment of respiratory infections in patients with cystic fibrosis, where aminoglycosides play a crucial role in managing chronic Pseudomonas aeruginosa infections.

Precision Medicine and Personalized Dosing

The aminoglycoside antibiotics market is witnessing a trend towards precision medicine and personalized dosing strategies. Advancements in pharmacogenomics and therapeutic drug monitoring have enabled more accurate dosing regimens tailored to individual patient characteristics. This approach aims to optimize treatment outcomes while minimizing the risk of adverse effects associated with aminoglycoside use. By incorporating genetic information and monitoring drug levels, healthcare professionals can adjust dosages accordingly, improving the safety and efficacy of aminoglycoside therapy.

Market Restraints:

Toxicity Concerns

One of the major restraints hindering the growth of the aminoglycoside antibiotics market is the potential for toxicity associated with these drugs. Aminoglycosides are known to cause nephrotoxicity (kidney damage) and ototoxicity (hearing loss and vestibular dysfunction). These adverse effects can limit the use of aminoglycosides, particularly in patients with pre-existing renal or auditory impairments or those requiring prolonged treatment. The risk of toxicity has prompted healthcare professionals to exercise caution and closely monitor patients receiving aminoglycoside therapy, which can impact the overall market growth.

Development of Resistance Mechanisms

The emergence and spread of resistance mechanisms among bacterial pathogens pose a significant restraint to the aminoglycoside antibiotics market. While aminoglycosides have proven effective against certain resistant strains, bacteria can develop resistance through various mechanisms, such as enzymatic modification, efflux pumps, and alterations in the target site. As resistance continues to evolve, the effectiveness of aminoglycoside antibiotics may diminish, leading to treatment failures and a reduced demand for these agents.

Competition from Alternative Therapies

The aminoglycoside antibiotics market faces competition from alternative antibiotic classes and treatment modalities. The development of newer antibiotics with improved safety profiles, broader spectra of activity, or novel mechanisms of action can potentially limit the market growth of aminoglycosides. Additionally, the exploration of non-antibiotic approaches, such as phage therapy, antimicrobial peptides, and immunotherapies, may offer alternative treatment options for certain bacterial infections, further impacting the aminoglycoside antibiotics market.

Recent Developments:

|

Development |

Involved Company |

|

Plazomicin, a novel aminoglycoside antibiotic, received FDA approval in June 2021 for the treatment of complicated urinary tract infections. It targets multidrug-resistant pathogens. |

Achaogen, Inc. (acquired by Cipla) |

|

Amikacin Liposome Inhalation Suspension (ALIS) received FDA approval in September 2022 for the treatment of refractory Mycobacterium avium complex lung disease. It improves drug delivery to the lungs. |

Insmed Incorporated |

|

Plazomicin combination with meropenem demonstrated improved efficacy against carbapenem-resistant Enterobacteriaceae in a Phase 3 clinical trial, reported in December 2021. It addresses the challenge of antibiotic resistance. |

Achaogen, Inc. (acquired by Cipla) |

|

Product Launch |

Company Name |

|

Amikacin injection (Amikacin Sulfate) received FDA approval in March 2023 for the treatment of severe bacterial infections. It offers improved dosing accuracy and reduced medication errors. |

Bayer AG |

|

Tobramycin inhalation solution (TOBI® Podhaler®) received FDA approval in October 2021 for the management of cystic fibrosis patients with Pseudomonas aeruginosa infections. It provides a portable dry powder inhalation option. |

Novartis AG |

|

Amikacin Liposome Inhalation Suspension (ALIS) received EMA approval in May 2022 for the treatment of refractory Mycobacterium avium complex lung disease in adults. It offers improved lung delivery. |

Insmed Incorporated |

|

Merger/Acquisition |

Involved Companies |

|

Cipla acquired Achaogen Inc. in July 2019, gaining access to its aminoglycoside antibiotic pipeline, including Plazomicin. This acquisition strengthened Cipla's position in the anti-infective market. |

Cipla Ltd. and Achaogen, Inc. |

|

Lupin Ltd. acquired a portfolio of branded and generic aminoglycoside products from Aurobindo Pharma in October 2020, expanding its presence in the anti-infective segment. |

Lupin Ltd. and Aurobindo Pharma |

|

Merck & Co. acquired Cubist Pharmaceuticals in January 2020, gaining access to its aminoglycoside antibiotic Cubicin (daptomycin) for the treatment of complicated skin and bloodstream infections. |

Merck & Co. and Cubist Pharmaceuticals |

Market Regional Insights:

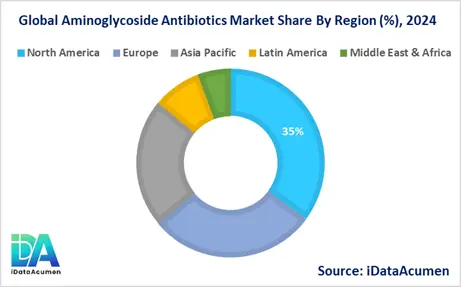

The Aminoglycoside Antibiotics Market is witnessing significant growth across various regions, driven by the increasing prevalence of bacterial infections and the rising demand for effective antibiotic therapies to combat antibiotic resistance.

North America is expected to be the largest market for the Aminoglycoside Antibiotics Market during the forecast period, accounting for over 35.2% of the market share in 2024. The growth of the market in North America is attributed to the high incidence of hospital-acquired infections, the well-established healthcare infrastructure, and the presence of major pharmaceutical companies in the region.

The Europe market is expected to be the second-largest market for the Aminoglycoside Antibiotics Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to the increasing prevalence of antibiotic-resistant infections and the implementation of stricter regulations to promote the judicious use of antibiotics.

The Asia-Pacific market is expected to be the fastest-growing market for the Aminoglycoside Antibiotics Market, with a CAGR of over 22.2% during the forecast period by 2024. The growth of the market in the Asia-Pacific region is attributed to the rising healthcare expenditure, improving healthcare infrastructure, and the increasing awareness about antibiotic resistance and its impact on public health.

Market Segmentation:

- By Product Type

- Amikacin

- Gentamicin

- Tobramycin

- Neomycin

- Streptomycin

- Paromomycin

- Others (Kanamycin, Netilmicin, Plazomicin)

- By Route of Administration

- Intravenous

- Intramuscular

- Topical

- Inhalation

- Others (Oral, Ophthalmic)

- By Application

- Respiratory Tract Infections

- Urinary Tract Infections

- Septicemia

- Endocarditis

- Meningitis

- Bone and Joint Infections

- Others (Peritonitis, Abdominal Infections)

- By End-user

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Others (Long-term Care Facilities, Veterinary Settings)

- By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Segmental Analysis:

The amikacin segment, under the "By Product Type" segmentation, is projected to witness significant growth in North America and Europe, driven by the increasing prevalence of antibiotic-resistant infections and the need for effective therapies against multidrug-resistant pathogens. The amikacin segment is expected to have a CAGR of around 8-10% and a market size of around $500 million in North America and $400 million in Europe by 2024.

The inhalation segment, under the "By Route of Administration" segmentation, is anticipated to grow rapidly in regions like North America and Europe, owing to the rising demand for targeted drug delivery methods in treating respiratory infections, particularly in cystic fibrosis patients. This segment is expected to have a CAGR of around 12-15% and a market size of approximately $250 million in North America and $200 million in Europe by 2024.

The respiratory tract infections segment, under the "By Application" segmentation, is projected to be the largest segment in 2024, driven by the high incidence of pneumonia, bronchitis, and other respiratory infections, especially in hospital settings. This segment is expected to account for around 35-40% of the overall market share in 2024.

The hospitals segment, under the "By End-user" segmentation, is likely to be the second-largest segment in 2024, owing to the widespread use of aminoglycoside antibiotics in hospital settings for the treatment of severe infections.

Top companies in the Aminoglycoside Antibiotics Market

- Pfizer Inc.

- Novartis AG

- Sanofi

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Bayer AG

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- AbbVie Inc.

- Astellas Pharma Inc.

- Achaogen, Inc.

- Melinta Therapeutics, Inc.

- Allergan plc

- Teva Pharmaceutical Industries Ltd.

- Wockhardt Ltd.

- Xellia Pharmaceuticals ApS

- Cipla Ltd.

- Lupin Ltd.

- Zydus Cadila

- Aurobindo Pharma Ltd.