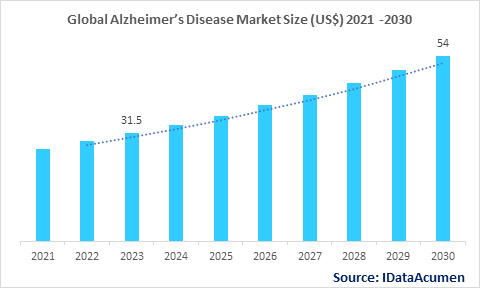

The Alzheimer's Disease Market is projected to expand to US $54 billion by 2030, compared to US $31.5 billion in 2023, exhibiting a compound annual growth rate (CAGR) of 8% throughout the forecast period. Alzheimer's disease is a progressive neurodegenerative disorder characterized by memory loss, impaired thinking, and changes in behavior. It is the most common cause of dementia. The rising prevalence of Alzheimer's disease due to aging populations is a key driver of market growth.

The Alzheimer’s Disease Market is segmented by drug class, route of administration, distribution channel, stage of disease, and region. By drug class, the cholinesterase inhibitors segment is expected to account for the largest market share owing to proven efficacy and safety. New cholinesterase inhibitors like Nemvaleaporsine are being developed to improve patient convenience.

Epidemiology Insights:

- Over 5 million people are living with Alzheimer's disease in the US. Alzheimer's prevalence is growing rapidly in developed countries like the US, Japan, and Germany due to aging populations.

- Key trends include earlier onset of Alzheimer's, and increasing diagnosis rates aided by biomarker testing and imaging techniques. The burden of Alzheimer's is rising in low and middle-income countries.

- The US has the highest Alzheimer's prevalence of around 6 million people. Japan and Germany also have over 1 million patients each.

- Rising patient pool globally presents opportunities for new diagnostic tests, digital solutions for patient monitoring and support.

- Alzheimer's is not a rare disease. It is quite common in older adults over the age of 65 years.

Market Landscape:

- There are significant unmet needs for disease-modifying and curative therapies as current options only provide symptomatic relief.

- Approved Alzheimer's drugs are cholinesterase inhibitors like Aricept and NMDA receptor antagonist like Memantine. These only temporarily improve cognition.

- Many new disease-modifying small molecules, antibodies, gene therapies targeting amyloid beta, tau proteins are under development. These can alter disease progression.

- Notable upcoming therapies include Biogen's Lecanemab, Cassava Sciences' Simufilam, Annovis Bio's Posiphen among others.

- The Alzheimer's market is dominated by patented branded drugs. Generics have limited penetration currently.

Alzheimer’s Disease Market Drivers:

The rising prevalence of Alzheimer's disease is a major driver of growth in the Alzheimer’s market. Alzheimer's is the most common form of dementia, accounting for 60-80% of dementia cases worldwide. Over 50 million people are living with dementia globally, with numbers expected to almost triple by 2050. The growing aging population across the world presents significant opportunities for companies developing novel diagnostic and therapeutic solutions. Government data indicates the population over 65 years in developed countries will double by 2050. Since age is the biggest risk factor for Alzheimer’s, the increasing elderly demographic will substantially expand the addressable patient pool and propel market growth.

Advances in diagnostic techniques and biomarker testing are boosting early and accurate detection of Alzheimer’s disease. Diagnosis of Alzheimer’s is challenging in the early stages since symptoms are ambiguous. Innovations in biomarkers like tau proteins and imaging technologies like PET scans can identify pathogenic changes before onset of dementia symptoms. Companies are developing and commercializing cerebrospinal fluid tests, blood tests, genetics tests leveraging biomarkers to improve diagnosis rates. Increased screening and identification of individuals likely to develop Alzheimer’s will allow intervention at early stages and open up opportunities for disease monitoring solutions.

The Alzheimer’s pipeline is robust with over 150 novel therapies in development targeting disease modification. Disease-modifying therapies that can slow or stop the progression of Alzheimer's have the potential to transform treatment paradigms. Many emerging therapies like Biogen’s aducanumab, Cassava’s simufilam, Annovis Bio’s posiphen target underlying pathologies like amyloid beta plaques and neurofibrillary tangles. Strong interest from pharmaceutical companies reflects the urgent need for therapies beyond symptomatic relief. As more disease-modifying candidates receive approvals, the market outlook will improve significantly.

Expanding research on the pathology and genetics of Alzheimer's disease is uncovering new drug targets and approaches. Ongoing studies have linked over 25 genes to Alzheimer’s disease risk, including APOE-e4, APP, PSEN1, and PSEN2 among others. Researchers are also investigating alternate pathological processes like neuroinflammation and cellular metabolism. The insights gained can help develop first-in-class therapies with novel mechanisms of action compared to existing options. Moreover, academics and industry players are collaborating more through public-private partnerships and research consortiums to accelerate drug discovery.

Alzheimer’s Disease Market Opportunities:

Digital therapeutics and mobile health solutions present tremendous opportunities to improve Alzheimer’s diagnosis and care coordination. Digital cognitive assessment tools can detect early cognitive impairment with greater sensitivity compared to paper-based tests. Wearable sensors can unobtrusively monitor physical activity, sleep patterns, and social engagement which provide insights on disease progression. Apps and virtual assistants incorporate cognitive training exercises and educational resources for patients. Investment in digital health is rising with deals like Biogen and Akili’s collaboration for cognitive measurement. As digital adoption grows, data analytics capabilities will strengthen to stratify patients and track outcomes.

Advances in biomarkers present opportunities for companies to develop companion diagnostics that identify patients likely to benefit from specific Alzheimer’s therapies. Since Alzheimer’s likely represents multiple subtypes, there is a push towards targeted therapies based on genetic and biomarker profiles. For instance, the presence of certain mutations predicts response to BACE inhibitors. Companion diagnostics can help select optimal treatments while excluding non-responders to improve clinical success rates and support personalized medicine approaches.

Emerging pipeline disease-modifying therapies create prospects for combination treatment approaches that can enhance efficacy. Given the complex pathology of Alzheimer’s, mono therapies may be inadequate to alter progression. However, combining synergistic MOAs like BACE inhibitors with anti-tau antibodies may amplify effects through complementary mechanisms of action. Companies are actively exploring combo regimens such as Eisai and Biogen’s BAN2401 and aducanumab. Combination treatments could become the standard of care if additive benefits are proven in ongoing combo trials.

Increasing investments in Alzheimer’s research by government organizations and non-profits create financial incentives for biopharma companies to boost R&D efforts. For instance, the US National Plan to Address Alzheimer's Disease has dedicated over $2.8 billion for Alzheimer's research since 2017. The Alzheimer’s Association’s Part the Cloud program has funded $50 million towards translational research projects. Such funding programs offset risks, subsidize infrastructure costs for clinical trials, and support the development of novel models. More partnerships between advocacy groups and industry will bolster innovation.

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 31.5 Bn |

|

CAGR (2023 - 2030) |

8% |

|

The revenue forecast in 2030 |

US$ 54 Bn |

|

Base year for estimation |

2021 |

|

Historical data |

2017-2020 |

|

Forecast period |

2023-2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

Drug Class: Cholinesterase inhibitors, NMDA receptor antagonists, Monoclonal antibodies, Others Route of Administration: Oral, Injectable, Others Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies Stage of Disease: Mild Alzheimer's, Moderate Alzheimer's, Severe Alzheimer's End User: Hospitals, Homecare, Specialty Clinics, Others |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Biogen, Eli Lilly, Roche, Novartis, Pfizer, Merck & Co., AstraZeneca, Johnson & Johnson, AbbVie, Amgen |

Alzheimer’s Disease Market Trends:

A significant trend is the use of big data analytics and machine learning for Alzheimer’s drug discovery and development. Pharma companies are tapping real-world evidence from medical records, clinical trial data, genomics databases and wearables to uncover new insights and predictors of disease progression. Machine learning can help identify novel correlations and patient subsets most likely to respond to treatments. For example, AiCure’s AI platform found behavioural biomarkers predictive of cognitive decline severity. Big data analytics enhance clinical success by enabling better trial design and patient selection.

The Alzheimer’s market is gradually moving away from a one-size-fits-all approach towards targeted therapies based on genetic drivers and biomarkers. Researchers have identified various Alzheimer’s subtypes linked to distinct genetic variants, pathology and clinical features. Many pipeline drugs target specific patient subsets, for instance people with certain mutations or amyloid status. Gene testing is being incorporated to identify at-risk individuals and recruit optimal subjects in clinical trials. As research on heterogeneity advances, precision medicine approaches will rise.

Due to the difficulties in Alzheimer’s clinical trials, companies are increasing the use of digital tools and decentralized trials to accelerate recruitment and improve retention. Virtual studies facilitate enrollment by allowing remote participation. Digital cognitive assessments boost sensitivity in detecting early decline. Wearables give insights on daily patient behaviours. Electronic consent and telehealth improve convenience. COVID-19 necessitated remote, hybrid models which are now being leveraged. Patient-centric trial designs will enhance participation and quality of evidence.

To address the limitations of animal models in translating to human disease, next-generation models like organoids, human stem cell models and microfluidic chips are gaining traction in Alzheimer’s research. These in vitro models derived from human tissues can effectively mimic aspects of Alzheimer’s pathology like protein aggregation, neuron death and blood-brain barrier function. Companies like Emulate and Stemonix partner with pharma firms to test compounds using Organ-Chips containing brain tissue. Advanced models better predict human responses to identify efficacious therapies earlier.

Alzheimer’s Disease Market Restraints:

The lack of definitive diagnostic tests and biomarkers is a key constraint in Alzheimer’s market growth. Accurate diagnosis at early stages remains challenging since symptoms are non-specific and subtle initially. Validated fluid or imaging biomarkers that confirm presence of Alzheimer’s pathology are still emerging. Misdiagnosis rates are high, delaying intervention.Insensitive cognitive assessments miss mild cognitive impairment. R&D to discover and integrate diagnostic markers is critical for the Alzheimer’s market outlook.

High failure rates of Alzheimer’s treatments in late-stage clinical trials hinder market prospects. The complex, multifactorial pathology complicates drug development. Between 1998-2019, 146 investigational Alzheimer’s drugs failed in Phase 2 and 3 trials due to lack of efficacy or safety concerns. Contradictory trial data for Biogen’s Aduhelm has sparked debate over clinical meaningfulness. Suboptimal trial design and heterogeneous patient populations contribute to negatives. Failed trials disincentivize investments from cautious biopharma firms.

Reimbursement challenges pose barriers to uptake of emerging Alzheimer’s therapies. While costly specialty drugs like monoclonal antibodies get approved, restrictive coverage policies limit access. For instance, CMS imposed strict eligibility criteria for Aduhelm coverage. Many private insurers do not cover therapies without demonstrated clinical benefit. Lack of reimbursement infrastructure in developing markets also hampers access. Pricing and payment pathways must evolve to match innovation areas like gene and cell therapies.

Recent Developments:

|

Development |

Involved Company |

|

FDA accelerated approval for Aduhelm |

Biogen |

|

Cassava Sciences announces positive Phase 2 results for Simufilam |

Cassava Sciences |

|

Roche terminates Crenezumab, Gantenerumab trials |

Roche |

|

Acceleration of BAN2401 trial into confirmatory Phase 3 |

Eisai, Biogen |

|

Annovis Bio begins Phase 2 trial for Alzheimer's drug Posiphen |

Annovis Bio |

June 2021: FDA granted accelerated approval to Aduhelm (aducanumab) from Biogen based on Phase 3 EMERGE trial showing reduction in amyloid beta plaques. This was the first Alzheimer’s drug approved in 20 years. However, conflicting trial data and lack of clinical benefit evidence has led to restricted usage.

July 2022: Leqembi from Eisai Co. and Biogen received accelerated FDA approval, becoming the second anti-amyloid beta antibody after Aduhelm to be approved for Alzheimer’s disease. Leqembi also reduces amyloid beta levels.

September 2022: FDA granted breakthrough therapy designation to Simufilam from Cassava Sciences based on positive Phase 2 results showing improvement in cognition scores and behavior. Simufilam is a new oral drug that restores altered filamin levels in Alzheimer's patients.

|

Merger/Acquisition |

Involved Companies |

|

Acquisition of Neuroimmune's NI006 program |

Biogen |

|

Lundbeck acquires Ablynx's early-stage tau antibody program |

Lundbeck, Ablynx |

|

Roche acquires Prothena's anti-amyloid beta antibody PRX002 |

Roche, Prothena |

Regional Analysis:

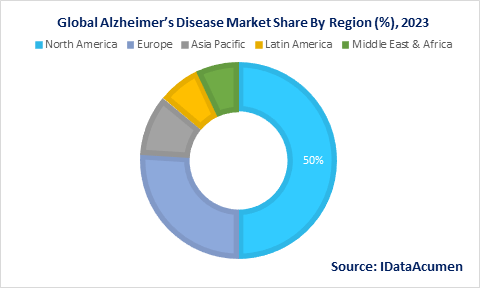

North America is expected to dominate the Alzheimer’s disease market through 2030 due to a high disease burden from aging populations. Rising diagnosis rates, healthcare spending, and access to new therapies in the US also boost the North American Alzheimer’s market, accounting for 60% of global revenues.

Europe represents the second largest regional market driven by high prevalence in countries like Germany, France, and Italy and government funding for dementia care. Favorable reimbursement also facilitates the uptake of approved Alzheimer's therapies in Europe, forecast to hold 26% market share.

The Asia Pacific Alzheimer’s disease market is anticipated to expand at the fastest CAGR of 10% over 2022-2030 owing to rapidly aging populations in China, Japan, and India. Increasing investments in healthcare infrastructure and digital solutions for dementia care present opportunities in the Asia Pacific.

Market Segmentation:

- By Drug Class

- Cholinesterase inhibitors

- NMDA receptor antagonists

- Monoclonal antibodies

- Others

- By Route of Administration

- Oral

- Injectable

- Others

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Stage of Disease

- Mild Alzheimer's

- Moderate Alzheimer's

- Severe Alzheimer's

- By End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Top Companies:

- Biogen

- Eli Lilly

- Roche

- Novartis

- Pfizer

- Merck & Co.

- AstraZeneca

- Johnson & Johnson

- AbbVie

- Amgen