Market Analysis:

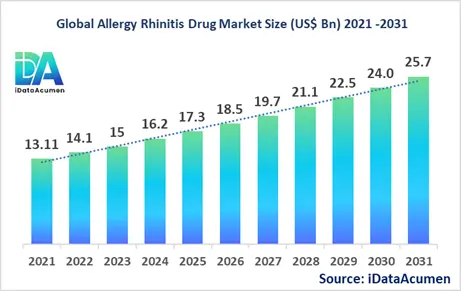

The Allergy Rhinitis Drug Market had an estimated market size worth US$ 16.2 billion in 2024, and it is predicted to reach a global market valuation of US$ 25.7 billion by 2031, growing at a CAGR of 6.8% from 2024 to 2031.

Allergy rhinitis drugs are medications used to treat the symptoms of allergic rhinitis, also known as hay fever, which is an inflammatory condition of the nasal passages caused by an overreaction of the immune system to airborne allergens like pollen, dust mites, or pet dander. These drugs provide relief from symptoms such as sneezing, itchy and runny nose, nasal congestion, and itchy and watery eyes. The primary drivers of the market include the increasing prevalence of allergic rhinitis worldwide, rising pollution and urbanization levels, and advancements in allergy immunotherapy treatments.

The Allergy Rhinitis Drug Market is segmented by drug class, route of administration, dosage form, distribution channel, allergen type, age group, and disease severity, and region. By drug class, the market is segmented into antihistamines, intranasal corticosteroids, decongestants, leukotriene receptor antagonists, immunotherapy, and others (mast cell stabilizers, combination drugs). The antihistamines segment is expected to hold a significant market share due to its widespread use as a first-line treatment for allergy symptoms and the availability of various formulations, including oral and nasal sprays.

For instance, in April 2022, Glenmark Pharmaceuticals launched Ryaltris, a novel fixed-dose combination nasal spray containing an antihistamine (olopatadine) and a corticosteroid (mometasone furoate), for the treatment of seasonal allergic rhinitis in adults and pediatric patients aged 12 years and older.

Epidemiology Insights:

- The disease burden of allergic rhinitis varies across major regions, with higher prevalence rates observed in developed countries. In North America, approximately 10-30% of the population is affected by allergic rhinitis, while in Europe, the prevalence ranges from 15-25%.

- Key epidemiological trends and driving factors behind the increasing prevalence of allergic rhinitis include urbanization, pollution, climate change, and improved diagnosis rates. Urbanization and industrialization have led to higher levels of air pollution, which can exacerbate allergic symptoms. Climate change has also contributed to longer pollen seasons and increased exposure to allergens.

- In the United States, the prevalence of allergic rhinitis is estimated to be around 30 million people, while in Europe, it affects approximately 100 million people. The disease incidence and prevalence rates are generally higher in developed countries compared to developing nations.

- The increasing patient population with allergic rhinitis presents growth opportunities for the Allergy Rhinitis Drug Market, as more individuals seek effective treatments to manage their symptoms.

- Allergic rhinitis is not considered a rare disease, as it affects a significant portion of the global population.

Market Landscape:

- There are still unmet needs in the Allergy Rhinitis Drug Market with respect to treatment options, particularly for severe and persistent cases of allergic rhinitis. Many patients experience inadequate symptom control or adverse effects with currently available therapies.

- Current treatment options for allergic rhinitis include antihistamines (oral and intranasal), intranasal corticosteroids, decongestants, leukotriene receptor antagonists, and immunotherapy (allergy shots or sublingual tablets). Examples of approved therapies include Zyrtec (cetirizine), Flonase (fluticasone propionate), and Grastek (timothy grass pollen allergen extract).

- Upcoming therapies and technologies for allergic rhinitis treatment include novel antihistamines with improved efficacy and safety profiles, biologic therapies targeting specific immune pathways involved in allergic responses (e.g., anti-IgE, anti-IL-4/IL-13 antibodies), and advancements in sublingual immunotherapy and allergen immunotherapy.

- Breakthrough treatment options currently being developed include gene therapies that aim to modify the immune response to allergens, as well as the use of nanotechnology for targeted drug delivery and improved bioavailability.

- The Allergy Rhinitis Drug Market is dominated by branded drug manufacturers, with several major pharmaceutical companies having a strong presence in this market. However, there is also a significant presence of generic drug manufacturers, particularly for older antihistamine and decongestant medications.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 16.2 Bn |

|

CAGR (2024 - 2031) |

6.8% |

|

The revenue forecast in 2031 |

US$ 25.7 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

GlaxoSmithKline, Sanofi, Merck & Co., Novartis AG, AstraZeneca, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim, Glenmark Pharmaceuticals, Hisamitsu Pharmaceutical Co., Inc., FAES Farma, Regeneron Pharmaceuticals, Meda Pharmaceuticals, UCB, Kyowa Hakko Kirin Co., Ltd., Shionogi & Co., Ltd., Torii Pharmaceutical Co., Ltd., Stallergenes Greer, ALK-Abello A/S, Anergis, HAL Allergy Group |

Market Drivers:

Rising Prevalence of Allergic Rhinitis

The increasing prevalence of allergic rhinitis worldwide is a significant driver for the Allergy Rhinitis Drug Market. This chronic condition affects a substantial portion of the global population, with estimates suggesting that up to 30% of individuals in some regions suffer from allergic rhinitis. Factors contributing to this rise include urbanization, air pollution, climate change, and shifting environmental conditions. As the number of affected individuals grows, the demand for effective treatments and medications to manage symptoms escalates, driving growth in the Allergy Rhinitis Drug Market.

Increasing Awareness and Early Diagnosis

Heightened awareness about allergic rhinitis, its symptoms, and the importance of seeking medical attention has contributed to the growth of the Allergy Rhinitis Drug Market. Public health campaigns, educational initiatives, and improved access to healthcare services have played a crucial role in raising awareness. Additionally, advancements in diagnostic techniques, such as allergen-specific IgE testing and nasal cytology, have facilitated earlier and more accurate diagnosis of allergic rhinitis. Early diagnosis enables timely intervention and treatment, thereby driving the demand for allergy medications.

Advancements in Allergy Immunotherapy

Allergy immunotherapy, also known as desensitization therapy, has emerged as an effective long-term treatment option for allergic rhinitis. This therapy involves gradually exposing individuals to increasing doses of allergens, helping to modify the immune system's response and reduce sensitivity over time. Recent advancements in immunotherapy, including the development of sublingual tablets and improved allergen extracts, have made this treatment more convenient and effective. As immunotherapy gains wider acceptance and adoption, it is expected to drive growth in the Allergy Rhinitis Drug Market.

Growing Geriatric Population and Comorbidities

The global population is aging, and the prevalence of allergic rhinitis is higher among older adults. Additionally, allergic rhinitis is often associated with other respiratory conditions, such as asthma and chronic obstructive pulmonary disease (COPD), which are more common in the elderly population. As the geriatric population continues to grow, the demand for effective allergy medications to manage symptoms and comorbidities is likely to increase, fueling the growth of the Allergy Rhinitis Drug Market.

Market Opportunities:

Development of Novel Drug Delivery Systems

The Allergy Rhinitis Drug Market presents opportunities for the development of novel drug delivery systems that can enhance the efficacy, convenience, and patient compliance of allergy treatments. For instance, researchers are exploring nanotechnology-based drug delivery systems that can target specific cells or tissues involved in allergic responses, potentially reducing side effects and improving therapeutic outcomes. Additionally, alternative routes of administration, such as transdermal patches or intranasal formulations, offer potential for improved bioavailability and patient adherence.

Personalized Medicine and Precision Diagnostics

Advances in personalized medicine and precision diagnostics open up new opportunities in the Allergy Rhinitis Drug Market. By identifying specific genetic or molecular markers associated with allergic responses, healthcare professionals can tailor treatments to individual patients' needs. This approach may lead to more effective and targeted therapies, minimizing the risk of adverse reactions and improving overall treatment outcomes. Furthermore, the development of point-of-care diagnostic tools can facilitate rapid and accurate diagnosis, enabling prompt intervention and appropriate medication selection.

Combination Therapies for Improved Efficacy

Combination therapies, which involve the use of multiple allergy medications with different mechanisms of action, present an opportunity for enhanced symptom relief and better disease management. By targeting multiple pathways involved in allergic responses, combination therapies have the potential to provide superior efficacy compared to monotherapies. For instance, the combination of antihistamines and intranasal corticosteroids has shown promising results in controlling allergy symptoms. As research continues in this area, new and more effective combination therapies may emerge, driving growth in the Allergy Rhinitis Drug Market.

Expansion in Emerging Markets

Emerging markets, particularly in regions like Asia-Pacific and Latin America, offer significant growth opportunities for the Allergy Rhinitis Drug Market. With increasing urbanization, rising disposable incomes, and improving healthcare infrastructure, these regions are witnessing a surge in the prevalence of allergic rhinitis. Additionally, growing awareness and access to medical care in these markets are expected to drive demand for effective allergy treatments. Pharmaceutical companies can leverage these opportunities by developing affordable and locally relevant solutions, tailored to the specific needs and preferences of these markets.

Market Trends:

Development of Biologic Therapies

The Allergy Rhinitis Drug Market is witnessing a growing trend towards the development of biologic therapies, which target specific immune pathways involved in allergic responses. These innovative treatments, such as monoclonal antibodies and fusion proteins, offer the potential for improved efficacy and longer-lasting relief compared to traditional medications. For instance, medications targeting the IgE pathway or interleukin pathways (e.g., IL-4, IL-5) have shown promising results in clinical trials for the treatment of severe allergic rhinitis. As research in this area progresses, biologic therapies are expected to become a significant part of the Allergy Rhinitis Drug Market.

Digital Health Solutions for Remote Monitoring

The integration of digital health technologies into the management of allergic rhinitis is an emerging trend in the Allergy Rhinitis Drug Market. Mobile applications, wearable devices, and remote monitoring tools are being developed to assist patients in tracking their symptoms, allergen exposure, and medication adherence. These digital solutions can provide real-time data to healthcare providers, enabling more personalized and proactive treatment approaches. Additionally, telemedicine platforms can facilitate virtual consultations and remote monitoring, improving access to care and enhancing treatment efficacy, particularly in underserved or remote areas.

Focus on Sustainable and Eco-Friendly Treatments

As concerns about environmental sustainability and eco-friendliness grow, the Allergy Rhinitis Drug Market is witnessing a trend towards the development of sustainable and environmentally conscious treatments. Manufacturers are exploring the use of plant-based and biodegradable materials in drug formulations, as well as implementing eco-friendly manufacturing processes. Additionally, there is a growing interest in exploring natural remedies and complementary therapies, such as herbal extracts and probiotics, as alternative or adjunct treatments for allergic rhinitis. This trend aligns with the increasing consumer demand for eco-friendly and sustainable products across various industries.

Expansion of Therapeutic Indications

Existing allergy medications are being explored for broader therapeutic indications beyond allergic rhinitis. For instance, certain antihistamines and leukotriene receptor antagonists have shown potential in the treatment of other conditions, such as chronic urticaria, asthma, and atopic dermatitis. This expansion of therapeutic indications can open up new market opportunities for pharmaceutical companies and drive growth in the Allergy Rhinitis Drug Market. Additionally, research is ongoing to investigate the potential of allergy medications in treating conditions like chronic rhinosinusitis and nasal polyposis, further broadening the scope of the market.

Market Restraints:

High Cost of Branded Treatments

One of the significant restraints in the Allergy Rhinitis Drug Market is the high cost associated with branded treatments, particularly for newer and more advanced medications. Many patients, especially in developing or low-income regions, may face financial barriers in accessing these expensive therapies, limiting their adoption and market growth. Additionally, the availability of affordable generic alternatives can further impact the sales and uptake of branded allergy medications, posing a challenge for pharmaceutical companies.

Side Effects and Safety Concerns

While allergy medications are generally considered safe, some patients may experience side effects or have safety concerns, particularly with long-term use or combination therapies. Common side effects associated with certain allergy medications include drowsiness, dry mouth, and headaches, which can impact patient adherence and treatment outcomes. Additionally, there are safety concerns related to the use of certain medications in specific populations, such as pregnant women, children, and the elderly. These factors can restrain the overall growth and adoption of allergy medications in the market.

Regulatory Challenges and Stringent Approval Processes

The development and commercialization of new allergy medications are subject to stringent regulatory requirements and rigorous approval processes. Pharmaceutical companies must navigate complex clinical trials, safety evaluations, and regulatory submissions, which can be time-consuming and costly.

Recent Developments:

|

Development |

Involved Company |

|

Glenmark Pharmaceuticals launched Ryaltris, a novel fixed-dose combination nasal spray for seasonal allergic rhinitis, in April 2022. It combines an antihistamine and a corticosteroid for improved symptom relief. |

Glenmark Pharmaceuticals |

|

Regeneron and Sanofi received FDA approval for Dupixent (dupilumab) as an add-on maintenance treatment for inadequately controlled chronic rhinosinusitis with nasal polyposis in June 2022. It targets a key driver of type 2 inflammation. |

Regeneron and Sanofi |

|

AstraZeneca announced positive Phase III results for its investigational monoclonal antibody tezepelumab in patients with severe, uncontrolled asthma in December 2022. It has the potential to treat multiple respiratory diseases, including allergic rhinitis. |

AstraZeneca |

|

Product Launch |

Company Name |

|

Sanofi launched Xhance, a novel nasal spray formulation of fluticasone propionate, for the treatment of nasal polyps in October 2021. It provides targeted drug delivery and improved symptom relief. |

Sanofi |

|

GSK received FDA approval for Nucala (mepolizumab) as the first and only biologic therapy for the treatment of chronic rhinosinusitis with nasal polyps in adults in September 2022. It targets the IL-5 pathway involved in inflammation. |

GlaxoSmithKline |

|

Merck launched Singulair (montelukast) in a new strawberry flavor for oral granules formulation in the US in January 2023, improving palatability for pediatric patients with allergic rhinitis and asthma. |

Merck & Co. |

|

Merger/Acquisition |

Involved Companies |

|

In August 2022, Novartis acquired Actuate Therapeutics, a biopharmaceutical company developing novel gene therapies for inflammatory diseases, including allergic rhinitis. This acquisition expands Novartis' pipeline in respiratory diseases. |

Novartis and Actuate Therapeutics |

|

Teva Pharmaceutical Industries acquired Allergan's Respiratory Portfolio, including several nasal spray products for allergic rhinitis, in October 2020. This strengthened Teva's presence in the respiratory and allergy market. |

Teva and Allergan |

|

GSK acquired Affinivax, a clinical-stage biopharmaceutical company developing novel vaccines, including a candidate for allergic rhinitis, in December 2022. This acquisition expands GSK's pipeline in respiratory and immunology diseases. |

GSK and Affinivax |

Market Regional Insights:

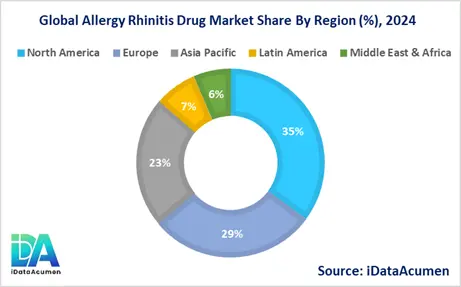

The Allergy Rhinitis Drug Market exhibits regional variations in terms of market size, growth rates, and adoption patterns. North America is expected to be the largest market for the Allergy Rhinitis Drug Market during the forecast period, accounting for over 35.2% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of allergic rhinitis, advanced healthcare infrastructure, and the presence of major pharmaceutical companies in the region.

The Europe market is expected to be the second-largest market for the Allergy Rhinitis Drug Market, accounting for over 28.7% of the market share in 2024. The growth of the market is attributed to increasing awareness about allergic rhinitis, favorable reimbursement policies, and the availability of a wide range of treatment options.

The Asia Pacific market is expected to be the fastest-growing market for the Allergy Rhinitis Drug Market, with a CAGR of over 22.5% during the forecast period by 2024. The growth of the market in the Asia Pacific is attributed to the rising prevalence of allergic rhinitis, increasing disposable incomes, and improving healthcare infrastructure. The Latin America and Middle East & Africa regions collectively account for the remaining market share of 13.6%.

Market Segmentation:

- By Drug Class

- Antihistamines

- Intranasal Corticosteroids

- Decongestants

- Leukotriene Receptor Antagonists

- Immunotherapy

- Others (Mast Cell Stabilizers, Combination Drugs)

- By Route of Administration

- Oral

- Nasal

- Sublingual

- Injectable

- Topical

- Others (Inhalation, Transdermal)

- By Dosage Form

- Tablets

- Capsules

- Nasal Sprays

- Liquids/Syrups

- Injections

- Others (Sublingual Tablets, Topical Creams)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

- Others (Clinics, Mail Order)

- By Allergen Type

- Pollen

- Dust Mites

- Mold

- Pet Dander

- Others (Insect Venom, Food Allergens)

- By Age Group

- Pediatrics

- Adults

- Geriatrics

- By Disease Severity

- Mild

- Moderate

- Severe

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The market is relatively consolidated, with a few major pharmaceutical companies occupying a significant market share.

Market Segmental Analysis:

- Drug Class Segment:

- The antihistamines segment is expected to maintain its dominance in the Allergy Rhinitis Drug Market due to its widespread use as a first-line treatment for allergy symptoms and the availability of various formulations.

- The intranasal corticosteroids segment is projected to witness significant growth, especially in developed regions like North America and Europe, owing to their efficacy in controlling nasal symptoms and their increasing adoption as a preferred treatment option.

- Immunotherapy, including sublingual and injectable formulations, is anticipated to experience a high growth rate, particularly in regions with a high disease burden and growing awareness about the long-term benefits of allergen immunotherapy.

- Route of Administration Segment:

- The oral and nasal routes of administration are likely to remain the largest segments due to the convenience and patient preference for these delivery methods.

- The sublingual route is expected to gain momentum, driven by the increasing adoption of sublingual immunotherapy tablets, especially in North America and Europe.

- Regional Segment:

- North America and Europe are projected to remain the largest regional markets for Allergy Rhinitis Drugs, driven by the high prevalence of allergic rhinitis, advanced healthcare infrastructure, and the presence of major pharmaceutical companies.

- The Asia Pacific region is anticipated to witness the highest CAGR, fueled by increasing urbanization, rising disposable incomes, and improving healthcare accessibility.

In 2024, the antihistamines segment is likely to be the largest, followed by intranasal corticosteroids, based on current market trends and product portfolios. The oral and nasal routes of administration are expected to be the largest segments, while sublingual administration may experience the highest growth rate.

Top companies in the Allergy Rhinitis Drug Market:

- GlaxoSmithKline

- Sanofi

- Merck & Co.

- Novartis AG

- AstraZeneca

- Teva Pharmaceutical Industries Ltd.

- Boehringer Ingelheim

- Glenmark Pharmaceuticals

- Hisamitsu Pharmaceutical Co., Inc.

- FAES Farma

- Regeneron Pharmaceuticals

- Meda Pharmaceuticals

- UCB

- Kyowa Hakko Kirin Co., Ltd.

- Shionogi & Co., Ltd.

- Torii Pharmaceutical Co., Ltd.

- Stallergenes Greer

- ALK-Abello A/S

- Anergis

- HAL Allergy Group