Market Analysis:

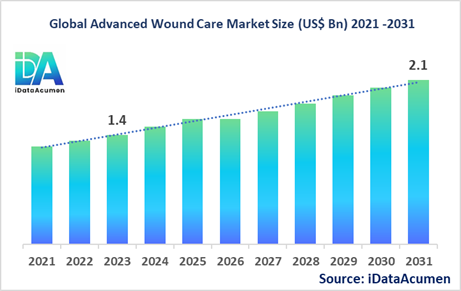

The Advanced Wound Care (AWC) Market had an estimated market size worth US$ 1.4 billion in 2023, and it is predicted to reach a global market valuation of US$ 2.1 billion by 2031, growing at a CAGR of 5.4% from 2024 to 2031.

The Advanced Wound Care (AWC) market encompasses a wide range of specialized products and technologies used for the management and treatment of complex and chronic wounds, such as those resulting from burns, surgical procedures, ulcers, and other underlying conditions. These advanced wound care solutions aim to promote faster healing, reduce the risk of infection, and improve patient outcomes.

One of the major drivers fueling the growth of the Advanced Wound Care (AWC) market is the rising prevalence of chronic diseases, particularly diabetes and obesity, which can lead to the development of complex wounds. According to the International Diabetes Federation, the global prevalence of diabetes was estimated to be 536.6 million in 2021, and it is expected to reach 783.2 million by 2045, contributing to the growing demand for advanced wound care solutions.

In summary, the Advanced Wound Care (AWC) Market is a crucial segment of the medical devices industry, providing innovative products and technologies to address the increasing burden of complex and chronic wounds globally.

The Advanced Wound Care (AWC) Market is segmented by Product Type, Wound Type, End-User, Distribution Channel, and Application. By Product Type, the market is segmented into Dressings, Wound Closure Products, Wound Therapy Devices, Active Wound Care Products, and Others (Skin Substitutes, Debridement Products). One of the largest sub-segments within the Product Type segment is Dressings, which are widely used in the management of various wound types due to their ability to create a moist healing environment, prevent infection, and facilitate wound healing.

Recent real-time examples of product launches in the Advanced Wound Care (AWC) market include the introduction of Smith & Nephew's PICO◊ Single Use Negative Pressure Wound Therapy (sNPWT) system, which provides portable and easy-to-use negative pressure wound therapy for various wound types. Additionally, Kinetic Concepts, Inc. (KCI), a subsidiary of Acelity, has a robust pipeline of advanced wound care products, including the VeraFlo◊ Therapy System, which combines negative pressure wound therapy with automated instillation and dwell time.

Epidemiology Insights:

The burden of chronic wounds, which are a major focus of the Advanced Wound Care (AWC) market, varies significantly across different regions. In North America, the prevalence of chronic wounds is estimated to be around 6.5 million cases, with a significant proportion attributed to diabetes-related foot ulcers and pressure ulcers. In Europe, the prevalence of chronic wounds is estimated to be around 4 million cases, with a similar distribution of wound types.

The key epidemiological trends driving the growth of the Advanced Wound Care (AWC) market include the increasing prevalence of chronic diseases, such as diabetes and obesity, which are major risk factors for the development of complex wounds. Additionally, the aging population in many developed countries is contributing to the growing patient pool, as the elderly are more susceptible to chronic wounds and require more specialized wound care solutions.

The latest data on disease incidence and prevalence in major markets such as the United States, European Union, and Japan shows a steady increase in the number of chronic wound cases. For instance, in the United States, the incidence of diabetic foot ulcers is estimated to be around 1.5 million cases per year, while the prevalence of pressure ulcers in healthcare settings is around 2.5 million cases.

The growing patient population, along with the increasing awareness of advanced wound care solutions and the need for better treatment outcomes, presents significant growth opportunities for the Advanced Wound Care (AWC) market. However, the management of rare wound types, such as those associated with genetic disorders or severe burns, remains a challenge and an unmet need in the market.

Market Landscape:

The Advanced Wound Care (AWC) market has several unmet needs, particularly in the areas of cost-effective and patient-friendly wound care solutions. While there are a variety of treatment options available, such as traditional dressings, wound closure products, and advanced wound therapy devices, the high cost of these interventions can be a barrier to access, especially in developing regions.

Current treatment options in the Advanced Wound Care (AWC) market include a wide range of products, such as antimicrobial dressings, foam dressings, hydrogel dressings, and negative pressure wound therapy devices. These approved therapies have demonstrated effectiveness in promoting wound healing, reducing the risk of infection, and improving patient outcomes.

In the pipeline, there are several upcoming therapies and technologies that are expected to revolutionize the Advanced Wound Care (AWC) market. These include the development of smart bandages with integrated sensors for real-time wound monitoring, the use of bioactive materials and tissue engineering solutions for advanced wound healing, and the increasing integration of digital technologies, such as telemedicine and remote patient monitoring, to improve access to specialized wound care services.

One breakthrough treatment option currently in development is the use of stem cell-based therapies for the treatment of chronic wounds. These novel approaches aim to harness the regenerative potential of stem cells to accelerate wound healing and improve long-term outcomes.

The Advanced Wound Care (AWC) market is relatively consolidated, with a few large players dominating the market, such as Smith & Nephew, Mölnlycke Health Care, and Convatec Group. These companies have a strong presence in the market and are actively investing in research and development to maintain their competitive edge.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 1.4 Bn |

|

CAGR (2024 - 2031) |

5.4% |

|

The revenue forecast in 2031 |

US$ 2.1 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Smith & Nephew plc, Mölnlycke Health Care AB, Convatec Group plc, Acelity L.P. Inc. (KCI), 3M Company, Coloplast A/S, Medtronic plc, Integra LifeSciences Holdings Corporation, Organogenesis Holdings Inc., Essity AB (BSN Medical), Medline Industries, Inc., Hartmann Group, Baxter International Inc., B. Braun Melsungen AG, Derma Sciences, Inc. (Integra LifeSciences), Hollister Incorporated, Systagenix Wound Management, Ltd. (Acelity L.P. Inc.), Urgo Medical, Scapa Healthcare, Laboratories Urgo |

Market Drivers:

Rising Prevalence of Chronic Diseases

The growth of the Advanced Wound Care (AWC) market is primarily driven by the increasing prevalence of chronic diseases, such as diabetes and obesity, which are major risk factors for the development of complex and hard-to-heal wounds. According to the International Diabetes Federation, the global prevalence of diabetes is expected to reach 783.2 million by 2045, up from 536.6 million in 2021. This alarming rise in chronic disease incidence has led to a surge in the number of individuals suffering from wounds, particularly diabetic foot ulcers and pressure ulcers, which require specialized advanced wound care solutions for effective management and improved healing outcomes.

Furthermore, the aging population in many parts of the world is another contributing factor, as the elderly are more susceptible to chronic wounds due to underlying health conditions and reduced skin integrity. As the global population continues to age, the demand for advanced wound care products and technologies is expected to increase, driving the growth of the AWC market.

Advancements in Wound Care Technologies

The Advanced Wound Care (AWC) market has witnessed significant technological advancements in recent years, which have played a crucial role in driving market growth. The introduction of innovative products, such as smart bandages with integrated sensors for real-time wound monitoring, advanced wound dressings with antimicrobial properties, and negative pressure wound therapy (NPWT) devices, have revolutionized the way complex wounds are managed.

These technological breakthroughs have not only improved the efficacy of wound care but have also enhanced the overall patient experience by providing more comfortable, convenient, and effective treatment options. As healthcare providers and patients become increasingly aware of the benefits of these advanced wound care solutions, the demand for such products is expected to rise, further propelling the growth of the AWC market.

Increasing Awareness and Adoption of Advanced Wound Care

The growing awareness among healthcare professionals and patients about the importance of advanced wound care solutions has been a significant driver for the AWC market. As the limitations of traditional wound management techniques become more evident, there has been a shift towards the adoption of more sophisticated and comprehensive wound care approaches.

Healthcare providers, particularly in developed regions, are increasingly recognizing the clinical and economic benefits of utilizing advanced wound care products, such as improved healing rates, reduced risk of complications, and decreased healthcare costs associated with prolonged wound care. This heightened awareness has led to the incorporation of advanced wound care protocols in healthcare settings, driving the demand for these specialized products and fueling the growth of the AWC market.

Expansion of Wound Care Services and Accessibility

The expansion of specialized wound care services and improved accessibility to advanced wound care solutions have been significant drivers for the growth of the AWC market. In many regions, the development of dedicated wound care centers, clinics, and outpatient services has made it easier for patients to receive specialized treatment and access the latest wound care technologies.

Furthermore, the integration of telemedicine and remote patient monitoring in wound care has enhanced the reach and availability of these services, particularly in underserved or geographically dispersed areas. By improving the accessibility and convenience of advanced wound care, this trend has contributed to the increasing adoption of AWC products and services, driving the overall market growth.

Market Opportunities:

Expansion into Emerging Markets

The Advanced Wound Care (AWC) market presents significant growth opportunities in emerging markets, such as Asia-Pacific, Latin America, and the Middle East and Africa. These regions often have a large patient population with unmet wound care needs, driven by the rising prevalence of chronic diseases, limited access to specialized healthcare services, and insufficient awareness of advanced wound care solutions.

By strategically expanding their presence and tailoring their product offerings to cater to the unique needs of these emerging markets, market players can unlock substantial growth potential. This could involve establishing local partnerships, investing in distribution networks, and conducting educational campaigns to raise awareness among healthcare providers and patients. Tapping into these underserved regions can be a key driver for the long-term expansion and success of the AWC market.

Integration of Digital Health Technologies

The integration of digital health technologies, such as telemedicine, remote patient monitoring, and mobile applications, into the Advanced Wound Care (AWC) market represents a significant opportunity for growth. These digital solutions can enhance the accessibility and effectiveness of wound care services by enabling real-time monitoring, remote consultations, and personalized treatment plans.

For instance, the development of smart bandages with integrated sensors can provide healthcare providers with valuable data on wound healing progress, allowing for more informed decision-making and timely interventions. Additionally, mobile apps and online platforms can empower patients to actively engage in their own wound care, leading to improved self-management and better outcomes.

As the healthcare industry continues to embrace digital transformation, the AWC market can capitalize on this trend by developing and incorporating cutting-edge digital technologies into their product offerings. This can not only improve patient experiences but also drive operational efficiencies and enhance the overall quality of wound care services.

Advancements in Biomaterials and Tissue Engineering

The Advanced Wound Care (AWC) market is poised to benefit from the advancements in the fields of biomaterials and tissue engineering. Researchers and innovators are exploring the use of novel biomaterials, such as hydrogels, scaffolds, and bioactive molecules, to create more effective and regenerative wound care solutions.

These advanced materials have the potential to mimic the natural extracellular matrix, promote cell proliferation, and accelerate the body's natural healing processes. The development of tissue-engineered skin substitutes and cell-based therapies can also revolutionize the treatment of complex and chronic wounds, offering patients better outcomes and improved quality of life.

As these cutting-edge technologies continue to evolve and transition from the research phase to commercial applications, the AWC market will have the opportunity to incorporate these innovative solutions into their product portfolios. This can lead to the development of more targeted and personalized wound care interventions, further driving the growth and adoption of advanced wound care solutions.

Emphasis on Preventive Wound Care

The Advanced Wound Care (AWC) market is also poised to capitalize on the growing emphasis on preventive wound care. As healthcare systems and payers increasingly focus on reducing the burden of chronic wounds and their associated complications, there is a heightened interest in implementing strategies to prevent the occurrence of complex wounds in the first place.

This shift towards preventive care presents an opportunity for AWC market players to develop and market products and services that address the root causes of wound development, such as pressure ulcers, diabetic foot ulcers, and surgical site infections. By offering comprehensive wound prevention solutions, including risk assessment tools, education programs, and specialized dressings, the AWC market can expand its reach and provide more holistic wound management approaches.

Moreover, the integration of predictive analytics and artificial intelligence into wound care can further enhance the ability to identify high-risk individuals and implement targeted preventive measures. Embracing this preventive care paradigm can not only improve patient outcomes but also contribute to the long-term sustainability and growth of the Advanced Wound Care (AWC) market.

Market Trends:

Shift Towards Patient-Centric Wound Care

The Advanced Wound Care (AWC) market is witnessing a significant shift towards a more patient-centric approach to wound management. Healthcare providers and market players are increasingly recognizing the importance of incorporating the patient's preferences, comfort, and overall quality of life into the design and delivery of wound care solutions.

This trend is evident in the development of advanced wound dressings and devices that offer improved comfort, flexibility, and ease of use for patients. For instance, the introduction of self-adhesive wound dressings and portable negative pressure wound therapy devices has enhanced patient mobility and independence, leading to better adherence and improved healing outcomes.

Additionally, the integration of digital technologies, such as mobile apps and telehealth services, has empowered patients to actively participate in their own wound care, fostering a more collaborative and personalized approach. As the AWC market continues to prioritize patient-centricity, it will drive the adoption of innovative solutions that cater to the evolving needs and preferences of individuals with complex wound care requirements.

Emphasis on Wound Infection Management

The Advanced Wound Care (AWC) market has witnessed a growing emphasis on the management of wound infections, which can significantly impede the healing process and lead to serious complications. Healthcare providers and market players are increasingly focused on developing and adopting solutions that address the prevention, early detection, and effective treatment of wound infections.

This trend is manifested in the development of advanced wound dressings and topical antimicrobial agents that incorporate antimicrobial properties, as well as the introduction of diagnostic tools that enable rapid and accurate identification of wound pathogens. Furthermore, the integration of smart wound monitoring technologies, such as sensor-enabled dressings, can help healthcare providers identify and respond to signs of infection in a timely manner.

By prioritizing wound infection management, the AWC market can contribute to improved patient outcomes, reduced healthcare costs associated with wound-related complications, and the overall enhancement of wound care standards.

Sustainability and Environmental Considerations

The Advanced Wound Care (AWC) market is also witnessing a growing trend towards sustainability and environmental consciousness. Driven by the increasing awareness of the environmental impact of medical waste and the need for more eco-friendly practices, market players are focusing on developing wound care solutions that are not only clinically effective but also environmentally responsible.

This trend is manifested in the introduction of biodegradable and recycled materials in the manufacturing of wound dressings and packaging. Additionally, there is a focus on designing products that minimize waste, optimize resource utilization, and support the transition towards a more circular economy in the healthcare sector.

As healthcare institutions and patients become more attuned to the environmental impact of their wound care practices, the AWC market will need to adapt and provide sustainable solutions that align with these shifting priorities. Embracing this trend can not only differentiate market players but also contribute to the long-term sustainability of the Advanced Wound Care industry.

Collaborative Partnerships and Ecosystem Expansion

The Advanced Wound Care (AWC) market is characterized by a trend of collaborative partnerships and ecosystem expansion. Market players are increasingly recognizing the value of strategic alliances, joint ventures, and acquisitions to enhance their product portfolios, gain access to new technologies, and expand their geographical reach.

These collaborative efforts span various stakeholders, including medical device manufacturers, pharmaceutical companies, research institutions, and healthcare providers. By fostering these partnerships, the AWC market can leverage complementary expertise, resources, and distribution networks to deliver more comprehensive and innovative wound care solutions to patients.

Moreover, the expansion of the AWC ecosystem beyond traditional product-based offerings to include services, digital platforms, and integrated care models has further driven the market's evolution. This holistic approach to wound management enables market players to provide a more seamless and patient-centric experience, ultimately driving the adoption and growth of advanced wound care solutions.

Market Restraints:

High Cost of Advanced Wound Care Solutions

One of the key restraints facing the Advanced Wound Care (AWC) market is the high cost associated with many of the specialized products and technologies. The development and manufacturing of advanced wound dressings, wound therapy devices, and other innovative wound care solutions often involve significant investments in research, clinical trials, and regulatory approvals.

This high cost of production and innovation is subsequently passed on to healthcare providers and patients, making advanced wound care solutions less accessible, particularly in resource-constrained settings. The financial burden associated with the adoption of these advanced technologies can be a significant barrier, limiting the penetration of AWC products and restricting the market's growth potential.

Addressing the issue of affordability through strategies such as cost optimization, value-based pricing, and the development of more cost-effective alternatives will be crucial for the AWC market to expand its reach and ensure equitable access to these vital wound care solutions.

Reimbursement Challenges

The reimbursement landscape for advanced wound care solutions is another significant restraint facing the AWC market. In many healthcare systems, the coverage and reimbursement policies for specialized wound care products and services can be inconsistent, complex, and often inadequate.

The lack of clear and comprehensive reimbursement guidelines, as well as the disparities in coverage across different regions and payer systems, can pose a significant barrier to the adoption of advanced wound care solutions. Healthcare providers and patients may be hesitant to invest in these technologies if the financial burden is not adequately supported by insurance or healthcare policies.

Navigating the reimbursement landscape and advocating for more favorable policies that recognize the clinical and economic benefits of advanced wound care will be crucial for market players to overcome this restraint and drive the widespread adoption of their products and services.

Limited Availability of Skilled Wound Care Professionals

The Advanced Wound Care (AWC) market also faces the challenge of limited availability of skilled wound care professionals, such as specialized nurses, podiatrists, and wound care specialists. In many regions, there is a shortage of healthcare providers with the necessary expertise and training to effectively manage complex and chronic wounds.

This shortage of skilled wound care professionals can hinder the proper implementation and utilization of advanced wound care solutions, as healthcare providers may lack the knowledge and experience to optimize the use of these technologies. Furthermore, the uneven distribution of specialized wound care services across different geographical areas can further exacerbate this challenge, leading to disparities in access to high-quality wound care.

Addressing this restraint will require comprehensive efforts to invest in wound care education, training programs, and the development of interdisciplinary wound care teams. Collaboration between market players, healthcare institutions, and policymakers will be crucial to build a robust and skilled workforce capable of delivering effective advanced wound care services.

Recent Developments:

|

Development |

Company Name |

|

In August 2022, Smith & Nephew received FDA clearance for its PICO◊ Single Use Negative Pressure Wound Therapy (sNPWT) system. The portable and easy-to-use device is designed to provide negative pressure wound therapy for a variety of wound types. |

Smith & Nephew plc |

|

In April 2021, Mölnlycke Health Care launched its Mepilex◊ Border Flex dressing, a new advanced wound care solution that offers improved conformability and flexibility for better patient comfort and wound management. |

Mölnlycke Health Care AB |

|

In September 2020, Convatec Group plc acquired Société Française de Matériel Médical (SFMM), a French medical device distributor, to expand its presence and distribution capabilities in the European market. |

Convatec Group plc |

|

In March 2022, Acelity L.P. Inc. (KCI) received FDA approval for its VeraFlo◊ Therapy System, which combines negative pressure wound therapy with automated instillation and dwell time, providing a more comprehensive wound management solution. |

Acelity L.P. Inc. (KCI) |

|

In July 2021, 3M Company introduced its Advanced Wound Dressing portfolio, including the 3M◊ Tegaderm◊ Foam Adhesive Dressing and the 3M◊ Tegaderm◊ Hydrocolloid Dressing, designed to address a wide range of wound types and improve patient comfort. |

3M Company |

These recent developments in the Advanced Wound Care (AWC) market demonstrate the continuous efforts by leading companies to introduce innovative products, expand their distribution capabilities, and enhance their market presence, ultimately improving the range of treatment options available to patients with complex and chronic wounds.

Market Regional Insights:

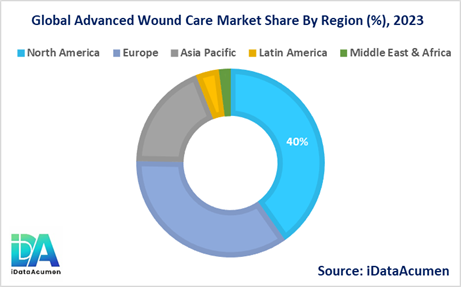

The Advanced Wound Care (AWC) Market is a global market, with significant opportunities across various regions. North America is expected to be the largest market, accounting for over 40% of the market share in 2024. The growth of the market in North America is attributed to the high prevalence of chronic diseases, such as diabetes and obesity, the availability of advanced healthcare infrastructure, and the presence of leading market players in the region.

The European market is expected to be the second-largest market for Advanced Wound Care (AWC), accounting for over 35% of the market share in 2024. The growth of the market in Europe is driven by the aging population, the rising incidence of chronic wounds, and the increasing adoption of advanced wound care technologies.

The Asia Pacific market is expected to be the fastest-growing market for Advanced Wound Care (AWC), with a CAGR of over 14% during the forecast period. The growth of the market in Asia Pacific is attributed to the increasing prevalence of chronic diseases, the expanding healthcare infrastructure, and the growing awareness of advanced wound care solutions in emerging economies, such as China and India.

The Latin American and Middle East & Africa regions are expected to have a relatively smaller share of the Advanced Wound Care (AWC) market, but they also present significant growth opportunities due to the increasing burden of chronic wounds and the expanding access to healthcare services in these regions.

Market Segmentation:

- By Product Type

- Dressings

- Wound Closure Products

- Wound Therapy Devices

- Active Wound Care Products

- Others (Skin Substitutes, Debridement Products)

- By Wound Type

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Others (Arterial Ulcers, Surgical Wounds)

- Acute Wounds

- Burns

- Traumatic Wounds

- Surgical Wounds

- Others (Pediatric Wounds, Radiation Wounds)

- Chronic Wounds

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Long-Term Care Facilities

- Home Care Settings

- Others (Specialty Clinics, Nursing Homes)

- By Distribution Channel

- Hospitals and Clinics

- Retail Pharmacies

- Online Platforms

- Others (Medical Supply Stores, Direct Sales)

- By Application

- Wound Healing

- Infection Management

- Pain Management

- Scar Management

- Others (Moisture Management, Odor Control)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East, and Africa

Market Segment Analysis:

The Advanced Wound Care (AWC) market can be analyzed by focusing on a few key segments, such as Wound Type, Product Type, and End-User.

Wound Type Segment: The Chronic Wounds segment is expected to be the largest and fastest-growing within the Wound Type category, with a projected CAGR of 2.1% from 2024 to 2031. This growth is primarily driven by the increasing prevalence of chronic diseases, such as diabetes and obesity, which are major risk factors for the development of complex wounds, such as diabetic foot ulcers and pressure ulcers. The market size for the Chronic Wounds segment is estimated to reach US$ 1.4 billion by 2031.

Product Type Segment: The Dressings segment is anticipated to be the largest within the Product Type category, accounting for over 2.0% of the market share by 2024. Dressings are widely used in the management of various wound types due to their ability to create a moist healing environment, prevent infection, and facilitate wound healing. The market size for the Dressings segment is projected to reach US$ 1.6 billion by 2031, growing at a CAGR of 2.3% during the forecast period.

End-User Segment: The Hospitals segment is expected to be the largest and fastest-growing within the End-User category, with a projected CAGR of 2.5% from 2024 to 2031. This growth is attributed to the increasing number of hospital admissions for complex wound management, the availability of advanced wound care solutions in hospital settings, and the rising awareness among healthcare professionals about the importance of specialized wound care. The market size for the Hospitals segment is estimated to reach US$1.7 billion by 2031.

Top Companies in the Advanced Wound Care (AWC) Market:

- Smith & Nephew plc

- Mölnlycke Health Care AB

- Convatec Group plc

- Acelity L.P. Inc. (KCI)

- 3M Company

- Coloplast A/S

- Medtronic plc

- Integra LifeSciences Holdings Corporation

- Organogenesis Holdings Inc.

- Essity AB (BSN Medical)

- Medline Industries, Inc.

- Hartmann Group

- Baxter International Inc.

- B. Braun Melsungen AG

- Derma Sciences, Inc. (Integra LifeSciences)

- Hollister Incorporated

- Systagenix Wound Management, Ltd. (Acelity L.P. Inc.)

- Urgo Medical

- Scapa Healthcare

- Laboratories Urgo