Market Analysis:

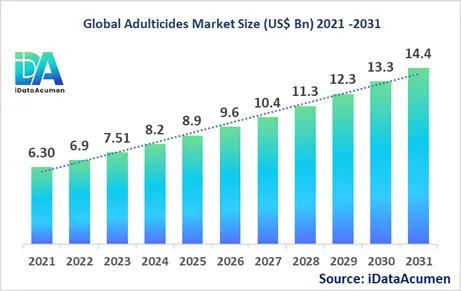

The Adulticides Market had an estimated market size worth US$ 8.2 billion in 2024, and it is predicted to reach a global market valuation of US$ 14.4 billion by 2031, growing at a CAGR of 8.4% from 2023 to 2030.

Adulticides are pesticides used to kill adult insects or arthropod pests. They are commonly used in agriculture, public health, and household applications to control various insect pests that can cause damage to crops, spread diseases, or pose a nuisance. The increasing demand for effective pest control solutions due to the rising global population and the need for improved food security, as well as the growing prevalence of vector-borne diseases and the need for public health protection, drive the demand for adulticides.

The Adulticides Market is segmented by product type, pest type, application, formulation, mode of action, source, and region. By product type, the market is segmented into synthetic adulticides, biopesticides, insect growth regulators, and others (botanical pesticides, microbial pesticides). The synthetic adulticides segment is expected to dominate the market due to its widespread usage and proven efficacy, but the biopesticides segment is also growing rapidly due to increasing consumer demand for eco-friendly and sustainable pest control solutions.

Epidemiology Insights:

- The disease burden for vector-borne diseases, such as malaria, dengue fever, and Zika virus, is highest in tropical and subtropical regions, particularly in Africa, Southeast Asia, and Latin America, where favorable climatic conditions and inadequate vector control measures contribute to the spread of these diseases.

- Key epidemiological trends driving the demand for adulticides include the increasing global travel and urbanization, climate change, and the emergence of insecticide resistance, which can lead to the resurgence and spread of vector-borne diseases.

- According to the World Health Organization (WHO), in 2020, there were an estimated 241 million cases of malaria worldwide, with 627,000 deaths, mostly in sub-Saharan Africa. The incidence of dengue fever has also increased drastically in recent decades, with an estimated 390 million infections occurring annually across over 100 countries.

- The increasing prevalence of vector-borne diseases, particularly in developing regions, presents growth opportunities for adulticide manufacturers as effective vector control measures, including the use of adulticides, are crucial for reducing the disease burden and improving public health.

- While vector-borne diseases are not generally considered rare, some insect-borne diseases like leishmaniasis, Chagas disease, and lymphatic filariasis are classified as neglected tropical diseases, affecting predominantly poor and marginalized populations in low-income countries.

Market Landscape:

- Unmet needs in the adulticides market include the development of more environmentally friendly and sustainable pest control solutions, as well as products with improved efficacy, reduced resistance, and targeted modes of action to minimize non-target effects.

- Current treatment options for controlling insect pests include synthetic chemical insecticides (organophosphates, pyrethroids, neonicotinoids), biopesticides (microorganisms, plant extracts), and insect growth regulators. Integrated pest management (IPM) strategies, combining multiple control methods, are also commonly employed.

- Upcoming therapies and technologies for pest control include the development of novel insecticides with new modes of action, gene drive technologies for population suppression, and the use of precision agriculture techniques for targeted application of adulticides.

- Breakthrough treatment options currently in development include RNA interference (RNAi) technology for insect pest control, which targets specific genes essential for insect survival and reproduction, as well as the use of microbial biopesticides and semiochemicals (insect pheromones) for more targeted and sustainable pest management.

- The adulticides market is dominated by a few large agrochemical companies that produce branded synthetic insecticides, while there are also numerous smaller companies focused on developing biopesticides and other alternative pest control solutions. Generic manufacturers also play a significant role in certain market segments.

Market Report Scope:

|

Key Insights |

Description |

|

The market size in 2024 |

US$ 8.2 Bn |

|

CAGR (2024 - 2031) |

8.4% |

|

The revenue forecast in 2031 |

US$ 14.4 Bn |

|

Base year for estimation |

2024 |

|

Historical data |

2019-2024 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Bayer CropScience, Syngenta, BASF, Dow AgroSciences, FMC Corporation, Sumitomo Chemical, ADAMA Agricultural Solutions, Nufarm, UPL, Corteva Agriscience, Valent BioSciences, Gowan Company, Agrium, Amvac Chemical Corporation, Arysta LifeScience, Cheminova, Chemtura, Marrone Bio Innovations, Monsanto, Nisso Chemical |

Market Drivers:

Increasing Prevalence of Vector-Borne Diseases

The rising incidence of vector-borne diseases, such as malaria, dengue fever, and Zika virus, has been a significant driver for the adulticides market. Insects like mosquitoes, flies, and ticks act as vectors, transmitting these diseases to humans and animals. As global travel and urbanization increase, the risk of disease transmission also rises, necessitating effective vector control measures, including the use of adulticides. Governments and public health organizations are investing in adulticide programs to combat the spread of these diseases, driving the demand for adulticides.

Growth in Agricultural Activities and Food Demand

The increasing global population and the subsequent rise in food demand have led to the expansion of agricultural activities worldwide. Insect pests can cause significant damage to crops, leading to reduced yields and economic losses for farmers. Adulticides play a crucial role in protecting crops from insect infestations, making them an essential component of integrated pest management strategies. The need to ensure food security and maximize crop yields has driven the demand for effective adulticide products in the agricultural sector.

Adoption of Integrated Pest Management (IPM) Practices

IPM is an environmentally sustainable approach to pest control that combines various methods, including the judicious use of adulticides. This approach aims to minimize the use of harmful chemicals while effectively managing pest populations. As awareness about the importance of sustainable agricultural practices grows, more farmers and growers are adopting IPM strategies, which in turn drives the demand for adulticides as part of a comprehensive pest management plan.

Development of Innovative and Targeted Adulticide Formulations

The adulticides market has witnessed significant innovations in recent years, with the development of new and improved formulations targeting specific pests or modes of action. These innovative adulticides offer enhanced efficacy, reduced environmental impact, and better resistance management. Advanced formulations, such as biopesticides, insect growth regulators, and novel chemical compounds, have gained popularity due to their targeted approach and reduced risk of resistance development, driving market growth.

Market Opportunities:

Increasing Demand for Eco-Friendly and Sustainable Pest Control Solutions

As environmental concerns and sustainability considerations gain prominence, there is a growing demand for eco-friendly and sustainable pest control solutions. Consumers and regulatory bodies are increasingly favoring the use of biopesticides, botanical-based formulations, and other alternative pest control methods that have minimal impact on the environment and human health. This presents an opportunity for adulticide manufacturers to develop and market innovative, environmentally-friendly products to meet this demand.

Precision Agriculture and Smart Application Technologies

The integration of precision agriculture techniques and smart application technologies offers significant opportunities for the adulticides market. Precision agriculture involves the use of advanced technologies, such as GPS-guided machinery, drones, and sensors, to optimize the application of adulticides and other crop protection products. This targeted approach reduces waste, minimizes environmental impact, and improves overall efficiency. As precision agriculture practices become more widespread, the demand for adulticides compatible with these technologies is likely to increase.

Expansion into Emerging Markets

Developing regions, particularly in Asia, Africa, and Latin America, present significant growth opportunities for the adulticides market. Many of these regions have rapidly growing populations, increasing urbanization, and expanding agricultural activities, all of which contribute to the demand for effective pest control solutions. Additionally, the prevalence of vector-borne diseases in some of these regions further drives the need for adulticides. By expanding their presence and tailoring their products to the specific needs of emerging markets, adulticide manufacturers can tap into new revenue streams.

Development of Resistance Management Strategies

Insect resistance to adulticides is a significant challenge faced by the industry. However, this challenge also presents an opportunity for developing innovative resistance management strategies. By combining different modes of action, rotating adulticide products, and integrating other pest control methods, manufacturers can develop effective resistance management programs. This not only extends the useful life of existing adulticides but also creates opportunities for developing new products with novel modes of action to combat resistant insect populations.

Market Trends:

Increasing Adoption of Biopesticides

There is a growing trend towards the adoption of biopesticides, which are derived from natural sources such as microorganisms, plant extracts, or other biological materials. Biopesticides are considered more environmentally-friendly and safer for humans and non-target organisms compared to synthetic chemical pesticides. As consumer demand for sustainable and eco-friendly products increases, the adulticides market is witnessing a surge in the development and commercialization of biopesticide-based adulticide formulations.

Integration of Digital Technologies

The adulticides market is embracing digital technologies to enhance product development, application, and monitoring processes. For example, the use of data analytics and predictive modeling can help identify potential pest outbreaks and optimize adulticide application strategies. Additionally, the integration of Internet of Things (IoT) devices, such as sensors and smart traps, can provide real-time data on pest populations, enabling more targeted and efficient use of adulticides.

Focus on Resistance Management

As insect pests develop resistance to existing adulticides, there is an increasing focus on resistance management strategies within the industry. This trend involves the development of adulticides with novel modes of action, the rotation of different adulticide products, and the integration of other pest control methods to prevent or delay the development of resistance. Manufacturers are investing in research and development efforts to address this challenge and ensure the long-term effectiveness of their products.

Regulatory Changes and Environmental Concerns

Regulatory bodies are continuously updating regulations and policies related to the use of adulticides, taking into account environmental concerns and potential health impacts. This trend has led to stricter guidelines and restrictions on the use of certain adulticides, particularly those with known negative environmental or health effects. As a result, the adulticides market is witnessing a shift towards the development and adoption of safer and more environmentally-friendly formulations that comply with evolving regulations.

Market Restraints:

Stringent Regulatory Frameworks and Approval Processes

The adulticides market is subject to stringent regulatory frameworks and approval processes aimed at ensuring product safety and minimizing environmental impact. These regulations govern various aspects, including product registration, labeling, and usage guidelines. Navigating these complex regulatory landscapes can be challenging and time-consuming for manufacturers, potentially hindering the introduction of new adulticide products to the market.

Public Concerns over Health and Environmental Impacts

Despite the benefits of adulticides in pest control, there are public concerns regarding their potential health and environmental impacts. Some adulticides have been associated with adverse effects on non-target organisms, such as pollinators and aquatic life, as well as potential human health risks. These concerns have led to increased scrutiny and resistance from certain consumer groups, which may limit the adoption and acceptance of certain adulticide products in some regions or markets.

Development of Insect Resistance

The development of resistance in insect pests to existing adulticides is a significant restraint for the market. Overuse or misuse of adulticides can accelerate the evolution of resistance mechanisms in insect populations, rendering the products ineffective over time. This resistance challenge necessitates the continuous development of new adulticide formulations with novel modes of action, which can be costly and time-consuming for manufacturers.

Recent Developments:

|

Development |

Involved Company |

|

In June 2022, FMC Corporation launched Zylo Active, a novel insecticide active ingredient targeting diamondback moth and other lepidopteran pests in vegetables and other crops, providing a new mode of action for resistance management. |

FMC Corporation |

|

In May 2022, Syngenta received approval from the U.S. Environmental Protection Agency (EPA) for Adepidyn, a new insecticide active ingredient with a novel mode of action for controlling sap-feeding insect pests in various crops. |

Syngenta |

|

In March 2022, Bayer CropScience introduced Vayego, a new biological insecticide based on a naturally occurring fungus, providing an effective and sustainable solution for controlling insect pests in fruits and vegetables. |

Bayer CropScience |

|

Product Launch |

Company Name |

|

In September 2021, BASF launched Versys, a new insecticide active ingredient for controlling chewing and sucking insect pests in various crops, offering improved environmental and toxicological profiles. |

BASF |

|

In June 2021, Corteva Agriscience introduced Semari, a new insecticide active ingredient for controlling lepidopteran pests in corn and other crops, featuring a novel mode of action for resistance management. |

Corteva Agriscience |

|

In April 2021, Gowan Company launched Orondis Opti, a new fungicide-insecticide combination product for controlling soil-borne diseases and insect pests in potatoes and other vegetable crops. |

Gowan Company |

|

Merger/Acquisition |

Involved Companies |

|

In August 2021, FMC Corporation acquired a portion of Bayer's global vegetable seeds business, expanding its portfolio of crop protection and seed products for vegetable growers. |

FMC Corporation, Bayer |

|

In November 2020, UPL Limited acquired a significant stake in Nurture Agtech, an agricultural technology company developing novel crop protection solutions, including biopesticides. |

UPL Limited, Nurture Agtech |

|

In September 2019, BASF acquired a range of businesses and assets from Bayer, including its vegetable seeds business, further strengthening its crop protection and seeds portfolio. |

BASF, Bayer |

Market Regional Insights:

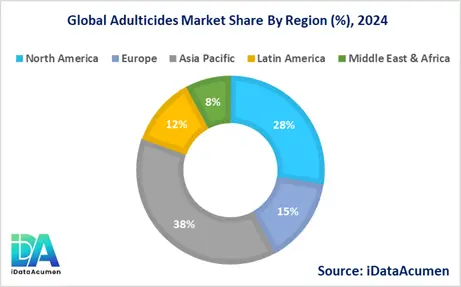

North America is expected to be the largest market for the Adulticides Market during the forecast period, accounting for over 27.5% of the market share in 2024. The growth of the market in North America is attributed to the well-established agricultural sector, stringent regulations for pest control, and the presence of major agrochemical companies in the region.

The Asia Pacific market is expected to be the second-largest market for the Adulticides Market, accounting for over 38.2% of the market share in 2024. The growth of the market in the Asia Pacific region is driven by the increasing demand for effective pest control solutions in the rapidly growing agricultural sector, as well as the high prevalence of vector-borne diseases in many countries.

The Latin America market is expected to be the fastest-growing market for the Adulticides Market, with a CAGR of over 11.8% during the forecast period by 2024. The growth of the market in Latin America is attributed to the expansion of agricultural activities, the increasing adoption of modern pest management practices, and the growing awareness of the importance of vector control for public health.

Market Segmentation:

- By Product Type

- Synthetic Adulticides

- Biopesticides

- Insect Growth Regulators

- Botanical Pesticides

- Microbial Pesticides

- By Pest Type

- Mosquitoes

- Flies

- Cockroaches

- Termites

- Ants

- Beetles

- Others (Thrips, Mites, Aphids)

- By Application

- Agriculture

- Public Health

- Commercial

- Residential

- Others (Forestry, Horticulture)

- By Formulation

- Liquid Formulations

- Solid Formulations

- Aerosol Formulations

- Others (Granular Formulations, Fumigants)

- By Mode of Action

- Acetylcholinesterase Inhibitors

- Sodium Channel Modulators

- Juvenile Hormone Mimics

- Chitin Synthesis Inhibitors

- Others (Oxidative Phosphorylation Disruptors, Ryanodine Receptor Modulators)

- By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segmental Analysis:

- By Product Type: The biopesticides segment is expected to witness significant growth across regions, driven by increasing consumer demand for eco-friendly and sustainable pest control solutions. The Asia Pacific region is likely to see the highest growth in the biopesticides segment, with a projected CAGR of around 12-15% during the forecast period. In terms of market size, the synthetic adulticides segment is expected to remain the largest in 2024, followed by biopesticides.

- By Pest Type: The mosquitoes segment is anticipated to grow rapidly across regions due to the increasing prevalence of mosquito-borne diseases like malaria, dengue, and Zika virus. The Asia Pacific and Latin America regions may witness the highest growth in this segment, with CAGRs ranging from 8-12%. In 2024, the mosquitoes segment is likely to be the largest, followed by the flies segment.

- By Application: The agriculture segment is expected to dominate the market and maintain steady growth across regions, driven by the increasing demand for effective pest control solutions to improve crop yields. However, the public health segment may experience the highest growth, particularly in regions with a high burden of vector-borne diseases, such as Africa and Southeast Asia, with CAGRs ranging from 10-15%.

Top companies in the Adulticides Market

- Bayer CropScience

- Syngenta

- BASF

- Dow AgroSciences

- FMC Corporation

- Sumitomo Chemical

- ADAMA Agricultural Solutions

- Nufarm

- UPL

- Corteva Agriscience

- Valent BioSciences

- Gowan Company

- Agrium

- Amvac Chemical Corporation

- Arysta LifeScience

- Cheminova

- Chemtura

- Marrone Bio Innovations

- Monsanto

- Nisso Chemical