Market Analysis:

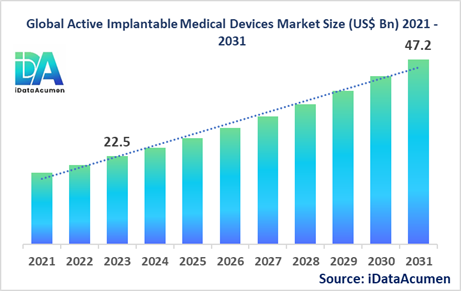

The Active Implantable Medical Devices Market had an estimated market size worth US$ 22.5 billion in 2023, and it is predicted to reach a global market valuation of US$ 47.2 billion by 2031, growing at a CAGR of 9.7% from 2024 to 2031. Active implantable medical devices are devices that are implanted into the human body and rely on an external source of power to function. These devices are used for various medical purposes, including cardiac rhythm management, neurostimulation, and hearing assistance. They offer several advantages, such as improved quality of life, better disease management, and reduced healthcare costs.

The market is primarily driven by the increasing prevalence of chronic diseases, the growing geriatric population, and technological advancements in the field of medical devices.

Active implantable medical devices are designed to improve the quality of life for patients with various medical conditions by providing targeted treatment and monitoring.

The Active Implantable Medical Devices Market is segmented by product type and region. By product type, the market is segmented into cardiac rhythm management devices, neurostimulation devices, implantable hearing devices, and others (implantable drug delivery systems, ventricular assist devices, etc.). The cardiac rhythm management devices segment is expected to hold a significant market share due to the rising prevalence of cardiovascular diseases worldwide.

For example, Medtronic recently launched the Micra AV Transcatheter Pacing System, the world's smallest pacemaker, which can be implanted directly into the heart via a minimally invasive procedure.

Epidemiology Insights:

- The disease burden for conditions requiring active implantable medical devices, such as cardiovascular diseases, neurological disorders, and hearing impairments, is substantial across major regions like North America, Europe, and Asia Pacific.

- Key epidemiological trends and driving factors behind the increasing demand for active implantable medical devices include an aging population, sedentary lifestyles, and a rise in chronic conditions like obesity, diabetes, and hypertension, which are risk factors for cardiovascular diseases and other related disorders.

- According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, with an estimated 17.9 million deaths annually. In the United States, the Centers for Disease Control and Prevention (CDC) reports that nearly 1 in 4 adults has some form of cardiovascular disease.

- Neurodegenerative disorders like Parkinson's disease and epilepsy are also on the rise, creating a growing demand for neurostimulation devices. The aging population and improved diagnostic techniques have contributed to the increasing incidence and prevalence of these conditions.

- The increasing patient population with chronic diseases and age-related disorders presents significant growth opportunities for the active implantable medical devices market, as these devices can improve patient outcomes and quality of life.

- While most conditions requiring active implantable medical devices are not considered rare diseases, some specific applications, such as treatment-resistant depression or certain neurological disorders, may fall under the category of rare diseases.

Market Landscape:

- There are still significant unmet needs in the market with respect to the treatment options for various conditions requiring active implantable medical devices. For instance, in the field of cardiovascular diseases, there is a need for more advanced and longer-lasting devices, as well as devices that can adapt to changing patient conditions.

- Current treatment options and approved therapies include pacemakers, implantable cardioverter defibrillators (ICDs), cochlear implants, deep brain stimulation devices, and spinal cord stimulators, among others.

- Upcoming therapies and technologies for disease treatment in this market include closed-loop systems for diabetes management, brain-computer interfaces for paralysis, and bioelectronic medicine, which uses electrical signals to treat various conditions.

- Some breakthrough treatment options currently being developed include leadless pacemakers, fully implantable left ventricular assist devices (LVADs), and responsive neurostimulation devices that can adapt to changing brain patterns.

- The market composition is diverse, with both branded and generic manufacturers present. While branded manufacturers like Medtronic, Boston Scientific, and Abbott Laboratories dominate the market, there is also a significant presence of generic manufacturers, particularly in the cardiac rhythm management device segment.

Market Report Scope:

|

Description |

|

|

The market size in 2023 |

US$ 22.5 Bn |

|

CAGR (2024 - 2031) |

9.7% |

|

The revenue forecast in 2031 |

US$ 47.2 Bn |

|

Base year for estimation |

2023 |

|

Historical data |

2019-2023 |

|

Forecast period |

2024-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2030 |

|

Market segments |

|

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Medtronic, Boston Scientific, Abbott Laboratories, LivaNova, Cochlear, Zimmer Biomet, Biotronik, Demant, Sonova, Nurotron Biotechnology, Nevro, Integer Holdings, Nuvectra, Impulse Dynamics, Stimwave, Inspire Medical Systems, Arthra, Inteneuro, Bioness, Axonics Modulation Technologies |

Market Drivers:

Increasing Prevalence of Chronic Diseases

The growing prevalence of chronic diseases, such as cardiovascular disorders, neurological conditions, and hearing impairments, is a significant driver for the active implantable medical devices market. As the global population ages and lifestyle factors like sedentary behavior and unhealthy diets contribute to the rise of chronic illnesses, the demand for these life-improving devices continues to surge. For instance, the increasing incidence of heart arrhythmias has driven the adoption of cardiac rhythm management devices, like pacemakers and implantable cardioverter-defibrillators (ICDs). Similarly, the rising cases of Parkinson's disease and chronic pain have fueled the demand for neurostimulation devices, such as deep brain stimulators and spinal cord stimulators.

Technological Advancements

Continuous technological advancements in active implantable medical devices have significantly driven market growth. These advancements have led to the development of more sophisticated, miniaturized, and user-friendly devices, improving patient outcomes and quality of life. For example, the introduction of leadless pacemakers, which can be implanted directly into the heart without leads, has revolutionized cardiac rhythm management. Additionally, the integration of remote monitoring and connectivity features has enabled better patient monitoring and disease management, further driving the adoption of these devices.

Increasing Healthcare Expenditure and Favorable Reimbursement Policies

Rising healthcare expenditure, particularly in developed economies, has played a vital role in fueling the growth of the active implantable medical devices market. Governments and healthcare organizations are allocating substantial funds to improve healthcare infrastructure and provide access to advanced medical technologies. Moreover, favorable reimbursement policies and insurance coverage for these devices have made them more accessible to a broader patient population, thereby driving market growth.

Growing Geriatric Population

The global population is aging rapidly, leading to an increased demand for active implantable medical devices. Older individuals are more susceptible to chronic conditions like cardiovascular diseases, neurological disorders, and hearing impairments, which often require the use of these devices. This demographic shift has significantly contributed to the market's growth, as healthcare systems strive to meet the medical needs of the elderly population.

Market Opportunities:

Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present a significant growth opportunity for the active implantable medical devices market. These regions are witnessing rapid economic development, rising disposable incomes, and increasing healthcare awareness, leading to a growing demand for advanced medical technologies. Moreover, governments in these regions are investing in improving healthcare infrastructure and expanding access to quality medical care, which can drive the adoption of active implantable medical devices.

Personalized Medicine and Precision Healthcare

The active implantable medical devices market has the potential to benefit from the growing trend of personalized medicine and precision healthcare. As these devices become more advanced and integrated with technologies like artificial intelligence and machine learning, they can be tailored to individual patient needs, enabling more precise and effective treatment. This personalized approach can improve patient outcomes, reduce complications, and ultimately drive market growth.

Bioelectronic Medicine

Bioelectronic medicine, a field that uses electrical signals to treat various conditions, presents a promising opportunity for the active implantable medical devices market. This emerging field has the potential to revolutionize the treatment of chronic diseases by modulating the body's neural circuits and biological processes. As research and development in this area continue to progress, new applications and innovative devices may emerge, driving market growth and expanding the scope of active implantable medical devices.

Integration with Wearable Devices and Remote Monitoring

The integration of active implantable medical devices with wearable technology and remote monitoring systems presents a significant opportunity for market growth. This integration can enable real-time data collection, continuous patient monitoring, and improved disease management. By leveraging the convenience and accessibility of wearable devices, patients can stay connected with their healthcare providers, leading to better treatment outcomes and increased adoption of active implantable medical devices.

Market Trends:

Miniaturization

One of the key trends in the active implantable medical devices market is the miniaturization of these devices. As technology advances, manufacturers are developing smaller and more compact devices, which are not only more comfortable for patients but also offer improved functionality and reduced risk of complications. Miniaturized devices can be implanted through minimally invasive procedures, leading to shorter recovery times and improved patient outcomes. This trend has been particularly evident in the cardiac rhythm management and neurostimulation device segments.

Integration of Wireless Connectivity and Remote Monitoring

The integration of wireless connectivity and remote monitoring capabilities into active implantable medical devices is a significant trend shaping the market. These features allow healthcare providers to monitor patients remotely, track device performance, and make necessary adjustments without requiring in-person visits. This not only improves patient convenience but also enables more efficient disease management and potentially reduces healthcare costs associated with frequent hospital visits.

Adoption of Renewable Energy Sources

As the demand for active implantable medical devices continues to grow, there is an increasing focus on the adoption of renewable energy sources to power these devices. Traditional battery-powered devices require frequent replacements, which can be inconvenient and costly for patients. Manufacturers are exploring alternative energy sources, such as kinetic energy harvesting and wireless power transfer, to develop self-powered or rechargeable devices. This trend aims to improve patient comfort, reduce the need for invasive procedures, and minimize the environmental impact of disposable batteries.

Increased Focus on Patient-Centric Design

The active implantable medical devices market is witnessing a trend towards patient-centric design, where devices are developed with a focus on improving patient comfort, convenience, and overall quality of life. Manufacturers are incorporating features such as user-friendly interfaces, personalized settings, and seamless integration with other devices or applications. This trend is driven by the increasing emphasis on patient satisfaction and the recognition that user-friendly devices can improve adherence to treatment and overall health outcomes.

Market Restraints:

High Costs and Limited Reimbursement Coverage

One of the major restraints in the active implantable medical devices market is the high cost of these devices, coupled with limited reimbursement coverage in certain regions. The development and manufacturing of these advanced medical devices involve significant research and development expenses, contributing to their high prices. While favorable reimbursement policies exist in developed economies, many developing countries still lack adequate coverage, making these devices inaccessible to a large patient population. This cost barrier can hinder market growth, particularly in regions with limited healthcare resources and low disposable incomes.

Regulatory Hurdles and Stringent Approval Processes

The active implantable medical devices market is subject to stringent regulatory requirements and rigorous approval processes to ensure patient safety and efficacy. Manufacturers must comply with various regulations and guidelines set by regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The extensive clinical trials and documentation required for approval can be time-consuming and costly, potentially slowing down the introduction of new and innovative devices to the market.

Risk of Device Failure and Potential Complications

Despite advancements in technology, there remains a risk of device failure and potential complications associated with active implantable medical devices. Device malfunctions, dislodgement, or compatibility issues can lead to adverse events and potentially life-threatening situations for patients. Additionally, the risk of infection, bleeding, or other surgical complications during implantation procedures can deter some patients from opting for these devices. Addressing these concerns through continued research, improved device design, and rigorous quality control measures is crucial to mitigating this restraint and building patient confidence in these technologies.

Recent Developments:

|

Development |

Involved Company |

|

In January 2023, Abbott launched the Aveir DR leadless pacemaker in Europe, a device that can be implanted directly into the heart without leads. It offers improved patient comfort and reduced risk of complications. |

Abbott Laboratories |

|

In September 2022, Medtronic received FDA approval for the Micra AV Transcatheter Pacing System, the world's smallest pacemaker with atrioventricular (AV) synchrony. It improves heart rhythm management and patient outcomes. |

Medtronic |

|

In July 2021, Boston Scientific acquired Preventice Solutions, a leading developer of mobile cardiac health solutions, for $925 million. This acquisition strengthened Boston Scientific's position in the remote patient monitoring market. |

Boston Scientific |

|

Product Launch |

Company Name |

|

In March 2023, Cochlear launched the Nucleus Kanso 2 Sound Processor, a next-generation cochlear implant audio processor with improved battery life and wireless connectivity features, enhancing the user experience. |

Cochlear |

|

In November 2022, LivaNova launched the Vertiflex Totalis Direct Decompression System, a minimally invasive spinal implant designed to treat lumbar spinal stenosis and alleviate back pain. |

LivaNova |

|

In August 2021, Nevro Corp. launched the Omnia Therapeutic Massager, a non-invasive device for pain relief that uses low-intensity pulsed electromagnetic fields to stimulate the body's natural pain relief mechanisms. |

Nevro Corp. |

|

Merger/Acquisition |

Involved Companies |

|

In January 2022, Medtronic acquired Affera, a medical technology company focused on developing cardiac mapping and navigation systems, for $1 billion. This acquisition strengthened Medtronic's portfolio in the cardiac ablation market. |

Medtronic, Affera |

|

In October 2021, Boston Scientific acquired Baylis Medical Company, a leading provider of cardiology medical devices, for $1.75 billion. This acquisition expanded Boston Scientific's portfolio in the electrophysiology market. |

Boston Scientific, Baylis Medical Company |

|

In September 2020, Abbott acquired Walkinsense, a company developing innovative foot-monitoring technologies for people with diabetes. This acquisition complemented Abbott's portfolio in diabetes care and digital health solutions. |

Abbott, Walkinsense |

Market Regional Insights:

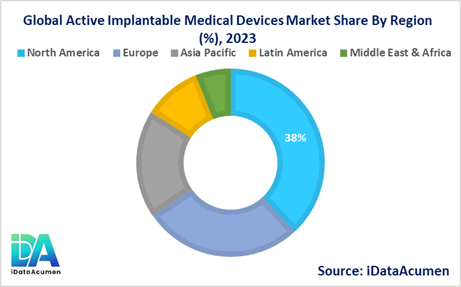

The Active Implantable Medical Devices Market is witnessing significant growth across various regions due to the increasing prevalence of chronic diseases, technological advancements, and the growing geriatric population.

- North America is expected to be the largest market for the Active Implantable Medical Devices Market during the forecast period, accounting for over 38.2% of the market share in 2024. The growth of the market in North America is attributed to the presence of well-established healthcare infrastructure, high healthcare expenditure, and a strong focus on research and development activities.

- Europe is expected to be the second-largest market for the Active Implantable Medical Devices Market, accounting for over 27.5% of the market share in 2024. The growth of the market is attributed to the increasing prevalence of chronic diseases, favorable reimbursement policies, and the presence of major market players in the region.

- The Asia Pacific market is expected to be the fastest-growing market for the Active Implantable Medical Devices Market, with a CAGR of over 10.2% during the forecast period by 2024. The growth of the market in the Asia Pacific region is attributed to the rapidly improving healthcare infrastructure, rising disposable incomes, and increasing awareness about advanced medical treatments, and third-largest share of 18.6%.

Market Segmentation:

- By Product Type

- Cardiac Rhythm Management Devices

- Neurostimulation Devices

- Implantable Hearing Devices

- Others (Implantable Drug Delivery Systems, Ventricular Assist Devices, etc.)

- By Technology

- Conventional

- Radiofrequency

- Rechargeable

- MRI-compatible

- Others (Bluetooth-enabled, Remote Monitoring, etc.)

- By Application

- Cardiovascular

- Neurological

- Audiology

- Ophthalmology

- Gastroenterology

- Others (Orthopedics, Oncology, etc.)

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others (Home Healthcare, Research Institutes, etc.)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Segmentation Analysis:

- By Product Type: The cardiac rhythm management devices segment is projected to experience significant growth across all regions, driven by the increasing prevalence of cardiovascular diseases and technological advancements in devices like pacemakers and implantable cardioverter-defibrillators (ICDs). In North America and Europe, this segment is expected to have a high CAGR and market size due to the well-established healthcare infrastructure and high adoption of advanced medical devices. The Asia Pacific region is also likely to witness substantial growth in this segment due to the rising aging population and improving healthcare facilities.

- By Technology: The rechargeable and MRI-compatible segments are expected to grow rapidly across all regions, with a high CAGR and increasing market size. These segments offer improved patient convenience, safety, and compatibility with other medical procedures. The demand for rechargeable devices is particularly high in developed regions like North America and Europe, where patients prioritize convenience and quality of life.

- By Application: The cardiovascular and neurological applications are likely to be the largest and second-largest segments, respectively, in 2024. The cardiovascular segment will continue to dominate due to the high prevalence of heart diseases and the growing adoption of cardiac rhythm management devices. The neurological segment is expected to witness substantial growth, driven by the increasing incidence of neurological disorders like Parkinson's disease, epilepsy, and chronic pain, and the rising demand for neurostimulation devices.

In terms of regional growth, North America and Europe are expected to have the highest market size and CAGR for the cardiovascular and neurological application segments due to their advanced healthcare systems and high adoption of active implantable medical devices. The Asia Pacific region is also likely to witness significant growth in these segments due to the increasing prevalence of chronic diseases and improving healthcare infrastructure.

Top companies in the Active Implantable Medical Devices Market:

- Medtronic

- Boston Scientific

- Abbott Laboratories

- LivaNova

- Cochlear

- Zimmer Biomet

- Biotronik

- Demant

- Sonova

- Nurotron Biotechnology

- Nevro

- Integer Holdings

- Nuvectra

- Impulse Dynamics

- Stimwave

- Inspire Medical Systems

- Arthra

- Inteneuro

- Bioness

- Axonics Modulation Technologies