Market Insights:

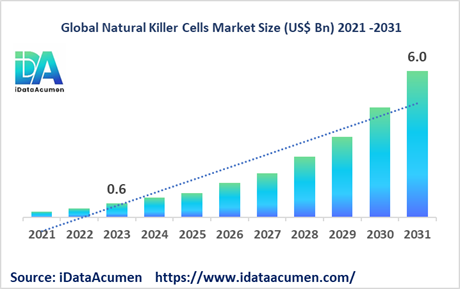

The Natural Killer Cells Market is poised for remarkable growth, with projections indicating it will surge to an impressive US$ 6.0 billion by the year 2031, marking a substantial leap from the modest US$ 0.559 billion recorded in 2023. This journey toward expansion is underpinned by a robust Compound Annual Growth Rate (CAGR) of 34.5% throughout the forecast period, spanning from 2024 to 2031.

Natural Killer (NK) cells, crucial players within the innate immune system, are cytotoxic innate lymphoid cells renowned for their ability to target and eliminate both tumor and virally infected cells. They assume a pivotal role in the immune system's innate defense against infections and the identification and obliteration of cancer cells. The escalating global prevalence of cancer stands as a paramount driver of the NK cells market, with WHO projections indicating a 70% surge in new cancer cases between 2015 and 2040. NK cell-based immunotherapies are emerging as highly promising therapeutic options, particularly in the context of blood cancers.

Within the broader landscape of pharmaceutical and biotechnology markets, the NK cells market is nestled comfortably as a vital component of the immunotherapy industry. NK cells, categorized as a subset of lymphocytes, represent a key facet of the innate immune system, proficiently targeting and eliminating both cancerous and virally infected cells.

The segmentation of the Natural Killer Cells Market hinges on multiple facets, including type, application, end-user demographics, and geographic region. Among these categories, the market is subdivided by type into cytokine-induced killer cells, tumor-infiltrating NK cells, allogeneic NK cells, and autologous NK cells. Notably, allogeneic NK cells are poised to dominate the market landscape, chiefly due to their off-the-shelf availability and reduced risk of graft-versus-host disease. In a significant development, KiadisPharma introduced its off-the-shelf NK cell therapy, CytoKill, to the European market in March 2023, catering to the treatment needs of blood cancer patients, thereby exemplifying the forward trajectory of the NK cells market and its burgeoning role in medical innovation.

Epidemiology Insights:

As per GLOBOCAN 2020 estimates, the burden of cancer rose to 19.3 million new cases and 10 million cancer deaths worldwide in 2020. North America and Europe account for nearly half of the cancer burden globally. The incidence of cancer is increasing globally due to growth and aging of the population as well as risk factors like smoking, alcohol use, physical inactivity, and urbanization. For instance, new cancer cases in the US are projected to rise from 1.7 million in 2019 to 2.2 million by 2040 as per National Cancer Institute projections. The high and growing prevalence of cancer globally is driving the demand for newer immunotherapies including NK cell-based drugs.

Market Landscape:

Despite recent advances, there remains an unmet need for curative immunotherapies for blood cancers and solid tumors. Chemotherapy remains the standard treatment for most cancers. Current NK cell therapies approved are limited to certain hematologic malignancies. Ongoing R&D is focused on CAR-NK cells, bispecific antibodies engaging NK cells, and combination immunotherapies. For instance, Nkarta Therapeutics is developing engineered NK cell platforms for cancer. Its lead candidate NKX101 is being tested in a Phase 1 trial for blood cancers. Fate Therapeutics and Janssen are co-developing off-the-shelf CAR NK and CAR T cell immunotherapies for hematologic and solid tumors.

Natural Killer Cells Market Drivers:

Rising Prevalence of Cancer Worldwide

Cancer has emerged as a major public health problem globally, with new cancer cases projected to rise substantially in the coming decades driven by growth and aging of the population. As per WHO, the cancer burden is estimated to increase by 70% over the next 2 decades. In 2020 itself, there were 19.3 million new cancer cases and 10 million cancer deaths worldwide as per GLOBOCAN estimates. The surging patient pool is creating an urgent need for newer and more effective therapies including cell-based immunotherapies such as those involving natural killer cells. NK cells can directly recognize and kill tumor cells without prior sensitization. The exceptional cytotoxic capacity of NK cells against cancer makes them an ideal candidate for developing targeted immunotherapies.

Advances in Genetic Engineering to Enhance NK Cell Antitumor Function

Recent advances in genetic engineering and cell processing technologies have enabled researchers to enhance natural killer cells’ native antitumor capacities and persistence by introducing chimeric antigen receptors, cytokines, and other enhancing factors. This has expanded the therapeutic potential of NK cells in targeting hematologic malignancies and solid tumors. For instance, cytokine pre-activated NK cells, when infused after hematopoietic stem cell transplant, can induce potent anti-leukemic responses. CAR-modified NK cells are also being evaluated in clinical trials, with early results showing promising efficacy and safety. Such advances are expected to drive increasing research and therapeutic interest in NK cell-based immunotherapies.

Surge in R&D Investments and Industry Activity

The rising burden of cancer and technological advances have prompted biotech and pharmaceutical companies to intensify investments in R&D to develop NK cell therapies. This is evident from the robust pipeline of NK cell therapy candidates spanning CAR-NK cells, off-the-shelf allogeneic NK cells, NK cell engagers, and combination immunotherapies using NK cells. Several platforms focused on NK cell expansion and engineering have also emerged. Fate Therapeutics, Affimed, Kiadis Pharma, Glycostem Therapeutics, and Nkarta Therapeutics are among leading companies developing allogeneic NK cell immunotherapies. Strategic partnerships are also on the rise, indicating industry confidence in NK cell therapies. Such factors will contribute to steady growth of the NK cells market.

Logistical Advantages of Off-the-Shelf, Allogeneic Products

The complexities and delays associated with manufacturing patient-specific cell therapies have driven research interest towards allogeneic, off-the-shelf NK cell products. Allogeneic NK cells from healthy donors can be expanded, engineered, and stored for later use in multiple patients. This provides logistical advantages compared to autologous cell therapies. The possibility of on-demand availability is also fueling development of allogeneic NK cell therapies, which currently dominate the developmental pipeline. With their off-the-shelf format, NK cells could overcome existing barriers to cell therapy adoption.

Market Scope:

|

Key Insights |

Description |

|

The market size in 2023 |

US$ 0.559 Bn |

|

CAGR (2023 - 2031) |

34.5% |

|

The revenue forecast in 2031 |

US$ 6.0 Bn |

|

Base year for estimation |

2021 |

|

Historical data |

2017-2020 |

|

Forecast period |

2023-2031 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2021 to 2031 |

|

Market segments |

By Source: NK-92 Cell Line, Peripheral Blood NK Cells, Umbilical Cord Blood NK Cells, iPSC-derived NK Cells, Embryonic Stem Cell-derived NK Cells By Type: Cytokine-Induced Killer Cells, Tumor-Infiltrating NK Cells, Allogeneic NK Cells, Autologous NK Cells By Application: Cancer Immunotherapy, Infectious Diseases, Immunoproliferative Disorders, Others By End User: Hospitals, Research Institutes, Pharmaceutical Companies, Biotech Companies, Others |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Market Drivers |

|

|

Market Restraints |

|

|

Competitive Landscape |

Fate Therapeutics, Affimed N.V., Glycostem Therapeutics, Kiadis Pharma, Innate Pharma, Nkarta Therapeutics, NantKwest, Phio Pharmaceuticals, Ziopharm Oncology, Sorrento Therapeutics, Celularity, Cytovia Therapeutics, EMERCell, ReeLabs Pte Ltd, Takeda Pharmaceutical (Adaptate Biotherapeutics), Bellicum Pharmaceuticals, Acepodia, Athenex, Gilead Sciences (Kite) |

Natural Killer Cells Market Opportunities:

Targeting Solid Tumors

While current NK cell therapies have largely focused on blood cancers, there is growing interest in leveraging their potential to tackle solid tumors which constitute over 90% of all cancers. NK cells have the inherent capacity to infiltrate and kill solid tumor cells. Advances in genetic engineering, cytokine support, and combination approaches are being explored to enhance NK cell homing, persistence, and antitumor effects against solid tumors. Success in this area would significantly expand the applicability of NK cell therapies. Several academic groups and companies like Takeda Oncology are conducting preclinical and clinical research on NK cell therapies for solid tumors.

Combination Strategies to Augment Efficacy

Given the heterogeneity of tumors, combination regimens that bring together the complementary strengths of multiple therapeutic modalities can improve outcomes compared to monotherapies. Exploring synergistic combinations using NK cells and existing cancer therapies like checkpoint inhibitors, targeted small molecules, dendritic cell vaccines etc. is an active area of opportunity. Early clinical insights indicate combining NK cells with standard tumor treatments may augment response rates without exacerbating toxicity. More research is however needed to identify optimal combinatorial strategies that can enhance NK cell proliferation, function, and persistence in vivo.

Emerging Markets to Offer Significant Growth Potential

Emerging markets across Asia Pacific, Latin America, and Middle East represent largely untapped opportunities for growth of NK cell therapies owing to their sizable patient population and improving healthcare infrastructure. Many global immunotherapy leaders are turning focus to expanding their presence in these high-growth markets. While affordability challenges and lack of specialized expertise remain key barriers currently, these are expected to decline as local economies grow. Specific initiatives to enable cell therapy manufacturing and enhance regulatory standards will also help emerging markets realize their potential.

Exploring Alternative NK Cell Sources

Harnessing NK cells from conventional sources like peripheral blood and cord blood involves challenges like limited cell numbers, need for donor matching, and variability in NK cell quality. This is driving R&D into newer NK cell sources like induced pluripotent stem cells (iPSCs) and human embryonic stem cells (hESCs) which offer advantages of yield, homogeneity and flexibility. Fate Therapeutics recently began Phase I trial of off-the-shelf, iPSC-derived CAR NK cells. EMERCell is also working on an hESC-derived allogeneic CAR-NK cell therapy. Further advances in reprogramming and differentiation methods can help realize the promise of stem cell-derived NK cells.

Natural Killer Cells Market Trends:

Growing Adoption of Automated, Closed Systems

To enable cost-effective commercial-scale manufacturing of NK cell therapies, companies are increasingly adopting automated, closed cell processing systems for steps like NK cell enrichment, activation, expansion, and engineering. For instance, Glycostem collaborated with Biosafe Group to implement an automated, standardized NK cell production platform using Biosafe’s cell processing equipment. Other players like Miltenyi Biotec, Terumo BCT, and Lonza also offer advanced automation solutions tailored to NK cell production. Automated, standardized solutions can enhance reproducibility and minimize risks during NK cell manufacturing.

CAR-NK Cell Therapies Emerging as Promising Strategy

Chimeric antigen receptor (CAR)-modified NK cells have shown remarkable potential in preclinical studies by combining NK cells’ innate anti-tumor activity with antigen-specific targeting. Multiple CAR-NK constructs targeting cancer antigens like CD19, CD20, HER2, EGFR and others are progressing through pipeline, including off-the-shelf, allogeneic candidates. CAR-NK cells appear to be well-tolerated in early clinical testing and have the advantages of standardized cell product and flexible engineering of optimized CAR constructs. Their ability to be dosed repeatedly is an added benefit. With promising safety and efficacy, CAR-NK cell therapies are emerging as an important trend.

Strategic Collaborations on the Rise

Given the challenges associated with developing complex cell therapies, collaborations between companies and with academic institutes are rising as an important strategic trend in advancing NK cell-based immunotherapies. Such partnerships allow leveraging complementary strengths in technology, manufacturing, clinical expertise etc. Recent collaborations like Glycostem with Univ. of Utah, Innate Pharma with Sanofi, and Affimed with Genentech exemplify this trend. Public-private partnerships like the CARB-X program are also supporting companies focused on developing NK cell therapies against antibacterial resistance. These strategic initiatives will be vital for the growth of the NK cells pipeline.

Shift Towards Off-the-Shelf, Allogeneic Therapies

While most developmental NK cell therapies initially involved patient-derived (autologous) NK cells, there is an increasing shift towards allogeneic, off-the-shelf products derived from healthy donors to simplify manufacturing logistics and costs. Allogeneic NK cells also allow timely treatment without the delays of individualized therapy production. Fate Therapeutics, Nkarta Therapeutics, Kiadis Pharma, and Affimed are among companies with allogeneic NK cell candidates in pipeline. This shift is enabled by advances in gene-editing to prevent graft rejection and induction of graft-vs-host disease with allogeneic cells.

Natural Killer Cells Market Restrain:

Manufacturing Complexities and High Production Costs

NK cell therapy production involves complex processes including cell isolation, activation, expansion to clinical scale, cryopreservation etc. that require specialized infrastructure and technical expertise which currently exist at limited centers. The costs per treatment dose are very high, estimated at $50,000–$500,000, making the therapies prohibitively expensive. Lack of standardized protocols also contributes to manufacturing challenges. These factors significantly restrain wider clinical adoption and commercialization of NK cell therapies.

Regulatory Uncertainties due to Novelty of Therapies

As an emerging class of advanced cell immunotherapies, NK cell therapies currently face significant regulatory uncertainties and risk of approval delays. There is lack of definitive guidelines specific to development and approval of NK cell therapies. Optimal preclinical models to evaluate product safety and potency are also unclear. Owing to differences from other cell therapies like CAR-T cells, establishing regulatory framework for NK cells requires focused efforts by companies and regulators. Addressing these challenges can facilitate regulatory progress of NK cell therapies.

Short In Vivo Product Lifespan and Functionality

A key limiting factor is that NK cells have a short circulating half-life of around 7-10 days. Enhancing the post-transplant persistence and survival of transfused NK cells remains a major challenge. This is compounded by factors in the tumor microenvironment like immunosuppression that can impair NK cell cytotoxicity. Without sustained viability and functionality, the antitumor effects of transferred NK cells remain suboptimal. Advances are needed to enhance the in vivo longevity, proliferative capacity, and activity of therapeutic NK cells to realize their full potential.

Intense Competition from Alternative Therapies

The remarkable success of other immunotherapies like monoclonal antibodies, immune checkpoint inhibitors, and CAR-T cell therapies in certain hematologic malignancies is creating intense competition for developmental NK cell therapies. While NK cells have some advantages in terms of safety and limitations of other modalities, their therapeutic niche in cancer remains to be established. Demonstrating superior efficacy and commercial viability compared to approved immunotherapies in advanced stages of testing will be vital for NK cell therapies to gain wider adoption.

Recent Developments:

|

Development |

Involved Company |

|

March 2023: FDA approved omidubicel, an advanced stem cell therapy for treatment of blood cancer |

Gamida Cell |

|

October 2021: Affimed announced first patient dosed in Phase 1 trial of autologous NK cell therapy AFM13 |

Affimed |

|

March 2021: FDA granted Regenerative Medicine Advanced Therapy designation to K-NK002 off-the-shelf NK cell therapy |

Kiadis Pharma |

|

February 2023: Innate Pharma announced US FDA clearance of Phase 2 trial of IPH6101/SAR443579 bispecific NK cell engager |

Innate Pharma, Sanofi |

|

December 2020: Fate Therapeutics treated first patient in Phase 1 trial of FT516 off-the-shelf iPSC-derived CAR NK cell product |

Fate Therapeutics |

|

July 2021: Kiadis Pharma launched its K-NK002 therapy in Europe for blood cancer patients |

Kiadis Pharma |

|

December 2021: Glycostem collaborated with Univ. of Utah to develop allogeneic NK cell therapy Cygro |

Glycostem, Univ. of Utah |

|

August 2020: Nkarta acquired cell therapy portfolio of CRISPR Therapeutics |

Nkarta, CRISPR Therapeutics |

|

February 2023: Affimed partnered, Genentech with Genentech on innate cell engager-based immunotherapies |

Affimed |

Natural Killer Cells Market Regional Insights:

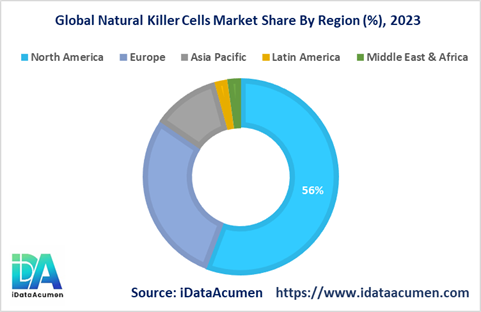

The Natural Killer Cells Market exhibits distinct regional trends and drivers, influenced by factors such as disease prevalence, research and development investments, and the presence of key industry players. A closer examination of regional insights reveals key growth dynamics.

- North America: Pioneering Advancements North America is poised to dominate the Natural Killer Cells market, commanding a substantial share of 56.0% in 2023. This region's leadership is underpinned by several factors, including a high prevalence of cancer cases, robust research and development initiatives in the field of cell therapy, and the presence of major market players. North America's forward-thinking approach and significant investments drive its prominence in the Natural Killer Cells market.

- Europe: A Strong Contender Europe solidifies its position as the second-largest market for natural killer cells, contributing a substantial market share of 28.9% in 2023. The growth in this region is fueled by an increasing industry focus on NK cell immunotherapies and strategic initiatives aimed at supporting research in cell therapy. Europe's commitment to advancing NK cell-based therapies underscores its significance in the market.

- Asia Pacific: A Rapidly Evolving Frontier The Asia Pacific market is poised to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by factors such as improving research infrastructure, increasing investments by global companies, and a growing patient pool. The Asia Pacific region represents a dynamic growth frontier for the Natural Killer Cells market, capturing a market share of 11.2%.

- Other Regions: Contributing to Global Growth While smaller in market share, Latin America and the Middle East & Africa regions play integral roles in the global Natural Killer Cells market. Latin America contributes with a market share of 2.1%, while the Middle East & Africa region accounts for 2.2%. These regions, while holding smaller shares, contribute to the global landscape and offer potential growth opportunities.

In summary, regional variations in disease prevalence, research focus, and investments significantly shape the dynamics of the Natural Killer Cells market. North America leads the way with its pioneering efforts, while Europe strengthens its position through focused initiatives. The Asia Pacific region emerges as a dynamic growth engine, and Latin America and the Middle East & Africa continue to contribute to the global market landscape.

Natural Killer Cells Market Segmentation:

By Source

- NK-92 Cell Line

- Peripheral Blood NK Cells

- Umbilical Cord Blood NK Cells

- Induced Pluripotent Stem Cell-Derived NK Cells

- Embryonic Stem Cell-Derived NK Cells

By Type

- Cytokine-Induced Killer Cells

- Tumor-Infiltrating NK Cells

- Allogeneic NK Cells

- Autologous NK Cells

By Application

- Cancer Immunotherapy

- Infectious Diseases

- Immunoproliferative Disorders

- Others

By End User

- Hospitals

- Research Institutes

- Pharmaceutical Companies

- Biotech Companies

- Others

Top companies in the Natural Killer Cells Market:

- Fate Therapeutics

- Affimed N.V.

- Glycostem Therapeutics

- Kiadis Pharma

- Innate Pharma

- Nkarta Therapeutics

- NantKwest

- Phio Pharmaceuticals

- Ziopharm Oncology

- Sorrento Therapeutics

- Celularity

- Cytovia Therapeutics

- EMERCell

- ReeLabs Pte Ltd

- Takeda Pharmaceutical (Adaptate Biotherapeutics)

- Bellicum Pharmaceuticals

- Acepodia

- Athenex

- Gilead Sciences (Kite)